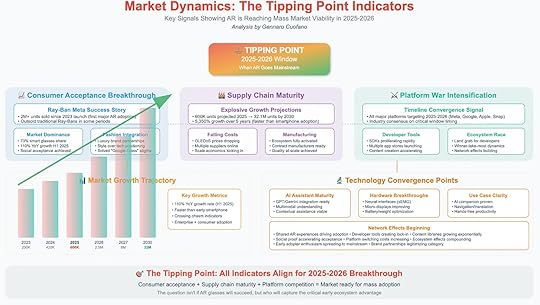

Market Dynamics: The Tipping Point Indicators

Every transformative technology crosses a moment where isolated advances and early adoption converge into inevitability. For augmented reality, that moment is arriving in 2025–2026. After years of cautious progress, false starts, and niche adoption, AR is now hitting the conditions that signal mass market viability. The tipping point isn’t speculative—it is visible in consumer acceptance, supply chain maturity, platform intensification, and technology convergence.

Meta’s Ray-Ban story has been the proof-of-demand case study, but this is no longer about one company. Instead, all indicators point to the same critical window: AR will go mainstream not through a single product launch, but through the alignment of consumer readiness, industrial capability, and competitive acceleration.

Consumer Acceptance BreakthroughThe biggest question for AR has never been technical feasibility—it has been social acceptability. Google Glass in 2013 failed not because it lacked vision, but because it misread culture. Clunky design, privacy concerns, and social stigma doomed it.

Meta’s Ray-Ban partnership flipped the script. By embedding AR into a fashion brand with cultural cachet, Meta solved the stigma problem. Two million units sold since 2023 created the first real mass adoption event in AR’s history. The glasses outsold traditional Ray-Bans in some periods, showing that consumers weren’t just tolerating the devices—they were choosing them.

Market dominance followed: Meta captured 73% of the smart glasses market, posting 110% year-over-year growth in H1 2025. These numbers mirror the adoption curve of early smartphones and signal the critical psychological shift: AR has crossed into cultural normalcy. Consumers no longer see AR glasses as futuristic experiments; they see them as lifestyle accessories.

Fashion integration is the silent driver here. Partnerships with luxury brands turned AR into a style decision before it became a tech decision. That inversion—style first, tech second—was the key to breaking through.

Supply Chain MaturityHardware adoption doesn’t scale without supply chain readiness. For AR, the economics of displays and optics have always been the constraint. In 2025, that constraint is breaking.

Explosive Growth Projections: 600,000 units projected for 2025, scaling to 32.1 million by 2030. This represents over 5,000% growth in five years, outpacing the early trajectory of smartphones.Falling Costs: OLED and microdisplay prices are dropping, multiple suppliers are online, and scale economics are kicking in. Hardware components once exotic are becoming commoditized.Manufacturing Ecosystem: Contract manufacturers are fully activated. Quality and scale have been achieved, meaning AR glasses can now be produced with the same industrial rhythm as smartphones.This is the inflection point supply chains always bring. What was once scarce becomes abundant, what was expensive becomes cheap, and what was niche becomes mainstream. Supply chain maturity means AR hardware can now ride the same wave of cost curves that fueled the explosion of mobile.

Platform War IntensificationConsumer acceptance and supply chain maturity are necessary, but they are not sufficient. The final spark comes from competitive intensity—and in AR, the platform war is now fully ignited.

Timeline Convergence: All major platforms—Meta, Google, Apple, Snap—are now targeting 2025–2026. Industry consensus has formed around this adoption window.Developer Tools: SDKs are proliferating. Multiple app stores are launching. Content creation is accelerating, ensuring that consumers will find utility when they unbox devices.Ecosystem Race: Platforms are fighting for developer loyalty, and network effects are beginning to build. Just as the iOS App Store locked in the iPhone’s dominance, the AR platform that secures developer gravity in 2025–2026 will dictate the decade ahead.Winner-take-most dynamics dominate platform wars. Developers don’t want to build for five platforms—they want to build for the one where users are. This convergence creates urgency and forces acceleration. Meta’s early push triggered the race, but now all players are locked in.

Technology Convergence PointsWhile acceptance, supply, and competition set the stage, technology convergence provides the final confirmation that AR is ready for mass adoption.

AI Assistant Maturity: GPT and Gemini-class models have proven multimodal understanding. Contextual assistance—navigation, translation, task automation—is now viable. AR glasses are no longer dumb displays; they are intelligent companions.Hardware Breakthroughs: Neural interfaces (sEMG), micro-display improvements, and battery-weight optimization have solved critical friction points. Devices are lighter, more usable, and socially acceptable.Use Case Clarity: The killer apps are becoming obvious: AI companions, navigation, translation, and hands-free productivity. Consumers no longer ask, “Why do I need AR glasses?” The value proposition is self-explanatory.Network Effects: Shared AR experiences are driving adoption. Social applications, multiplayer AR, and developer-created lock-in mechanisms are creating compounding momentum.The convergence of AI and AR is particularly transformative. AR without intelligence was always limited to overlaying information. AR with agentic AI becomes a different category altogether: proactive, adaptive, and personalized.

The Market Growth TrajectoryThe indicators translate into numbers that tell their own story:

2023: 200,000 units2024: 420,000 units2025: 600,000 units (tipping point year begins)2026: 2.5 million units (crossing the chasm)2027: 8 million units2030: 32 million units projectedThis trajectory represents not just growth, but acceleration. AR adoption is now expanding faster than the early smartphone market did—a sign of compressed timelines and stronger network effects.

The Tipping Point: 2025–2026All these factors align in the same critical window.

Consumer acceptance has been achieved.Supply chains are mature and ready to scale.Platform wars are intensifying, forcing accelerated launches.Technology convergence points are removing friction and clarifying use cases.The conclusion is unavoidable: 2025–2026 is the tipping point when AR crosses into mainstream adoption.

The question is no longer whether AR glasses will succeed—it is which ecosystem will capture the critical early developer and consumer loyalty.

Conclusion: The Ecosystem AdvantageWhen all indicators align, the question of adoption becomes inevitable. What remains uncertain is leadership.

Meta has the advantage of consumer validation and developer momentum. Apple has the brand power to dictate demand once its products land. Google can leverage Android ubiquity, while Snap bets on cultural edge and developer intimacy.

But regardless of who wins, the tipping point is here. AR is no longer a promise—it is a market. The 2025–2026 window will decide not just which devices succeed, but which ecosystems define the next decade of computing.

The future of AR isn’t in doubt. Only its winners are.

The post Market Dynamics: The Tipping Point Indicators appeared first on FourWeekMBA.