The Current Inflection Point in AI

The Context: Four Layers, One Market Confusion

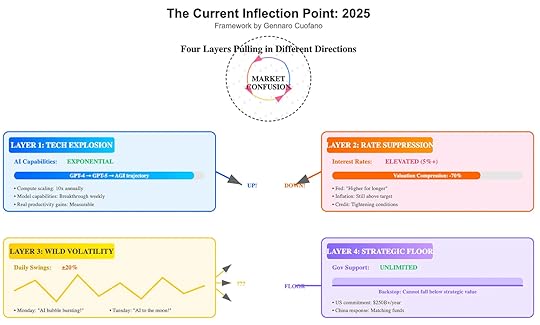

The Context: Four Layers, One Market ConfusionThe year 2025 marks an inflection point for technology and markets. We’re in a rare moment where four structural layers are pulling in opposite directions:

Exponential tech growth pushing valuations upward.Rate suppression compressing valuations downward.Volatility cycles creating daily chaos.Strategic floors holding up sectors deemed too critical to fail.The result? Market confusion. Investors, operators, and policymakers alike are caught in the crossfire between technological inevitability and financial headwinds.

Layer 1: The Tech ExplosionAt the core, AI capabilities are compounding exponentially.

Compute scales 10x annually.Breakthroughs arrive weekly.Productivity gains are measurable across industries.The trajectory from GPT-4 to GPT-5 to AGI-like systems is not theoretical. It’s unfolding in real time, reshaping workflows, industries, and expectations.

On pure technology fundamentals, valuations should be screaming upward. But markets rarely price pure reality — they price through filters.

Layer 2: Rate SuppressionThe first distorting filter is the interest rate regime.

Fed policy remains “higher for longer.”Rates sit above 5%.Inflation, though cooled, is still above target.Credit conditions are tightening.At these levels, the present value of future cash flows is crushed. High-duration assets like AI startups, robotics firms, and cloud infrastructure are repriced down 70% or more.

This creates the paradox: just as AI breakthroughs accelerate, valuations are mechanically compressed by monetary policy.

The market sees “AI miracles” on the ground but “AI bubbles” on the charts.

Layer 3: Wild VolatilityBetween exponential progress and rate suppression lies a layer of chaos: market volatility.

Daily swings of ±20% are becoming common.

Monday: Headlines scream “AI bubble bursting!”Tuesday: Narratives flip to “AI to the moon!”This isn’t random noise. It’s the clash between short-term narrative cycles and long-term technological certainty. Traders chase momentum, while institutions struggle to form conviction in the face of such violent reversals.

Volatility amplifies confusion. Instead of pricing fundamentals, markets oscillate between euphoria and despair.

Layer 4: The Strategic FloorThen comes the fourth layer: geopolitical necessity.

Governments cannot allow strategic technologies to collapse, regardless of market cycles.

The U.S. has committed $250B+ per year in direct and indirect AI, semiconductor, and infrastructure support.China is matching with equivalent funds.Europe, Japan, and the Middle East are following with sovereign commitments.This creates a strategic floor. No matter how much rates compress valuations, there is a level below which capital will not allow critical industries to fall.

AI is no longer just a market sector. It’s a matter of national competitiveness and security.

The Market ConfusionWhen all four forces interact, the outcome is not clarity but confusion.

Tech Explosion: Pushes valuations up.Rate Suppression: Forces valuations down.Volatility: Masks long-term trends with short-term noise.Strategic Floors: Prevents full collapse, holding valuations artificially high.Investors face a reality where price signals are broken. Markets no longer reflect the underlying trajectory of technology. They reflect the tug-of-war between exponential innovation, financial compression, speculative volatility, and geopolitical override.

Why 2025 Is DifferentThis is not another dot-com bubble. The technology is real, deployed, and scaling. Productivity effects are visible across software engineering, design, healthcare, logistics, and education.

But the financial environment is the opposite of the 1990s. Instead of low inflation, falling rates, and globalization, we have sticky inflation, high rates, and geopolitical fragmentation.

The inflection point of 2025 is defined by this contradiction:

The fastest technological acceleration in history.The tightest financial conditions in a generation.Strategic ImplicationsFor InvestorsTraditional valuation models break down.Short-term multiples are distorted by rates, not fundamentals.Long-term conviction requires a thesis on policy floors, not just cash flows.For OperatorsExecution matters more than timing markets.Focus on productivity gains that show resilience under high-rate regimes.Align with government-backed programs to secure funding immunity.For PolicymakersRate hikes aimed at inflation suppression risk slowing the very innovations needed for long-term productivity.Strategic overrides will increasingly conflict with monetary orthodoxy.Coordination between Fed policy and industrial strategy becomes essential.The Road AheadThe “current inflection point” is not about choosing between optimism or pessimism. It’s about recognizing layered contradictions.

Tech will not slow down.Rates will not drop quickly.Volatility will not disappear.Governments will not step back.Navigating 2025 requires embracing this complexity: markets can remain confused while technology advances unstoppably.

Closing ThoughtThe great mistake of 2025 will be assuming the market is telling the truth about technology. It isn’t.

Markets are mirrors distorted by rates, narratives, and geopolitics. The real signal is in the ground truth of exponential progress and government commitment.

The inflection point of 2025 is not the bursting of a bubble. It is the moment when financial gravity collides with technological inevitability.

The post The Current Inflection Point in AI appeared first on FourWeekMBA.