J. Bradford DeLong's Blog, page 2118

January 19, 2011

Econ 210a: January 19. Introduction, and the Malthusian Economy (DeLong)

Econ 210a: Memo Question for January 26, 2011

"The treasure captured outside Europe by undisguised looting, enslavement and murder, floated back to the mother-country and were there turned into capital."

-- Marx, Capital, Vol. 1 Ch. 32.

Do the other assigned readings for January 26 provide any basis for assessing the general truth of this passage from Marx? In what sense did colonial trade in the 1497-1800 period contribute to capital formation in Europe?

January 26. The Commercial Revolution (deVries)

Daron Acemoglu, Simon Johnson, and James Robinson (2005), "The Rise of Europe: Atlantic Trade, Institutional Change, and Economic Growth," American Economic Review 95, pp. 546-79.

Karl Marx (1867), "The So-called Primitive Capital Accumulation," Capital, Vol. 1, Part VIII, Primitive Accumulation, chapters 26-32. http://tinyurl.com/dl20090112k

Jan de Vries, "The Limits to Globalization in the Early Modern World," Economic History Review 63 (2010), pp. 710-33.

Jeffrey Williamson and Kevin O'Rourke (2002), "After Columbus: Explaining the Global Trade Boom 1500-1800," Journal of Economic History 62:2, pp. 417-56. http://www.jstor.org/stable/2698186

Ralph Austen and Woodruff Smith (1990), "Private Tooth Decay as Public Economic Virtue: The Slave-Sugar Triangle, Consumerism, and European Industrialization," Social Science History 14:1, pp. 95-115. http://www.jstor.org/stable/1171366

Opinions on Shape of Earth Differ

Jay Ackroyd points out that for the New York Times it is no longer defining "balanced" as halfway between the Republicans and the Democrats, but halfway between the Republicans and CBO:

Eschaton: Non-partisan: So now "balance" in the New York Times is between the GOP and the CBO.

Why oh why can't we have a better press corps?

Republicans Burning Down the Policy Village

Ezra Klein:

Ezra Klein: The Congressional Budget Office... provide[s] politically independent, fairly cautious estimates and explanations of legislation so that when we debate, we can at least work off the same basic set of... educated guesses. They've safeguarded this reputation quite effectively over the years, repeatedly disappointing Republicans and Democrats alike.... Democrats were pretty angry at the CBO in 2009, too, as the scorekeeper refused to give them credit for delivery-system reforms and technological improvements that they -- and many health-care experts -- believed would save the system a lot of money. That meant Democrats had to include blunter, surer financing mechanisms, like Medicare cuts and taxes. They may not have agreed with the CBO's estimate, but they recognized it as a legitimate and credible guess, and responded.

But the Republicans have refused to play by those rules. They have claimed, as Doug Holtz-Eakin, Joseph Antos and James Capretta do in today's Wall Street Journal, that the CBO's work is now the product of "budget gimmicks, deceptive accounting, and implausible assumptions used to create the false impression of fiscal discipline." They have created a separate world for themselves... where there are no accepted estimates except the ones they choose to accept (notably, they regularly mention the CBO results that they think help their case), where there is no neutral arbiter... where policy debate is not really possible.

It doesn't take long for the bad-faith arguments underlying the case against the CBO to present themselves. Holtz-Eakin, Antos and Capretta mockingly wonder how "the ACA magically convert[s] $1 trillion in new spending into painless deficit reduction," knowing full well that the deficit reduction isn't painless at all: It's more than $500 billion in Medicare cuts that Republicans used to slaughter Democrats in the midterm election, and it's a tax on expensive health-care plans that almost drove unions out of the Democratic coalition on the bill.

They say that the Medicare cuts -- which are smaller than the cuts we successfully made to Medicare in the 1990s -- can't possibly be sustainable, but they know full well -- and admit in the op-ed -- that Medicare requires cuts that are many orders of magnitude larger over the coming decades. And notice how this argument, that these cuts are implausible, conflicts with another common conservative argument, that these cuts represented the "low-hanging fruit" that should've been saved for a future deficit-reduction bill.

And then there are the straightforwardly wrong and dishonest arguments that get tossed around: that the costs of fixing a disastrous Medicare reform that Republicans passed in 1997 should be attached to the Democrats' health-care reforms in 2010. That the $115 billion of discretionary spending that is either already in the budget or won't be appropriated without further action from Congress has been unfairly left out of the bill. That the CBO is "double-counting" Medicare savings, when it's doing nothing of the kind (something even Rep. Paul Ryan admits).

You could spend all day knocking these arguments around. Trust me: I've done it. But the point isn't the arguments themselves, but their cumulative effect. If you're a conservative and you consume conservative media, you now live in a world where it's simultaneously preposterous to believe that the health-care law saves money and commonly asserted that it cuts Medicare to the bone and raises taxes all across the country. You live in a world so different from the one that Democrats share with the CBO that no argument is really possible. Democrats say the bill reduces the deficit. Republicans say that the bill explodes the deficit. And when the scorekeeper tries to intervene, Republicans take aim at the scorekeeper...

Back to Disagreeing with Scott Sumner...

Scott Sumner:

TheMoneyIllusion » On or about December 1978, the world’s ideology changed: We all know about dates that historians consider turning points in history; 1914, 1789, etc. I’d like to add 1978 to the list. Maybe it’s just because I was a young adult in 1978. Things seem very important when we are young. (Do NOT ever talk to a baby-boomer about 60s pop music.)It seems like almost everything that crosses my desk reminds me of 1978.... This quotation from Joan Robinson did not seem insane in 1977. From the Economist:

Before the last Korean war in 1950, the North was home to most of the country’s heavy industry. As late as 1975, its income per head still exceeded the South’s, according to Eui-Gak Hwang of Korea University in Seoul. “Obviously, sooner or later the country must be reunited,” wrote Joan Robinson, a Cambridge economist, in 1977, “by absorbing the South into socialism.”

Within about 5 years a comment like that would have seemed far-fetched, and today it would seem completely loony. I’m not saying I necessarily would have agreed with her in 1977, but North and South Korea were about equally developed at that time. North Vietnam had just taking over the South. No communist country had ever gone non-communist. And even non-communist countries seemed to be getting more statist every day...

Let me just say that I remember reading that in 1977--and it sounded loony to me back then.

Really existing socialism (a) killed an awful lot of people, (b) erased the possibility of an awful lot of freedoms for an awful lot of people, and (c) could not attain the economic allocative efficiency of the market economies.

There was in 1977 an argument that really-existing socialist economies would wind up with higher levels of measured GDP per capita--precisely because they starved their people of good things they could invest more, create a more capital intensive economy, and that capital intensity would offset allocative efficiency. I remember being taught in Ec 10 by Rick Ericson in 1978 that that argument was a very weak one.

And North Korea added to the defects of really existing socialism those of theocracy and of absolutist heriditary monarchy.

So Scott is wrong: the idea that the absorption of South Korea by North Korea would be a good thing was loony in 1977--albeit not as loony as it was to be by 1982.

Assessing Structural Unemployment

The usually-reliable David Leonhardt gets it wrong, I think, when he writes:

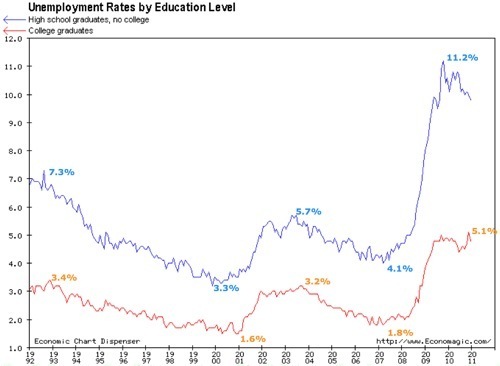

Arguing Over the Jobs Slump: I agree that structural unemployment is a major problem. You can see it in the fact that the unemployment rate for less educated workers has risen much more than for more educated workers...

But unemployment always rises more for less educated workers in recessions and falls by more in booms:

More educated workers have bigger and better job-search networks, and the same things that made them more educated also make them make better use of their networks. When the labor market goes south, the consequences are much worse for those for whom the system does not work terribly well in normal times. But that doesn't mean that any significant component of unemployment is "structural."

