J. Bradford DeLong's Blog, page 1097

January 5, 2015

Why Yes, I Do Believe Jeffrey Sachs Has Lost His Mind. Why Do You Ask?: Live from The Roasterie

For could anything possibly lead somebody who has not lost his mind to call a real GDP growth rate of 2.2%/year "brisk"?

Jeff Sachs:

Paul Krugman and the Obama Recovery:

"Paul Krugman has delivered one main message to his loyal readers: deficit-cutting 'austerians'...

...(as he calls advocates of fiscal austerity) are deluded.... Deficit cuts would court a reprise of 1937.... Well, Congress and the White House did indeed play the austerian card.... Yet... real economic growth in 2011 stood at 1.6%, and the IMF expects it to be 2.2% for 2014 as a whole.... So much for Krugman’s predictions. Not one of his New York Times commentaries in the first half of 2013, when 'austerian' deficit cutting was taking effect, forecast... that economic growth would recover to brisk rates...

Noted for Your Morning Procrastination for January 5, 2015

Over at Equitable Growth--The Equitablog

Over at Equitable Growth--The Equitablog

Marshall Steinbaum: The End of One Big Inflation and the Beginning of One Big Myth

I Respond to William Gale's Response to Me on the Fiscal Sitch: Daily Focus

Simon Wren-Lewis: In Defence of NGDP Targets

Nouriel Roubini: Where Will All the Workers Go?

Ed Luce: US Should Enjoy Sunshine While It Lasts

Plus:

Things to Read on the Morning of January 5, 2015

Must- and Shall-Reads:

Dylan Matthews:

The Senate's 46 Democrats got 20 million more votes than its 54 Republicans

National Review (1957):

Why the South Must Prevail

Mark Thoma:

Are happy days here again for the economy?

Simon Wren-Lewis:

The War with the Banks Has To Be Fought on Two Fronts

Marshall Steinbaum:

The End of One Big Inflation and the Beginning of One Big Myth

Nouriel Roubini:

Where Will All the Workers Go?

Simon Wren-Lewis:

In Defence of NGDP Targets

And Over Here:

Over at Equitable Growth: Marshall Steinbaum: The End of One Big Inflation and the Beginning of One Big Myth

Hard Power, Soft Power, Muscovy, Strategy, and My Once-Again Failure to Understand Where Niall Ferguson Is Coming From: Live from Le Pain Quotidien

Over at Equitable Growth: I Respond to William Gale's Response to Me on the Fiscal Sitch: Daily Focus

Liveblogging World War II: January 4, 1945: Eleanor Roosevelt

Liveblogging the American Revolution: January 5, 1777: Washington Describes Victory at Princeton,

Marshall Steinbaum:

The End of One Big Inflation and the Beginning of One Big Myth:

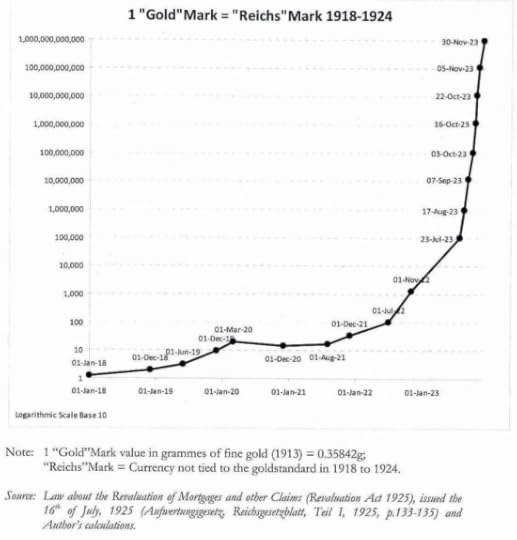

"Tom Sargent's... 'The Ends of Four Big Inflations'... I called it 'terrible history and questionable economics'... post-World-War-I monetary histories of Austria, Hungary, Poland, and Germany, which they all experienced hyperinflations, on the one hand, and Czechoslovakia, which did not, on the other... highly influential.... The titular Four Big Inflations were actually one big inflation... caused by the near-state-collapse embodied in the Treaties of Versailles, St. Germain-en-Laye, and Trianon... denuding the defeated... of... industrial capability... reparations.... Keynes' argument is that the reparations... exceeded... the maximum amount of government revenue that can be extracted from the productive economy.... A particularly important aspect of Keynes' argument is the tension between France and Poland's abject public finances, only made paper-solvent by ambitious reparations schedules.... [The] hyperinflations ended when the vague commitment to reparations imposed on them was removed by the League of Nations.... The German hyperinflation was a consequence of the postwar settlement, and most importantly, the huge reparations it faced....

Nouriel Roubini:

Where Will All the Workers Go?:

"Recent technological advances... capital-intensive... skill-intensive... labor-saving.... The factory of the future may be 1,000 robots and one worker manning them... no guarantee... [of] gains in service-sector employment.... Foxconn... plans to replace much of its Chinese workforce of more than 1.2 million with robots.... Voice recognition software will replace the call centers of Bangalore.... And, of course technological innovation... together with the related winner-take-all effects [are] driving the rise in income and wealth inequality.... The gains from technology must be channeled to a broader base... a major educational component... permanent income support to those whose jobs are displaced by software and machines..."

Simon Wren-Lewis:

In Defence of NGDP Targets:

"Tony Yates... [is] slamming the idea of NGDP targets.... I want to stay close to the academic literature, at least as a starting point.... Tony should be very worried that one of the supporters of NGDP targets is Michael Woodford, who literally wrote the book on modern monetary theory. He rightly focuses on the big plus for any levels based target, which is that it can mimic the optimal but time-inconsistent policy.... The welfare gains from following the optimal time inconsistent policy are large... so to wave those away as ‘difficult to communicate’ seems--if I may say so--terribly old school central banking.... One final argument Tony uses... is that simple models show that inflation variability is about twenty times more important than output variability in assessing welfare, and therefore NGDP targets give too great a weight to output.... Having said all this, it is great that Tony is opening up the discussion on the correct level, so we can get away from what often seem like faith-based arguments for NGDP targets.... My one last plea is that arguments make clear whether a NGDP targeting regime is being compared to some form of optimal policy, or policy as currently practiced: as I suggest here these are (unfortunately) different things."

Should Be Aware of:

Economist:

"The collapse in the rouble is caused by Vladimir Putin’s belligerence, greed and paranoia..."

Michael Schiavo: “If you want a government that’s gonna intrude on your life, enforce their personal views on you, then I guess Jeb Bush is your man,” Schiavo explained, adding, “We really don’t need another Bush in office.”

MOAR American Enterprise Institute Quality Thought https://twitter.com/delong/status/543038648653193217

Agent Carter

Mu-Jeung Yang: I was planning on posting merry pictures from Dubai tonight. Instead, I have to report that I was attacked by a pack of white people in the middle of Capitol Hill, Seattle. I was choked, while three (white) people kept on punching me. I was kept paralyzed on the ground. Seattle police did nothing. They got my version of the story while confirming with six other people that it happened another way. Three of which kept on beating me while I was chocked on the ground by a fourth person. I do not write this because I want pity. I am upset! What is wrong here?!? I lived 22 years in Germany, a country that supposedly has Neo-Nazis. I was never treated this way there."

"Some reacted to Chris Hughes's hiring of Gabriel Snyder and firing of Franklin Foer and Leon Wieseltier by writing things like: 'The [Old] New Republic has been the flagship and forum of American liberalism. Its reporting and commentary on politics, society, and arts and letters have nurtured a broad liberal spirit in our national life. The magazine’s present owner and managers... seem determined to strip it of the intellectual, literary, and political commitments that have been its essence and meaning. Their pronouncements suggest that they hold those commitments in contempt...' Others think that that Old New Republic was long dead. Some of them say it died in 1975, when Marty Peretz fired Gilbert Harrison. Others of them say it died 1991, when Marty Peretz fired Hendrik Hertzberg. Since then there had been only a shambling zombie, populated by various writers--some very good, others very bad, whose principal distinguishing characteristic is their willingness to go the extra mile to suck up to the racial and religious bigotry of Martin Peretz. As Fellow Travelers of the Juice-Box Mafia, we cannot see why anyone would think that Chris Hughes's money is likely to be less-well deployed by Gabriel Snyder than by Franklin Foer. Cf.: Max Fisher: The New Republic and the Beltway Media's Race Problem. Spencer Ackerman: Best of toohotfortnr"

Over at Equitable Growth: Morning Must-Read: Marshall Steinbaum: The End of One Big Inflation and the Beginning of One Big Myth

Over at Equitable Growth: One of the nice things about economics as an intellectual discipline is that you can effectively score intellectual-reputation points by taking on the work of giants a generation older than you--something that, IMHO, too-rarely happens in other disciplines. Here smart young whippersnapper Marshall Steinberg takes on the very sharp Tom Sargent's "The End of Four Big Inflations" account of Europe's post-WWI hyperinflations. READ MOAR

Marshall Steinbaum:

The End of One Big Inflation and the Beginning of One Big Myth:

"Tom Sargent's... 'The Ends of Four Big Inflations'...

...I called it 'terrible history and questionable economics'... post-World-War-I monetary histories of Austria, Hungary, Poland, and Germany, which they all experienced hyperinflations, on the one hand, and Czechoslovakia, which did not, on the other... highly influential.... The titular Four Big Inflations were actually one big inflation... caused by the near-state-collapse embodied in the Treaties of Versailles, St. Germain-en-Laye, and Trianon... denuding the defeated... of... industrial capability... reparations.... Keynes' argument is that the reparations... exceeded... the maximum amount of government revenue that can be extracted from the productive economy.... A particularly important aspect of Keynes' argument is the tension between France and Poland's abject public finances, only made paper-solvent by ambitious reparations schedules.... [The] hyperinflations ended when the vague commitment to reparations imposed on them was removed by the League of Nations.... The German hyperinflation was a consequence of the postwar settlement, and most importantly, the huge reparations it faced....

Sargent tells a very different story. Each of his four hyperinflations ends when a central bank is reorganized to be politically independent of a national treasury. Thereafter, although the circulation of national currency continued to increase, inflation was kept under control because newly-independent central banks adhered to reserve requirements and only purchased securities on the open market, rather than accepting worthless government bonds from the Treasury. At the same time, national treasuries were disciplined by their lack of access to the money-printing presses to enforce fiscal austerity. That combination of institutional changes constitutes what Sargent calls a 'regime shift.'... The notion of a regime change might be helpful, but Sargent... mis-deploys it.... There was a regime shift... the US and Britain... prevailed over France and abandoned the most onerous aspects of the postwar settlement.

Before turning to the later intellectual history following Sargent, let's consider his 'control' case of Czechoslovakia... also created at the Treaty of [Saint-Germain-en-Laye], but... well-endowed with the most productive territory of the former Austria-Hungary... a perceived victim... never had to pay reparations....

So what's the harm in Sargent's paper?... As I see it, two things: 1. The conflation of inflation and hyperinflation. Sargent seeks economic lessons in the cost to output and employment from ending the sort of stagflation that characterized the 1970s in developed economies.... [But] hyperinflation happens because of state collapse or near-collapse. That's fundamentally different.... 2. More importantly, 'The Ends of Four Big Inflations' propagates the myth that monetary policy is easy to get right, once it's in the hands of a superman central banker whose force of discipline cows disorderly workers into accepting at least a restraint in wage increases.... Thanks to the Maastricht Treaty, [this] is enshrined in the mandate of the European Central Bank, to devastating effect....

When I TAed undergraduate macroeconomics at the University of Chicago, there was a problem set with the following scenario, presented as a factual historical statement: in order to win the 1980 general election, the government of Brazil decided to fool voters into thinking their wages had gone up by printing money at a greater rate. What is the time path of nominal and real wages? Then, in 1985, a new government decided to tame inflation by appointing a central banker from the University of Chicago. What happens to inflation then?

In 1980 (and until the late 80s-early 90s), Brazil was governed by a US-backed military junta. Needless to say, there was no general election in 1980.... If it suffered from high inflation, that wasn't because its democratically-elected regime was too spineless to give the voters a dose of UChicago patent medicine. Nonetheless, this idea of the craven politicians and the savior economists/central bankers has been a persistent but useful myth. The actual treatment can start with a dose of historical reality.

Marshall's central points are:

Sargent uses a conventional monetarist model--the price level rises with the central bank-determined stock of money--to analyze a situation to which the fiscal theory of the price level--the price level rises until the real value of the government's debt falls to a level that can be paid by the taxes that can be collected--applies.

As a result he mistakes the "régime change" that brought an end to the post-WWI hyperinflation.

The key régime change was not the appointment of a tough, independent central banker, but rather the abandonment of the reparations demands that had made the hyperinflationary countries' public finances unsustainable.

Sargent's paper played a big and destructive role in the development of the Curse of the Eurozone--the cult of the tough, independent, inflation-averse central banker.

I think Marshall's (1), (2), and (4) are completely correct. But I think that there is more to be said for Tom on (3) than Marshall allows. Yes, you cannot stop hyperinflation until you have changed the fiscal regime so that it is possible to collect enough taxes to amortize the government's debt at the current price level. But there is nothing that says that the hyperinflation has to stop then. You also need--after the fiscal régime change--a monetary régime change that both (a) steps up the pace of printing money, but (b) removes the ability of the government to finance its ongoing expenditures via seigniorage, and (c) creates a central bank credibly committed to price stability. Hjalmar Horace Greeley Schacht's and the other stabilizations could not have been accomplished earlier, before the abandonment of largest-scale reparations demands. But they did require a monetary régime change to put into effect after they were possible.

IIRC, Stanley Fischer essentially made Marshall's criticism of Tom's paper when it was presented, and Tom wrote a follow-up--"Stopping Moderate Inflation: the Methods of Poincare and Thatcher" contrasting the French cold-turkey régime change stabilization of 1926-1927 with Thatcherite British gradualist monetary growth rules in the 1980s, to the discredit of the latter. IIRC, it was a little too optimistic on how painlessly the French stabilization was accomplished...

January 4, 2015

Liveblogging the American Revolution: January 5, 1777: Washington Describes Victory at Princeton,

George Washington:

Pluckamin, January 5, 1777:

Sir: I have the honor to inform you, that since the date of my last from Trenton I have remov'd with the Army under my Command to this place. The difficulty of crossing the Delaware on Acct. of the Ice made our passage over it tedeous, and gave the Enemy an oppertunity of drawing in their Several Cantonments, and assembling their whole Force at Princeton. Their large Picquets, advanc'd towards Trenton; their great preparations, and some Intelligence I had received, added to their knowledge that the first of Janry. brought on a dissolution of the best part of our Army, gave me the strongest reasons to conclude that an attack upon us was meditating.

Our Situation was most critical and our strength [force] small; to remove immediately, was again destroying every dawn of hope which had begun to revive in the breasts of the Jersey Militia, and to bring those Troops which had first cross'd the Delaware, and were laying at Crosswixs under Genl. Cadwallader, and those under Genl. Mifflin at Bordenton (amounting in the whole to abt. 3600) to Trenton, was [to] bringing of them to an exposed place; one or the other however, was unavoidable; the latter was prefered, and these Troops [they] orderd to join us at Trenton which they did by a Night March on the first Instt.

On the Second, according to my expectation, the Enemy began to advance upon us, and after some skirmishing, the head of their Column reach'd Trenton about 4 O'Clock whilst their rear was as far back as Maidenhead; they attempted to pass Sanpinck [Assunpink] Creek (which runs through Trenton) at different places, but finding the Fords guarded, halted, and kindled their Fires. We were drawn up on the other Side of the Creek. In this Situation we remaind till dark canonading the Enemy, and receiving the Fire of their Field pieces, which did us but little damage.

Having by this time discoverd that the Enemy were greatly Superior in Numbers, and that their drift [design] was to surround us. I orderd all our Baggage to be removd silently to Burlington soon after dark, and at twelve O'Clock (after renewing our Fires, and leaving Guards at the Bridge in Trenton, and other passes on the same stream above March'd by a round about road to Princeton where I knew they could not have much force left, and might have Stores. One thing I was sure of, that it would avoid the appearance of a Retreat, which (was of Consequence) or to run the hazard of the whole Army's being cut of was unavoidable whilst we might, by a fortunate stroke withdraw Genl. Howe from Trenton, give some reputation to our Arms; happily we succeeded.

We found Princeton about Sunrise with only three Regiments of Infantry and three Troops of Light Horse in it, two of which were upon their March for Trenton; these three Regiments (especially the two first) made a gallant resistance and in killed, wounded and Prisoners must have lost near 500 Men upwards of one hundred of them were left dead in the Field, and with what I have with me, and what was taken in the pursuit, and carried across the Delaware, there are near 300 Prisoners, 14 of wch. are Officers, all British.

This piece of good fortune, is counter ballanced by the loss of the brave and worthy Genl. Mercer, [Cols Hazlet and Potter, Captn. Neal of the Artillery, Captn. Fleming, who commanded the 1st Virginia Regiment and four and five] and several other valuable Officers who [with 25 or 30 Privates] were slain in the Field and have since died of their Wounds. Our whole loss cannot be ascertained, as many who were in pursuit of the Enemy (who were chased three or four Miles) are not yet come in. Our Slain in the Field was about 30.

The rear of the Enemy's army laying at Maidenhead (not more than five or Six Miles from Princeton) were up with us before our pursuit was over, but as I had the precaution to destroy the Bridge over Stony Brooke (about half a Mile from the Field of Action) they were so long retarded there, as to give us time to move of in good order for this place. We took two Brass Field pieces from them, but for want of Horses could not bring them of. We also took some Blankets, Shoes, and a few other trifling Articles, Burnt the Hay and destroyed such other things as the Shortness of the time would admit of.

My original plan when I set out from Trenton was to have pushed on to Brunswick, but the harrassed State of our own Troops (many of them having had no rest for two Nights and a day) and the danger of loosing the advantage we had gaind by aiming at too much, Induced me, by the advice of my Officers, to relinquish the attempt but in my judgment Six or Eight hundred fresh Troops upon a forcd March would have destroyed all their Stores, and Magazines; taken (as we have since learnt) their Military Chest containing 70,000 £ and put an end to the War. The Enemy from the best Intelligence I have been able to get, were so much alarmed at the apprehension of this, that they March'd immediately to Brunswick without Halting (except at the Bridges, for I also took up those on Millstone on the different routs to Brunswick) and got there before day.

From the best Information I have received, Genl. Howe has left no Men either at Trenton or Princeton; the truth of this I am endeavouring to ascertain that I may regulate my movements accordingly. The Militia are taking Spirit, and, I am told, are coming in fast from this State; but I fear those from Philadelphia will scarce Submit to the hardships of a Winter Campaign much longer, especially as they very unluckily sent their Blankets with their Baggage to Burlington; I must do them the justice however to add, that they have undergone more fatigue and hardship than I expected Militia (especially Citizens) would have done at this Inclement Season. I am just moving to Morristown where I shall endeavour to put them under the best cover I can, hitherto we have lain without any, many of our poor Soldiers quite bearfoot and ill clad in other respects.

I am &c.

Hard Power, Soft Power, Muscovy, Strategy, and My Once-Again Failure to Understand Where Niall Ferguson Is Coming From: Live from Le Pain Quotidien

In which I once again fail to understand where Niall Ferguson is coming from...

Niall Ferguson:

The ‘Divergent’ World of 2015:

"Hard power is resilient...

...Having annexed Crimea to Russia, President Putin still has forces camped out in eastern Ukraine. And all over the Muslim world, myriad Islamist organizations, from Islamic State to the Taliban, are using violence to pursue their atavistic goals. In practice, the Obama administration has had little choice but to keep using hard power, from the airstrikes on Islamic State to the economic sanctions on Russia...

And I think: Of course hard power can be decisive--but one needs to have a lot of it, and be willing not just to threaten to use it but to actually use it, and not care that one's use of it may lead the abyss to look into you, and turn you into something you did not want to be, and so cause you to lose even as you "win".

And I think: The science fiction/horror/fantasy author David Drake very effectively and rightly, I think, puts it thus in the mouth of one of his characters, the Goddess Athene Danny Pritchard:

Force accomplishes a lot of things. They just aren’t the ones you want here. Bring in the Slammers [Regiment] and we kick ass for as long as you pay us. Six months, a year. And we kick ass even if the other side brings in mercs of their own--which they’ll do--but that’s not a problem, not if you’ve got us. So, there’s what? Three hundred thousand people....

So, you want to kill fifty kay? Fifty thousand people, let’s remember they’re people for the moment.... You see, if we go in quick and dirty, the only way that has a prayer of working is if we get them all. If we get everybody who opposes you, everybody related to them, everybody who called them master--everybody.... They’re not dangerous now, but they will be after the killing starts. Believe me. I’ve seen it often enough. Not all of them, but one in ten, one in a hundred. One in a thousand’s enough when he blasts your car down over the ocean a year from now. You’ll see. It changes people, the killing does. Once it starts, there’s no way to stop it but all the way to the end. If you figure to still live here on Tethys....

What do you think the Slammers do, milady? Work magic? We kill, and we’re good at it, bloody good. You call the Slammers in to solve your problems here and you’ll be able to cover the Port with the corpses. I guarantee it. I’ve done it, milady. In my time...

And I think: If Niall Ferguson thinks internationally-agreed economic sanctions are "hard power", I do not think he understands what hard power and soft power are. But I would like the very smart Joe Nye to weigh in on this... UPDATE: Dan Drezner informs me that I am the one who is confused here--that Joe Nye counts economic sanctions as "hard power"...

Putin does not have enough hard power to dominate the world, or the North Atlantic, or the ex-Soviet Empire, or even Russia's Muscovy's near abroad.

What he has managed to do with his hard power is grab one peninsula (the Crimea), and four provinces--Abkhazia, South Ossetia, Luhansk, and Donetsk. In return, he has shrunk Russia--formerly the predominant power in eastern Europe and the primus inter pares of the Slavic nations--into a generally-disliked albeit somewhat-feared Muscovy. The Muscovite generals who danced in Paris in 1815, in Berlin in 1945, in Havana in 1962, and in Saigon in 1975 are now... camped along the right bank of the lower Don near the Sea of Azov? Siberia aside, the borders of Muscovy look a lot like those under... Dread Ivan Rurik at the time of the Livonian War?

And this is supposed to be a demonstration of Putin's hard power? Of the rewards to military adventurism, and evidence that we should do what we did in Iraq in 2003 again?

665 words

Liveblogging World War II: January 4, 1945: Eleanor Roosevelt

Eleanor Roosevelt:

My Day:

WASHINGTON, Wednesday—We had a real treat yesterday. A young man now in the army had written to me about some writing which he hoped to do in the future, and sent me copies of the camp paper he is editing. As he was home on furlough, I invited him to lunch.

In the course of conversation it turned out that he had worked with Paderewski, and so we asked if he would like to see the piano on which this great artist practiced when he stayed here. Afterward I asked our young man to play on the piano in the East Room, which is so rarely used nowadays since we no longer have musicales or evening entertainments. It was really a treat, and was much enjoyed by one of my other guests, a boy back from the Pacific who brought the President a war club which was a gift from the head of one of the villages in British Samoa.

In the evening young Colonel Hoover, who is one of our son Elliott's pilots, brought his new wife to dine with us. The colonel had not gone back with the rest of the crew because he decided to get married, but he will follow them after a brief leave. Out of the whole crew only one enlisted man and one officer went back unmarried, which shows, I think, the urge that the men who go overseas have to leave someone waiting just for them on this side of the ocean.

A group of student veterans of World War II, who are at present studying at George Washington University under the vocational rehabilitation and the G.I. Bill of Rights programs, came in at 7 o'clock to see a movie. Afterward they came up to the State Dining Room for refreshments, and we all sat around and talked for a while.

After an early lunch today, Mrs. Henry Morgenthau Jr. and I are going to New York City. Tonight we are going to the play, but I will tell you more about that tomorrow.

In the meantime I want to tell you about a very lovely Christmas card from the Rev. Frederick Brown Harris, pastor of one of our Washington churches. The first two paragraphs struck me as something we might all find comforting in these days, so I pass them along to you:

In the year 1809, with Napoleon on the march, men's feverish thoughts were on the latest news of the war. And all the while, in their own homes, babies were being born. But who could think about babies? Everybody was thinking of battles.

In that very year, in the birth lists, were written the names of Gladstone and Tennyson and Oliver Wendell Holmes and Darwin and Abraham Lincoln and Chopin and Mendelssohn and Samuel Morley and Elizabeth Barrett Browning. But nobody thought of babies. Everybody was thinking of battles.

January 3, 2015

Over at Equitable Growth: I Respond to William Gale's Response to Me on the Fiscal Sitch: Daily Focus

Over at Equitable Growth: I ought to write a response to the very sharp Bill Gale's response to my questions in response to hist paper for Brink Lindsey's Cato Economic Growth Forum:

William Gale:

Response to DeLong on the Fiscal Sitch....

And it would probably be good if I kept it relatively brief.

Given the extraordinary global demand for the debt of the US federal government as a safe and secure store of value in today's economy, right now the financing of the expenditures of the federal government should be pushed off, as far into the future as intergenerational equity, to allow us to take advantage of this extraordinary sale price on repayment duration that the world economy's individual rich, public sovereign wealth funds, and central banks seeking dollar reserves are offering us. READ MOAR:

Given the extraordinary gap, as evidenced by a remarkably low employment-to-population ratio and remarkably subdued inflation, between America's current level of production and potential output, right now is the time for the federal government to spend to soak up this output gap--spend on infrastructure, spend on education, spend on research and development, spend on other things that accelerate economic growth, and, to the extent that intergenerational equity allows, on enhancing the societal welfare of America today.

But as long as interest rates and the output gap remain in their current configuration, sober technocratic fiscal policy would involve substantial increases in the debt-to-annual-GDP ratio and then, after the macroeconomic configuration has changed, debt paydown in the form of a gradual return to the normal-time target debt-to-annual-GDP ratio.

What that normal-time target debt-to-annual-GDP ratio will be and what will be the appropriate share of GDP and mix of federal government expenditures once the macroeconomic configuration has changed will be for future voters to choose legislators and president who will then decide. We cannot dictate to them.

What we can do is assume that they will do their job, in which case we should do our job--which the elementary math says would involve federal government spending and deficits considerably larger than those we have today.

Alternatively, we can assume that they will not do their job, in which case we should try to do their jobs for them. We should pass a long-run slowly-increasing carbon tax. We should preserve the health insurance Cadillac tax against attempts to around it. We should pass symmetric standby tax increases and sequesters to force the future to make in a timely fashion the decisions it faces rather than to delay them further. But do we need to cut Medicare's spending growth path? Not unless we are confident that Medicare expenditures a generation hence will have low benefits at the margin. Do we need to cut Social Security's spending growth path? Not unless we are confident that Americans in generations hence will have ample retirement security.

As I see it, calls to "first, put our long-run fiscal house in order!" are calls for us to do what we are already doing (preserve the Cadillac tax), to do what we will not do until the Republican Party as we currently know it vanishes from the page of time (carbon tax and symmetric standbys), to do what we should not do (Medicare and Social Security cuts), and not to do what we should be doing--i.e., running higher deficits with more federal government spending until the macroeconomic configuration changes.

565 words

Noted for Your Lunchtime Procrastination for January 3, 2015

Over at Equitable Growth--The Equitablog

Over at Equitable Growth--The Equitablog

William Gale Responds to Me on the Fiscal Sitch...: The Honest Broker

Ezra Klein: In 2014 Obama Picked Getting Things Done Over Fixing US Politics

Dylan Matthews: Greg Mankiw's Worst Argument Against Piketty Yet

Paul Krugman: Recent History in One Chart

Michael Joyce et al.: The Portfolio Balance Effect of QE

Plus:

Noted for Your Lunchtime Procrastination for January 3, 2015

Must- and Shall-Reads:

Leon Nayfak:

How the elevator transformed America

Jonathan Portes:

"Halving the deficit--however measured--was not the [Osborne-Cameron-Clegg] government’s plan; not even close. Eliminating it... was..."

Stephany Griffith-Jones:

"Sir, The headline to Gideon Rachman is unfortunate: ‘Eurozone’s weakest link is the voters’.... If Greek citizens are democratically voting against policies that are seen as failing, the policies need changing..."

Trevon Logan

Michael Joyce et al.:

The Portfolio Balance Effect of QE

Paul Krugman:

Recent History in One Chart

Dylan Matthews:

Greg Mankiw's Worst Argument Against Piketty Yet

Ezra Klein:

In 2014 Obama Picked Getting Things Done Over Fixing US Politics

Michael McCarthy:

The Power of Bad Ideas

Dani Rodrik:

Fundamental Lessons Economists Have Refused to Learn

And Over Here:

What Are the Experiences That MOOCs Need to Replicate?: Early (Monday) DeLong Smackdown Watch

Liveblogging the American Revolution: January 3, 1777: Battle of Princeton

For the Weekend...

Mallory Ortberg Gets Thrown by an Egg Avatar!: Live from La Farine

William Gale Responds to Me on the Fiscal Sitch...: The Honest Broker

Weekend Reading: John Cassidy's Interview with James Heckman: Selections

Michael Joyce et al.:

The Portfolio Balance Effect of QE:

"A key transmission mechanism of QE... has been the ‘portfolio balance’ channel.... Insurance companies and pension funds... [in] the UK.... Investors shifted their portfolios away from government bonds towards corporate bonds. But portfolio rebalancing has been limited to corporate bonds and did not extend to equities..."

Paul Krugman:

Recent History in One Chart:

"A number of people have been putting up candidates for chart of the year. For me, the big chart of 2014 was... from earlier work (pdf) by Branko Milanovic.... It shows income growth since 1988 by percentiles of the world income distribution... the surge by the global elite (the top 0.1, 0.01, etc. would be doing even better than his top 1), plus the dramatic rise of many but not all people in emerging markets. In between is what Branko suggests corresponds to the US lower-middle class, but what I’d say corresponds to advanced-country working classes in general, at least if you add post-2008 data with the effects of austerity. I’d call it the valley of despond..."

Dylan Matthews:

Greg Mankiw's Worst Argument Against Piketty Yet:

"Greg Mankiw has been a vocal critic of Thomas Piketty's Capital in the Twenty-First Century since its release.... He challenges Piketty's claim that wealth inequality threatens democracy.... 'A final possibility is that wealth inequality is somehow a threat to democracy. Piketty alludes to this worry throughout his book. I am less concerned. The wealthy includes supporters of both the right (the Koch brothers, Sheldon Adelson) and the left (George Soros, Tom Steyer), and despite high levels of inequality, in 2008 and 2012 the United States managed to elect a left-leaning president committed to increasing taxes on the rich. The fathers of American democracy, including George Washington, Thomas Jefferson, John Adams, and James Madison, were very rich men. With estimated net worth (in today’s dollars) ranging from $20 million to $500 million, they were likely all in the top 0.1 percent of the wealth distribution, demonstrating that the accumulation of capital is perfectly compatible with democratic values. Yet, to the extent that wealth inequality undermines political ideals, reform of the electoral system is a better solution than a growth-depressing tax on capital...' Contra Mankiw, the Founding Fathers are a vivid illustration of Piketty's point, not a refutation of it. The United States in the 1780s was controlled by economic elites that were universally white and male and owned considerable capital, much of it... slaves.... The slave-holding class was able to translate its wealth into political influence, enough to maintain the institution for 77 years after the Constitution was ratified... a system that was, by any reasonable definition, not a democracy.... It'd be preposterous to argue that the staggering wealth gap between white men and women and African-Americans played no role in the latter's systematic exclusion from political life for most of American history. There was enormous wealth inequality, and the result was a massive betrayal of democratic values in favor of an apartheid system. This is exactly the kind of thing Piketty is concerned about."

Ezra Klein:

In 2014 Obama Picked Getting Things Done Over Fixing US Politics:

"2014 was the year that Barack Obama saved his presidency by... abandoning... his 2008 campaign. It was the year that he accepted that the only way to bring the policy changes he had promised was to abandon the political ideals that first got him elected.... The 2008 Democratic primary was, as Mark Schmitt wrote, a 'theory of change' primary. The different candidates didn't disagree all that much about what to do. They disagreed about how to get it done. Hillary Clinton's argument was that she best understood the conflictual nature of American politics: she had fought these battles before and so she was best positioned to win them in the future. Change would come through mastery of the old politics. Obama's argument was just the opposite: the conflictual nature of politics, he said, was the product of the people who knew no politics other than conflict. He would win the battle by ending it... ending the partisan divisions and moneyed interests that had broken American politics.... Obama pushed more change through the political system than any serious observer expected.... But he didn't do all this by fixing American politics.... He's one of the most polarizing presidents since the advent of polling. There isn't much Obama could have done about this. Party polarization is bigger than any one president. When the Senate Minority Leader says publicly, as Mitch McConnell did, that 'the single most important thing we want to achieve is for President Obama to be a one-term president,' then it's a safe bet that legislative cooperation isn't forthcoming..."

Michael McCarthy:

The Power of Bad Ideas:

"The Power of Market Fundamentalism: Karl Polanyi’s Critique

by Fred Block and Margaret Somers"

Dani Rodrik:

Fundamental Lessons Economists Have Refused to Learn:

"This is not the first time that developing countries have been hit hard by abrupt mood swings in global financial markets. The surprise is that we are surprised. Economists, in particular, should have learned a few fundamental lessons long ago. First... governments that can intervene massively to restructure and diversify the economy, while preventing the state from becoming a mechanism of corruption and rent-seeking, are the exception. China and (in their heyday) South Korea, Taiwan, Japan, and a few others had such governments; but the rapid industrialization that they engineered has eluded most of Latin America, the Middle East, Africa, and South Asia. Instead, emerging markets’ growth over the last two decades was based on... fortuitous... high commodity prices, low interest rates, and seemingly endless buckets of foreign finance.... Financial globalization has been greatly oversold. Openness to capital flows was supposed to boost domestic investment and reduce macroeconomic volatility. Instead, it has accomplished pretty much the opposite.... Portfolio and short-term inflows fuel consumption booms and real-estate bubbles, with disastrous consequences when market sentiment inevitably sours.... Floating exchange rates are flawed shock absorbers.... Few economies can bear the requisite currency alignments without pain. Sharp currency revaluations wreak havoc on a country’s international competitiveness. And rapid depreciations are a central bank’s nightmare, given the inflationary consequences.... The Fed’s... quantitative easing... benefited the world as a whole by propping up demand and economic activity in the US.... The rest of the world will benefit when Europeans are able to get their policies right.... The rest is in the hands of officials in the developing world. They must resist the temptation to binge on foreign finance when it is cheap and plentiful.... It is true, but unhelpful, to say that governments have only themselves to blame for having recklessly rushed into this wild ride. It is now time to think about how the world can create a saner balance between finance and the real economy."

Should Be Aware of:

Monty Python:

Oscar Wilde

Dani Rodrik:

["Levels of intellectual responsibility in enabling the steady deterioration of the political climate in Turkey over the last decade."](http://rodrik.typepad.com/dani_rodrik...

Kevin Drum:

Quote of the Day: Hooray For Nerdy Details!:

"The problem is that the internet does help people who are 'sufficiently motivated and clueful,' but that's never been a big part of the population. And sadly, the internet is probably as bad or worse than Dr. Oz for all the people who don't know how to do even basic searches and don't have either the background or the savvy to distinguish between good advice and hogwash. Regular readers will recognize this as a version of my theory that 'the internet is now a major driver of the growth of cognitive inequality.' Or in simpler terms, 'the internet makes dumb people dumber and smart people smarter.'"

The Onion:

Lovecraftian School Board Member Wants Madness Added To Curriculum:

"ARKHAM, MA—Arguing that students should return to the fundamentals taught in the Pnakotic Manuscripts and the Necronomicon in order to develop the skills they need to be driven to the very edge of sanity, Arkham school board member Charles West continued to advance his pro-madness agenda at the district's monthly meeting Tuesday. 'Fools!' said West, his clenched fist striking the lectern before him. 'We must prepare today's youth for a world whose terrors are etched upon ancient clay tablets recounting the fever-dreams of the other gods—not fill their heads with such trivia as math and English. Our graduates need to know about those who lie beneath the earth, waiting until the stars align so they can return to their rightful place as our masters and wage war against the Elder Things and the shoggoths!'... West's plan for increased madness... included field trips to the medieval metaphysics department at Miskatonic University, instruction in the incantations of Yog-Sothoth, and a walkathon sponsored by local businesses to raise money for the freshman basketball program..."

Comments:

Maynard Handley,

in reply to Altoid:

"The point is: this is NOT about rational expectations, it is about theology. The issue is not whether the rich and powerful would be better off going down path A rather than path B, it is is that Western Society (ie the entire construct, meaning not just what the rich and powerful believe, but how the man on the Clapham omnibus views the world) has a particular view of how the world works, and decisions are made according to that view, not according to reason. It has always been thus. Byzantium would rather die at the hand of the Turks than accept some changes in its theology. There are a whole bunch of countries in 'The Middle East' that are likewise on a fairly obvious path to destruction (a compound of dwindling natural resources and rapidly growing populations) where theology dictates that they reject the one realistic life raft (education, industrialization, democratization) available to them. And so it is with the West. There ARE some things that we will not do purely because of the influence of the rich and powerful (eg constraints on how banks operate; or technical details regarding tax, or how stock markets operate) but that is not the driving force behind austerity in its various forms, from Germany to Kansas. THAT is driven by deep theology, by how the society as a whole views causes, effects, and how the cosmos works, by how society believes karma plays itself out. It is changed by changing these deep beliefs of society, which is a generational project..."

Nicholas Beaudrot:

Warn of an Even Bigger Fire Next Time:

"I think you're presuming that financial elites are interested in their absolute personal financial fortunes to the exclusion of all else. But there are other possible interests for someone who's done so well: (1) their relative personal financial fortunes (hard money might not be optimal for the elite, but it's much worse for most everybody else); (2) social standing (from the Clinton election until 2007, not many people said bad things about the banksters; no longer true);

(3) being proven f*ing right and making sure those dirty hippies who took sociology classes and ended up in academia or nonprofits were proven f*ing wrong"

Alex H.,

in reply to Nicholas Beaudrot:

"Yeah, added wealth can maybe allow an already rich man to buy a few more things. Only increasing inequality can make him an aristocrat, and that's worth way more."

Maynard Handley,

in reply to Graydon:

"Again, I think this imputes the wrong motives to 'the people paying for the chanting'. Savonarola-rites paid for plenty of chanting that was counter-productive to their wealth. Ghost-dancers in their various manifestations really did believe their magic was going to slay their enemies. Repetition holds just as much for the rich and powerful as the poor. European history is littered with high society corpses, from Anne Boleyn and Thomas Moore to Nikolai Bukharin who went to their deaths fervently believing in and supporting the system that condemned them. The problem with the rich and powerful is not that they are more evil and cynical than the poor, it is that they are EVERY BIT AS STUPID as the poor."

Kaleberg:

Noted for Your Afternoon Procrastination:

"So Robert Lucas rejects the idea of chemistry. How can we predict the behavior of 6.023 x 10^23's of molecules? The very outer fabric of the atoms that comprise molecules are probabilistic, unpredictable charge clouds. The very idea is absurd. But then, strangely enough, I ignite a mixture of hydrogen and oxygen and get water. Why does anyone take anything he says seriously? Does he even have an inkling of how silly he sounds?"

Noted for Your Morning Procrastination for January 6, 2015

What Are the Experiences That MOOCs Need to Replicate?: Early (Monday) DeLong Smackdown Watch

Maynard Handley:

[on Duncan Black: Does Anybody Remember MOOCs?(http://delong.typepad.com/sdj/2014/12...

"'So we should be able to build experience machines...

...that will push that 1% up to 20% or so and that 10% up to 70% or so' What do you think these experiences ARE, Brad, that the experience machine needs to deliver?

If the experiences are things like:

compelled daily structure--you are expected to wake up at this time, go to classes at this time, spend this time reading

social pressure--everyone around you is behaving the same way. And while some frats at some party schools may be truly atrocious, one hopes that at most schools, most of the time, the expected norm is that you will be spending a limited amount of time watching TV, getting drunk, and chasing tail; and deviating too far from that norm will get people to look down on you and scorn you.

It seems unlikely that any MOOC can enforce either of these very well...

You could, perhaps, force that lectures are live-streamed at a particular time, and if you miss that, you've missed that class. But people will obviously aggressively rebel against that. And even then, all you've captured is the class-time element of structure, not the larger studying-time element.

As for the social pressure, MOOCs seem to think this is all about "class participation" and attempt to replicate that. I don't see (and can't imagine a very effective form of) what I consider even more important, which is the implicit threat of sanctions against "not behaving like a serious student".

We are perfectly aware, in other social disciplines, of the importance of the social and physical environment for conditioning behavior. A big part of preventing recidivism in crime, or preventing relapse into addictive behavior, is getting people into different physical and social environments, because their existing environments send a (hard to resist) set of behavioral cues. But MOOCs seem utterly uninterested in this fact.

Believing that the primary learning facilitation college provides is the lecturer, the study group discussion, the exams; and that replicating those will replicate college is as naive as believing that the only reason to choose Harvard over State U is because Harvard is closer to home (no network and old boy effects here, no sirree) or that the only purpose of credentials is to prove that you have learned a particular set of facts and techniques.

Weekend Reading: John Cassidy's Interview with James Heckman: Selections

John Cassidy:

Interview with James Heckman: Selections:

H: I want to distinguish between two different ideas.... The part of the Chicago School that has been justified is the claim that people react to incentives.... The other part of the Chicago School, which Stiglitz and Krugman have criticized, is the efficient-market hypothesis. That is something completely different.... I think you could fault the regulators as much as the market. From about 2000 on, there was a decision made in Washington not to regulate these markets. People like Greenspan were taking a very crude and extreme form of the efficient-markets hypothesis and saying this justified not regulating the markets. It was a rhetorical use of the efficient-markets hypothesis to justify policies.

C: What about the rational-expectations hypothesis, the other big theory associated with modern Chicago? How does that stack up now?

H: I could tell you a story about my friend and colleague Milton Friedman. In the nineteen-seventies, we were sitting in the Ph.D. oral examination of a Chicago economist who has gone on to make his mark in the world. His thesis was on rational expectations. After he’d left, Friedman turned to me and said, ‘Look, I think it is a good idea, but these guys have taken it way too far.’... It didn’t have any empirical content. When Tom Sargent, Lars Hansen, and others tried to test it using cross equation restrictions, and so on, the data rejected the theories. There were a certain section of people that really got carried away. It became quite stifling....

C: What about Robert Lucas? He came up with a lot of these theories. Does he bear responsibility?

H: Well, Lucas is a very subtle person, and he is mainly concerned with theory. He doesn’t make a lot of empirical statements. I don’t think Bob got carried away, but some of his disciples did. It often happens. The further down the food chain you go, the more the zealots take over.... We knew Keynesian theory was still alive in the banks and on Wall Street. Economists in those areas relied on Keynesian models to make short-run forecasts. It seemed strange to me that they would continue to do this if it had been theoretically proven that these models didn’t work....

C: What about the efficient-markets hypothesis? Did Chicago economists go too far in promoting that theory, too?

H: Some did. But there is a lot of diversity here. You can go office to office and get a different view.... [Fischer Black] was very close to the markets, and he had a feel for them, and he was very skeptical. And he was a Chicago economist. But there was an element of dogma in support of the efficient-market hypothesis. People like Raghu [Rajan] and Ned Gramlich [a former governor of the Federal Reserve, who died in 2007] were warning something was wrong, and they were ignored. There was sort of a culture of efficient markets—on Wall Street, in Washington, and in parts of academia, including Chicago.... Everybody was blindsided by the magnitude of what happened. But it wasn’t just here. The whole profession was blindsided....

It is what I see as the booster stage—the rational-expectation hypothesis and the vulgar versions of the efficient-markets hypothesis that have run into trouble. They have taken a beating—no doubt about that. I think that what happened is that people got too far away from the data, and confronting ideas with data. That part of the Chicago tradition was neglected, and it was a strong part of the tradition. When Bob Lucas was writing that the Great Depression was people taking extended vacations—refusing to take available jobs at low wages—there was another Chicago economist, Albert Rees, who was writing in the Chicago Journal saying, No, wait a minute. There is a lot of evidence that this is not true.

Milton Friedman—he was a macro theorist, but he was less driven by theory and by the desire to construct a single overarching theory than by attempting to answer empirical questions. Again, if you read his empirical books they are full of empirical data. That side of his legacy was neglected, I think.

When Friedman died, a couple of years ago, we had a symposium for the alumni devoted to the Friedman legacy. I was talking about the permanent income hypothesis; Lucas was talking about rational expectations. We have some bright alums. One woman got up and said, ‘Look at the evidence on 401k plans and how people misuse them, or don’t use them. Are you really saying that people look ahead and plan ahead rationally?’ And Lucas said, ‘Yes, that’s what the theory of rational expectations says, and that’s part of Friedman’s legacy.’ I said, ‘No, it isn’t. He was much more empirically minded than that.’ People took one part of his legacy and forgot the rest. They moved too far away from the data...

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers