Geopolitical Architecture: The Power Layer of Markets

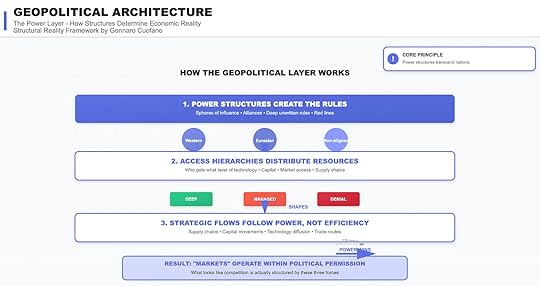

Most market commentary begins at the wrong end. Analysts obsess over competitive dynamics or regulatory changes without asking the deeper question: what structures make those dynamics possible in the first place? The geopolitical architecture is that foundation. It is the layer of power that sets the rules, distributes access, and determines which flows of capital, technology, and resources are even possible.

The core principle is stark: power structures transcend nations. Markets, companies, and even states operate within invisible but rigid boundaries of political permission.

1. Power Structures Create the RulesAt the highest level, power is rule-setting.

These rules are not always codified in treaties or trade agreements. More often, they are:

Spheres of influence: regions where one bloc’s security umbrella dominates.Alliances: formal and informal pacts that shape flows of capital and technology.Unwritten rules: red lines that everyone understands but few articulate.Today, three broad blocs structure the global order:

Western: U.S.-led alliances, NATO, dollar hegemony.Eurasian: China-centric networks, BRICS+ expansion, yuan settlement systems.Non-Aligned: States hedging between the two, extracting concessions while trying to avoid entrapment.Markets behave differently inside each bloc. A startup in California, a chip fab in Taiwan, and a refinery in the Gulf are not just businesses—they are assets embedded in power structures that decide their fates when crises erupt.

Key insight: competition is not free. It is bounded by who sets the rules of the game.

2. Access Hierarchies Distribute ResourcesOnce rules are established, power manifests through access hierarchies.

This is the real mechanism of geopolitical influence: deciding who gets what level of technology, capital, and market access.

Three tiers dominate:

Deep access – Allies and close partners receive privileged entry to advanced technologies, capital markets, and supply chain integration. Example: Japan and South Korea inside the U.S. semiconductor alliance.Managed access – Middle-tier states are allowed selective integration but under strict conditions. Example: India gaining access to Western defense tech while facing restrictions on dual-use AI.Denial – Strategic adversaries are excluded from critical flows altogether. Example: China’s exclusion from cutting-edge GPUs and lithography systems.This hierarchy shapes the contours of globalization. The naive story says markets allocate resources efficiently. The structural reality says: markets allocate resources politically.

Efficiency does not win. Power does.

3. Strategic Flows Follow Power, Not EfficiencyThe third mechanism is control over flows—the arteries of the global economy.

Supply chains are not just logistics—they are power tools. Chokepoints in rare earths, lithium, and semiconductors are deliberately cultivated.Capital movements follow sanction regimes and reserve currency dominance. A sovereign wealth fund in Riyadh may prefer dollar-denominated assets not out of efficiency, but because the dollar still anchors the global system.Technology diffusion is tightly controlled. Export licenses, security reviews, and joint-venture restrictions dictate who can climb the technology ladder.Trade routes become geopolitical flashpoints. The South China Sea, the Strait of Hormuz, and the Arctic passages are not just shipping lanes—they are strategic levers.The myth of globalization was that supply chains follow efficiency. The reality is that strategic flows follow permission.

4. Markets Operate Within Political PermissionThe outcome of these three forces—rule-setting, access hierarchies, and flow control—is simple but easily forgotten:

Markets operate within political permission.

What looks like open competition between firms is structured competition inside power boundaries. A company may out-innovate its rival but still lose access to markets, inputs, or capital because of political decisions. Conversely, firms with state backing may survive despite inefficiency.

Examples abound:

Huawei, cut off from advanced semiconductors, cannot compete on efficiency alone.ASML, monopolist in EUV lithography, is constrained by Dutch and U.S. export policies.Gulf energy producers, despite efficiency, remain structurally dependent on maritime chokepoints protected by the U.S. Navy.The deeper truth: efficiency is secondary to permission.

The Core Principle RevisitedTo understand markets at the surface, one must begin at the geopolitical base.

Power structures set the game.Access hierarchies distribute the spoils.Flows obey power, not efficiency.Thus, when investors or strategists talk about “market forces,” they are often mistaking symptoms for causes. The true drivers are structural, geopolitical, and deeply embedded in the architecture of power.

Strategic ImplicationsFor operators, investors, and policymakers, the implications are profound:

Market entry is political. Every new market opportunity requires permission, explicit or implicit, from the ruling power bloc.Supply chains are sovereignty chains. They reveal not just economic dependence but political alignment.Technology is weaponized capital. Access to frontier technology is the ultimate expression of trust—or distrust—between blocs.Efficiency myths are dangerous. Betting on “best product wins” without mapping geopolitical permission is a strategic error.Conclusion: Seeing the Hidden LayerThe Geopolitical Architecture reminds us that what appears to be free competition is, in fact, bounded competition. Companies, investors, and even nations operate inside rules they did not choose.

Markets are not neutral. They are politically constructed.

In this sense, strategy is not about reading financial statements or market forecasts alone. It is about reading the map of power. Because until you know which rules, hierarchies, and flows shape the game, you don’t know what the game really is.

The post Geopolitical Architecture: The Power Layer of Markets appeared first on FourWeekMBA.