What Is The Circular Flow Of Income? Circular Flow Of Income In A Nutshell

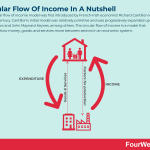

The circular flow of income model was first introduced by French-Irish economist Richard Cantillon in the 18th century. Cantillon’s initial model was relatively primitive and was progressively expanded upon by Karl Marx and John Maynard Keynes, among others. The circular flow of income is a model that illustrates how money, goods, and services move between sectors in an economic system.

Understanding the circular flow of incomeThe circular flow of income describes the way money moves through society. In very general terms, money flows from producers to employees in the form of wages and then back to the producers as employees purchase goods and services.

In reality, however, the flow of money through society is far more complicated. In modern capitalist economies, several other parties participate in the flow of money. We will take a look at these in the next section.

The five sectors involved in the circular flow of incomeMany choose to describe the circular flow of income with two, three, or even four sectors. However, we feel the five sector model is the most detailed and holistic interpretation.

The five sectors include:

The household sectorAs we hinted at earlier, households receive income from firms in exchange for labor. However, they also receive money from governments with some of this money returning to the government in the form of tax.

The government sectorThe key functions of the government sector are to purchase goods and services, collect revenue through taxes and other fees, and send money to households in the form of social security or welfare payments. If the government spends more than it receives in taxes, it must borrow money from financial markets.

The financial sectorThe financial sector is perhaps the most important part of the circular flow of income because it encompasses the behavior of banks and other financial institutions. These companies receive household savings income and then make investments in other companies, with this linkage representing one of the most important ideas in macroeconomics. The financial sector also lends money to the government when required and receives money from foreign investment.

The foreign sectorSome suggest the foreign sector is the hardest to define because of the opaque nature of international transactions. Nevertheless, many of the goods produced in an economy are exported to other countries. The foreign sector is concerned with how resources including goods and currency are exchanged between two or more trading partners.

The firm sectorThe flow of money in and out of a firm sector economy must balance. In other words, the total flow of money from the firm sector is the total value of production in an economy. Conversely, the total flow of money into the sector is equivalent to the total GDP expenditure. Households send money to firms for goods and services in a process called consumption. The financial sector can also invest in firms to help companies increase their output.

Key takeaways:The circular flow of income is a model that illustrates how money, goods, and services move between sectors in an economic system.The most simplistic interpretation of the flow of income suggests money flows from producers to employees in the form of wages and then back again in the form of consumption. However, modern capitalist economies are more complex.Five sectors describe the intricacies and interconnectedness of the circular flow of income. These include the household sector, government sector, financial sector, foreign sector, and firm sector. Connected Business Concepts Creative destruction was first described by Austrian economist Joseph Schumpeter in 1942, who suggested that capital was never stationary and constantly evolving. To describe this process, Schumpeter defined creative destruction as the “process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.” Therefore, creative destruction is the replacing of long-standing practices or procedures with more innovative, disruptive practices in capitalist markets.

Creative destruction was first described by Austrian economist Joseph Schumpeter in 1942, who suggested that capital was never stationary and constantly evolving. To describe this process, Schumpeter defined creative destruction as the “process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.” Therefore, creative destruction is the replacing of long-standing practices or procedures with more innovative, disruptive practices in capitalist markets. Happiness economics seeks to relate economic decisions to wider measures of individual welfare than traditional measures which focus on income and wealth. Happiness economics, therefore, is the formal study of the relationship between individual satisfaction, employment, and wealth.

Happiness economics seeks to relate economic decisions to wider measures of individual welfare than traditional measures which focus on income and wealth. Happiness economics, therefore, is the formal study of the relationship between individual satisfaction, employment, and wealth. In a command economy, the government controls the economy through various commands, laws, and national goals which are used to coordinate complex social and economic systems. In other words, a social or political hierarchy determines what is produced, how it is produced, and how it is distributed. Therefore, the command economy is one in which the government controls all major aspects of the economy and economic production.

In a command economy, the government controls the economy through various commands, laws, and national goals which are used to coordinate complex social and economic systems. In other words, a social or political hierarchy determines what is produced, how it is produced, and how it is distributed. Therefore, the command economy is one in which the government controls all major aspects of the economy and economic production. The term “animal spirits” is derived from the Latin spiritus animalis, loosely translated as “the breath that awakens the human mind”. As far back as 300 B.C., animal spirits were used to explain psychological phenomena such as hysterias and manias. Animal spirits also appeared in literature where they exemplified qualities such as exuberance, gaiety, and courage. Thus, the term “animal spirits” is used to describe how people arrive at financial decisions during periods of economic stress or uncertainty.

The term “animal spirits” is derived from the Latin spiritus animalis, loosely translated as “the breath that awakens the human mind”. As far back as 300 B.C., animal spirits were used to explain psychological phenomena such as hysterias and manias. Animal spirits also appeared in literature where they exemplified qualities such as exuberance, gaiety, and courage. Thus, the term “animal spirits” is used to describe how people arrive at financial decisions during periods of economic stress or uncertainty. State capitalism is an economic system where business and commercial activity is controlled by the state through state-owned enterprises. In a state capitalist environment, the government is the principal actor. It takes an active role in the formation, regulation, and subsidization of businesses to divert capital to state-appointed bureaucrats. In effect, the government uses capital to further its political ambitions or strengthen its leverage on the international stage.

State capitalism is an economic system where business and commercial activity is controlled by the state through state-owned enterprises. In a state capitalist environment, the government is the principal actor. It takes an active role in the formation, regulation, and subsidization of businesses to divert capital to state-appointed bureaucrats. In effect, the government uses capital to further its political ambitions or strengthen its leverage on the international stage. The boom and bust cycle describes the alternating periods of economic growth and decline common in many capitalist economies. The boom and bust cycle is a phrase used to describe the fluctuations in an economy in which there is persistent expansion and contraction. Expansion is associated with prosperity, while the contraction is associated with either a recession or a depression.

The boom and bust cycle describes the alternating periods of economic growth and decline common in many capitalist economies. The boom and bust cycle is a phrase used to describe the fluctuations in an economy in which there is persistent expansion and contraction. Expansion is associated with prosperity, while the contraction is associated with either a recession or a depression.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What Is The Circular Flow Of Income? Circular Flow Of Income In A Nutshell appeared first on FourWeekMBA.