Think Like an Investor: Create Your System

Today I saw an old man walking with a stroller.

He must’ve been 90-100 years old.

He was dressed sharp, wearing a suit and tie, a hat, and shiny shoes.

I observed him from a distance. He took 5-10 steps at a time before stopping to rest. When he had to pull his stroller down the curb it required tremendous effort.

Then he slowly crossed the street in the same way he had got there, by pausing intermittently. Making slow and steady progress in a pace suitable to him. Finally he arrived on the other side of the street.

He scaled the curb with his stroller, and you could tell he was completely focused on the task, exerting much willpower.

My instinctive reaction was to go and help him, but I didn’t. Because I realized that. . .

. . . This is a man on a mission. This is a man of character, a man of virtue; a man who fights his own battles, and for me to interfere would be an inexcusable insult to his pride.

Just the way I don’t want to be interrupted when I’m in flow, or about to break a record in the gym, this old man clearly didn’t want to be interrupted during his walking session.

Then I saw another man passing him. This man was at least 20 years younger and he had one of those electric wheelchairs. He wore a dirty jacket and a kid’s cap. He was followed by a middle-aged woman, probably a relative or some sort of nurse.

This was a weak man.

The difference between these two men is that the older man has a daily routine in which he takes great pride, and challenges himself. It matters enough to him that he will dress up for the occasion. This daily routine was clearly part of a larger system – a system he has probably stuck to for a long time. . .

. . . Whereas the younger (less old) man has no system at all.

His days aren’t aimed towards any purpose whatsoever. He has neglected his willpower and turned soft. Now he’s paying the price — rolling around in his electric wheelchair like a dirty corpse.

The old man with the stroller is the sort of man I want to be when I am 100 years old. The second man disgusts me.

You need to be like the old man:

You Need a System

And you need to start thinking like an investor.

Because you are one, even if you don’t think of yourself that way yet.

You may not have huge sums of money to place in the financial market — yet — but you’re still investing other resources; such as your time and energy.

Your are making investment decisions when you decide what university to attend, what job to get, the people you spend time with and associate with, as well as the skills you choose to practice.

Now, let me ask you:

Do you know the difference between an intelligent investor and an unintelligent investor?

Is it that only intelligent investors make money and become successful?

Not necessarily.

Over the short-term – a few years — it’s very hard to tell whether an investor is intelligent or if he’s just lucky. Warren Buffett shares a good story on the topic:

I would like you to imagine a national coin-flipping contest. Let’s assume we get 225 million Americans up tomorrow morning and we ask them all to wager a dollar. They go out in the morning at sunrise, and they all call the flip of a coin. If they call correctly, they win a dollar from those who called wrong. Each day the losers drop out, and on the next day the stakes build as all previous winnings are put on the line. After ten flips on ten mornings, there will be approximately 220,000 people in the United States who have correctly called ten flips in a row. They each will have won a little over $1,000.

Now this group will probably start getting a little puffed up about this, human nature being what it is. They may try to be modest, but at cocktail parties they will occasionally admit to attractive members of the opposite sex what their technique is, and what marvellous insights they bring to the field of flipping.

Assuming that the winners are getting the appropriate rewards from the losers, in another ten days we will have 215 people who have successfully called their coin flips 20 times in a row and who, by this exercise, each have turned one dollar into a little over $1 million. $225 million would have been lost, $225 million would have been won.

By then, this group will really lose their heads. They will probably write books on “How I turned a Dollar into a Million in Twenty Days Working Thirty Seconds a Morning.” Worse yet, they’ll probably start jetting around the country attending seminars on efficient coin-flipping and tackling skeptical professors with, ” If it can’t be done, why are there 215 of us?”

By then some business school professor will probably be rude enough to bring up the fact that if 225 million orangutans had engaged in a similar exercise, the results would be much the same – 215 egotistical orangutans with 20 straight winning flips.

The moral of the story is that it’s easy to get “fooled by randomness” and mistake luck for skill.

But over the long-term — 10 years — it becomes easier to tell who’s intelligent and who’s not.

The intelligent investors are more consistent in finding valuable investments, whereas the not-so-intelligent investors — who were lucky — regress to the mean, or achieve poor results. The main difference between the two is that. . .

. . .Intelligent investors have a system.

And they have strict guidelines for how much risk they’re willing to take.

That’s the difference.

Intelligent investors rely less on luck and more on. . . Intelligence.

That’s interesting. But how does that help me?

Well, as you are about to find out, investment philosophy is extremely applicable self-development and success in life, because it’s based on how to think better than other people.

If you can create a system for yourself and break it down to a consistent process, then — like the intelligent investor — you’ll probably be successful over the long-term.

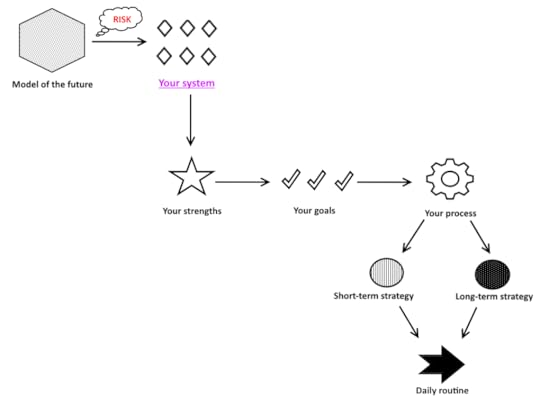

But the system needs to be tailor-made to you. It should involve the following factors:

Your model of the future

Your risk-appetite

Your strengths

Your goals

Your process

Your short-term and long-term strategies

Your daily routine

Let’s talk a bit more about each of these components.

Your model of the future

How do you think the future is going to turn out to be?

Most people either think nothing at all about it or they’re too opinionated. And usually they cannot base their opinions on anything solid. You don’t want to be like most people.

You want to learn from smart people and read quality books. That will give you a decent idea of how:

Things look like right now

And how the future may turn out

No one really successful — and I’m talking about guys like Arnold, Napoleon or Caesar – got that way by following herd behavior. They predicted a certain future and then they bet heavily on that scenario. . .

–And not just once. They did it repeatedly. That’s why we know their names.

The bottom line is this: making predictions about the future and positioning yourself to profitably always involves an element of. . .

Risk

And risk is best explained by the term “shit happens”.

The big difference between probability and outcome is that probable things fail to happen while improbable things do happen — all the time.

–Howard Marks

. . . And this is why it’s hard to tell what’s luck versus what’s not over a short timespan. Skill and intelligence first become evident over a longer period of time.

When you read enough stuff — and study history — you realize that there have been lots of schmucks and scammers who fooled people for years, like Bernie Madoff for example.

No one can predict the future perfectly and nothing is ever certain. Everything involves some degree of risk. The question to ask is:

How much risk am I willing to take?

That’s a personal question — I can’t answer that for you.

But there are four basic things you should know about risk:

1) Most people have a skewed understanding of risk due to mainstream media brainwashing and lack of education. (They believe sharks, earthquakes and terrorists pose a bigger risk to their lives than obesity, cancer, or car crashes)

2) Most people are by nature risk averse. There’s not necessarily anything wrong with that. But you need to figure out whether this is true of you or not — you must “know thyself“.

3) Most people either take too little risk or they (foolishly) take too much of it without adequate compensation.

4) Without risk there can be no reward. If people understood this, they wouldn’t fall for absolute returns of 8-11 % (like Madoff promised).

And one last principle: At the end of the day you tend to. . .

5) . . . put your money resources where your mouth is.

But you shouldn’t take any big risks, or try to predict the future, unless it’s related to. . .

Your strengths

Which, hopefully, is what you do for a living.

Or what you spend most of your time doing.

Or an area where you:

Have expertise and

Inside information.

Your strengths (and interests) are where you should invest most of your time and effort, and it’s where you should have your most ambitious goals.

Your goals

What do you want to accomplish?

There are two types of goals:

Short-term goals and long-term goals.

Set short and “easy” goals to aim for each week or month to boost your self-esteem and put yourself on the right track.

As for longer goals, I set 18-month goals.

I learned this from reading books by Peter Drucker. The reason to use 18-month goals is because it’s hard for the mind to specify and clarify the a goal that’s longer than that.

You achieve your goals through. . .

Your process

Success is NOT an event, it is a process.

Success cannot be attributed to one thing, it’s the combinatorial effect of doing a bunch of things the right way consistently over a long period of time.

Sometimes you get lucky. Usually you don’t.

But in either case you shouldn’t care. When you know you’re doing the right thing — and that your system works — just stick to it. Disregard short-term results and focus on the process.

Your process will change from time to time based on. . .

Your short-term and long-term strategies

The Wikipedia definition of a strategy is:

A high level plan to achieve one or more goals under conditions of uncertainty.

As you see, the strategy as to take into account your goals and your willingness to take risk.

Your strategy determines how you use your resources. Your main resources are your time, energy, and money. But there are many other resources — notably so your social network. A lot of people forget that.

Most (young) people are too focused on short-term strategies, because they want to make quick money.

But what they don’t realize is that most short-term strategies — especially those that have to do with making money — come with high risk. . .

. . . Meaning, you may end up with nothing.

That doesn’t mean short-term strategies are bad.

But it’s usually a bad idea to allocate all of your resources to a short-term strategy.

I prefer to spend most of my time on long-term strategies. This is a more sustainable approach to success. It ensures that I incrementally get a bit smarter, stronger, healthier; and that I associate with more intelligent and successful people as time goes by.

It’s more reliable to stick to a long-term strategy. But most people don’t do it because it’s less popular, less flashy, and it offers less ego-gratification. Another general truth about short-term strategies is that. . .

. . . They’re usually based on trends.

This is why lots of people:

Yo-yo diet

Invest in trendy businesses

Create websites full of affiliate links and ads

Finally, you need to figure out how to break down your strategies to a daily routine.

Your daily routine

When I saw the old man with the stroller I was probably seeing him during the hardest part of his daily routine.

And a daily routine should be hard — it should harden you.

It should bring you closer to your goals.

And your most ambitious goals should:

Stem from your model of the future

Involve an acceptable element of risk

Be based on your strengths

Be distilled down to short & long-term strategies for how to use your resources

Here’s. . .

How Your System Plays Into Your Decision-Making

Before I learn a thing, try something new, or start to consistently do a thing, I always think:

How do I incorporate this into my system?

Where does it fit in given my long-term goals?

Is this a short-term strategy to help me achieve some near-future milestone?

Or. . .

Is this a long-term strategy which I need to stick to indefinitely before seeing visible results?

As far as growth, long-term thinking, and improvement goes. . .

I think this way of doing things is becoming increasingly valuable for two reasons.

First, because of its cumulative effect as you grow older.

Second, because it’s not what the masses are doing.

And if everyone else is doing something you probably shouldn’t do it.

If everyone else wants to do something that means there’s a high demand.

And if everyone else can do something that means there’s a high supply.

This usually means there’s a low barrier of entry.

And if there’s a low barrier of entry, that means there’s going to be a lot of competition. And if there’s a lot of competition that means you can’t expect to make big profits and improve your status.

–And without those things you won’t be in a position of control and have the freedom to do as you wish.

This basic theory explains why there are a lot of people with shitty jobs in the public sector, a lot of people with shitty websites on the Internet, and a lot of semi-knowledgeable people regurgitating shitty information.

These things are the norm.

They’re average.

And you’ll inevitably be part of it unless you. . .

Create Your Own System for Success

Now. . .

. . . I don’t know how things will go for me over the next few months. I can’t predict what events will or won’t occur.

But I’m fine with that.

I can deal with that risk.

Because I have a lot of faith in my process, and where it’ll take me over the long-term.

My system-oriented approach may not grant me any overnight success. But it will grant me incremental improvement and harden me. Similar to coal being hardened over millennia while it’s pressed upon by its surroundings.

I don’t rely on luck or short-term thinking.

I don’t believe “tomorrow will be different” for me.

I know it won’t.

I don’t believe next year will be different for me either.

I know it will be.

Because I’m sticking to my system.

And you should too.

–And if you aren’t, why don’t you?

–And if you don’t have a system, create one.

The post Think Like an Investor: Create Your System appeared first on Startgainingmomentum.