Matthew Yglesias's Blog, page 2276

June 13, 2011

Corporate Profits Surging As Compensation And Asset Prices Both Lag Far Behind

Inspired in part my this post at Macro Resilience I wanted to do a bit more research on the theme of macroeconomic policymakers seeking to stabilize asset prices rather than wages, thinking that perhaps maintaining some slack in the labor market is good for asset-owners since it promotes wage moderation.

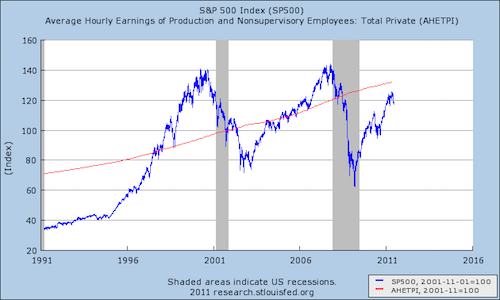

But it turned out that I couldn't actually make the case that stockholders have made out better than workers:

Don't get me wrong, stock is overwhelmingly owned by rich people, so it's not that stockholders aren't better off than workers. It's just that there's no interesting trend here. The value of the S&P 500 fluctuates a lot more than worker compensation, but it seems to gyrate around the same underlying trend.

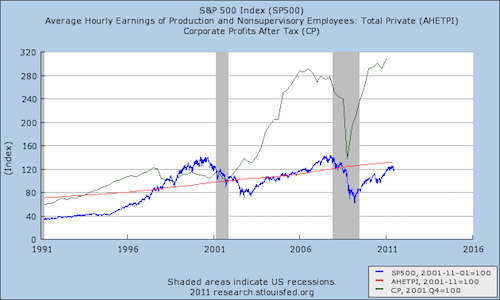

Things look different when you put corporate profits into the picture:

Thus, if not for Search Engine Optimization considerations, this post would be titled "Dude, Where's My Profits?" Why would profits go up in a way that enriches neither labor nor capital? Maybe the real value is accruing to private firms. Or maybe somehow the real value is accruing to bank managers. Or maybe the profits are somehow fake, the result of accounting trickery. I think the real story here is something more complicated than Bloomberg's optimistic "Surging Corporate Profits Should Feed U.S. Job Growth" headline.

Mitt Romney Polls Pretty Well

For all that smart pundits have written him off, and conservatives elites don't seem to like him, the continuing reality is that Mitt Romney has the best poll numbers out there:

What's more, despite conservative media's general antipathy to Romney, Ben Smith reports that Matt Drudge seems to be in his corner. What's more, Nick Confessore's reporting into the White House's effort to woo Wall Street donors pissed off about Dodd-Frank seems to strongly indicate that Romney is now the favored candidate of the financial services community. Romney continues to have large, obvious vulnerabilities, but I wouldn't write him off in a multi-candidate race.

One relevant question it would be interesting to see some reporting on is whether or not there's a substantial number of lower-level Republican elected officials who privately agree with the David Frum view that Fox News and talk radio hosts have come to wield too much party over the movement. Obviously a small fish — a state senator, a mayor, a freshman member of Congress in a PVI D+1 House seat — isn't going to want to pipe up vocally with that view. But these kinds of minor league elites have a big role to play as the party decides, and it's not clear that the folks with the biggest megaphones in the national press actually speak for them.

America Needs More Demand For Goods And Services, Not More Labor Supply

The argument that providing unemployment benefits can reduce employment seems pretty clear. People take jobs, in part, to get money. So to the extent that you maximize the hardship associated with not having a job, people will be more willing to engage in desperate measures to get a job. Right now, for example, North Dakota has a far below average unemployment rate, but relatively few people are eager to relocate to North Dakota. This is perfectly understandable. But if we eliminated unemployment benefits, people would be a bit more motivated. Even better, we could deliver regular public lashings to unemployed people and then they'd be in a hurry to get themselves to North Dakota and get a job.

This kind of thing motivates hedge fund manager Todd G. Buchholz to argue for the more humane path of sharply curtailing unemployment benefits and adding a "signing bonus" to further motivate people to get jobs. The idea here is that labor markets would "clear" more quickly, as people become more willing to accept worse jobs. Now on the flipside to this you might marshall Raj Chetty's various arguments including the key point that making people more desperate leads to worse job-matching and worse outcomes over the long-term. If you have a skilled engineer, you actually want him to stay unemployed and wait for an engineering position to open. Frightening him into taking a job at Subway two weeks sooner doesn't help you in the long run.

What's more, when you scare/bribe the engineer into taking the Subway job, you have to ask yourself what happens to the kind of person who might be working at Subway in a full-employment economy. Pushing skilled workers into lower paid, lower quality jobs just pushes less skilled workers into unemployment or out of the labor force. In a good FT op-ed today, Larry Summers offers the general point that "training programmes or measures to increase work incentives for those with high and low incomes may affect who gets the jobs, but in a demand-constrained economy will not affect the total number of jobs."

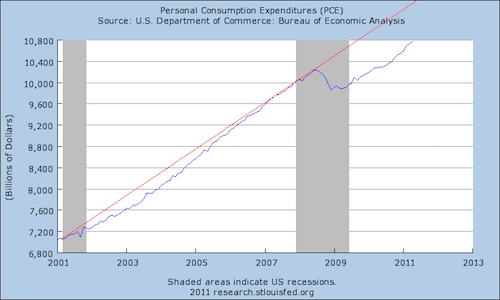

Now of course over the long-term, more skills will make a country richer. And more incentives to do paid work will increase the total amount of paid work that gets done. But at the moment we're suffering from a huge shortfall in aggregate demand due largely to the huge gap in personal consumption. Lots of different kinds of policies could close that gap or substitute for closing it, but increasing the supply of labor won't.

The Case For Co-Ed Dorms

I hadn't realized this was a burning issue, but obviously if you're a college student and you have a choice, you should live in a co-ed dorm. As John Garvey explains, "Students in co-ed housing are more likely (55.7%) than students in single-sex dorms (36.8%) to have had a sexual partner in the last year—and more than twice as likely to have had three or more."

Except strangely Garvey presents this as part of an argument against co-ed dorms. Which is silly. College students are adults. It's of course true that, thanks to technological change, it's now important for a large share of young adults to dedicate themselves to additional schooling at an age when traditionally they would have been engaged in full-time back-breaking agricultural labor. But that doesn't change the fact that a college student is a person fully equipped to enjoy having sex — a fun, affordable, and ecologically sustainable passtime.

Dirk Nowitzki And The Virtues Of Immigration

Having offered an unpopular progressive case for the Miami Heat before their defeat at the hands of the Dallas Mavericks, it's worth considering the success of Dallas as a case study in the virtues of immigration.

The case here is straightforward. The Mavericks are by no means a one-man show, but they rely on a German guy as their main shot-taker and point-scorer. No Dirk, no championship. What's more, Nowitzki's skills are to a considerable extent complementary to the skills of other workers employed by the Mavericks. Tyson Chandler and Jason Kidd are prodigious rebounders, for example. Combining their skills with Nowitzki's more scoring-oriented game enhances the value of both players. It's not necessarily a case of any of them "making their teammates better" as much as it is a case of there being significant economic rewards to playing deeper into the playoffs. At the same time, there's only one ball. No matter how much shooting talent you employ, only one guy can take the shot. No matter how much rebounding talent you employ, only one guy can grab the rebound. But by combining players with different talents, you can put together a more formidable firm. And Nowitzki, in particular, offered a extremely unusual skillset — a seven-foot-tall player who can shoot accurately with range.

America's openness to the world's most skilled basketball players — regardless of the country of their birth — helps ensure that America will continue to be the location of the most important basketball league. We have the best league because the best players from all around the world play here. And the best players want to play here because they want to prove themselves in the best league. And because it's the best league, it's able to obtain global recognition and a global audience so that talented basketball players all around the world know that it's the best league and they want to play here. Trying to preserve "good NBA jobs" by keeping foreigners out would be an extremely shortsighted move that only served to undermine the longer-term sources of American basketball domination.

Tim Pawlenty Attempts To Rebut Allegations Of Dullness With Lame Joke, Bad Timing

On paper, Tim Pawlenty seems like a formidable political candidate. But he's been dogged since the beginning of the campaign with alleged dullness. Asked about this yesterday on Fox News Sunday with Chris Wallace, the former governor responded with appallingly bad delivery of a lame joke.

Watch it:

The reality is that both presidential nominees and presidents are called on to deliver lame jokes pretty frequently. It's of critical importance that an effective leader be able to do this in a way that renders the jokes at least mildly amusing.

Breakfast Links: June 13, 2011

— David Cameron vows that "we will not introduce an American-style private system" for UK health care.

— I'm not sure why people keep referring to this as Iceland "crowdsourcing" its new constitution; it seems like a pretty elementary and praiseworthy form of public input.

— Lawrence Summers calls for more stimulus.

— Obama seeks to win back Wall Street cash.

— Pundits aside, Mitt Romney is widening his lead in the GOP primary.

— Light rail success in Minneapolis.

— Historic preservation law, keeping my neighborhood blighted.

— Wall Street Prepping for financial problems related to the debt ceiling.

June 12, 2011

Michele Bachmann's Generational Politics

There's lots of interest in Michele Bachmann's interview with the WSJ editorial page's Stephen Moore, but what I think's particularly interesting about it is that part of Bachmann positioning herself as the rightmost candidate in the field is that she wants to practice incredibly savage generational warfare:

Her big challenge is whether the country is ready to support deep spending cuts. On this issue, she carries a sharper blade than everyone except Ron Paul. She voted for the Paul Ryan budget—but "with an asterisk." Why? "The asterisk is that we've got a huge messaging problem [on Medicare]. It needs to be called the 55-and-Under Plan. I can't tell you the number of 78-year-old women who think we're going to pull the rug out from under them."

Ms. Bachmann also voted for the Republican Study Committee budget that cuts deeper and faster than even Mr. Ryan would. "We do have an obligation with Social Security and Medicare, and we have to recognize that" for those who are already retired, she says. But after that, it's Katy bar the door: "Everything else is expendable to bring spending down," and she'd ax "whole departments" including the Department of Education.

If you're old, then Bachmann thinks there's an "obligation" for you to keep your health care and pension benefits. But not only do those of us born later than 1956 have no right to decent health care and pension when we are old, but if we're right now relying on student loans to make college affordable, that's going to be cut. If you're a parent relying on Medicaid to cover your autistic child's treatment, you're out of luck. If commute to work and are hoping America continues to have a viable transportation infrastructure, you're out of luck. Absolutely everyone born after 1956 is going to be subject to immediate draconian cuts in the programs we benefit from, while we're supposed to believe that nobody born earlier than that will suffer even the slightest bit.

Earlier in the interview she's going on about Ludwig Von Mises and Milton Friedman, but the actual economic agenda here is rather different from small government as such. It's all about who's the right kind of people and who's not.

The Mystery Of Private Health Insurance

Paul Krugman is shrill on the idea of controlling health care costs by rolling back Medicare:

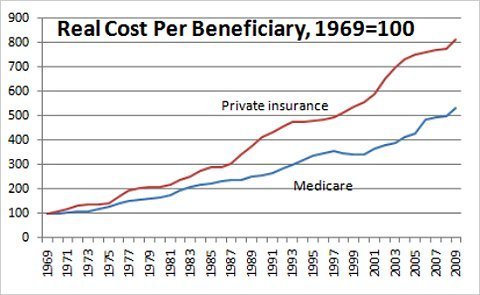

It's a mystery why anyone claims that shifting more people into private insurance is a good idea. Actually, no, it isn't a mystery; it's an outrage.

This is one situation in which I think it's unfortunate that debates about the best way to organize public services get bound up with debates about redistributive taxation. The primary organizing principle of the contemporary conservative movement is the idea that it's difficult for rich people to get a fair shake in tax policy debates, and someone needs to stand up for them. And obviously the need to finance a Universal Medicare program through taxation could become the vehicle for substantial redistributive taxation. But the point underscored by Krugman's chart is that Medicare being a good deal for the vast majority of people isn't dependent on the assumption that rich people will be picking up the tab. It's simply more efficient to organize an insurance function with the largest possible risk pool.

Debt Ceiling Fight Risks Squandering The Legacy Of America's First And Best Bailout

In lieu of substantive commentary about banks scrambling to avoid regulatory definition as too big to fail (until they're on the verge of failure, of course) I wanted to write about the fact that though it's little-discussed today the United States of America was substantially forged as a result of a massive bailout.

The setting was New York City, then-capital of the then-new United States of America in the fall of 1789. The Revolutionary War had been won years ago, but the constitution was brand new. What's more, the war had been a long one. A long one financed primarily by state governments. And one financed with a large degree of debt. That debt took two forms. To an extent, both the Continental Congress and state governments took out loans, and then used the money raised by loans to pay for things. And to an extent both the Congress and state governments found themselves paying soldiers with promissory notes. Fight now, and when we win the war we'll pay you back. Of the course of the war years, the value of those promissory notes had often declined sharply below face value. Liquidity constrained soldiers and veterans had sold their notes for cash money to late 18th century vulture investors.

In his "report on public credit", Alexander Hamilton proposed a kind of double bailout. First, all debts owed by state governments would be assumed by the federal government which had greater fiscal capacity to raise taxes without wrecking the economy. Second, with all the debt consolidated under federal aegis, the debt would all be paid off in full to the present owner of the paper. James Madison objected to both such bailouts. On the one hand, he felt that there was no reason citizens of less-indebted states should pay the debts of more-indebted ones. And on the other hand, he felt that though an obligation existed to fulfill Congress' commitment to actual Revolutionary War soldiers there was no reason that hardworking people should be taxes to pay the full face value of securities owned by speculators.

Ultimately, Hamilton's view prevailed and the debt was consolidated and paid. Yet Madison's arguments about fairness seem unimpeachable. Here we are taxing a nation of farmers to transfer wealth to bond speculators. Why do that? But Hamilton's argument that acting swiftly and decisively in this regard would establish the credit of the United States, give America access to capital, and ultimately boost the prosperity of the nation seems amply vindicated by history. And here were are, over 200 years later, citizens of a country with the very best credit in the world poised on the brink of an easily avoidable debt default as a side-consequence of dangerous political brinksmanship.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers