Matthew Yglesias's Blog, page 2230

July 25, 2011

John Boehner's Debt Ceiling Plan: Do It Again, Again, And Again

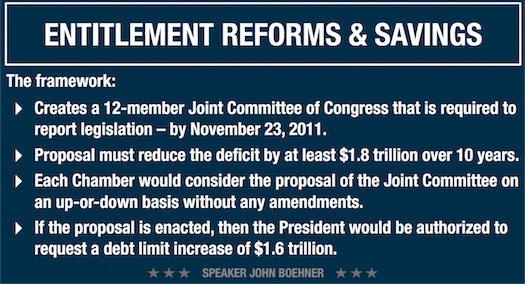

Lurking right at the center of John Boehner's "plan" (PDF) to resolve the debt ceiling crisis is this proposal to create a brand new debt ceiling crisis:

So instead of having the House, the Senate, and the president need to agree to a plan here in July, we kick the can to November and this time the plan needs to meet the needs of the House, the Senate, the president and a special cross-chamber committee. How does that help?

John Boehner's Debt Ceiling Plan: Do It Again, Again and Again

Lurking right at the center of John Boehner's "plan" (PDF) to resolve the debt ceiling crisis is this proposal to create a brand new debt ceiling crisis:

So instead of having the House, the Senate, and the President need to agree to a plan here in July, we kick the can to November and this time the plan needs to meet the needs of the House, the Senate, the President and a special cross-chamber committee. How does that help?

Erick Erickson Will Look Down and Whisper 'No.'

Erick Erickson reports, "In the past 48 hours I have had call after call after call from members of the United States Congress" seeking permission from the conservative blogger to strike a deal on the debt ceiling. But he says no:

You went to Washington to change Washington. You went to Washington because you said it was broken and you worried about the future for your children and grandchildren.

And now, at the moment of crisis you are worried and second guessing yourself and looking for alternatives, ways out, and most of all a clear conscience. Cut, Cap, and Balance is the only plan that can save our credit rating and our financial integrity. I can offer you nothing else, nor should you waver from fighting for it alone. You should, however tired you may be of hearing me say it, hold the line.

But what you think will give you a clear conscience — the alternative you seek — is what has been done before. You punt. You kick the can down the road. You take the chimera and convince yourself it is real and you have done good.

Incidentally, I note that Republicans easily control enough state legislatures to hold a constitutional convention and submit any wingnutty constitutional amendments to the states that they like. There's actually no need whatsoever to involve Congress in this. So if Erickson is really the puppetmaster behind the whole thing, he can just release his minions to vote for a clean debt ceiling increase and start lobbying state legislatures.

Obama's Worst Campaign Promise

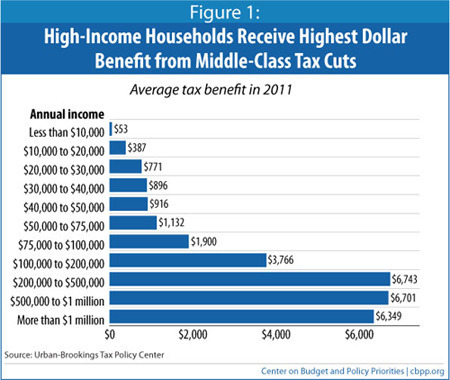

Jamelle Bouie has a smart piece about the tactical and budgetary problems with Barack Obama's pledge against any tax increases on people earning less than $250,000. Something about this that I think often goes overlooked is that the "middle class" tax cuts Obama is defending are sharply regressive in their distributive impact:

But I also think there's a serious conceptual problem here. I think of progressive budget policy as having three planks. One is that budgeting should be counter-cyclical rather than pro-cyclical. The tax structure issue here isn't very important. A second is that budgeting should be redistributive—we need to put money into the hands of people who need it. Clearly this leg of the stool depends on a progressive rate structure. But the third is that public services are valuable. That we "win the future" with investments in education, science, and infrastructure. That single-payer is a more efficient way of organizing health insurance markets. Whatever you like. Thus it's somewhat odd, in terms of long-term movement-building, to be running around the country arguing on the one hand that public services are valuable but on the other hand that the genius of public services is that only the super-rich have to pay the bill. A little redistribution (take money from those who have a lot, give to those who have a little) is great, but public services worth having are worth asking middle class people to contribute to.

Crime In Oslo

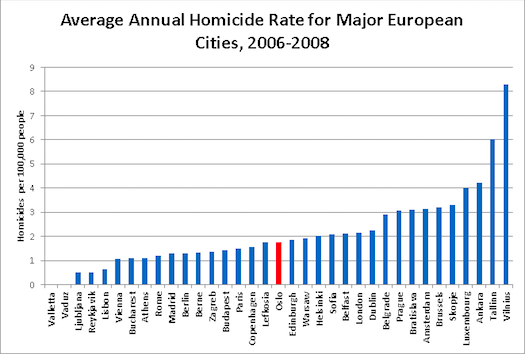

The Anders Breivik case sparked some discussion in our office about the relatively cushy prison conditions in Norway. Interestingly, even though Norway is an outlier countries in so many ways, Oslo is a pretty average western European capital in terms of violent crime:

Clearly, compared to the United States, all western European cities are quite safe. In 2009, we had a nationwide murder rate of 5 per 100,000 with the figures for many large cities obviously much worse than that. But compared to other European countries, Oslo is getting beaten out by the capitals of some other substantially poorer countries like Portugal and Spain. Of course much more goes into crime control policy than prison conditions so I would hesitate to draw any firm conclusions.

Captain America And Total War

Something I rather enjoyed about watching Captain America on Sunday afternoon is that for a war movie (which is what it is, more than a comic book movie), it offered an unusually comprehensive view of mobilization for total war. You get the soldiers, of course, whose willingness to risk their lives for their country and their fellow troops is crucial. But the movie also makes clear that the notion that "wars are fought with weapons but won by men" is little more than a motivational slogan. One of the main things that soldiers do is try to prevent the Nazis from developing war-winning super-weapons. Meanwhile, the Allies are working on super-weapons of their own. You see in the film that in order to fight and win a war, you need to be able to finance a war. And this is a multi-dimensional process. On the one hand you have patriotic exhortations to lend money to the government at sub-market rates. On the other hand, even as fighting men volunteer to risk their lives, scientists Howard Stark and Abraham Erskine are doing their own wartime service rather than focusing their energies on finding erectile dysfunction treatments.

It's interesting to look at this in contrast to our current wars. Obviously on the soldiering front, you've still got the spirit of patriotism and sacrifice. We financially compensate our soldiers, obviously, but we also celebrate them. And with good reason. Even high-level officers who aren't putting their lives on the line are clearly underpaid relative to managers of comparably sized organizations in the business world. But beyond that, it's not a total war. The war is financed by market-rate borrowing, and if you want scientists to work on defense related projects, you need to pay them enough to make it worth their while to focus ont hat rather than other projects.

This is because you just couldn't mobilize society around the idea of the war in Afghanistan the way you could mobilize people around the idea of fight against Hitler. But this itself should be telling us something. We motivate soldiers in part with rhetoric that emphasizes the idea that they're serving to "defend freedom." But if we as a society really believed that — the way we quite clearly did believe it in the 1940s — we would see it spill over into other sectors.

Crisis And Recovery In East Asia

Dani Rodrick has a very good column pushing back against naive optimism that the past decade of strong growth in poor countries will be sustained:

Growth that relies on capital inflows or commodity booms tends to be short-lived. Sustained growth requires devising incentives to encourage private-sector investment in new industries – and doing so with minimal corruption and adequate competence. If history is any guide, the range of countries that can pull this off will remain narrow. So, while there may be fewer economic collapses, owing to better macroeconomic management, high growth will likely remain episodic and exceptional. On average, performance might be somewhat better than in the past, but nowhere near as stellar as optimists expect.

My bottom line is that predictions are hard to make, especially about the future. But if you forced me to bet, I'd side with the optimists. Lately I've been revisiting the 1997 Asian financial crisis, and something I find striking is the extent to which the hardest-hit countries all did come roaring back:

For the sake of keeping the chart scale reasonable I left off Korea, but as you can see here it features the same basic pattern. This was a really horrible economic calamity and it was not especially well handled by the domestic governments or the international community. Over a decade later, the IMF still has a horrible reputation in many circles due to the scale of the carnage. And many took the whole episode to reveal the idea that these economies were paper tigers. But in fact after bottoming out, all these countries managed to re-obtain their pre-crisis peaks and then exceed them until falling back into recession in 2009 along with most of the world. But this time, they're not in financial/political crisis and should have no trouble growing again.

The basic picture here, arguably, is that the logic of conditional convergence is extremely powerful. The fact that it kept not happening, generation after generation, despite the powerful logic in its favor made a lot of people suspicious of the whole concept. But over the past twenty years it really has been happening. Countries are still susceptible to things like devastating civil war (Congo) or financial crisis (see above) or evil misgovernment (North Korea) but these kind of things now look like the exceptions to the converge rule. As countries age, their growth will presumably slow down, as we've seen in Japan and to a lesser extent Europe but I'm optimistic about the per hour worked trends.

This American Life On Patent Trolls

The most recent episode of This American Life tackles the important question of America's dysfunctional patent system. They focus on Nathan Myhrvold's company, Intellectual Ventures, which exists purely to amass patents in order to threaten to sue firms with actual products and extort them for settlement money. Myhrvold is, by all accounts, a brilliant man and he seems to have taken a really poorly designed system and figured out a brilliant way to put his brilliance to work finding ways to make huge sums of money destroying the economy rather than coming up with useful products to sell to people. But TAL also delves into the increasing tendency of large firms to spend time acquiring patent portfolios as purely protective measures. They know that any good product they release will become the subject of patent litigation, so they need an arsenal of counterclaims to make in order to be able to settle the lawsuits in a reasonable even-handed way. The whole thing's great.

Felix Salmon loved it too, but I think he's wrong to say that "Chuck Schumer's bill taking aim at business-method patents in the financial industry is a good start." Schumer's bill actually strikes me as the perfect example of America going to hell in a handbasket. Rather than the elites who are injured by the current system working to reform the system, they're working to forge a loophole for themselves. If they succeed, the reform coalition will get even weaker.

Private Plane Sector Surging In Increasingly Inegalitarian America

Christine Haughney reports on the recovery summer:

For decades, parents in the Northeast who sent their children to summer camp faced the same arduous logistics of traveling long distances to remote towns in Maine, New Hampshire and upstate New York to pick up their children or to attend parents' visiting day. Now, even as the economy limps along, more of the nation's wealthier families are cutting out the car ride and chartering planes to fly to summer camps. One private jet broker, Todd Rome of Blue Star Jets, said his summer-camp business had jumped 30 percent over the last year. This weekend, a popular choice for visiting day at camps, private planes jammed the runways at small rural airports.

This, needless to say, is why progressive taxation is a good idea. Very rich people experience a sharply declining marginal utility of money. If this kind of high-end consumption was more heavily taxed with the proceeds used to finance the consumption of the less fortunate, overall well-being could be easily enhanced.

Harry Reid Calls House Republicans' Bluff

Something you often see in negotiations is a mismatch between one side's stated sticking points and its real sticking points. In the debate over the debt ceiling, for example, Republicans have sought to portray themselves as having two bottom lines. One is that any increase in the debt ceiling must be met dollar-for-dollar with spending cuts. The other is that no revenue increases can be part of the deal. What Harry Reid did yesterday was essentially call the GOP's bluff by outlining a plan that raises the debt ceiling by $2.7 trillion and includes $2.7 trillion in spending cuts, a healthy share of which comes from winding down the wars in Iraq and Afghanistan.

Republicans are rejecting this even though it nominally meets their demands. Why? Because it doesn't achieve either of their two real objectives. In particular, the plan doesn't cut Medicare, which means that Democratic party candidates for office in November 2012 and 2014 can accurately remind voters of the content of the Republican budget plan. In case you forgot, this plans repeals Medicare. Having repealed Medicare, it then gives seniors vouchers to purchase more expensive private health insurance. And having replaced Medicare with a voucher system, it then ensures that the vouchers will grow steadily stingier over time. It was only after voting for this plan that Republicans seem to have realized that repealing Medicare is unpopular. Since that time, they've been trying to entrap Democrats into reaching some kind of Medicare détente with them, which would immunize them from criticism. Reid's plan doesn't do that.

Second, while Reid's plan doesn't raise taxes, it also doesn't take tax increases off the table. Currently, the Bush tax cuts are scheduled to expire in 2012. If Reid's all-cuts plan passes, that still leaves the door open to significant revenue increases. Now that doesn't mean this is brilliant 11-dimensional chess. The Reid Plan is consistent with substantial revenues coming online in 2012, but that will only happen if President Obama and Senate Democrats stand firm and play hardball on the tax issue. Back in December 2010, they utterly failed to do so.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers