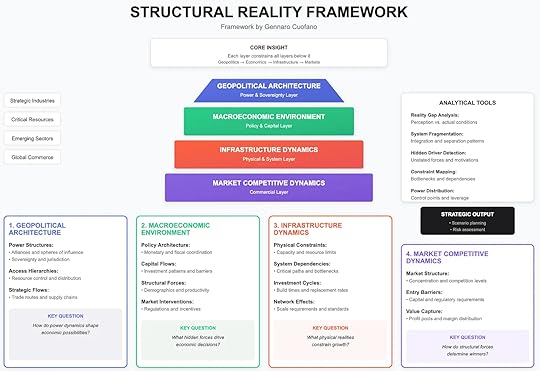

The Structural Reality Framework

Markets never move in isolation. They are the final expression of deeper structural forces—forces that are rarely visible in quarterly earnings calls, policy briefings, or product roadmaps. The Structural Reality Framework offers a way to analyze these layers systematically, exposing how power, policy, infrastructure, and competition interact to shape outcomes.

At its core, the framework rests on a simple but profound insight: each layer constrains all layers above it.

Geopolitics constrains economics.Economics constrains infrastructure.Infrastructure constrains markets.This is why understanding markets requires starting from the bottom.

1. Geopolitical Architecture: The Sovereignty LayerThe deepest layer is geopolitics—the architecture of power and sovereignty.

Here, what matters are:

Power structures: alliances, spheres of influence, and great-power competition.Access hierarchies: who controls resources, supply chains, and distribution routes.Strategic flows: the trade corridors and chokepoints that determine resilience.The key question at this level is:

How do power dynamics shape economic possibilities?

When the U.S. restricts semiconductor exports to China, it isn’t just a trade move—it resets the boundaries of what is economically possible for entire industries. Similarly, when the Red Sea or South China Sea become contested, the flow of goods becomes a structural constraint, not a logistical hiccup.

Markets cannot transcend geopolitics. They operate within it.

2. Macroeconomic Environment: The Capital LayerOn top of geopolitics sits the macroeconomic environment—the world of policy and capital.

Its drivers include:

Policy architecture: coordination between monetary and fiscal levers.Capital flows: where investment moves, and what barriers it faces.Structural forces: demographics, productivity, and technological diffusion.Market interventions: regulation, incentives, and industrial policy.The key question here is:

What hidden forces drive economic decisions?

For example, a demographic collapse in advanced economies isn’t a short-term market event—it drives labor shortages, changes savings patterns, and forces immigration debates. Similarly, sovereign wealth funds in the Gulf don’t just allocate capital; they tilt the playing field by deciding which technologies and sectors scale.

Capital, like water, flows where it is allowed—and where it is pushed.

3. Infrastructure Dynamics: The Physical LayerBeneath every market outcome lie the hard realities of infrastructure.

This layer is defined by:

Physical constraints: the limits of energy, compute, land, or bandwidth.System dependencies: chokepoints in supply chains and industrial clusters.Investment cycles: build times, replacement rates, and depreciation schedules.Network effects: standards, interoperability, and adoption flywheels.The key question is:

What physical realities constrain growth?

This is where structural optimism often collapses. You cannot scale AI without GPUs, gigawatts of power, and gigaliters of water. You cannot expand manufacturing without overcoming permitting timelines, grid access, and labor bottlenecks.

Markets ignore infrastructure until they run into it. By then, it is often too late.

4. Market Competitive Dynamics: The Commercial LayerAt the top of the pyramid sits what most analysts focus on: market competition.

Here, the questions are tactical:

Market structure: How concentrated is the sector?Entry barriers: What capital or regulatory hurdles exist?Value capture: Who controls the profit pools, and where do margins flow?The key question is:

How do structural forces determine winners?

Take AI. At the commercial layer, the discussion is about OpenAI vs. Anthropic vs. Google. But at the infrastructure layer, the reality is about NVIDIA’s GPU chokehold. And at the macroeconomic layer, it’s about U.S. industrial policy subsidizing semiconductor fabs. At the geopolitical layer, it’s about U.S. export controls preventing China from closing the gap.

Seen this way, the market fight is not just about models—it is about structures cascading down.

Analytical ToolsThe framework isn’t just descriptive. It provides analytical tools for interrogating reality:

Reality Gap Analysis: Where do narratives diverge from structural conditions?System Fragmentation: Which systems are integrating, which are decoupling?Hidden Driver Detection: What unstated motivations force actors’ hands?Constraint Mapping: Where are the bottlenecks? Who controls them?Power Distribution: Who sits at the levers of control?These tools move analysis away from surface explanations and toward causal depth.

Strategic OutputThe goal is not theory. It is action.

By applying the Structural Reality Framework, operators, investors, and policymakers can produce:

Scenario planning: plausible futures anchored in structural forces.Risk assessment: exposure maps that reveal where vulnerabilities really lie.For instance, a company betting on European AI growth cannot just look at user adoption. It must ask:

What is the EU’s energy mix (infrastructure layer)?How do EU capital markets treat growth risk (macroeconomic layer)?What geopolitical dependencies exist with U.S. and China (geopolitical layer)?Only then can market strategy make sense.

The Core InsightThe core insight of the Structural Reality Framework is simple:

Markets are the surface expression of deeper realities.

Analysts who start at the top (competition) often confuse symptoms for causes.Analysts who start at the bottom (geopolitics, macroeconomics, infrastructure) see the constraints that define what markets can and cannot do.This is why structural analysis outperforms tactical commentary. It reveals not just what is happening, but what must happen.

Conclusion: Seeing Through the LayersThe Structural Reality Framework forces a change in perspective. Instead of asking, “Who will win?” it asks, “What structures make winning possible?”

Geopolitics sets the outer boundaries.Macroeconomics directs the flow of capital.Infrastructure dictates the pace of growth.Markets allocate what’s left.The mistake is to see markets as free-floating contests. They are not. They are constrained by deeper forces.

In strategy, the advantage goes to those who see through the layers.

The post The Structural Reality Framework appeared first on FourWeekMBA.