J. Bradford DeLong's Blog, page 1089

January 20, 2015

Hoisted from the Archives: Feeling Good: My 2005 Social Security Reform Statement

The feel-good thing to read this week is my 2005 Social Security Reform statement:

Statement on Social Security Reform

http://delong.typepad.com/sdj/2005/05/statement_on_so.html

2005-05-12

In my view, a Social Security reform plan needs to clear five hurdles before it is worth considering:

The private accounts it offers people must be a good deal for beneficiaries.

The plan must raise national savings.

The plan must preserve the valuable defined-benefit nature of the current program.

The plan should restore long-run solvency, and put in place mechanisms for automatic adjustment should the system fall further out of balance.

We must have confidence that the plan will be competently implemented.

You have already heard from Robert Shiller on how private accounts as proposed by the Bush administration are not a good deal for beneficiaries... higher returns are not worth the risk... the extra purchasing power gained in those states of the world when stocks do well does not match the losses beneficiaries see in states of the world when stocks do not do so well.... I don't have more than quibbles with Shiller....

I am actually, in at least one of my hearts-of-hearts, the heart-of-hears of an Eisenhower Republican, a believer in private accounts. I agree with Marty Feldstein that the... equity premium... over the past half-century tells us that the stock market has... not... mobiliz[ed] the risk-bearing capacity of the American economy... that... steps... to broaden and deepen stock ownership promise... significant improvements in the ability of America's business to raise capital.... I agree with ... Kent Smetters that it is a scandal and an outrage that the poorest half of Americans have no easy... low-fee way of investing in stocks.

But the Bush plan's private accounts are not private accounts that anybody should endorse. The 3%-plus-inflation clawback rate is just too high given likely future asset returns... [READ MOAR1

Liveblogging the American Revolution: January 20, 1777: Battle of Millstone

Wikipedia: Battle of Millstone:

A British foraging party of 500 men, led by Lieutenant Colonel Robert Abercromby of the 37th Foot, left New Brunswick on January 20, and headed west toward the Millstone River. They crossed over the river (it is unclear exactly which bridge they used), leaving a rear guard of Hessians with some field artillery to cover the bridge, and eventually reached Van Nest's mill at Weston, New Jersey (near present day Manville, New Jersey), a few miles north of Somerset Court House, and near the point where the Millstone empties into the Raritan. There they seized supplies of all varieties, and prepared to return to New Brunswick.

Militia companies to the north were alerted to the British movement early in the day, and some marched for Bound Brook, New Jersey. When reports arrived of the activity at Van Nest's mill, they marched for that place. In all about 400 New Jersey militia and 50 Pennsylvania militia formed under Brigadier General Philemon Dickinson to dispute the British action. While detailed accounts of their movements are sketchy, Dickinson apparently divided his forces, sending one force to meet the front of the British wagon train, while a second moved to flank them. Both of these forces forded one of the rivers, wading in icy water that was waist deep.

One successfully surprised the British wagon train in the lane near the mill, before it reached the main road and the bridge toward New Brunswick; their fire struck horses from the first wagon. This stopped the train, scattered the wagon drivers and drove the British to retreat precipitously toward the bridge, leaving their booty behind.

When the militiamen reached the bridge, the Hessian rear guard fired grape shot from its artillery to cover the retreat. After an exchange of fire across the river without apparent consequence, the British withdrew.

Dickinson wrote in a letter to Colonel John Nielson on January 23, 'I have the pleasure to inform you that on Monday last with about 450 men chiefly our militia I attacked a foraging party near V. Nest Mills consisting of 500 men with 2 field pieces, which we routed after an engagement of 20 minutes and brought off 107 horses, 49 wagons, 115 cattle, 70 sheep, 40 barrels of flour - 106 bags and many other things, 49 prisoners.' General Washington, who was not always happy with the performance of the militias, wrote, 'Genl Dickinsons behaviour reflects the highest honour upon him, for tho' his Troops were all raw, he lead them thro' the River, middle deep, and gave the Enemy so severe a charge, that, altho' supported by three field pieces, they gave way and left their Convoy', and only reported the taking of nine prisoners.

Archibald Robertson, a British officer who was not part of the expedition, reported that 'Lieutenant Colonel Abercromby with 500 men went on a foraging party towards Hillsborough. Part of this Corps was attacked by the Rebels, which occasion'd such disorder Amongst the Waggon Drivers that 42 Waggons were left behind.'[4] One British witness was 'absolutely certain the attackers were not militia, they were sure that no militia would fight in that way.'

Casualty figures were extremely variable, but British casualties (killed, wounded, or captured) appear to have been in the low 30s according to press accounts (contrary to Dickinson's claim of 49 prisoners taken), while militia casualties were relatively small in number...

January 19, 2015

Noted for Your Nighttime Procrastination for January 19, 2015

Over at Equitable Growth--The Equitablog

Over at Equitable Growth--The Equitablog

Tim Duy: Will The Fed Take a Dovish Turn Next Week?

Ahem!: I Believe the London Economist Needs to Step Up Its Game...

Morning Must-Read: Willem Buiter: The SNB, the Exchange-Rate Peg, and the Interest-Rate ZLB

Franklin Delano Roosevelt (1935): "A Hope of Many Years' Standing...

Ezra Klein: Why Republicans Can't Replace ObamaCare

Plus:

Things to Read on the Evening of January 19, 2015

Must- and Shall-Reads:

Ben Friedman: "James Tobin often remarked that there are worse things than three percent inflation, and from time to time we have them. Indeed, we just did. In the same vein, there are worse things than sovereign debt defaults, and from time to time we have them too. They are in progress as we meet."

James Hamilton: "The [SNB] just wanted to try something different. But I confess that it is a great mystery to me why.... This has to be a major hit to Swiss exports and tourism, leave the SNB with little credibility and negative capital... cause significant financial disruptions... around the world."

Barry Eichengreen: Hall of Mirrors: The Great Depression, The Great Recession, and the Uses-and Misuses-of History

Jenée Desmond-Harris: The Poor People's Campaign: the little-known protest MLK was planning when he died

C. Kirabo Jackson et al.: The Effects of School Spending on Educational and Economic Outcomes: Evidence from School Finance Reforms

Tim Duy: Will The Fed Take a Dovish Turn Next Week?

Willem Buiter: The SNB, the Exchange-Rate Peg, and the Interest-Rate ZLB

Franklin Delano Roosevelt (1935): "Today a hope of many years’ standing...

Ezra Klein: Why Republicans Can't Replace ObamaCare

And Over Here:

Liveblogging World War I: January 19, 1915: First Air Raid on Britain

Tim Duy: Will The Fed Take a Dovish Turn Next Week?: "We are heading into the next FOMC meeting with the growing expectation that the Fed will take a dovish turn... global economic turmoil, collapsing oil prices, weak inflation, and a stronger dollar... pointing to rapidly rising downside risks.... Expectations of the first rate hike have been pushed out to the end of this year, seemingly in complete defiance of Fed plans.... [But] kind of a 'Fed is from Mars, markets are from Venus' situation.... My takeway is that the Fed sees the timing of the first rate hike as less important than everything that comes after that hike. This will leave them less eager to delay the hike... I suspect they see little chance of damage from that first hike alone.... I don't see how they can justify raising rates without some reasonable acceleration in wage growth... [but] perhaps... they can justify it on the basis of 25bp won't hurt anyone .."

Willem Buiter: The SNB, the Exchange-Rate Peg, and the Interest-Rate ZLB: "[Superior] would have been the continuation of the exchange rate floor.... The old regime, with or without the additional 50bps cut... was viable and superior to the new regime.... Central banks can live with very large balance sheets... diversify... out of euro forex.... There is no ostensible problem with the central bank having to live with becoming an even larger hedge fund/asset manager or Sovereign Wealth Fund.... It may be that the political scrutiny that would come with an even larger balance sheet... was a source of concern.... But such discomfort would seem to be a small price to pay compared to the cost to the nation of a massively overvalued currency, serious deflation and the resulting harmful effects on the real economy.... The second superior alternative would have been to abolish the effective lower bound on the nominal interest rate.... There is little empirical evidence on demurrage for paper currency.... There are no serious arguments against creating a financial system where nominal policy rates can be set with equal ease at -5% as at +5%.... The ELB can be eliminated... by abolishing currency/cash... checkable deposits... credit cards, debit cards and cash-on-a-chip cards... existing and yet-to-be invented e-money... taxing currency, in the spirit of Gesell (1916)... end the fixed exchange rate, currently set at unity, between SNB deposits and cash... encourage the use of the deposit Franc as the numéraire... for price and wage setting.... The good news is that, apart for the reputational damage suffered by the SNB... much of the damage can be undone. The SNB... [could] restore as much of the status quo ante as possible by restoring a floor to the exchange rate of the CHF and the euro (or to the effective exchange rate of the CHF for some suitable basket of currencies).... No doubt the euros would be galloping in at any floor that is not well below 1.20 CHF per euro, but Switzerland has many skilled asset managers who could invest the rapidly expanding resources of the SNB in a globally diversified portfolio of nominal and real assets. The second damage-limiting option is to abolish the ELB on nominal interest rates as soon as possible...

Franklin Delano Roosevelt (1935): "Today a hope of many years’ standing is in large part fulfilled. The civilization of the past hundred years, with its startling industrial changes, has tended more and more to make life insecure. Young people have come to wonder what would be their lot when they came to old age. The man with a job has wondered how long the job would last..."

Ezra Klein: Why Republicans Can't Replace ObamaCare: "Cato's Michael Cannon scolds the right for getting outplayed, again and again, on health care. 'Conservatives are falling into the same trap... conceding... that the government should be trying to provide everybody with health insurance.... Once you accept those premises, all of your solutions look like the left’s solutions.’... Cannon is right. The basic project of health reform, at least as it's been understood in American politics in recent decades, involves the government giving money to poor people so they can buy health-care insurance. That money needs to come from somewhere.... The problem for conservatives is that making sure poor people have health insurance is politically popular.... Philip Klein illuminates an inconvenient truth: upheaval in the health-care system typically makes for terrible politics.... This is the central problem for conservative health reformers... the party doesn't want to make the sacrifices necessary to unite behind an alternative to Obamacare, much less actually pass and implement it.... Klein identifies three schools of conservative thought on what to do next: the Reform School... the Replace School... repeal Obamacare and replace it with Obamacare-lite; and the Restart School, which... rejects the idea that the government should be... expand[ing] access to health care.... Klein's book is... far and away the clearest, most detailed look at conservative health-policy thinking.... But... the important cleavage... is between those in the party who want to prioritize health reform and those who don't.... And that's really the problem for conservative health reformers. For all the plans floating around, there's little evidence Republicans care enough about health reform to pay its cost."

Should Be Aware of:

Steven Miner: Review of Roger Moorhouse: 'The Devils' Alliance: Hitler's Pact With Stalin, 1939-41'

Robert Reich: The New Compassionate Conservatism and Trickle-Down Economics

Snowdonia Cheese Company

John Holbo: The Race Card, Circa 1871: "Jon Chait has an interesting column... Stephen Budiansky... ‘waving the bloody shirt’ wasn’t functionally a smear against post-Civil War Democrats, turning every debate about post-war issues into a re-commencement of old hostilities. Rather.... 'In 1871, Klansmen in Mississippi accosted Allen Huggins, a northerner who had helped educate freed slaves, thrashed him within an inch of his life, and threatened to kill him.... The bloody shirt was Huggins’s, allegedly waved by Republican Benjamin Butler on the House floor... not the relic of an ancient feud but evidence of an ongoing epidemic of rampant violence.'... It was, right from the start, the double-reverse ‘bloody shirt’ gambit. False flag. An attempt to generate a smokescreen to conceal present violence, by falsely alleging that the people drawing attention to present violence were merely trying to inflame people regarding past violence.... Think of how weird it is that the Democratic attitude, which evolved ‘waving the bloody shirt’ as a rhetorical defense mechanism, was probably something like this: ‘I do not oppose Reconstruction, but of course that does not mean that I do oppose the near-murder of any carpetbagger who would educate former slaves!’ Chait’s point is that, in this case, a propaganda talking point won, becoming proverbial historical wisdom..."

Munilass**: A Defense of Disruption as a Cultural Phenomenon: "Wieseltier’s remark.... Isn't it possible both to resent living in a universe of content-driven drones, mindlessly copying and pasting articles and co-opting narratives, but still be excited about the democratization of ideas?... Disruption is not the same thing as nihilism. Moreover, nihilism wasn't invented in the 21st century..."

Images:

Links:

Barry Eichengreen: Hall of Mirrors: The Great Depression, The Great Recession, and the Uses-and Misuses-of History

Willem Buiter: The SNB, the Exchange-Rate Peg, and the Interest-Rate ZLB: Much food for thought here...

James Hamilton: "The [SNB] just wanted to try something different. But I confess that it is a great mystery to me why.... This has to be a major hit to Swiss exports and tourism, leave the SNB with little credibility and negative capital... cause significant financial disruptions... around the world."

Ben Friedman: "James Tobin often remarked that there are worse things than three percent inflation, and from time to time we have them. Indeed, we just did. In the same vein, there are worse things than sovereign debt defaults, and from time to time we have them too. They are in progress as we meet."

Ezra Klein: Why Republicans Can't Replace ObamaCare: "For all the plans floating around, there's little evidence Republicans care enough about health reform to pay its [political and budgetary] cost..."

C. Kirabo Jackson et al.: The Effects of School Spending on Educational and Economic Outcomes: Evidence from School Finance Reforms

Jenée Desmond-Harris: The Poor People's Campaign: the little-known protest MLK was planning when he died

Robert Reich: The New Compassionate Conservatism and Trickle-Down Economics

Franklin Delano Roosevelt (1935): "Today a hope of many years’ standing is in large part fulfilled..."

Steven Miner: Review of Roger Moorhouse: 'The Devils' Alliance: Hitler's Pact With Stalin, 1939-41': "In his closing chapters, Moorhouse persuasively shows how the USSR did not effectively use the twenty-two months of their pact with Hitler to prepare for an invasion, and how Stalin misread the many intelligence warnings he received..."

John Holbo: The Race Card, Circa 1871: Jon Chait and Stephen Budiansky on post-Civil War Democratic complaints that Republicans were "waving the bloody shirt" as the original false-flag propaganda defense of ongoing anti-Black violence...

Munilass: A Defense of Disruption as a Cultural Phenomenon: "Wieseltier.... Isn't it possible both to resent... drones, mindlessly copying and pasting articles and co-opting narratives, but still be excited about the democratization of ideas?... Disruption is not the same thing as nihilism. Moreover, nihilism wasn't invented in the 21st century..."

Snowdonia Cheese Company

Afternoon Must-Read: Tim Duy: Will The Fed Take a Dovish Turn Next Week?

Tim Duy: Will The Fed Take a Dovish Turn Next Week?: "We are heading into the next FOMC meeting...

...with the growing expectation that the Fed will take a dovish turn... global economic turmoil, collapsing oil prices, weak inflation, and a stronger dollar... pointing to rapidly rising downside risks.... Expectations of the first rate hike have been pushed out to the end of this year, seemingly in complete defiance of Fed plans....

[But] kind of a 'Fed is from Mars, markets are from Venus' situation.... My takeway is that the Fed sees the timing of the first rate hike as less important than everything that comes after that hike. This will leave them less eager to delay the hike... I suspect they see little chance of damage from that first hike alone.... I don't see how they can justify raising rates without some reasonable acceleration in wage growth... [but] perhaps... they can justify it on the basis of 25bp won't hurt anyone...

Liveblogging World War I: January 19, 1915: First Air Raid on Britain

History.com: First air raid on Britain:

During World War I, Britain suffers its first casualties from an air attack when two German zeppelins drop bombs on Great Yarmouth and King's Lynn on the eastern coast of England.

The zeppelin, a motor-driven rigid airship, was developed by German inventor Ferdinand Graf von Zeppelin in 1900. Although a French inventor had built a power-driven airship several decades before, the zeppelin's rigid dirigible, with its steel framework, was by far the largest airship ever constructed. However, in the case of the zeppelin, size was exchanged for safety, as the heavy steel-framed airships were vulnerable to explosion because they had to be lifted by highly flammable hydrogen gas instead of non-flammable helium gas.

In January 1915, Germany employed three zeppelins, the L.3, the L.4, and the L.6, in a two-day bombing mission against Britain. The L.6 turned back after encountering mechanical problems, but the other two zeppelins succeeded in dropping their bombs on English coastal towns.

Morning Must-Read: Willem Buiter: The SNB, the Exchange-Rate Peg, and the Interest-Rate ZLB

Willem Buiter: The SNB, the Exchange-Rate Peg, and the Interest-Rate ZLB: "[Superior] would have been the continuation...

...of the exchange rate floor.... The old regime, with or without the additional 50bps cut... was viable and superior to the new regime.... Central banks can live with very large balance sheets... diversify... out of euro forex.... There is no ostensible problem with the central bank having to live with becoming an even larger hedge fund/asset manager or Sovereign Wealth Fund.... It may be that the political scrutiny that would come with an even larger balance sheet... was a source of concern.... But such discomfort would seem to be a small price to pay compared to the cost to the nation of a massively overvalued currency, serious deflation and the resulting harmful effects on the real economy....

The second superior alternative would have been to abolish the effective lower bound on the nominal interest rate.... There is little empirical evidence on demurrage for paper currency.... There are no serious arguments against creating a financial system where nominal policy rates can be set with equal ease at -5% as at +5%.... The ELB can be eliminated... by abolishing currency/cash... checkable deposits... credit cards, debit cards and cash-on-a-chip cards... existing and yet-to-be invented e-money... taxing currency, in the spirit of Gesell (1916)... end the fixed exchange rate, currently set at unity, between SNB deposits and cash... encourage the use of the deposit Franc as the numéraire... for price and wage setting....

The good news is that, apart for the reputational damage suffered by the SNB... much of the damage can be undone. The SNB... [could] restore as much of the status quo ante as possible by restoring a floor to the exchange rate of the CHF and the euro (or to the effective exchange rate of the CHF for some suitable basket of currencies)....

No doubt the euros would be galloping in at any floor that is not well below 1.20 CHF per euro, but Switzerland has many skilled asset managers who could invest the rapidly expanding resources of the SNB in a globally diversified portfolio of nominal and real assets. The second damage-limiting option is to abolish the ELB on nominal interest rates as soon as possible...

January 18, 2015

Noted for Your Nighttime Procrastination for January 18, 2015

Over at Equitable Growth--The Equitablog

Over at Equitable Growth--The Equitablog

Lawrence Summers: Focus on Middle Class Growth

How Do Projected Long-Run Deficits Matter?: Daily Focus

Matt O'Brien: President Obama Finally Has His Piketty Moment

Plus:

Things to Read on the Evening of September 18, 2015

Must- and Shall-Reads:

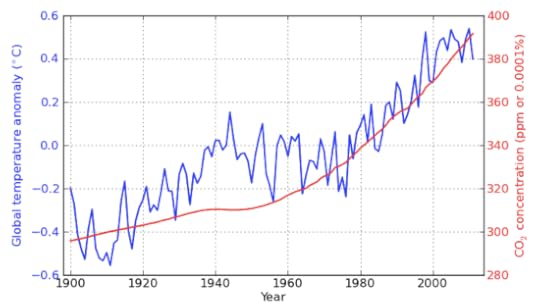

Kevin Drum: Will 2014 Finally Be the Year That Puts the Climate Denialists' 1998 Chestnut to Rest?

Gavyn Davies: The Swiss Currency Bombshell--Cause and Effect

Noah Smith: DeLong Smackdown Patrol: How worse off are we really?

Republican Governors Accept Medicaid Expansion, Make It Costlier

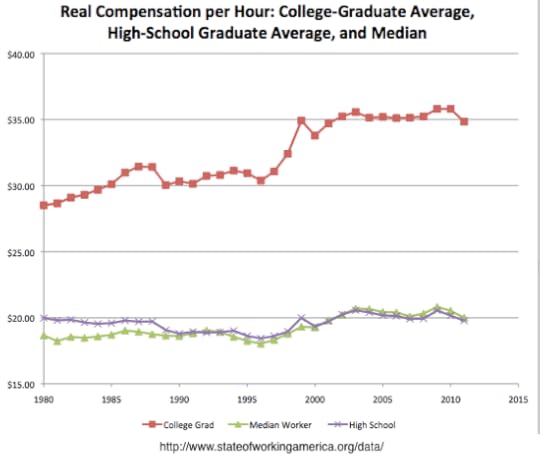

Lawrence Summers: : Focus on Middle Class Growth

Matt O'Brien: President Obama Finally Has His Piketty Moment

Willem Buiter: Did the SNB Score an Own Goal? Francly, Yes

Noah Smith: DeLong Smackdown Patrol: How worse off are we really?

Biagio Bossone: The ‘Safety Trap’ and Eurozone Secular Stagnation

And Over Here:

DeLong Smackdown Watch: How Do Projected Long-Run Deficits Matter?

Yet More Right-Wing Grifters Gotta Grift: Ben Carson Edition

Liveblogging World War II: January 18, 1945: The Death Marches from the Camps Begin

Lawrence Summers: : Focus on Middle Class Growth: "Growth that is a necessary condition for rising incomes is threatened by the specter of secular stagnation and deflation. In... 2014... 10-year Treasury rates have fallen by more than 1 percentage point in the United States and are only half as high in Germany and Japan as they were a year ago. In... Germany, France and Japan, short-term interest rates are now negative... suggest[ing] a chronic excess of saving over investment and the likely persistence of conditions that make monetary policy ineffective.... The world has largely exhausted the scope for central bank improvisation as a growth strategy.... It is time for concerted and substantial measures to raise both public and private investment.... The United States has enjoyed growth of about 11 percent over the past five years. Of this, standard economic calculations suggest that about 8 percent can be regarded as cyclical.... That leaves just 3 percent over five years as attributable to growth in the economy’s capacity. Even after our recovery, the share of American men age 25 to 54 who are out of work exceeds that in Japan, France, Germany and Britain.... Third, if it is to benefit the middle class, prosperity must be inclusive, and in the current environment this is far from assured.... These three concerns... are real but... not grounds for fatalism.... Canada and Australia in this century... show that sustained growth in middle-class living standards is attainable. But it requires elites to recognize its importance and commit themselves to its achievement. That must be the focus of this year’s Davos"

Matt O'Brien: President Obama Finally Has His Piketty Moment: "Obama... will call for $320 billion of new taxes [over ten years] on rentiers, their heirs, and the big banks to pay for $175 billion of tax credits that will reward work... fighting a two-front war against a Piketty-style oligarchy where today's hedge funders become tomorrow's trust funders... trying to slow the seemingly endless accumulation of wealth among the top 1, and really the top 0.1, no actually the top 0.001.... And...trying to help the middle help itself by subsidizing work, child care, and education.... End the step-up [at death of] basis for capital gains.... Raise the top capital gains tax rate from 23.8 to 28 percent.... Tax the big banks for being big.... Subsidize middle-class work... a second-earner tax credit of $500... calling for the Earned Income Tax Credit to be doubled for childless workers, to try to get more young men in particular into the workforce... college tax credits to be streamlined, extended, and expanded... automatically enrolling [workers] in an IRA.... These are ideas, to be honest, that some Republicans support.... The question, then, isn't how to help the middle class. It's how to pay for it. Obama wants to make the top 1 percent and Wall Street do so. Republicans don't. That, like every other one, will be what the 2016 election is about."

Willem Buiter: Did the SNB Score an Own Goal? Francly, Yes: "1. The removal of the 1.20 floor on the CHF-euro exchange rate was a mistake. 2. Superior policy alternatives existed. 3. The old regime was indefinitely sustainable. 4. Removing the lower bound on nominal interest rates would have been the best choice. This can be done one of three ways. 5. The economic damage can be limited by restoring the exchange rate floor at a level not below the old one, and/or by eliminating the lower bound on nominal interest rates. 6. The rest of the world can learn from the SNB’s experience with a -0.75% deposit rate."

Noah Smith: DeLong Smackdown Patrol: How worse off are we really?: "Bad Brad! In 2000, you believed that American economic policy and the American economy, though far from perfect, had been largely a success (right?). It's understandable to think the 15 years since then have been a big disappointment - they have! - but why should that cause you to revise your evaluation of the period from 1980 to 2000? Do you think that we are now paying for excesses we enjoyed in that period, and that our prosperity increases during that period were thus illusory? I don't think you think that. So don't succumb to excessive pessimism!"

