Why I Got a 0% APR Card to Help Pay Down Debt

Also see:

Should You Use a 0% APR Card to Pay Off Debt?

Welp, I finally did it. Got a new credit card to help pay down my student loans.

It’s an idea I floated before. But I didn’t bite because there have always been other cards I wanted instead. Plus, I like to save or invest money instead of throwing it toward student loans.

I hate their name. I hate how their logo has an apple in it. I hate everything about it pretty much

I’m constantly torn about taking a solid year to get rid of it, then I think… man, I could invest that. Or pay down my mortgage. Or just have it.

Ultimately, I think a hybrid approach is best: break everything down into buckets and work on each one a little at a time. Save a little, invest a little, use the rest for bills.

But I’ve decided to give myself a head start on the student loan bucket. Here’s why.

Lower principal means less interest

That’s the smoking gun right there. My student loan has a 6.75% interest rate (ouch). My investments return a little more than that. But that’s not guaranteed.

Paying down the student loan is guaranteed savings as opposed to non-guaranteed earnings.

My mortgage is 4%. Those are pretty much the only two big loans I have to repay. So it’s obvious to go after the one with the larger interest rate first.

Current state of loans

Right now, if I want the loans gone in 5 years, I’d have to pay ~$993 a month. And pay ~$9,153 in total interest.

Dramatic improvement

In running the numbers, if I can eat into the principal by even $7,000, my monthly payment drops to ~$855 and the total interest paid goes down to ~$7,882.

That saves me ~$138 a month and reduces the interest by ~$1,271.

$138 x 60 (5 years of payments) is $8,280 saved. Of course, I’d have to pay back the $7,000, so it’s really like saving $1,280 but also still saving the $1,271 in interest payments, for a total of $2,551.

That’s pretty nice! Plus, I can pay back the $7,000 at my own pace if it has 0% APR and isn’t accruing interest of its own for a while.

Where the Citi Diamond Preferred comes in

Link: 0% APR Credit Cards

Citi has two cards with a 21-month o% APR: Citi Diamond Preferred and Citi Simplicity.

Pretty much identical

On the surface the cards are the same. The only major difference is a 1% variation in the regular APR. Both have $0 annual fees.

However, something about the Simplicity card turned me off: “No late fees, no penalty rate.”

To me, that implies it’s intended to be a “training wheels” card, which could mean a lower credit line. I wanted a line of about $7,000 so I could get my loan payments below the $900 a month mark and get them paid in 5 years. For that reason, I applied for the Diamond Preferred card and was approved for a $2,000 limit.

That feeling is so intense

However, with a quick call to Citi, I was able to move $5,000 from my Citi ThankYou Premier (which I never use any more with Chase Sapphire Reserve in the mix) to reach the $7,000 threshold I had in mind.

This is my 7th Citi card (the other 6 are Prestige, ThankYou Premier, AT&T Access More, 2 AA cards, and a Hilton Visa). So I think that was the reason for the initial low limit. But it all worked out.

And now I have a card that won’t gather a dime of interest until February 2019 – that’s awesome!

Effects and consequences

Once I make the initial student loan payment via Plastiq, I can immediately get on my new student loan plan to have them wiped in 5 years. And can invest or save the rest.

It still feels like throwing money into the toilet somehow, but at least I can start to see the end of it… forever. This also reinforces my commitment to finally kick this thing. I’m not thrilled about it. But I will try to stay on schedule as much as possible. And, I’m grateful for this head start.

I’m not worried about the impact on my credit report because my used to available credit ratio will still be very low.

I also found out if my student loans are “paid up” for at least a year it does not have to be included in my DTI (debt-to-income) ratio if I want to get a second mortgage on an investment property (!).

My current loans as-is are $543 per month. Even if the new card shows my monthly payment as $100 a month, that’s still much lower than what I have right now – and will make me a shoo-in for another mortgage approval.

The effect seems minimal

Of course, I’ll still have to pay back that lingering $7,000. I’m fine with leaving it there until 2019 because there is literally nothing else I’d want to use this card for.

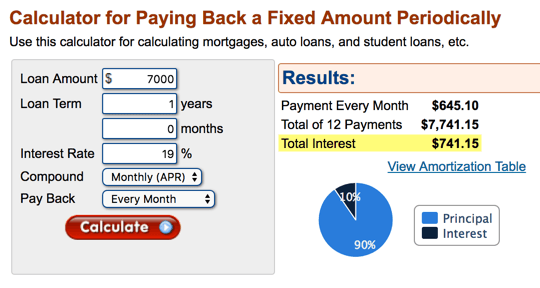

Even if I carried the balance beyond February 2019, for a year at a 19% interest rate, I’d still only pay ~$741 in interest – which is still much lower than the ~$1,271 I’d pay on my student loan.

So, in all ways, it seems like a total win. There’s no sign-up bonus on this card, but getting all these good side benefits and savings is worth it for me.

Plus, I can’t really get other cards any more anyway. Amex: nope. Chase: nope. Other Citi cards: nope. What else is left? An Alaska card every 45 days.