Gennaro Cuofano's Blog, page 192

October 24, 2020

Who Owns Twitch?

In 2014, Twitch was bought by Amazon for $970 million. Therefore Twitch is part of Amazon, comprising other subsidiaries bought over the years, like Audible, Whole Foods, and Zappos (in total, Amazon has 12 subsidiaries). Therefore, as of 2020, Twitch is a multi-billion dollar company, making money primarily via advertising through its video streaming platform (creators use Twitch today across many other verticals).

Inside the Amazon Tech Empire

[image error]Amazon is a consumer e-commerce platform with a diversified business model spanning across e-commerce, cloud, advertising, streaming, and more. Over the years Amazon acquired several companies. Among its 12 subsidiaries, Amazon has AbeBooks.com, Audible, CamiXology, Fabric.com, IMDb, PillPack, Shopbop, Souq.com, Twitch, Whole Foods Market, Woot! and Zappos.

[image error]Amazon is a consumer e-commerce platform with a diversified business model spanning across e-commerce, cloud, advertising, streaming, and more. Over the years, Amazon acquired several companies. As it operates across several industries, Amazon has a wide range of competitors across each of those industries. For instance, Amazon E-commerce competes with Shopify, Wix, Google, Etsy, eBay, BigCommerce.

[image error]Amazon has a diversified business model. Amazon’s primary revenue streams comprise its e-commerce platform, made of Amazon labeled products and Amazon third-party stores. In addition to that, Amazon makes money via third-party seller services (like fulfilled by Amazon), advertising on its platform, AWS cloud platform, and Prime membership.

[image error]Amazon has a diversified business model. In 2019 Amazon posted over $280 billion in revenues and over $11.5 billion in net profits. Online stores contributed to over 50% of Amazon revenues, followed by Physical Stores, Amazon AWS, Subscription Services, Third-party Seller Services, and Advertising revenues.

More about Amazon:

Amazon Business ModelAmazon SWOT AnalysisAmazon SubsidiariesAmazon CompetitorsWho Owns AmazonWhat Is the Receivables Turnover Ratio?What Is Cash Conversion Cycle?Amazon FlywheelAmazon Value Propositions

Read More:

Business ModelsPlatform Business ModelsDigital Business ModelsDistribution ChannelsBusiness StrategyValue PropositionMarketing StrategyBrand BuildingSWOT Analysis

The post Who Owns Twitch? appeared first on FourWeekMBA.

Who Owns PayPal?

PayPal was first founded in 1998; it was called Confinity (among its founders was Peter Thiel); later, it merged with X.com, its major competitor, founded by Elon Musk (which would become known for other companies like Tesla and SpaceX). From this merger, PayPal was born. In 2002, PayPal was bought by eBay for $1.5 billion. eBay spun-off PayPal in 2015, which would be listed as an independent entity. Today PayPal owns brands like Braintree, Venmo, Xoom, and iZettle.

PayPal major shareholders

[image error]

[image error]PayPal major institutional and individual shareholders, as of 2020 (Source: PayPal Financials).

The spin-off from eBay

The official spin off of PayPal from eBay, as announced on eBay’s website (Source: eBay News).

The official spin off of PayPal from eBay, as announced on eBay’s website (Source: eBay News).As announced at the time:

In the distribution, eBay Inc. stockholders will receive one share of PayPal common stock for each share of eBay Inc. common stock held as of the close of business on July 8, 2015, the record date for the distribution. Subject to the satisfaction of the conditions to the distribution, the distribution of PayPal common stock is expected to occur on July 17, 2015. PayPal will not issue fractional shares of its common stock in the distribution. Immediately following the distribution, PayPal will be an independent, publicly traded company and will be listed on the NASDAQ Stock Market under the ticker “PYPL.” eBay will continue to trade on the NASDAQ Stock Market under the ticker “EBAY.”

[image error]eBay core business is a platform business model that makes money from transaction fees happening through its marketplaces (eBay and StubHub). eBay also makes money through advertising on its classifieds marketplace and other services. The company primarily makes money by charging fees on successfully closed transactions.

