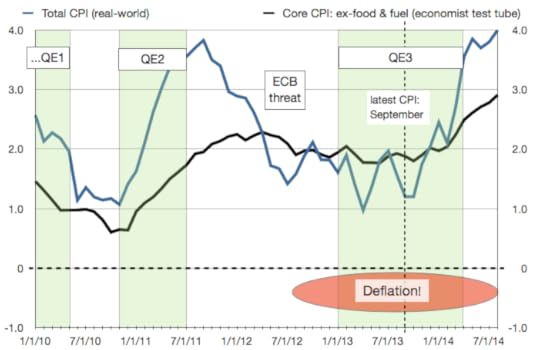

The latest CPI data was released from the BLS an hour ago. September showed benign inflation at the consumer level. It would appear the Fed’s got a green flag to continue QE until January –according to my inflation estimates.

But look at 2014. If the Fed keeps the brick on the gas pedal through April, real-world inflation is likely to reach 4% by next summer.

I don’t have a Ph. D. in economics, but I’m pretty sure 4% inflation will crush a consumer that remains laden in debt with no negotiating leverage for a pay raise.

The Fed is going to have to begin hinting that a QE taper is in the cards for 2014. Maybe not today. Perhaps in the December FOMC meeting. Lump of coal for Christmas?

Published on October 30, 2013 06:37