J. Bradford DeLong's Blog, page 2134

December 18, 2010

Time to Think About the Stability of Web Services...

Google may come to rule the world because it is the only web services company large enough to be able to commit to keeping all of its web services up and operating for the foreseeable future. That is a powerful competitive advantage.

John Gruber:

Daring Fireball: What’s Next for Delicious?: The actual [del.icio.us] blog is slammed, so here it is from Google’s cache:

Is Delicious being shut down? And should I be worried about my data?

No, we are not shutting down Delicious. While we have determined that there is not a strategic fit at Yahoo!, we believe there is a ideal home for Delicious outside of the company where it can be resourced to the level where it can be competitive.

What is Yahoo! going to do with Delicious?

We’re actively thinking about the future of Delicious and we believe there is a home outside the company that would make more sense for the service and our users. We’re in the process of exploring a variety of options and talking to companies right now. And we’ll share our plans with you as soon as we can.

Note that Yahoo does not dispute that the entire Delicious team has been fired, though.

What kind of sense does this make? We’d like to sell the service, find it a new home, and to help, we’ve fired the entire product team, effective immediately.

Does Living in Southern California Rot Your Brain?

Xeni Jardin:

(1) Twitter / Home: @xenijardin: Angelenos do get dumb in rain. “@LAFD: Twitter is NOT a tool for requesting emergency help in LA. Residents needing emergency help call 911

James Kwak on the "Obama Renaissance"

From the Baseline Scenario:

The Obama Renaissance « The Baseline Scenario: President Obama is enjoying something of a political resurgence... among the commentariat. Ezra Klein points out that his approval ratings remain higher than those of his Congressional opposition, as opposed to Clinton in 1994 and Bush in 2006.... Obama is certainly in a decent position politically, and I would bet on him to be reelected comfortably in 2012. First off, his opponents in Congress are deeply irresponsible... and face a huge political problem within their own party: a significant portion of the conservative base really does want lower deficits, yet the only thing the Republican caucus knows how to do is cut taxes.... Obama is likely to face an opponent who has been pulled dangerously close to the lunatic fringe during the primary....

Bai basically parrots the Obama administration’s line: they did the tax cut deal because it was good policy, it would stimulate the economy, and they got a good deal... it’s good governance.... I think the Obama team may actually believe that, because their idea of good policy was centrist to begin with.

Did you notice that their key talking point on the tax cut issue was about not raising middle-class taxes in the middle of a recession? Well, this conveniently overlooks... that the administration wanted to make the "middle-class tax cuts" permanent.... Obama’s preferred policy — killing the tax cuts on the super-rich (over $250,000) and keeping them for the upper-middle class and the moderately rich — is... regressive... increases the pressure to cut Social Security and Medicare....

So no, I don’t think Obama is abandoning his principles for political advantage; I think these are his principles.... I’m upset at him for being wrong on the policy level.... I always thought Obama was a moderate who looked like a progressive.... [A]s Nate Silver said, “what Obama has wound up with is an unpopular, liberal sheen on a relatively centrist agenda.” What’s happening now, if his good run continues, is he is shedding the liberal sheen and getting a centrist sheen on a centrist agenda. And politically, that’s all good for him. Combine that with his obvious political skills, and the future looks bright for him.

Unfortunately, the future does not look very bright for the country. Obama was supposed to be educable--to respond to empirical evidence about how, say, the economy needs more demand right now and not for the government to "tighten its belt," and about how, say, imprisoning and torturing goatherds sold to us by their clan enemies makes us less and not more secure because they all have relatives.

My fear right now is that Obama genuinely does not understand the arithmetic of the budget--that he is willing to endorse the Simpson-Bowles 21% of GDP maximum size of the government because he does not understand that that means the repeal of both his health care reform and of Medicare...

Barkley Rosser on This Year's Winners: "Douglas Holtz-Eakin Falls Into Lunatic Panderin"g

Barkley:

EconoSpeak: Douglas Holtz-Eakin Falls Into Lunatic Pandering: Once upon a time Douglas Holtz-Eakin was a reasonable professional economist, if of a conservative bent and clearly associated with the Republican Party.... [N]ow Douglas Holtz-Eakin has fallen into lunatic pandering, I can only guess in the hopes of becoming an adviser to Sarah Palin or some other future GOP prez nominee who is equally out to lunch on economic matters. Accounts are given on Mark Thoma at http://economistsview.typepad.com/economistsview/2010/12/words-will-never-hurt-us-or-our-cronies-if-we-dont-allow-them-to-be-used.html a few days ago and today by Paul Krugman at http://www.nytimes.com/2010/12/17/opinion/opinion/17krugman.html?_r=1.

As one of the four GOP members of the financial crisis commission he has joined with the others in voting to refuse to allow the words/phrases "Wall Street" or "shadow banking" or "interconnection" or "deregulation" to appear in its final report.... DH-E and company have absconded to issue their own report that blames it all on Fannie Mae and Freddie Mac, along with the 1977 Community Reinvestment Act. As Krugman points out, the F's did not even get into buying subprime mortgages until 2004 and other countries without them or the CRA have had worse housing bubbles than has the US. This is just fantasyland stuff that is only taken seriously by, well, Fox News and the Tea Party crowd..

Joe Nocera on the Winners of This Year's "Stupidest Economist Alive" Contest--Wallison, Hennessy, Holtz-Eakin, and Thomas

Nocera:

Republican Financial Crisis Report Repeats Party Dogma - NYTimes.com: [T]he commission’s Republican members having now issued this public, partisan smoke signal, the final product, no matter how rigorous, will be inevitably dismissed as a Democratic document.... To fix a problem, though, it helps to know what the problem is. The F.C.I.C., with all those witnesses and documents, could have really helped here. But the paper released by the commission’s Republicans this week reads as if they couldn’t be bothered. It simply reiterates longstanding Republican dogma that could have been written without a $6 million investigation....

The problem the Republicans want to fix is the two government-sponsored entities, Fannie Mae and Freddie Mac. Without question, Fannie and Freddie need fixing.... [Wallison's] precrisis prognosis of Fannie and Freddie’s ills was wrong in a number of key ways. Like most Fannie and Freddie critics at the time, he believed the risk they posed was interest-rate risk, rather than credit risk.... He also argued that Fannie and Freddie were consistently ignoring their mission to help make affordable housing available to Americans. As he wrote in 2004, “Study after study have shown that Fannie Mae and Freddie Mac, despite full-throated claims about trillion-dollar commitments and the like, have failed to lead the private market in assisting the development and financing of affordable housing.” After the crisis, his tune changed considerably — as did that of many other Republicans, who tended to follow his intellectual lead on this issue. Now, he said, it was government policy aimed at increasing homeown....

The Republican document issued earlier this week did little more than regurgitate this theory of the case. “Subsidizing mortgages through the G.S.E.’s was a particularly expedient way to increase the homeownership rate,” they write at one point. At the same time, they tread lightly over the culpability of other nongovernmental culprits.... The only problem with Mr. Wallison’s theory is that it’s not, as they say, reality-based. Anyone who has looked at the role of Fannie and Freddie will discover they spent most of the housing bubble avoiding subprime loans, because those loans didn’t meet their underwriting standards.... When Fannie and Freddie finally did get into the business, it was very late in the game. But the motivation wasn’t pressure from the government; it was pressure from the marketplace....

What is most troubling is that the Republicans are going to try to create new policy based on Mr. Wallison’s analysis....

I’m all for reforming Fannie and Freddie. Who isn’t? But at this stage of the game, you can’t reform the G.S.E.’s without reforming the private market too. That may not be where the Republicans’ theory of the case takes them. But it happens to be true.

We Really Would Be Better Off without the Republican Party

Yet another example of why there is something morally wrong with anybody who votes for Republican politicians.

Ezra Klein:

Republicans embrace ObamaCare, call it Ryan-Rivlin: If you're looking for a description of the Ryan/Rivlin Medicare reforms... Ryan-Rivlin plan basically turns Medicare into Obamacare. And in that context, Republicans love the idea behind ObamaCare and think it'll save lots of money.... [T]he current Medicare program is completely dissolved and replaced by a new Medicare program that "would provide a payment – based on what the average annual per-capita expenditure is in 2021 – to purchase health insurance." You'd get the health insurance from a "Medicare Exchange", and "health plans which choose to participate in the Medicare Exchange must agree to offer insurance to all Medicare beneficiaries, thereby preventing cherry picking and ensuring that Medicare’s sickest and highest cost beneficiaries receive coverage." Sound familiar?...

I don't know that accusations of hypocrisy are really worth making in American politics, but consider the way this policy and its rationale interacts with the case against ObamaCare. Right now, Medicare is much cheaper than private insurance. If you think that moving Medicare to a model of private insurance sold on exchanges will make it even cheaper, what you're saying is that an ObamaCare model will not only be cheaper than the current private-insurance system, but cheaper than the even-cheaper Medicare system. If you believe this logic, the Affordable Care Act is a great bill that will save much more money than CBO currently assumes. And yet this is the reform package that's gaining adherents among the group of people who want to repeal the Affordable Care Act and think it a monstrous and unconstitutional piece of legislation with no redeeming features worth mentioning.

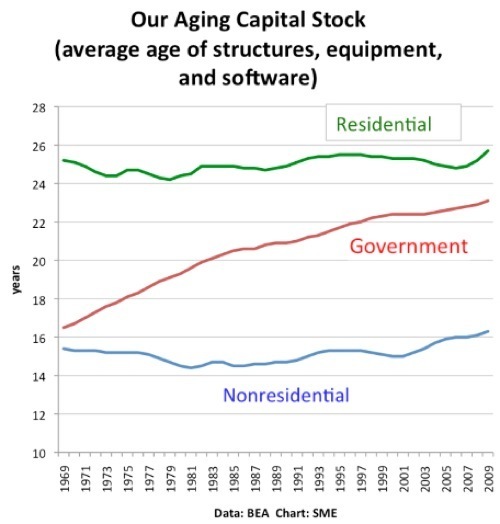

Paul Krugman Sends Us to Michael Mandel's Capital Age Chart

Paul Krugman:

Build We Won't - NYTimes.com: It’s been obvious for a while that America, once the nation of heroic infrastructure, has become the place that can’t build stuff — the place whose greatest city continues to rely on a century-old tunnel under the Hudson, and can’t muster the political will to build another. What I didn’t realize is that failure to build applies to small-scale projects too. Michael Mandel says, “If things feel more decrepit and worn-out these days, it’s because they are. And he has a chart:

Time for a big long-run public infrastructure initiative...

December 17, 2010

Jay Alan of the California Office of Emergency Services Tries to Speak Metaphorically, and Fails

Kelly Zito:

Blustery storms heading to Northern California: the federal weather agency is holding regular briefings with state and local authorities to plan for any major snafus.

"These storms are on our radar," said Jay Alan, spokesman for the California Office of Emergency Services. "When the weather folks say we might have significant storms like this, we pay attention."

The problem with Jay's statement is that these storms really are on our radar.

Here they are, on our radar:

More on the Four Stupidest Economists Alive of 2010: Thomas, Hennessy, Holtz-Eakin, and Wallison

Richard Green tells us to look at Peter Wallison vs. Peter Wallison. Perter Wallison says that the GSEs ought to have been lending a lot more to the relatively high-risk low- and moderate-income homebuyers of America. By contrast, Peter Wallison says that the origin of the financial crisis was the government's unconscionable use of the GSEs as instruments of social policy to make lower-quality loans to high-risk low- and moderate-income homebuyers.

Peter Wallison, 2006:

The GSEs are not doing the job they should for low-income homebuyers: [T]he GSEs’ record in providing assistance for homebuyers of low and moderate income has not been good. The Department of Housing and Urban Development has long had regulations intended to focus Fannie and Freddie on low-income or affordable housing. HUD secretaries have set goals, but these have had little effect in helping ensure the GSEs meet the housing needs of the underserved.... [T]he GSEs were doing less than conventional lenders in helping the underserved.... Fannie and Freddie should do a much better job of providing affordable home financing to a neglected portion of the mortgage market...

Peter Wallision, 2010:

Primr: Government... was following a social policy in addition to an investment policy.... [D]uring the bubble’s expansion, the largest investors in the mortgage market, the government-sponsored enterprises (GSEs)—Fannie Mae and Freddie Mac—were instruments of U.S. government housing policy.... Subsidizing mortgages through the GSEs was a particularly politically expedient way to increase the homeownership rate.... During the inflation of the housing bubble, the GSEs lowered their standards and began investing in subprime and Alt-A mortgages... guaranteeing ever-riskier loans... MBS backed by subprime and Alt-A mortgages.... [T]he government supported the financing of high-risk mortgages... subsidized and, in some cases, mandated the extension of credit to high-risk borrowers, propagating risks for financial firms, the mortgage market, taxpayers, and ultimately the financial system...

Are All European Policymakers Insane?

Matthew Yglesias:

Yglesias » The Latvian Catastrophe: Klaus Regling, chief executive of the European Financial Stability Facility, wants you to know that monetary union without fiscal integration is workable after all and he offers, as an example, Latvia:

Latvia which has a currency pegged to the euro, testifies to the success of this policy. Contrary to commentators who predicted disaster for Latvia early last year unless it gave up its hard peg – in line with advice from the commission – it did not devalue its exchange rate. A real effective devaluation was achieved through severe cuts in nominal income. Today its economy is growing again. Those outside “experts”, who always seem to know what is good for Europe, should take note.

So to be clear about this, the Latvian economy suffered a 4.2 percent contraction in 2008. By way of comparison, in the horrible year of 2009 the US economy contracted 2.44 percent. So that was a very bad recession, much worse than the American recession. At this point, so called “outside ‘experts’” predicted disaster for Latvia in early 2009 unless it devalued its exchange rate. Latvia declined to devalue and its GDP shrunk 18 percent! That’s the disaster right there. Overall GDP growth for 2010 is forecast to be slightly negative again. So, yes, Latvia has returned the growth. But the toll was terrifyingly high.

As ever, there were some “real” shocks involved in this. Some loss in Latvian living standards was inevitable and unavoidable. But the unemployment rate in Latvia is nearly 20 percent. That means a great many able-bodied adults are simply not working, not producing any goods and services for market consumption. That represents a vast loss of living standards that could have been largely avoided in a floating exchange rate regime.

To suggest that this is some kind of success story that illustrates the underlying workability of the system is horrifying.

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers