Why AI Is Nothing Like the Web Bubble

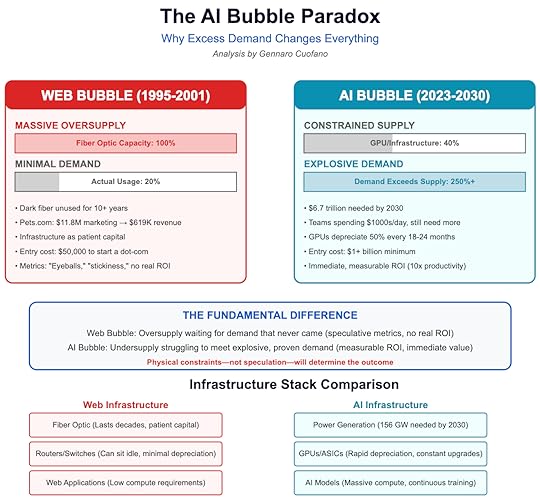

The web bubble was built on a fundamental lie: that eyeballs equal revenue. Companies with no path to profitability commanded billion-dollar valuations based on “clicks,” “stickiness,” and “mindshare.”

Pets.com spent $11.8 million on marketing to generate $619,000 in revenue. Webvan burned through $1.2 billion building infrastructure for a market that didn’t exist.

The metrics were fake, the demand was speculative, and the business models were fantasy.

The AI revolution presents the exact opposite problem. The demand is desperately real—companies are spending thousands of dollars daily on AI services and begging for more capacity.

The ROI is immediately measurable—legal teams reducing contract review from days to hours, security teams cutting incident response from 15 minutes to 5, marketing teams achieving 10x creative output.

This isn’t about hoping users might someday pay for something; it’s about customers with credit cards in hand being turned away because we literally cannot build capacity fast enough.

During the web bubble, the infrastructure investment was patient capital that could wait for demand. Fiber optic cables don’t deteriorate meaningfully over decades. Routers and switches could sit in warehouses.

The infrastructure was an option on future demand—if the internet grew as predicted, great; if not, the infrastructure would still be there when needed. Dark fiber from 2000 is still being lit up today, twenty-five years later.

AI infrastructure is impatient capital that deteriorates rapidly.

Data centers consume millions of dollars in electricity, whether fully utilized or not. Cooling systems require constant maintenance.

You can’t build AI capacity and wait for demand—by the time demand arrives, your infrastructure is obsolete.

This creates a vicious cycle where companies must constantly build to maintain their position, let alone grow.

The web bubble was also fundamentally democratic in its failure; anyone could start a dot-com with $50,000 and a dream.

The AI bubble is oligarchic by necessity. The entry ticket is measured in billions, not thousands.

You need relationships with NVIDIA, access to massive power generation, teams of PhD researchers, and most importantly, the kind of balance sheet that can sustain $80 billion annual capex without going bankrupt.

This concentration means the AI bubble can’t diffuse through thousands of startup failures—it will concentrate in a handful of titanic successes or catastrophic collapses.

And this will power up thousands of AI startups on the applications layer.

But here’s the catch that changes everything: We can’t pre-build AI capacity like we did with fiber.

Every GPU depreciates at Moore’s Law speed. Every data center requires constant, massive power draws.

Every technological advance makes yesterday’s infrastructure obsolete within quarters, not decades.

This creates a fundamentally different bubble dynamic, one that could stall not from lack of demand, but from our physical inability to supply what the world desperately needs.

The post Why AI Is Nothing Like the Web Bubble appeared first on FourWeekMBA.