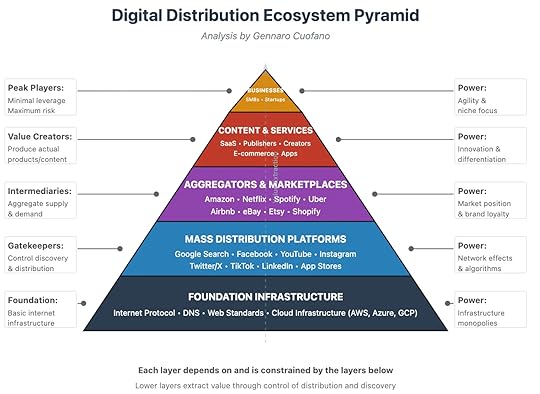

The Digital Distribution Ecosystem Pyramid

How Value and Power Flow in the Online Economy

Framework by Gennaro Cuofano, The Business Engineer

The internet economy isn’t flat—it’s structured like a pyramid of dependency. At the base are the protocols and infrastructure that make the web function. At the top sit businesses, creators, and startups trying to capture customer attention.

The pyramid shows a hard truth: value flows upward, but power concentrates downward. Each layer extracts value from the one above it through control of infrastructure, discovery, and distribution.

Layer 1: Foundation InfrastructureAt the bottom is the plumbing of the internet.

Internet Protocol, DNS, and web standards.Cloud infrastructure from AWS, Azure, and GCP.This layer doesn’t create consumer experiences but controls the conditions for everything else. Infrastructure monopolies like Amazon Web Services or Microsoft Azure can dictate terms because businesses literally can’t function without them.

Power: Infrastructure monopolies.

Layer 2: Mass Distribution PlatformsOn top of the foundation sit the distribution giants:

Search (Google)Social (Facebook, Instagram, TikTok, Twitter/X, LinkedIn)Video (YouTube)App stores (Apple, Google Play)These companies control discovery, recommendation algorithms, and traffic flows. They decide who gets visibility. Their weapon is scale: network effects, algorithmic feeds, and monopolistic control over attention.

Power: Network effects and algorithms.

Layer 3: Aggregators & MarketplacesNext are the demand aggregators—platforms that bring together buyers and sellers at scale:

Amazon for retail.Netflix and Spotify for content.Uber and Airbnb for services.Etsy, Shopify, eBay for niche commerce.Their strength lies in brand loyalty and market position. Once consumers habitually search Amazon before Google for products, Amazon captures the higher-margin position in the stack.

Power: Market position and brand loyalty.

Layer 4: Content & ServicesAbove aggregators are the actual producers:

SaaS providers.Publishers.Creators.E-commerce apps.This is where innovation and differentiation happen. But content providers remain dependent on the layers below for distribution. Publishers live and die by Google search rankings. Creators depend on TikTok’s algorithm. SaaS companies rely on cloud infrastructure.

Power: Innovation and differentiation.

Layer 5: BusinessesAt the very top are businesses—SMBs and startups—trying to build brands, products, and customer relationships.

These peak players carry maximum risk and minimal leverage. They rely on infrastructure, platforms, and aggregators for everything from hosting to traffic to payments. One algorithm change or fee increase can destroy their economics overnight.

Power: Agility and niche focus—but fragile.

The Dependency FlowThe pyramid makes one principle clear:

A Shopify merchant depends on Shopify (aggregator), which depends on Google Ads (distribution), which depends on AWS (infrastructure).A SaaS startup depends on Azure cloud hosting, relies on LinkedIn ads for customer acquisition, and must navigate Apple or Google app store rules if mobile-first.Each layer depends on and is constrained by the layers below.

At every stage, control sits below value creation.

Why Lower Layers Extract MoreThe bottom layers operate like toll roads. They don’t need to innovate at the same pace as the upper layers because they control gateways.

Google doesn’t need to make the best content—it just needs to control how content is found.AWS doesn’t need to build consumer apps—it just needs to make itself indispensable as the computational substrate.The higher you go, the more creative freedom you have—but the less leverage you hold.

Implications for BusinessesFragile Positioning at the TopSMBs and startups innovate, but they’re easily crushed by changes at lower layers.Example: publishers wiped out by Google’s algorithm updates or Facebook’s pivot to video.Aggregator CaptureMarketplaces like Amazon capture consumer demand and commoditize suppliers.Sellers innovate on product, but aggregators capture the brand relationship.Platform RiskContent and services depend on the whims of app stores or search ranking systems.Building on “rented land” remains the biggest strategic risk.Strategic Escape RoutesIf you’re building at the top of the pyramid, survival requires mitigating dependency.

Own distribution: Build direct channels—email lists, communities, first-party data.Leverage multi-platform presence: Don’t rely on a single gatekeeper for traffic.Move down the stack: Some companies escape fragility by building infrastructure themselves. Shopify started as a SaaS product but expanded into payments, logistics, and infrastructure.The further down the pyramid you move, the more control you gain—but the higher the capital requirements.

The Pyramid in the AI EraAI reshuffles the pyramid but doesn’t erase it.

Foundation: Now includes GPUs (NVIDIA), foundation models (OpenAI, Anthropic), and cloud AI services.Distribution: Conversational agents and AI interfaces (ChatGPT, Gemini, Copilot) may replace search boxes.Aggregators: AI-native marketplaces will form around data, models, and vertical agents.Content: AI-generated services flood the layer, increasing dependence on distribution filters.Businesses: Must learn to design for AI visibility, not just SEO or app store rankings.AI shifts the battleground but keeps the pyramid intact: power remains with whoever controls the bottom layers.

Closing ThoughtThe Digital Distribution Ecosystem Pyramid is more than a static diagram—it’s a lens to understand where power concentrates and where fragility lies.

If you’re building at the top, agility is your weapon, but dependency is your weakness. The enduring lesson:

Value may flow upward, but control always flows downward.

The post The Digital Distribution Ecosystem Pyramid appeared first on FourWeekMBA.