Gea Elika's Blog, page 108

August 15, 2018

What to Expect when Hiring and Working with an Architect

When you are planning a renovation, particularly a large and expensive one, we advise hiring an architect, unless you have specific expertise in this area. If you try to do it yourself, you will likely end up costing yourself more money, and the project will take a lot more time than you planned.

This is one task where you should hire an expert, and not rely on yourself, a relative with a good design sense, or leave it to the contractor. With that in mind, we hope to give you a better understanding of what you can expect when you hire an architect.

Hiring an architect

You should look for an architect with experience in the job you are planning. Contractors typically have architects that they work with, which is an excellent place to start. You can find qualified ones through friends and family, and you can ask to see his/her work. Word-Of-Mouth referrals are the most common way to hire an architect. You can also use the Internet, and there are specific websites such as Angie’s List, which include handy tools such as ratings and comments. No matter which route you go with, this is one area where checking referrals are very important.

In New York State, to call yourself an architect, you need a license. This means you need to have good moral character, be at least 21 years old, and meet educational, experience, and examination requirements. An architect can also obtain several credentials. A common one is the NCARB certificate, which requires passing an exam which shows that he/she has met the national standards and received a license.

An architect can also join a professional association, with the American Institute of Architects (AIA) being a popular one. AIA are licensed architects, but an Associate AIA is not. The Construction Specifications Institute (CSI) has specific certification programs that might indicate your architect has specialized training that can help you.

Conduct an interview

Once you know his/her qualifications, we recommend conducting an interview. Aside from asking for references, you should also ask to see samples and who else will work on the project. When you contact the references, have a list of questions ready. These could include his/her overall satisfaction, whether the architect was professional, and what kind of job he/she completed. If it is not similar to yours, you are going to have a hard time judging his/her work.

For instance, if it was a small kitchen remodel, and you are doing an extensive remodel, you are not going to know whether or not he/she can handle it. Additional questions might include how well he worked with you and the contractor. Then, if you are satisfied, you can ask to meet him/her.

Following the references check, you can turn your attention to the interview phase. Everyone asks questions before hiring a contractor, and the industry has a reputation for various scams. However, the architect is also a key person in the process, and it is just as essential to interview before hiring him/her.

Essential to ask

We suggest asking specifically about his/her role in the process. You may feel comfortable picking out the fixtures and managing the contractor, or, perhaps you would rather have the architect handle it. It is also a good idea to ask how problems had been dealt with on other jobs. For instance, if the contractor ran into unexpected issues, how did he/she work it out?

Another good question is how frequently the architect visits the site. Perhaps he/she only does it once, and charges for other visits. You may be fine with this, and it works for your project, but you need to know this ahead of time.

You should feel comfortable talking with the prospective architect about your wants and your vision.

What does an architect do?

An architect visits your home. This way, he/she can see the space, take measurements, determine the feasibility, and produce schematic drawings, which are highly technical. This should include an analysis of your apartment’s shape and structure. For you to get a better idea, a three-dimensional design on the computer allows you to see what it is going to look like when the work is done. This should let you know which ideas are practical, and which ones cannot get done, perhaps due to impracticality or the cost.

At this point, the architect moves into the design development phase. This includes the floor plan, kitchen and bathroom details (if applicable) and selecting the building materials. He/she should discuss the various options, along with the costs. There are a lot of choices, potentially including the type of flooring, countertops, cabinets, faucets, appliances, even down to the paint color.

Documentation Process

The next phase involves producing construction documents. This is the master plan the contractor will follow. It is all the necessary details, including a schedule and a detailed sketch of dimensions, along with selected finishes, lighting, and appliances. The construction documentation will also include guidelines from the NYC Department of Buildings. It needs a lot of details since this is the roadmap the contractor will follow.

Then, once you hire the contractor, he/she will check on the progress to make sure the plan is being followed. This is called construction administration. You can expect the architect to conduct regular site visits, or, at a minimum, at least one. If something is amiss, the architect can discuss it with you and your contractor. Of course, the architect likely has more construction expertise, and his/her words probably carry greater weight with the contractor. Any needed changes require the architect to produce new drawings. If the project is running over the estimated time allotted and coming in more expensive than the estimate, your architect can make suggestions to bring the time and cost back in line.

There is wide latitude when it comes to these tasks, however. Architects can have different ideas about what these mean, which makes it imperative to find out what type of service you will receive.

The fee

The architect can either charge an hourly rate, a fixed fee, or a percentage of the construction costs. It is important to delve deeper to understand the fee structure. For instance, if his/her price is based on a percentage of construction costs, you need to understand what this includes. Asking for an itemized list clears up potential misunderstandings.

The post What to Expect when Hiring and Working with an Architect appeared first on ELIKA Real Estate.

August 14, 2018

5 Mistakes to Avoid When Selling an Apartment

It’s an emotional moment when a homeowner decides to sell. After many cherished years, it can be an emotional moment to wish goodbye to your home. However, some sellers later get emotional because they can’t sell. We all make mistakes but when you’ve got something big on the line like an NYC apartment to sell mistakes can cost you big. It pays to do everything right, especially when it’s your first home sale. Here are some you don’t want to make when trying to sell your NYC apartment.

1. Staying emotionally attached

If you’ve lived in your home for more than a few years, it’s normal to feel an emotional attachment to it. This is the place where you’ve created your own nest and made many treasured memories with friends and family. But once you’ve decided to sell you have to detach emotionally and start to see your home more objectively. If you allow your emotions to get in the way, this can paralyze negotiations. Try to see your home the way a buyer would. Be aware of its strengths and flaws.

2. Not hiring a professional to help you sell

You might be tempted to take the FSBO route, but this comes with a lot of difficulties. Even if you can devote the time to marketing, hosting open houses, pre-qualifying and meeting multiple potential buyers you’ll still have trouble with negotiations and handling all the paperwork. Hiring a seasoned real estate broker means they can devote themselves fulltime to getting it sold. They have the skills, contacts, and experience to find the right buyers and the right price. Those who try to sell on their own often take longer and end up with less money than sellers who hired a broker.

3. Mistiming the sale for maximum tax benefits

You stand to lose tens of thousands of dollars in taxes if you miss-scheduled your closing day by as much as one day. Before setting a timeline for the sale make sure you talk with your accountant to find out if any long-term capital gains tax breaks apply to you. Mark the day they come into play on your calendar, so you don’t fudge the closing.

4. Not staging your home

If you’ve already moved out and the apartment is empty you can’t afford not to stage. Potential buyers tend to have a hard time visualizing living somewhere when they can’t see how the space can be utilized. If you’re still living there and have all your personal possessions around it can be even harder to attract a buyer. Declutter everything and look for ways you can arrange the furniture to show your home at its best. And if you really want to knock the socks off buyers on open house day, hire a professional staging company. They know exactly how to stage an apartment that will appeal to the right buyers.

5. Underestimating the costs of selling

If it’s your first sale, it’s easy to underestimate how high the costs of selling can be. Get this wrong and that fat check on closing day suddenly doesn’t look so big anymore. The real estate brokers commission will take up 5-6% of the sale price. That’s easy to estimate but what takes a little more effort is:

Moving expenses

Final property taxes

Utilities and insurance

Repair credits to the buyer

Short term rental or lease-back costs

Final closing costs

These non-commission costs can add up to 4% or more of your sales price. Combined with your broker’s commission, your selling costs can be up to 10%. Do the research and the math before you sign that contract of sale.

The post 5 Mistakes to Avoid When Selling an Apartment appeared first on ELIKA Real Estate.

August 13, 2018

Maximize Your Cash Payout from a Lease Buyout

If you are a New York City renter, landlords may want to lease your rent stabilized or rent control apartment for a higher amount. The NYC Rent Guidelines Board approves any annual increases for rent-stabilized apartments. If the building’s owner wants to shed these regulations in order to maximize his/her monthly rental intake, he/she may want to provide you an incentive to vacate the apartment.

