J. Bradford DeLong's Blog, page 1091

January 16, 2015

Liveblogging World War II: January 16, 1945: Hitler Descends into His Bunker

This Day in History:

Hitler descends into his bunker:

On this day, Adolf Hitler takes to his underground bunker, where he remains for 105 days until he commits suicide.

Hitler retired to his bunker after deciding to remain in Berlin for the last great siege of the war. Fifty-five feet under the chancellery (Hitler's headquarters as chancellor), the shelter contained 18 small rooms and was fully self-sufficient, with its own water and electrical supply. He left only rarely (once to decorate a squadron of Hitler Youth) and spent most of his time micromanaging what was left of German defenses and entertaining Nazi colleagues like Hermann Goering, Heinrich Himmler, and Joachim von Ribbentrop. Constantly at his side during this time were his companion, Eva Braun, and his Alsatian, Blondi.

On April 29, Hitler married Eva in their bunker hideaway. Eva Braun met Hitler while working as an assistant to Hitler's official photographer. Braun spent her time with Hitler out of public view, entertaining herself by skiing and swimming. She had no discernible influence on Hitler's political career but provided a certain domesticity to the life of the dictator. Loyal to the end, she refused to leave the bunker even as the Russians closed in.

Only hours after they were united in marriage, both Hitler and Eva committed suicide. Warned by officers that the Russians were only about a day from overtaking the chancellery and urged to escape to Berchtesgarden, a small town in the Bavarian Alps where Hitler owned a home, the dictator instead chose to take his life. Both he and his wife swallowed cyanide capsules (which had been tested for their efficacy on his 'beloved' dog and her pups). For good measure, he shot himself with his pistol."

January 15, 2015

MOAR LINKS!

Annalee Newitz: Welcome to the Future Initiative http://annaleenewitz.kinja.com/welcome-to-the-future-initiative-1679760525

Anatole Kaletsky: 'If one number determines the fate of the world economy, it is the price of a barrel of oil' http://www.project-syndicate.org/commentary/oil-prices-ceiling-and-floor-by-anatole-kaletsky-2015-01

Dani Rodrik: From Welfare State to Innovation State http://www.project-syndicate.org/commentary/labor-saving-technology-by-dani-rodrik-2015-01

Ezra Klein (2007): Trending Toward Inanity: Mark Penn’s Microtrends Is so Epically Awful It Could Take the Entire Polling Industry Down with It http://inthesetimes.com/article/3320/trending_towards_inanity

Barry Eichengreen: Secular Stagnation: The Long View http://www.nber.org/papers/w20836.pdf

Plato: The Republic http://www.gutenberg.org/files/1497/1497-h/1497-h.htm#link2H_4_0004

Prakash Loungani: Battling Global Unemployment: Too Soon to Declare Victory http://blog-imfdirect.imf.org/2015/01/14/battling-global-unemployment-too-soon-to-declare-victory

Matt O'Brien: Bitcoin revealed: a Ponzi scheme for redistributing wealth from one libertarian to another http://www.washingtonpost.com/blogs/wonkblog/wp/2015/01/14/bitcoin-is-revealed-a-ponzi-scheme-for-redistributing-wealth-from-one-libertarian-to-another

Lawrence Summers, Ed Balls, et al.:: Report of the Commission on Inclusive Prosperity https://www.americanprogress.org/issues/economy/report/2015/01/15/104266/report-of-the-commission-on-inclusive-prosperity

Paul De Grauwe and Yuemei Ji: Quantitative easing in the Eurozone: It's possible without fiscal transfers http://www.voxeu.org/article/quantitative-easing-eurozone-its-possible-without-fiscal-transfers

Lawrence Summers: Response to Marc Andreessen on Secular Stagnation

Jared Bernstein: "I was chatting about that ‘why’ question with EPI research director Josh Bivens this morning and he said, ‘the Fed’s interest rate increase is the new deficit reduction. Everyone just knows it needs to happen.’ It’s an awfully apt analogy, if you ask me. For years, even when the evidence of pre-emptive fiscal contraction, aka austerity, was known to be clearly negative, serious people insisted that deficits had to come down. Now many of those same finger-waggers just feel it in their bones: the Fed needs to liftoff..."

Via Mark Thoma: Simon Wren-Lewis: "Let us hope for a Syriza victory: If you think this sentiment is dangerous, because you have read that if this left wing party formed a government after the forthcoming Greek elections the Eurozone would be plunged into crisis, I suspect you should reconsider where you get your information..."

Jean-Claude Trichet (June 2010): A Trip Down Euromemory Lane

Ta-Nehisi Coates (2013): Some Thoughts on Michael Kelly

Kevin Drum**: America's Real Criminal Element: Lead

Dean Baker and Jared Bernstein: Getting Back to Full Employment: A Better Bargain for Working People

Jared Bernstein: Here’s why wages aren’t growing: The job market is not as tight as the unemployment rate says it is http://

www.washingtonpost.com/posteverything...

Giovanni Pico della Mirandola: Oration on the Dignity of Man

Paul Krugman: "Robert Samuelson... declared himself ‘maddened’ by [my] column whose economic analysis he doesn’t actually dispute. What’s going on?... Reaganolatry.... Reagan must be seen as the hero who saved America... must be given credit for a disinflation carried out by a Fed chairman who was appointed by, and began his anti-inflation crusade under, Jimmy Carter. Anything perceived as detracting from the Reagan legend is infuriating, even if you can’t find anything wrong with the substance."

Mark Thoma: Full Employment Alone Won’t Solve Problem of Stagnating Wages

Frances Moore: "We estimate that the social cost of carbon is not $37 per ton, as previously estimated, but $220 per ton..."

Ian Millhiser: "Walker, according to Cannon, ‘is the only Republican governor who refused to establish an exchange but still put forward a proposal that relied on there being subsidies in a federal exchange’.... Cannon himself... [thus states] that Walker did not embrace the King plaintiffs’ reading.... Walker’s views... demonstrate that ‘a state official...' was unable to ascertain the alleged consequences.... Thus, even if the King plaintiffs are correct that Obamacare conditions tax credits on a state setting up its own exchange, that condition is unconstitutional."

Nick Rowe: Worthwhile Canadian Initiative: Did Inflation Targeting Destroy Its Own Signal?

John Plender: Bewitched by mandarins of central banking

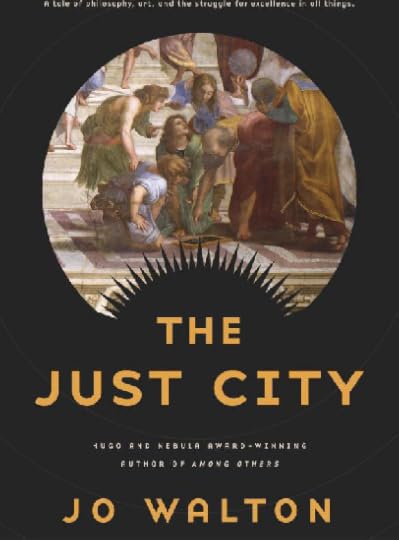

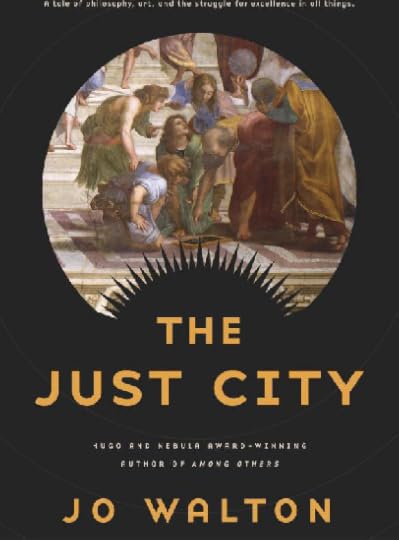

Cory Doctorow: Jo Walton's "The Just City"

Ryan Cooper: The Eurozone must choose: Democracy or austerity?

Ada Palmer: "Machiavelli awoke such a firestorm by creating an ethics which works without God. Utilitarianism depends entirely on evaluating the earthly consequences of an act, and can be used as a functional system for decision-making whether or not there exists any external divine force or absolute code of Truth"

Jo Walton: The Flight Into Egypt

Matthew C. Klein: Getting around the “safe asset shortage”, Australian style

Carola Binder: Targeting from Below

Nick Bunker: Jobless recoveries and the decline of startups

Réka Juhász: Temporary Protection and Technology Adoption: Evidence from the Napoleonic Blockade

Aaron Carroll: Philip Klein’s "Overcoming Obamacare"

Peter Orszag: What Brill's 'Bitter Pill' Gets Wrong on Obamacare

John Makin: Fed too complacent on US deflation damage

Wolfgang Münchau: Eurozone Must Act Before Deflation Grips

span class="author">Paul Krugman: On Econoheroes

Simon Wren-Lewis: On the Monetary Offset Argument

James Pethokoukis: Should Republicans Ignore Income Inequality?

Max Roser: World Income Distribution: 1820, 1970, 2000

The Box That Changed the World (2006):

Chirag Mehta: Tip of My Tongue

Neil Irwin: The Depression’s Unheeded Lessons: A Review of Barry Eichengreen's Hall of Mirrors

Kevin Drum: Non-Chart of the Day: Where's the Austerity? http://www.motherjones.com/kevin-drum/2015/01/non-chart-day-wheres-austerity

James Pethokoukis: Should Republicans Ignore Income Inequality?

David Frum: The Real Story of How America Became an Economic Superpower

Yael T. Abouhalkah: KC and St. Louis are big cities facing lots of big challenges

Financial Times: Markets Prophesy Secular Stagnation

John Kay: Rise in US and UK inequality principally due to financialisation and executive pay

Noted for Your Afternoon Procrastination for January 15, 2015

Over at Equitable Growth--The Equitablog

Over at Equitable Growth--The Equitablog

Afternoon Must-Read: Thomas Piketty: On the Elasticity of Capital-Labor Substitution - Washington Center for Equitable Growth

Afternoon Must-Read: Dani Rodrik: From Welfare State to Innovation State - Washington Center for Equitable Growth

Afternoon Must-Read: Barry Eichengreen: Secular Stagnation: The Long View - Washington Center for Equitable Growth

Nick Bunker:

Technology and the decline in the U.S. labor share

Plus:

Things to Read on the Afternoon of January 15, 2015 - Washington Center for Equitable Growth

Must- and Shall-Reads:

Lawrence Summers, Ed Balls, et al.::

Report of the Commission on Inclusive Prosperity

Prakash Loungani:

Battling Global Unemployment: Too Soon to Declare Victory

Neil Irwin:

Economic Lessons From Switzerland’s One-Day, 18 Percent Currency Rise

Dani Rodrik:

From Welfare State to Innovation State

Barry Eichengreen:

Secular Stagnation: The Long View

Thomas Piketty:

On the Elasticity of Capital-Labor Substitution

Paul De Grauwe and Yuemei Ji:

Quantitative easing in the Eurozone: It's possible without fiscal transfers

Robert Waldmann:

Secular Stagnation, The US Recovery, and Houses

And Over Here:

Over at Equitable Growth: Thomas Piketty: On the Elasticity of Capital-Labor Substitution (Brad DeLong's Grasping Reality...)

Liveblogging 301 BC, Fall: The Battle of Ipsus (Brad DeLong's Grasping Reality...)

Dani Rodrik:

From Welfare State to Innovation State:

"When the... industrial working class began to organize, governments defused the threat of revolution from below that Karl Marx had prophesied by expanding political and social rights, regulating markets, erecting a welfare state that provided extensive transfers and social insurance, and smoothing the ups and downs of the macroeconomy... reinvented capitalism to make it more inclusive.... Today’s technological revolutions call for a similarly comprehensive reinvention.... The trouble is that the bulk of [our] new technologies are labor-saving.... Few jobs are really protected from technological innovation.... A world in which robots and machines do the work of humans need not be a world of high unemployment. But it is certainly a world in which the lion’s share of productivity gains accrues to the owners of the new technologies and the machines that embody them. The bulk of the workforce is condemned either to joblessness or low wages.

Indeed, something like this has been happening in the developed countries for at least four decades.... Imagine that a government established a number of professionally managed public venture funds, which would take equity stakes in a large cross-section of new technologies.... Central banks offer a model of how such funds might operate independently of day-to-day political pressure. Society, through its agent--the government--would then end up as co-owner.... The public venture funds’ share of profits from the commercialization of new technologies would be returned to ordinary citizens in the form of a ‘social innovation’ dividend.... The welfare state was the innovation that democratized--and thereby stabilized--capitalism in the twentieth century. The twenty-first century requires an analogous shift to the ‘innovation state’..."

Barry Eichengreen:

Secular Stagnation: The Long View:

"Four explanations for secular stagnation... a rise in global saving, slow population growth that makes investment less attractive, averse trends in technology and productivity growth, and a decline in the relative price of investment goods. A long view from economic history is most supportive of the last of these.... I define secular stagnation as a downward tendency of the real interest rate, reflecting an excess of desired saving over desired investment, resulting in a persistent output gap and/or slow rate of economic growth.... A wide variety of connected activities and sectors, such as health care, education, industrial research and finance, are being disrupted by the latest wave of new technologies.... Again, this is not a prediction but a suggestion to look to the range of adaptation required in response to the current wave of innovations when seeking to interpret our slow rate of productivity growth and when pondering our future...

Thomas Piketty:

On the Elasticity of Capital-Labor Substitution:

"I do not believe in the basic neoclassical model. But I think it is a language that is important to use in order to respond to those who believe that if the world worked that way everything would be fine. And one of the messages of my book is, first, it does not work that way, and second, even if it did, things would still be almost as bad.... My response to Summers and others is... what we observe... [is] a rise in the capital/income ratio and a rise in the capital share... [in] the standard neoclassical model... the only possible logical... expla[nation]... would be an elasticity of substitution somewhat bigger than 1... that there are more and more different uses for capital over time and maybe in the future robots will make substitution even more.... Now, does this mean that it is the right explanation for what we have seen in recent decades? Certainly not.... All I am saying to neoclassical economists is this: if you really want to stick to your standard model, very small departures from it like an elasticity of substitution slightly above 1 will be enough to generate what we observe in recent decades. But there are many other, and in my view more plausible, ways to explain it.... It is perfectly clear to me that the decline of labor unions, globalization, and the possibility of international investors to put different countries in competition... have contributed to the rise in the capital share..."

Paul De Grauwe and Yuemei Ji:

Quantitative easing in the Eurozone: It's possible without fiscal transfers:

"The ECB has been struggling to implement a programme of quantitative easing (QE) that would successfully target deflation. The main difficulty is political, stemming from opposition from German institutions. Their argument against is that a government bond buying programme by the ECB would mix fiscal and monetary policy. This column argues the opposite – such a programme can be structured so that it does not mix fiscal and monetary policy. It, therefore, would not impose a risk on German taxpayers."

Robert Waldmann:

Secular Stagnation, The US Recovery, and Houses:

"Larry Summers... responds to Marc Andreesen on secular stagnation. The post is rather brilliant (no surprise there).... I like Summers’s list of possible causes of secular stagnation... it is appropriately long. A model-addicted economist would look at one possible explanation and assume away all the others.... The point (if any) of this post is to add another explanation--lower demand for housing.... First lower population growth causes much lower housing investment.... Second... maybe the housing bubble has lasted for decades and the generally-recognised housing bubble post 2000 was just more extreme.... There is a similar issue related to consumption and savings. The suspicion that inequality leads to secular stagnation is based on the idea that the super rich are satiated..."

Should Be Aware of:

Matt O'Brien:

Bitcoin revealed: a Ponzi scheme for redistributing wealth from one libertarian to another

Ezra Klein (2007):

Trending Toward Inanity: Mark Penn’s Microtrends Is so Epically Awful It Could Take the Entire Polling Industry Down with It

Melia Robinson:

Mission District Is More Hipster Than Brooklyn

Plato:

The Republic: "Sok: One woman has a gift of healing, another not; one is a musician, and another has no music in her nature? Gla: Very true. Sok: And one woman has a turn for gymnastic and military exercises, and another is unwarlike and hates gymnastics? Gla: Certainly. Sok: And one woman is a philosopher, and another is an enemy of philosophy; one has spirit, and another is without spirit? Gla: That is also true. Sok: Then one woman will have the temper of a guardian, and another not. Was not the selection of the male guardians determined by differences of this sort? Gla: Yes. Sok: Men and women alike possess the qualities which make a guardian; they differ only in their comparative strength or weakness. Gla: Obviously. Sok: And those women who have such qualities are to be selected as the companions and colleagues of men who have similar qualities and whom they resemble in capacity and in character? Gla: Very true. Sok: And ought not the same natures to have the same pursuits? Gla: They ought. Sok: Then, as we were saying before, there is nothing unnatural in assigning music and gymnastic to the wives of the guardians—to that point we come round again. Gla: Certainly not..."

Scott Lemieux:

Eviscerating Chris Caldwell's "Why History Will Eviscerate Obama":

"From the right, the argument should be even easier—most of what Obama has done will either result in the entrenchment of policies inconsistent with conservative values or fail to endure. Which makes Christopher Caldwell's attempt to argue that historians will 'eviscerate' Obama such a remarkable achievement. It reads as if he had outtakes from some random Weekly Standard articles lying around, and given the assignment, hastily complied some sentences from them at random while pretending that his argument had something to do with Obama. Laden with falsehoods, remarkable feats of illogic, implausible predictions, non-sequiturs, and some ugly race-baiting, almost every sentence of the Caldwell's argument makes a better case for Obama's positive legacy than the most fawning hagiography could. Hence, we bring you the annotated Christopher Caldwell..."

Yael Levine:

Dollar Guilt in the Land of the Collapsing Ruble:

"I’ve gotten a 100 percent raise. Not as a reward for hard work or long-term loyalty to my employer, but as a gift of timing. This windfall isn’t a one-off like a bonus, nor is it evenly spaced like paychecks after a promotion. I get richer at random. Almost every time I visit the ATM, what I take out is a smaller slice of what I make than it was the time before. I’m paid in dollars, but I live in Russia, where the currency is currently collapsing.... As the ruble falls, I think back on a night in late autumn of 2007.... Moscow had been named the world’s most expensive city for expatriates to live in.... My driver heard my foreignness.... 'Americans, what do they think in America now that it’s 25 rubles to the dollar!' he demanded.... When I first visited Russia seven years ago, Ziploc bags were commonly washed and hung to dry on a clothesline in the kitchen, and not out of environmentalism.... Russia was 'rising from its knees'... but it hadn’t stood up quite yet.... But although the city felt, objectively, far from the most desirable place in the world to live, a personal-sized pizza with gluey cheese cost $30.... By the time I arrived for my gig in Moscow this June, the ruble was clocking in at around 35.... There is a giddy gambler’s thrill to watching your money gain value for reasons beyond your control.... Taxis no longer felt like an indulgence and on more than one occasion, I ordered an extra two entrees for dinner to meet the delivery minimum.... I walked in the cold among these masses and the thought went through my mind repeatedly: 'I’m getting richer and richer, they’re getting poorer and poorer.' That night I gave the woman who walks my dog while I’m at work a 60 percent raise.... After the ruble hit 80 to the dollar yesterday, I walked down Tverskaya Street toward the Kremlin. Every single pedestrian I passed averted their eyes from the neon displays that advertise currency exchange rates..."

Comments:

Maynard Handley: Nighttime Must-Read: Richard Florida: Is Life Better in America’s Red States?:

"

JRich makes a good point buried in a bad point. Brad likewise misses the point. Transport is an astonishingly large part of the cost of living, maybe 80% of the cost of housing, and it's this way across most of America. New York is an outlier (housing higher than average, transport lower than average) but the pattern is pretty consistent across red and blue states. The cheapest big cities overall (relative to income, costing in housing and transport) look pretty blue to me, with Dallas the first red one coming in at 9th. Florida may still be correct in that some other aspects of standard of living are part of his index, though I don't know what they would be. (Healthcare MAY be cheaper, once you get past the "Obamacare is teh work of Satan and not for you if you're poor" crap? College may be cheaper?) Finally let's not get lost in the weeds with value judgements that are outside the purview of the actual issue being discussed. People like cars (revealed preference, WORLDWIDE not some crazy American thing) and if those cost a little more than public transport, people have the right to decide that's worth it. We're NOT discussing here issues of sustainability, the long term future, or whatever; and cannot have a useful discussion if side issues are brought in. Let's stick to the actual numbers --- how much money DO people spend on transport, without going off into the weeds of how they SHOULD (by your or my lights) be spending that money. All numbers (with lots of pretty graphs) here:

http://blogs.reuters.com/data-dive/2014/08/26/the-expense-of-sprawl/ (Apropos of my editorial above, I'd ignore the spin put on the article by the author which is more of the same "people should live the way I think they should, goddamnit" that's made a certain type of liberal so popular in the past...)"

Over at Equitable Growth: Thomas Piketty: On the Elasticity of Capital-Labor Substitution

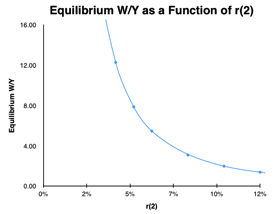

Over at Equitable Growth: As I have said before in Very Rough: Exploding Wealth Inequality and Its Rent-Seeking Society Consequences (backed up by the numbers of https://www.icloud.com/numbers/AwBUCAESEClb5VcMwjLJSBQQ90kTwzMaKUxB6_WCLZAfXLz1z3UT9I4hfYXqx6Igi7h4ZLFMjXXKOR3hQyuhEeGhMCUCAQEEIJPCSiJ_LdTd3IlxVH0-VvhIG5nYypcMustkcP_RZXnB#20140602_Roughing_Out_a_Piketty_Model) and elsewhere, in my view Thomas because he really needed a rent seeking society chapter in his Capital in the 21st Century. The underlying logic of his argument seems to be that wealth can take two forms: investments in capital-embodied technological wealth that boost wages in the economy, or investments in rent-seeking wealth that erode wages in the economy. And, I think, his argument is that we are headed for a society with a higher wealth-to-income ratio, and in such a society a greater share of wealth will find its way into the second channel. READ MOAR

Maybe that is not what Pikitty's argument is. But I at least think that it is what Piketty's argument should be--because I think it is highly likely to be true...

Thomas Piketty:

On the Elasticity of Capital-Labor Substitution:

"I do not believe in the basic neoclassical model...

...But I think it is a language that is important to use in order to respond to those who believe that if the world worked that way everything would be fine. And one of the messages of my book is, first, it does not work that way, and second, even if it did, things would still be almost as bad....

My response to Summers and others is... what we observe... [is] a rise in the capital/income ratio and a rise in the capital share... [in] the standard neoclassical model... the only possible logical... expla[nation]... would be an elasticity of substitution somewhat bigger than 1... that there are more and more different uses for capital over time and maybe in the future robots will make substitution even more.... Now, does this mean that it is the right explanation for what we have seen in recent decades? Certainly not....

All I am saying to neoclassical economists is this: if you really want to stick to your standard model, very small departures from it like an elasticity of substitution slightly above 1 will be enough to generate what we observe in recent decades. But there are many other, and in my view more plausible, ways to explain it.... It is perfectly clear to me that the decline of labor unions, globalization, and the possibility of international investors to put different countries in competition... have contributed to the rise in the capital share...

Cf.: Suresh Naidu:

Capital Eats the World, and The Slack Wire: Notes from Capital in the 21st Century Panel; and me: The Hourly Piketty: Paul Krugman, "Gattopardo Economics", and Economic Modelling, and The Honest Broker: Mr. Piketty and the “Neoclassicists”: A Suggested Interpretation: For the Week of May 17, 2014.

January 14, 2015

Liveblogging 301 BC, Fall: The Battle of Ipsus

Plutarch:

Plutarch:

Life of Demetrius:

A general league of the kings, who were now gathering and combining their forces to attack Antigonus, recalled Demetrius from Greece. He was encouraged by finding his father full of a spirit and resolution for the combat that belied his years. Yet it would seem to be true, that if Antigonus could only have borne to make some trifling concessions, and if he had shown any moderation in his passion for empire, he might have maintained for himself till his death and left to his son behind him the first place among the kings. But he was of a violent and haughty spirit; and the insulting words as well as actions in which he allowed himself could not be borne by young and powerful princes, and provoked them into combining against him. Though now when he was told of the confederacy, he could not forbear from saying that this flock of birds would soon be scattered by one stone and a single shout.

He took the field at the head of more than 70,000 foot, and of 10,000 horse, and 75 elephants. His enemies had 64,000 foot, 500 more horse than he, elephants to the number of 400, and a 120 chariots. On their near approach to each other, an alteration began to be observable, not in the purposes, but in the presentiments of Antigonus. For whereas in all former campaigns he had ever shown himself lofty and confident, loud in voice and scornful in speech, often by some joke or mockery on the eve of battle expressing his contempt and displaying his composure, he was now remarked to be thoughtful, silent, and retired.

He presented Demetrius to the army and declared him his successor; and what every one thought stranger than all was that he now conferred alone in his tent with Demetrius; whereas in former time he had never entered into any secret consultations even with him; but had always followed his own advice, made his resolutions, and then given out his commands. Once when Demetrius was a boy and asked him how soon the army would move, he is said to have answered him sharply, 'Are you afraid lest you, of all the army, should not hear the trumpet?'

There were now, however, inauspicious signs, which affected his spirits. Demetrius, in a dream, had seen Alexander, completely armed, appear and demand of him what word they intended to give in the time of the battle; and Demetrius answering that he intended the word should he 'Zeus and Victory,' 'Then,' said Alexander, 'I will go to your adversaries and find my welcome with them.'

And on the morning of the combat, as the armies were drawing up, Antigonus, going out of the door of his tent, by some accident or other stumbled and fell flat upon the ground, hurting himself a good deal. And on recovering his feet, lifting up his hands to heaven, he prayed the gods to grant him, 'either victory, or death without knowledge of defeat.'

When the armies engaged, Demetrius, who commanded the greatest and best part of the cavalry, made a charge on Antiochus, the son of Seleucus, and gloriously routing the enemy, followed the pursuit, in the pride and exultation of success, so eagerly, and so unwisely far, that it fatally lost him the day; for when, perceiving his error, he would have come in to the assistance of his own infantry, he was not able, the enemy with their elephants having cut off his retreat.

And on the other hand, Seleucus, observing the main battle of Antigonus left naked of their horse, did not charge, but made a show of charging; and keeping them in alarm and wheeling about and still threatening an attack, he gave opportunity for those who wished it to separate and come over to him; which a large body of them did, the rest taking to flight.

But the old King Antigonus still kept his post, and when a strong body of the enemies drew up to charge him, and one of those about him cried out to him, 'Sir, they are coming upon you,' he only replied, 'What else should they do? But Demetrius will come to my rescue.' And in this hope he persisted to the last, looking out on every side for his son's approach, until he was borne down by a whole multitude of darts, and fell. His other followers and friends fled, and Thorax of Larissa remained alone by the body.

Noted for Your Nighttime Procrastination for January 14, 2015

Over at Equitable Growth--The Equitablog

Over at Equitable Growth--The Equitablog

Lawrence Summers: Response to Marc Andreesen on Secular Stagnation

Jean-Claude Trichet: A Trip Down Euromemory Lane

Kevin Drum: America's Real Criminal Element: Lead

Nick Bunker:

A welcome jolt to the labor market

Nick Bunker:

Is higher education the answer to reducing income inequality?

Plus:

Things to Read at Nighttime on January 14, 2015

Must- and Shall-Reads:

Jared Bernstein:

Here’s why wages aren’t growing: The job market is not as tight as the unemployment rate says it is

Dean Baker and Jared Bernstein:

Getting Back to Full Employment: A Better Bargain for Working People

Steven Johnson:

How We Got to Now: Six Innovations That Made the Modern World - Boing Boing

Via Mark Thoma: Simon Wren-Lewis:

"Let us hope for a Syriza victory: If you think this sentiment is dangerous, because you have read that if this left wing party formed a government after the forthcoming Greek elections the Eurozone would be plunged into crisis, I suspect you should reconsider where you get your information..."

Jared Bernstein:

"I was chatting about that ‘why’ question with EPI research director Josh Bivens this morning and he said, ‘the Fed’s interest rate increase is the new deficit reduction. Everyone just knows it needs to happen.’ It’s an awfully apt analogy, if you ask me. For years, even when the evidence of pre-emptive fiscal contraction, aka austerity, was known to be clearly negative, serious people insisted that deficits had to come down. Now many of those same finger-waggers just feel it in their bones: the Fed needs to liftoff..."

Lawrence Summers:

Response to Marc Andreessen on Secular Stagnation

Jean-Claude Trichet (June 2010):

A Trip Down Euromemory Lane

Kevin Drum:

America's Real Criminal Element: Lead

And Over Here:

Liveblogging World War II: January 14, 1945: Bovigny, Belgium

Half a Dozen for the Week of January 14, 2015

Lawrence Summers:

Response to Marc Andreessen on Secular Stagnation:

"The essence of the secular stagnation issue is not whether technology has stopped advancing; but rather whether there is a mismatch between desired saving and investment opportunities that results in low equilibrium real interest rates, precipitates financial instability, and may inhibit economic growth.... For the roughly 30 years after World War II, the American economy generated consistent growth in living standards with business cycles of relatively low amplitude. From the early 1980s until the late 1990s, the economy again preformed quite well.... We have plenty of experience with satisfactory economic performance to set as an aspiration.... Markets--in the form of 30-year indexed bonds--are now predicting that real rates well below 2 percent will prevail for more than a generation.... I think it is quite plausible and consistent with Marc’s picture that equilibrium real rates were roughly constant at around 2 percent until the mid-1990s and have trended downward since that time.... Marc and I agree that we are headed into a period of soft real interest rates, where there will be more money available than great deals. This may, as he suggests, not be all bad; as it will make it easier for risky ideas to get funded. The danger... is that the zero lower bound on nominal rates will prevent the attainment of full employment as desired investment falls short of desired saving. A related danger is that the very low interest rates will encourage risk-taking and asset price inflation in ways that will ultimately give rise to financial instability.... The experience of the US economy in the 1930s demonstrates [that] even with rapid innovation it is possible for economic performance to be very poor when finances are not successfully managed..."

Jean-Claude Trichet (June 2010):

A Trip Down Euromemory Lane:

"As regards the economy, the idea that austerity measures could trigger stagnation is incorrect … In fact, in these circumstances, everything that helps to increase the confidence of households, firms and investors in the sustainability of public finances is good for the consolidation of growth and job creation. I firmly believe that in the current circumstances confidence-inspiring policies will foster and not hamper economic recovery, because confidence is the key factor today..."

Kevin Drum:

America's Real Criminal Element: Lead:

"Washington, DC, didn't have either Giuliani or Bratton, but its violent crime rate has dropped 58 percent since its peak. Dallas' has fallen 70 percent. Newark: 74 percent. Los Angeles: 78 percent.... Howard Mielke... Sammy Zahran... lead and crime... six US cities that had both good crime data and good lead data going back to the '50s, and they found a good fit in every single one. In fact, Mielke has even studied lead concentrations at the neighborhood level in New Orleans and shared his maps with the local police. 'When they overlay them with crime maps,' he told me, 'they realize they match up.'... We now have studies at the international level, the national level, the state level, the city level, and even the individual level. Groups of children have been followed from the womb to adulthood, and higher childhood blood lead levels are consistently associated with higher adult arrest rates for violent crimes. All of these studies tell the same story: Gasoline lead is responsible for a good share of the rise and fall of violent crime over the past half century.... The gasoline lead hypothesis helps explain some things we might not have realized even needed explaining.... Murder rates have always been higher in big cities than in towns... big cities have lots of cars in a small area, they also had high densities of atmospheric lead during the postwar era. But as lead levels in gasoline decreased, the differences between big and small cities largely went away. And guess what? The difference in murder rates went away too..."

Should Be Aware of:

Ta-Nehisi Coates (2013):

Some Thoughts on Michael Kelly

Oliver Landmann:

EMU and the Cyclical Behavior of Fiscal Policy: A Suggested Interpretation

Alan Taylor:

Surprising New Findings Point to “Perfect Storm” Brewing in Your Financial Future: "This basic aggregate measure of gearing or leverage is telling us that today’s advanced economies' operating systems are more heavily dependent on private sector credit than anything we have ever seen before. Furthermore, this pattern is seen across all the advanced economies, and isn’t just a feature of some special subset (e.g. the Anglo-Saxons)."

Comments:

Nathanael: Noted for Your Morning Procrastination for January 5, 2015:

"

It's not clear whether the Constitution allows the Senate can be abolished by amendment -- but it certainly allows all the powers of the Senate to be transferred to another body, leaving the Senate as a ceremonial body."

Nathanael: Noted for Your Morning Procrastination for January 5, 2015:

"

Marshall is 100% right in his criticism of Sargent. And you're wrong in your criticism of him! Removing the ability of the government to print money is actually extremely bad. It leads to deflation. Regime change occurs when the regime changes, that is to say when the people in charge change. Money-printing can be a power of the new government just as it was a power of the old government; the key is that the new government must be different people, so that people do not expect them to behave like the old government. The "tough, independent central banker" is of zero value -- or in fact, of negative value -- what he traditionally does is to distort policy in favor of the rich and against the general public. This is because the government has some interest in retaining support from the general public, while the central banker is only interested in retaining popularity among other bankers."

Maynard Handley: Noted for Your Nighttime Procrastination for January 8, 2015:

"

Interesting, in light of Samsung's feet of clay, is Xiaomi's meteoric rise as discussed here:

http://stratechery.com/2015/xiaomis-ambition/ and here

https://medium.com/@mvakulenko/only-for-fans-or-why-xiaomi-is-not-what-you-think-it-is-41e7274b13c5 We can all have our opinions about this, but to me the Xiaomi hype looks basically the same as what I was seeing about Samsung say four years ago, and the biggest cheerleaders look to me like people talking up their book, not dispassionate and rational observers. In particular, I see Xiaomi following the Samsung model which in turn followed the SONY model --- slap your brand on anything that moves and charges the rubes an extra 15% for the privilege. This works as long as those products ARE best of breed --- I'm happy to pay a little more to delegate to someone else the task of figuring out the optimal set of features in any product. But at some point SONY stopped bothering with even that minimal task, and from that point on it was all downhill. Back in the early 2000s a colleague of mine (I won't give his name, but let me just say that he's part of that same elite club as Stallman or Linus or Herb Sutter --- an alpha geek known by name to the other alpha geeks) worked with SONY on a project to unify their UIs across the vast range of devices they produce, to create a single "Sony Style", the way there is a recognizable Apple style across all their products. Technically the result was pretty awesome and, IMHO, was exactly was SONY needed --- an easy way for designers to create a uniform UI on top of the low level device specific code. Needless to say, SONY paid him for his work --- and then promptly ignored it. Samsung reprised the story of SONY, like the Bourbons forgetting nothing and learning nothing, and running at a speed about 3x as fast. Xiaomi are interesting, IMHO, because they now have not one but two failures as evidence of the consequences of a particular way of "growing the brand", along with trying to be a tech company without any real, seriously differentiating, tech of your own; and Xiaomi are interesting because their future and staying power are still not obvious --- Justin Fox may be reporting Samsung's situation to the masses today, but it was obvious to any unbiased observer at least a year ago."

Half a Dozen for the Week of January 14, 2015

http://tinyletter.com/braddelong/letters/half-a-dozen-for-the-week-of-january-14-2014

Plato's "Republic" FanFic: Jo Walton's The Just City http://delong.typepad.com/sdj/2015/01/lunchtime-must-read-cory-doctorow-jo-waltons-the-just-city.html

Serena Ryder and Melissa Etheridge have a sing-off http://delong.typepad.com/sdj/2015/01/for-the-weekend-2.html

My "Sisyphus as Social Democrat: A review of 'John Kenneth Galbraith: His Life, His Politics, His Economics', by Richard Parker http://delong.typepad.com/sdj/2015/01/hoisted-from-the-archives-1.html

Slides for a Talk: Thoughts on Making a Better Economics: http://delong.typepad.com/sdj/2015/01/eb-slides-for-a-talk-thoughts-on-making-a-better-economics.html

The Already-Written Fidel Castro Obituary comes from a century ago: Rosa Luxemburg, The Russian Revolution http://delong.typepad.com/sdj/2015/01/hoisted-from-other-peoples-archives-from-97-years-ago-the-already-written-fidel-castro-obituary-rosa-luxemburg-the-russ.html

What Was and Is the Real Macroeconomic Research Frontier? http://delong.typepad.com/sdj/2015/01/over-at-equitable-growth-what-was-and-is-the-real-macroeconomic-research-frontier-daily-focus.html

January 13, 2015

Plato's "Republic" FanFic: Jo Walton's "The Just City"

Highly recommended.

Highly recommended.

The School of Athens, Plus Gods and Robots...

Jo Walton: The Just City

Cory Doctorow:

Jo Walton's "The Just City":

"Athena... outside of time... constrained by fate and providence...

...has heard the prayers of all her worshipers through the ages who have read Plato's Republic.... So she summons them all to a volcanic island... doomed to be lost to eruption... ensuring that her tampering... will not unduly disrupt the future, which will only dimly remember the island as Atlantis. In this place, men and women from all times and places set to making a place for the children whom they will raise to be philosopher kings....

The children of the Just City are then inducted into the Platonic system of education and indoctrination. And here is where Walton shines... the small and hurtful and glorious business of interpersonal relationships... the incredible beauty and the cruelty of utopian projects. Nobody writes like Walton.

The Just City manages to both sympathize with social engineering at the same time as it demolishes paternalistic solutions to human problems. In so doing, this book about philosophy, history, gender and freedom also manages to be a spectacular coming-of-age tale that encompasses everything from courtroom dramas to sexual intrigue...

Jo Walton:

The Just City:

"Writing about Plato’s Republic being tried...

...seems to me an idea that is so obvious everyone should have had it, that it should be a subgenre, there should be versions written by Diderot and George Eliot and Orwell and H. Beam Piper and Octavia Butler. Of course, it simultaneously seems like a crazy idea that makes people roll their eyes when I describe it. It’s about Greek gods and time travellers setting up Plato’s Republic, on Thera before it erupted, with robots and Socrates and ten thousand children, and it all goes just as well as you might expect… and the other thing I can say about it is that it’s about love and excellence...

Noted for Your Nighttime Procrastination for January 13, 2015

Over at Equitable Growth--The Equitablog

Over at Equitable Growth--The Equitablog

Sheryl Sandberg and Adam Grant: Why Women Stay Quiet at Work

Nick Rowe: Did Inflation Targeting Destroy Its Own Signal?

John Plender: Bewitched by Mandarins of Central Banking

Cory Doctorow: Jo Walton's "The Just City"

Plus:

Things to Read at Nighttime on January 13, 2015

Must- and Shall-Reads:

Mark Thoma:

Full Employment Alone Won’t Solve Problem of Stagnating Wages

Carola Binder:

Targeting from Below

Matthew C. Klein:

Getting around the “safe asset shortage”, Australian style

Josh Barro:

Fidelity Introduces Location-Based Stock-Picking App, for Some Reason

Ryan Cooper:

The Eurozone must choose: Democracy or austerity?

World Bank:

Understanding the Plunge in Oil Prices: Sources and Implications

Gavyn Davies:

The global deflation shock – how big and how bad?

Ian Millhiser:

"Walker, according to Cannon, ‘is the only Republican governor who refused to establish an exchange but still put forward a proposal that relied on there being subsidies in a federal exchange’.... Cannon himself... [thus states] that Walker did not embrace the King plaintiffs’ reading.... Walker’s views... demonstrate that ‘a state official...' was unable to ascertain the alleged consequences.... Thus, even if the King plaintiffs are correct that Obamacare conditions tax credits on a state setting up its own exchange, that condition is unconstitutional."

Frances Moore:

"We estimate that the social cost of carbon is not $37 per ton, as previously estimated, but $220 per ton..."

Nick Rowe:

Worthwhile Canadian Initiative: Did Inflation Targeting Destroy Its Own Signal?

John Plender:

Bewitched by mandarins of central banking

Sheryl Sandberg and Adam Grant:

Why Women Stay Quiet at Work

Cory Doctorow:

Jo Walton's "The Just City"

PGL:

Robert Samuelson Credits Reagan for the Volcker Disinflation

Dylan Matthews:

Bernie Sanders opens a new front in the battle for the future of the Democratic Party

Miles Kimball:

Cognitive Economics

And Over Here:

Liveblogging the American Revolution: January 13, 1777: The American Crisis

Over at Equitable Growth: John Plender: Bewitched by Mandarins of Central Banking

Nick Rowe:

Worthwhile Canadian Initiative: Did Inflation Targeting Destroy Its Own Signal?:

"The Calvo Phillips Curve has a very special property: the subset of firms that change their prices in any period is a perfectly representative sample of all firms... [that] makes the Calvo Phillips Curve very easy to use, which is why macro modellers like to use it. But that property stacks the modeller's deck in favour of inflation targeting and against NGDP targeting. Because it makes deviations of inflation from target a perfect signal of monetary disequilibrium.... Inflation targeting has such desirable welfare properties... [because] the firms that can change prices do exactly what the firms that cannot change prices would like to do.... Real world central banks know... some prices are stickier... pay more attention to core inflation... 'target the stickiest price' is the slogan that captures this idea.... Fluctuations in inflation are a noisy signal of monetary disequilibrium, because the firms that do change prices are not always representative of the firms that don't. And by targeting inflation the central bank makes inflation stickier, and this reduces inflation's signal/noise ratio. Fluctuations in output are also a noisy signal.... NGDP targeting is unlikely to be exactly optimal, but may well be better than inflation targeting, which puts all the weight on one noisy signal and ignores the other.... The big puzzle of the recent recession is why the inflation guard dogs failed to bark.... The NGDP guard dogs barked loud and clear, giving a consistent and correct signal. That is what we need to model. And if we can model that, we may also have a model in which targeting NGDP can do better than targeting inflation. But we will need to move away from the Calvo Phillips Curve to build that model. Which is going to make it harder."

John Plender:

Bewitched by mandarins of central banking:

"The continuing fall in government bond yields in the advanced economies at the turn of the year was a salutary reminder of how hard it is to invest in markets that are heavily distorted by central banks. At the start of 2013 there was near-consensus among investors that US Treasury yields had nowhere to go but up.... The US Federal Reserve did indeed stop buying in the summer, but Treasury prices continued to rise and yields to fall. The most plausible explanation for this defiance of conventional wisdom was the persistence of global imbalances... excess savings in Asia and northern Europe had to find a home. The additional yield available in the US market, along with the potential for further dollar strength, made this a compelling trade.... Central banks, most notably the Fed, have put a cushion under asset prices when they go down while imposing no cap when they bubble up.... The great bond bull market that began in 1982 has yet to revert.... Market professionals who have hitherto contributed to the efficiency of market pricing through their analytical skills are reduced to hanging sheeplike on the words of central bankers about the likely direction of bond-buying programmes. And they remain bewitched by the mandarins of central banking despite the mixed quality of their forward guidance.... Whatever the benefits of QE, there are bound to be significant economic costs arising from the artificially cheap cost of capital. Capital will be misallocated. And it may go on being misallocated, for the central banks seem to be trapped in a process whereby measures to counteract the fallout from one bubble pave the way for another."

Sheryl Sandberg and Adam Grant:

Why Women Stay Quiet at Work:

"YEARS ago, while producing the hit TV series ‘The Shield,’ Glen Mazzara noticed that two young female writers were quiet during story meetings. He pulled them aside and encouraged them to speak up more. Watch what happens when we do, they replied. Almost every time they started to speak, they were interrupted or shot down before finishing their pitch. When one had a good idea, a male writer would jump in and run with it before she could complete her thought.... We’ve both seen it happen again and again. When a woman speaks in a professional setting, she walks a tightrope. Either she’s barely heard or she’s judged as too aggressive. When a man says virtually the same thing, heads nod in appreciation for his fine idea. As a result, women often decide that saying less is more.... This speaking-up double bind harms organizations by depriving them of valuable ideas.... The long-term solution to the double bind of speaking while female is to increase the number of women in leadership roles.... When President Obama held his last news conference of 2014, he called on eight reporters — all women. It made headlines worldwide. Had a politician given only men a chance to ask questions, it would not have been news; it would have been a regular day. As 2015 starts, we wonder what would happen if we all held Obama-style meetings.... Doing this for even a day or two might be a powerful bias interrupter.... We’re going to try it to see what we learn..."

Cory Doctorow:

Jo Walton's "The Just City":

"Athena... outside of time... constrained by fate and providence... has heard the prayers of all her worshipers through the ages who have read Plato's Republic.... So she summons them all to a volcanic island... doomed to be lost to eruption... ensuring that her tampering... will not unduly disrupt the future, which will only dimly remember the island as Atlantis. In this place, men and women from all times and places set to making a place for the children whom they will raise to be philosopher kings.... The children of the Just City are then inducted into the Platonic system of education and indoctrination. And here is where Walton shines... the small and hurtful and glorious business of interpersonal relationships... the incredible beauty and the cruelty of utopian projects. Nobody writes like Walton. The Just City manages to both sympathize with social engineering at the same time as it demolishes paternalistic solutions to human problems. In so doing, this book about philosophy, history, gender and freedom also manages to be a spectacular coming-of-age tale that encompasses everything from courtroom dramas to sexual intrigue..."

PGL:

Robert Samuelson Credits Reagan for the Volcker Disinflation:

"We can go back to a 1986 discussion from Tom Redburn: 'President Reagan's four appointees as governors of the Federal Reserve Board prodded Fed Chairman Paul A. Volcker toward a less restrictive monetary policy when they outvoted him last month on a cut in a key interest rate charged to financial institutions, sources said Tuesday.' The people that President Reagan was appointing to the Federal Reserve did not agree with the Volcker majority and eventually garnered enough influence to force a less restrictive monetary policy. I offer this not as a criticism of President Reagan as some of us loathed the severity of Volcker’s tight monetary policy. But people like Samuelson heart both Reagan and tight monetary policies. Faced with the inconsistency of these two positions--they decide to rewrite history. Update: Dean Baker has more on this including a nice graph of inflation that undermines this line from Samuelson: 'Worse, government seemed powerless to defeat it.' Never mind that Dean’s graph shows inflation fell when the FED did tight money under Nixon and again fell after Gerald Ford started up with those damn WIN buttons."

Dylan Matthews:

Bernie Sanders opens a new front in the battle for the future of the Democratic Party - Vox:

"President Obama's biggest problem in the Senate is obviously its new Republican majority, but opposition from the left wing of the Democratic caucus appears to be growing too. Most prominently, Sen. Elizabeth Warren (D-MA) has clashed with the White House on a key Treasury Department position and the CRomnibus spending package. But new budget committee ranking member Sen. Bernie Sanders (I-VT) is poised to break dramatically from traditional Democratic views on budgeting, from Obama to Clinton to Walter Mondale and beyond. His big move: naming University of Missouri - Kansas City professor Stephanie Kelton as his chief economist. Kelton is not exactly a household name, but to those who follow economic policy debates closely, tapping her is a dramatic sign. For years, the main disagreement between Democratic and Republican budget negotiators was about how to balance the budget — what to cut, what to tax, how fast to implement it — but not whether to balance it. Even most liberal economists agree that, in the medium-run, it's better to have less government debt rather than more. Kelton denies that premise..."

Miles Kimball:

Cognitive Economics:

"Economic research using more and more direct data about what is in people’s minds is flourishing. But much more can be done. Fostering continued progress in this area of Cognitive Economics calls for three inputs. First, new theoretical tools for dealing with finite cognition need to be developed, and existing theoretical tools sharpened. Second, welfare economics needs to be toughened up for the rugged landscape revealed by peering into people’s minds. Third, the statement ‘The data are endogenous’ needs to become not only an econometrician’s warning but also a motto reminding economists that new surveys can be designed and new data of many kinds can be collected to answer pressing questions."

Should Be Aware of:

Marc Andreessen:

The Future of the News Business: A Monumental Twitter Stream All in One Plac

Ada Palmer:

"Machiavelli awoke such a firestorm by creating an ethics which works without God. Utilitarianism depends entirely on evaluating the earthly consequences of an act, and can be used as a functional system for decision-making whether or not there exists any external divine force or absolute code of Truth"

Paul Krugman:

"Robert Samuelson... declared himself ‘maddened’ by [my] column whose economic analysis he doesn’t actually dispute. What’s going on?... Reaganolatry.... Reagan must be seen as the hero who saved America... must be given credit for a disinflation carried out by a Fed chairman who was appointed by, and began his anti-inflation crusade under, Jimmy Carter. Anything perceived as detracting from the Reagan legend is infuriating, even if you can’t find anything wrong with the substance."

Giovanni Pico della Mirandola:

Oration on the Dignity of Man

Yael T. Abouhalkah:

KC and St. Louis are big cities facing lots of big challenges:

"St. Louis is in a world of hurt for many reasons. The latest blow... Stan Kroenke... might build a stadium in Los Angeles County and possibly move the Rams there.... Kansas City looks at least a little better than St. Louis in key metrics such as population growth, crime rates and job gains.... Several emailed responses also made the excellent point that the state of Missouri’s future will be a lot brighter if both Kansas City and St. Louis can find ways to prosper. These two cities... are the economic engines of the entire state. Both cities have plenty of strong points.... Yet boosters... often forget that many other large cities offer the same--or even better--amenities... bring new life to Kansas City and St. Louis... add lots more people and jobs... reducing outrageous violent crime rates... exist such as investing in better public schools, infrastructure and transit.... Kansas City had 16.5 murders per 100,000 residents. St. Louis, with a staggering 50 murders per 100,000.... 31 of the 50 largest cities had under 10.... Kansas City was a woeful 21st on gaining employment over a three-year timetable; St. Louis was 24th... trailed a long list of more successful employment magnets: Raleigh, Dallas/Ft. Worth, Seattle, San Diego, Portland, Austin, San Antonio, Charlotte, Oklahoma City, Denver, Nashville, Milwaukee, Indianapolis, Louisville, Cincinnati and Minneapolis..."

Jo Walton:

The Flight Into Egypt: "The Holy Family flew economy, of course,/Every seat taken, after the holidays,/The donkey crammed into the luggage rack,/Lying patiently among outsize carry-on,/Ears twitching, and one little bray at takeoff. The baby doesn't make a sound,/Strapped inside Mary's seatbelt, smiling,/Good as gold, beautific,/From the tip of His halo to the soles of His chubby feet. Mary has eyes for no one but Him,/If she must fasten oxygen masks it will be His first,/Whatever they tell her./A harried flight attendant pauses to coo,/'What a little one, isn't he lovely!' And Joseph nodding, 'Just two weeks old,/Visiting family, yes, very first flight,'/Accepts the plush airplane, crayons, frankincense,/Compulsively checking the papers inside his jacket,/Looking ahead through the turbulence towards the landing, Hoping they will be granted/Refugee status.

"

Izabella Kaminsky:

Do you have a finance degree from the university of Bitcoin?:

"As ever, even in the cyber age, we therefore find ourselves at the mercy of same old suspects: ‘the good’ (the legal government systems that supposedly defend our interests or in some cases doesn’t) ‘the bad’ (organised private mercenary operations who have the loyalty of those who can defend our interests but which demand protection rents from us weaker common folk) and ‘the ugly’ (malevolent predators who just want to mess with the system and/or survive by preying on the weak, and who the bad claim to defend us from.) If that’s the case, the above is a true reflection of anacyclosis at work. It also suggests the only way society can truly preserve the stability and technological advances achieved by collaborative processes is by all of us mastering the techniques that can help defend us from the predators and destabilisers who understand how easy it is to cheat the system. And that, we dare say, amounts to a population-wide IT/encryption literacy campaign. Which, by definition, is a multi-generational project which will be unlikely to reap returns within the next business cycle, let alone overnight."

Comments:

John Howard Brown: Thoughts on Making a Better Economics: Daily Focus:

"As I have written in a (lamentably) unpublished essay, the fundamental scarcity which conditions all other scarcities is the scarcity of information. As was pointed out by Hayek almost seventy years ago, markets possess very desirable informational qualities, aggregating information about any commodity and producing a sufficient statistic. However, as Brad points out, there are important commodities/services where the operation of markets does not appear to generate the efficient results that Hayek implied were universal. The grammar of organizational forms which he proposes ought to have as one dimension, the informational characteristics which define them. Ronald Coase and Oliver Williamson started this approach long ago. However, still more needs to be done along these lines."

Coconino: On the U.S. Health Care System as Boss Hogg in "The Dukes of Hazzard": Douglas Coupland in the Financial Times:

"Just wow. I've been having upper respiratory issues/infections for the last 8 years, since moving to NM/CO (it's my horrid allergies). Only once in all that time have I even been prescribed codeine cough syrup. The doc was obviously a money-grubbing creep and should lose his license."

Downpuppy: The Recent Thing Closest to a High-Quality DeLong Smackdown I Can Find: Legacy Journalism Skills Edition:

"The best legacy skills are the slow cooker kind. A deep piece, that requires multiple sources, physical exposure, and background knowledge. Three that I can think of are Balko on Ferguson's structural oppression, Taibbi on foreclosure courts, and Monica Potts on poor women's life expectancy - http://prospect.org/article/whats-killing-poor-white-women"

Chris Y: Hoisted from Other People's Archives from 97 Years Ago: The Already-Written Fidel Castro Obituary--(Rosa Luxemburg, "The Russian Revolution" Chapter 6):

"

Lenin in particular, but also Trotsky, were obsessed with the model of the French revolution and the role of the Jacobin clubs. This was understandable, because models of even partially successful revolutions were few and far between, more so then than now. But they completely failed to grasp that by substituting the Jacobin leadership for the broader range of ideas in the National Assembly and the Parisian sans culottes for the entirety of the oppressed classes in France, they made the job of the counter-revolution easier: Bonaparte had a huge constituency to appeal to which the leadership in Paris had largely come to ignore in practice. Trotsky sorta kinda realised this after it was far too late, and there's some (inconclusive) evidence that if Lenin had lived he would have tried to push the revolution down a Deng Xiaoping path rather than the one chosen by Stalin, but Luxemburg was typically astute in her analysis, possibly because she didn't give a damn about Robespierre: substitutionism created the conditions in which Stalin and his supporters could flourish, and that danger went right over the heads of the original leadership. Stalin, as the Soviet Napoleon, might have been said to have repeated tragedy as farce, except that the tragedy was so much greater than the first time."

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers