J. Bradford DeLong's Blog, page 1095

January 8, 2015

The Early Impact of the Affordable Care Act: Comment

Comment on:

Amanda Kowalski:

The Early Impact of the Affordable Care Act:

This very interesting paper by Amanda Kowalski tells me that costs have risen by a lot in many places. I am surprised

That suggests to me that many of the previously uninsured were not low-value consumers, the kind who would not demand much health care, as we saw in the case in Massachusetts.

That foregone consumer surplus caused by not insuring the uninsured earlier has thus turned out to be very much bigger in the pre-ACA regime than I had thought. And so the potential positive social welfare effects of the ACA are significantly greater than I had believed likely.

Moreover, the paper seems to me to imply that the division of the surplus from subsidies between insurance companies on the one hand and consumers on the other is very different between the states that have aggressively pursued ACA enforcement and those that have not. In the passive and nonimplementing states--the nullification states--insurance companies appear to have grabbed a greater amount of the surplus. I wonder if that might explain some of the absence of a strong insurance lobby in nullification states for more aggressive implementation? Non-implementation means that insurance companies forego some of the potential subsidy pool. But it also means that the pressures in the ACA that would increase market competition are also largely absent.

Hoisted from the Archives: My "Sisyphus as Social Democrat: A review of 'John Kenneth Galbraith: His Life, His Politics, His Economics', by Richard Parker,"

A feel-good thing to read from my archives 9 3/4 years ago is my Parker-Galbraith review:

J. Bradford DeLong (2005), "Sisyphus as Social Democrat: A review of John Kenneth Galbraith: His Life, His Politics, His Economics, by Richard Parker," Foreign Affairs May/June 2005

http://delong.typepad.com/sdj/2005/04/foreign_affairs.html

2005-04-20

Morning Must-Read: Financial Times: Markets Prophesy Secular Stagnation

A view diametrically opposed to the Federal Reserve's view as set out by William Dudley. While Dudley wants to take current very-low rates as a sign that Ms. Market doesn't understand the world and that the Fed should raise rates sooner and faster than it was planning to, the FT does not--it thinks that the market accurately perceives the Federal Reserve as, once again, failing to understand the gravity of the situation...

Note also the next to last sentence I quote. Larry Summers and I have completely won the intellectual argument that as long as interest rates are this low governments should be spending more and taxing less, no? So why have we had no effect on policy?

Financial Times:

Markets Prophesy Secular Stagnation:

"This is indeed a downbeat story...

...It is neither healthy nor sustainable for long-term rates to stay this low for this long.... Savers cannot survive on negative real returns. Pension funds are already struggling.... Although finance ministries sell bonds more easily in such an environment, they should not look to prolong it. Their policies should aim at restoring growth to levels that would lead to a higher level of interest rates.... he first recourse is for central banks to show fewer qualms in pursuit of higher inflation. But a useful next step would be for governments to take advantage of these cheap rates to borrow and invest.... It is hard to imagine a future finance minister wishing he had borrowed less when the price was negative."

Over at Equitable Growth: Today's Essay at Trying to Understand Current FedThink: Daily Focus

[Over at Equitable Growth][1]: The "more thoughts about this" I promised earlier below...

Jon Hilsenrath:

Could Lower 10-Year Yields Spark A More Aggressive Fed?:

"Falling long-term interest rates pose a quandary for Federal Reserve officials....

...If falling yields are a reflection of diminishing inflation prospects... it ought to prompt the Fed to hold off on raising short-term interest rates.... If... lower long-term rates are a reflection of investors pouring money into U.S. dollar assets, flows that could spark a U.S. asset price boom, it might prompt the Fed to push rates higher sooner.... The latter interpretation is less conventional, but it is one that New York Fed President William Dudley made.... [READ MOAR][1]

[1]:

During the 2004-07 period, the (Fed) tightened monetary policy nearly continuously, raising the federal funds rate from 1 percent to 5.25 percent in 17 steps. However, during this period, 10-year Treasury note yields did not rise much... the availability of mortgage credit eased.... With the benefit of hindsight, it seems that either monetary policy should have been tightened more aggressively or macroprudential measures should have been implemented in order to tighten credit conditions in the overheated housing sector.

Mr. Dudley’s conclusion was that the pace of the Fed’s short-term interest rate moves this time around ought to be dictated in part by whether the rest of the financial system is moving with or against the Fed’s intentions when it decides it ought to start restraining credit creation:

When lift-off occurs, the pace of monetary policy normalization will depend, in part, on how financial market conditions react to the initial and subsequent tightening moves....

The challenge for the Fed is that one can make any number of arguments about the cause of falling long-term rates today.... The Fed’s next policy meeting is three weeks away. It is clear officials will spend a considerable time debating the correct response to a perplexing lurch down in long-term rates.

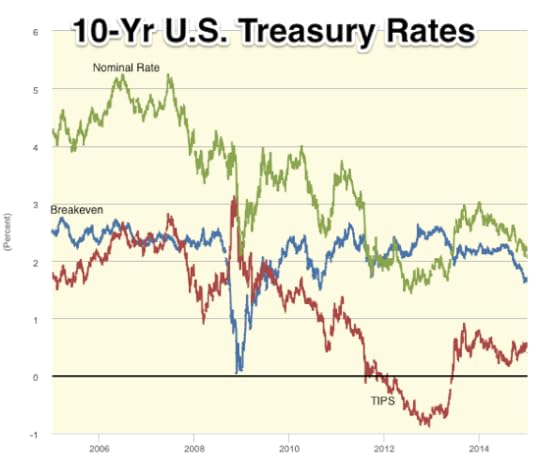

Our current remarkably-low long-term interest rates has three possible interpretations:

Ms. Market expects currently-planned near-term Fed policy to produce a very weak economy for a long time to come, and hence very low interest rates in the out years. Ms. Market is correct. In this case, low long-term interest rates are a signal that the Federal Reserve's current liftoff plans are a mistake and should be revisited.

Ms. Market expects currently-planned near-term Fed policy to produce a very weak economy for a long time to come, and hence very low interest rates in the out years. Ms. Market is wrong. In this case, low long-term interest rates are not a signal that the Federal Reserve's current liftoff plans are a mistake and should be revisited. Rather, the Federal Reserve should act as in (3).

Ms. Market expects currently-planned near-term Fed policy to produce a normal economy in the out-years, but the U.S. Treasury market has an unusually small or negative term premium because of the large number of foreign investors seeking U.S.-based political and economic risk insurance via holdings of U.S. Treasuries. In this case, low long-term interest rates are inappropriately stimulative and run the risk of generating an overheating economy, and the proper response by the Federal Reserve is to announce that it will raise interest rates sooner and faster in order to push long-term rates to where they need to be for a sustainable Goldilocks continued recovery.

The Federal Reserve strongly believes that Ms. Market has no information about the future course of the macroeconomy that the Federal Reserve does not have--that (1) is simply unthinkable. That leaves (2)--Ms. Market thinks the Federal Reserve's currently-planned near-term policy path is risking another lost decade, but Ms. Market is wrong--or (3)--long-term rates have an anomalously-low term premium because of foreign-investor demand.

A glance at the graph above would seem to rule out (3): 10-Yr breakeven inflation has fallen from 2.5%/year just before the taper tantrum to 1.6%/year today, while the TIPS has risen from -0.7%/year to +0.4%/year today. If it were (3), the surge of foreign demand ought to have put downward pressure on both nominal Treasuries and TIPS, leaving the breakeven largely unchanged. That is not what has happened. If the Federal Reserve wants to hold to (3), therefore, it needs to add to it:

3'. Something else weird and unrelated has happened in the market for TIPS.

While that is possible, it is disfavored by Occam's Razor.

Thus Dudley seems to be chasing down a red herring. The interpretation he wants to put forward ought to be this: "Today Ms. Market expects inflation over the next ten years to be 0.9%/year less than it expected it to be back in June 2013. But we know better: the economy is actually much stronger than Ms. Market thinks."

Coming from a Federal Reserve that has overestimated the future strength of the economy in every single quarter since the start of 2007, that is not a terribly reassuring posture for it to take.

804 words

Liveblogging World War II: January 8, 1945: Battle of the Bulge

World War II Today:

Battle of the Bulge: Three Medal of Honor Heroes:

Sgt Day G. Turner, Company B, 319th Infantry, 80th Infantry Division, Dahl, Luxembourg, 8 January 1945:

He commanded a 9-man squad with the mission of holding a critical flank position. When overwhelming numbers of the enemy attacked under cover of withering artillery, mortar, and rocket fire, he withdrew his squad into a nearby house, determined to defend it to the last man.

The enemy attacked again and again and were repulsed with heavy losses. Supported by direct tank fire, they finally gained entrance, but the intrepid sergeant refused to surrender although 5 of his men were wounded and 1 was killed. He boldly flung a can of flaming oil at the first wave of attackers, dispersing them, and fought doggedly from room to room, closing with the enemy in fierce hand-to-hand encounters.

He hurled handgrenade for handgrenade, bayoneted 2 fanatical Germans who rushed a doorway he was defending and fought on with the enemy’s weapons when his own ammunition was expended. The savage fight raged for 4 hours, and finally, when only 3 men of the defending squad were left unwounded, the enemy surrendered.

Twenty-five prisoners were taken, 11 enemy dead and a great number of wounded were counted. Sgt. Turner’s valiant stand will live on as a constant inspiration to his comrades. His heroic, inspiring leadership, his determination and courageous devotion to duty exemplify the highest tradition of the military service.

Technical Sergeant Charles F. Carey, Jr.:

Technical Sergeant Charles F. Carey, Jr., ASN: (6253699), United States Army, for conspicuous gallantry and intrepidity in action above and beyond the call of duty on January 8 and 9, 1945, while serving with the 397th Infantry Regiment, 100th Infantry Division, in action at Rimling, France.

Technical Sergeant Carey was in command of an antitank platoon when about 200 enemy infantrymen and twelve tanks attacked his battalion, overrunning part of its position. After losing his guns, Technical Sergeant Carey, acting entirely on his own initiative, organized a patrol and rescued two of his squads from a threatened sector, evacuating those who had been wounded.

He organized a second patrol and advanced against an enemy-held house from which vicious fire issued, preventing the free movement of our troops. Covered by fire from his patrol, he approached the house, killed two snipers with his rifle, and threw a grenade in the door. He entered alone and a few minutes later emerged with 16 prisoners. Acting on information he furnished, the American forces were able to capture an additional 41 Germans in adjacent houses.

He assembled another patrol, and, under covering fire, moved to within a few yards of an enemy tank and damaged it with a rocket. As the crew attempted to leave their burning vehicle, he calmly shot them with his rifle, killing three and wounding a fourth.

Early in the morning of 9 January, German infantry moved into the western part of the town and encircled a house in which Technical Sergeant Carey had previously posted a squad. Four of the group escaped to the attic. By maneuvering an old staircase against the building, Technical Sergeant Carey was able to rescue these men. Later that day, when attempting to reach an outpost, he was struck down by sniper fire.

The fearless and aggressive leadership of Technical Sergeant Carey, his courage in the face of heavy fire from superior enemy forces, provided an inspiring example for his comrades and materially helped his battalion to withstand the German onslaught.

Technical Sergeant Russell E. Dunham Company I, 30th Infantry, 3d Infantry Division:

For conspicuous gallantry and intrepidity at risk of life above and beyond the call of duty. At about 1430 hours on 8 January 1945, during an attack on Hill 616, near Kayserberg, France, T/Sgt. Dunham single-handedly assaulted 3 enemy machine guns. Wearing a white robe made of a mattress cover, carrying 12 carbine magazines and with a dozen hand grenades snagged in his belt, suspenders, and buttonholes, T/Sgt. Dunham advanced in the attack up a snow-covered hill under fire from 2 machine guns and supporting riflemen.

His platoon 35 yards behind him, T/Sgt. Dunham crawled 75 yards under heavy direct fire toward the timbered emplacement shielding the left machine gun. As he jumped to his feet 10 yards from the gun and charged forward, machine gun fire tore through his camouflage robe and a rifle bullet seared a 10-inch gash across his back sending him spinning 15 yards down hill into the snow. When the indomitable sergeant sprang to his feet to renew his 1-man assault, a German egg grenade landed beside him. He kicked it aside, and as it exploded 5 yards away, shot and killed the German machine gunner and assistant gunner. His carbine empty, he jumped into the emplacement and hauled out the third member of the gun crew by the collar.

Although his back wound was causing him excruciating pain and blood was seeping through his white coat, T/Sgt. Dunham proceeded 50 yards through a storm of automatic and rifle fire to attack the second machine gun. Twenty-five yards from the emplacement he hurled 2 grenades, destroying the gun and its crew; then fired down into the supporting foxholes with his carbine dispatching and dispersing the enemy riflemen.

Although his coat was so thoroughly blood-soaked that he was a conspicuous target against the white landscape, T/Sgt. Dunham again advanced ahead of his platoon in an assault on enemy positions farther up the hill. Coming under machinegun fire from 65 yards to his front, while rifle grenades exploded 10 yards from his position, he hit the ground and crawled forward.

At 15 yards range, he jumped to his feet, staggered a few paces toward the timbered machinegun emplacement and killed the crew with hand grenades. An enemy rifleman fired at pointblank range, but missed him. After killing the rifleman, T/Sgt. Dunham drove others from their foxholes with grenades and carbine fire.

Killing 9 Germans—wounding 7 and capturing 2—firing about 175 rounds of carbine ammunition, and expending 11 grenades, T/Sgt. Dunham, despite a painful wound, spearheaded a spectacular and successful diversionary attack.

January 7, 2015

Weather Elsewhere...

If it's too cold for you, it's too cold for them. Bring your Tauntauns inside #takecareofyourpets pic.twitter.com/j3uoV7O8V0

— U of Iowa Police (@UIowa_Police) January 8, 2015

Noted for Your Nighttime Procrastination for January 7, 2015

Over at Equitable Growth--The Equitablog

Over at Equitable Growth--The Equitablog

The U.S. Economy: Overview and Prospect: Notes for Orinda, CA, Rotary Club Talk

Books! Books! Books!

Mary C. Daly and Bart Hobijn: Why Is Wage Growth So Slow?

Larry Mishel: American Wages Have Stagnated

[Megan McArdle: Yes, You're Rich, and It's Time You Admit It](http://equitablegr

Plus:

Things to Read at Night on January 7, 2015

Must- and Shall-Reads:

Ezra Klein:

"Allowing extremists to set the limits of conversation validates and entrenches the extremists' premises. That was true in the criticism of Charlie Hebdo's covers, and it's even truer in today's crimes.... This is a tragedy. It is a crime. It is not a statement, or a controversy."

Just heard first healthcare.gov advertisement ever on Missouri radio...

Judy Solomon:

"Contrary to Senate Republican leaders’ recent claim, residents of 34 states with federally run health insurance marketplaces will not have to repay their premium tax credits if the Supreme Court rules in June that health reform doesn’t authorize the credits in those states..."

Ken Rogoff:

"Oil prices are the big story for 2015. They are a once-in-a-generation shock and will have huge reverberations..."

Chris Mooney:

"The 'pause' argument largely relies on the then-record temperatures of 1998 in order to create the impression that there's been little or no global warming ever since. Yet... the 2000s were considerably hotter than the 1990s, and... [even] without... 2014... NASA considers 1998 merely the fourth hottest year... NOAA considers it third..."

Adriana Lee:

Intel Pledges $300M To Take On GamerGate And Diversity In Tech

Mary C. Daly and Bart Hobijn:

Why Is Wage Growth So Slow?

Larry Mishel:

American Wages Have Stagnated

Megan McArdle:

Yes, You're Rich, and It's Time You Admit It

And Over Here:

Turkey and the Washington Post: Live from The Roasterie

¡No Pasarán!: Charlie Hebdo, and Juan Cole: Why al-Qaeda Attacked Satirists in Paris

The U.S. Economy: Overview and Prospect: Notes for Orinda, CA, Rotary Club Talk

Re-Reading My Weblog: April 2005

Liveblogging World War II: January 7, 1945: Managing Montgomery

Books! Books! Books!: Live from Mrs. Dalloway's (and from the Evans Hall Mail Inbox)

Mary C. Daly and Bart Hobijn:

Why Is Wage Growth So Slow?:

"Despite considerable improvement in the labor market, growth in wages continues to be disappointing. One reason is that many firms were unable to reduce wages during the recession, and they must now work off a stockpile of pent-up wage cuts. This pattern is evident nationwide and explains the variation in wage growth across industries. Industries that were least able to cut wages during the downturn and therefore accrued the most pent-up cuts have experienced relatively slower wage growth during the recovery..."

Larry Mishel:

American Wages Have Stagnated:

"If most people believe, as I think they do, that if they’d leave their current job, they’d get a worse job, then exit does not give you much leverage. So, the single most important policy response right now should be to get to a vigorous full employment. That makes the decisions of the Federal Reserve board over the next few years the most consequential economic policy decisions to be made on wages and income inequality."

Megan McArdle:

Yes, You're Rich, and It's Time You Admit It:

"Jack Lew made a lot of money working for Citibank. So why... did he say last week that 'My own compensation was never in the stratosphere'? Jack Lew is not the only person who says this sort of thing. The media is routinely filled with people making six- and seven-figure incomes who modestly report that they are very middle class, struggling, really, to make it from paycheck to paycheck. And if you live in a big coastal city like New York, Washington, Boston or San Francisco, you... can go to any private-school parents night or Ivy League alumni reunion to hear a veritable chorus of people remarking that they really don't know how they keep body and soul together on just $350,000 per annum. Be warned, however, that it is not polite to point and laugh the way that you would on Twitter..."

Should Be Aware of:

Arthur Goldhammer:

Let’s not sacralize Charlie Hebdo

The Minimum Wage and the EITC

http://delong.typepad.com/sdj/2004/07/the-minimum-wage-and-the-eitc.html

2004-07-09

Rucker Johnson:

School Quality and the Long-run Effects of Head Start

Ryan Broderick:

23 Heartbreaking Cartoons From Artists Responding To The Charlie Hebdo Shooting

Palo Alto Farmers' Market:

Spicy Sesame Yuba Noodle Stir Fry: "1 package of Hodo Soy Yuba sheets. 2 tbsp vegetable oil. 2 tsp toasted sesame oil. 4 tbsp soy sauce. 1 tbsp brown sugar. Japanese red chili powder. Green peppers & toasted sesame seeds (garnish). Instructions: Cut the yuba sheets into ½-inch slices. Gently separate to make the noodle strips. Heat vegetable oil in a large pan over medium heat. Drop the noodles into the pan and let cook for about 3 minutes – until warm and some edges are slightly crispy. Don’t let the noodles get too crispy. In a medium bowl, combine sesame oil, soy sauce, brown sugar and chili powder. When all the noodles are cooked, toss them in the sesame soy sauce to coat all the noodles. Plate while still warm and garnish with sesame seeds, green onions and a dash of chili powder if you desire."

Comments:

Dan Nexon:

Hard Power, Soft Power, Muscovy, Strategy:

"Not your fault. The 'soft power' concept has become hopelessly confused since Nye introduced. It originally meant 'attraction' -- think of it as combining Bourdieu's objectified cultural capital ('American blue jeans') and symbolic capital, but has come to mean any non-kinetic or non-economic power resource. In this latter formulation, Dan D. is technically right that sanctions are non-kinetic hard power, but you're right that putting them into place required diplomatic skill, legitimacy, and other soft-power-esque resources. And you're doubly right about Russia's position in the global balance of power."

Maynard Handley:

Hard Power, Soft Power, Muscovy, Strategy:

"The guy who says this with the most detail and panache (the US has basically burned up all the massive soft power it once had in some sort of insane Bonfire of the Vanities) is Francis Fukuyama in his most recent book, Political Order and Political Decay: From the Industrial Revolution to the Globalization of Democracy. Lots of very depressing stuff there about the current US political order, to complement Piketty's economic take. "

Kansas Jack:

Hard Power, Soft Power, Muscovy, Strategy:

"Be careful M. Putin... ‘To every administrator, in peaceful, unstormy times, it seems that the entire population entrusted to him moves only by his efforts, and in this consciousness of his necessity every administrator finds the chief rewards for his labors and efforts. It is understandable that, as long as the historical sea is calm, it must seem to the ruler-administrator in his frail little bark, resting his pole against the ship of the people and moving along with it, that his efforts are moving the ship. But once a storm arises, the sea churns up, and the ship begins to move by itself, and then the delusion is no longer possible. The ship follows its own enormous, independent course, the pole does not reach the moving ship, and the ruler suddenly, from his position of power, from being a source of strength, becomes an insignificant, useless, and feeble human being.’ ― Leo Tolstoy, War and Peace"

Claudius:

Washington Describes Victory at Princeton:

"Well, General Howe's report noted 18 killed, 58 wounded, and 200 missing. So it is likely that Washington inflated the numbers. But the British were flanked, and they also fled, and the Americans had some horse and some of the Americans pursued the fleeing British until nightfall."

derrida derider:

John Cassidy's Interview with James Heckman:

"The trouble with the 'all that is needed for the EMH to hold is proper regulation to ensure a fully informed market' meme is that it is characteristic of booms and busts that the relevant animal spirits infect the regulators - and the economic theorists behind them too. It seems obvious that when the market is delivering the goodies to all involved that it must be perfectly efficient and therefore that dabbling with it can only do harm (especially obvious as we know any bust will immediately be blamed on the dabbler). It similarly seems obvious when the goodies disappear that market failures and rent seeking of all kinds are pervasive, so both efficiency and equity require the firm and visible hand of good government. Thus we get the classic pattern - the barn door is removed as the horse begins to get frisky 'so as not to cramp its movements'. Then, after the horse is no longer anywhere in sight, the regulators solemnly close that door and reinforce it with armour plating, muttering 'never again'."

Bloix:

John Cassidy's Interview with James Heckman:

"'When Bob Lucas was writing that the Great Depression was people taking extended vacations—refusing to take available jobs at low wages...' What an evil, evil man. This is from what is IMHO the greatest novel of the Depression, Waiting for Nothing, by Tom Kromer: 'I am in this mission. I lie on top of this bunk... I turn my eyes to the stiff in the bunk next to mine ... His face is pasty white. The bones almost stick out of his skin ... I turn my head away but still I can hear him groan .. He does not breathe. He only rattles. 'For Christ sake, what is the matter with that stiff?' says this stiff in the next bunk. 'He is croaking up here in his lousy bunk, that's what's the matter with him,' I say. 'Does he have to make that much racket to croak?' he says. 'I see plenty of stiffs croak, but nI ever see one make that much racket at it.' ... I lie up here and think ... This stiff has not always been a stiff. Somewhere sometime, this stiff has had a home. Maybe he had a family ... He is alone. The fritz has made him alone. He will die cooped up in a mission with a thousand stiffs who snore through the night, but he will die alone ... I try think back over the years that I have lived. But I cannot think of years any more. I can only think of the drags I have rode, of the bulls that have sapped up on me, and the mission slop I have swilled. People I have known, I remember no more. They are gone... I lie up here on my three-decker bunk and shiver. I am not cold. I am afraid. What is a man to do? All he do is try to keep his belly full of enough slop so that he won't rattle when he breathes. All he can do is try and find himself a lousy flop at night. Day after day, week after week, year after year, always the same - three hots and a flop.' Tom Kromer, the son of a coal miner who had died of cancer, was 22 and had two years of college and had held several decent jobs - proofreader, elementary schoolteacher - when he ran out of money and work and began five years of vagrant life in 1929. In 1935 he managed to enroll in the CCC, but by that time he had contracted severe tuberculosis from sleeping in missions and flophouses. He spent several years in a sanatorium in New Mexico, but he remained an invalid, more or less bedridden, for the next 25 years, until he died. Waiting for Nothing has a dedication: 'To Jolene, who turned off the gas.' Bob Lucas - what an evil, evil man."

Kaleberg:

What Are the Experiences That MOOCs Need to Replicate?:

"MOOCs have been attacking the wrong problem. The cost of teaching has not been increasing. Faculty salaries have been falling if anything. College level education costs are driven by increased investment in fixed plant, larger bureaucracies and higher management salaries. College level education prices are driven by decreased public subsidies. Both of these are driven ideologically as college level education is increasingly seen as a business rather than a vital government service. It might be possible to use computer and communications technology to drive down college management costs, shrink the size of the bureaucracy and cut the need for additional fixed plant. Instead of buildings, invest in intelligent leasing management to provide classrooms and other spaces as needed. Rely on computer software to manage student and faculty needs, ideally simplifying the software so that individuals can manage their own education. Of course, this has no room for high investor returns and inflated salaries and payrolls, so it is a non-starter. There is a move towards leaner financial products like self balancing index funds. Perhaps we need a move towards leaner educational products."

Tracy Lightcap:

What Are the Experiences That MOOCs Need to Replicate?:

"'This involves a completely unfounded assumption: that the present financial structure of higher education in the US is 'unsustainable'.' I run into this occasionally and it always bewilders me. It is true that US higher education is becoming more unaffordable. But that is the result of a variety of easily reversed public policy decisions: the withdrawal of public funds to support tuition costs from public post-secondary education, the intrusion of private businesses into areas where they compete with higher education, the egregious increases in administrative personnel and their salaries, and, finally, the attempt to reduce faculty costs through adjuncts and on-line courses as much as possible. All of these are connected, of course. Taxpayers complain about increased tuition costs because, like all Americans, they want Swedish-style social services for Mississippi-style taxes. They get the Feds to step in with subsidies. For-profit colleges see a tremendous opportunity for them arising from this and use the subsidies to provide cut-rate education that is generally good for less then nothing. Colleges and universities, caught between a rock and a hard place, hire hoards of administrators to intrigue private donors, 'brand' collegiate experiences, and cajole students by providing a 'student experience' that will keep them around long enough for one more subsidized tuition check. And they also short change their students education by increasing the number of impoverished, over-worked adjuncts and turning to on-line courses as a way out. The solution is not to be found in this policy mix. It is a simple one: replace the levels of funding once given to public post-secondary education. That would: increase pressure on faculties to reduce salary demands, drive for-profit post secondary education out of business, vastly reduce the number of extra administrators needed to make up the present deficits, end the need to replace educational functions with social ones to keep students, and re-establish the collegiate experience. And, as the reaction to the attempted firing of Teresa Sullivan at the University of Virginia and the recent funding increases for public education in California show, there is public support for putting funding for public universities back to a level that will insure a college education within the means of those students who can qualify and curbing the entrepreneurial model of higher education. MOOC's and their ilk will continue to be around in some subjects; we still have correspondence courses too. But a wholesale restructuring of higher education (only called for in the US, UK, and Australia, for obvious reasons) is not and was never the answer."

Turkey and the Washington Post: Live from The Roasterie

This one starts with Claire Berlinski's much-warrented dismay at who the Washington Post opens its op-ed pages to--without proper vetting or context. The net effect is to subtract from rather than add to most Washington Post readers' understanding of what is going wrong in Turkey right now:

Initial tweet I first saw at: https://twitter.com/ClaireBerlinski/status/551358577366282240:

@bb1mm1: I don't expect freedom of expression in TR to be an American problem, but what sections of the US press is doing w/ the cemaat is obscene.

@ClaireBerlinski: Then we'll be on to something beyond "whining" and "talking in what's basically riddles to everyone else among a small clique. @bb1mm1”

@bb1mm1: @ClaireBerlinski within the narrow scope I don't think either of us've had any problem explaining it to a regular American who's interested.

@ClaireBerlinski: @bb1mm1 I have. Some regular Americans are interested. More respond with "Why should I give a shit?" No matter how patiently I explain.

@bb1mm1: @ClaireBerlinski they are not interested then and I don't blame them. That's why I narrowed down the scope.

@ClaireBerlinski: However, to prove this requires making them focus on the details of a case study that seems superficially boring. @bb1mm1

@bb1mm1: @ClaireBerlinski I'm not convinced. If pushed, AFAIR, lay people there already do understand the nature of unaccountable concentrated power.

@ClaireBerlinski: @bb1mm1 I may now be speaking so epigrammatically that my point is unclear even to you, which is really a sign of going the wrong direction.

@bb1mm1: @ClaireBerlinski yes. The problem I saw and reacted to was parts of the US press handing their pages to some of the sly-est and most sinister enemies of freedom of expression in TR purportedly in support of the very same right in TR

@ClaireBerlinski: Let me at least repeat that in very simple language for anyone who's puzzled by those RTs. WaPo published this: http://t.co/A97VOmF8lp. Author is a sly, sinister enemy of freedom of expression in Turkey. WaPo did not note this. This is a big problem for the US. Get it?

@delong: .@ClaireBerlinski @rodrikdani it would seem that this problem is best addressed at the @washingtonpost @nytimes level

@ClaireBerlinski: @delong @rodrikdani @washingtonpost @nytimes You would think, but given that it isn't, what next?

@rodrikdani: @ClaireBerlinski @delong Market for ideas, good opeds drive out bad ones bla bla bla ...

@ClaireBerlinski: Must be whole intellectual disciplines we're overlooking here. If you're an economist everything looks like a market. @rodrikdani @delong

@ClaireBerlinski: @Steven_Strauss @rodrikdani @delong He's being ironic. Yes. He's making a point about the difference between my washing machine & an op-ed.

@ClaireBerlinski: @Steven_Strauss @rodrikdani @delong To which I'm responding: "That they're different problems does not mean one is soluble, the other, not."

@ClaireBerlinski: @Steven_Strauss @rodrikdani @delong But I get stuck on "Solve problem two w/out solutions worse than the problem they're meant to solve."

@ClaireBerlinski: Really not how I envisioned the future of liberal democracy in, say, 1989. RT @vvanwilgenburg WaPo turned into Zaman for a day.

delong: .@ClaireBerlinski The problem with the @washingtonpost (and the @nytimes) is that it sells itself as a trusted intermediary interested in informing you while it is actually focused on seizing your eyeballs so that it can sell them to advertisers. Same true of CNN, Fox News, The Journal of the Party of a New Type, National Review, Daily Worker, Ron Paul's Survivalist Newsletter, etc. It is like Goldman Sachs and Magnetar: GS's clients thought it was a trusted intermediary making them aware of an opportunity to exploit counterparty John Paulson who had too much subprime risk in his portfolio. Was not so. Got taken to the cleaners. People who think @washingtonpost or @nytimes, etc., is a trusted information intermediary get similarly taken to the intellectual cleaners.

One thing you can do is for you and all your friends to make sure to say, in every conversation about the news you have: "You know that Dean Baquet and Marty Baron are not in the business of running a trusted information intermediary? Dean Baquet has set up The Upshot run by David Leonhardt in an attempt to get some of that trusted-information-intermediary status, and Marty Baron has his analogous WonkBlog that was originally Ezra Klein's trusted-information-intermediary platform, but the fact that both find those necessary speaks volumes about how that is not the business of the main platform."

Debunking @washingtonpost and @nytimes's claims to be trusted information intermediaries is, I think, an important first step...

¡No Pasarán!: Charlie Hebdo, and Juan Cole: Why al-Qaeda Attacked Satirists in Paris

And:

Juan Cole:

Sharpening Contradictions: Why al-Qaeda attacked Satirists in Paris:

"The horrific murder of the editor, cartoonists and other staff...

...of the irreverent satirical weekly Charlie Hebdo, along with two policemen, by terrorists in Paris was in my view a strategic strike, aiming at polarizing the French and European public.

The problem for a terrorist group like al-Qaeda is that its recruitment pool is Muslims, but most Muslims are not interested in terrorism. Most Muslims are not even interested in politics, much less political Islam. France is a country of 66 million, of which about 5 million is of Muslim heritage. But in polling, only a third, less than 2 million, say that they are interested in religion. French Muslims may be the most secular Muslim-heritage population in the world (ex-Soviet ethnic Muslims often also have low rates of belief and observance). Many Muslim immigrants in the post-war period to France came as laborers and were not literate people, and their grandchildren are rather distant from Middle Eastern fundamentalism, pursuing urban cosmopolitan culture such as rap and rai.

In Paris, where Muslims tend to be better educated and more religious, the vast majority reject violence and say they are loyal to France.

Al-Qaeda wants to mentally colonize French Muslims, but faces a wall of disinterest. But if it can get non-Muslim French to be beastly to ethnic Muslims on the grounds that they are Muslims, it can start creating a common political identity around grievance against discrimination.

This tactic is similar to the one used by Stalinists in the early 20th century.

Decades ago I read an account by the philosopher Karl Popper of how he flirted with Marxism for about 6 months in 1919 when he was auditing classes at the University of Vienna. He left the group in disgust when he discovered that they were attempting to use false flag operations to provoke militant confrontations. In one of them police killed 8 socialist youth at Hörlgasse on 15 June 1919. For the unscrupulous among Bolsheviks–who would later be Stalinists– the fact that most students and workers don’t want to overthrow the business class is inconvenient, and so it seemed desirable to some of them to ‘sharpen the contradictions’ between labor and capital.

The operatives who carried out this attack exhibit signs of professional training. They spoke unaccented French, and so certainly know that they are playing into the hands of Marine LePen and the Islamophobic French Right wing. They may have been French, but they appear to have been battle hardened. This horrific murder was not a pious protest against the defamation of a religious icon. It was an attempt to provoke European society into pogroms against French Muslims, at which point al-Qaeda recruitment would suddenly exhibit some successes instead of faltering in the face of lively Beur youth culture (French Arabs playfully call themselves by this anagram). Ironically, there are reports that one of the two policemen they killed was a Muslim.

Al-Qaeda in Mesopotamia, then led by Abu Musab al-Zarqawi, deployed this sort of polarization strategy successfully in Iraq, constantly attacking Shiites and their holy symbols, and provoking the ethnic cleansing of a million Sunnis from Baghdad. The polarization proceeded, with the help of various incarnations of Daesh (Arabic for ISIL or ISIS, which descends from al-Qaeda in Mesopotamia). And in the end, the brutal and genocidal strategy worked, such that Daesh was able to encompass all of Sunni Arab Iraq, which had suffered so many Shiite reprisals that they sought the umbrella of the very group that had deliberately and systematically provoked the Shiites.

‘Sharpening the contradictions’ is the strategy of sociopaths and totalitarians, aimed at unmooring people from their ordinary insouciance and preying on them, mobilizing their energies and wealth for the perverted purposes of a self-styled great leader.

The only effective response to this manipulative strategy (as Grand Ayatollah Ali Sistani tried to tell the Iraqi Shiites a decade ago) is to resist the impulse to blame an entire group for the actions of a few and to refuse to carry out identity-politics reprisals.

For those who require unrelated people to take responsibility for those who claim to be their co-religionists (not a demand ever made of Christians), the al-Azhar Seminary, seat of Sunni Muslim learning and fatwas, condemned the attack, as did the Arab League that comprises 22 Muslim-majority states.

We have a model for response to terrorist provocation and attempts at sharpening the contradictions. It is Norway after Anders Behring Breivik committed mass murder of Norwegian leftists for being soft on Islam. The Norwegian government launched no war on terror. They tried Breivik in court as a common criminal. They remained committed to their admirable modern Norwegian values.

Most of France will also remain committed to French values of the Rights of Man, which they invented. But an insular and hateful minority will take advantage of this deliberately polarizing atrocity to push their own agenda. Europe’s future depends on whether the Marine LePens are allowed to become mainstream. Extremism thrives on other people’s extremism, and is inexorably defeated by tolerance.

Let me conclude by offering my profound condolences to the families, friends and fans of our murdered colleagues at Charlie Hebdo, including Stephane Charbonnier, Bernard Maris, and cartoonists Georges Wolinski Jean Cabut, aka Cabu, and Berbard Verlhac (Tignous)– and all the others. As Charbonnier, known as Charb, said, ‘I prefer to die standing than to live on my knees.’

Rudolph: This vile tactic was exploited in the late 1990s: ‘[B]in Laden, Zawahiri, and company were pursuing bigger ambitions [than other jihadists]—waking the Muslim community from its slumber.… In a secret 1998 letter to another militant—recovered in 2001 from captured Al Qaeda computers in Kabul—Zawahiri points out that Al Qaeda had escalated the fight against ‘the biggest of the criminals, the Americans’ to drag them for an open battle with the nation’s masses…’ Bin Laden and Zawahiri ‘expected a Muslim response similar to that following the Russian invasion and occupation of Afghanistan. Their goal was to generate a major world crisis, provoking the United States…; American attacks on Muslim countries would reinvigorate and unify a splintered, war-torn jihadist movement and restore its credibility in the eyes of [Muslims]…’

Mark Vuletic: I’m willing to be argued with, but I find it difficult to believe that the primary goal of this attack was to provoke a backlash against French Muslims. If that had been the primary goal, then why they attack Charlie Hebdo of all things? As strong as the reaction has been, it surely would be a thousand times stronger had they targeted, say, an elementary school. If there is a recruitment message in the attack, the choice of target makes it seem as though the message is aimed directly at any other Muslims who might already be primed for radicalization.

Juan Cole: They also attacked intellectuals in Iraq as a way of polarizing things; intellectuals have fans.

Neil: ‘Most of France will also remain committed to French values of the Rights of Man, which they invented. ’ Great article; thanks. A correction: if any people invented the Rights of Man, it was most likely the Persians. Google the Cyrus Cylinder.

George Carty: One major reason why the Front National is polling well in France is the failure of François Hollande’s economic policies. He desperately wants to help the French working class, but he is trapped by the Euro (much as Ramsay MacDonald – the Depression-era British Labour prime minister – was trapped by the Gold Standard). The Front National’s policy of quitting the Euro (and presumably allowing the New Franc to depreciate so that France could regain competitiveness) probably looks like an attractive alternative.

Anyway, could the Front National itself have been a target in this latest atrocity? Marine Le Pen has sought to distance the party from its neo-Nazi past as much as possible, as well as from genuine Islam-haters such as the Netherlands’ Geert Wilders. Perhaps this attack was meant to bolster hard-line Islamophobes against moderates within the FN?

Appalled: Very good and important insight from Juan Cole. But just to note, referring to ‘Stalinist’ tactics in 1919 rings a slipshod note. Stalinist as a term applies to later era. ‘Bolshevik,’ I think would be more historically correct.

Michael G. Renner: Your analysis seems, sadly, spot-on. This horrific attack will lift the hopes of all those who are already pushing their reactionary agendas on the back of perceived ‘Islamization.’ In Germany, for example, the reactionary Pegida (an acronym that stands for ‘Patriotic Europeans against the Islamization of the Occident’) has been rearing its ugly head for several weeks now, but counter-demonstrations have attracted far more people, and thankfully the political elites have largely distanced themselves from this anti-immigrant, anti-Muslim group.

But the Paris slaughter will be wind under their wings, judging by initial reactions on the discussion boards of German newspapers. We are in for highly-charged, difficult times, in many countries. Perspectives like yours, Prof. Cole, are desperately needed. So, a heartfelt thanks for your analysis.

Juan Cole: Out of 5-6 million Muslims, a few hundred went to fight in Syria; note that the French gov’t wanted Bashar overthrown, too. This is not a counter argument

A. Waters: I would go even further, Juan, and say that ‘‘sharpening the contradictions’ exists as a strategy because of the problem of creating ‘imagined communities’ for a global diaspora whose religious beliefs and linguistic diversity make it incredibly challenging for there to be cross-cultural solidarity.... Few people understand how secular the Muslim population in France is as well as in Central Asia. Even fewer understand that the overwhelming majority of Iranians under 50 are ‘pro-Western.’

It’s politically shrewd though morally repugnant to use violence to create a sense of transnational solidarity among people whose cultural tastes, social identities and economic needs are so very different. It’s a tactic that is probably one of best ‘weapons of the weak’ in a militarized asymmetric political struggle.

Fear is a great mobilizer and how many states can adopt the Norwegian response to acts of terror? Unfortunately, reliance on panic, fear and distrust continue to be successful ways of accomplishing an otherwise impossible political strategy.

The U.S. Economy: Overview and Prospect: Notes for Orinda, CA, Rotary Club Talk

Part I: Thinking About the Current Business Cycle

The circular flow of economic activity

Everyone's income becomes their spending and investing, which is then someone else's income

Except: When people want to hoard (or de-hoard) their cash

When people want to spend down their cash, (planned) spending is greater than (expected) income

Unexpected inflation

Job of the Federal Reserve to sell bonds and soak that excess cash up to rebalance the economy

When people want to hoard cash, (planned) spending is less than (expected) income

Unemployment and depression

Job of the Federal Reserve to buy bonds and so give the economy the cash it needs to make people comfortable spending and investing their incomes

Private sector cannot do this job: in a panic nothing banks can provide counts as "cash"; in a euphoria everything counts as "cash"

Take away the punchbowl before the party really gets going; but be sure there is a punchbowl

The Situation as of 10 Years Ago

Interest Rates

The Federal Reserve back then was trying to manage the economy: full employment and rough price stability

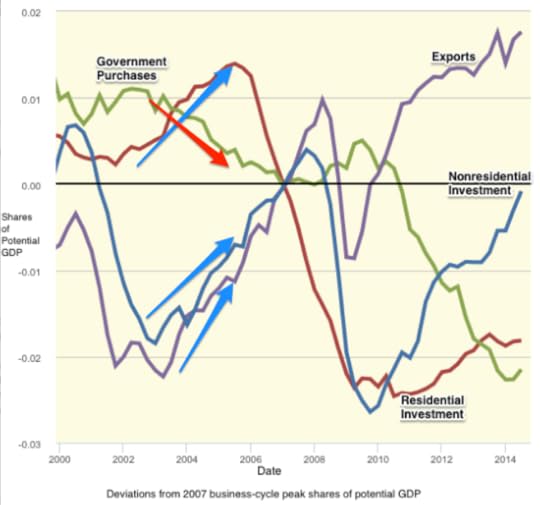

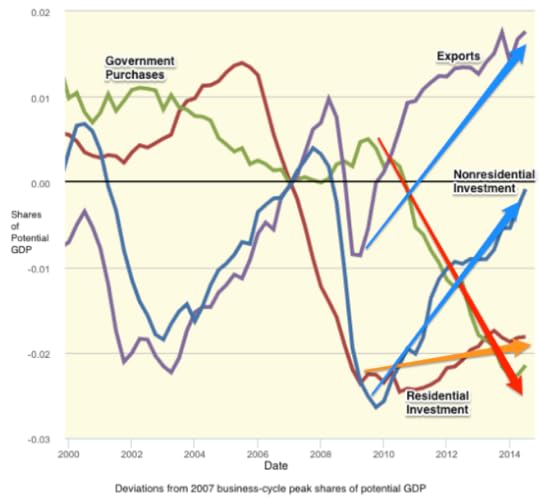

Salient Components of Spending

Deviations as shares of potential production from recent business-cycle peak values

As of 2005 we were pretty optimistic about the near-term and medium-term future of the American economy

Worries about budget deficits and trade deficits, but not a source of immediate disaster

U.S. economy had fallen into recession in 2001 for two reasons:

People who had been investing in high-tech businesses decided to hoard their cash

Fall-off in demand for U.S. exports as people elsewhere decided they wanted to hoard more cash inside the U.S.

But recovery was in train

A housing boom

An export recovery as foreigners figured they had about enough assets in the United States

Employment-to-Adult-Population Ratio

Only big black spot: next to no recovery in employment as a share of the adult population, but that was expected to come in time...

Managing the Correction of Imbalances

Salient Components of Spending

2005-2008: collapse of the housing bubble

Became clear that a lot of the housing investment had been based on people taking on risks that they did not understand--and when they learned what the risks were, they were unhappy

But from 2005-2008 the economy rebalanced--people who had been investing in financing construction shifted to financing exports, business investment instead

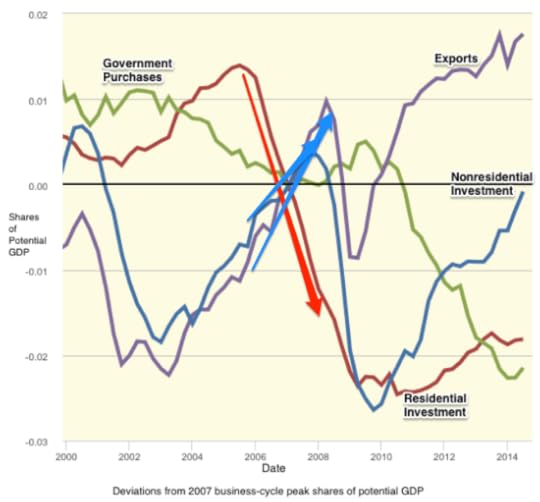

The Collapse

Salient Components of Spending

Then the financial crisis...

Should not have happened...

Became clear that not just the "frothier" parts of housing investment were made by people taking on risks that they did not understand, but that Wall Street had no control whatsoever over what its derivative positions were...

A collapse of trust--and an enormous demand for cash to hoard--as (planned) spending fell way below (expected) income

And then actual income fell below expected incomes because spending had collapsed

Employment-to-Adult-Population Ratio

The worst employment decline since the Great Depression

Interest Rates

Federal Reserve responds by flooding the economy with cash by buying short-term Treasury bills--but it doesn't work: people are so eager to hoard that they take the cash, sock it into their portfolios, where the Treasury bills used to be, and still demand to hoard more...

The Flatlining

Interest Rates

"Quantitative Easing" does not return spending to normal...

Employment-to-Adult-Population Ratio

And the employment-to-adult-population ratio does not recover to normal either

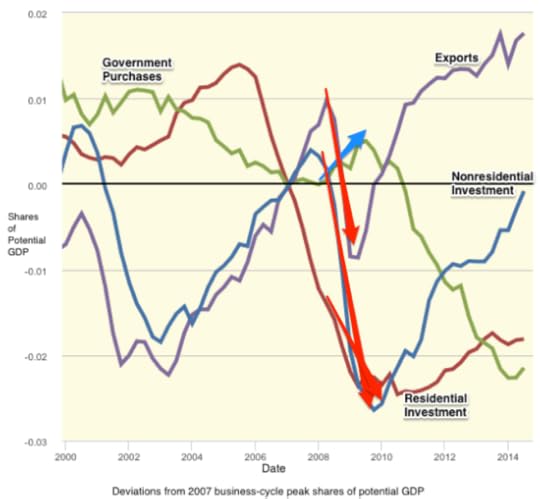

Salient Components of Spending

Why not?

Housing finance not fixed--even very low interest rates and ample cash do not induce people to de-hoard that cash and start investing in construction again (except in a few places)

Businesses see that they have ample capacity and are not enthusiastic about spending their cash on capacity that would then sit idle for a while

Exports do bounce back, but there is a depression going on in most of our export markets as well, so that is limited help

And we hit the economy on the head with a brick by cutting way back on what the government purchases

Exactly the wrong thing to do

Why we do it is a mystery

Part II: The Next Two Years

Labor Force Participation and Employment-to-Adult Population

The Federal Reserve is about to start "normalizing" policy

The question of trend labor-force participation

Federal Reserve believes (a) demography is shrinking desired hours, and (b) many of those who lost their jobs in 2008-9 and haven't gotten good ones since are never going to come back

Hence the economy has nearly "recovered to normal"

But not because production and employment have risen from their depressed levels back to normal

Because the financial crisis, the collapse, and the flatlining have done permanent damage that has pushed "normal" down to nearly where we are today...

Inflation-Adjusted Price of Oil

Only bright spot: Saudi Arabia's loss of pricing power in the oil market--that will give a big boost to Americans' incomes and spending

And it will entail a substantial regional shift within America of wealth from Texas-Oklahoma-North Dakota to California-New York-Florida-Illinois

Also: ObamaCare implementation

Part III: The Next Ten Years

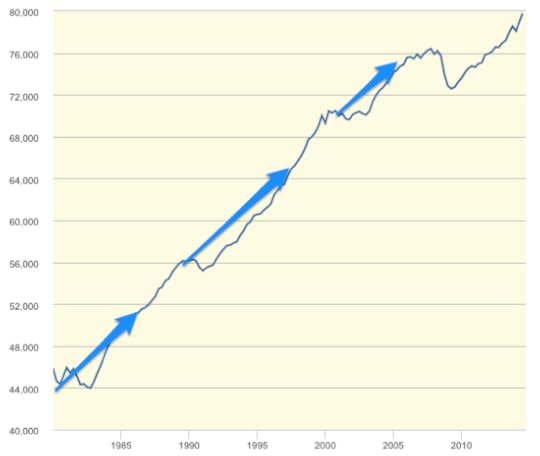

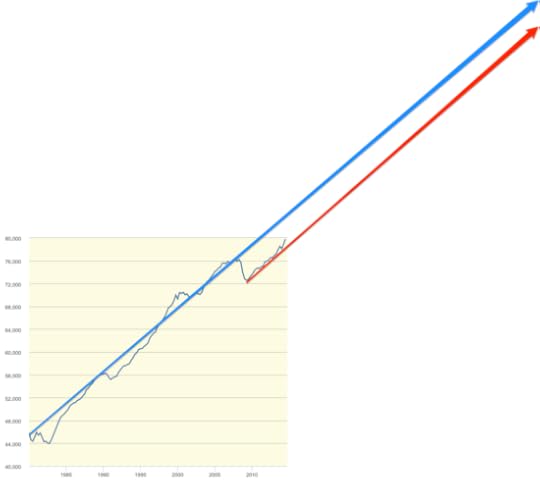

Real GDP

We used to bounce-back from business-cycle downturns and return to normalcy

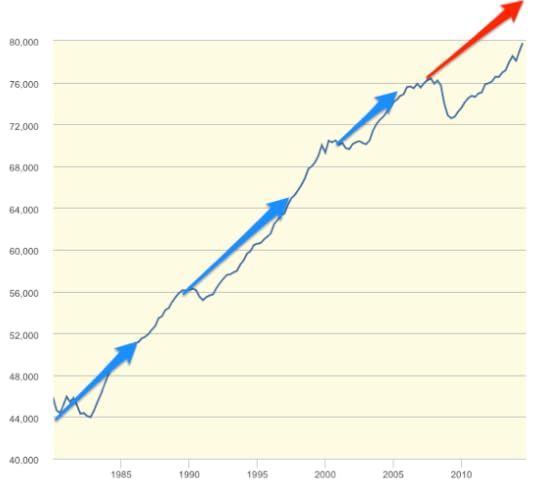

Real GDP

We are showing no signs of bouncing-back from this one

$6,000 per adult in potential production lost--that's $1.2 trillion/year of real wealth that we could be making that we are not, and that it looks like we are never going to recoup.

But we are producing $80,000 per adult a year these days--twice what we were producing in the 1970s. $6,000 a year is very painful--7.5%. But that is only an eight-year delay in the course of economic growth, a "lost growth decade" only.

Data caveats: $80,000/year includes depreciation, benefits, imputed rent on your house, taxes taken out before the money hits your paycheck, and so forth--figure $50,000/year per working age adult of something that looks like "income"

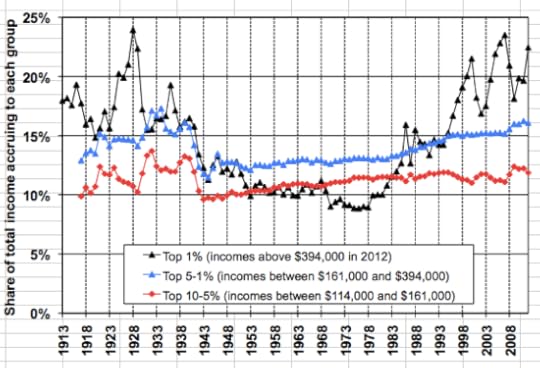

Inequality: The Rise of the 1%

Back in the 1970s--when we had $40,000/year productivity for your average working-age adult--the top 1% took 8%, the rest of the top 5% took 13%, the rest of the top 10% took 12%.

Top 1%: $320,000/year

96-99%: $130,000/year

91-95%: $96,000/year

Bottom 90%: $30,000/year

Today: $80000/year productivity

Top 1%: 24%: $1,920,000/year

96-99%: 16%: $320,000/year

91-95%: 12%: $192,000/year

Bottom 90%: $42,700/year

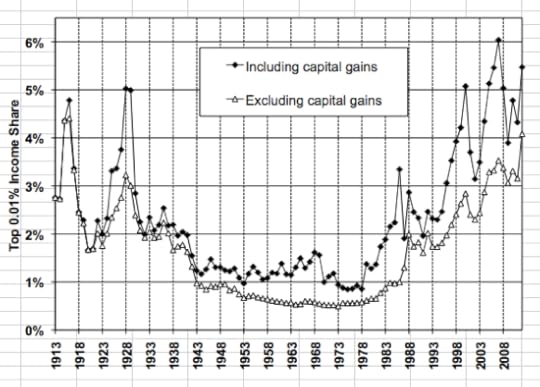

Inequality: The Rise of the 0.01%

1970s:

Top 0.01%: 1%: $4,000,000/year (12000 people)

Rest of top 1%: 7%: $280,000

Today:

Top 0.01%: 6%: $48,000,000/year (20000 people)

Rest of top 1%: 16%: $1,280,000/year

What are we getting for this rise in inequality? We are paying our top 1% and our top 0.01% very handsomely, yet...

Finance and health-care administration very nearly zero if not negative-sum...

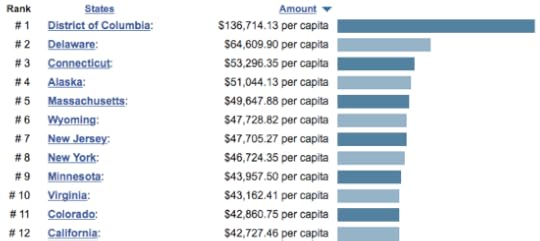

Regional Factors

...

Normally Americans moved to opportunity--to where people were more productive...

Not anymore--the triumph of NIMBYism

Part IV: The Next Fifty Years

Long-Run Impact of the Downturn

$6000 per adult in potential production lost--that's $1.2 trillion/year of real wealth that we could be making that we are not, and that it looks like we are never going to recoup.

Capitalize at 4%/year in real terms, that's a $30 trillion hit in real wealth--$150000 per adult

But perform the same calculation as to how wealthy we and our descendants will be. At a 1.5%/year real growth rate of productivity and a 4%/year real discount rate, our total prospective wealth is $3.2 million per American adult--$640 trillion

Plus the wealth of future immigrants

$32 trillion is painful, but not crushing, in that scale

Long-Run Prosperity: The Math

No reason not to see a growth of 1.5%/year in measured real product per working-age adult over the next 50 years.

Economic growth as measured comes from making cheaper the things we currently make expensively, and there is enormous human ingenuity devoted to that...

$80,000/year x exp(1.5% x 50) = $170,000/year come 2065

Cf: Median household income in Orinda today is $160,000/year

An America that looks--in prosperity--like Orinda today

What Could Go Wrong?

Politics

War

Inequality

What will people do?

Backs

Fingers

Brains as cybernetic control mechanisms for managing machines

Brains as routine paper-shuffling control mechanisms

Smiles

Ideas

There will be jobs: nothing guarantees they will be well paid

"Peak horse"

Prime-Aged Male Employment

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers