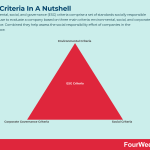

What Are ESG Criteria? ESG Criteria In A Nutshell

Environmental, social, and governance (ESG) criteria comprise a set of standards socially responsible investors use to evaluate a company based on three main criteria: environmental, social, and corporate governance. Combined they help assess the social responsibility effort of companies in the marketplace.

Understanding ESG criteriaPlatforms such as Robinhood and Wealthfront have made investing more accessible to a new generation of investors who prefer to invest in companies whose values align with their own. Climate change, social unrest, and the coronavirus pandemic have also increased awareness about the interconnectedness of sustainability and the financial system.

In response to these trends, brokerage firms and mutual fund companies now offer exchange-traded funds (ETFs) and other financial products that respect various environmental, social, and governance criteria.

Data released by The Forum for Sustainable and Responsible Investment shows the total US-domiciled assets under management using sustainable investment strategies reached $17.1 trillion in 2020. This figure constituted around 33% of the total assets under professional management in the United States.

While rarely mentioned in mandatory financial reporting, many investors evaluate ESG criteria to better understand the various companies in their investment portfolio. Indeed, investors consider companies that share their values and concerns about the world, with the profitability and risk of the company a secondary concern at best.

In the following sections, we will discuss some specific criteria for each category. Before we proceed, however, it should be noted that there is no exhaustive or definitive list of ESG criteria. Furthermore, some criteria are interrelated and it can be difficult to assign one to a single category.

Environmental criteriaEnvironmental criteria deal with the conservation of the natural world and external factors not affected by market mechanisms that can impact company revenue.

Examples include:

Air and water pollution.Waste management.Climate change and greenhouse gas emissions.Biodiversity, andDeforestation.Microsoft recently became the first company among its peers to target a “carbon negative” status by the year 2030. To that end, the company created a $1 billion fund to reduce emissions and remove all the carbon it has emitted since it was founded in 1975.

Social criteriaSocial criteria encompass the various relationships a company has with people, institutions, and communities. Since every company operates within a broader society, the way in which it carries itself is critical to attracting socially responsible investors.

Examples of social criteria include:

Customer satisfaction.Community relations and involvement. Human rights.Employee engagement, andData protection and privacy.Graphics card manufacturer NVIDIA has a strict policy to never use conflict minerals in its products. The company’s Conflict Minerals Policy ensures that gold, tantalum, tungsten, and tin purchased from the Democratic Republic of Congo do not directly or indirectly finance armed militia groups.

Corporate governance criteriaCorporate governance criteria are assessed by investors to ensure the company uses accurate and transparent accounting methods, avoids potential conflicts of interest, and allows shareholders to vote on important issues.

Governance criteria include:

Bribery and corruption.Executive compensation.Shareholder rights.Political contributions and lobbying.Audit committee structure, andHiring and onboarding best practices.Pharmaceutical giant GlaxoSmithKline (GSK) is working toward at least 45% female representation in senior roles before the end of 2025. Construction and infrastructure company Emcor Group is also known for giving employees unprecedented encouragement to raise potential ethics breaches.

Key takeaways:Environmental, social, and governance (ESG) criteria comprise a set of standards socially responsible investors use to evaluate a company. Younger investors are considering ESG criteria as the basis for investment decisions, with less credence given to profitability or risk.Environmental criteria encompass the natural world and external market mechanisms, including water pollution, air pollution, climate change, waste management, and deforestation.Social criteria describe the relationships a company has with wider society and the reputation it earns as a consequence. Governance criteria, on the other hand, may include executive compensation, shareholder rights, and recruitment best practices.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkConnected Business Frameworks To The ESG Criteria Change is an important and necessary fact of life for all organizations. But change is often unsuccessful because the people within organizations are resistant to change. Change management is a systematic approach to managing the transformation of organizational goals, values, technologies, or processes.

Change is an important and necessary fact of life for all organizations. But change is often unsuccessful because the people within organizations are resistant to change. Change management is a systematic approach to managing the transformation of organizational goals, values, technologies, or processes. An effective risk management framework is crucial for any organization. The framework endeavors to protect the organization’s capital base and revenue generation capability without hindering growth. A risk management framework (RMF) allows businesses to strike a balance between taking risks and reducing them.

An effective risk management framework is crucial for any organization. The framework endeavors to protect the organization’s capital base and revenue generation capability without hindering growth. A risk management framework (RMF) allows businesses to strike a balance between taking risks and reducing them. Timeboxing is a simple yet powerful time-management technique for improving productivity. Timeboxing describes the process of proactively scheduling a block of time to spend on a task in the future. It was first described by author James Martin in a book about agile software development.

Timeboxing is a simple yet powerful time-management technique for improving productivity. Timeboxing describes the process of proactively scheduling a block of time to spend on a task in the future. It was first described by author James Martin in a book about agile software development. Herzberg’s two-factor theory argues that certain workplace factors cause job satisfaction while others cause job dissatisfaction. The theory was developed by American psychologist and business management analyst Frederick Herzberg. Until his death in 2000, Herzberg was widely regarded as a pioneering thinker in motivational theory.

Herzberg’s two-factor theory argues that certain workplace factors cause job satisfaction while others cause job dissatisfaction. The theory was developed by American psychologist and business management analyst Frederick Herzberg. Until his death in 2000, Herzberg was widely regarded as a pioneering thinker in motivational theory. The Kepner-Tregoe matrix was created by management consultants Charles H. Kepner and Benjamin B. Tregoe in the 1960s, developed to help businesses navigate the decisions they make daily, the Kepner-Tregoe matrix is a root cause analysis used in organizational decision making.

The Kepner-Tregoe matrix was created by management consultants Charles H. Kepner and Benjamin B. Tregoe in the 1960s, developed to help businesses navigate the decisions they make daily, the Kepner-Tregoe matrix is a root cause analysis used in organizational decision making. The ADKAR model is a management tool designed to assist employees and businesses in transitioning through organizational change. To maximize the chances of employees embracing change, the ADKAR model was developed by author and engineer Jeff Hiatt in 2003. The model seeks to guide people through the change process and importantly, ensure that people do not revert to habitual ways of operating after some time has passed.

The ADKAR model is a management tool designed to assist employees and businesses in transitioning through organizational change. To maximize the chances of employees embracing change, the ADKAR model was developed by author and engineer Jeff Hiatt in 2003. The model seeks to guide people through the change process and importantly, ensure that people do not revert to habitual ways of operating after some time has passed. The CATWOE analysis is a problem-solving strategy that asks businesses to look at an issue from six different perspectives. The CATWOE analysis is an in-depth and holistic approach to problem-solving because it enables businesses to consider all perspectives. This often forces management out of habitual ways of thinking that would otherwise hinder growth and profitability. Most importantly, the CATWOE analysis allows businesses to combine multiple perspectives into a single, unifying solution.

The CATWOE analysis is a problem-solving strategy that asks businesses to look at an issue from six different perspectives. The CATWOE analysis is an in-depth and holistic approach to problem-solving because it enables businesses to consider all perspectives. This often forces management out of habitual ways of thinking that would otherwise hinder growth and profitability. Most importantly, the CATWOE analysis allows businesses to combine multiple perspectives into a single, unifying solution. Agile project management (APM) is a strategy that breaks large projects into smaller, more manageable tasks. In the APM methodology, each project is completed in small sections – often referred to as iterations. Each iteration is completed according to its project life cycle, beginning with the initial design and progressing to testing and then quality assurance.

Agile project management (APM) is a strategy that breaks large projects into smaller, more manageable tasks. In the APM methodology, each project is completed in small sections – often referred to as iterations. Each iteration is completed according to its project life cycle, beginning with the initial design and progressing to testing and then quality assurance. A holacracy is a management strategy and an organizational structure where the power to make important decisions is distributed throughout an organization. It differs from conventional management hierarchies where power is in the hands of a select few. The core principle of a holacracy is self-organization where employees organize into several teams and then work in a self-directed fashion toward a common goal.

A holacracy is a management strategy and an organizational structure where the power to make important decisions is distributed throughout an organization. It differs from conventional management hierarchies where power is in the hands of a select few. The core principle of a holacracy is self-organization where employees organize into several teams and then work in a self-directed fashion toward a common goal. The CAGE Distance Framework was developed by management strategist Pankaj Ghemawat as a way for businesses to evaluate the differences between countries when developing international strategies. Therefore, be able to better execute a business strategy at the international level.

The CAGE Distance Framework was developed by management strategist Pankaj Ghemawat as a way for businesses to evaluate the differences between countries when developing international strategies. Therefore, be able to better execute a business strategy at the international level. First proposed by accounting academic Robert Kaplan, the balanced scorecard is a management system that allows an organization to focus on big-picture strategic goals. The four perspectives of the balanced scorecard include financial, customer, business process, and organizational capacity. From there, according to the balanced scorecard, it’s possible to have a holistic view of the business.

First proposed by accounting academic Robert Kaplan, the balanced scorecard is a management system that allows an organization to focus on big-picture strategic goals. The four perspectives of the balanced scorecard include financial, customer, business process, and organizational capacity. From there, according to the balanced scorecard, it’s possible to have a holistic view of the business. Scrum is a methodology co-created by Ken Schwaber and Jeff Sutherland for effective team collaboration on complex products. Scrum was primarily thought for software development projects to deliver new software capability every 2-4 weeks. It is a sub-group of agile also used in project management to improve startups’ productivity.

Scrum is a methodology co-created by Ken Schwaber and Jeff Sutherland for effective team collaboration on complex products. Scrum was primarily thought for software development projects to deliver new software capability every 2-4 weeks. It is a sub-group of agile also used in project management to improve startups’ productivity. Kanban is a lean manufacturing framework first developed by Toyota in the late 1940s. The Kanban framework is a means of visualizing work as it moves through identifying potential bottlenecks. It does that through a process called just-in-time (JIT) manufacturing to optimize engineering processes, speed up manufacturing products, and improve the go-to-market strategy.

Kanban is a lean manufacturing framework first developed by Toyota in the late 1940s. The Kanban framework is a means of visualizing work as it moves through identifying potential bottlenecks. It does that through a process called just-in-time (JIT) manufacturing to optimize engineering processes, speed up manufacturing products, and improve the go-to-market strategy.

The post What Are ESG Criteria? ESG Criteria In A Nutshell appeared first on FourWeekMBA.