How to Enter 2022 Mega Backdoor Roth in FreeTaxUSA (Updated)

[Updated on January 16, 2023 with screenshots from FreeTaxUSA for 2022 tax filing.]

A Mega Backdoor Roth means making non-Roth after-tax contributions to a 401k-type plan and then moving it to the Roth account within the plan or taking the money out (with earnings) to a Roth IRA. It’s a great way to put additional money into a Roth account without having to pay much additional tax. Not all plans allow non-Roth after-tax contributions but some estimated that 40% of people can do it.

Suppose your plan allows it and you did a Mega Backdoor Roth. You’ll receive a 1099-R form from your plan in the following year. You’ll need to account for it on your tax return.

It’s quite straightforward. Here’s how to do it in the inexpensive online tax software FreeTaxUSA. If you use other tax software, please read:

How To Report Mega Backdoor Roth in TurboTax or How To Report Mega Backdoor Roth In H&R Block Tax SoftwareIn-Plan RolloverYou can do the Mega Backdoor Roth in two ways — convert within the plan or withdraw to a Roth IRA. Converting within the plan is much easier, and many plans automate the process. Withdrawing to a Roth IRA also works. See the previous post Mega Backdoor Roth: Convert Within Plan or Out to Roth IRA?

Let’s first look at converting to the Roth account within the plan. Here’s the scenario we’ll use as an example:

You contributed $10,000 as non-Roth after-tax contributions to your 401(k). By the time you converted the money to the Roth account within the plan, your contributions earned $200. You converted $10,200 to your Roth 401(k) account.

I’m using 401(k) as a shorthand. It works the same in a 403(b).

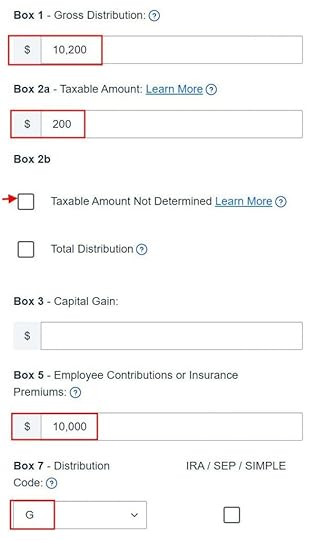

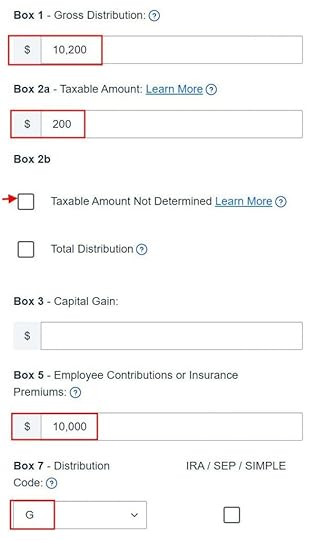

1099-R EntriesNow the entries into FreeTaxUSA. Go to Income -> Common Income -> Retirement Income (1099-R). Enter the numbers from your 1099-R as-is. Ours looks like this:

The gross amount converted to the Roth 401k account shows up in Box 1. The earnings are in Box 2a. If you didn’t have earnings in your conversion, Box 2a is zero. “Taxable Amount Not Determined” under Box 2b is left unchecked. The amount of your non-Roth after-tax contributions (“the principal”) should be in Box 5. Box 7 has code “G” and the IRA/SEP/SIMPLE box is unchecked.

Leave the rest at default unless your 1099-R has values in other boxes.

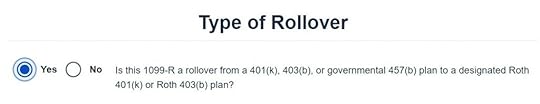

When it asks whether it was a rollover to a Roth 401(k) account, we say yes.

That’s it. It’s as simple as that.

Verify on Form 1040Now we verify we’re taxed only on the $200 in earnings, and not on the $10,000 non-Roth after-tax contributions.

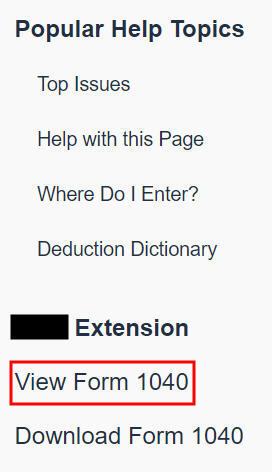

Click on the “View Form 1040” link on the right-hand side.

A draft 1040 form pops up. Look at Line 5. Line 5a shows the gross amount transferred to the Roth 401k. Line 5b shows we’re taxed only on the $200 in earnings. If you didn’t have earnings in your rollover, Line 5b will be zero.

Rollover to Roth IRAIt’s just as easy to report the Mega Backdoor Roth if you took the money out of the 401k plan and sent it to a Roth IRA. We’ll use the same example as above except you did the rollover to a Roth IRA instead of to the Roth 401k account within the plan.

Enter your 1099-R as-is in the same way as above.

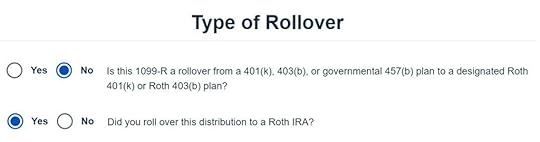

When it asks how we did the rollover, answer “No” to the first question and “Yes” to the second question. That’s it.

Verify that you’re taxed only on the earnings in the same way as above. Click on View Form 1040 on the right.

Look at Line 5 in your draft 1040 form. Line 5a shows the gross amount. Line 5b shows the amount you’re paying tax on.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How to Enter 2022 Mega Backdoor Roth in FreeTaxUSA (Updated) appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower