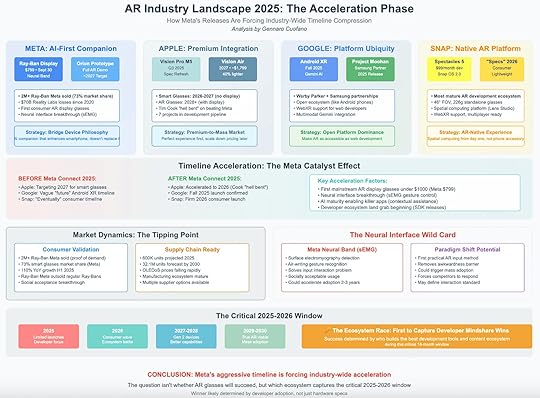

AR Industry 2025: The Meta Acceleration Effect

The augmented reality industry has lived in the shadow of “next year” promises for more than a decade. From Google Glass to Magic Leap to Snap Spectacles, the technology has cycled through hype and retreat, always postponed by missing hardware maturity, weak developer tools, or consumer indifference. That inertia broke in late 2025, when Meta’s aggressive moves compressed the entire industry timeline. What had been a slow burn toward 2027–2030 suddenly shifted into a high-stakes race defined by the 18-month window of 2025–2026.

The story is no longer whether AR glasses will succeed. The question is which ecosystem captures developer mindshare first—because in AR, as in mobile, platforms that win the developer race dominate the hardware cycle.

Meta: AI-First CompanionMeta has become the unexpected catalyst. Its Ray-Ban Meta glasses, priced at $799, proved that there is real consumer demand at scale. More than 2 million units sold, giving Meta an estimated 73% share of the smart-glasses market. For the first time, AR glasses outsold the company’s own non-smart Ray-Bans, signaling a cultural tipping point.

The strategy is not to replace the smartphone but to bridge it—positioning glasses as an AI companion. That framing reduces the adoption barrier: these are not fully immersive AR headsets, but familiar form factors enhanced with real-time AI assistance. Meta’s Orion prototype, scheduled for a full AR demo by 2027, represents the longer-term push, but its current success has already forced competitors to accelerate.

Apple: Premium IntegrationApple’s approach reflects its classic strategy: perfection before mass adoption. The Vision Pro remains the flagship, while the Vision Air ($1,799, ~40% lighter) pushes the product closer to mainstream usability. Smart glasses without a display are expected by 2026–2027, with full AR displays targeted for 2028 or later.

Apple’s integration advantage lies in its ecosystem. iOS, Apple Silicon, and a tightly controlled developer environment create the conditions for premium-to-mass scaling. The company’s delay is not technical incapacity but brand protection: Apple will not risk releasing an unfinished product. However, Meta’s acceleration pressures Apple to move earlier than Tim Cook may prefer.

Google: Platform UbiquityGoogle, burned by its premature Glass launch a decade ago, is taking a platform-dominance strategy. With Android XR launching in Fall 2025 and Project Moohan in 2026, Google is treating AR like the web—open, API-driven, and hardware-agnostic. Partnerships with Samsung and Warby Parker point to a mass-market ubiquity play: AR as a default extension of Android.

By positioning itself as the Windows of AR, Google doesn’t need to win hardware. It needs to make AR development as accessible as web development, ensuring that most apps run on Android XR first. If this succeeds, Google controls the middle layer of the stack, regardless of which hardware dominates.

Snap: Native AR PlatformWhile Meta, Apple, and Google balance hardware strategies, Snap plays to its strengths: software-native AR. Spectacles 5 and the forthcoming “Specs” 2026 are less about raw specs than about Snap’s developer ecosystem. With Lens Studio and WebXR support, Snap has cultivated one of the most mature AR creation communities.

Snap’s strategy is to define AR as a content platform from day one, not as a smartphone accessory. If it can capture creator mindshare and consumer culture, Snap could carve out the TikTok-of-AR position, even without dominating hardware sales.

Timeline Compression: The Meta CatalystBefore Meta Connect 2025, industry timelines looked conservative. Apple aimed at 2027. Google and Snap were vague. After Meta’s announcements:

Apple accelerated to 2026.Google confirmed a 2025 launch.Snap committed to a 2026 consumer wave.Three factors explain this sudden compression:

Affordable hardware breakthrough: Glasses under $1,000 with credible functionality.Neural interface leap: Surface electromyography (sEMG) enables wrist-based gesture control, solving the input problem that doomed earlier attempts.AI maturity: Contextual assistance apps make glasses useful from day one, creating a reason to wear them.The Neural Interface Wild CardThe biggest unknown is the neural interface. Meta’s sEMG band, capable of detecting micro-muscle signals for precise gesture recognition, could be the equivalent of the iPhone’s multitouch moment.

If socially acceptable and reliable, this interface removes the biggest friction in AR: input awkwardness. No waving hands in public, no clumsy voice commands. A subtle wristband becomes the gateway.

If successful, neural input could accelerate mass adoption by 2–3 years, forcing every competitor to follow Meta’s standard. If it fails, AR risks another cycle of half-solutions.

Market Dynamics: Tipping PointsTwo tipping points are converging:

Consumer Validation: Meta’s Ray-Ban sales prove mainstream demand. For the first time, AR glasses outsold comparable non-AR products.Supply Chain Readiness: With OLED microdisplays scaling, 600k units projected for 2025, and costs falling, the ecosystem can support volume.This combination of cultural acceptance and supply maturity echoes the smartphone inflection point of 2007–2009.

The Critical 2025–2026 WindowThe next 18 months will determine the industry’s trajectory. By 2027, the market will either have:

Ecosystem leaders with developer lock-in, driving Gen 2 devices with better capabilities.Or a fragmented market where no player dominates, delaying true AR adoption until 2029–2030.The outcome hinges not on specs but on developer tools and ecosystems. The company that wins developer mindshare by 2026 will define the AR economy for the next decade.

Conclusion: The Acceleration EconomyMeta’s aggressive push has forced the industry out of delay mode. The timelines are no longer 2030-plus—they are 2025–2026. The real competition is not hardware specs but ecosystem capture.

The decisive factor is simple: who builds the best development tools and captures developer loyalty first?

AR’s success or failure is no longer about whether consumers want glasses. That question has been answered. The real battle is whether developers build for Meta, Apple, Google, or Snap—and whether neural interfaces unlock the interaction model that makes AR inevitable.

The clock is ticking. The window is narrow. The acceleration has begun.

The post AR Industry 2025: The Meta Acceleration Effect appeared first on FourWeekMBA.