Gennaro Cuofano's Blog, page 193

October 20, 2020

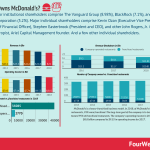

Who Owns McDonald’s?

The major institutional shareholders comprise The Vanguard Group (8.98%), BlackRock (7.1%), and State Street Corporation (5.2%). Major individual shareholders comprise Kevin Ozan (Executive Vice President and Chief Financial Officer), Stephen Easterbrook (President and CEO), and other John Rogers, Jr. investor, philanthropist, Ariel Capital Management founder. And a few other individual shareholders.

[image error]

[image error]

McDonald’s Business Model

[image error]McDonald’s is a heavy-franchised business model. In 2018, of McDonald’s total restaurants, 93% were franchised. The long-term goal of the company is to transition toward 95% of franchised restaurants. The company’s operating income in 2018 was $8.8 billion compared to $9.55 in operating income for 2017.

Related business models

[image error]Coca-Cola’s Purpose is to “refresh the world. make a difference.” Its vision and mission are to “craft the brands and choice of drinks that people love, to refresh them in body & spirit. And done in ways that create a more sustainable business and better-shared future that makes a difference in people’s lives, communities, and our planet.”

[image error]Coca-Cola follows a business strategy (implemented since 2006) where through its operating arm – the Bottling Investment Group – it invests initially in bottling partners operations. As they take off, Coca-Cola divests its equity stakes, and it establishes a franchising model, as long-term growth and distribution strategy.

[image error]Coca-Cola is the market leader of the soft drink industry. It is also the most widely recognized brand, with a Business Insider study revealing that a staggering 94% of the world population recognizes the red and white logo. However, Coca-Cola faces significant challenges with increasingly health-conscious consumers and less access to water resources.

Read Also: McDonald’s Business Model, Coca-Cola Business Model, Coca-Cola Distribution Strategy.

Read More:

Business ModelsPlatform Business ModelsDigital Business ModelsBusiness StrategyValue PropositionMarketing StrategyBrand Building

The post Who Owns McDonald’s? appeared first on FourWeekMBA.

Who Owns Walmart?

As of April 2020, 2,833,701,902 Shares were outstanding for Walmart. The Walton family is the company’s major shareholder whose mission is to “helping people around the world save money and live better – anytime and anywhere – in retail stores and through eCommerce.” While its vision is to “make every day easier for busy families.” Walmart defines “busy families” as the bull’s eye of its business strategy. From humble beginnings just over 50 years ago, Walmart has grown to become the world’s largest retail company.

[image error]The Walton family is the owner and primary shareholder of Walmart (Source: Walmart Financials).

More about Walmart business model

[image error]With over $495 in net sales as of January 2018, and over $4.5 billion coming from Membership and other income. The company operates three primary units that in 2018 comprise Walmart U.S. (approximately 64% of our net sales), Walmart International (about 24% of net sales), and Sam’s Club (approximately 12% of its net sales) a membership-only warehouse clubs and operates in 44 states in the U.S. and in Puerto Rico, as well as eCommerce.

[image error]Walmart’smission can be summarized as “helping people around the world save money and live better – anytime and anywhere – in retail stores and through eCommerce.” While its vision is to “make every day easier for busy families.” Walmart defines “busy families” as the bull’s eye of its business strategy.

[image error]From humble beginnings just over 50 years ago, Walmart has grown to become the world’s largest retail company. A single small discount store in Arkansas has now expanded to over 11,000 stores in 28 countries. Some reports suggest that the company now makes $1.8 million of profit every hour.

Read Also: Walmart Business Model, Walmart SWOT Analysis, Walmart Mission Statement, Costco Business Model.

Read More:

Business ModelsPlatform Business ModelsDigital Business ModelsBusiness StrategyValue PropositionMarketing StrategyBrand Building

The post Who Owns Walmart? appeared first on FourWeekMBA.

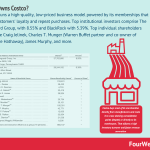

Who Owns Costco?

Costco runs a high-quality, low-priced business model powered by its memberships that draw customers’ loyalty and repeat purchases. Top institutional investors comprise The Vanguard Group, with 8.55% and BlackRock with 5.39%. Top individual shareholders comprise Craig Jelinek, Charles T. Munger (Warren Buffet partner and co-owner of Berkshire Hathaway), James Murphy, and more.

Costco top individual and institutional investors

[image error]

[image error]

Costo Business Model

[image error]With a substantial part of its business focused on selling merchandise at the low profit-margin, Costco also has about fifty million members that each year guarantee to the company over $2.8 billion in steady income at high-profit margins. Costco uses a single-step distribution strategy to sell its inventory.

[image error]Costco is a large American multinational corporation with a focus on low-cost, membership-only retail warehouse clubs. Costco is the 4th largest retail operator in the world, operating 785 warehouses in 10 different countries. Indeed, it has enjoyed rapid success growing from zero to $3 billion in sales within six years.

Read Also: Costco Business Model, Costco SWOT Analysis.

Read More:

Business ModelsPlatform Business ModelsDigital Business ModelsBusiness StrategyValue PropositionMarketing StrategyBrand Building

The post Who Owns Costco? appeared first on FourWeekMBA.

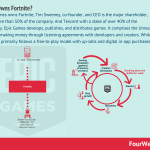

Who Owns Fortnite?

Epic Games owns Fortnite; Tim Sweeney, co-founder, and CEO is the major shareholder, with more than 50% of the company. And Tencent with a stake of over 40% of the company. Epic Games develops, publishes, and distributes games. It comprises the Unreal Engine, making money through licensing agreements with developers and creators. While Fortnite primarily follows a free-to-play model with up-sells and digital in-app purchases.

More about Fortnite

[image error]Fortnite developed by Epic Games is available in three modes. Save the World follows a premium model, where the game is sold, starting at $14.99- Battle Royale follows a free-to-play model, available for free. Still, gamers can buy things or customize characters with its digital currency (V-Bucks), and Creative Mode. As reported by Variety, Fortnite made $1.8 billion in 2019 and $2.4 billion in 2018.

[image error]Epic Games is a gaming company, that develops, publishes, and distributes games. It comprises the Unreal Engine, making money through licensing agreements with developers and creators. Its games (like Fortnite) mostly follow a free-to-play model on PC and an in-app purchase model on the digital marketplace. And its storefront Epic Games Store, taking a 12% cut on games’ sales.

[image error]

[image error]A free-to-play is a model that became particularly popular in gaming. Free-to-play is also commonly referred to as free-to-start. For instance, companies like Epic Games have launched popular games like Fortnite’s Battle Royale, which had ingrained a free-to-play model. This is a model that become extremely popular in the digital age of gaming.

[image error]The gaming industry, part of the entertainment industry, is comprised of three main types of players. From game engines, which help developers build their games. To publishing gaming houses. And gaming consoles. While the prevailing business model for decades has been that of selling the console at cost, and make money on games. Digital games changed the way games are distributed and sold, and it opened up the way to free-to-play models.

[image error]EA Sports is among the largest gaming publishers, with a hybrid strategy of fully-owned games and licensed games distributed with a cross-platform approach. FIFA is the game that most contributes to its revenues and live services (Ultimate Team in particular) are the largest revenue contributors to EA revenues.

[image error]Discord makes money in several ways. From its Discord Store, where users can buy premium games, to the seller shops, that primarily works with a 90/10 revenue share for developers and game sellers. And the ability for sellers to get more visibility on the platform by adding features to the game visibility.

Read Also: How Much Money Has Fortnite Made, Epic Games Business Model, Free-To-Play Business Model, Gaming Industry, EA Sports Business Model, Discord Business Model.

Read Also:

Business ModelsPlatform Business ModelsDigital Business ModelsBusiness StrategyValue PropositionMarketing StrategyBrand Building

The post Who Owns Fortnite? appeared first on FourWeekMBA.

October 19, 2020

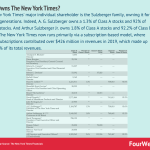

Who Owns The New York Times?

The New York Times‘ major individual shareholder is the Sulzberger family, owning it for several generations. Indeed, A. G. Sulzberger owns a 1.3% of Class A stocks and 92% of Class B stocks. And Arthur Sulzberger Jr. owns 1.8% of Class A stocks and 92.2% of Class B stocks. The New York Times now runs primarily via a subscription-based model, where digital subscriptions contributed over $426 million in revenues in 2019, which made up over 23% of its total revenues.

New York Times Revenue Breakdown

[image error]The New York Times primary revenue streams comprise Subscription (printed and digital), advertising and other revenues (like licensing, commercial printing, the leasing of floors in the

Company Headquarters, affiliate referrals, television and film) – Data Source: The New York Times Financials

[image error]Digital-only subscription revenues represented over 23% of the total revenues, as of 2019 – Data Source: The New York Times Financials

Top shareholders

[image error]

Class A vs. Class B stocks

To guarantee a certain degree of independence and control, media companies have been historically structuring themselves with two classes of shares: A and B.

Usually, Class A shares, give more voting power, while Class B shares give ownership but with limited voting power, compared to Class A shares.

However, in the case of The New York Times, as of 2020, Class A stockholders are entitled to elect 4 of the 12 directors, where Class B shares are entitled to vote 8 of the 12 directors.

[image error]The New York Times made over $1.6 billion in revenues in 2017. Its monetization strategies based on both subscription (both print and digital) and advertising (both print and digital). NY Times has successfully managed to shift its business model over subscription over the years. As of 2017, subscriptions contribute more than advertising to its revenue generation. The subscription revenues primarily based on print have also been slowing down, while digital subscriptions have increased substantially. The NY Times is shifting toward a digital subscription business model.

[image error]Business Insider is among the most popular business information websites in the world. According to Alexa Business Insider is among the top 100 most popular sites in the US, and according to Similar Web that is the most popular business news site in the US. Its mission is to inform and inspire the audience, help its clients, and get better every day.

Read Also: The New York Times Business Model, Business Insider Business Model, Subscription-Based Business Models, Paywalls

Read More:

Business ModelsPlatform Business ModelsDigital Business ModelsBusiness StrategyValue PropositionMarketing StrategyBrand Building

The post Who Owns The New York Times? appeared first on FourWeekMBA.

October 17, 2020

Continuous Intelligence Business Model

The business intelligence models have transitioned to continuous intelligence, where dynamic technology infrastructure is coupled with continuous deployment and delivery to provide continuous intelligence. In short, the software offered in the cloud will integrate with the company’s data, leveraging on AI/ML to provide answers in real-time to current issues the organization might be experiencing.

Sumo Logic and the rise of continuous intelligence

[image error]How Sumo Logic describes the process of continuous intelligence (Image Source: Sumo Logic S-1).

Continuous intelligence gets delivered as a service to enable continuous innovation. Below, some of the features that companies like Sumo Logic, describe it:

[image error]The platform of continuous intelligence is always on, scalable and secure. And it needs to have built-in, advanced analytics able to give real-time insights to the client’s firm.

Therefore some of the features of the continuous intelligence business model are:

Always on, current, scaling, elastic, learning (through advanced machine learning algorithms), and secure service.Built-in, advanced analytics, uncovering patterns, and anomalies across the entire infrastructure and/or application stack.Delivered via a subscription-based revenue model, coupled in some cases with consumption-based APIs.

Another key element of the Continous Intelligence Business Model is its real-time component:

Speed to value (fast to deploy).Speed to resolution (fast troubleshooting).Speed to discipline.

Continuous Intelligence to achieve Continuous Innovation

Continuous Intelligence is tied to the trend of continuous innovation achieved through:

Cloud-based software is integrated within the firm’s data pipelines. Speed to investigate, solve issues, and fix them in real-time. Security. Ability to use the software across various departments within the same organization. Read Also: Business Models Guide, Sumo Logic Business Model, Snowflake Business Model, Unity Software Business Model, Business Strategy.

The post Continuous Intelligence Business Model appeared first on FourWeekMBA.

October 11, 2020

How Does Unity Work And Make Money? Unity Business Model Explained

Unity is a platform for 3D content development, free for companies below $100K in revenues, and subscription-based for companies beyond that. It also makes money on a revenue-share basis with its Operate Solutions helping creators monetize their 2D and 3D content across several platforms. Unity also generates revenues through revenue-share arrangements with strategic partners and within its Asset Store marketplace.

VTDF Framework

[image error]

The VTDF Framework which I’ve developed to analyze tech business models on FourWeekMBA will be the basis to this analysis.

The evolution of the Unity platform

[image error]Source: Unity Software Prospectus

Founded in 2004, Unity Software evolved over the years, from a simple platform to becoming a real-time 3D content development platform.

More precisely by 2005 Unity had deployed on Mac OS and Microsoft Windows platforms. By 2014, Unity launched its Unity Ads and by 2016 the company started to offer its Create Solutions, on a subscription basis. This would become a major contributor to the company’s revenues.

By 2019, Unity Simulation enabled creators to play and perform complex 3D spatial simulation in the cloud. Unity’s platform currently employs a set of diversified use cases, that go beyong gaming.

The company is trying to position itself as a comprehensive AR/VR platform where to build any sort of virtual reality.

Today some of the key customers/users of the Unity’s platform range from game developers to artists, architects, automotive designers, filmmakers, and others.

Some of the key characteristics of Unity’s philosophy toward 2D and 3D content are skewed toward creating dynamic and interactive content, that can adapt in real-time to users‘ behavior and feedback.

This applies to creators as well, which can use Unity as a collaboration tool to interact with each other and improve the content quality as it gets released, thus reducing the development cycle times, to move toward continuous and dymanic content development.

This is at the core of the Unity platform and philosophy to content.

Value Model

Unity Software value model moves around the way content has evolved over the last two decades. Especially 3D content, that has finally become viable for a series of technological development all coming together (increased compute power, cloud-based infrastructures, massive distribution network made of billions of devices across the world).

These elements together served as the basis for the value model Unity developed and filled over the years.

Vision

As John Riccitello, CEO of Unity Software pointed out at the debut of the company’s IPO:

The world is a better place with more creators in it. And, we intend to make that more true tomorrow than it is today, to the point where real-time interactive 3D is the dominant form of content globally. As a company, we will invest for the long term. And, through this long-term investment orientation, we plan to realize the opportunity we see to drive significant growth in the world of real-time, interactive 3D content. We are building Unity to make this vision a reality.

Therefore, Unity’s vision is to bring 3D, interactive content to the masses by enabling creators to generate content in any niche.

Mission

Unity’s mission is to enable more people to be creators

Creators, therefore, represent the major stakeholder for the company. Born as a company that enabled game creators to develop content in that vertical. Unity’s platform expanded beyond that to offer many other use cases. Beyond gaming, creators use the Unity platform for automobile and building design, online and augmented reality product configurators, autonomous driving simulation, and augmented reality workplace safety training.

Thus, we can break down Unity’s platform use cases in three primary groups:

Gaming.AR & VR.Industries Beyond Gaming.

What makes Unity’s platform compelling to creators?

Value propositions

We’ll break down the value proposition by looking at what core problem Unity identified, and what solution is offered to it, and from there who are the key customers/users that make up the DNA of its platform.

Problem: offer a platform for creators to develop, run and monetize their content

The hardest part of content development, especially when it comes to 3D content, is the fact it might require a separate rendering across formats, platforms, devices, and ecosystems. This makes it hard for content creators, developers, and smaller companies to keep up.

And that is why developing dynamic 3D content can be quite expensive and time consuming. Unity, over the years, built a comprehensive platform to tackle all the aspects, from content development, deployment, interaction/improvement and monetization.

From the development side, for developers and creators, it was (and it is) extremely hard to make sure their content is properly rendered across platforms and devices. That is why Unity built a comprehensive platform for that.

As for the monetization part, apps have been transitioning to a free-to-play model, this means that those same apps will need to make money through in-app purchases that also require the handling of strategic partnerships with big players like Google and Apple.

As a larger platform, with more leverage, over the years Unity has built strategic partnerships that give access to a wide variety of ecosystems for creators (perhaps, as of 2020, most of the games on Nintendo Switch have been developed through Unity).

Solution: from static content, driven by long development cycles, to dynamic content, driven by short development cycles and live feedback between creators and from users

The key change in how content is developed was radical, especially in the last decade, where we moved from static, 2D content to more dynamic, immersive content. It’s possible now to interact in real-time with users, shorten the content development cycle, and improve the experience. Those changes have been driven by a few forces and technological trends:

Cheaper computing power: As GPUs have improved exponentially, this also made it possible to deliver 3D dynamic and high-resolution content on smaller devices and develop the same content on computers and machines that most developers could afford. The proliferation of new content platforms, devices, and ecosystems: Back in the days, 3D content could be primarily distributed through PCs and gaming consoles. Today many more physical platforms are available (comprising smartphones and tablets with a huge global reach). That, of course, also increased the demand for that type of content widely. With the rise of cloud-based infrastructures, the new distribution and monetization models could freely deliver across new platforms. This opened up a vast ecosystem (think of Apple and Android) that also changed how this content could be monetized. For instance, in the past, games would be primarily monetized with a razor and blaze model (the console sold at cost, while most margins were made on games). Today, as most games are distributed via app stores, they are free to download (the free-to-play model), and users will be prompted to upgrade or to buy ancillary things within, via in-app purchases. These new distribution models have greatly influenced how companies do business in the first place. Hyperconnectivity and content feedback loops: The easy access to the web has enabled billions of users to interact in real-time with content. This proves valuable for the user experience, but it creates a whole new way of developing content.Continous content development, release, and iteration: This hyperconnectivity enables developers to gather feedback even more quickly than they used to, thus giving them the chance to perform more product releases and iterate quickly to improve the user experience further. This endless loop is possible thanks to the above elements (cheaper computing power, cloud-based content platform, and new distribution models).

Therefore, the killer value proposition for Unity is its ability to provide faster content creation and efficient deployment across formats, use cases, and distribution platforms.

Unity does that via two core set of solutions:

Create Solutions used by content creators (developers, artists, designers, engineers and architects) to create interactive, real-time 2D and 3D content. Operate Solutions enablung cystomers to grow and engage their end-user base, run and monetize their content.

Customer composition

[image error]The makeup of Unity Software customers. At the same time, the company acquires any customers, ranging from individuals to enterprise clients. Most of the sales and marketing efforts are skewed toward acquiring and retaining larger enterprise accounts. Perhaps, as of June 2020, Unity had 716 customers with over $100K in revenues per year, which made up 74% of its total revenues. (Financials source: Unity, S-1).

Unity serves a variety of customers, that range from individual creators to large enterprises.

Most sales and marketing efforts instead are focused on acquiring larger enterprise accounts (customers with over $100K in revenues per year), which by June 2020 were 716, making up 74$ of its revenues.

[image error]The growth of enterprise customers over the years (financials source: Unity S-1).

[image error]The growth of the portion of revenues coming from larger enterprise accounts, between 2018-2020 (Financials source: Unity S-1).

Technological Model

Technological models don’t just start from an engineering standpoint. In many cases, there is a whole new philosophy behind them. And this is true also for Unity. Over the years technology has enabled a philosophical shift in the way we conceive content.

From a world primarily captured through a 2D lens, finally, compute power. bandwidth and new devices enabled the distribution of real-time 3D content.

Gaming proved as an incredible platform for that evolution. Where 3D virtual, interactive objects could be created. This led to the growth of an industry that only a couple decades back was worth a few billion and that now is moving toward the hundreds of billions mark.

But what makes up interactive, real-time 3D content, from a technological perspective?

Interactivity: not only the quality of 3D content lets users dive into virtual environments that are incredibly immersive, but the fact that those same users can play experience the same in a multiplayer mode, this changes the whole experience of gaming. Real-Time: content rendering makes it possible for users to instantly interact with the content which like never before appears lifelike.3D: finally 3D content makes it possible to experience content from multiple angles, and have a whole new way around it.

Interactive, real-time 3D is also driving innovation in the content creation process. For example, with real-time technology, creators can:

Live-edits of the 3D objects part of the virtual world, thus pushing out those changes at the speed of light. This what Unity defined as instantaneous adaptation where creators collaborate to bring faster changes, driven by fast feedback loops between creators and users. New use cases: Unity’s use cases well expanded beyond games, to help architects, designers, and project partners use real-time 3D models with an ultrarapid iteration process.

Core technology

[image error]The set of products part of the Unity platform. They move around two core: Create Solutions and Operate Solutions. The former primarily focused on content development. The latter primarily focused on distribution and monetization.

Unity platform is made of two core sets of solutions:

Create Solutions

where the content created can be deployed to more than 20 platforms (some of which include Windows, Mac, iOS, Android, PlayStation, Xbox, Nintendo Switch, and other leading augmented and virtual reality platforms).

[image error]Some of the games developed with the Unity Create Solutions products (Source: Unity S-1).

[image error]Other use cases developed beyond gaming, by companies using the Create Solutions products.

Operate Solutions

This is the part of the platform interfacing with customers, building the customer base, and optimize the acquisition of users, the cost of acquisition, and the lifetime value of those accounts.

R&D management

Most of the R&D expenses are about maintaining and evolving the existing platform. Therefore, those comprise the personnel-related costs for the design and development of the same, sustain the third-party software services, and maintain the current infrastructure.

Leapfrog Innovation

What we can call the leapfrog innovation is represented by the AR&VR applications and the fact that Unity is trying to establish itself as a leading platform for generating content for augmented and virtual reality. If AR and VR will prove to be the next hardware platform for the next wave of the web, being positioned as a platform/CMS for 3D content creation might be very powerful.

Distribution Model and Go-to-market strategy

Unity Software distribution model and strategy moves around four elements:

Direct sales. Digital channels.Customer and community support.Strategic partnerships.

Direct Sales

The direct sales is used primarily to acquire enterprise-sized customers and increase the adoption of products and services among them.

The direct sales force here is made of:

Inside sales (salespeople working within the company remotely from the customer) and field sales (accounts able to build stronger relationships with enterprise customers). Customer success. And field engineering teams.

Unity also has a group of technical professionals helping customers completing and facilitating the content development and deployment process.

For mid-sized and smaller companies the salesforce is primarily made instead of the inside sales team. This acquisition process is justified by the fact its more cost-effective for the company.

For smaller accounts Unity also leverages on certified resellers.

Unity also leverages conferences and live events to support its communities of developers.

Digital Channel

Digital channels are used to bring in independent creators and mid-sized, or small and independent studios through a self-service digital model. The workflow starts by enabling smaller companies to use the platform for free, until they reach $100K in annual revenues or funding.

The company makes money there, by enabling those same companies to monetize their content via the Operate Solutions, which is primarily a self-service platform.

On the Create Solutions side, when creators start to use more of the platform, increase their revenues to over $100K, or get funding for over that amount, they will upgrade to paid plans. While most of the Unity users are free accounts, those can be in the future potentially converted as paid accounts. But besides that, they work as branding, and a way for Unity to spread its platform through digital world-of-mouth.

Customer Support & Community Building

The customer support and community moves around three pillars:

Forums: Which his the central hub for the Unity community discussions. Answers: Represented by a self-service repository relating to common questions on product and workflows.Documentation: This is translated into four languages, and it covers how to use every component in Unity.

Strategic Partnerships

The partner ecosystem that Unity built over the years is a key element of its distribution and go-to-market strategy.

The partners that make up this ecosystem are:

Apple: iOS, AppleTV, and Mac, Mac App Store, the App Store, and Apple Arcade for customers. Autodesk: This streamlines workflows and eliminates creator friction between Autodesk and Unity products.ARM support and optimization across ARM’s technology ecosystem. Google and DeepMind: Unity and its partnerships on the 1. Android distribution, 2. ARCore for distribution of augmented reality content, 3. AdMob that Unity creators can leverage on via the Unified auction platform, 4. Google Cloud Platform where Unity can run on Google’s infrastructure at cheaper pricing, 5. Stadia Unity developers and provides can publish games to this streaming platform. 6. And DeepMind for AI research. Intel partnership to maximize the usage of Intel GPU for creators and CPU powered platforms.Microsoft, whose main partnership is about Games and apps building (enabling native games and applications for Windows, Xbox One, Xbox Live, future hardware, and distribution channels).Nintendo primarily for the Nintendo Switch Console, where developers can build native games with Unity. As of June 2020, over half of the games on Nintendo Switch have been made with Unity.Samsung device partnership allows Unity to collaborate on gaming performance on Samsung mobile devices.Sony’s partnership enables creators to build native games and VR experiences for Sony PlayStation 4, Sony PlayStation VR.Tencent’s partnership will enable creators to access the Tencent Cloud service for high-performance last-mile delivery of their content within China.

Financial Model

Let’s review the Unity financial model before to dive into it in details:

Revenue Model: This is mainly driven by 1. Create Solutions (free until $100K of revenues, and subscription-based model afterward), 2. Operate Solutions (revenue-share on ad-serving products and usage-based revenues on cloud-based products), 3. Strategic Partnerships (mostly fixed fees royalties or revenue-share agreements) and Other (the store owned and run by Unity is called Asset Store on a revenue-share model). Cost Structure: This is built mainly upon customer support and cloud-related expenses.Profitability: Unity is not profitable by June 2020. Cash Generation: The company still burns cash from operating and investing activities, and it leveraged from cash coming from financing activities to build its cash balance.

Revenue Model

[image error]Create Solutions drive the revenue model of Unity (free until $100K of revenues, and subscription-based model afterward), Operate Solutions (revenue-share on ad-serving products and usage-based revenues on cloud-based products), and Strategic Partnerships and Other (the store owned and run by Unity is called Asset Store and its revenue-share based).

(Financial figures source: Unity, S-1).

The Unity Software revenue model moves around two core set of products (running with two separate revenue models), strategic partnerships and its own marketplace:

Create Solution Revenue Model

Create Solution revenue model is primarily monetized through monthly subscriptions. This product is free until the company reaches over $100K in revenues.

Subscriptions for Create Solutions drive the adoption of Unity Operate Solutions. By June 2020, Create Solutions made about 38% of the company’s total revenues.

It’s important to highlight that also when creators accounts are not monetized through the Create Solutions (until they reach over $100K in revenues), those accounts still drive the adoption of Operate Solutions that instead are based on a revenue-share model and on usage-based.

The three subscription-based plans are Unity Plus, Unity Pro or Unity Enterprise.

[image error]Unity Software premium plans running via subscriptions.

Operate Solutions Revenue Model

Operate Solutions run at revenue-share and usage-based models.

By June 2020, those Operate Solutions made around 62% of the company’s revenues.

Most of it from revenue-share, and a minor chunk from usage-based of various cloud-based products offered by Unity. Operate Solutions can be used whether or not the content is built using Unity’s Create Solutions. Unity runs a platform for content monetization. This is a real-time Unified Auction platform.

Unity retains a share of the revenue that is generated through these auctions.

A smaller chunk of revenues in this segment is generated through the use of deltaDNA, Multiplay, and Vivox products, which are cloud-based products. For instance, the majority of revenue from deltaDNA is generated based on the number of active users in the application each month.

Strategic Partnerships Revenue Model

Unity generates Strategic Partnerships revenue from agreements with hardware, operating system, device, game console, and other technology providers. Those partnerships enable Unity creators to deploy their content on all devices and platforms, preventing them from having to readapt or re-code that content to make it compliant to those platforms.

The Unity revenue model here is mostly made of fixed-fee service arrangements, while some other partnerships are based on a revenue-share model (Unity receives royalties based on the sales of games on partner platforms incorporating its software).

Asset Store Revenue Model

A smaller chunk of revenues are also generated by the Unity marketplace, the Asset Store.

[image error]Unity Asset store, the marketplace run by Unity (Source: Unity Website).

Cost Structure

Cost of revenue consists primarily of hosting expenses, personnel costs related to product support and professional services organizations, third party license fees, and credit card fees.

Profitability

[image error]Unity income statement, with over $541 million in revenues by 2019, and loss of operations of over $150 million by 2019. And with over $351 million revenues by the first six months of 2020, and over $52 millions in loss from operations. (Source of financial data: Unity S-1).

The company run at net loss as it ramped up its operations.

Cash Generation

[image error]Unity balance sheet. By June 2020 the company had over $453 million in cash, primarily driven by financing activities, (Source: Unity S-1).

[image error]While Unity generated cash outflows from the operating and investing activities (primarily due to business acquisitions). It generated cash inflows from financing activities (primarily due to the issuance of stocks).

(Source: Unity S-1)

Putting it all together

Unity Software is a platform for 3D content development, born in gaming; it evolved beyond that. It now offers several use cases and a platform for developing augmented and virtual reality content.The company makes money primarily through its Create and Operate Solutions. Create Solutions run on a subscription-based service. And Operate Solutions run on a revenue-share model. Other revenues come from Strategic Partnerships and Unity’s marketplace.The company’s technological model is based on enabling creators to deliver 3D content quickly while having fast releases and content iteration on the platform. The company’s acquisition of smaller accounts runs through its digital self-serving channels, where the salesforce is primarily used to acquire larger enterprise accounts, making over $100K per year. As of June 2020, the company is not profitable, and it doesn’t generate cash from operations. Unity invests its resources to position itself as a leading 3D platform for content development and, in the future, as a leading “CMS” for AR/VR content development.

Read Also: Sumo Logic Business Model, Snowflake Business Model, Epic Games Business Model, Free-To-Play Business Model, Gaming Business Models.

Additional Resources:

Successful Types of Business Models You Need to KnowThe Complete Guide To Business DevelopmentBusiness Strategy: Definition, Examples, And Case StudiesWhat Is a Value Proposition? Value Proposition Canvas ExplainedMarketing Strategy: Definition, Types, And ExamplesMarket Segmentation

The post How Does Unity Work And Make Money? Unity Business Model Explained appeared first on FourWeekMBA.

October 8, 2020

What Is PropTech And Why It Matters In Business

PropTech stands for property technology, is a relatively recent movement in the real estate industry. The movement is an innovative approach that uses technology to optimize how consumers and real estate professionals interact with property. PropTech, therefore, leverages digitalization to help property managers, owners, builders, and landlords to manage their assets.

Understanding PropTech

Real estate is one of the largest and most lucrative asset classes in the United States and indeed in many other countries. In fact, it accounts for over 13% of the global GDP.

However, real estate processes are riddled with inefficiencies resulting from a lack of flexibility and automation. Payment and leasing arrangements are tedious and housing markets are often constrained by supply which increases unaffordability.

PropTech seeks to address these issues by allowing property managers, owners, builders, and landlords to manage their assets digitally. This is achieved by various means, including big data, blockchain, construction technology, and drone technology to name a few.

Regardless of the method, digital transformation is enabling real estate businesses to rapidly embrace innovation and increase efficiency in the process.

Real-world applications of PropTech

Artificial intelligence – developers are now beginning to use AI to identify areas deemed the most profitable to invest in. AI is also being used in building design, where it plays an important role in optimizing spatial layouts.Robotics – several robots have been manufactured specifically for use in the construction industry. Australian company FBR recently released a robot that laid the bricks for a 3-bedroom, 2-bathroom home in under 3 days. The robot could lay 1000 bricks an hour, compared to 400 bricks an hour by a human bricklayer.Virtual and augmented reality – builders are now able to quickly and immersively provide walkthrough experiences for potential clients. This saves time and money in constructing demonstration homes and makes open inspections more efficient.Streamlined office employee solutions – technology now enables office building workers to manage a broad array of functions within a single app. This includes access in the form of a mobile key card, food ordering, and visitor registration.Streamlined property manager/tenant interactions. Through central data portals, property managers can increase the efficiency of building maintenance and alert tenants to service outages. Tenants can use the same portal to make rental payments and submit work orders in a collaborative and transparent manner.

Examples of successful PropTech companies

Opendoor

Opendoor enables homeowners to sell their homes from the comfort of their sofa. The company purchases the property from the homeowner online at a price set by a data-driven algorithm.

Then, it sends a team of renovators to upgrade the property and puts it back on the market. Interestingly, the company also uses connected locks and cameras to enable self-guided visits by prospective buyers.

Brickblock

Brickblock is a smart contract platform that allows buyers to purchase real-world assets with cryptocurrencies. The organization has tokenized real estate assets through blockchain technology to subvert barriers to entry often imposed by banks and other lending institutions.

Ultimately, this process saves time, reduces costs, and takes much of the hassle and stress out of buying real estate.

Key takeaways:

PropTech describes technology that streamlines processes in the real estate industry, which has historically been slow to innovate and is inefficient.PropTech helps property managers, landlords, office employees, and tenants interact with commercial and residential property in a cohesive and transparent manner.PropTech encompasses a suite of different technologies, including AI, robotics, virtual reality, blockchain, and big data.

Read Also: WeWork Business Model, Blockchain Business Models

Additional Resources:

Successful Types of Business Models You Need to KnowThe Complete Guide To Business DevelopmentBusiness Strategy: Definition, Examples, And Case StudiesWhat Is a Value Proposition? Value Proposition Canvas ExplainedMarketing Strategy: Definition, Types, And ExamplesMarket Segmentation

The post What Is PropTech And Why It Matters In Business appeared first on FourWeekMBA.

Brand Promise And Why It Matters In Business

A brand promise is usually one or two sentences that accurately communicates what a consumer should expect when interacting with a brand. When a business creates a brand promise, it is making a declaration of assurance. Brand promises are often seen as extensions of brand positioning statements that explain why a business exists. A brand promise then tells the consumer how a product is service is better than those of a competitor.

Understanding brand promise

Brand promises can be overt in nature – with courier company FedEx being a prime example. The company motto “when it absolutely, positively has to get there overnight” is a public promise which the company has never compromised.

Brand promises can also be less overt. McDonald’s delivers on familiar, consistent, and affordable meals without incorporating making specific promises around these characteristics. Instead, the brand promise of McDonald’s is the less tangible ability to help families take the guesswork out of choosing a restaurant.

Three steps to creating a successful brand promise

1. Define the promise

The most successful brand promises will combine the personality, mission statement, values, and USP of a business into a succinct and deliverable package.

Combining these important elements ensures that a business creates a brand promise that is not only authentic but unique.

Here, the brand promise should be written down for clarity. But the promise itself must also be present in a less tangible form. That is, the promise should be reflected in every aspect of internal and external business culture.

2. Deliver the promise

Next, determine how the promise might be delivered. FedEx’s promise of overnight delivery seems simplistic on paper, but tremendous buy-in from employees and other relevant stakeholders is consistently required to make this promise unbreakable.

At this step, it’s important to remember that cutting corners and making promises do not mix. Businesses who promise to prioritize consumer needs without first determining what they need are doomed to failure.

3. Track and adjust performance where necessary.

While it is true that there is some degree of art in developing a brand, businesses still need a trackable strategy in place. Engagement metrics will provide clear insights on whether a brand is resonating with its audience or whether marketing needs to reconsider its approach.

Surveys and questionnaires are also a great way of determining whether consumers understand a brand. Indeed, carefully worded questions can reveal a range of insights around the credibility and authenticity of a brand promise.

Some more examples of companies with successful brand promises

Apple – who give consumers a chance to own the trendiest, sleekest, and most technologically advanced electronics.Lynda.com – offering affordable and convenient high-quality training on a range of topics.Nike – with an all-encompassing promise to bring inspiration and innovation to world athletes. Coca-Cola – whose beverages promise to instill a mindset of fun and optimism through refreshing and uplifting experiences.

Key takeaways:

Brand promises set expectations for the business to consumer relationship. The promise should permeate every aspect of a business and be authentic, unique, and consistent.Brand promises can be tangible and overt in the sense that they are explicitly stated. But they can also encapsulate specific experiences that consumers come to expect when interacting with an organization.To develop a brand promise, businesses must combine aspects of their values, mission statement, values, and USP. Importantly, there must be no potential for the promise to be broken through inadequate due diligence or a lack of employee buy-in.

Read Next: Brand Building

Additional resources:

Successful Types of Business Models You Need to KnowThe Complete Guide To Business DevelopmentBusiness Strategy: Definition, Examples, And Case StudiesWhat Is a Value Proposition? Value Proposition Canvas ExplainedMarketing Strategy: Definition, Types, And ExamplesMarket Segmentation

The post Brand Promise And Why It Matters In Business appeared first on FourWeekMBA.

What Is A Fat-tailed distribution And Why It Matters In Business

Fat-tailed distributions are graphical representations of the probability of extreme events being higher than normal. In many domains fat tails are significant, as those extreme events have a higher impact and make the whole normal distribution irrelevant. That is the case when it comes to power laws. Therefore, understanding the properties of those extreme events become critical to business survival and success.

Understanding fat-tailed distributions

Typical bell curve graphs depict the probability distribution of data with the apex of the curve representing the mean, mode, or median. The width of the bell relative to the apex is determined by its standard deviation. This normally distributes the data and forms the shape of the bell curve with two “lean” tails of outlier data on either side.

Normal distributions can be analyzed to predict stock market volatility and make educated predictions around future stock prices. Bell curves can also be used by educators to compare test scores and also in the assessment of employee performance.

However, data are not always normally distributed. Some bell curves have fatter tails with a higher prevalence of data significantly different to the mean. Fat-tailed distributions are said to decay more slowly, allowing more room for outlier data to exist sometimes 4 or 5 standard deviations above the mean. As a result, extreme events are more likely to occur.

Lean tail curves, on the other hand, have distributions that decrease exponentially from the mean. This means that extreme events are highly unlikely, which helps to mitigate risk in a variety of situations.

Examples of fat-tailed distributions

Some of the more obvious fat-tailed distributions include:

Wealth – mean annual income globally is approximately $2,000. Yet there is a high number of millionaires and even billionaires who are many, many standard deviations above this mean.Urban populations – the vast majority of cities worldwide have populations in the tens to hundreds of thousands, but the increasing prevalence of megacities such as Tokyo, Delhi, and Shanghai skews normally distributed data.Costs of natural disasters – climate change is increasing the severity of natural disasters, leading to higher insurance claims. For example, the costliest hurricane in the US was Hurricane Andrew in 1992 at $41.5 billion. Just 13 years later, Hurricane Katrina set a new record inflicting $91 billion worth of damage.

Implications for fat-tailed distributions in business

Finance

Normal distributions tend to understate asset prices, stock returns, and associated risk management strategies. This was highlighted during the 2008 Global Financial Crisis (GFC), where conventional financial wisdom was unable to predict fat tail risks brought about by unpredictable human behavior.

Devastating events such as the GFC might have been avoided if preceding periods of financial stress – also represented by fat-tail distribution – were acknowledged and planned for accordingly.

Insurance

Insurance companies rely on normally distributed, historical data to generate profits. However, claims relating to flood and crop damage in particular are challenging historical assumptions of normal distribution. Health insurance claims are also rising as obesity rates soar in many developed western nations.

Companies that offer uncapped insurance contracts are at an increased risk of bankruptcy as climate change and more sedentary lifestyles challenge assumptions of lean-tail distribution.

Key takeaways:

Fat-tailed distributions are found on bell curves with a greater prevalence of outlier data. These distributions suggest a higher probability of extreme events than would be typical in a normally distributed bell curve.Fat-tailed distributions decay more slowly than lean-tailed distributions, resulting in outlier data that is often 4 or 5 standard deviations above the mean. Fat-tailed distributions explain variation in the distribution of global incomes and urban population size. In the finance and insurance industries, external stressors are challenging historical assumptions of normal distribution and in turn, profit potential.

Additional resources:

Successful Types of Business Models You Need to KnowThe Complete Guide To Business DevelopmentBusiness Strategy: Definition, Examples, And Case StudiesWhat Is a Value Proposition? Value Proposition Canvas ExplainedMarketing Strategy: Definition, Types, And ExamplesMarket Segmentation

The post What Is A Fat-tailed distribution And Why It Matters In Business appeared first on FourWeekMBA.