Today’s relief rally / short covering rally was impressive. A new all-time high (1733) was set on the S&P500 (1729 was the previous all time peak). However, once the shorts have fully covered (are they done yet?), we’ll see how much buying support there is.

With a P/E (cyclically adjusted P/E) of 24.8, we are now 50% above the long term mean (and that’s 130+ years of data). The only times that saw higher P/Es were circled in red below.

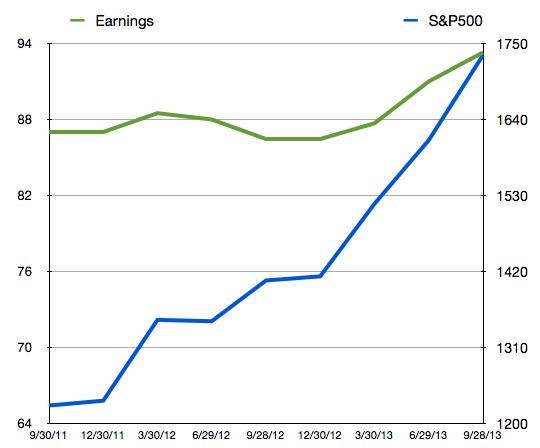

Some will argue this bubble can inflate further. Yes, it can. I don’t see earnings driving this though. Then again, 85% of the gains made on the S&P500 over the past 2 years have come from an expansion of the P/E multiple, not earnings. The hallmark of a hyped, frothy market.

If earnings aren’t going to drive the market higher, we’re left with sentiment (the greater fool theory). Perhaps faith in Fed QE will continue to drive the market higher. However, since QE is -according to the San Fran Fed- having virtually no impact, maybe the currently deployed QE will merely act as a brake that slows the collapse but fails to stop it.

According to the Greedometers, the final peak in the S&P500 should fall within 1% of the previous peak (it did in 2000 and 2007). That translates to 1711 – 1746. We’re certainly there.

Published on October 17, 2013 14:11