Matthew Yglesias's Blog, page 2416

February 18, 2011

The Strangest Social Security Cut

The most regressive way to cut Social Security is to raise the retirement age, but the strangest is the one Brian Beutler reports on, a House plan to cut the Social Security Administration's administrative budget:

The Republicans claim the cuts amount to about $1 billion below what President Obama requested. But when dig in deeper, Democrats have found the cuts add up to about $1.7 billion — a hefty chunk of SSA's operating budget.

This includes rescinded stimulus funds, and the $500 million SSA currently has in its reserve account to meet legal requirements and other operating expenses.

This comes at a time when the Social Security Administration is already stretched thin. SSA is operating under a hiring freeze because its current allocations are too low. Democrats warn the cuts would cause blackout periods in SSA's operations, and create a huge backlog of claims across the program.

Love it or hate it, Social Security is a pretty lean, mean, check-writing machine. Money comes in through payroll taxes and it comes out through checks. It's practically automatic. But of course it's not 100 percent automatic. It does need a few human beings to run it. But thinking that it's somehow smart to try to trim the fat here is bizarre. Actually reducing the quantity of money in the checks would make old people mad but also save a ton of money. Gumming up the administration of the check-sending process packs a lot of oldster-aggravating punch but barely gets you anything. It's weird.

February 17, 2011

Endgame

Never gonna reach you:

— China's urbanization dilemma.

— The need to scale up the good charter schools.

— We're more likely to become cyborgs than be replaced by robots.

— This guy's missing the point.

— EPA regulation of greenhouse gasses is popular.

Cut Copy, "Need You Now".

Why Federal Arts Subsidies?

Reading Isaac Butler's defense of subsidies for arts and culture I have two main reactions. One is that I want off the Drum/Chait list of philistines. All I said about this is that the big federal arts subsidy is the indirect subsidy provided through the tax code. I think decentralized subsidization of aesthetic endeavors makes a lot of sense, I was just observing that perennial complaining about the NEA is kind of a sideshow.

Modern Art Museum of Ft Worth

In terms of direct subsidies, however, this is a relatively rare case where I think "federalism" is a non-BS issue. It seems to me that a city might want to spend money on an art museum for roughly the same reason it might want to spend money on a park—these things improve quality of life. But I think you'd like to see as much Tiebout competition as possible around this sort of thing. Expending resources on aesthetic matters, whether they're arts or trees or what have you, is a perfectly defensible course of action but it's basically a kind of local or community benefit.

"Shared Sacrifice" in Michigan

Normally, when conservative politicians say something, what they mean is "lower taxes on rich people." When I saw that Michigan Governor Rick Snyder is proposing a budget calling for "shared sacrifice" I assumed that I was going to have another example for my file. It turns out, though, that he's actually taking an innovative tack and by "shared sacrifice" he means "lower taxes on business."

Mr. Snyder, a newcomer to politics who ran on his business expertise as the former head of Gateway Inc., outlined his budget proposals before legislators at the state capitol. Mr. Snyder said that he hoped to address the state's longstanding financial problems through "shared sacrifice." [...]

Like many states around the country, Michigan is facing a huge budget deficit of $1.4 billion. Mr. Snyder's budget would make $1.2 billion in cuts to schools, universities, local governments and other areas while asking public employees for $180 million in concessions. Mr. Snyder said that he would set an example by reducing his salary this year to $1.

Mr. Snyder's plan also calls for big changes to the state's tax system. He would eliminate the current business tax in favor of a flat 6 percent corporate income tax, resulting in $1.8 billion in tax cuts for businesses. To pay for those changes, he would eliminate many personal income tax credits and require pensions to be taxed.

So that's lower government services for the poor and the middle class, plus higher taxes for the poor and middle class, plus lower taxes for business. Innovative!

The Impossible Dream of Majoritarian Democracy

(cc photo by kevindooley)

Watching all these scenarios for impossible "grand bargains" to emerge, my thoughts turn to an impossible dream . . .

. . . imagine politics playing out via regularly scheduled electoral contests between two political parties. And imagine that while the interest group coalitions behind the parties have a wide array of concerns, the voters are primarily interested in the growth rate of their real disposable income. Consequently, voters react poorly to cuts in spending, react poorly to increases in taxes, and react poorly to sluggish economic growth. What's more, at these regularly scheduled elections one party "wins" and the other party "loses" at which point the "winning" party gets to make policy decisions until the next election. It seems to me that in such a system a governing party in office at a time of depressed output and near-zero nominal interest rates would calculate that the political penalty of deficit cutting measures exceeds the political reward of boosting growth by lowering interest rates. After all, rates are near zero so there's no gain to be made this way. But if in the future circumstances changed and some combination of higher output and bigger deficits created a situation in which faster growth was worth paying the price for program cuts or tax hikes, then they'd cut the deficit. Then I wake up and . . .

. . . we have a broad elite consensus that American political institutions are perfect but the government needs to immediately enact short-term deficit cutting measures that have zero economic benefit and are therefore politically damaging to those who enact them and therefore must be enacted via a "grand bargain."

The Value of Feistiness

More mail:

What's your take on how people nominally to the left of you (firedoglake, digby, etc.) are responding to this whole deficit movement. Digby's pretty apocalyptic about the whole thing. If you could at some point get into this I think it'd help out people like me (21 y/o) who form their opinions on macroeconomics basically by combing through trusted sources.

After I was invited to the White House to talk to David Axelrod, I did a grumpy post just summing up the fact that progressives generally think the strategy of unctuousness reasonableness isn't as good an idea as Team Obama thinks it is. And I think that's what a lot of Obama-bashing blogging amounts to. But over the years I've come to think that too high a proportion of political commentary is devoted to second-guessing the tactical political judgment of the professionals, and/or to criticize other people's second-guessing of the tactical political judgment of the professionals. I don't really think I add much value through those kind of activities and prefer to try to focus on calmly and clearly explaining the policy options and ethical choices confronting us. But I think it's a good thing that we have a large and feisty left-wing community online and I hope it gets bigger and has more success in penetrating the media. A demobilized and perennially calm left wouldn't help the country.

The Reagan Legacy

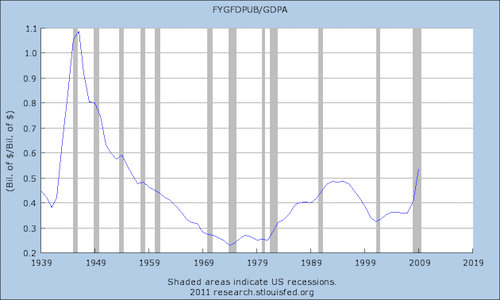

It seems to me that if you want to talk about the political economy of the national debt you need to look at this chart:

And when you look at this chart, you need to think of Ronald Reagan. It's not that all deficits are Reagan's fault, or that all deficits are Republicans' fault, or even that all deficits are bad. But people generally think that the 1980 election was a big deal in American political history. As best I understand it, conservatives generally think that the 1980 election was a big deal in American political history. And one of the things that made it a big deal is that it inaugurated a structural shift from a politics of small deficits linked to the business cycle and shrinking debt burdens to the deficit politics we know today. Post-Reagan politics sometimes cares about the deficit, but it cares much more about low taxes and somewhat more about lavish military spending.

The Coming Abortion Backlash

Dave Weigel foresees a backlash looming against a lot of newly elected anti-abortion House Republicans, a group that "include[s] lots of people who took over suburban districts that had been trending more liberal."

It sounds plausible to me. Anti-abortion activists quietly cemented their control over even northeastern outposts of the GOP back during the 2000s, as witnessed by Chris Christie's pre-primary abortion flip-flop. Clearly, though, the surge in GOP vote in 2010 relative to 2008 and 2006 wasn't actually driven by a shift in the ground on abortion.

Booze Gap

Via Robert Farley, the USA is more sober than most European countries:

Farley deems this "a national disgrace." Given prevailing land use patterns and automobile dependency, I say it's a good thing Americans don't drink very much. Indeed, Americans almost certainly drink too much relative to their transportation strategies. I think it's an underrated problem. One that, obviously, I prefer to see solved on the land/transportation side.

Retracted Claim of the Day

Upon consideration, I don't think what I wrote on Tuesday about Presidents getting things done in their second term is supportable. One mistake is that in my head, I'd mistakenly attributed the welfare reform and the 1996 Telecommunications Act to Bill Clinton's second term. With those bill correctly located in his first term, then clearly Clinton signed more significant bills in his first term than in his second. With that as the context, then I agree with Scott Lemieux that the incredibly productive 1965-66 congress in Lyndon Johnson's second term starts to look a lot like a classic instance of the "exception that proves the rule" since in so many ways that was like a first term.

The other thing, as I've just been reading from David Mayhew is that it's worth trying to distinguish between legislative initiatives that come at the request of the White House and legislative initiatives that are more congressionally generated. Stuff gets done all the time, including in circumstances of divided government, but there's a special kind of "getting stuff done" that happens when a new president sweeps into town and issues a bunch of proposals.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers