J. Bradford DeLong's Blog, page 2116

January 21, 2011

The Microfoundations of Condensed Matter Physics Was a Doomed Research Program Until the 1920s

Cosma Shalizi:

Must Macroeconomic Theories Have Microfoundations?: Macroeconomic theories which do not derive such phenomena from microscopic interactions are thus incomplete, and intellectually unsatisfying.... So: the true and complete theory of macroeconomics must emerge from the true and complete theory of microeconomics.... [But if] a good macro-level theory cannot be founded on our current micro-level theory, this could be due to:

(a) defects or weaknesses in our techniques for calculating aggregate consequences of micro-level interactions;

(b) specifying the wrong sort of initial/boundary conditions, or interaction structures, in the microscopic models;

(c) errors in our understanding of micro-level interactions and dynamics;

(d) errors in our formulation of the macro-level theory.

There will certainly be some situations where (d) is right.... But it is hard for me to see why (d) should always be the preferred option in economics... it seems mere prejudice that it should always be macro which adjusts....

[C]irca 1900 classical mechanics and electromagnetism were extremely well-confirmed theories, in much better shape that microeconomics is. Nonetheless, any attempt to explain condensed matter physics on that basis, starting from molecular interactions, was doomed...

See "ultraviolet catastrophe."

A Message from Former Senator Bill Frist (R-TN)

Bill Frist on the Affordable Care Act:

Bill Frist: Health Care Is 'Law Of The Land,' GOP Should Drop Repeal And Build On It: It is not the bill that [Republicans] would have written. It is not the bill that I would have drafted. But it is the law of the land and it is the platform, the fundamental platform, upon which all future efforts to make that system better, for that patient, for that family, will be based. And that is a fact. I know the discussion of Washington is repeal and I'm sure we will come back to that discussion.... [The bill] has many strong elements. AAnd those elements, whatever happens, need to be preserved, need to be cuddled, need to be snuggled, need to be promoted and need to be implemented. But how do you do it? How do you do a lot of what is in this law?

An Anemic and Unhealthy Union Movement

Here is one that the Republicans have won over the past fifty years.

The BlS reports:

Union Members Summary: In 2010, the union membership rate--the percent of wage and salary workers who were

members of a union--was 11.9 percent, down from 12.3 percent a year earlier, the U.S.

Bureau of Labor Statistics reported today. The number of wage and salary workers be-

longing to unions declined by 612,000 to 14.7 million. In 1983, the first year for

which comparable union data are available, the union membership rate was 20.1 per-

cent....

The union membership rate for public sector workers (36.2 percent) was substantially higher than the rate for private sector workers (6.9 percent).... In 2010, 7.6 million public sector employees belonged to a union, compared with 7.1 million union workers in the private sector.

A union movement that is predominantly a public-employees movement is not, I think, sustainable in America.

How Large Would Our Construction Industry Be If We Were at Full Employment Right Now?

Quite large, I think. Scott Sumner agrees, and presents the argument:

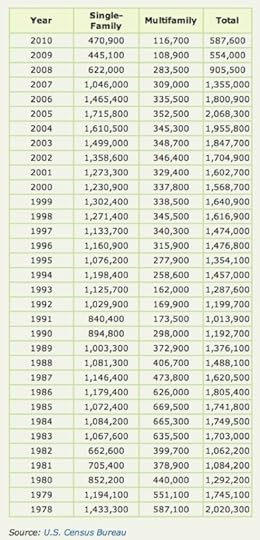

TheMoneyIllusion » America’s housing shortage: Housing construction normally seems to fluctuate between one and two million units. Let’s take 1.5 million as roughly the trend rate which keeps up with population. Yes, it’s true that we exceeded that number every single year from 2002 to 2006, and the total excess production was about 1.87 million units. That’s a lot. But over the next four years there was a shortfall of about 2.6 million units. So why do we seem to have a hugely excessive number of homes, if we are actually 730,000 short?....

The year 2008 was the first year below a million since my records began in 1978 (and probably much earlier.) That’s clearly below any reasonable estimate of normal absorption. Then in 2009 and 2010 we were down close to a half million units, a mind-boggling low rate of construction. Vacancies should be plunging under any reasonable estimate of market absorption. But guess what: over the past three years there has been no decline in housing vacancies... vacancies have leveled off since March 2008 at just under 19 million units, up from 16 million in early 2006.

Given ultra-low construction and US population growth of about 3 million/year, there is only one explanation for that pattern. Astoundingly low demand for housing. Do young people actually enjoy living with their parents, or might America be experiencing an aggregate demand shortfall?

Another reason we need more NGDP.

This was spurred by a Chicago alumni magazine article that made the following claim:

Economic recovery will be slow, [Erik] Hurst says, because the massive misallocation of resources that the housing boom created cannot be quickly remedied. During the ten years after 1997, he said, 40 percent more housing was constructed in the United States than in any decade on record. Today 2.3 percent of single-family homes are vacant, an increase of more than 64 percent since 2005.

The housing oversupply, in turn, has contributed significantly to high unemployment. As the construction industry boomed, much of the American workforce shifted to housing-related industries, on both the construction and banking sides. Now, of 3 million open jobs in the United States, only 65,000 are in housing-related fields, Hurst said. Thus, many unemployed workers are qualified for jobs that are no longer available—jobs, he predicts, that won’t come back.

This is completely inaccurate.... [H]ousing construction in 1998-2007 was only 8.4% above the levels of 1978-87. And it was much lower in per capita terms. The 2.3 million single family homes that are vacant are probably little changed from a few years ago, whereas the number should be plunging with low construction. There is no reason construction jobs shouldn’t come back, unless we shoot ourselves in the foot....

If all you knew was the housing construction data from the noughties, you’d expect another 1.5 million homes a year to be built in the teens, just like other decades. I’m not saying that will happen. Indeed I think it won’t happen. But if it doesn’t there will only be two possible explanations; a crackdown on immigration or a prolonged NGDP deficiency (perhaps combined with supply-side problems with the labor market.) It won’t be because we built too many houses in the 2000s. We didn’t.

The Question of What Americans Want Fiscal Policy to Be Has Been Answered...

When you ask Americans if they want to cut projected growth in Medicare, Social Security, and Medicaid spending in order to avoid tax increases, they say "no." When you ask Americans if they want to cut defense and foreign aid spending to avoid tax increases, they say "yes." When you ask Americans if they want to cut spending to avoid tax increases, they say "yes"--but that is because they are confused about how much of the government budget is defense and foreign aid as opposed to Medicare, Medicaid, and Seocial Security.

Thus I think that Doug Elmendorf is wrong when he says and David Leonhardt is wrong when he endorses the claim that:

The United States faces a fundamental disconnect between the services that people expect the government to provide, particularly in the form of benefits for older Americans, and the tax revenues that people are willing to send to the government to finance those services.

You can create the appearance of such a disconnect, but only if you ask questions while working carefully to avoid telling the voters just what their taxes are going to be spent on.

David Leonhardt:

The Deficit We Want: It’s a comforting story, to be sure. It holds the promise of a painless solution, because it suggests that the country’s huge looming deficits are not really our fault. Instead, they seem to stem from weak-willed politicians, wasteful government programs that do not benefit us and tax avoidance by people we have never met. In truth, the coming deficits are a result, above all, of the fact that most Americans are scheduled to receive far more in Medicare benefits than they have paid in Medicare taxes. Conservative and liberal economists agree on this point. After Medicare on the list of big, growing budget items come Social Security and the military. The three programs are roughly as popular as tax increases are unpopular – which is precisely why solving the deficit problem will be so difficult.

The new Times/CBS News poll highlights the problem... when given a straight-up choice between broad spending cuts and tax increases, Americans say they would prefer to reduce the deficit mostly through less spending.... [but] would people rather eliminate Medicare’s shortfall through reduced Medicare benefits or higher taxes? The percentages then switch, becoming nearly a mirror image of what they had been. Some 64 percent of respondents preferred tax increases, while 24 percent chose Medicare cuts. The same is true of Social Security: 63 percent for higher taxes, 25 percent for reduced benefits.

Herein lies the political problem. We want to cut spending. We just don’t want to cut the benefits that the spending pays for. “The United States faces a fundamental disconnect between the services that people expect the government to provide, particularly in the form of benefits for older Americans,” Doug Elmendorf, the director of the Congressional Budget Office, has said, “and the tax revenues that people are willing to send to the government to finance those services.”...

The crucial question today is, simply: Would you rather have your taxes increased or your Medicare and Social Security benefits reduced? “All of the above” is a reasonable answer. “None of the above” is not.

If there any politicians who can get us to accept this reality, they haven’t done so yet.

Department of "Huh?!" (Long Run Fiscal Outlook 9001 of the Affordable Care Act Department)

People who disagree with the CBO score of the ACA rarely, rarely say why they disagree with the CBO score.

For example, Clive Crook:

Is Health Care Reform Fiscal Reform?: The [Affordable Care Act] might reduce the deficit, and restrain health costs more broadly too, if it really did spur innovations of the kind described in Atal Gawande's latest fine piece for the New Yorker--and if these ideas were widely taken up, and if every other good thing the act envisages comes to pass. My own guess is that it will take improbably zealous execution, constant vigilance, and further legislation too for this rosy scenario to come true, and I rate the chances of all that working out pretty low. Also bear in mind, since the plan will be amended in Congress and revised administratively every which way, and since the counterfactual of no ACA will be unavailable, we might never know whether ACA in the form just passed would have been deficit-reducing or deficit-increasing. It's guesswork now, and probably always will be. As I say, my own guess would be deficit-increasing--and, if taxpayers are unlucky, very much so...

Journal of Accountancy:

Tax Provisions in the Health Care Act: New IRC § 4980I imposes an excise tax on insurers if the aggregate value of employer-sponsored health insurance coverage for an employee (including, for purposes of the provision, any former employee, surviving spouse and any other primary insured individual) exceeds a threshold amount. The tax is equal to 40% of the aggregate value that exceeds the threshold amount. For 2018, the threshold amount is $10,200 for individual coverage and $27,500 for family coverage, multiplied by the health cost adjustment percentage (as defined in the act) and increased by the age and gender adjusted excess premium amount (as defined in the act). The provision is effective for tax years beginning after Dec. 31, 2017...

To wit:

http://democrats.senate.gov/reform/patient-protection-affordable-care-act-as-passed.pdfSEC. 9001. EXCISE TAX ON HIGH COST EMPLOYER-SPONSORED HEALTH COVERAGE.

(a) IN GENERAL.—Chapter 43 of the Internal Revenue Code of 1986, as amended by section 1513, is amended by adding at the end the following:

SEC. 4980I. EXCISE TAX ON HIGH COST EMPLOYER-SPONSORED HEALTH COVERAGE.

(a) IMPOSITION OF TAX.—If— ‘‘(1) an employee is covered under any applicable employer-sponsored coverage of an employer at any time during a taxable period, and

(2) there is any excess benefit with respect to the coverage, there is hereby imposed a tax equal to 40 percent of the excess benefit....

(C) APPLICABLE DOLLAR LIMIT.—Except as provided in subparagraph (D)—(i) 2013.—In the case of 2013, the dollar limit under this subparagraph is—(I) in the case of an employee with self-only coverage, $8,500, and (II) in the case of an employee with coverage other than self-only coverage, $23,000....(iii) SUBSEQUENT YEARS.—In the case of any calendar year after 2013, each of the dollar amounts under clauses (i) and (ii) shall be increased... by an amount equal to the product of—(I) such amount as so in effect, multiplied by (II) the cost-of-living adjustment determined under section 1(f)(3) for such year... increased by 1 percentage point...

To translate this back into English: It imposes is a 40% tax on the high-cost component of the value of any health insurance plan, with the threshold of "high cost" growing by the rate of CPI inflation plus 1% per year thereafter.

Either health-care costs do not grow faster than GDP in the future, or they do.

If health-care costs do not grow faster than GDP in the future, then we don't have a long-run fiscal deficit problem at all.

If health-care costs do grow faster than GDP in the future, then family insurance costs will rapidly breach the $23K-in-2013-plus-inflation-plus-1%-per-year, and we will be imposing a 40% tax on a larger and larger proportion of health insurance payments. That tax will raise a lot of revenue in the 2020s, remarkable amounts of revenue in the 2030s, and unbelievably large amounts of revenue in the 2040s and the 2050s. And these revenue increases overwhelm the extra spending to cover the 30-plus million uninsured that the bill will cover.

Future congress may well repeal or suspend the operation of or cut back on Section 9001.

But if and when they do, it is their actions that increase the long-run deficit--not the ACA.

To say that the ACA might bust the budget--rather than that future congresses may amend the ACA to bust the budget--is simply wrong.

This isn't rocket science, people. §9001 is not a secret, people.

Context: CBO to Rep. Paul Ryan, March 19, 2010:

You also asked about the effects on the federal budget beyond the 2010–2019 period of enacting the reconciliation proposal (the amendment to H.R. 4872) and the Senate-passed health bill (H.R. 3590) if several provisions were altered, either now or at some point in the future. In particular, you asked about the effects if:

the [§9001] excise tax on insurance plans with relatively high premiums—which would take effect in 2018 and for which the thresholds would be indexed at a lower rate beginning in 2020—was never implemented;

the annual indexing provisions for premium subsidies offered through the insurance exchanges continued in the same way after 2018 as before—in contrast with the arrangements under the reconciliation proposal, which would slow the growth of subsidies after 2019;

the adjustment to payment rates for physicians under Medicare contained in H.R. 3961 and described above was included; and

the Independent Payment Advisory Board—which would be required, under certain circumstances, to recommend changes to the Medicare program to limit the rate of growth in that program’s spending, and whose recommendations would go into effect automatically unless blocked by subsequent legislative action—was never implemented.

A detailed year-by-year projection, like those that CBO prepares for the 10-year budget window, would not be meaningful over a longer horizon because the uncertainties involved are simply too great. Among other factors, a wide range of changes could occur—in people’s health, in the sources and extent of their insurance coverage, and in the delivery of medical care (such as advances in medical research, technological developments, and changes in physicians’ practice patterns) —that are likely to be significant but are very difficult to predict, both under current law and under any proposal.

CBO has therefore developed a rough outlook for the decade following the 10- year budget window. Under the analytic approach described in the agency’s previous letters, the combined effect of enacting H.R. 3590 and the reconciliation proposal would be to reduce federal budget deficits over the decade beyond 2019 relative to those projected under current law—with a total effect during that decade in a broad range around one-half percent of gross domestic product (GDP). If the changes described above were made to the legislation, CBO would expect that federal budget deficits during the decade beyond 2019 would increase relative to those projected under current law—with a total effect during that decade in a broad range around one-quarter percent of GDP.

January 20, 2011

The Labour Party Regains Sanity on Economic Policy

George Parker:

http://www.ft.com/cms/s/0/439e4bd8-24da-11e0-a919-00144feab49a.html?ftcamp=rss&ftcamp=crm/email/2011120/nbe/InTodays/test/product#axzz1BdxXXwFU: Balls appointed shadow chancellor: Ed Miliband has been forced to share control over Labour economic policy with his leadership rival Ed Balls, after the resignation on Thursday evening of shadow chancellor Alan Johnson for "personal and family reasons".

Mr Miliband was determined to keep Mr Balls' hands off economic policy when he became Labour leader last September, promoting the self-proclaimed economic novice Mr Johnson to the post instead.

When Mr Johnson told Mr Miliband of his intention to resign on Monday, the Labour leader pleaded with him to stay in the job. Amid Westminster speculation that his marriage is in trouble, Mr Johnson said it was impossible for him to continue. Mr Miliband's aides said the resignation had nothing to do with Mr Johnson's numerous slip-ups during his short time as Labour's economics spokesman. "We were very happy with his performance," said one.

The Labour leader was left with little choice but to appoint Mr Balls in recognition that the combative former cabinet minister is arguably the party's most effective opposition politician and sharpest economic mind.

Mr Miliband's aides say he did not offer the job to his brother David, who has been waiting in the wilderness. The only other obvious candidate was Yvette Cooper, another economist, who is married to Mr Balls.

On a night of high drama at Westminster, Mr Miliband put on a brave face: "Ed Balls is an outstanding economist and is hugely qualified to take our economic message to the country."

The smoothly executed reshuffle also saw Ms Cooper replace her husband in the home affairs brief, with Douglas Alexander succeeding her as shadow foreign secretary.

Mr Balls' elevation is a huge gamble for Mr Miliband, who will have to share economic policymaking with a man certain in his opinions and intimately associated with Gordon Brown's 13-year stewardship of the British economy. "It beggars belief that Ed Balls has been appointed as shadow chancellor – the man responsible for the economic mess we inherited," said Michael Fallon, deputy Conservative chairman.

George Osborne, chancellor, was said to be delighted, but has previously told colleagues Mr Balls would be a tough opponent: "He will be down my throat 24 hours a day."

Mr Miliband feared last year that Mr Balls could leave Labour open to accusations of being "deficit deniers" because of his refusal to discuss detailed spending cuts and insistence that growth should be put before deficit cutting. In government Mr Balls opposed a VAT hike to cut the deficit – preferring a rise in national insurance – and in July 2010 he claimed that Labour's plan to halve the deficit in four years was "a mistake" and not deliverable...

Yosuke Matsuoka Liveblogs World War II: January 21, 1941

The Foreign Minister of Japan speaks:

ADDRESS DELIVERED BEFORE THE 76TH SESSION OF THE IMPERIAL DIET: The Three Power Pact stipulates that Germany and Italy recognize and respect the leadership of Japan in the establishment of a new order in greater East Asia. It is our avowed purpose to bring all the peoples in greater East Asia to revert to their innate and proper aspect, promoting conciliation and co-operation among them, and thereby setting the example of universal concord. The Pact also provides that Japan recognizes and respects the leadership of Germany and Italy in their similar endeavours in Europe. Far from antagonizing any country, the Pact is the embodiment of a peaceful....

Of the nations in greater East Asia, Manchoukuo has special and inseparable relations with this country. As you are aware, during the ten years which have already elapsed since her emergence as an independent nation, her national foundations have become strong and secure while her international position has been greatly enhanced, her teeming millions ever enjoying an increasing measure of prosperity. In June, last year, the Emperor of Manchoukuo paid a visit to Japan to offer his felicitations personally to our Imperial House on the auspicious occasion of the 2,600th anniversary of the foundation of our Empire. This is a Source of genuine congratulation for the peoples of Japan and Manchoukuo....

Inasmuch as an early settlement of the China Affair is desirable in the interests of the creation of this sphere of common prosperity throughout greater East Asia, the present Government ever since its formation, has urged the Chiang Kai-shek regime to reconsider and reverse its attitude, with a view of bringing about its amalgamation with the Nanking Government, but it remains still struggling against Japan. The Chiang regime, however, is riddled with internal disruption and friction which are rapidly growing acute, while the masses under its control are suffering from high prices, a dearth of commodities and other severe tribulations.... [T]he Chinese communist troops have greatly gained in influence, with the result that they are steadily encroaching upon the sphere of influence of the Chungking armies....

Great Britain recently granted the Chiang regime a ten million pound sterling loan, while about the same time the United States, too, offered a loan of one hundred million dollars. The latter country is now endeavouring to extend assistance to Great Britain on a large scale by mobilizing her entire resources, while the Burma route is being seriously and successively damaged by appropriate measures taken by our loyal and gallant air forces. It seems highly problematical, therefore, what assistance Great Britain and the United States can actually afford the Chiang regime. In the light of such an international situation, the Japanese Government, in pursuance of their fixed policy, recognized the National Government at Nanking and on November 30 of last year concluded with the latter the Sino-Japanese Basic Treaty. This treaty embodies the three basic principles of good neighbourliness, economic co-operation and joint defence against communist activities. It stipulates that both Japan and China respect each other's sovereignty and territorial integrity, and undertake close economic co-operation on the basis of equality and reciprocity, and that Japanese forces be stationed in certain specified areas in Mengchiang and North China....

Let me now make a brief survey of our relations with the Netherlands East Indies, French Indo-China, and Thailand, which lie within the above-mentioned sphere of common prosperity. The Netherlands East Indies and French Indo-China, if only for geographical reasons, should be in intimate and inseparable relationship with our country. Therefore, the situation which has hitherto thwarted the development of this natural relationship must be thoroughly remedied, and relations of good neighbourliness secured for the promotion of mutual prosperity....

I should like to refer to the relations between our country and Thailand. It may be recalled that at the General Assembly of the League of Nations dealing with the Manchurian Affair, in 1933, the Thai delegate did not leave the Assembly hall but remained in his seat, and boldly announced his abstention from voting. This is still fresh in the memory of our people.

In June, last year, a Treaty of Amity and Neutrality was concluded by Japan with Thailand. With the exchange of ratifications, completed on December 23 at Bangkok, the bonds of friendship between the two countries have been drawn still closer....

An exchange of diplomatic representatives has taken place between Japan and Australia. We expect that the two countries will make contributions toward the promotion of the peace of the Pacific by further advancing their friendly relations through cordial co-operation and the elimination of unnecessary misunderstandings....

In establishing a sphere of common prosperity in greater East Asia, and ensuring the peace of the Orient, it is not desirable that the present diplomatic relations between Japan and the Soviet Union should be left as they are. The utmost efforts are being made, therefore, to remove mutual misunderstandings and, if possible, to bring about a fundamental and far-reaching adjustment of diplomatic relations. We are pursuing negotiations at this moment upon such questions as the frontier demarcation between Manchoukuo and Outer Mongolia, the fisheries and the Japanese concessions in North Saghalien....

I should like to refer to our relations with the United States. The United States has evinced no adequate understanding of the fact that the establishment of a sphere of common prosperity throughout greater East Asia is truly a matter of vital concern to Japan. She apparently entertains an idea that her own first line of national defence lies along the mid-Atlantic to the East, but westward not only along the eastern Pacific-but even as far as China and the South Seas. If the United States assumes such an attitude, it would be, to say the least, a very one-sided contention on her part, to cast reflections on our superiority in the Western Pacific, by suggesting that it betokens ambitious designs. I, for one, believe that such a position assumed on the part of the United States would not be calculated to contribute toward the promotion of world peace. Speaking frankly, I should extremely regret such an attitude of the United States for the sake of Japanese-American friendship, for the sake of peace in the Pacific and, also, for the sake of the peace of the world in general. It is my earnest hope that a great nation exerting the influence that the United States does will realize her responsibility for the maintenance of peace, will reflect deeply on her attitude with truly God-fearing piety, will courageously liquidate past circumstances and bend her utmost efforts to allay the impending crisis of civilization....

With an unbroken line of Emperors reigning since its foundation, our Empire constitutes a unique family-State unparalleled in the world for unity and solidarity, which grow stronger with every national emergency. It is reassuring, moreover, to observe that the Japanese Empire is endowed with most favourable geographical conditions, powerful enough to influence the course of world politics. Establishment of the new world order, the goal of the Three Power Pact, if only time be given, will surely be accomplished. There is no room for doubt that it will be crowned with brilliant success. If the Japanese people are fully and firmly prepared for this task, the future of our Empire will indeed be great and glorious.

In concluding my address, I respectfully pay my tribute to the spirits of those loyal and valiant officers and men, our countrymen, who have fallen in action, and at the same time, I tender my warm thanks to the armed forces of our nation for enduring so many hardships and privations, devoting to them my most sincere wishes for every success in the field.

Hoisted from Comments: Thinking About Aristotle of Stagira and Moses Finley

Scott Martens writes:

Hoisted from the Archives: Thinking About Aristotle of Stagira and Moses Finley: You have to see this in the light of the rest of Aristotle. Consider his notion of science -- under the label "episteme" -- what he considers the highest form of human knowledge:

The nature of Scientific Knowledge (employing the term in its exact sense and disregarding its analogous uses) may be made clear as follows. We all conceive that a thing which we know scientifically cannot vary; when a thing that can vary is beyond the range of our observation, we do not know whether it exists or not. An object of Scientific Knowledge, therefore, exists of necessity. It is therefore eternal, for everything existing of absolute necessity is eternal; and what is eternal does not come into existence or perish.

His idea of science is totally non-empirical. It consists solely of principles of logic and mathematics, and not even all of those. The dirty business of thinking about things that actually are is relegated at best to second class human knowledge: tekhne, or perhaps phronesis or sophia -- art of making things and strategies for doing things, or sometimes simply good ideas; and at worst to mere doxa or to enthymemes - hardly more than rank prejudice and rules of thumb. He does not deem it appropriate for a seeker of truth to dwell much on the dirty business of real stuff.

This attitude comes through just as strongly from Plato and his whole theology of Forms. It's a major player in Hellenic thought. It figures strongly in Christianity as the rejection of "worldly things." You can see it in the Physiocrats who saw industry and commerce as parasitic on agriculture and government. It has parallels in China with its historical love-hate relationship with trade and commerce.

There ain't much more worldly than the pursuit of survival through labour and wealth through trade.

Why Might There Be High Unemployment?

Mark Thoma sends us to Nick Rowe, who has a taxonomy:

Worthwhile Canadian Initiative: Three ZMPs and two Co-ordination failures: "ZMP"... should really stand for "Zero Value Marginal Product". Can an additional worker produce no additional goods of any value? Is that why they are unemployed? Yes, but...

There are three types of ZMP....

ZMP1. No coordination failure: It is possible that some potential workers, perhaps because of severe disabilities, simply cannot produce anything useful, even in a perfectly functioning economy. Even the mythical central planner, who could allocate resources perfectly, wouldn't be able to think of anything useful they could work at, and would leave them idle. They have a Zero Value Marginal Product. There's no coordination failure. The problem simply can't be solved, given existing technology, tastes, and resources. Nobody (I think) is talking about ZMP1.

ZMP2. Coordination failure 1:... The unemployed plumber wants his house re-wired. The unemployed electrician wants his pipes replaced. But the plumber doesn't know that there's an electrician in town; and the electrician doesn't know that there's a plumber in town. Given the current state of knowledge, both workers have Zero Value Marginal Product. Nobody is willing to pay for their labour. They would be willing to pay, if they knew of each other's existence, but they don't. The mythical central planner, who knows everything that anybody knows, would sort this one out immediately. All he has to do is introduce the plumber and the electrician, and both jobs are done.... There's an excess supply of plumbers' and electricians' services, and an excess demand for plumbers' and electricians' services, all at the same time. Both want to sell more of their own labour, and buy more of the other's labour.

ZMP3. Coordination failure 2: The unemployed hairdresser wants her nails done. The unemployed manicurist wants a massage. The unemployed masseuse wants a haircut. The hairdresser knows where the manicurist can be found. The manicurist knows where the masseuse can be found. The masseuse knows where the hairdresser can be found. But all three women are short of money, and won't spend any until after she earns some. Given the unwillingness of each to spend money, each of the three has a Zero Value Marginal Product. Nobody is willing to pay for their labour. This one's a bit trickier for the mythical central planner to solve. Introductions alone won't do the trick. Each woman already knows where to find the service she wants. That's not the problem.

The central planner could simply order them all to provide the desired service, for no cash. That would make all three women better off. But if the central planner is mythical, and can only give mythical orders, that won't work. He could try to get all three women together, and try for a three-way barter deal. But it's hard to cut someone's hair while your customer is giving a massage and you are having a manicure. Who's going to go first, and how will she know the other two won't break the chain?

The easiest solution is for the central planner to print more money and give each of the three women enough so they buy what they want.

ZMP3 is what the rest of us Monetarists and Keynesians (quasi or otherwise) are talking about.

There's an excess supply of each woman's labour. Each one wants to sell her labour and can't. In one sense (in Robert Clower's sense) there's also an excess notional demand for each woman's labour, because each woman would like to buy labour from one of the others. But she would only actually buy it if she could sell her own labour, and she can't. So there's no excess constrained or effective demand for labour.

I think Nick is wrong. I think a great many people are talking about ZVMP1--that, at least, is what I take people like Niall Ferguson and Tyler Cowen and Tom Sargent to be talking about. They think, I think, that our excess unemployed since 2007 are overwhelmingly made up of people whom (i) it costs more to supervise than the value of what they could produce, or (ii) the value of what they could produce is less than the minimum wage, or (iii) the value of what they could produce is less than the UI benefits they are collecting.

There is the question of why people back in 2007 had no trouble employing these 8 million ZVMP1 workers. The answer proposed, I think, is that back then people thought that they had a high marginal product working in construction because people overestimated the value of newly-built houses. I don't think it holds together, but that is what they are saying, I think.

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers