Plastiq Rent Payments With US Bank Altitude Code as Travel but Do NOT Earn 3X

On May 1st, I got the US Bank Altitude Reserve card – the first day it was available.

I wrote how payments with Plastiq coded as travel with the Chase Sapphire Reserve card (lots of peeps on Reddit confirm this, too). So I was hoping that would be the case with the US Bank Altitude Reserve. Especially because the minimum spending requirement is $4,500 – that would’ve been a nice points haul at 3X.

The merchant code gave me hope for 3X

And the charges did code as travel. But my statement just closed and I only got 1X point per $1.

This US Bank card and the Chase Sapphire Reserve are both Visa cards. So while it doesn’t work for the former, I’m hoping it will still earn 3X with the latter for a while longer.

Here’s what I found.

A charge that codes as travel but didn’t earn 3X

Link: Visa merchant codes (PDF file)

Link: Sign up for Plastiq and get $500 fee-free dollars

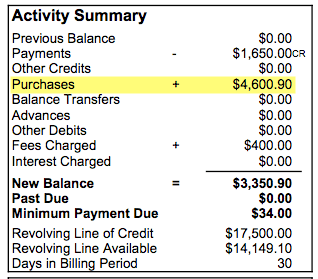

I made all my rent and mortgage payments last month via Plastiq. And mixed in a couple of regular purchases to meet the minimum spending requirement.

After the Plastiq payments cleared, I noticed the merchant code was listed as 7011 (see pic above).

Lodging? Sweet!

Then I got excited after I looked up the code and saw it was for “Lodging” and that my “itinerary” was for 1 night. All the makings of a 3X travel charge. I was even hoping to trigger the $325 annual travel credit.

I made ~$4,601 in purchases

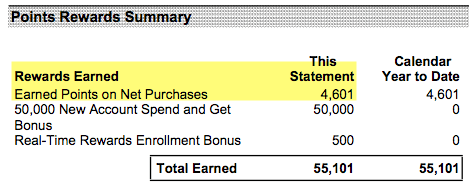

I spent a little more than needed to earn the full 50,000 point sign-up bonus. And was hoping to score 13,000+ more points for the Plastiq rent payments.

Sad trombone

However, I earned exactly 4,061 points AKA 1 point per $1. Womp womp.

Why did this happen?

I was kind of expecting to get 3X on these purchases. It worked with my Chase Sapphire Reserve, so I thought surely…

But the fact that it didn’t code as 3X but did code as travel makes me think US Bank knows more than they’re letting on. I have no idea why they’d code these charges as “lodging” and not reward 3X points. It makes me a little nervous for the future of 3X with my other cards with travel as a bonus category, like:

3X with Chase Sapphire Reserve

2X with Chase Sapphire Preferred

3X with Citi Prestige and Citi ThankYou Premier

Pretty bizarre.

I still think the US Bank Altitude Reserve is worth it

Link: US Bank Altitude Reserve card

I have yet to do a full review of this card. But so far, I am loving it, if only for the sign-up bonus, $325 travel credit, and 12 Gogo in-flight passes.

I wrote about how to save on in-flight wifi. I regularly see in-flight internet selling for $20+ for the duration of the flight. So the 12 Gogo passes, at $20 each, are worth $240 on their own. That and the $325 travel credit easily cover the card’s $400 annual fee. And the 3X with mobile pay is certainly nice. Just don’t buy gift cards! And you can’t get the card without at least 35 days as a US bank customer (another credit card, mortgage, checking account, etc.).

Bottom line

So now I know Plastiq rent and mortgage payments do NOT earn 3X with the US Bank Altitude Reserve card even though they code as travel.

Now I wonder what would happen with Citi Prestige and Citi ThankYou Premier… but as long as it still works with the Chase Sapphire Reserve, that’s really all I care about for now. I just hope that whatever US Bank is doing with their purchase data doesn’t make its way to Chase.

The Plastiq payments were worth it to meet the minimum spending this month. And next month I’ll finish getting 2X with my AMEX Starwood biz card. After that, I’ll ride the 3X train with the Chase Sapphire Reserve for as long as I can. If that comes to an end, there’s always my trusty Citi AT&T Access More card. Just another reminder to hop on the good deals while they’re still around.

Have you had a different experience with Plastiq rent payments? I’d love to hear more datapoints!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!