“…inflation expectations can change quickly”

One of the arguments for acting sooner rather than later on monetary policy is that if the slack disappears, inflationary expectations will surge. That’s represented in this quote from reader Peak Trader’s comment. While I don’t rule out this possibility, it seems reasonable to me to empirically assess whether this is true for the United States over the past thirty years.

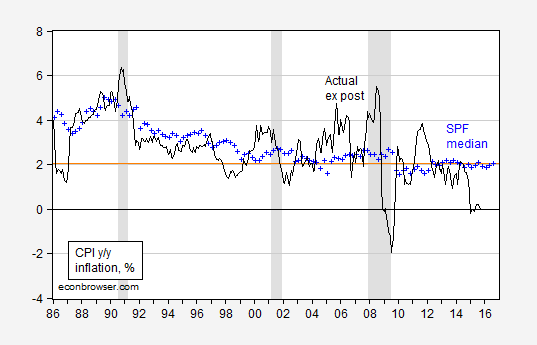

Figure 1: Ex post CPI inflation, year-on-year (black), survey median expectations of 1 year ahead inflation (blue +). NBER defined recession dates shaded gray. Source: BLS via FRED, Survey of Professional Forecasters, NBER, and author’s calculations.

I am sure if there is a drastic regime change, one could see a rapid and dramatic shift in measured expectations; the question is whether that scenario is relevant and/or plausible.

Update, 1PM Pacific: Reader Steven Kopits comments:

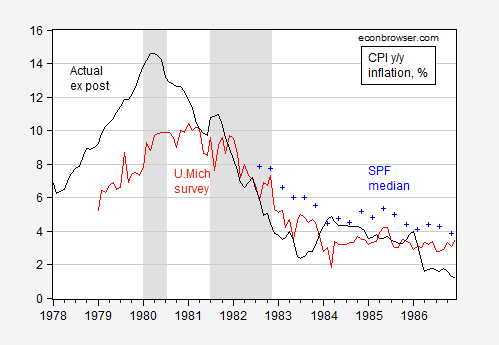

The relevant period would be 1960 to 1985. Inflation has been modest since the Volcker days.

Here is a graph with the available survey data.

Figure 2: Ex post CPI inflation, year-on-year (black), survey median expectations of 1 year ahead inflation (blue +), and U.Michigan household survey of 1 year ahead inflation (red). NBER defined recession dates shaded gray. Source: BLS via FRED, U.Michigan via FRED, Survey of Professional Forecasters, NBER, and author’s calculations.

I will let readers decide whether expecations turned on a dime. They seem pretty adaptive to me.

Menzie David Chinn's Blog