This is going to tick you off - stock market crash 2014

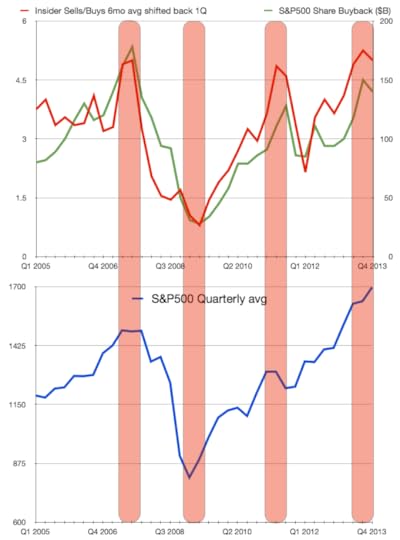

This chart is going to tick you off. The top half shows the pace of S&P500 share buy-backs (green), and the ratio of insider selling. To be more complete, the insider selling data is for the preceding 6 month period, and has been pushed back by 1 quarter. I’ll explain why I’ve done this after you take a look at the chart. The bottom half of the chart is the S&P500 quarterly average.

Observations:

Corporate executives use company money to buy shares at the most expensive times (buy high). They’re doing this in order to remove shares from the public float. In so doing, the earnings per share goes up –since there are fewer shares to distribute the earnings. This drives the stock price up.

Corporate executives sell their own personal shares before the market peaks but capture most of the upside (sell high). Also: when the S&P500 is tanking, they reduce their pace of selling dramatically –again in advance but still manage to time the trough very well.

As has been pointed out previously, insiders were panic selling in 2007 (at the top); in 2011 (before QE2 was switched off, causing the S&P500 to plummet nearly 20% during the summer before being stopped by yet more Fed & ECB intervention); and they’ve been panic selling this year at a sustained pace that exceeds every other point in time.

Among other things, this chart demonstrates that corporate executives are experts at turning shareholder money into their own personal money.

No wonder there has been a steadily increasing concentration of wealth among the top 1% of earners in the U.S. Perhaps it won’t surprise you -but it should disturb you- that the top 1% will earn approximately 24-25% of the pie this year — topping the previous all-time share seen in 1928-1929. Let’s see. I know 1929 is famous for something….

(The data for Q4 2013 was estimated. Obviously.)