Gea Elika's Blog, page 111

July 23, 2018

Getting Rid of an Abusive Co-op Neighbor

Co-ops present a lot of difficulties for buyers such as the dreaded board interview and the board rules of what you can and can’t do once you move in. It’s no surprise that most buyers prefer condos, even if they do cost more. But that said, there are some things a co-op board can do which a condo board can’t. Namely, evict an unruly resident. This is due to something called the “Pullman Clause.” Are you a co-op owner and suffering from a neighbor that is making life unbearable? Read on to learn what you can do.

What is a Pullman Clause?

Unlike other NYC properties, when you purchase a condo apartment, you don’t own it. Instead of a deed to the apartment, you sign a proprietary lease which – in the eyes of the law – creates a landlord-tenant relationship. The difference between this and a regular lease is that a resident can be kicked out for bad behavior after a vote of the board and your fellow co-op neighbors.

The power to do this comes from the 2002 case of 40 West 67th Street v. Pullman. Co-op resident David Pullman waged war against a couple living above him. The court ruled that he was infringing on a neighbor’s right to quietly enjoy their home. This lead to the termination of his lease and forceful eviction. The case is commonly cited and carries strong authority. To “Pulmanize” an unruly neighbor a process must be followed if you want the best chance of success.

1. Check that your proprietary lease has a Pullman Clause

Nowadays, the majority of proprietary leases have a Pullman clause, usually located in the section on termination of the lease. Before starting the eviction process, first double check that the lease has one.

2. Check whether all shareholders need to vote

Depending on what your lease says you will need either a vote of the shareholder or a vote of the board. A few co-ops require the vote of both. Check what your lease requires, and the number of votes needed.

3. Serve notice to your neighbor

The courts require that the unruly resident in question be served a notice. It should be in writing and state that they are breaking the rules while giving them enough time to reform. The wording in your lease will state how much time is enough time. Before proceeding any further, send a written notice detailing your complaints and that failure to reform could lead to them being evicted. Also, inform your co-op board of the situation and that you have served the notice.

4. Review and organize the evidence

If things go to court, you and everyone else will have a much easier time if everything has been documented. Photographs, police records, recordings and other proof of their misdeeds will show that the board isn’t motivated by a personal vendetta but is looking out for the best interests of the building.

5. Call a meeting

The co-ops by-laws will state how a Pullman action must proceed. Read through them to understand how a meeting must be called (regular or special) and how much notice must be given. The purpose of the meeting must be clearly stated, and it’s a good idea to have a stenographer present. Pullman cases can be thrown out if it can be demonstrated that the neighbor did not have enough time or opportunity to be heard. The neighbor and their attorney should be given enough time to speak, comment and rebut the charges. It’s a good idea to have your attorney present if the neighbor brings one.

6. Serve a termination notice

The terms of the proprietary lease will state what rules must be followed in serving the lease termination notice. The specific dates, times, locations and nature of the incidents must be clearly stated. It should also state that the board and shareholders have voted in favor of termination and how they reached their conclusion.

7. Go to court

A Pullman action cannot be enforced without first going through the “heightened vigilance” review by the court. If everything has been done right ,the court will defer to the boards/shareholders decision and allow the unruly neighbor to be booted out. Most Pullman cases are decided on summary judgment, meaning you can win without having to go to trial.

The post Getting Rid of an Abusive Co-op Neighbor appeared first on | ELIKA Real Estate.

July 21, 2018

Voting Particulars of Building Board Elections

Co-ops and condos both have a board of directors that oversee matters, but how they get into office is a bit opaque. While a directorship is an elected position, the mechanics behind it are a bit of a mystery to most, even co-op and condo owners.

Given the power they wield over large and small matters, including capital improvements and house rules, it behooves potential and current shareholders/owners to understand the process.

The election

Residents elect the board members. Unlike a for-profit corporation, the candidates are not professional managers, but rather fellow shareholders in the case of a co-op or unit owners if it is a condo.

The election is typically held at the annual meeting, but that is not necessarily the case. The bylaws dictate how often the board of director elections occurs.

How votes are cast can vary. Some buildings allow residents to vote online, but others use old fashioned paper. The most important thing is that everybody has a chance to vote.

The voting particulars

In a co-op, those with more shares have a greater voice. This is based on square footage and other factors. For condo owners, voting power is based on the percentage of interest, which is initially assigned by the developers. With condo ownership, you own the airspace within your unit and a percentage of interest in the common elements.

A proxy is the list of directors and other matters you are voting on. The board candidates’ names could be on the proxy. Alternatively, you could receive a blank proxy slate, and the people running are put on the slate at the annual meeting.

Typically, the managing agent oversees the election. An alternative, the managing agent, could bring in an independent company to take on this function. This helps maintain the appearance of independence. If the managing agent has given an outside company oversight responsibility, it must provide the firm with a list of the building’s residents. Following this, the managing agent takes a step back and is not involved in the process.

Overseeing the election involves mundane, but essential tasks that make sure the election process is correctly followed. The agent makes sure a quorum is present, which is typically a majority of the voting interest. Ballots are handed out, votes are counted, and the winning directors are announced. The managing agent, an outside company, or a voting committee will tally the votes.

There is also cumulative voting or non-cumulative voting. In the former, you can aggregate your total number of shares based on the number of candidates however you like. For instance, if you own 10 shares in the co-op, and there are seven directors, you have a total of 70 votes to disperse on as many candidates as you like. If you choose, you can use the 70 on one candidate. In non-cumulative voting, you vote your 10 shares on each candidate. In this case, your favorite seven that you would like to see serve on the board.

Anyone can contest an election up to 120 days after it occurs, but, hopefully, the board is transparent about the entire voting process.

The post Voting Particulars of Building Board Elections appeared first on | ELIKA Real Estate.

Voting Particulars of Board Elections in Condo’s and Co-op’s

Co-ops and condos both have a board of directors that oversee matters, but how they get into office is a bit opaque. While a directorship is an elected position, the mechanics behind it are a bit of a mystery to most, even co-op and condo owners.

Given the power they wield over large and small matters, including capital improvements and house rules, it behooves potential and current shareholders/owners to understand the process.

The election

Residents elect the board members. Unlike a for-profit corporation, the candidates are not professional managers, but rather fellow shareholders in the case of a co-op or unit owners if it is a condo.

The election is typically held at the annual meeting, but that is not necessarily the case. The bylaws dictate how often the board of director elections occurs.

How votes are cast can vary. Some buildings allow residents to vote online, but others use old fashioned paper. The most important thing is that everybody has a chance to vote.

The voting particulars

In a co-op, those with more shares have a greater voice. This is based on square footage and other factors. For condo owners, voting power is based on the percentage of interest, which is initially assigned by the developers. With condo ownership, you own the airspace within your unit and a percentage of interest in the common elements.

A proxy is the list of directors and other matters you are voting on. The board candidates’ names could be on the proxy. Alternatively, you could receive a blank proxy slate, and the people running are put on the slate at the annual meeting.

Typically, the managing agent oversees the election. An alternative, the managing agent, could bring in an independent company to take on this function. This helps maintain the appearance of independence. If the managing agent has given an outside company oversight responsibility, it must provide the firm with a list of the building’s residents. Following this, the managing agent takes a step back and is not involved in the process.

Overseeing the election involves mundane, but essential tasks that make sure the election process is correctly followed. The agent makes sure a quorum is present, which is typically a majority of the voting interest. Ballots are handed out, votes are counted, and the winning directors are announced. The managing agent, an outside company, or a voting committee will tally the votes.

There is also cumulative voting or non-cumulative voting. In the former, you can aggregate your total number of shares based on the number of candidates however you like. For instance, if you own 10 shares in the co-op, and there are seven directors, you have a total of 70 votes to disperse on as many candidates as you like. If you choose, you can use the 70 on one candidate. In non-cumulative voting, you vote your 10 shares on each candidate. In this case, your favorite seven that you would like to see serve on the board.

Anyone can contest an election up to 120 days after it occurs, but, hopefully, the board is transparent about the entire voting process.

The post Voting Particulars of Board Elections in Condo’s and Co-op’s appeared first on | ELIKA Real Estate.

Classification for a Legal Bedroom in NYC

As anyone who’s tried to find rental apartments in NYC knows, landlords tend to stretch the truth when it comes to room descriptions. Take for instance this Brooklyn beauty stairway room (featuring “a special ergonomic space for your mattress with a gentle 45-degree angled slope”). Even when the descriptions aren’t quite that outlandish, it’s still common to come across terms like an alcove, flex/convertible, or junior to describe the almost (but not quite) bedroom.

It’s just as frustrating for buyers who have to figure out the livability of a space and also its legal status for purchase, renovation, and resale purposes. Here we explain what constitutes a legal bedroom in NYC, exceptions and what buyers and renovators need to consider.

What constitutes a bedroom in NYC?

The New York Administrative Code, with its various caveats and upgrades, is notorious for being difficult to understand. As such, this is a tricky question to answer. The exact provisions can be found spread out among the Housing Maintenance Code, the Multiple Dwelling Law, the Residential Code, and the Building code. Summarized together, the following requirements must be met for any living space to be declared a legal bedroom:

Be a minimum of 80 square feet total.

Have a minimum width of 8 feet in any direction.

Have a minimum ceiling height of 8 feet.

At least one window with a minimum of 12 square feet. A window that opens out onto a balcony also counts. The window must open onto a public area such as a park, yard, plaza or street.

Two means of egress (entrance and exit), for instance, via a door to a window. You must be able to open both from the inside.

Access to the bedroom has to be direct; there cannot be a need to pass from one bedroom to reach another.

Are there any exceptions to the rules?

There are a few exceptions to the rules. Also note, a bedroom does not need to have a closet to be legal, something of popular opinion. Exceptions include:

If there are three or more bedrooms in the apartment, one half of them may have a minimum dimension of 7 feet.

If the bedroom is located in the basement or on the top floor, the minimum ceiling height is 7 feet.

If the bedroom has a sloped ceiling, there must be a minimum ceiling height of 7 feet over 1/3rd of the room.

Do you plan to add or remove a bedroom?

If you’re purchasing an apartment with the intention of adding or removing a bedroom, it would be wise first to check if this is a possibility. Consult the building’s board along with the architect to see if whether there would be any objections or issues. Before any renovations can begin, you’ll need to secure the permission of both the Department of Buildings (DOB) and the condo/co-op board. This often takes months, so make sure to account for it when coming up with your timeline. Take all the following points into consideration.

If you wish to get creative with how you use the space, keep in mind that while the city’s square footage requirements may appear generous, the egress requirements are in place for safety against the very real threat of fire.

If you add or remove bedrooms with the permission of the DOB, you may have to undo the changes if this comes during the home inspection.

If you’re making the changes for the sake of personal needs, keep in mind that any reductions in the number of bedrooms can negatively impact the resale price.

The question of the legality of a bedroom is incidental if you can make it work for you. But by knowing the exact legal definition, you can conduct better negotiations when making an offer and know how to price the property if you decide in future to sell.

The post Classification for a Legal Bedroom in NYC appeared first on | ELIKA Real Estate.

July 20, 2018

A Co-op Board Can Derail Your Low Offer

A co-op board retains certain powers, which also comes with responsibilities. One of a co-op board’s powers includes approving or rejecting sales and purchases. A board can reject an applicant for virtually any reason, providing it complies with federal, state, and city housing laws. This likely means a co-op board can deem your offer is too low and either cause the purchase to fall through or force you to reevaluate your offer.

You may have an agreement with the seller, but this does not mean you should celebrate.

Why a board does it

Board members have a fiduciary duty to shareholders. They also own co-op units in the building. Therefore, they want to protect their financial interests. Co-op boards are concerned that a low price will skew prices, affecting comps, and potentially lowering prices on future apartment sales.

Mitigating factors

A co-op board must follow the business judgment rule. Based on case law, courts cannot reverse a board decision, even a bad one, providing they made it in good faith. On this basis, courts have generally upheld the board’s authority to reject a co-op sale based on a sales price that was substantially below the current market value. There are restrictions, such as the board setting an arbitrary minimum price that is not based on the current market.

The board has to balance their fiduciary duty to co-op owners with fairness to an individual shareholder. Accepting a single low-ball offer might not necessarily impact the other units’ value.

Rather than rejecting the sale outright, a board can consider certain unique factors when deciding whether or not the offer is accepted. A board should conduct its due diligence to determine the reason for the low price. These include divorce, estate sale, or if the unit is either about to go into foreclosure or the bank has already foreclosed. In these cases or other extenuating circumstances, the board might decide the price is acceptable.

Does it impact value?

There are reasons to believe a single sale, even if it below the current market value, does not materially impact the sales price of other units. When trying to measure a unit’s fair market value, an appraisal firm looks at comps, but weighs certain factors more heavily, such as recent sales, particularly those similar to the unit for sale.

This means apartments in the same building, even on the same floor, with similar square footage, count more. However, a single below-market sale is not likely to affect the other building units’ other values since there could have been special circumstances, such as those above.

The current New York City housing market, particularly below the $3 million thresholds, is humming along. But, should the market turn, you may have to prove that your offer reflects the current market environment, which goes beyond comps.

A final decision

Making the matter murkier, when a board rejects your application, they do not have to provide a reason. Aside from your offer price, a board can also decide to take a pass based on your interview, financials, letters of recommendation, employment history, or a host of other reasons.

The post A Co-op Board Can Derail Your Low Offer appeared first on | ELIKA Real Estate.

You Can’t Always Rely on Square Footage Numbers

Calculating square footage should be a straightforward and easy calculation. However, in New York City’s co-ops and condos, the number you are given does not always reflect reality. Sometimes, seller’s agents or sponsors overestimate the size in an attempt to mislead buyers. Other times it an honest error, perhaps one that has gotten repeated through the years.

Given New York City’s high per square foot price, this is not a trivial matter. As with any significant investment, it is essential to thoroughly understand what you are receiving in exchange for your hard earned money.

Discrepancies

There can be some reasons for different square footage calculations. Some brokers and sponsors include common spaces such as elevator shafts and hallway, and they can do so legally in some instances. Some errors are due to miscalculations, whether done intentionally or not. While the calculation is done with a laser, it is still subject to human error. An apartment with an odd layout adds to the challenge.

In any case, there are consequences including your loan status and resale value, when there is a miscalculation.

The lenders weigh in

Your lender is going to do its calculation before extending you a loan. Its total may come in below the seller’s square footage claim. Whether you lender is underestimating the apartment’s size or the agent/sponsor is exaggerating the square footage, you have an issue.

This could delay your loan and closing, or even torpedo the entire deal. This can create a host of complications, including potentially losing your deposit, however.

Your remedies

In an extreme situation, you can sue, although this is usually an uphill battle. Many sellers’ brokers deny responsibility, and you need to prove fraud, which must include a misrepresentation of “material” facts, which is open to interpretation. A seller often claims he/she does not know the true square footage.

There is typically limited oversight in these matters. A condo developer is required to disclose its square footage calculation in its offering plan, which is registered with New York State’s Office of the Attorney General, so at least you know what it is based on. However, this is not the case for co-ops.

Doing your homework

Some sellers’ agents do not include the square footage in the property’s description, or state it is only an approximation. In these cases, it is up to you to find out on your own by hiring an engineer or architect, if you are inclined. Given the price per square foot is one standard pricing mechanism, you might find this worthwhile.

If it is a new building, your lawyer should read the offering plan as part of his/her due diligence.

Final thoughts

One way to measure the fairness of your offer is to break it down on a price per square foot basis. After all, this allows an apples-to-apples comparison. If the square footage is materially different, you may find that your offer is too high, although there are other factors, such as the building, neighborhood, view, and a host of other factors that come into play.

The post You Can’t Always Rely on Square Footage Numbers appeared first on | ELIKA Real Estate.

July 19, 2018

The Complete Guide to Selling Your Home in NYC

Selling a home in NYC can seem like a long and daunting prospect, and it is. You’ll need to decide how best to approach putting it on the market, consider your closing costs, hire a broker and real estate attorney, deal with multiple offers, conduct negotiations and much more before you can walk away on the closing day. Fortunately, it needn’t be as complicated as it seems. In this complete guide, we break down all the steps involved in the entire selling process in NYC. Whether it’s a condo, co-op or townhouse, you’ll find all the information you’ll need right here.

1. Should you sell your home in NYC?

It probably hasn’t been an easy decision in deciding to sell your NYC home. Even if you’ve already settled on the decision to sell, first retake a moment to determine if you should. NYC has for a long time been and continues to be, one of the most valuable real estate markets in the world. The last few decades have seen a dramatic rise in property values, and it doesn’t look like that’s going to slow down anytime soon. If you’re selling because your growing family has outgrown the old home but plan to still reside in NYC, why not consider becoming a property investor?

This route makes sense if you have enough saved to make a down payment on a new home without having to sell your current one. This way you’ll not only save money on closing costs but also receive tax benefits from being a property investor.

But if you don’t have enough capital or borrowing capacity with your bank to own two homes at once or need the cash from the sale to buy your new home, it makes perfect sense to sell. The same applies if you’re moving out of the city and don’t want the headaches of being a remote property manager, however, you could hire a management company to do so.

2. Should you hire a seller’s broker or go FSBO?

So you’re ready to sell, the next question is, do you hire a seller’s broker or sell directly through for-sale-by-owner (FSBO)? The standard real estate commission of 5-6% of the sales price will be a sellers biggest closing cost and stops many potential sellers cold in their tracks. That said, going FSBO is not for the faint of heart. Unless you’ve got a lot of time on your hands and an in-depth understanding of the real estate market, it’s probably better to go the route of the vast majority of NYC sellers and hire a seller’s agent.

Even those with the confidence and knowledge to go FSBO still flounder. A few years ago, somewhat famously in the local brokerage community, the founder of FSBO.com gave up after six months trying to sell on his own and hired a broker to sell his $2 million Chelsea condo. Furthermore, going FSBO means you’ll miss out on the 90% of buyers who are represented by buyer’s agents.

Hiring a seller’s broker means they do all the hard work such as advertising, pre-approving buyers, scheduling appointments and setting up open houses, negotiating, completing a deal sheet, expediting a board package in the case of a condo or co-op and dealing with a contract of sale. Furthermore, they know the market and how to price competitively. If you want to sell fast and for the best price possible it’s nearly always better to hire a broker. When interviewing a broker to hire, make sure to ask them the right questions and choose one that has experience selling property in your price point and neighborhood. Once you’ve chosen the right broker, you’ll be asked to sign a listing agreement. Make sure to read it carefully and understand what it does and doesn’t cover.

3. Decide on an asking price

If you want to sell fast, then it’s always best to slightly underprice your property against comparable properties on the market. With such a transparent market in NYC, it’s easy for buyers to see if your asking price is above or below the average. Price it too high, and you’ll scare away a lot of potential buyers who know an overpriced property when they see one.

Somewhat paradoxically, if you slightly underprice your property, you can end up with more than you asked for as this can set off a bidding war as multiple offers rush in. An experienced broker knows how to price a property correctly that will attract the maximum number of offers. Also, be ready to reduce your asking price if you’re not getting enough bites. It’s hard to predict how the market will respond until your property hits the market so choose a price that you’re willing to slightly lower if necessary.

4. Prepare and market you’re home

Your agent will advise you want you can do to prepare your apartment for sale before it hits the market. At a minimum, this will mean cleaning and depersonalize your home so that it appeals to a broad audience of buyer’s. Depending on the condition of the apartment, there may be a need for some minor renovations such as painting. Open houses are one of the best ways to show off your apartment to potential buyers, so it pays to do it right. It might even be worth it to hire a professional staging company to maximize the aesthetic appeal of your space. Once again, having an agent means they can recommend all the right people such as contractors and stagers to make your apartment as presentable as possible.

You won’t get any offers from buyer’s who haven’t seen the property, so you must be ready and willing to show your apartment when requested. It is best to make yourself scarce when there’s an open house or private showing. It’s difficult for potential buyers to visualize themselves living there if the current owners are hanging around. Trust your agent to show them around and answer all their questions. If you’ve done everything right, you should have multiple offers within two weeks of listing.

5. Negotiations, multiple-offers, and counteroffers

One of the best advantages of hiring a good real estate agent is that they know how to negotiate. Have a plan in place with your broker for how to handle multiple offers. It’s best to review them all at once as it gives you more control and leverage over the process. A good strategy is to ask for a “best and final” offer, which sets a date by which all interested buyers must come up with their best offer. Play this right, and you could start a bidding war and see the offer price go beyond the original asking price. Other tips on handling negotiations and offers to include:

Always make a counter offer – Many buyers are only “testing the waters” when they make their first offer and may raise it if you come back with a counteroffer that is just below your original asking price.

If you’re serious, don’t make your counteroffer too small – A reduction of only 1% from your original asking price can be perceived as insulting. If you want to get the negotiations moving, reduce 1-3%.

Insist that they show a mortgage pre-approval letter or proof of funds – You don’t want the deal falling through because the buyer was refused a mortgage. Ask for proof that they can close the sale on receiving their first offer.

The price isn’t everything – Don’t get too focused on only the amount. Other important considerations are the closing costs, contingencies, and the purchasing timeline.

Once you have an offer, you’re satisfied with, either your agent or the seller’s agent will circulate a deal sheet to the lawyers and brokers on both sides. Both attorneys will then negotiate the purchase contract on behalf of their respective clients. Once an agreement has been reached, the buyer will sign the contract and hand over a check for the down payment (usually 10% of the contract price). The contract is then sent to the seller for countersigning which only then makes the contract legally binding.

6. Schedule a home inspection

If the home in question is a free-standing property such as a townhouse or multi-family property, the buyer will typically request a home inspection. You should expect this to come once the offer has been accepted but before the purchase contract has been signed. A typical home inspection will take two or three hours as the inspector examines everything from the roof to the boilers.

If problems are found, the buyer may try to renegotiate the price or ask that repairs be done before they sign the contract. Your attorney will negotiate on your behalf. Most properties in NYC are sold “as is” so many sellers will reject requests to make repairs as a precondition to signing the contract. If you have other offers, then don’t be afraid to call them on their bluff to walk away.

7. Have the home appraisal done correctly

If the home appraisal comes back lower than expected, it can quickly send the whole deal into free fall. Buyers will get spooked by a low number which can potentially upset the loan-to-value ratio required by the buyer’s mortgage lender. This will mean the buyer must come up with more cash or you’ll have to reduce your price. Once completed an appraisal is very difficult to challenge so you and your broker should be doing everything you can to make sure the appraiser gets it right. For instance:

Prepare a dossier of comparable sales in the building and neighborhood – Don’t expect the appraiser to know the building and neighborhood. The dossier should outline the condition and sales price of comparable properties in your area.

Fix small defects – Make whatever minor renovations you can such as plastering and repainting walls, removing mold, etc.

Don’t hover – This suggests anxiety and gives the impression that something might be wrong.

8. Final Walk-through

Once the appraisal has been completed, and the buyer has received a mortgage commitment letter you have a green light to close. The attorneys will work to schedule a closing date that suits both parties while the brokers will schedule a final walk-through of the apartment. On the final walk-through, usually on or a day before closing day, the buyers have a chance to inspect the property before closing to ensure it’s in the same condition since the last viewing.

9. Closing day

Congratulations, you’ve reached the finish line. Closing day is usually the least stressful moment as all the issues and negotiations have been worked out. Present will be the buyer’s and seller’s attorney, the buyer’s banks attorney, the buyers and sellers, and a closing coordinator or representative of the title company. The seller will provide a check for the remaining amount owed, the seller signs the deed over to the buyer, and final closing costs are paid.

Once all documents have been signed, and all funds have been properly distributed, the deed of ownership along with the keys will be transferred to the buyer. The brokers will usually not be present on closing day as they have no role to play. At its end, they may show up to congratulate their clients and collect their commission checks or arrange a future date to do so.

The post The Complete Guide to Selling Your Home in NYC appeared first on | ELIKA Real Estate.

July 18, 2018

Top 5 Situations When You Should Hire a Buyer’s Agent in NYC

In NYC, the vast majority of homes are represented by a listing agent. Their primary responsibility is to protect the interests of the seller. So how can a buyer protect their interests? Simple, hire a buyer’s agent. There are many good reasons why it’s better to work with a buyer’s agent. Despite this, some buyers choose to go it solo and deal directly with the seller’s broker. The theory being that since the seller’s broker won’t have to split the commission (4-6%) with another agent, they may subtly or not so subtly encourage the seller to accept their offer. If the market is not very competitive, some buyers will work directly with the seller’s agent and try to have them kick in a percentage point of the commission towards the purchase price.

The problem with this strategy is that you’ll be working with the seller’s agent. Their fiduciary duty including obedience, loyalty, disclosure, confidentiality, and accountability is to the seller. When it comes to estimating fair market value and negotiating, they will not have your best interests in mind and may not divulge specific information about problems with the apartment or building. The sole job of a listing agent is to sell the property not to advise the buyer of the pros and cons. Something which they are not obliged to do under state law. Here are some valid reasons why you should hire a buyer’s broker in NYC.

1. You’re new to the city

Not knowing the local market is one of the biggest reasons why you should hire a buyer’s broker. Every market is different from town to town and even neighborhood to neighborhood. If you know exactly what neighborhood you’d like to find a home in, make sure you hire an agent that has experience finding homes there. Also, try to avoid making the most common first-time buyer mistakes.

2. You’re buying a problematic co-op

Purchasing a co-op apartment tends to be much longer and stressful process than a condo or townhouse. You’ll need to go through all the usual negotiating, offers and counteroffers with the extras of putting together a co-op board package and passing the board interview. A good agent will be able to help you compile a great board package that caters to the whims of the board and give you the best chance of success. Before you even make an offer, they can inform you of how easy or difficult the board interview will be. Meaning that everyone saves time and money.

3. You’re buying for investment

If you’re looking to invest in NYC real estate, then you’ll need the guidance of a broker with experience in investment properties. They can help you model anticipated cash flows, internal rates of return, cap rates, and expected net profits. They can also put you in touch with all the right people such as lenders, contractors and property managers. If you plan to rent out units, you can even hire the broker to market the properties and find suitable tenants. They’ll handle everything from open houses to advertising to making it accessible for potential buyers.

4. You’re not confident at negotiating

The moment when the value of a broker begins to shine is when they conduct negotiations on your behalf. Good agents will have a thorough understanding of the property, the building, and the current market, making them crucial when it comes time to strike a deal. Without a buyer’s agent, you’ll be forced to negotiate yourself and even if you are a confident negotiator you may still come up short from your lack of insider knowledge on the market.

5. You’re unsure about financing

If you’re in need of financing and expect that you may have some difficulty with getting it (for example, poor credit), then a buyer’s agent may be able to help. They’re not miracle workers, but they can help you navigate through the various financing options and banks and help you decide which type of mortgage is best for you.

Bonus Tip: You won’t pay a dime

The above points are all very valid reasons for hiring a buyer’s broker, but the most obvious one has been overlooked. Namely that it’s free. There are very few circumstances where the buyer will have to pay for the agent. They get their payment through the commission on the sale, usually 4-6%, which is split between them and the listing agent.

The post Top 5 Situations When You Should Hire a Buyer’s Agent in NYC appeared first on | ELIKA Real Estate.

July 17, 2018

Understanding a Co-op Ownership Structure and Proprietary Lease

We have discussed co-ops, but we turn our attention to a co-op’s basic structure. Unlike a condo where you own the individual unit, you are buying shares in a corporation. Technically, you are not a homeowner. In fact, you do not own any real property but, rather, you are a corporate stockholder.

We explain what this means in practice.

A certificate and lease

You receive shares and a proprietary lease when you close on your co-op purchase. The shares are your ownership in the corporation, while the proprietary lease allows you to live in a particular unit in the building. This means you are a building tenant. The proprietary lease outlines the house rules your rights and obligations, such as whether you can sublet the apartment, your monthly maintenance charges, and the rules regarding the sale of shares. If you are applying for a mortgage, the bank’s collateral are the co-op shares and proprietary lease.

Your ownership interest

A board can authorize any amount of shares it chooses. Once it does so, it assigns a number of shares to each unit. Obviously, this is not done equally since the apartments are not the same. There are different square footages, number of bedrooms, views, and a host of other factors that affect a unit’s value. The amount of shares for each apartment is assigned based on these valuations, but this needs a fair basis, which is typically independently verified by an appraisal firm or real estate broker.

What does it mean?

Owning a greater number of shares means you theoretically have a greater voice. You have more shares to vote for the board of directors, for instance. Since certain utilities, maintenance costs, the building’s mortgage, property taxes, and other operating costs are paid by shareholders, you also bear a higher cost.

Of course, this likely means you are living in a bigger apartment, so it is fair since you are incurring a greater portion of certain expenses.

What happens when more shares are issued?

Generally, the share count is fixed. The board needs to authorize the issuance of more shares. Unlike a regular corporation, this does not necessarily mean more dilution. When Microsoft issues more shares of stock, it needs to use the funds to grow earnings since there are now additional shares outstanding.

In a co-op, additional shares are issued if the board has decided to expand the building’s residential space. While this may mean more competition when you are ready to sell, the additional shares should not impact your unit’s market value.

Inheritance

Your spouse can inherit your shares without any questions, meaning he/she can continue to live in the unit without any issues.

It becomes a thornier issue when you are passing on your co-op shares to others besides your spouse. In this instance, leaving your condo unit to your other heirs is an easier proposition. You designate the shares to whomever you like. However, that doesn’t mean he/she can live in the co-op unit. The board needs to give its stamp of approval, and he/she must present financial statements and undergo an interview. Otherwise, your heir must sell the co-op unit.

The post Understanding a Co-op Ownership Structure and Proprietary Lease appeared first on | ELIKA Real Estate.

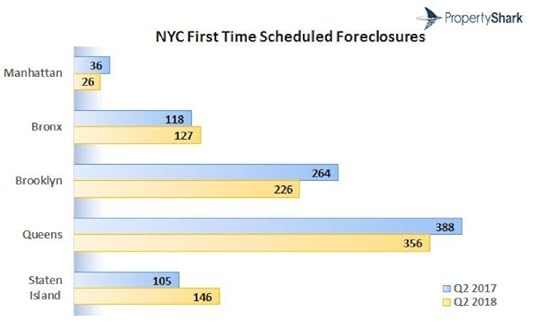

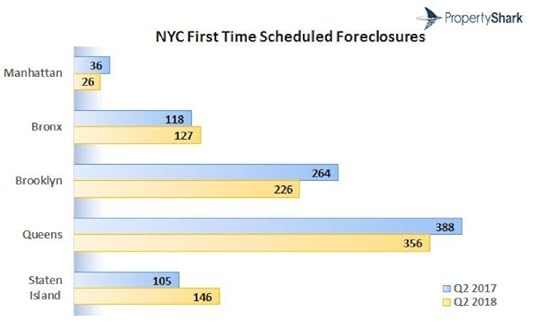

NYC Foreclosures Flatline in Q2 2018

New York City foreclosures saw a mild 3% decrease year-over-year, with 881 homes heading to auction in Q2 2018. Across the city, the number of foreclosures remains stable but high, at a rate of 800 to 900 per quarter since Q1 2017.

Key Takeaways:

First-time foreclosures in NYC dropped by 3% in Q2 2018

Staten Island foreclosures increased 39% year-over-year

With 356 cases, Queens had the most properties going to auction in Q2

Foreclosures in Brooklyn decreased 14% Y-o-Y

Foreclosures in the Bronx rose 8% year-over-year, with 127 properties going to auction

The number of lis pendens across NYC decreased by 13% year-over-year

While the number of foreclosure auctions dropped in Manhattan, Brooklyn, and Queens, the Bronx registered a slight increase of 8%. Additionally, Staten Island foreclosures grew 39% since the second quarter of 2017 and decreased by 23% since the previous quarter.

Queens Still has the Most Foreclosures, although Dropping 8% Y-o-Y

The borough had the highest number of foreclosures, even though the number of properties headed to the auction block dropped 8% year-over-year. Quarter-over-quarter, Queens registered a 17% increase. The zip-code with most foreclosures was also in the borough, with 30 cases associated to zip 114334.

Queens was 30 properties short of matching foreclosure activity of Q2 2017 when 388 properties hit the auction block. The number of auctioned properties has remained stable since Q1 2017, hovering between the low 200s and high 300s.

Brooklyn Foreclosures Down 14% Year-Over-Year

With 226 properties headed to auction in Q2 2018, activity dropped 18% quarter-over-quarter and 14% year-over-year. The number of foreclosures remains the second highest in NYC after Queens.

The highest number of properties scheduled for auction in Brooklyn were recorded in zip-code 11236, covering Canarsie and Flatlands.

Staten Island Closes Q2 2018 with 39% More Properties Going to Auction Y-o-Y

While foreclosures stagnated or deflated in other boroughs, cases in Staten Island were up 39% year-over-year. However, this quarter saw only 146 homes heading to auction, compared to the 189 from the previous quarter, a 23% decline. Zip 10301 registered the largest number of foreclosures: 23 properties.

The Bronx Sees 8% Increase Y-o-Y, Manhattan has the Least Foreclosures

With 127 homes going to auction in the second quarter of the year, the Bronx registered an 8% decrease year-over-year. Compared to Q1 2018, the rate dropped by 9%.

Following the same trend of having the lowest number of foreclosures in the city, Manhattan closed the second quarter of 2018 with 26 properties headed to the auction block. This translates to a 28% decrease both year-over-year and quarter-over-quarter.

13% Less Homes Entering Pre-Foreclosure Y-o-Y

With 2,772 cases, the rate of lis pendens decreased by 13% since Q2 2017 but registered an 8% increase quarter-over-quarter. In Q2 2017, there were 2,862 cases, while in Q1 2018 the city recorded 2,694 pre-foreclosures.

As for the boroughs, Queens topped the list with 1,005 cases of pre-foreclosures in Q2 2018, followed by Brooklyn at 861 lis pendens and Staten Island at 378 cases. Year-over-year, the rate of pre-foreclosures generally dropped, apart from the Bronx, where there was a slight 2% growth. The largest drop in lis pendens was registered in Brooklyn, down 16% year-over-year.

The original PropertyShark report is available here: https://www.propertyshark.com/Real-Estate-Reports/NYC-Foreclosure-Report.

The post NYC Foreclosures Flatline in Q2 2018 appeared first on | ELIKA Real Estate.