Macroeconomic Environment: Where Power Becomes Policy

If the geopolitical layer sets the rules of the game, the macroeconomic environment is where those rules are translated into policy, capital allocation, and economic outcomes. It is the layer where sovereignty becomes spreadsheets.

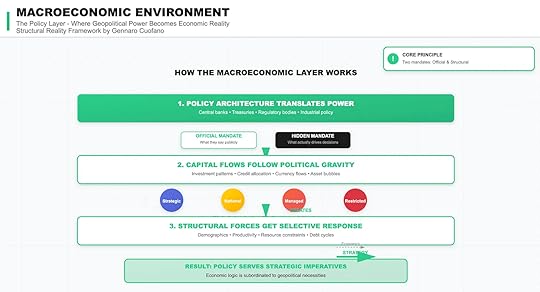

The core principle here is that every macroeconomic system runs on two mandates: an official mandate and a structural mandate.

The official mandate is what central banks, treasuries, and regulators declare—price stability, employment, fiscal discipline.The structural mandate is what actually drives decisions—geopolitical imperatives, strategic priorities, and survival of the state.Understanding the gap between the two is essential.

1. Policy Architecture Translates PowerThe first mechanism of this layer is the policy architecture.

Institutions such as central banks, treasuries, and regulatory agencies do not act in a vacuum. They are transmission belts that convert power structures into economic reality.

Consider:

Central banks claim independence but act as instruments of state power when crises hit. The Federal Reserve’s emergency facilities in 2008 and 2020 weren’t about abstract price stability—they were about systemic survival.Industrial policy is officially about competitiveness but is structurally about sovereignty. The U.S. CHIPS Act is not just an economic development program—it is a geopolitical firewall against China.Regulatory bodies shape financial and industrial flows, often aligning them with strategic objectives rather than market efficiency.Key insight: The macroeconomic environment is not neutral. It is policy designed to protect and project state power.

2. Capital Flows Follow Political GravityThe second mechanism is the way capital flows are bent by political gravity.

Officially, capital is supposed to follow efficiency, risk-adjusted returns, and investor choice. Structurally, it flows along the channels that political power allows.

Four archetypes illustrate this:

Strategic flows – Subsidized, incentivized, or guaranteed by governments for long-term security. Example: sovereign investment in energy independence or defense supply chains.National flows – Directed domestically for employment stability, infrastructure, or strategic industries. Example: Japan’s postwar keiretsu financing model.Managed flows – Heavily regulated or steered into politically safe directions. Example: China’s capital controls and credit guidance.Restricted flows – Entirely blocked by sanctions, export controls, or financial exclusion. Example: Russia post-2022 being cut off from dollar settlement systems.Markets may call these distortions. In structural terms, they are the operating system.

3. Structural Forces Get Selective ResponseMacroeconomics is supposed to respond to structural forces like demographics, productivity, debt cycles, and resource constraints. But in practice, those forces get selective attention depending on strategic priorities.

Demographics matter until they conflict with strategic labor policies, migration controls, or security fears.Productivity growth is ideal, but if it requires reliance on a rival’s technology stack, it will be sacrificed.Debt cycles are tolerated or extended when collapse would weaken state power, even at the cost of inflation or future instability.Resource constraints are real, but states bend enormous financial effort to suppress them when national security is at stake—think U.S. shale or China’s rare earth dominance.Result: economics is not an impartial referee. It bends to strategic imperatives.

The Structural Mandate: Policy as StrategyThe outcome of these three mechanisms is clear: policy serves strategy, not abstract efficiency.

Every central bank statement, fiscal policy, or regulatory action operates with two audiences in mind:

The public—who are given the official mandate: employment, stability, inflation control.The state—which pursues the hidden mandate: sovereignty, survival, and strategic advantage.This duality explains why macroeconomic logic often seems inconsistent: why deficits are tolerated in wartime but vilified in peacetime, why interest rates sometimes chase inflation and sometimes ignore it, why industrial subsidies appear in systems supposedly committed to free markets.

Strategic ImplicationsFor analysts and operators, the lesson is to stop treating macroeconomics as a closed system of economic logic. It is always subordinated to the geopolitical layer.

Implications include:

Follow the hidden mandate. When official and structural mandates diverge, the structural mandate always wins.Capital is political. Where it flows, where it is restricted, and where it is subsidized tells you more about the future than yield curves or balance sheets.Policy is selective. Structural problems like aging populations or sovereign debt are not solved—they are managed according to strategic priorities.Markets misread consistency. Investors expecting linear economic logic will be blindsided when policy bends suddenly under geopolitical stress.Conclusion: Economics as StrategyThe Macroeconomic Environment layer teaches us that economics is not about efficiency or neutrality. It is about translating power into policy.

Officially, central banks and treasuries defend price stability, employment, or fiscal prudence. Structurally, they defend sovereignty, sustain alliances, and manage strategic vulnerabilities.

The truth is simple but uncomfortable: economic logic is always subordinated to geopolitical necessity.

To forecast markets or industries without factoring in this layer is to mistake appearances for reality.

The post Macroeconomic Environment: Where Power Becomes Policy appeared first on FourWeekMBA.