Unemployment is "structural" when attempts to boost spending boost not employment but rather prices because the products where demand increases are not products that can be made by hiring the currently-unemployed. You see structural unemployment when there are significant groups of businesses and industries that are frantically raising wages in an attempt to attract more qualified workers while wages in the economy as a whole are stagnant.

We don't see any of that.

There is no date currently showing that structural unemployment unamenable to cure by spending stimulus is any significant part of our current problem. (Of course, we will if unemployment stays near 10% for very much longer: cyclical unemployment turns into structural unemployment.)

As Scott Sumner writes:

January 2006 — housing starts = 2.303 million, unemployment = 4.7%

April 2008 — housing starts = 1.008 million, unemployment = 4.9%

October 2009 — housing starts = 527,000, unemployment = 10.1%

[H]ousing starts fall by 1.3 million over 27 months [from 1/2006 to 4/2008], and unemployment hardly changes. Looks like those construction workers found other jobs, which is what is supposed to happen if the Fed keeps NGDP growing at a slow but steady rate. Then NGDP plummeted [from 4/2008 to 10/2009], and housing fell another 480,000.... [T]he huge run-up in unemployment did not occur when the big fall in housing construction occurred, but much later, when output in manufacturing and services also plummeted.

January 18, 2011

Progressive Taxes to Pay for Sewers Are Immoral...

Paul Krugman:

Stuff Happens: Stuff Happens

Joe Romm has some fun with the Texas Attorney General, who declares himself opposed to regulation of CO2 on the grounds that

It is almost the height of insanity of bureaucracy to have the EPA regulating something that is emitted by all living things.

As Joe points out, this argument says that we should adopt an equally laissez-faire attitude toward sewage.

But hey, there was a time when conservatives did, in fact, argue for doing nothing about effluent of any kind. In the years leading up to the Great Stink of 1858, which finally got the British to build a London sewer system, The Economist editorialized against any such foolish notion (pdf):

suffering and evil are nature’s admonitions—they cannot be got rid of.

Or, to put it (almost) in the modern vernacular, stuff happens.

And given the way we’re heading — with politicians arguing that the federal government has no right to ban child labor — don’t be surprised to see the anti-sewer movement making a comeback, and to see elected representatives, even if they know better, holding their noses and going along.

Vatican FAIL

Shawn Pogatchnik:

Vatican letter urged Irish bishops not to report sex-abuse cases to police: A newly revealed 1997 letter from the Vatican warned Ireland's Catholic bishops not to report all suspected child-abuse cases to police.... The letter, obtained by Irish broadcasters RTE and provided to The Associated Press, documents the Vatican's rejection of a 1996 Irish church initiative to begin helping police identify pedophile priests following Ireland's first wave of publicly disclosed lawsuits. The letter undermines persistent Vatican claims, particularly when seeking to defend itself in U.S. lawsuits, that the church in Rome never instructed local bishops to withhold evidence or suspicion of crimes from police...

Dublin, 31 January 1997

Strictly confidential

Your Excellency,

The Congregation for the Clery has attentively studied the complex question of sexual abuse of minors by clerics and the document entitled "Child Sexual Abuse: Framework for a Church Response", published by the Irish Catholic Bishops' Advisory Committee.

The Congregation wishes to emphasize the need for this document to conform to the canonical norms presently in force.

The text, however, contains "procedures and dispositions which appear contrary to canonical discipline and which, if applied, could invalidate the acts of the same Bishops who are attempting to put a stop to these problems. If such procedures were to be followed by the Bishops and there were cases of eventual hierarchical recourse lodged at the Holy See, the results could be highly embarrassing and detrimental to those same Diocesan authorities.

In particular, the situation of 'mandatory reporting' gives rise to serious reservations of both a moral and a canonical nature."

Since the policies on sexual abuse in the English speaking world exhibit many of the same characteristics and procedures, the Congregation is involved in a global study of them. At the appropriate time, with the collaboration of the interested Episcopal Conferences and in dialogue with them, the Congregation will not be remiss in establishing some concrete directives with regard to these Policies.

For these reasons and because the abovementioned text is not an official document of the Episcopal Conference but merely a study ocument, I am directed to inform the individual Bishops of Ireland of the preoccupations of the Congregation in its regard, underlining that in the sad cases of accusations of sexual abuse by clerics, the procedures established by the Code of Canon Law must be meticulously followed under pain of invalidity of the acts involved in the priest so punished were to make hierarchical recourse against his Bishop.

Asking you to kindly let me know of the safe receipt of this letter and with the assurance of my cordial regard, I am

Yours sincerely in Christ,

Luciano Storero

Apostolic Nuncio

Paul Krugman: The Road to Economic Crisis Is Paved With Euros

PK:

The Road to Economic Crisis Is Paved With Euros: In Greece the story is straightforward: the government behaved irresponsibly, lied about it and got caught. During the years of easy borrowing, Greece’s conservative government ran up a lot of debt — more than it admitted. When the government changed hands in 2009, the accounting fictions came to light; suddenly it was revealed that Greece had both a much bigger deficit and substantially more debt than anyone had realized. Investors, understandably, took flight.

But Greece is actually an unrepresentative case. Just a few years ago Spain, by far the largest of the crisis economies, was a model European citizen, with a balanced budget and public debt only about half as large, as a percentage of G.D.P., as that of Germany. The same was true for Ireland. So what went wrong?... [A] large direct fiscal hit from the slump... the costs of financial clean-up.... [O]ther nations — in particular, both the United States and Britain — that have been running deficits that, as a percentage of G.D.P., are comparable to the deficits in Spain and Ireland. Yet they haven’t suffered a comparable loss of lender confidence. What is different about the euro countries?

One possible answer is “nothing”: maybe one of these days we’ll wake up and find that the markets are shunning America.... But the real answer is probably... it’s the euro itself that makes Spain and Ireland so vulnerable. For membership in the euro means that these countries have to deflate their way back to competitiveness, with all the pain that implies. The trouble with deflation isn’t just the coordination problem.... Even when countries successfully drive down wages, which is now happening in all the euro-crisis countries, they run into another problem: incomes are falling, but debt is not. As the American economist Irving Fisher pointed out almost 80 years ago, the collision between deflating incomes and unchanged debt can greatly worsen economic downturns....

Some economists, myself included, look at Europe’s woes and have the feeling that we’ve seen this movie before, a decade ago on another continent — specifically, in Argentina.... As I see it, there are four ways the European crisis could play out (and it may play out differently in different countries). Call them toughing it out; debt restructuring; full Argentina; and revived Europeanism.

Toughing it out: Troubled European economies could, conceivably, reassure creditors by showing sufficient willingness to endure pain.... The role models here are the Baltic nations: Estonia, Lithuania and Latvia.... Have these policies been successful?... The Baltic nations have, to some extent, succeeded in reassuring markets.... All of this has, however, come at immense cost.... It says something about the current state of Europe that many officials regard the Baltics as a success story....

Debt restructuring.... I find it hard to see how Greece can avoid a debt restructuring, and Ireland isn’t much better. The real question is whether such restructurings will spread to Spain and — the truly frightening prospect — to Belgium and Italy, which are heavily indebted but have so far managed to avoid a serious crisis of confidence.

Full Argentina: Argentina didn’t simply default on its foreign debt; it also abandoned its link to the dollar, allowing the peso’s value to fall by more than two-thirds. And this devaluation worked: from 2003 onward, Argentina experienced a rapid export-led economic rebound. The European country that has come closest to doing an Argentina is Iceland.... Iceland took advantage of the fact that it had not joined the euro and still had its own currency.... The combination of default and devaluation has helped Iceland limit the damage from its banking disaster. In fact, in terms of employment and output, Iceland has done somewhat better than Ireland and much better than the Baltic nations....

Revived Europeanism: The preceding three scenarios were grim. Is there any hope of an outcome less grim? To the extent that there is, it would have to involve taking further major steps toward that “European federation” Robert Schuman wanted 60 years ago.... [A]s the earlier Ireland-Nevada comparison shows, the United States works as a currency union in large part precisely because it is also a transfer union, in which states that haven’t gone bust support those that have. And it’s hard to see how the euro can work unless Europe finds a way to accomplish something similar. Nobody is yet proposing that Europe move to anything resembling U.S. fiscal integration; the Juncker-Tremonti plan would be at best a small step in that direction. But Europe doesn’t seem ready to take even that modest step....

For now, the plan in Europe is to have everyone tough it out...

IAS 107: 20110118 Lecture: Introduction

Slides: 20110118_107_for_upload.pdf

Audio: 20110118 IAS 107 Lecture-_0

IAS 107: Intermediate Macroeconomics:

U.C. Berkeley: Spring 2011:

Schedule and Readings

J. Bradford DeLong: delong@econ.berkeley.edu: 925 708 0467: W 2-4 Evans 601.

Dariush Zahedi:

Lecture: TuTh 11-12:30 VLSB 2060

Sections: M 2 183 Dwinelle; M 3 251 Dwinelle; W 1 255 Dwinelle; W 4 83 Dwinelle; F 9 106 Wheeler; F 1 247 Dwinelle

REQUIRED MATERIALS: Joe Nocera: All the Devils Are Here. Portfolio ISBN-10: 1591843634.

J.B. DeLong and Martha Olney: Macroeconomics (2nd ed.) McGraw-Hill

ISBN-10: 0072877588.

iClicker ISBN-10: 0716779390.

2010 Economic Report of the President http://www.whitehouse.gov/administration/eop/cea/economic-report-of-the-President

WEBSITE: http://delong.typepad.com/berkeley_econ_101b_spring

SCHEDULE:

Introduction:

Tu Jan 18: The Four Branches of Macroeconomics (read ch. 1: Introduction to Macroeconomics).

Th Jan 20: Keeping Track of the Macroeconomy (read chs. 2 and 3: Measuring the Macroeconomy and Thinking Like an Economist).

Growth Economics:

Tu Jan 25: Economic Growth Overview (read ch. 4: The Theory of Economic Growth).

Th Jan 27: The Industrial Revolution, the Demographic Transition, and the Coming of Modern Economic Growth (read ch. 5: The Reality of Economic Growth) (problem set 1 due).

Tu Feb 01: The Macroeconomics of Development: Convergence and Divergence Across Nations.

Th Feb 03: Spurring the Rate of Technological and Organizational Progress (problem set 2 due).

Depression Economics:

Tu Feb 08: The Great Recession.

Th Feb 10: The Income-Expenditure Model (read chs. 6 and 9: Building Blocks of the Flexible-Price Model and The Income-Expenditure Framework) (problem set 3 due).

Tu Feb 15: IS, LM, and Interest Rate Spreads (read chs. 10 and 11: Investment, Net Exports, and Interest Rates and Extending the Sticky Price Model).

Th Feb 17: Policies to Fight the Great Recession (problem set 4 due).

Tu Feb 22: The Great Recession Outside the United States.

Inflation Economics:

Th Feb 24: Inflation and the Phillips Curve (read chs. 8 and 12: Money, Prices, and Inflation and The Phillips Curve and Expectations (problem set 5 due).

Tu Mar 01: Expected Inflation and the Natural Rate of Unemployment.

Th Mar 3: Monetary Policy Reactions (read ch. 13: Stabilization Policy) (problem set 5 due).

Midterm:

Tu Mar 08: Pre-Midterm Review.

Th Mar 10: Midterm.

Debt-and-Deficit Economics:

Tu Mar 15: From the Short-Run to the Long-Run.

Th Mar 17: Government Debt Economics: Crowding Out and Crowding In (read chs. 7 and 14: Equilibrium in the Flexible Price Model and The Budget Balance, the National Debt, and Investment) (problem set 6 due).

Tu Mar 29: Four Topics of Macroeconomics Review.

After Mar 29:

Starting Th Mar 31, any one of three things might happen:

First, perhaps our schedule will have slipped.

Second, we can go back over some in more depth some of the topics: economic growth, catch-up and economic development, depression economics, inflation economics, government debt economics, international finance.

Third, we could do something else that seems interesting--the world will be different at the start of April than it looks today...

Final:

Th Apr 28: Final Review

Th May 12: 8-11: FINAL EXAM

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers