Tips to Get Started With Aspiration Summit Bank Accounts

Also see:

New Aspiration Checking Account Has 1% APY and Free Global ATM Use

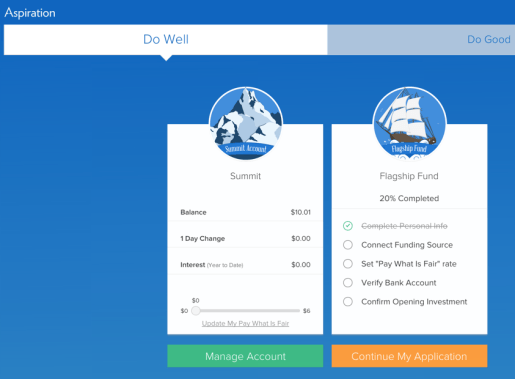

My new favorite banking product has, over the last month, become the Aspiration Summit account.

Even the debit card is cool looking

But, getting started wasn’t exactly a cakewalk. So here are a few tips that’ll help you, should you decide to open this account for yourself.

What’s an Aspiration Summit Account?

Link: Aspiration Summit Account

It’s kinda like a checking account, but kinda like a savings account. In that regard, it’s a hybrid.

Give it a climb

The account is only worth a diddy damn if you plan on keeping over $2,500 in it.

That’s the threshold to earn 1% APY.

Anything below that, even a cent, gets you just .25% APY (which is still, sadly, more than most corporate banks’ savings accounts).

My APY on my Chase Plus Savings account is .01%. Yup. So Aspiration Summit is 100x more.

There are also no setup fees, no maintenance fees, no service fees. And no ATM fees.

Anywhere in the world

This is great for frequent travelers!

Use any ATM worldwide.

Fees are reimbursed monthly.

The sign-up process is a little cumbersome, but I don’t think it’s possible for them to streamline it any more than they already have.

So after you sign up and get the debit card, then what?

Keep this stuff in mind

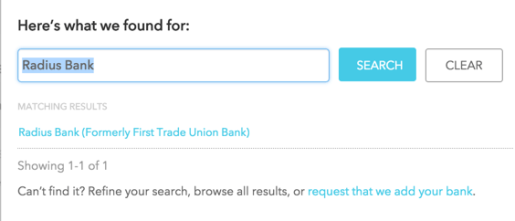

1. Radius Bank

At a certain point in the sign-up process, you realize that Aspiration has partnered with another organization, and it’s a little out-of-the-blue.

Aspiration Summit is totally, completely powered by Radius Bank.

For all purposes, you are signing up for an account with Radius Bank.

Radius Bank has a really similar account

They have a really similar account called the Radius Hybrid account.

But for balances in that account under $2,500, you get 0% APY and over that amount, you get “up to” 1%.

Aspiration Summit is much more clear about its earning structure which I really appreciate.

You’ll be asked to create a login for Radius Bank. Remember it, because it’s what you’ll want to use moving forward.

2. Don’t sign in on the Aspiration website

Sign up for the account on the Aspiration webpage, and then forget it exists.

Because functionally, it’s a mess.

Not impressed

Yes, it looks all slick and pretty, but it doesn’t really do all that much.

Login on the Radius Bank webpage instead.

Muuuuch better

This is your key to access:

Bill pay (which is very robust, with most payees already in their system)

Account services

Support

Alerts

Account preferences

Updated transaction history

The ability to export your transactions

You know, the things you actually want to have with a bank?

The Aspiration Summit page is spare and minimal, but it’s the Radius Bank page that shows you this is a real, actual bank account with normal banking features.

Thank gods.

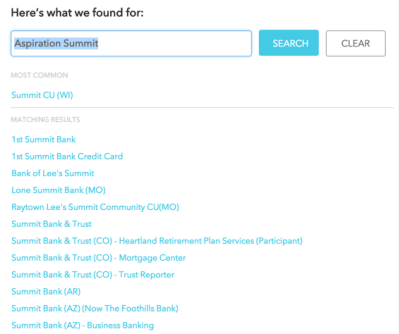

3. Mint.com, App, and Mobile Check Deposit

Then, I started to compare Aspiration Summit to my other accounts. I wanted to plug it into Mint.com to track my transactions.

None of the above?

It wasn’t there.

But then:

A-ha!

Same thing for app access.

If you search “Aspiration,” you won’t find anything. Search for Radius Bank, and you’ll find their app.

That’s the ticket to accessing your Aspiration Summit account on your mobile.

And, it’s how to deposit checks through your phone.

It’s pretty much a bare-bones version of the website with the option to deposit checks, which is more than enough for my purposes.

And those were honestly my biggest concerns.

Moving forward, I think I’ll use the account as an emergency fund. The debit card assures constant access to funds, and the interest rate is really high.

Bottom line

It took me a second to figure these things out, so hopefully this will save you some time!

Or, if you don’t already have an Aspiration Summit account, maybe you’d like to sign up for one.

It’s an online-only checking/savings account hybrid with free, unlimited ATM use worldwide. So it might encourage you to dump the brick-and-mortar bank once and for all, and it’s great for travelers.

There’s a wait list to get an account, but if you email me (or comment below – your email is only visible to me), I’ll send you an invite so you can skip the line.

Things to note:

The account is really only worth having if you plan to save at least $2,500 in it at all times to get the 1% APY

It’s an account with Radius Bank. Forget Aspiration Summit. It’s Radius Bank

Login with Radius Bank

To access your account on your phone, and to deposit checks on the go, download Radius Bank’s app

For Mint.com compatibility, use your Radius Bank login info

ATM fees are reimbursed at the end of each billing cycle, not “as you go” like with Fidelity

Anyway, those were my biggest concerns. If you think of anything I missed, or if you’ve had an experience with any of this, feel free to comment below!

And, email me (or comment) if you’d like an invite to Aspiration Summit!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!