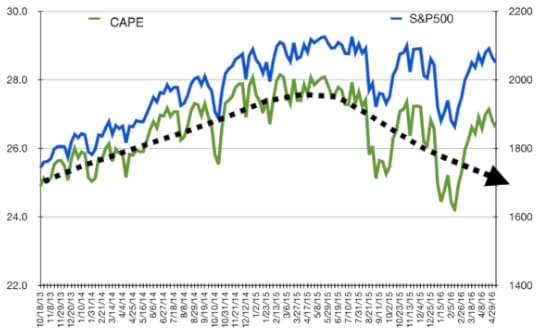

The cyclically adjusted price-earnings ratio (CAPE) is an input parameter to the Greedometer® because it is a reasonable indicator of whether current stock prices are expensive or cheap. On it’s own, the CAPE is not terribly useful as a market timing tool because the value may remain high for prolonged periods. Over the past century, the S&P500 rarely had a CAPE of 25 or higher. This point was breached in December 1995, yet the S&P 500 continued to climb a further 25% higher over the ensuing five and a half years until reaching an all-time peak of 44.

With a long term average of approximately 16.5, the CAPE has been parked at 25+ for the past 2.5 years. That said, it has been rolling over since May 2015.

There is a long way down from the 27.0 reading 2 weeks ago (SPX 2100) to 16.5. A 40% drop in the SPX from 2100 is easily supportable. In fact, since previous secular troughs saw the CAPE at approximately 5, then, 6, then 7, it would be reasonable to expect to see it at the 6-8 range at this trough. Yes a 75% drop in the SPX is supportable given the previous 130+ years of data (SPX at 550). FYI, the CAPE bottomed at 13 in March 2009 when the Fed intervened to stop the crash. Since that crash was stopped by the Fed I do not consider that a secular trough.

Published on May 06, 2016 08:24