In these instances, you can turn the situation to your advantage, monetarily. You can approach your landlord, if he/she has not come to you already, regarding a lease buyout.

The basics

When you sign a lease, you agree to pay a certain amount of rent per month for a period of time (e.g. one year or two years. However, you may want to leave early. In this case, you approach your landlord, and, he/she may offer you a deal to leave. The landlord has the incentive to do so when your rent is below market, such as a rent-stabilized unit.

In other cases, the landlord may approach you since he/she wants to raise the rent, but the law forbids it since you are a rent-regulated tenant. There are various ways a rent-stabilized apartment becomes deregulated while a rent-controlled apartment becomes decontrolled through a vacancy.

If you do not want to move and receive the buyout, you can refuse the offer, and the landlord cannot contact you for six months. Otherwise, it is considered harassment.

What I need to know

In the past, the amount landlords have offered varied greatly. There is no regulation on the amount he/she can offer or even a standard for determining the amount. You are in a better position to negotiate if your unit is in a desirable location, your rent is well below the market rate, and you are one of the last holdouts. However, there are a host of other factors that can come into play.

It is a complicated area. Not only do you need to understand the economics, but also the building owner’s motivation, and the tax consequences to both you and the landlord.

Can someone advise me?

You can turn to a lawyer for advice. You should look for a real estate attorney that has done lease buyouts.

There are also specialized firms that are dedicated to the task. In some cases, you only make a payment should the deal go through.

You should expect an in-depth analysis, covering a multitude of factors. This allows you to come in with an offer with substantial data backing it up. Alternatively, if the landlord approached you, your counter offer will have a lot more weight, or you may decide to forgo the lease buyout since you determine the offer is below fair value.

Cost-Benefit Analysis

You need to weigh the cost of moving and renting or buying another apartment. There are emotional factors that come into play, too. Perhaps the apartment has special meaning, or you like the location and you are surrounded by friends and family. Alternatively, you may wish to move since you have little family and friends remaining in the neighborhood.

The post Maximize Your Cash Payout from a Lease Buyout appeared first on ELIKA Real Estate.

August 12, 2018

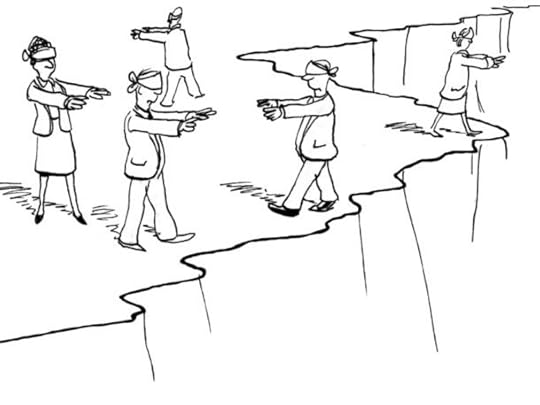

Top Negotiating Mistakes Sellers Make

Recently, we covered the top mistakes buyer’s make when negotiating a home purchase. Now let’s take a lot at it from the seller’s perspective. Some things apply just as much to sellers such as allowing emotions get in the way, talking too much in front of the buyer’s agent and seeing it as a zero-sum deal. But sellers are also prone to mistakes of their own. It’s all a matter of perspective so here are some of the worst negotiating mistakes when selling an NYC home.

1. Not having a plan B

Never go into negotiations with a buyer without a plan B. Without a safety net you’ll be under more pressure and may give concessions you could otherwise have avoided or reduced. Consider the possibility that the right offer might not come around so be ready with a backup plan. For instance, holding onto the property and remodeling it before putting it back on the market at a later date. Your broker will go through everything with you and will feel more confident themselves if they know you have a plan B. It gives them more leverage in negotiations.

2. Being insulted by low-ball offers or not responding to them

By far this is the most repeated lament of seller’s agents. Sellers who view a low-ball offer as nothing but an insult fail to see that it’s quite possible they can get it up to a more acceptable level. You have nothing to lose by coming back with a counter-offer and going through a bit of back and forth until you arrive at a deal that pleases everyone. Countering the offer, even with the original asking price shows that you’re serious and have confidence in the property’s value.

3. Making a counteroffer that is too low

Countering a low-ball offer with your original asking price can be a strategic response if you have a plan B and plenty of offers. However, it can backfire if you don’t make a reasonable reduction. A reduction of 1% will only insult most buyers and could make them walk away without a further word. Reducing the price by 3-5% is seen as a more serious response and a willingness to negotiate.

4. Focusing too much on the price

Every seller wants a good price, but when selling a home, there is always far more to the deal than just the price. When dealing with multiple offers, this is important as the highest bidder may not be the best deal. You need to closely examine the financial qualifications of each buyer and see who is a more sure bet. If deadlocked on a price, try to get creative and look for other areas that can give you some wiggle room. Perhaps adding or dropping a few contingencies, adjusting the timeline or looking at closing costs to name just a few.

5. Using the wrong numbers

There’s a good reason why you see store items priced at $19.95 rather than $20. The opening bid seems to influence how our brains think about value and shape our bidding behavior. A study at the University of Florida confirmed this with multiple tests on different products. Studies of real estate sales over five years in Alachua County, Florida found that when homeowners asked for a specific, non-rounded price – say, $694,500 instead of $700,000 – they sold their properties at a faster rate and for a price closer to their initial offer. This tactic has been seen to work to stay away from round numbers when setting a price.

The post Top Negotiating Mistakes Sellers Make appeared first on ELIKA Real Estate.

Top Negotiating Mistakes Sellers and their Brokers make

Recently, we covered the top mistakes buyer’s make when negotiating a home purchase. Now let’s take a lot at it from the seller’s perspective. Some things apply just as much to sellers such as allowing emotions get in the way, talking too much in front of the buyer’s agent and seeing it as a zero-sum deal. But sellers are also prone to mistakes of their own. It’s all a matter of perspective so here are some of the worst negotiating mistakes when selling an NYC home.

1. Not having a plan B

Never go into negotiations with a buyer without a plan B. Without a safety net you’ll be under more pressure and may give concessions you could otherwise have avoided or reduced. Consider the possibility that the right offer might not come around so be ready with a backup plan. For instance, holding onto the property and remodeling it before putting it back on the market at a later date. Your broker will go through everything with you and will feel more confident themselves if they know you have a plan B. It gives them more leverage in negotiations.

2. Being insulted by low-ball offers or not responding to them

By far this is the most repeated lament of seller’s agents. Sellers who view a low-ball offer as nothing but an insult fail to see that it’s quite possible they can get it up to a more acceptable level. You have nothing to lose by coming back with a counter-offer and going through a bit of back and forth until you arrive at a deal that pleases everyone. Countering the offer, even with the original asking price shows that you’re serious and have confidence in the property’s value.

3. Making a counteroffer that is too low

Countering a low-ball offer with your original asking price can be a strategic response if you have a plan B and plenty of offers. However, it can backfire if you don’t make a reasonable reduction. A reduction of 1% will only insult most buyers and could make them walk away without a further word. Reducing the price by 3-5% is seen as a more serious response and a willingness to negotiate.

4. Focusing too much on the price

Every seller wants a good price, but when selling a home, there is always far more to the deal than just the price. When dealing with multiple offers, this is important as the highest bidder may not be the best deal. You need to closely examine the financial qualifications of each buyer and see who is a more sure bet. If deadlocked on a price, try to get creative and look for other areas that can give you some wiggle room. Perhaps adding or dropping a few contingencies, adjusting the timeline or looking at closing costs to name just a few.

5. Using the wrong numbers

There’s a good reason why you see store items priced at $19.95 rather than $20. The opening bid seems to influence how our brains think about value and shape our bidding behavior. A study at the University of Florida confirmed this with multiple tests on different products. Studies of real estate sales over five years in Alachua County, Florida found that when homeowners asked for a specific, non-rounded price – say, $694,500 instead of $700,000 – they sold their properties at a faster rate and for a price closer to their initial offer. This tactic has been seen to work to stay away from round numbers when setting a price.

The post Top Negotiating Mistakes Sellers and their Brokers make appeared first on ELIKA Real Estate.

August 10, 2018

Understanding Condo, Co-op and Building Insurance

Having insurance is vital for every homeowner, but a surprising number of people don’t understand what their insurance covers. Or, more specifically, what is covered by apartment insurance and what is covered by building insurance. This is especially important for co-op and condo owners because these tend to be much more complicated then homeowner insurance. It’s crucial that you understand the full implications of what you’re responsible for. Otherwise, you could run into a lot of frustration and surprises when something goes wrong.

Here we explain the differences between condo and co-op insurance. A good understanding of what it covers means you’ll save money and have fewer problems when al claim is made.

The difference between apartment insurance and building insurance

Most condo and co-op buyers are so caught up in the buying process that they fail to read the fine print on what is covered by the building insurance. You should find out about this before you buy because they can vary significantly from one property to another. In a nutshell, your private apartment insurance covers everything within the four walls of your apartment. Building insurance covers everything that happens outside of them. Don’t make the mistake of thinking that the building insurance will cover damage to your apartment. Get a separate policy for your apartment.

What the master building policy covers will be stated in your proprietary lease or agreement with the building. So make sure to read through it carefully. Understand what is covered, what is not covered, and how claims are handled in the event of damage.

Condo insurance

Unlike homeowners, co-op and condo owners do not need to provide a binder of insurance when applying for a mortgage because the building itself is insured on the association policy. This often confuses condo owners and makes them think that everything is covered.

Condo insurance will cover, at its most basic, the following:

Your personal liability

Your personal property

Your improvements, alterations or additions

Most basic insurance policies have clauses which limit coverage on certain high-value items. If you have any high-value items such as jewelry, artwork or other limited items, you might want to get a sperate policy to cover them. Your insurance representative will take you through the range of insurance options and recommend what works best for you.

Co-op insurance

Although condos and co-ops might seem quite similar to living spaces, they are actually very different legally and financially. Because of these legal differences, the way they are insured varies. Unlike condos, co-op owners do not own the actual property. They get the right to live there via purchasing shares in the building. What this means is that they do not own the walls or an individual part of the building. Because of this, the insurance they need is more like a tenant policy.

The master building insurance will cover the building as a whole, which includes any common areas or shared areas. It’s up to the co-op owner to have their own personal liability, and specific unit features covered.

Making a claim

When it comes to making a claim, there will be a few hurdles to overcome in deciding who is paying as you won’t be dealing with just one insurance company or policy. Every co-op and condo owner will have to deal with both the master building insurance and their own policy when making a claim. If a third party is involved, such as a neighbor which you feel was responsible for the damage because of negligence, then their policy will also come into play.

There are often several steps to the process of deciding among the parties involved who is responsible. You can best protect yourself by reading carefully through what’s covered in the master building insurance and look for gaps between that and your own policy.

The post Understanding Condo, Co-op and Building Insurance appeared first on | ELIKA Real Estate.

Can I install a washer/dryer in my apartment in NYC?

Buying a washer and dryer is a seemingly simple task. However, for New York City’s apartment dwellers, it is a complicated endeavor. This impacts everyone that resides in an apartment, whether you are a renter, co-op shareholder, or condo owner.

We provide a roadmap to you in order for you to better prepare yourself.

Am I allowed?

The first question to ask is whether you are permitted to have a washer and dryer. It seems incongruous, but many New York City buildings do not allow a washer and/or dryer in any of its apartments. There are solid reasons for this, however. Certain buildings may not have adequate plumbing or other conditions that allow the appliances to function correctly. Management may fear leaks and fires, even if the proper infrastructure is in place. This situation not only affects you but other apartments as well.

In some cases, your co-op or condo board, or landlord, may permit some units to have a washer and dryer, while disallowing it in others. While this seems unfair, the board or landlord may have solid practical reasons, such as better drainage in certain apartments.

Therefore, if you are interested in buying these appliances, find out if the building permits it, and whether you can put in your own unit.

Consider your options if the board/landlord disallows the appliances. Perhaps your building has machines, and you find this an acceptable alternative. If not, learn where the nearest laundromat is, and whether this works for you. Otherwise, there are services you can use, but this could get pricey.

Buying a machine

If you have received the board’s blessing, you cannot purchase any type of machine, particularly dryers. You likely need to purchase an electric dryer since gas ones require access to an outside vent.

Installing the machines

Generally, you need to have the machines installed either in your bathroom or kitchen or close by. Space is a premium in New York City, so you may wish to consider stackable units, or a washer/dryer combination.

For a new washer or dryer, you are going to need a permit from the New York City Department of Buildings. A licensed plumber has to do the work.

However, while it is an additional expense, there are ways to make the washer and dryer look nice, while also serving a practical function. You can build a special cabinet for the unit in your kitchen, particularly for a combination washer/dryer. This is a nice option if your square footage is constrained. Another option is to repurpose space for the units, although this works best if you are not concerned about using the square footage for this purpose. One suggestion is to use extra closet space.

The cost

Buying a washer and dryer does not come cheap, however. The cost of new plumbing and electrical can cost several thousand dollars. The machines’ prices vary, depending on the model and which features you desire.

However, if you own the unit, this likely adds value. One expert estimates a 5% boost to your resale value. Additionally, you have a distinguishing selling point. Of course, you also benefit from the convenience of having your own washer and dryer.

The post Can I install a washer/dryer in my apartment in NYC? appeared first on | ELIKA Real Estate.

August 7, 2018

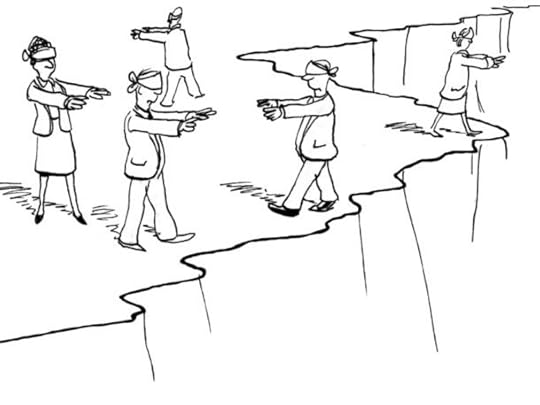

Top Negotiation Mistakes Buyers Make

Negotiating is a key component of any real estate transaction. It’s very rare for the ideal home to pop up on the first search or to get the perfect deal without first going through a bit of back and forth. Most people have experience negotiating business deals and buying cars but negotiating to buy a home is a little different. The key difference between this type of deal and the others is one thing, pride of ownership. Sellers tend to be proud of their homes and if they’ve been living in them for many years there will be an emotional attachment.

Buyers and their brokers need to understand the seller’s motivations and what mistakes to avoid. If you’re hunting for an apartment in NYC, whether it be a co-op, condo or townhouse, here are the top negotiating mistakes you need to avoid.

1. Bashing the property

Blatantly pointing out the flaws and shortcomings in a home might be a common negotiation tactic in other markets but it doesn’t work so well in the real estate market. As mentioned, sellers have an emotional attachment to the home and may even be very reluctant about selling. Insulting the property to get a better price is more likely to get the sellers angry and go instead with another buyer. If you must point out certain flaws, try to do it tactfully.

2. Talking too much in front of the seller’s agent

The presentation is everything in negotiating, meaning you should be very careful about what you say and don’t say in front of the other party. This should be kept well in mind until you have a binding contract. When you visit an open house, be careful of what you say about your current financial position or eagerness to buy as the seller’s agent will be looking for any leverage they can use in negotiations. There’s nothing wrong with asking them questions but don’t show any of your cards. Saying the wrong thing may give the agent reason to believe you can afford more than you initially offer, or you could disqualify yourself by underselling your qualifications.

3. Letting emotions get in the way

This applies to all negotiating but it’s worth stating it again here, keep your emotions in check. Don’t appear either too eager or too desperate. Have your buyer’s agent conduct all the hard negotiating so you’ll have a buffer against sudden emotional outbursts which can tank a whole deal. Be completely neutral, if you look desperate you could end up paying more, if too eager they could pull on your heart-strings during price and concession negotiations.

4. Seeing it as a zero-sum deal

This is a particular problem with New York buyers, many of which are attorneys or executives in other fields that are used to negotiating in a zero-sum fashion. They think they have to win and the other side has to lose. When conducting real estate negotiations, you must look at it from a more collective bargaining perspective. Move slowly, stress your qualifications and, where you can, be willing to give ground and meet somewhere in the middle.

5. Not taking the time to write a proper offer letter

There’s far more to an offer letter than simply scribbling a number on a piece of paper. It should explain the reasoning behind the offer such as references to comparable market sales and include your financial documents to prove you can close the deal. It should be neatly typed up on a Word document with your agent’s letterhead and include a “Love Letter” to sweeten the deal. This shows a lot more sincerity and seriousness to close. If you’re financing, you should include your mortgage pre-approval letter and the standard REBNY financial statement. If buying all-cash, include a proof of funds/bank statement to give the seller a sense of comfort.

The post Top Negotiation Mistakes Buyers Make appeared first on ELIKA Real Estate.

Top Negotiation Mistakes Buyers and their Brokers Make

Negotiating is a key component of any real estate transaction. It’s very rare for the ideal home to pop up on the first search or to get the perfect deal without first going through a bit of back and forth. Most people have experience negotiating business deals and buying cars but negotiating to buy a home is a little different. The key difference between this type of deal and the others is one thing, pride of ownership. Sellers tend to be proud of their homes and if they’ve been living in them for many years there will be an emotional attachment.

Buyers and their brokers need to understand the seller’s motivations and what mistakes to avoid. If you’re hunting for an apartment in NYC, whether it be a co-op, condo or townhouse, here are the top negotiating mistakes you need to avoid.

1. Bashing the property

Blatantly pointing out the flaws and shortcomings in a home might be a common negotiation tactic in other markets but it doesn’t work so well in the real estate market. As mentioned, sellers have an emotional attachment to the home and may even be very reluctant about selling. Insulting the property to get a better price is more likely to get the sellers angry and go instead with another buyer. If you must point out certain flaws, try to do it tactfully.

2. Talking too much in front of the seller’s agent

The presentation is everything in negotiating, meaning you should be very careful about what you say and don’t say in front of the other party. This should be kept well in mind until you have a binding contract. When you visit an open house, be careful of what you say about your current financial position or eagerness to buy as the seller’s agent will be looking for any leverage they can use in negotiations. There’s nothing wrong with asking them questions but don’t show any of your cards. Saying the wrong thing may give the agent reason to believe you can afford more than you initially offer, or you could disqualify yourself by underselling your qualifications.

3. Letting emotions get in the way

This applies to all negotiating but it’s worth stating it again here, keep your emotions in check. Don’t appear either too eager or too desperate. Have your buyer’s agent conduct all the hard negotiating so you’ll have a buffer against sudden emotional outbursts which can tank a whole deal. Be completely neutral, if you look desperate you could end up paying more, if too eager they could pull on your heart-strings during price and concession negotiations.

4. Seeing it as a zero-sum deal

This is a particular problem with New York buyers, many of which are attorneys or executives in other fields that are used to negotiating in a zero-sum fashion. They think they have to win and the other side has to lose. When conducting real estate negotiations, you must look at it from a more collective bargaining perspective. Move slowly, stress your qualifications and, where you can, be willing to give ground and meet somewhere in the middle.

5. Not taking the time to write a proper offer letter

There’s far more to an offer letter than simply scribbling a number on a piece of paper. It should explain the reasoning behind the offer such as references to comparable market sales and include your financial documents to prove you can close the deal. It should be neatly typed up on a Word document with your agent’s letterhead and include a “Love Letter” to sweeten the deal. This shows a lot more sincerity and seriousness to close. If you’re financing, you should include your mortgage pre-approval letter and the standard REBNY financial statement. If buying all-cash, include a proof of funds/bank statement to give the seller a sense of comfort.

The post Top Negotiation Mistakes Buyers and their Brokers Make appeared first on | ELIKA Real Estate.

Top Negotiating Mistakes Buyers and their Brokers Make

Negotiating is a key component of any real estate transaction. It’s very rare for the ideal home to pop up on the first search or to get the perfect deal without first going through a bit of back and forth. Most people have experience negotiating business deals and buying cars but negotiating to buy a home is a little different. The key difference between this type of deal and the others is one thing, pride of ownership. Sellers tend to be proud of their homes and if they’ve been living in them for many years there will be an emotional attachment.

Buyers and their brokers need to understand the seller’s motivations and what mistakes to avoid. If you’re hunting for an apartment in NYC, whether it be a co-op, condo or townhouse, here are the top negotiating mistakes you need to avoid.

1. Bashing the property

Blatantly pointing out the flaws and shortcomings in a home might be a common negotiation tactic in other markets but it doesn’t work so well in the real estate market. As mentioned, sellers have an emotional attachment to the home and may even be very reluctant about selling. Insulting the property to get a better price is more likely to get the sellers angry and go instead with another buyer. If you must point out certain flaws, try to do it tactfully.

2. Talking too much in front of the seller’s agent

The presentation is everything in negotiating, meaning you should be very careful about what you say and don’t say in front of the other party. This should be kept well in mind until you have a binding contract. When you visit an open house, be careful of what you say about your current financial position or eagerness to buy as the seller’s agent will be looking for any leverage they can use in negotiations. There’s nothing wrong with asking them questions but don’t show any of your cards. Saying the wrong thing may give the agent reason to believe you can afford more than you initially offer, or you could disqualify yourself by underselling your qualifications.

3. Letting emotions get in the way

This applies to all negotiating but it’s worth stating it again here, keep your emotions in check. Don’t appear either too eager or too desperate. Have your buyer’s agent conduct all the hard negotiating so you’ll have a buffer against sudden emotional outbursts which can tank a whole deal. Be completely neutral, if you look desperate you could end up paying more, if too eager they could pull on your heart-strings during price and concession negotiations.

4. Seeing it as a zero-sum deal

This is a particular problem with New York buyers, many of which are attorneys or executives in other fields that are used to negotiating in a zero-sum fashion. They think they have to win and the other side has to lose. When conducting real estate negotiations, you must look at it from a more collective bargaining perspective. Move slowly, stress your qualifications and, where you can, be willing to give ground and meet somewhere in the middle.

5. Not taking the time to write a proper offer letter

There’s far more to an offer letter than simply scribbling a number on a piece of paper. It should explain the reasoning behind the offer such as references to comparable market sales and include your financial documents to prove you can close the deal. It should be neatly typed up on a Word document with your agent’s letterhead and include a “Love Letter” to sweeten the deal. This shows a lot more sincerity and seriousness to close. If you’re financing, you should include your mortgage pre-approval letter and the standard REBNY financial statement. If buying all-cash, include a proof of funds/bank statement to give the seller a sense of comfort.

The post Top Negotiating Mistakes Buyers and their Brokers Make appeared first on | ELIKA Real Estate.