What the Taylor Rule(s) Say(s)

The St. Louis Fed has a handy webpage where it shows the Taylor-rule implied Fed funds target rate given measures of the output and inflation gaps, and the natural real rate of interest. Here’s recent snapshot I downloaded for my classes.

Source: Federal Reserve Bank of St. Louis accessed 11/4/2015.

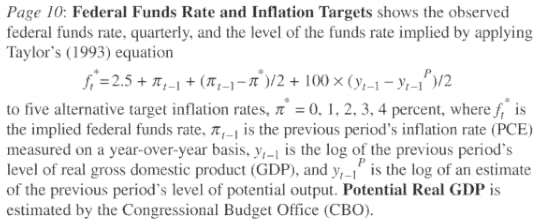

The description of the calculations are very transparently presented:

Given a 2% PCE inflation target, the Fed funds rate as of 2015Q2 was just at the implied level.

The careful reader will observe that there are many “Taylor rules”, even from Professor Taylor himself. Besides debates over the proper measures of y, y*, and π (including present or future), and the values of the parameters, there is a crucial debate regarding r*, the real natural rate of interest. For expositional purposes, the St. Louis Fed website uses the 2.5% figure, which — if I were teaching in 2007 — would seem relatively defensible. But for policy purposes, a more nuanced position would seem reasonable. This is where the whole debate over the real natural rate, and more specifically the recent Laubach-Williams estimates come into play. Figure 2 displays the Laubach-Williams estimates as well as the default 2.5% rate used in the above figure.

Figure 1: Laubach-Williams real natural rate (blue), and 2.5% (orange). NBER defined recession dates shaded gray. Source: Federal Reserve and CBO via FRED, Laubach-Williams [xls], and NBER.

Substituting in these estimates for r* yields a substantially different picture.

Figure 2: Fed funds rate (black), Taylor rule using 2.5% real natural rate of interest (red), Taylor rule using Laubach-Williams real natural rate (blue), and Wu-Xia Shadow Fed funds rate (dark gray). NBER defined recession dates shaded gray. Source: Federal Reserve and CBO via FRED, Laubach-Williams [xls], Wu and Xia, NBER, and author’s calculations.

Since the Laubach-Williams estimates for the natural rate only extend up to 2015Q2, the implied target only goes up to that data. Nonetheless, the fact that the implied target is about 2.6 percentage points lower than the corresponding value derived using the standard 2.5% equilibrium rate suggests that now is not the time to raise the Fed funds rate; see for instance President Williams’ statement.

Note that if the shadow Fed funds rate equals the actual when the Fed funds rate exceeds zero, then an increase of the target by 25 bps implies that the jump in the shadow rate will be on the order of three-quarters of a percentage point (the end-October shadow rate is -0.53%).

Menzie David Chinn's Blog