[image error]PayPal makes money primarily by processing customer transactions on the Payments Platform and from other value-added services. Thus, the revenue streams are divided into transaction revenues based on the volume of activity or total payments volume. And value-added services, such as interest and fees earned on loans and interest receivable. As of 2017 PayPal generated over $13 billion in net revenues and almost $1.8 billion in net income.

[image error]Venmo is a peer-to-peer payments app enabling users to share and make payments with friends for a variety of services. The service is free, but a 3% fee applies to credit cards. Venmo got acquired in 2012 by Braintree, and Braintree got acquired in 2013 by PayPal.

[image error]Venmo got acquired in 2012 by Braintree. Braintree was acquired in 2013 by PayPal. Thus, Venmo is part of the PayPal ecosystem. Venmo is a peer-to-peer payments app that allows users to share and make payments with friends for a variety of services. When you send money using your Venmo balance the fees are wained. Thus the service is free. However, the 3% fee applies to credit cards. That is how the company generates revenues.

Read Also:

How Does PayPal Make MoneyHow Does Venmo Make MoneyWho Owns VenmoeBay Business Model

Read more:

Business ModelsPlatform Business ModelsDigital Business ModelsDistribution ChannelsBusiness StrategyValue PropositionMarketing StrategyBrand BuildingSWOT Analysis

The post Who Owns PayPal? appeared first on FourWeekMBA.

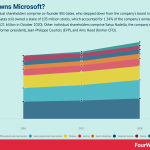

Who Owns Microsoft?

Major individual shareholders comprise co-founder Bill Gates, who stepped down from the company’s board in 2020. As of 2019, Gates still owned a stake of 103 million stocks, which accounted for 1.34% of the company’s ownership (worth over $21 billion in October 2020). Other individual shareholders comprise Satya Nadella, the company’s CEO, Brad Smith (former president), Jean-Philippe Courtois (EVP), and Amy Hood (former CFO).

Microsoft top shareholders

[image error]

[image error]Microsoft major institutional and individual shareholders in 2020, disclosed within its financials (Source: Microsoft Financials).

[image error]Microsoft major institutional and individual shareholders in 2019, disclosed within its financials (Source: Microsoft Financials).

It’s important to notice that in 2020, Bill Gates stepped down from the board of directors. Thus we don’t have anymore an exact disclosing for the company’s stock ownership. Therefore, we can find that for 2019, when Bill Gates still owned a substantial stake in Microsoft, a stake of almost 103 million stocks, worth 1.34% of the company. In October 2020, Microsoft market cap passed 1.6 trillion-dollar, thus making Bill Gates‘ stake potentially worth more than $21 billion.

Over the last decade, Bill Gates has been selling most of Microsoft‘s shares, focusing more and more on his foundation. Therefore, what we see is the left stake of the company’s ownership.

More about Microsoft

[image error]Microsoft’s mission is to empower every person and every organization on the planet to achieve more. With over $110 billion in revenues in 2018, Office Products and Windows are still the main products. Yet the company also operates in Gaming (Xbox), Search Advertising (Bing), Hardware, LinkedIn, Cloud, and more.

[image error]Microsoft has a diversified business model spanning across Office products, Windows, Gaming (Xbox), Search Advertising (Bing), Hardware, LinkedIn, Cloud and more.

[image error]Founded in 1975 by Bill Gates and Paul Allen, Microsoft is a revolutionary company in the world of personal computing. The company designs and manufactures software, hardware, operating systems, apps, and devices. Indeed, Windows and Microsoft Office are staples in billions of homes worldwide.

Read Also:

Microsoft Business ModelMicrosoft SWOT AnalysisMicrosoft Mission Statement

Read More:

Business ModelsPlatform Business ModelsDigital Business ModelsDistribution ChannelsBusiness StrategyValue PropositionMarketing StrategyBrand BuildingSWOT Analysis

The post Who Owns Microsoft? appeared first on FourWeekMBA.

Who Owns Venmo?

PayPal owns Venmo. Indeed, since 2002, PayPal acquired several brands. In 2013, as PayPal bought Braintree, indirectly, it also bought Venmo. In fact, Braintree had acquired Venmo in 2012 for $26.2 million. Therefore, by 2013, Venmo entered into the PayPal family of brads comprising payment solutions like Braintree, Venmo, Xoom, and iZettle products.

[image error]Venmo is a peer-to-peer payments app enabling users to share and make payments with friends for a variety of services. The service is free, but a 3% fee applies to credit cards. Venmo got acquired in 2012 by Braintree, and Braintree got acquired in 2013 by PayPal.

[image error]Venmo got acquired in 2012 by Braintree. Braintree was acquired in 2013 by PayPal. Thus, Venmo is part of the PayPal ecosystem.

Venmo is a peer-to-peer payments app that allows users to share and make payments with friends for a variety of services.

When you send money using your Venmo balance the fees are wained. Thus the service is free. However, the 3% fee applies to credit cards. That is how the company generates revenues.

[image error]eBay core business is a platform business model that makes money from transaction fees happening through its marketplaces (eBay and StubHub). eBay also makes money through advertising on its classifieds marketplace and other services. The company primarily makes money by charging fees on successfully closed transactions.

[image error]PayPal makes money primarily by processing customer transactions on the Payments Platform and from other value-added services. Thus, the revenues streams are divided into transaction revenues based on the volume of activity or total payments volume. And value-added services, such as interest and fees earned on loans and interest receivable. As of 2017 PayPal generated over $13 billion in net revenues and almost $1.8 billion in net income.

Read Also:

How Does PayPal Make MoneyHow Does Venmo Make MoneyeBay Business Model

Read more:

Business ModelsPlatform Business ModelsDigital Business ModelsDistribution ChannelsBusiness StrategyValue PropositionMarketing StrategyBrand BuildingSWOT Analysis

The post Who Owns Venmo? appeared first on FourWeekMBA.

October 22, 2020

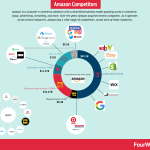

Amazon Competitors

Amazon is a consumer e-commerce platform with a diversified business model spanning across e-commerce, cloud, advertising, streaming, and more. Over the years, Amazon acquired several companies. As it operates across several industries, Amazon has a wide range of competitors across each of those industries. For instance, Amazon E-commerce competes with Shopify, Wix, Google, Etsy, eBay, BigCommerce.

How to analyze a company with tentacles across many industries

Analyzing a company can be done from several perspectives. For a diversified business model, like Amazon, things can get even more complicated. Indeed, over the years, Amazon started with a simple use case (books), and it expanded in all directions on online commerce. At the same time, over the years, Amazon also bought several companies,

[image error]Amazon is a consumer e-commerce platform with a diversified business model spanning across e-commerce, cloud, advertising, streaming, and more. Over the years Amazon acquired several companies. Among its 12 subsidiaries, Amazon has AbeBooks.com, Audible, CamiXology, Fabric.com, IMDb, PillPack, Shopbop, Souq.com, Twitch, Whole Foods Market, Woot! and Zappos.

Amazon expanded in several verticals, and for each vertical we can identify different competitors:

E-commerce (Amazon.com): Shopify, Wix, Google, Etsy, eBay, BigCommerce.Physical retail (Whole Foods): Target, Walmart, BestBuy, The Home Depot, Costco, Walgreens, Kroger, Trader Joe’s. Last-mile delivery: Flipkart, Instacart, Doordash. Streaming (Prime): Netflix, Spotify, YouTube (Google), Disney+, Hulu, HBO. Cloud (Amazon AWS): Microsoft, Google, IBM.Digital advertising: Google, YouTube, Facebook (Instagram), Bing (Microsoft), Twitter, Pinterest.

We could expand farther the analysis, if we were to zoom further from the perspective of all the Amazon‘s subsidiaries.

More on Amazon

[image error]Amazon has a diversified business model. Amazon’s primary revenue streams comprise its e-commerce platform, made of Amazon labeled products and Amazon third-party stores. In addition to that, Amazon makes money via third-party seller services (like fulfilled by Amazon), advertising on its platform, AWS cloud platform, and Prime membership.

[image error]Amazon has a diversified business model. In 2018 Amazon posted over $232 billion in revenues and over $10 billion in net profits. Online stores contributed to nearly 52% of Amazon revenues, followed by Physical Stores, Third-party Seller Services, Amazon AWS, Subscription Services, and Advertising revenues.

[image error]Amazon is among the most diversified business model in the tech industry. The company is well-positioned to dominate e-commerce further. And while its online stores have tight profit margins, Amazon still unlocks cash for growth, while consolidating its dominance in the cloud and grabbing new opportunities like voice.

[image error]Amazon future success is influenced by Political (new regulations and potential breakups of the company), Economic (new global economic dynamics influencing e-commerce adoption), Social (changing consumer behavior at a global level), Technological (new technological challenges, like last-mile delivery at scale), Environmental (enabling sustainable operations), and Legal (compliance with international laws).

More about Amazon:

Amazon Business ModelAmazon SWOT AnalysisAmazon SubsidiariesWho Owns AmazonWhat Is the Receivables Turnover Ratio?Amazon Case StudyWhat Is Cash Conversion Cycle?Amazon FlywheelAmazon Value PropositionsWhy Amazon Is Doubling Down On AWSThe Economics Of The Amazon Seller Business In A NutshellHow Much Is Amazon Advertising Business Worth?What Is the Cost per First Stream Metric?Jeff Bezos Teaches You When Judgment Is Better Than Math And DataAlibaba vs. Amazon Compared in a Single InfographicAmazon Mission Statement and Vision Statement In A Nutshell

Read More:

Business ModelsPlatform Business ModelsDigital Business ModelsDistribution ChannelsBusiness StrategyValue PropositionMarketing StrategyBrand BuildingSWOT Analysis

The post Amazon Competitors appeared first on FourWeekMBA.

October 21, 2020

Tesla Q3 2020

Tesla Core Technology moves around three pillars (Autopilot & full self-driving, vehicle software, and battery & powertrain). Tesla has opened several factories where it will be producing at scale its models; some of those factories are already producing Tesla’s models, while others are in construction or development. Tesla’s automotive revenues were $7.6 billion in Q3 and $331 million in net profits.

[image error]Tesla Core Technology moves around three pillars (Autopilot & full self driving, vehicle software and battery & powertrain) – Source: Tesla Q3.

[image error]Tesla has opened several factories where it will be producing at scale its models, some of those factories are already producing Tesla’s models, while others are in construction or development (Source: Tesla Q3).

[image error]In Q3-2020 Tesla produced 16,992 Model 5/X and 128,044 Model 3/Y, while it delivered 15,275 Model 5/X and 124,318 Model 3/Y – (Source: Tesla Q3).

[image error]Tesla’s automotive revenues were $7.6 billion in Q3 and $331 million in net profits – (Source: Tesla Q3).

Read Also: Tesla Business Model, Tesla SWOT Analysis, Transitional Business Models, Tesla Mission And Vision, Who Owns Tesla.

Read More:

Business ModelsPlatform Business ModelsDigital Business ModelsDistribution ChannelsBusiness StrategyValue PropositionMarketing StrategyBrand BuildingSWOT Analysis

The post Tesla Q3 2020 appeared first on FourWeekMBA.

Amazon Subsidiaries

Amazon is a consumer e-commerce platform with a diversified business model spanning across e-commerce, cloud, advertising, streaming, and more. Over the years Amazon acquired several companies. Among its 12 subsidiaries, Amazon has AbeBooks.com, Audible, CamiXology, Fabric.com, IMDb, PillPack, Shopbop, Souq.com, Twitch, Whole Foods Market, Woot! and Zappos.

[image error]Amazon has a diversified business model. Amazon’s primary revenue streams comprise its e-commerce platform, made of Amazon labeled products and Amazon third-party stores. In addition to that, Amazon makes money via third-party seller services (like fulfilled by Amazon), advertising on its platform, AWS cloud platform, and Prime membership.

[image error]Amazon has a diversified business model. In 2018 Amazon posted over $232 billion in revenues and over $10 billion in net profits. Online stores contributed to nearly 52% of Amazon revenues, followed by Physical Stores, Third-party Seller Services, Amazon AWS, Subscription Services, and Advertising revenues.

[image error]A company like Amazon has multiple value propositions, as it serves several target customers in different markets. With its mission “to be Earth’s most customer-centric company, where customers can find and discover anything they might want to buy online and endeavors to offer its customers the lowest possible prices,” Amazon value propositions range from “Easy to read on the go” for a device like Kindle, to “Sell better, sell more” to its marketplace.

[image error]The cash conversion cycle (CCC) is a metric that shows how long it takes for an organization to convert its resources into cash. In short, this metric shows how many days it takes to sell an item, get paid, and pay suppliers. When the CCC is negative, it means a company is generating short-term liquidity.

[image error]Amazon mission statement is to “serve consumers through online and physical stores and focus on selection, price, and convenience.” Amazon vision statement is “to be Earth’s most customer-centric company, where customers can find and discover anything they might want to buy online, and endeavors to offer its customers the lowest possible prices.”

[image error]The Amazon Flywheel or Amazon Virtuous Cycle is a strategy that leverages on customer experience to drive traffic to the platform and third-party sellers. That improves the selections of goods, and Amazon further improves its cost structure so it can decrease prices which spins the flywheel.

More about Amazon:

Amazon Business ModelWhat Is the Receivables Turnover Ratio? How Amazon Receivables Management Helps Its Explosive GrowthAmazon Case Study: Why from Product to Subscription You Need to “Swallow the Fish”What Is Cash Conversion Cycle? Amazon Cash Machine Business Model ExplainedWhy Is AWS so Important for Amazon Future Business Growth?Amazon Flywheel: Amazon Virtuous Cycle In A NutshellAmazon Value Proposition In A NutshellWhy Amazon Is Doubling Down On AWSThe Economics Of The Amazon Seller Business In A NutshellHow Much Is Amazon Advertising Business Worth?What Is the Cost per First Stream Metric? Amazon Prime Video Revenue Model ExplainedJeff Bezos Teaches You When Judgment Is Better Than Math And DataAlibaba vs. Amazon Compared in a Single InfographicAmazon Mission Statement and Vision Statement In A Nutshell

Read More:

Business ModelsPlatform Business ModelsDigital Business ModelsDistribution ChannelsBusiness StrategyValue PropositionMarketing StrategyBrand BuildingSWOT Analysis

The post Amazon Subsidiaries appeared first on FourWeekMBA.

Who Owns Volkswagen?

The major shareholder for Volkswagen is Porsche Automobil Holding SE, a company investing in various automakers. This is the holding of the Porsche family, who is the primary shareholder of Volkswagen, with a 31.3% ownership stake in the company and a 53.1% voting power. Volkswagen is an automaker empire with brands that comprise Audi, Skoda, Seat, Lamborghini, Bugatti, Porsche, Bentley, and Ducati.

[image error]Percentage of ownership of Volkswagen (Source: Volkswagen).

[image error]Percentage of voting power for Volkswagen’s stocks (Source: Volkswagen).

[image error]The family of brands part of the Volkswagen family (Source: Volkswagen).

[image error]The cars sold by Volkswagen in 2019 and 2018 (from left to right) – (Source: Volkswagen).

[image error]Revenue breakdown of Volkswagen’s business segments (Source: Volkswagen).

Read Also: Who Owns Bugatti, Who Owns Tesla, Tesla Business Model, Tesla SWOT Analysis, Transitional Business Models, Tesla Mission And Vision.

Read More:

Business ModelsPlatform Business ModelsDigital Business ModelsDistribution ChannelsBusiness StrategyValue PropositionMarketing StrategyBrand BuildingSWOT Analysis

The post Who Owns Volkswagen? appeared first on FourWeekMBA.

Who Owns Bugatti?

The iconic brand Bugatti, founded by Ettore Bugatti in 1909, is now owned by the German’s Volkswagen, one of the world’s largest automakers. Other brands in the Volkswagen family comprise Audi, Skoda, Seat, Lamborghini, Porsche, Bentley, and Ducati. As a high-performance car maker, Bugatti only sells a limited number of cars each year. Indeed, in 2019, Volkswagen sold 82 Bugatti, compared to 76 Bugatti in 2018.

Inside the Volkswagen’s family of brands

[image error]The brands part of the Volkswagen’s family (Source: Volkswagen).

[image error]

The number of cars sold by Volkswagen in 2019 (left column) and 2018 (central column). To gain a bit of context, Volkswagen’s passenger cars, the most affordable sold over six million cars across the world. Where Bugatti only sold 82 cars in 2019. Like a high-performance car maker, Bugatti only sold 82 cars in 2019 (Source of Financials: Volkswagen).

[image error]Most of Volkswagen sales come from Europe/other markets and Asia-Pacific.

[image error]The breakdown of sales for each Volkswagen’s business segment (Data Source: Volkswagen).

Read Also: Tesla Business Model, Tesla SWOT Analysis, Transitional Business Models, Tesla Mission And Vision.

Read More:

Business ModelsPlatform Business ModelsDigital Business ModelsDistribution ChannelsBusiness StrategyValue PropositionMarketing StrategyBrand BuildingSWOT Analysis

The post Who Owns Bugatti? appeared first on FourWeekMBA.

October 20, 2020

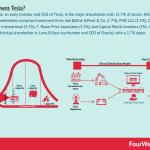

Who Owns Tesla?

Elon Musk, an early investor and CEO of Tesla, is the major shareholder with 21.7% of stocks. Other major shareholders comprise investment firms like Baillie Gifford & Co. (7.7%), FMR LLC (5.3%), Capital Ventures International (5.2%), T. Rowe Price Associates (5.2%), and Capital World Investors (5%). Another major individual shareholder is Larry Ellison (co-founder and CEO of Oracle), with a 1.7% stake.

Tesla major shareholders and business model

[image error]Tesla Major Shareholders (Source: Tesla Financials).

[image error]Tesla is vertically integrated. Therefore, the company runs and operates the Tesla’s plants where cars are manufactured and the Gigafactory which produces the battery packs and stationary storage systems for its electric vehicles, which are sold via direct channels like the Tesla online store and the Tesla physical stores.

[image error]Tesla made over $24.5 billion in revenues, and it lost $69 million from operations, while its net losses were $862 million. In Q4 2019, Tesla turned a profit for the first time. And its main market is still the US.

[image error]Among the most recognized car manufacturers, Tesla is valued more than the combined market capitalization of GM and Ford. While the company’s direct distribution is a strength, its lack of financial viability is a weakness. Competition is a future threat. However, if Tesla defines a new market for car manufacturing its potential growth will be massive.

[image error]Tesla’s vision is to “create the most compelling car company of the 21st century by driving the world’s transition to electric vehicles,” while its mission is “to accelerate the advent of sustainable transport by bringing compelling mass-market electric cars to market as soon as possible.” Tesla used a transitional business model as its ecosystem grows.

[image error]

[image error]

[image error]

Read Also: Tesla Business Model, Tesla SWOT Analysis, Transitional Business Models, Tesla Mission And Vision.

Read More:

Business ModelsPlatform Business ModelsDigital Business ModelsDistribution ChannelsBusiness StrategyValue PropositionMarketing StrategyBrand BuildingSWOT Analysis

The post Who Owns Tesla? appeared first on FourWeekMBA.