Wealthfront vs. Betterment Business Model

Wealthfront and Betterment are major players in the Robo-advising space. Both companies make money via advisory fees. And Betterment has additional revenue streams like the service for advisors, the cash reserves, and the checking accounts.

Wealthfront is an automated Fintech investment platform providing investment, retirement, and cash management products to retail investors, mostly making money on the annual 0.25% advisory fee the company charges for assets under management. It also makes money via a line of credits and interests on the cash accounts.

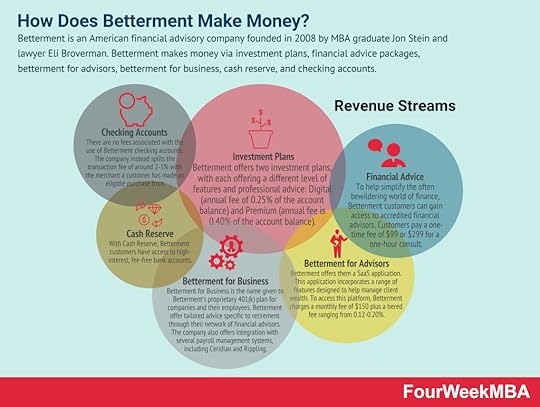

Wealthfront is an automated Fintech investment platform providing investment, retirement, and cash management products to retail investors, mostly making money on the annual 0.25% advisory fee the company charges for assets under management. It also makes money via a line of credits and interests on the cash accounts. Betterment is an American financial advisory company founded in 2008 by MBA graduate Jon Stein and lawyer Eli Broverman. Betterment makes money via investment plans, financial advice packages, betterment for advisors, betterment for business, cash reserve, and checking accounts.

Betterment is an American financial advisory company founded in 2008 by MBA graduate Jon Stein and lawyer Eli Broverman. Betterment makes money via investment plans, financial advice packages, betterment for advisors, betterment for business, cash reserve, and checking accounts. Read Next: Affirm Business Model , Chime Business Model, Coinbase Business Model, Klarna Business Model, Paypal Business Model, Stripe Business Model, Robinhood Business Model.

Fintech business models leverage tech and digital to enhance the financial service industry. Fintech business models, therefore, apply tech to various financial service use cases. Fintech business model examples comprise Affirm, Chime, Coinbase, Klarna, Paypal, Stripe, Robinhood, and many others whose mission is to digitize the financial services industry.

Fintech business models leverage tech and digital to enhance the financial service industry. Fintech business models, therefore, apply tech to various financial service use cases. Fintech business model examples comprise Affirm, Chime, Coinbase, Klarna, Paypal, Stripe, Robinhood, and many others whose mission is to digitize the financial services industry. Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Wealthfront vs. Betterment Business Model appeared first on FourWeekMBA.

Published on April 20, 2021 13:57

No comments have been added yet.