The Snap Factor: The Scrappy Underdog’s Advantage

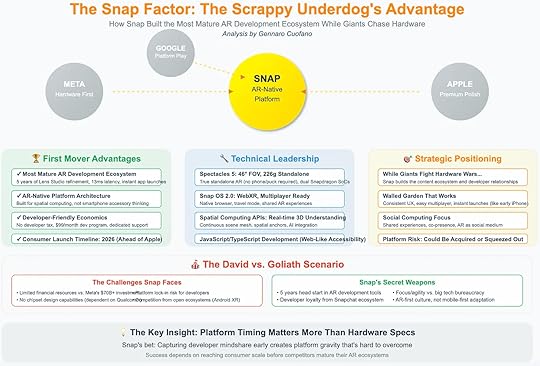

When the AR wars are written into history, the spotlight will naturally fall on the giants—Meta, Apple, and Google. Billions in investment, proprietary silicon, and integrated ecosystems make them appear unstoppable. Yet hidden in plain sight is a scrappy underdog that has been quietly building the most mature AR development ecosystem in the industry: Snap.

While the tech titans fight expensive hardware wars, Snap has focused on cultivating a developer-first AR platform. This strategic bet—prioritizing ecosystem gravity over hardware supremacy—may prove decisive in the years ahead.

First Mover AdvantagesSnap’s greatest strength lies in its five-year head start. Lens Studio, refined since 2018, has evolved into the most mature AR development environment on the market. Developers have spent years experimenting, iterating, and launching AR applications on Snapchat’s ecosystem. By 2025, Snap had achieved instant app launches with latency as low as 13 milliseconds—a technical feat that ensures AR feels native, not experimental.

This maturity translates into developer trust. While Meta and Apple are still convincing developers to build for their platforms, Snap already commands loyalty from thousands of AR creators worldwide.

Snap also avoided the strategic trap of treating AR as a smartphone accessory. From the beginning, it built an AR-native platform architecture, with tools designed for spatial computing rather than mobile add-ons. That decision positions Snap to move seamlessly into a future where AR isn’t an app feature—it is the operating environment itself.

Economically, Snap keeps developers happy by eliminating punitive costs. Instead of charging developer taxes like Apple’s App Store or platform fees like Meta, Snap offers a $99 monthly developer program with dedicated support. For early-stage developers, this predictability makes Snap the most accessible on-ramp into AR.

Finally, Snap’s consumer launch timeline—2026—puts it ahead of Apple and competitive with Meta. Unlike Apple’s premium-first approach, Snap’s goal is to democratize AR, appealing to younger audiences and grassroots adoption.

Technical LeadershipDespite being smaller than its rivals, Snap has made surprising technical strides.

Spectacles 5: Featuring a 46° field of view and weighing just 226 grams, Snap’s standalone glasses run on dual Snapdragon SoCs. Unlike previous versions, no phone or puck is required. This creates a self-contained AR experience—a critical leap toward mainstream usability.Snap OS 2.0: With WebXR support and multiplayer readiness, the operating system supports native browsers, travel modes, and shared AR environments. The addition of a web-like API model ensures developer accessibility.Spatial Computing APIs: Snap has built real-time 3D understanding capabilities, enabling scene mapping, anchors, and AI integration. This creates the technical scaffolding for AR-native applications beyond filters and lenses.JavaScript/TypeScript Development: By using familiar languages, Snap reduces friction for millions of developers. The choice mirrors the strategy of the early web: make development accessible, not elitist.Together, these innovations mean Snap’s platform isn’t an experiment—it’s already a functional ecosystem for AR-native experiences.

Strategic PositioningWhere the giants chase hardware polish and ecosystem lock-in, Snap is playing a different game: build the ecosystem before the hardware matures.

While giants fight hardware wars… Snap builds relationships with developers and creators. By the time Apple and Meta finalize their hardware, Snap will already have an entrenched ecosystem.Walled garden that works: Snap’s approach mirrors Apple’s early iPhone era—a tightly controlled environment delivering consistent UX, fast multiplayer, and instant launches. For AR, where latency kills immersion, this trade-off makes sense.Social computing focus: Snap views AR not as productivity software or luxury devices but as a social medium. Shared experiences, co-presence, and community engagement make AR playful, viral, and sticky.Platform risk: The obvious downside is Snap’s vulnerability. With limited financial resources compared to Meta’s $70B+ investment in Reality Labs, Snap could be acquired, squeezed out by Android XR, or marginalized by hardware-dominant players.Still, Snap’s agility is its secret weapon. Free from bureaucratic weight, Snap can move faster, adapt quicker, and take risks the giants would never consider.

The David vs. Goliath ScenarioSnap’s position is precarious yet promising. On one side, it faces existential risks:

Financial limits: Competing with trillion-dollar companies is inherently unequal.Chipset dependency: Without proprietary silicon, Snap relies on Qualcomm and others, reducing control.Platform lock-in: Developers tempted by Meta’s subsidies or Apple’s lucrative App Store could defect.Yet Snap has two secret weapons:

A five-year lead in AR development tools. No competitor can erase the accumulated knowledge and loyalty built within Lens Studio.A cultural alignment with its audience. Snap doesn’t need to “teach” users how to use AR. Its Gen Z user base is already fluent in lenses, filters, and spatial content.This combination gives Snap a chance to punch above its weight, even in a market dominated by Goliaths.

Platform Timing Matters More Than SpecsThe key insight driving Snap’s strategy is simple: in AR, platform timing trumps hardware specs.

Hardware will inevitably improve across the board. Field of view, weight, battery life—all players will converge on acceptable baselines by 2027.What will not converge is developer gravity. Ecosystems that capture developers first create self-reinforcing loops: more apps attract more users, which attract more developers.This is the exact dynamic that made Apple’s App Store dominant in mobile, even though Android outsold the iPhone in hardware volume. Snap is betting that the same principle applies in AR—capture developer mindshare early, and platform gravity will do the rest.

Conclusion: Snap’s BetSnap is not trying to outspend Meta or out-polish Apple. Instead, it is betting on ecosystem gravity. By building the most mature AR development environment, prioritizing accessibility, and focusing on AR as a social medium, Snap positions itself as the underdog with asymmetric potential.

The risk is existential. Without deep financial backing, Snap could be acquired or squeezed out. But if it holds its ground through 2026, it could emerge as the AR-native platform of choice, not because of superior hardware, but because it captured developer mindshare before the giants fully arrived.

In the end, AR history may remember Snap not as the company that built the flashiest glasses, but as the one that built the ecosystem foundation that made AR a cultural reality.

The post The Snap Factor: The Scrappy Underdog’s Advantage appeared first on FourWeekMBA.