How Does Betterment Make Money? The Betterment Business Model In A Nutshell

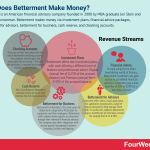

Betterment is an American financial advisory company founded in 2008 by MBA graduate Jon Stein and lawyer Eli Broverman. Betterment makes money via investment plans, financial advice packages, betterment for advisors, betterment for business, cash reserve, and checking accounts.

Origin StoryBetterment is an American financial advisory company. Based in New York City, it was founded in 2008 by MBA graduate Jon Stein and lawyer Eli Broverman.

Initially, Stein and Broverman wanted to create an investment and broker-dealer advice service for customers. After securing the relevant regularly approvals, the Betterment platform was launched in 2010.

The company quickly expanded its product range to include goal-based investment advice, auto-deposit and rebalancing, checking and savings accounts, and individual retirement accounts (IRAs).

As of 2012, Betterment has more than $29 billion in assets under management across 600,000 customers.

Betterment revenue generationBetterment generates revenue via multiple channels.

Let’s take a look at them in more detail.

Investment plansBetterment offers two investment plans, with each offering a different level of features and professional advice:

Digital – where the company charges an annual fee of 0.25% of the account balance.Premium – where the annual fee is 0.40% of the account balance.Financial advice packagesTo help simplify the often bewildering world of finance, Betterment customers can gain access to accredited financial advisors.

For the privilege, customers pay a one-time fee of $99 or $299 for a one-hour consult. However, it should be noted that these advisors do not work for Betterment directly. It must be assumed the company only receives a portion of the total fee.

Betterment for AdvisorsTo strengthen the relationship between the company and its financial advisors, Betterment offers them a SaaS application. This application incorporates a range of features designed to help manage client wealth.

To access this platform, Betterment charges a monthly fee of $150 plus a tiered fee ranging from 0.12-0.20%.

The exact fee is dependent upon the aggregate assets of the advisor in question.

Betterment for BusinessBetterment for Business is the name given to Betterment’s proprietary 401(k) plan for companies and their employees.

Betterment offer tailored advice specific to retirement through their network of financial advisors. The company also offers integration with several payroll management systems, including Ceridian and Rippling.

Pricing for this service depends on the number of employees and the monetary assets deployed. Add-on features and the payroll system chosen also influence the total price.

Cash ReserveWith Cash Reserve, Betterment customers have access to high-interest, fee-free bank accounts.

Since the company does not derive revenue from fees, it instead receives compensation from partnering banks such as Citi and Barclays.

Checking accountsFor those who prefer a simple checking account with an attached debit card, Betterment has them covered also.

Like the Cash Reserve facility, there are no fees associated with the use of Betterment checking accounts. The company instead splits the transaction fee of around 2-3% with the merchant a customer has made an eligible purchase from.

Key takeaways:Betterment is an American financial advisory company founded in 2008 by Jon Stein and Eli Broverman. It offers a range of investment, banking, and retirement services and advice.Betterment drive revenue from two investment plans, charging a flat fee based on the total investment balance.The company also makes money in an advisory capacity, offering individuals and businesses sound financial advice and access to a host of tools. Betterment also makes a less significant amount of money via fee-free checking and high-interest bank accounts.Read Next: Affirm Business Model , Chime Business Model, Coinbase Business Model, Klarna Business Model, Paypal Business Model, Stripe Business Model, Robinhood Business Model.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post How Does Betterment Make Money? The Betterment Business Model In A Nutshell appeared first on FourWeekMBA.