2022 Tax Brackets, Standard Deduction, and 0% Capital Gains

My previous post listed the 2022 retirement account contribution and income limits. The IRS will publish a separate notice shortly with the inflation-adjusted tax brackets and other income limits for 2022. I calculated some of the most commonly used numbers using the published inflation numbers and the same formula prescribed in the tax law. In general, the 2022 numbers will increase by 3.1% from 2021 before rounding.

These numbers don’t take into account the draft legislation currently being considered by Congress. Some of the numbers may change if laws change.

2022 Standard DeductionAbout 90% of all taxpayers take the standard deduction. The standard deduction in 2022 is:

20212022Single or Married Filing Separately$12,550$12,950Head of Household$18,800$19,400Married Filing Jointly$25,100$25,900Standard DeductionSource: IRS Rev. Proc. 2020-45, author’s own calculation.

People who are age 65+ or blind have a higher standard deduction than these.

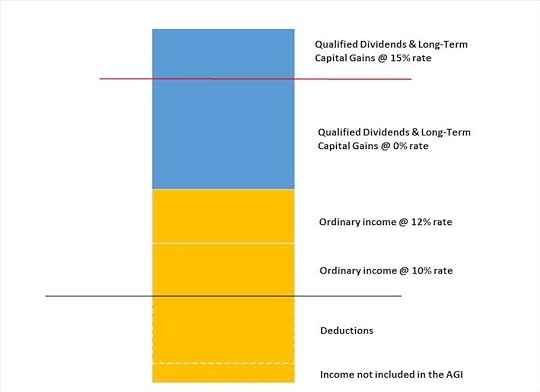

2022 Tax BracketsThe tax brackets are based on taxable income, which is AGI minus various deductions.

SingleMarried Filing Jointly10%$0 – $10,275$0 – $20,55012%$10,275- $41,775$20,550 – $83,55022%$41,775 – $89,075$83,550 – $178,15024%$89,075 – $170,050$178,150 – $340,10032%$170,050 – $215,950$340,100 – $431,90035%$215,950 – $539,900$431,900 – $647,85037%> $539,900> $647,850Tax BracketsSource: author’s own calculation.

2022 0% Capital Gains TaxWhen your other taxable income plus your qualified dividends and long-term capital gains are below a cutoff, you will pay no federal income tax on your qualified dividends and long-term capital gains under this cutoff.

The cutoff is close to the top of the 12% tax bracket but they don’t line up exactly.

20212022Single$40,400$41,675Head of Household$54,100$55,800Married Filing Jointly$80,800$83,350Maximum Zero Rate AmountSource: IRS Rev. Proc. 2020-45, author’s own calculation.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2022 Tax Brackets, Standard Deduction, and 0% Capital Gains appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower