An extremely powerful and manipulative cheerleader (Q3 2013 GDP growth was not +2.8%) - BEA GDP estimates are overestimated

Today’s 2.8% real GDP growth estimate from the BEA is absolutely meaningless. That fact did not stop the stock market from selling-off because of fears the Fed may take the QE3 punch bowl away. As much as I firmly believe the Fed should do exactly that, today’s BEA estimate of GDP was not a reason to expect QE3 to be taken away. (Don’t worry, tomorrow’s BLS report on employment for September is likely to be dismal enough to cause the same investors to rush back into the market out of hopes QE3 keeps going.)

The Bureau of Economic Analysis (the BEA) is a section of the Commerce Department. They’ve done a stunningly miserable and misleading job in their estimates of Q3 GDP from year 2000 through present. Since 2013 is still unfolding, we’ll focus on a discussion of Q3 GDP estimates from 2000 through 2012.

First, you must know the BEA provides three estimates of GDP in the months immediately following a quarter. They also periodically update previous year estimates, but no one pays attention to something that happened years ago. That’s too bad. Over the previous 13 years, the BEA has lowered the Q3 GDP estimate -from their initial estimate to their latest- by an average of nearly 0.9%. Considering the average GDP growth over the past 13 years has only been 1.8%, an ongoing average overstatement of GDP by 0.9% is monumentally misleading.

I’m going to break the data into two groups: the non-recession years, and the recession years. This is being done because of the clear distinction in how the BEA represents their estimates.

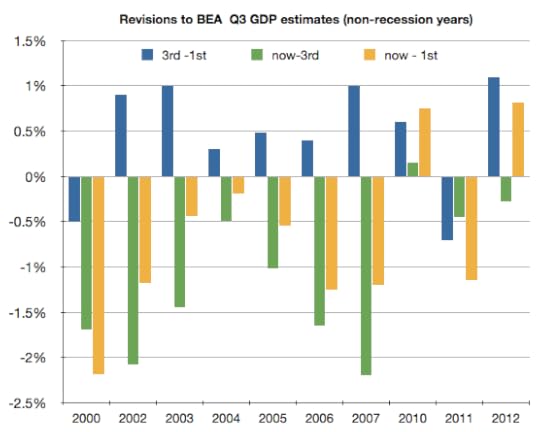

The non-recession years:

In the 10 years that did not experience recession:

80% of the time, the BEA raised their GDP estimate on the 3rd estimate vs 1st.

On average, the 3rd estimate was raised 0.46% from the first estimate (blue bars above). The BEA admits their first and second estimates are based on thin data representation and therefor suggests their 3rd estimate is more credible. Now some of you are going to think that’s OK, they had more data by the 3rd estimate and the economy was growing, so it makes sense they raised the GDP growth estimate. Hold that thought. It’s about to be torn to shreds….

The most recent estimate (now) of previous year GDP is based on the most complete set of information. So using the same logic as the previous assertion, recently revised GDP estimates for previous years should be higher still. They’re not. 90% of the time, the BEA lowered the GDP estimate from their third estimate.

The most recent estimates for these 10 years show an average drop of 1.12% from their 3rd estimate (green bars above), and 0.66% lower than their initial estimate (yellow bars above).

This sort of revision is nowhere near random! I’m sorry but if 80% of the time your 3rd guess is higher than your first, you’re probably trying to make things look better on the 3rd estimate. It is even more damning if 90% of the time you lower your estimate after the third one. Again, please keep in mind the BEA stresses that the third estimate is the one you should place the most faith in.

In the 3 years that did experience recession, the BEA did an even worse job. Their estimates were even more wrong and even more excessively optimistic:

All three years saw the 3rd estimate lowered vs their first estimate (blue bars above). The average was a lowering by 0.8%. Wow!

The average lowering from their 3rd estimate to their latest (green bars above) is 0.78%.

In sum, the BEA has lowered their Q3 GDP estimate by nearly 1.6% vs their first estimate.

The wrap up:

The BEA’s Q3 GDP estimates are nearly useless until years after the fact.

Their estimates are nearly always a considerable overstatement of GDP growth. 11 of the previous 13 years have seen the BEA lower their most recent GDP estimate from their first estimate. And the two years that were not lowered were 2012 and 2010. Maybe the BEA has not got around to lowering those two yet because they’re too close in memory and might scare someone.

When we’re in a year that experiences a recession, expect the BEA to slowly lower their GDP estimates. They put-off providing any estimates of large GDP drops until it’s undeniable. In 2008, it went like this:

1st est: -0.3%

2nd est: -0.5%

3rd est: -0.5%

years later: -2.0% !

Based on the past 13 years, when it’s all said and done, 2013 Q3 GDP growth is likely to end up:

around 2.1% provided we did not enter and stay in recession for more than 1 quarter this year OR

around 1.2% if we did enter /stay in recession for 2+ quarters (earlier this year). FYI: ECRI seems to think we flirted with recession earlier this year.

If you’re going to be this lousy at providing GDP estimates, why bother? Then again, if your job is to continually present an overoptimistic economic picture then lower it when no ones cares, I’d have to say mission accomplished. But is this what we’re paying for –an extremely powerful and manipulative cheerleader? Can’t we handle the truth?

( December 2007 was when the last recession began, but 11/12ths of 2007 was not in recession, so I’m counting 2007 in with the non recession group).