How to Use Mint.com to Track Your Minimum Spending Requirements

Thought this might be useful for peeps who need to meet minimum spending requirements AKA all of us.

This requires you to have:

An account at Mint.com with your bank info plugged into it

Excel (or some other software that supports .csv files)

My daily jam

Then, you can use simple tools on the website to show you clearly how much you’ve spent on a certain card, to the cent, including pending transactions.

What’s Mint.com?

Link: Mint.com

Mint.com is, quite simply, is a budgeting tool. It tracks multiple accounts from nearly every bank, and shows you your balance, updated daily (or more often, if you want).

I use it for so many things:

To track my savings

To keep an eye out for weird-looking transactions

To make sure my payments clear, and see when they’re applied

And to have an idea of how much I’ve spent in a given month (a sorta-budget)

But, I found an ingenious little trick whilst wondering how much I had left to spend on my new Citi Hilton Visa to get 75,000 Hilton points.

How to do it

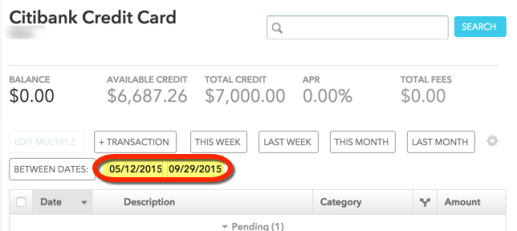

Once you’re logged in and have it all set up, select the account you want to track, over on the left.

If it’s a new card, don’t worry about filtering for dates.

Or, if you have to meet a certain amount of spend within a time period, (like if you were targeted by Barclays to spend $1,250 on restaurants in Q4 like I was!), enter in the dates you want to track.

Enter in dates if you want, but it’s not necessary for new cards

Scroll allllll the way down to the bottom. You’ll see this:

See those tiny words? They say “Export all XX transactions“

Click “Export all XX transactions.” Save the .csv file somewhere. Open the file.

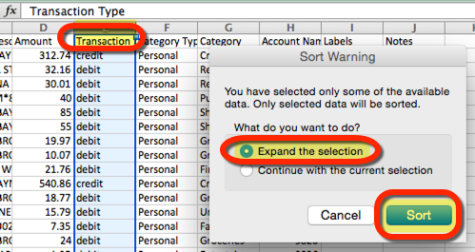

Select the “E” column (“Transactions” – the whole column), then click “Sort.”

This’ll alphabetize, and thus separate, debits from credits

Be sure to “Expand the selection,” otherwise, the other columns won’t sort correctly. This’ll divvy up credits and debits.

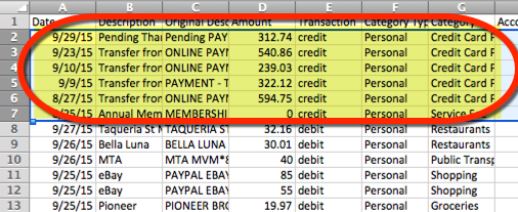

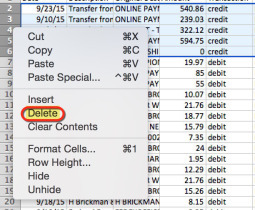

Select all the credits… then delete them

Delete the credits.

(Or, if you have a $0 balance and no pending transactions, you could just add up the credits.)

But if you have pending transactions, and a small balance, like I do, get rid of them.

Delete!

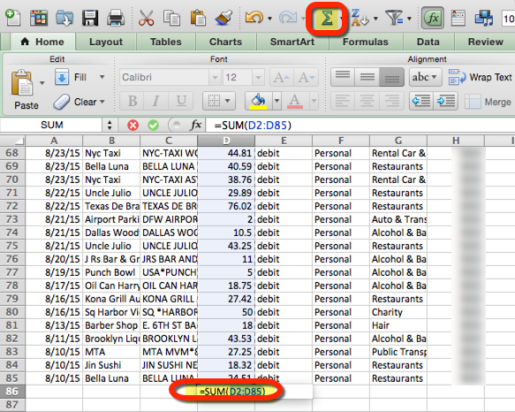

Then select the “D” column (“Amount”).

Hit Sum and Enter to see the damage

Hit “Sum” (the button that looks like a weird-looking “E”) and then Enter.

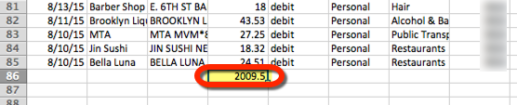

That’s it! It’ll let you know, to the cent, exactly what you’ve spent on the card so far.

And me?

Golden

I just completed the $2,000 minimum spending requirement on my new Citi Hilton Visa!

75,000 Hilton points, here I come!

A few notes

When it comes to meeting minimum spending requirements, I always like to go slightly over. And by slightly, I mean like $50, to account for any returns, or services like Paribus that credit money back to my card.

You do NOT want to be in the last month of minimum spending requirements and not get a sign-up bonus over $3 or $4. How much would that suck?

If you have another billing cycle, sure, cut it a little closer (if you’re not in a hurry). But I always like to be safe than sorry.

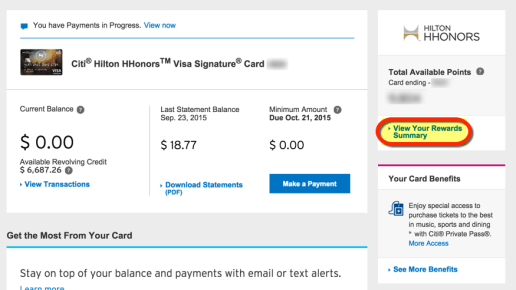

And, Citi already has a built-in tracker for minimum spending. Why they all don’t, I have no idea.

But it only updates at the close of each billing cycle, not after each posted transaction. Still, it’s handy to let you know how much more you have left.

OUT AND OUT - Investing. Positivity. Oh, and travel.

OUT AND OUT - Investing. Positivity. Oh, and travel.