Biagio Bossone: The ‘Safety Trap’ and Eurozone Secular Stagnation: "I have recently worked out a... DSGE model where the upsurge of pessimistic expectations causes high liquidity preference to become the source of a persistent drop in demand.... Would breaching the ZLB through negative interest rates (NIR) really help the economy exit the trap? Theoretically, it would; in practice, it is much less certain... push agents to search for alternative safe assets earning higher returns... [which] would then supplant... those liquid assets whose liquidity premiums the monetary authorities had sought to neutralize through NIR.... For similar reasons, quantitative easing... is ineffective.... Yet under liquidity preference dominance (Landau’s safety trap) and a binding ZLB, agents absorb any amounts of reserve money created and hold on to them without changing their consumption and investment plans.... Assume the central bank commits to being ‘irresponsible’... [if] QE policy actually becomes ‘helicopter money’... [it] impact[s] spending decisions through the fiscal lever.... Short of this twist... the central bank is left without effective channels..."

Should Be Aware of:

Paul Rosenberg: Now they’re sliming Elizabeth Warren: Fox News tactics and the surprising water carriers for the 1 percent

HiLine Coffee Company

dew: Warren, public opinion, and inequality: "

Paul Rosenberg has a good response to Amitai Etzioni’s rather lame attempt at a hatchet-job on Elizabeth Warren at The Atlantic: 'Taking Norton and Ariely’s results seriously, we can say that the American people want a much fairer society than they live in, but that the means for articulating this desire—the stories, concepts, policy proposals, etc.—are in scandalously short supply, a de facto example of hypocognition thwarting what people want. Elizabeth Warren is particularly popular precisely because she provides some of the missing means that people are so hungry for—an antidote to the hypocognition that thwarts their desire for a fairer, more just vision of America, which respects both their hard work and their compassionate values. There may be relatively little polling to support this view (though there’s considerably more than you’d expect) but that’s partly just another example of how elites dominate the landscape of acceptable thought to protect their interests, as underscored by recent research by Martin Gilens and Benjamin Page. Warren represents a clear alternative to this narrow-minded view. Her popularity derives in large part from her ability to shape narratives that reflect the hidden majority’s shared values and articulate them in policy terms, reversing a decades-long trend by which elites of both parties have turned their backs on the welfare of ordinary Americans.' While Rosenberg offers a much more accurate portrait of American public opinion than does Etzioni, there are reasons to think this offers an overly optimistic account. He’s right, of course, that Americans want a more egalitarian distribution of wealth and income than they’ve got. But it’s almost certainly the case that partisan identity is likely to significantly diminish the ‘hidden majority’ support for redistribution when it turns into an actual plan promoted by and associated with Democratic politicians (as the continued unpopularity of something called ‘Obamacare’ demonstrates). Raising the minimum wage manages to remain broadly popular despite the partisan divide, so it’s important not to be too fatalistic about this. (I suspect one reason for this is the simplicity of the policy; it’s harder to spin or dissemble the basic fairness of it away.) But the lack of specific policy proposals cuts both ways–lots of inequality-reducing proposals could be quite popular in the abstract, but once they become ‘Democratic’ proposals support is likely to conform to a more familiar partisan pattern."

Comments:

Paul G. Brown: The Politics of Tribe? From the good wiki ... the Kansas tribe is ~80% “non-hispanic white”, with below-national-median income and education, and well above-national-average religosity (~10% of Kansans answer the question ‘no religion’ where the national average is now ~20%). I don’t think Gov. Brownback is self-consciously malevolent; I don’t think he’s particularly deceptive (self or otherwise). I think idler has the truth of it above. Gov. Brownback believes that the marginal freedom of individual citizens is increased with each marginal shrinking of the state, and that individual freedoms trumps everything else. For him--and people who think like him, such as Grover Norquist, Barry Goldwater etc--actual socio-economic outcomes are irrelevant. The disutility teachers, firefighters, police and other public servants in Kansas experience as their wages and pensions are cut (and the disutility experienced by the people they served before they were made redundant) is outweighed by the increased freedoms that tax-paying folks will experience. Brownback would rather be patriarch of a dung-hill village than citizen of a vibrant polis. And so do just enough Kansans.

Images:

DeLong Smackdown Watch: How Do Projected Long-Run Deficits Matter?

Over at Equitable Growth: Howard Gleckman writes:

Howard Gleckman: Two economists debate whether the Federal budget deficit matters: "Do deficits, or at least currently projected deficits, matter?...

...A recent debate between my Tax Policy Center colleague Bill Gale and UC Berkeley economist Brad DeLong.... Bill wrote that ‘a major priority should be to get our long-term fiscal house in order.’... Brad argued that... the fiscal gap is really not that bad... especially if you assume that Congress will eventually enact a carbon tax and that the Affordable Care Act will help control future health costs.... With interest rates so low... why worry about deficits in the current environment? Long-term debt is a problem for future generations. Let them figure out how to address it...

I don't think that that last paraphrase from the excellent Howard Gleckman quite gets at what I was trying to say. READ MOAR

And since that is what Howard got, that means I said it wrong. Let's try again, in a different way:

Sokrates: I did not expect to see you here at Davos!

Gorgias: Wherefore not? I am a rhetorician. That as, as Homer would say: "what I boast myself to be!" Where better to practice my excellence? And acquire clients so that I can live at the standard of living I dream of?

Sokrates: And what topic are you going to use to demonstrate your excellence as a rhetorician this forthcoming week?

Gorgias: "Fix the Debt!" of course. It is really important to pass laws to cut spending and raise taxes and so get our debt-to-GDP ratio on a trajectory where it is declining rapidly. That is one of the three things we could do to most effectively boost economic growth.

Sokrates: Right now, if President Obama and the centrist Democrats agreed, to join the Republican coalition, we could pass laws to cut Social Security, Medicaid, Medicare, SCHIP, and ACA spending. But there are no counterparts on the Republican side to pass laws to raise taxes now and in the future.

Gorgias: That is true. But that is not terribly relevant. The important thing to do is to Fix the Debt. Any steps that Fix the Debt are good--we are not partisan about this, it is simply that right now it is possible if moderate Democrats agree to pass one set of steps to Fix the Debt.

Sokrates: And moderate Republicans?

Norman Ornstein: Moderate Republicans are party loyalists first and moderates second. They will never break party discipline.

Gorgias: Unfortunate. But not relevant. Fix the Debt!

Sokrates: Is it that government spending is too high and needs to be cut?

Peter Diamond: Actually not. As we move into the twenty-first century, it is likely that categories of domestic spending in which the government has a comparative advantage vis-a-vis the market--pensions and other retirement social insurance, medical insurance, education, research and development, information goods--will grow as a share of GDP. Optimal fiscal policy will in all likelihood have the government spending a greater share of GDP in the twenty-first century than it did in the 20th.

Sokrates: Do you disagree Gorgias?

Gorgias: I neither agree nor disagree: I say that we need to Fix the Debt!

Sokrates: So if the government were now to pass a law that would greatly increase the tax base by, in the long run, severely reducing the tax preference offered to employer-sponsored health insurance, you would be in favor of that? That would help Fix the Debt?

Gorgias: Yes. But since the moderate Republicans will not break party discipline to support it, that is irrelevant. Fix the Debt!

Sokrates: And if government would pass a law giving the Secretary of HHS power to curb Medicare spending in a smart, technocrat way, you would be in favor of that? That would help Fix the Debt?

Gorgias: Yes. But since the moderate Republicans will not break party discipline to support it, that is irrelevant. Fix the Debt!?

Marty Weitzman: Since if we do not pass a carbon tax in the next generation, the U.S. long-run fiscal gap is likely to be way, way, way down on our list of serious problems, we should carve our policies toward the debt presuming that we will pass such a carbon tax and its revenues will be available to help Fix the Debt, nu?

Sokrates: But we have already Fixed the Debt. The ACA--ObamaCare--contains the IPAB, which gives the Secretary of HHS power to curb Medicare spending in a smart, technocrat way. The ACA--ObamaCare--contains the Cadillac Tax, would greatly increase the tax base by, in the long run, severely reducing the tax preference offered to employer-sponsored health insurance. When we include those two and a reasonable carbon tax in our long-run forecasts, the Debt Is Fixed: resources available exceed projected spending.

Gorgias: But future congresses will repeal the IPAB! Future congresses will repeal the Cadillac Tax! Future congresses, if they do pass a carbon tax, will couple it with tax cuts so that it will not raise any revenue! We must Fix the Debt.

Sokrates: So, if I understand you, we Fixed the Debt in the Clinton administration in the sense that there was no fiscal gap if future congresses adhered to the pay-as-you-go principle. And then the George W. Bush administration unfixed it. And we have Fixed the Debt in the Obama administration in the sense that there is no fiscal gap if future congresses adhere to the pay-as-you-go principle. But you do not believe that future congresses will adhere to the pay-as-you-go principle?

Gorgias: No. I do not. And you should not either.

Sokrates And if I say that interest rates right now are so low that any optimal fiscal policy would say that the debt-to-GDP ratio should be rising, rather than falling?

Gorgias: I would say that such considerations would apply if we had a plan for balancing the long-term finances of the federal government that will be put into effect. But we do not. Fix the Debt!

Sokrates: So the things that the Obama administration has done to Fix the Debt do not count because you see them as likely to be undone by future congresses?

Gorgias: Exactly!

Sokrates: And the plans you have for policy changes to Fix the Debt are painful and difficult to pass?

Gorgias: Yes!

Sokrates: And even if you do pass them, they are likely to be unpopular?

Gorgias: Yes...

Sokrates: But you believe that future congresses will not repeal your policies--even though you believe future congresses will repeal the IPAB and the Cadillac Tax, and offset the carbon tax that is coming--because?...

Gorgias: [Silence]

I would be very happy if I could get an answer from the Fix the Debt crowd as to why Fix the Debt doesn't mean working to:

enforce pay-as-you-go on congress,

defend the Cadillac Tax,

protect the IPAB, and

pass a carbon tax.

But that's not what Fix the Debt means in America today. And until it does, I will be highly skeptical of all who want to put it high on the list of policy priorities...

1184 words

Yet More Right-Wing Grifters Gotta Grift: Ben Carson Edition

And Wonkette tells us that National Review IS ON IT:

Shrill: Ben Carson Shilled Scam AIDS And Cancer Cures For 10 Years, Will Be Your Next President Obvs: "Just how much clownery do you need...

...to completely obliterate the good will you built up from starting a foundation to do brain surgery for poor kids?... Dr. Ben Carson, 2016 GOP presidential nomination hopeful/flirt... being a student of the scientific method, he is apparently extremely determined to find out.... Mannatech (yes, manna-tech, they wanted the religious overtones of naming it after the miraculous God-bread that fell from the sky in the Old Testament, combined with, y’know, modern science and technology)... our best buddies over at the National Review:

In 2007... Texas attorney general... sued... charging them with orchestrating an unlawful marketing scheme that... offered testimonials from individuals claiming that they’d used Mannatech products to overcome... autism, non-Hodgkins lymphoma... life-threatening heart conditions... toxic shock syndrome, heart failure, asthma, arthritis, Lou Gehrig’s Disease, Attention Deficit Disorder, and lung inflammation....

Needless to say, Mannatech products can’t actually cure any of these diseases.... [That] did not... dissuade Carson.... Carson’s... most recent feat was... a promotional video on Mannatech’s website, giving a testimonial... [that] culminates... [as] Carson suggests that Mannatech is the key to achieving the original diet handed down to us by God in the Garden of Eden:

The wonderful thing about a company like Mannatech is that they recognize that when God made us, He gave us the right fuel. And that fuel was the right kind of healthy food. You know we live in a society that is very sophisticated, and sometimes we’re not able to achieve the original diet. And we have to alter our diet to fit our lifestyle. Many of the natural things are not included in our diet. Basically what the company is doing is trying to find a way to restore natural diet as a medicine or as a mechanism for maintaining health.

Look, Ben Carson is perfectly within his rights as an American and as a human being to take advantage of the placebo effects of scam unscience.... He’s smart enough to know that... Mannatech asks him to speak... as Dr. Ben Carson... brain surgeon, Presidential Medal of Freedom winner... to be used in this, uh, MannaManner. Stay MannaBlessed.

And, of course, the kicker. Go to Jim Geraghty's piece in National Review on Ben Carson. Look at the ads on that page. You find the same grifting--although about keeping your wealth rather than keeping your health--as Ben Carson engaged in:

[5 Sure Signs the U.S. Economy is Finished](http://moneymorning.com/ext/articles/... "A well-connected Washington, D.C. insider...

...recently issued a major warning that could dramatically affect ALL U.S. citizens, but would hit everyday Americans particularly hard. His name is Jim Rickards and he's a financial market advisor to the Office of the Director of National Intelligence, which oversees the CIA, the NSA, and 14 other U.S. intelligence agencies. And with his knowledge about the inner workings of the government, the economy, and the U.S. banking system, he sees some big, major changes ahead for the United States.

In fact, what he's predicting just might be the final nail in the coffin of the middle class...

Liveblogging World War II: January 18, 1945: The Death Marches from the Camps Begin

United States Holocaust Museum: Death Marches:

Near the end of the war, when Germany's military force was collapsing, the Allied armies closed in on the Nazi concentration camps. The Soviets approached from the east, and the British, French, and Americans from the west. The Germans began frantically to move the prisoners out of the camps near the front and take them to be used as forced laborers in camps inside Germany. Prisoners were first taken by train and then by foot on 'death marches,' as they became known.

Prisoners were forced to march long distances in bitter cold, with little or no food, water, or rest. Those who could not keep up were shot. The largest death marches took place in the winter of 1944-1945, when the Soviet army began its liberation of Poland. Nine days before the Soviets arrived at Auschwitz, the Germans marched tens of thousands of prisoners out of the camp toward Wodzislaw, a town thirty-five miles away, where they were put on freight trains to other camps. About one in four died on the way.

The Nazis often killed large groups of prisoners before, during, or after marches. During one march, 7,000 Jewish prisoners, 6,000 of them women, were moved from camps in the Danzig region bordered on the north by the Baltic Sea. On the ten-day march, 700 were murdered. Those still alive when the marchers reached the shores of the sea were driven into the water and shot.

January 18, 1945: The SS begins evacuating Auschwitz and its satellite camps. Nearly 60,000 prisoners are forced on death marches from the Auschwitz camp system. Thousands are killed in the days before the death march. Tens of thousands of prisoners, mostly Jews, are forced to march to the city of Wodzislaw in the western part of Upper Silesia. SS guards shoot anyone who falls behind or cannot continue. More than 15,000 die during the death marches from Auschwitz. In Wodzislaw, the prisoners are put on unheated freight trains and deported to concentration camps in Germany, particularly to Flossenbuerg, Sachsenhausen, Gross-Rosen, Buchenwald, Dachau, and Mauthausen. On January 27, 1945, the Soviet army enters Auschwitz and liberates the few remaining prisoners.

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers