Matthew Yglesias's Blog, page 2278

June 10, 2011

Let's Draw Some Sweeping Ideological Conclusions From The Indian City Of Gurgaon

"Whether you're liberal or conservative," writes Kevin Drum, "you'd be wise not to try to draw too many lessons for the United States from Gurgaon."

As Barney Stinson would say: Challenge accepted.

The first takeaway point from Gurgaon's success in the face of the lack of municipal government is to underscore the incredible value of good government. In India, good government is exceptionally rare. Not only is there a ton of corruption, there are often downright absurd regulations. Central Mumbai has a maximum floor area ratio of 1.33 and the Indian government favors draconian parking mandates. This bad government is so bad that Gurgaon was able to overcome a lot of initial disadvantages. Americans spend a lot of time debating "big" versus "small" government, but quality of public services varies widely from place to place and makes a huge practical difference.

The other is that scale matters. A lot of what we think of as necessary "public services" could, in fact, be provided privately. Imagine if someone owned all of San Francisco and leased the land and structures out. Well obviously he'd want to have some kind of fire department and building standards to protect his investment. And he'd want to have a security force, since crime would reduce the value of the rent. And he'd want there to be some parks, because people like parks and their presence will increase the rent he can charge. (Indeed, my building includes a small private park). And obviously he'd need schools and really all the rest. Of course, a private owner might catastrophically mismanage the city, but so might public officials. But in order to internalize the benefits of privately provided infrastructure, parks, public safety, etc. the scale of the enterprise would have to be really big. Like the size of a whole city.

San Francisco has a land area of about fifty square miles. In rural Nebraska they have roads spaced exactly one mile apart, so you can easily find a largely uninhabited fifty square mile block (mine's even airport-adjacent):

So how come private developers don't buy up all this farmland and build a city there? Well, maybe they never thought of it or maybe Big Government won't let them, but realistically it's hard to do things on that kind of scale if you're not a state. To build Libertopolis, Nebraska, we'd probably need eminent domain plus a loan guarantee at which point Libertopolis is a big government plot.

Of course once Plotsville is up and running, you might wonder where the line between firm ends and state begins. Presumably actual and potential residents of Plotsville would put some positive value on having input into how the place is run. You could try to make decisions based on surveys, but it might be easier to assemble some kind of representative decision-making council. Alternatively, a lot of municipalities de facto function like private associations of their current residents, using zoning rules to control the pace of new construction and minimum lot size rules to restrict the ability of poor undesirables to move in. Essentially all states severely curtail immigration, and the generally accepted view is that Denmark should operate for the benefit of Danish people not on a principle of universal benevolence. And it's a nice, albeit dull place, sort of the gated community of nations.

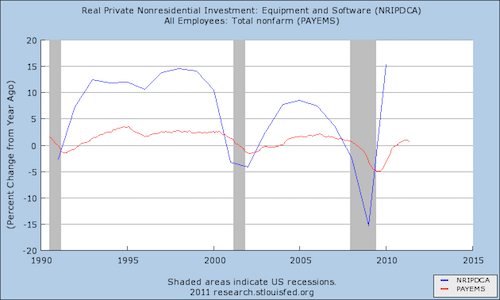

Investment Is Always More Volatile Than Employment

Catherine Rampell has an interesting piece out about how employers are investing in new capital at a faster rate than they're investing in new hiring. I think the most important part of the piece, however, comes at the end where she observes that this was also the case in the 1990s but the boom was strong enough then that labor markets were tight.

I think if you look at the numbers, you'll find that investment is just much more volatile than employment:

The difference between a labor market boom and the tragedy of mass unemployment is, on this chart, just much smaller than the difference between an investment boom and an investment drought. There's nothing really new about that. The other thing I think we see here is the implausibility of hoping that the Confidence Fairy will ride to the economy's rescue. Businesses are, in fact, investing at a perfectly healthy clip after a terrifying dip. That leaves it unclear what problem business confidence is supposed to be the solution to. Business confidence won't boost net exports, business confidence won't provoke a residential construction boom, business confidence won't boost government consumption, and business confidence won't boost consumer spending. So how much investment do we think the Confidence Fairy is going to bring us?

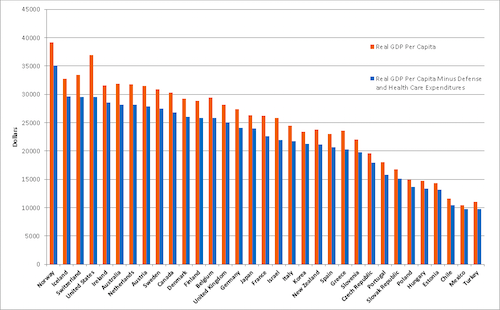

Large Share Of American Wealth Goes To Health And Defense

Measured in PPP terms, the United States is just about the richest country on earth in output per head. But it's also well-known that the United States has substantially higher defense spending than other rich countries and leads the world in health care spending. Yet whatever you think about America's large military budgets, American citizens pretty clearly are't safer from invasion and conquest than are Portugese people. Our military spending is either largely wasted, or else its benefits are widespread and extend to our allies. And similarly, Americans aren't healthier on the whole than citizens of other rich countries.

But as you can see from this chart Matthew Cameron put together using OECD data, a lot of America's lead in output per capita over other rich countries consists of defense and health care:

I think the optimistic read you can give here is that the United States is both a rich country and a generous one. Not only do we provide military public goods for the entire world, our bloated health care sector implicitly subsidizes medical R&D for the entire world. You see this most clearly in pharmaceuticals. A firm invests in research primarily in the hopes of achieving windfall profits in the United States. The firm then turns around and is willing to sell the drug at something much closer to marginal cost in the Netherlands. Thus the Dutch, with their much lower hours worked and much less inequality, are free riding on our willingness to blow so much of national output on guns and medicine. On a pessimistic view, we're just wasting lots of private and public funds.

Adventures In Counterveiling Forces

Interesting press release earlier this week from America's larger (though, oddly, less covered) teacher's union, the National Education Association:

WASHINGTON – June 07, 2011 – NEA President Dennis Van Roekel said today that the recent $39 billion acquisition of T-Mobile USA by AT&T has positive implications for American consumers, students and the nation's economic future.

"Good news for business is not always good news for consumers, but this merger represents a win for everyone," said NEA President Dennis Van Roekel. "The merger will expand access to high-speed wireless Internet service and help narrow the digital divide."

Absent strong labor unions, who would exist to lobby against the might of giant corporations? Meanwhile, Eliza Krigman has a great piece in Politico about how not only the NEA but also the NAACP and the Gay & Lesbian Alliance Against Defamation have come out on AT&T's side, and all these groups have benefitted from AT&T's largess. Ellen Miller from the Sunlight Foundation calls it "deep lobbying."

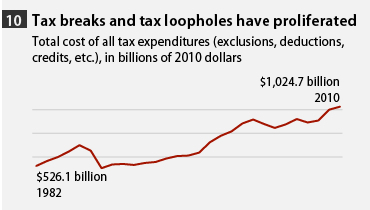

The Price of Taxophobia: Inefficient Taxes

Ever since Ronald Reagan's election in 1980, American politics has been dominated by the presence of a large and powerful ideological movement that's primarily dedicated to the cause of tax cuts. One result, as shown by my econ team colleagues' suite of charts is that we increasingly make public policy by creating tax loopholes:

It's not a good trend. Simpler taxes and efforts to do a more straightforward consideration of what is and isn't worth spending money on are a much better idea.

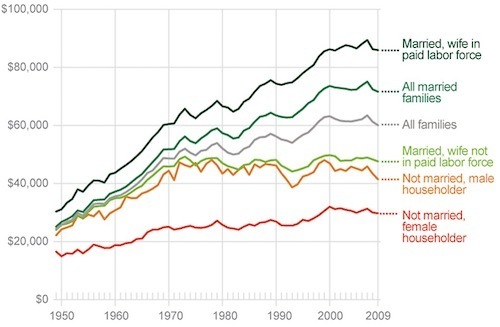

Heritage's Plan For Marriage: Regressive Tax Cuts

Earlier this summer we watched in amazement as the Heritage Foundation turned the otherwise non-controversial subject (among wonks that is) of reforming farm subsidies into a regressive tax cut. Today, I'm puzzling over item one on the Heritage Foundation's Marshall plan for marriage:

Eliminate marriage penalties from federal programs. Married couples tend to be better off financially than their single or cohabitating counterparts. Policymakers should encourage such beneficial economic decisions by removing financial disincentives to marriage from tax and welfare policies.

The causal link here is pretty questionable. But the basic logic seems badly flawed. Married people are better off than unmarried people, so we need to give the married people extra subsidies? Lawyers tend to be financially better off than janitors, but that's not a reason to subsidize lawyers. How many extra marriages, at the margin, is subsidizing married people supposed to generate, and how does that compare to the amount of money that will be spent subsidizing the already-richer already-married? Some other ideas on the list like "[i]mplement state-driven divorce reform that encourages reconciliation" have more merit but seem mighty hand-wavy.

It seems to me that if you want to think about family policies that will really make a difference, you need to look at some different models for promoting/subsidizing parental leave time, especially if you can encourage men to participate. In general, subsidizing childrearing makes a lot of sense (positive externalities!) and alleviating financial stress on parents could reduce divorce.

Stimulative Grand Bargains

Ezra Klein writes about the idea of a grand bargain on stimulus and long-term deficit reduction that "the two parties should, but won't, strike."

He's of course correct. But if I were in charge of trying to broker a bargain that I think would at least tempt people, I'd be aiming for something more cynical than Klein's "GOP agrees to spend more now, Democrats agree to spend less later" bargaining. How much do Republicans really even care about long-term spending? What I think would actually tempt people on both sides would be a giant state/local government bailout package paired with a temporary radical relaxation of private business regulation. In terms of who really matters in American politics — politicians who want to get re-elected, rich businessmen, and public service providers — this is win-win. Private sector labor unions, serious small government ideologues, and environmentalists would get skewered. I think those are groups powerful politicians can easily afford to skewer in a go for broke push for short-term job creation. Basically the deal would combine a return to public sector job creation (jobs!) with allowing private firms to hire people to dump toxic waste on pristine wilderness for $2 an hour (jobs!) and would almost certainly succeed in boosting the economy over the short-term and helping everyone get re-elected, albeit at a potentially serious long-term cost.

Now of course this isn't going to happen, in part because politicians aren't (I think) actually as cynical as people often make them out to be.

Spending And Jobs

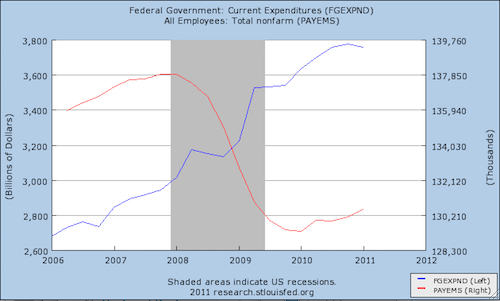

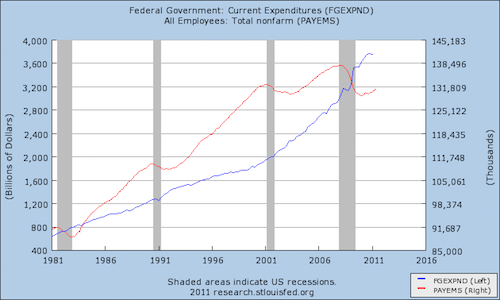

Cato's Mark Calabria offers a chart to show that federal spending doesn't create jobs:

Striking! But what if you look at the same data on a longer-scale:

Not so striking. It seems that both spending and total employment trend up over time because the population is growing, and there's also a business cycle such that employment suffers periodic drops. It's true that if you pick a random time slice that includes a recession, you can generate the Calabria "result," but it's silly to do so.

Joe Lieberman's Plan To 'Save' Medicare By Doing Less Of It

Joe Lieberman is out today with a plan to reduce Medicare expenditures without privatizing the program. The essence of his alternative is just to "do less Medicare." This takes a few forms. Most crudely, right now if you're 65, you get Medicare. If you're 66, you also get Medicare. Lieberman wants to change that so if you're 65, you don't get Medicare, and if you're 66, you also don't get Medicare. Obviously this does, in fact, reduce Medicare outlays, though Igor Volsky has the facts and finds that the actual savings here are kind of surprisingly low.

The larger issue here, if you ask me, is that though this really is preferable to some other ideas I've heard it really fails to put the Medicare issue in the proper context.

Health care services are expensive in the United States of America and the cost is growing at a rapid rate. Consequently, all endeavors that pay for health care services are costly and increasingly so. Medicaid is big burden on state governments. Public sector worker health care costs are a big burden on government at all levels. Medicare is a big burden on the federal government. Tax subsidies for private employer-provided insurance put a big hole in the federal deficit. Employee health costs are a big burden on large firms. If you look at any one of these things in isolation, you can wind up losing perspective. It's important to keep in mind that all major modes of delivering health care services in the United States benefit from government subsidies, and they're all expensive. But Medicaid is considerably cheaper than Medicare, and Medicare is considerably cheaper than private insurance. The right kind of policies try to reduce cost pressure throughout the system with minimal cost to patient wellbeing. The evidence, both from comparing different sectors of U.S. health care to each other and from comparing U.S. health care to foreign health care, indicates that getting the state more deeply involved is the way to do this. That's why the CAP plan for the long-term budget deficit reduces Medicare outlays by reforming the entire system.

Everything Is Culture War

Here's a van I saw on my way to work this morning, it's primarily dedicated to exposing the evils of abortion, but as you'll see, one van can encompass much. Zoom view:

Wide view:

Abortion is, obviously, a very emotional and very ideological issue. There's nothing wrong with that. But it's a problem for the country when strong emotional and ideological views about abortion get intimately linked in people's ideas with views about much more technical questions about the merits of raising the debt ceiling or whether we have too much inflation or too little.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers