J. Bradford DeLong's Blog, page 2115

January 21, 2011

McSweeney's Internet Tendency: TED Talks Throughout History.

John Cafiero:

Have We Been Worshiping the Wrong Sacred Tree?

The Wheel Will Change the Way We Live Forever, Once We Turn It on Its Side and Attach It to Something, But What?

Global Initiatives for Making God Less Angry

How "Coins" Are Revolutionizing Bartering

Dragon Lairs, Leprechaun Hoards, and Other Promising Sources of Wealth in the New Economy

We Already Have the Technology to Turn Lead into Gold. Why Aren't We Doing It?

Not Your Father's Execution: How the Guillotine is Changing the Way We Think about Beheading

Reinventing the Factory: How the Use of Children In Manufacturing Benefits Us All

Are Peasants People?

Why Republicans Should Be Embarrassed to Advocate Repealing the ACA

Aaron Carroll:

More mandate-relevant evidence | The Incidental Economist: Yesterday I described a new paper that provided evidence that the individual mandate in Massachusetts has done the job it was designed to do, namely to cause the individual insurance market risk pool to become more favorable (include more relatively healthy individuals than it otherwise would). >Today there is more evidence that a means of motivating healthy individuals to enroll (like a mandate) is a necessary part of insurance market reforms. Anthony Lo Sasso shows that community rating and guaranteed issue in the absence of a mandate (or some other incentive for the healthy to enroll) cause the risk pool to become more adverse (include more relatively sick individuals)....

Lo Sasso explains:

T[C]ommunity rating was associated with a worsening of the non-group risk pool as younger and healthier individuals left the individual market while older and sicker individuals joined or remained in themarket. To test the robustness of this conclusion, we used data from the National Health Interview Survey (NHIS) to compare changes in detailed measures of health status and utilization for people with non-group coverage in several community rating and non-community rating states. We found that those maintaining non-group coverage after the adoption of community rating were significantly more likely to have days when they were restricted to bed or when their activities were otherwise restricted because of health problems as well as more doctor visits and hospital stays. In other words, community rating in the non-group insurance market led to a pool of enrollees in poorer health. [...]

Our results provide a compelling portrait of the distortions that can result from community rating and guaranteed issue regulations in the non-group market when there are no provisions in place to keep people enrolled in coverage. The deterioration of the risk pool is consistent with predictions from economic theory and potentially lays the foundation for an adverse selection death spiral...

Aaron Carroll again:

Let’s be clear about what all this means. There are sound theoretical reasons and substantial empirical support for the idea that guaranteed issue and community rating without a mandate (or similar inducement) cause problematic levels of adverse selection. Adverse selection leads to higher premiums and can destabilize the insurance market. These are as close to facts as one gets in social science. Consequently, if one is in favor of a well-functioning insurance market in which everyone can obtain affordable insurance, one cannot advocate guaranteed issue and community rating and nothing else. One needs some way to keep adverse selection under control. To be blunt, one can’t just take the favorable parts of the ACA and reject the unfavorable part (the mandate), at least not with suggesting a replacement that will do the same job...

Steven Hyder Thinks He Has a Constitutional Right to Be a Freeloader (No Libertarians in the Emergency Room Watch)

Jonathan Cohn goes to interview him:

Repealing Health Care Reform: How It Could Happen And What It Would Mean: Steven Hyder, 40, runs his own legal practice out of a shared office in downtown Monroe, Michigan, a blue-collar town south of Detroit. Mostly he handles relatively routine, low-profile work: bankruptcies, personal injury claims, that sort of thing. But recently, he became part of a much bigger case. He’s a named plaintiff in a lawsuit challenging the constitutionality of the Patient Protection and Affordable Care Act. The focus of Hyder’s suit, which was organized and written by a conservative legal organization, is the “individual mandate”—the requirement that everybody obtain health insurance or pay a fee to the government. The case is one of several moving through the federal judiciary. Sometime in the next few years, at least one of them is likely to end up before the Supreme Court.

A few weeks ago, I spoke with Hyder at his office, in order to learn more about why he had brought this case. He said his motive was straightforward. He’s opted not to carry health insurance because he doesn’t think the benefits justify the price, and he doesn’t want the government forcing him to do otherwise. Okay, I asked, but what if he gets sick and needs hospitalization? How will he afford those bills? It was a distinct possibility, he agreed, patting his waist and noting that he was a little overweight. But those potential bills would be problems for him and his hospital, he suggested, not society as a whole.

When I told him that I disagreed—that his decision to forgo health insurance meant other people would be paying his bills, via higher taxes and insurance premiums—he politely and respectfully took issue with my analysis. The discussion went back and forth for a while, but soon it became apparent that our differences went beyond the finer points of health care policy, to our most basic understanding of the rights and obligations of citizenship. “It’s a complete intrusion into my business and into my private life,” he told me. “I think it’s one big step towards a socialist society and I’m purely capitalist. I believe in supply-side economics and freedom”...

Note that Hyder doesn't say that if he can't pay his hospital bills cash he should die in the gutter in front of the hospital.

Donald Marron Says Greg Mankiw Gets It Wrong

Donald Marron is correct. Donald Marron:

What is Health Care Reform?: The policy community and commentariat often equate health care reform with the legislation (actually two pieces of legislation) that President Obama signed into law last year. As everyone knows, the Congressional Budget Office estimated that those two laws would, if fully implemented, reduce the federal budget deficit by $143 billion from 2010-2019. That’s the basis for the claim that “health care reform would reduce the deficit over the next ten years.” (CBO also discussed what would happen in later years, where the law, if allowed to execute fully, would have a bigger effect, but let’s leave that to the side right now.) The complication... is that the health care reform legislation included many provisions. Greg [Mankiw] notes, for example, that some expanded health insurance, while others raised taxes. In his view, only the first part constitutes health care reform....

In fact, it’s more complicated than that. By my count, the two pieces of health care reform legislation combined seven different sets of provisions:

Expanding health insurance coverage (e.g., by creating exchanges and subsidies and expanding Medicaid)

Expanding federal payments for and provision of health care services (e.g., reducing the “doughnut hole” in the Medicare drug benefit)

Cuts to federal payments for and provision of health care services (e.g., cuts to Medicare Advantage and some Medicare payment rates)

Tax increases related to insurance coverage (e.g., the excise tax on “Cadillac” health plans)

Tax increases not related to insurance coverage (e.g., the new tax on investment income)

The CLASS Act, which created an insurance program for long-term care

Reform of federal subsidies for student loans....

Greg’s point, I think, is that... [t]o say “the health care reform law reduces the deficit over the next ten years according to CBO” is absolutely true. But it often gets elided to “health care reform reduces the deficit over the next ten years” which isn’t true if, like Greg, you think the revenue raisers, student loan changes, and CLASS Act aren’t really health care reform.....

Greg’s analogy has a flaw: it presumes that none of the tax increases count as health reform. I disagree. Our current tax system provides enormous ($200 billion per year) subsidies for employer-provided health insurance. They should be viewed as part of the government’s existing intervention in the health marketplace. And rolling back those subsidies strikes me as essential to future health care reform.... [The] tax on “Cadillac” health plans... will clearly affect health insurance markets, and it offset a portion of existing tax subsidies... [is] as part of health care reform.

The key thing is not the difference between spending and revenues, but between provisions that fundamentally change the health care system and those that do not...

By my count, more than half of the tax increases in the Affordable Care Act over the next two decades are provisions that fundamentally affect the health care system--and the share of tax increases that are clearly health related grows over time,

Congressional Representative Jeb Hensarling (R-TX) Calls for the Repeal of the Affordable Care Act and Its Replacement by Medicare-for-All

Very good to see a Republican joining the single-payer caucus:

Henserling: The American people don’t want [the Affordable Care Act]. It’s personal. Here’s my story, two days ago, I was in San Antonio, Texas, and my mother had a large tumor removed from her head. They wheeled her away at 7:20 in the morning, and by noon, I was talking to her along with the rest of our family. It proved benign, thanks to a lot of prayers and good doctors at the Methodist hospital in San Antonio. My mother’s fine. I’m not sure that would be the outcome in Canada, the U.K., or anywhere in Europe. No disrespect to our President, but when it comes to the health of my mother, I don’t want this President or any President or his bureaucrat or commissions making decisions for my loved ones. Let’s repeal [the Affordable Care Act] today, replace it tomorrow.

Matthew Yglesias comments:

Hensarling is 53 years old, so his mother is, of course, eligible for Medicare. And it’s true that Medicare, for all its flaws, is an excellent system of coverage. It’s also a system of universal taxpayer-financed government-provided health insurance... [like] Canada’s system of universal health care, which is probably why the Canadian program is also called “Medicare.” The biggest difference is that in Canada you get Medicare whether you’re 8, 18, 38, 68, or 88 whereas in the United States Medicare is only available to senior citizens. But seniors like Medicare! And so do their kids!

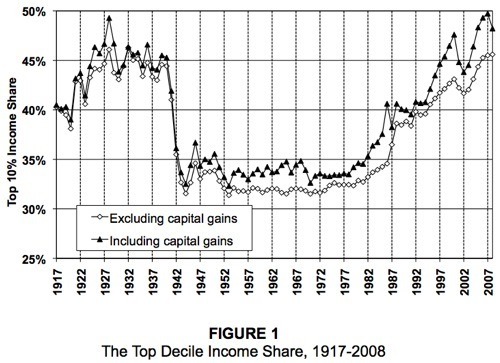

High and Rising Unequality Does Not Mean that Unemployment Is "Structural"

David Leonhardt has a good response, pointing to the increasing college-high school wage premium as evidence that I am wrong and that the unemployment generated by the current downturn is structural:

Debating the Causes of Joblessness: The data that the Bureau of Labor Statistics released on Thursday gives me a chance to explain why I disagree [with Brad]. In short, the relative performance of more educated and less educated workers over the last few years has not been the typical pattern for a recession. Less educated workers, by many measures, are faring worse than they ever have.

The ratio of the typical four-year college graduate’s pay to a typical high-school graduate’s pay hit a record in 2010 — 1.56. Since 2007, the inflation-adjusted median weekly pay of college graduates has risen 1.6 percent. The inflation-adjusted pay of every other educational group — high school dropouts, high school graduates and people who attended college but did not get a four-year degree — has fallen since 2007. The same is true over the last decade; amazingly, only college graduates have received a raise.

It’s pretty surprising that college graduates’ real pay has risen during a three-year period when the economy was in miserable shape. It seems like a clear indication that our economy has an undersupply of skilled, educated workers. To put it another way, if there were more of these workers than they are, more of them would have jobs today...

I think that less-educated workers are faring worse in relative terms than they have since the end of the Gilded Age. I think that the economy is definitely short of well-educated workers--that that is why the college-high school wage premium is so high and continues to rise.

But I also think that these are issues that are almost completely separate from those of whether current unemployment is

"structural"--by which I mean that an increase in aggregate demand would not produce higher employment but rather higher inflation.

After all, a rising college-high school wage premium was perfectly consistent with sub-five percent unemployment in 1999. Why should it require anything close to ten percent unemployment today?

The Most Emailed 'New York Times' Article Ever | The Awl

David Parker:

The Most Emailed 'New York Times' Article Ever: THE WAY WE NOW: It’s a week before the biggest day of her life, and Anna Williams is multitasking. While waiting to hear back from the Ivy League colleges she’s hoping to attend, the seventeen-year-old senior at one of Manhattan’s most exclusive private schools is doing research for a paper about organic farming in the West Bank, whipping up a batch of vegan brownies, and, like an increasing number of American teenagers, teaching her dog to use an iPad.

For the last two weeks, Anna has been spending more time than usual with José de Sousa Saramago, the Portuguese water dog she named after her favorite writer. (If José Saramago bears an uncanny resemblance to Bo Obama, the First Pet, it’s no coincidence: the two dogs are brothers. Anna’s father was an early fundraiser for Barack Obama; José Saramago was a gift from the President.)

Anna takes José Saramago’s paw in her hands and whispers in his ear. He taps the iPad and the web browser opens. José Saramago gives a little yelp.

“It’s entirely conceivable that a dog could learn simple computer functions,” says Dr. Walker Brown, the director of the Center for Canine Cognition, a research facility in Maryland. “Word processing, e-mailing, even surfing the web: for many dogs, the future is already here”...

Yet Another Reason Why Friends Don't Let Friends Support the Republican Party

Digby:

Hullabaloo: Wow. I thought these people were out of touch, but this really takes the cake:

Yesterday, the Department of Health and Human Services released a new report showing that up to 129 million Americans have a pre-existing condition.... Republicans have questioned the results of the report by arguing that many Americans with pre-existing conditions already have insurance coverage, but during this afternoon’s floor debate in the House, Rep. Phil Gingrey (R-GA) took the argument one step further, belittling the ailments:

GINGREY: One hundred and twenty nine million people with pre-existing conditions! They would all have to have hang nails and fever blisters to have pre-existing conditions and if you believe those statistics, I’ve got a beach to sell you in Pennsylvania.

These pampered princes with their federal cadillac plan have absolutely no idea what it's like to try to deal with the private health insurance market. I was denied health insurance from three different companies because I had been treated for gingivitis in the previous five years. I kid you not. It took me appealing all the way to the top, with proof that the condition had been reversed, before a fourth would take me.

Not a hangnail or a fever blister, but close. They will use any excuse to exclude you, particularly if you are over a certain age. Gingrey is a privileged ass.

Austin Frakt Is Extremely Unhappy with Those Who Claim the Affordable Care Act Is a Budget-Buster

Looking at the world, it is increasingly clear that there is no hope for responsible governance in America until the Republican Party as currently constituted vanishes from the earth.

Austin Frakt:

Fuzzy math | The Incidental Economist: There have been a lot of charges and counter-charges of fuzzy math out there.... As important as defending the CBO is (and it is), it just isn’t that interesting to me. I don’t like to fight or repeat myself.

Actually, I mostly find the CBO scoring argument sad. There really is no hope for progress of any kind if we can’t even agree to abide by the budget scoring of a non-partisan office. If you don’t think that office is operating in good faith or don’t like the rules by which it operates, then that’s where the debate should be. Tell me some other way to score bills that everyone will agree to and abide by. Better, tell it to your colleagues across the aisle. Figure out the rules. AND THEN STICK BY THEM AND STOP WHINING WHEN THE BALL BOUNCES THE OTHER WAY!!!

I am not impressed with selective second guessing of the work produced by an office so established. I don’t want to hear it from Republicans. I don’t want to hear it from Democrats. I don’t want to hear it from the Tea Party. If my own mother said such things I’d have some firm words with her (respectfully, kindly, but firm). And I love my mother!

Like Jon Cohn, I may sound upset. I am, but only because I care. I don’t want to be upset by one party or the other. I don’t enjoy it. I don’t get a rush. It’s not why I pay attention to politics. I would love nothing better than to see everyone settle down and get to work–good faith, honest, hard work–addressing the problems of this nation, including health care coverage, cost, and quality. I don’t expect we’ll agree on solutions or even what the problems are. But I damn well expect we’ll honor the outcomes of the process we’ve agreed to follow. If we can’t do that, we don’t have a government. We have a bunch of children. I don’t put my children in charge of anything nearly as important as the nation’s health care system. Nor should you.

One more thing, Cohn wrote, “This relentless effort to discredit the Affordable Care Act’s budgeting has been the equivalent of a full employment for folks like Austin, Ezra, and me. For that, I guess, I’m grateful.”

I’m not. It may keep me preoccupied, but I don’t get paid for this. I do it because I care. I want people to understand. I want to be part of the solution. I do love this country, almost as much as my own mother. For country and mom, I pledge not to bash the CBO or to second guess their estimates. Care to join me?

And Jon Chait is if anything even more unhappy:

Charles Krauthammer Laughs At Arithmetic: Charles Krauthammer writes:

Suppose someone - say, the president of United States - proposed the following: We are drowning in debt. More than $14 trillion right now. I've got a great idea for deficit reduction. It will yield a savings of $230 billion over the next 10 years: We increase spending by $540 billion while we increase taxes by $770 billion. He'd be laughed out of town.

Uh... why? As I noted the other day, "Conservatives think the notion that a piece of legislation can spend some money to cover the uninsured, while simultaneously cutting spending and raising taxes by some greater sum, so that the overall bill reduces the deficit, is conceptually absurd." It would literally be impossible to craft a bill that provided for universal coverage and also reduced the deficit and have Republicans accept its accounting as valid.

Krauthammer holds this belief so strongly that he presents a straightforward arithmetic property -- $770 billion in revenues minus $540 billion in spending equals $230 billion in lower deficits -- as not just wrong but hilariously wrong: Why, they're increasing spending while increases taxes more, while claiming this will reduce the deficit! The morans!

Indeed, Krauthammer deems the "$770 billion > $540 billion" scoring method so self-evidently silly he doesn't even bother to refute it. The paragraph I quoted is all the refutation he deems necessary.

Now, increasing spending by $540 billion and increasing taxes by $770 billion is a ridiculous way to reduce the size of government. But, despite Republican efforts to conflate the two, the size of government is not the same thing as the debt, as even Milton Friedman recognized.

So Krauthammer, convinced that $540 billion is clearly larger than $770 billion, proceeds to recycle some familiar Republican talking points attempting to cast doubt on the CBO score. His shining example is the endlessly repeated saw that the law combines six years of benefits with ten years of revenue in order to appear revenue-neutral:

Most glaringly, the entitlement it creates - government-subsidized health insurance for 32 million Americans - doesn't kick in until 2014. That was deliberately designed so any projection for this decade would cover only six years of expenditures - while that same 10-year projection would capture 10 years of revenue. With 10 years of money inflow vs. six years of outflow, the result is a positive - i.e., deficit-reducing - number. Surprise.

That would be bad if true. But it's not.... The benefits phase in slowly as do the revenues. Krauthammer's six years of benefits/ten years of revenue canard would mean that, once fully phased in, the costs dramatically exceed the revenue. That isn't the case. The law's effect deficit-reduction effect increases over the last ten years.

Health care analysts have pointed this out over and over. Yet conservatives like Krauthammer keep repeating these debunked claims. Either Krauthammer lives so deep within the right's misinformation feedback loop that he has never heard any refutation of his false claims, or else he simply doesn't care what's true.

Anyway, Krauthammer frames his entire column as a plea for concern with the deficit. If this were truly his concern, as Austin Frakt points out, why don't Republicans propose to repeal just the coverage expansions in the PPACA, and keep all the cost savings? Or even just some of them? if they refuse to violate their religious opposition to tax hikes, they could just keep in place the Medicare cuts and repeal the coverage expansions. that would undeniably shrink the deficit, and the size of government. But they won't even consider that. The bad faith at work here is just staggering.

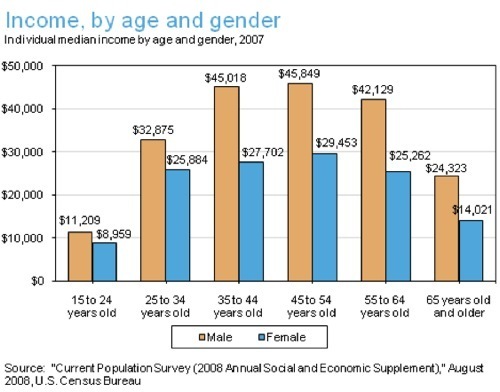

The Age-Income Profile Is Less Steeply Sloped than I Had Thought It Was

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers