Gea Elika's Blog, page 110

July 31, 2018

How to Rent an Apartment in NYC

Before you begin your search, it’s important to familiarize yourself with the Manhattan market. Seeking the help of an experienced rental agent can give you keen insights into the many different neighborhoods New York City has to offer, thereby helping you narrow down your search for rental apartments that are within your budget and are the best fit for your lifestyle. Manhattan is the cultural, business and social crossroads of the world, and each of its neighborhoods claim unique offerings regarding schools, restaurants, shopping, and recreation, amongst much other quality of life factors.

New York City is composed of five boroughs, with Manhattan itself taking up the smallest amount of land. However, with over one million inhabitants, Manhattan, lays claim to being the most densely populated county in the U.S. Its boundaries include the Hudson River on the west, the East River on the east, the New York Harbor to the south and the Harlem River to the north. With its streets laid out in a grid, it is also one of the most easily navigated cities in the country.

Manhattan’s avenues run north to south with Twelfth Avenue being the farthest west and First Avenue the eastern-most boundary. The streets run east to west across the avenues, and as you make your way north, the street numbers increase. Fifth Avenue runs through the center of Manhattan and divides the city into its East and West sides. As a result, there is an East 57th Street and a West 57th Street. Broadway runs diagonally across Manhattan from the Lower East Side to the Upper West Side. The grid system disappears downtown, where getting around becomes somewhat more problematic, but getting lost in Lower Manhattan, particularly in areas like the West Village, can lead to some great restaurant and shopping finds.

Timing is everything

Timing is everything on the NYC apartment rental scene. During the winter, most people are content to stay put, while the summertime is historically the busiest renting season, as students and recent grads descend upon the city creating a severe upswing in demand, and with it, prices. Therefore, Elika recommends that if you can put off your search, the best time to look for a rental apartment is in the late fall and winter months, when rentals are less costly.

Of course, seasonal fluctuations also depend on apartment size, neighborhood and how the overall economy is doing.

To get the best deal, we recommend following the market close by reviewing rental market reports and news, and by studying the apartment listings on a daily basis. Most prospective renters don’t have the luxury of choosing exactly when they will need to get an apartment and recommends that you start looking one month to 45 days before you need to move in. Landlords usually select move-in dates for vacant apartments on the 1st or 15th day of the upcoming month, so prospective renters should plan accordingly.

Steps to Renting an Apartment in NYC

The first thing you need to do before renting is determining your criteria for an apartment. Here are some factors we suggest you consider when thinking about a rental:

1. Consider advantages when using a Rental Agent versus doing it alone.

Before the advent of the Internet, searching for an NYC apartment on your own was a complicated and challenging task. Now that the online world has bloomed, that is no longer the case. It is possible to do all the research you need to do online through the free online websites, no–fee rental sites, public real estate databases. However, you should know that if you go it alone, the process of finding a Manhattan rental apartment can be extremely time-consuming.

If you decide to search for an apartment on your own, you will be forced to spend countless hours pouring over real estate ads and arranging for apartment viewings at times that are often inconvenient for you. Further, you may waste your time checking out 15 apartments, only to find that none of them are suitable and that you have missed out on “the one.” Also, you’ll have to contend with everything from irresponsible owners who don’t return your calls to outright scams. In short, searching for a Manhattan apartment on your own can make you want to scream.

If you decide to go with a rental agent, you will be spared what can seem like unrelenting aggravation. Experienced rental agents will save you valuable time because they know exactly what is available, what apartments are worth and whether or not they meet your criteria. Agents will be able to select the most suitable property for you, help you avoid scams, help you prepare your application package, and negotiate a deal with the landlord. In a city where time is such a valuable commodity, such assistance can be invaluable.

Another benefit of having an experienced agent is the connections they have with other local professionals and landlords. Also, they will be able to provide you with recommendations for services like movers and decorators — which can be especially helpful if you are new to Manhattan.

1. Determine your budget.

By far the most constraining factor in your search for an apartment is your budget. Before even starting your search, you need to get a clear picture of the minimum you want to pay and the maximum you can afford to pay per month. Once you have calculated your monthly expenses with rent figured in, you can get a much better idea of what apartments are in your price range. To qualify for a New York City rental most brokerages and landlords require that you make 40 times the monthly rent in annual income.

2. Choose a Neighborhood.

Regarding neighborhoods, no other city offers the choices that Manhattan does. From the chic and trendy to the upscale and sophisticated, there are an array of neighborhood options. Depending on such criterion as accessibility and food shopping, the vibe may even be different from block to block within a particular neighborhood.

When it comes to Manhattan neighborhoods, no two are the same. From Chelsea to the Upper West Side, each community has its unique qualities. Rental agents will introduce you to the many enclaves that comprise Manhattan, ensure that you know how to navigate around them and help you pick the location that is best suited for you.

You can visit our Manhattan and Brooklyn Neighborhood Guide for more details on specific neighborhoods, but don’t forget that there is no substitute for checking out a neighborhood in person to get a feel for its atmosphere. By actually going to an area, you can discover firsthand its flavor and character by talking to residents and visiting stores, schools, restaurants and other local haunts.

New Yorkers may have a reputation for being gruff, but they still love to talk about themselves and where they reside. By asking a simple question like, “Do you like living here?” you can get a wealth of information that you cannot get online or by talking to an agent.

3. Decide on the size of the apartment you need.

Space is a costly commodity in the Manhattan real estate market, so it is essential that you be realistic about your needs. Ask yourself such questions as how many people will I be living with? Am I amenable to sharing a bathroom or bedroom? The more people sharing the rent, the less costly the apartment will be, but that comes at a sacrifice of privacy. Know your limits, but above all, keep an open mind and be ready for compromise.

4. Pick the essential amenities to you.

Regarding amenities, New York City apartments offer an array of choices. Some luxury buildings feature such things as laundry service, on-site gyms, and electronic rent payment. Modest walk-up rentals have fewer amenities, can be more attractive because the rents are more affordable. Consider compromising on things that are non-essential to you, but that you keep your safety uppermost in your mind as your security should be non-negotiable.

5. Research the Market.

If you are considering a range of options, like renting a studio by yourself or sharing a two–bedroom with a roommate, remember to set up searches for all of these options. Even if you can’t afford a studio in your favorite neighborhood, you might be able to rent in that area if you split the cost of a more significant place with friends. Further, look to your friends and their real estate choices for market information and renting advice. Those who already live in a particular neighborhood are the best sources of information about it. Then, once you narrow down your search to specific properties, you will get a better idea of the types of apartments and features that mesh with your budget.

7. Organize and schedule viewings of the apartments you picked.

Once you’ve selected a broker, you can put them to work scheduling viewings for you. All you have to do is tell your rental agent the dates and times that you are available, and we will do the rest. You probably have a full-time job that makes mid-week viewings difficult, but keep in mind that the faster you see an apartment, the quicker you can snap it up. To save time, schedule back-to-back viewings of some apartments in the same neighborhood (allowing yourself between thirty minutes and an hour to see each apartment). Make sure, however, that you are thorough when you evaluate the property because your first viewing could potentially be your last before you sign the lease and move in.

Keeping tabs on your appointments is vital, and can be accomplished by using a spreadsheet that contains the time, date, location and contact information for each apartment. Agents will also keep track of your appointments in such a manner. It is also essential that you be on time for your viewings to show prospective landlords and your agent that you are reliable and serious about renting. Above all, it is vital that you visit each apartment that you are investigating in person. Advertisements can be deceiving, and what looks great on the Web, can turn out to be a disaster when you visit the place and that dream pad turns out to be a five-floor walk-up with the smells of the restaurant below wafting through the door.

8. Be prepared when viewings apartments.

We highly recommend when you view an apartment, you come prepared with all the information necessary to apply to rent it. Since Manhattan apartments are grabbed up quickly, you will then be able to submit your application on the spot and can rest assured that no one will steal the place out from under you. Plus, the landlord will see that you are someone who is responsible and savvy. Bring the following things with you when you go to your apartment viewings:

Essential Application Information – Required documents can vary depending on the landlord. However, most will require the list of items below to proceed with a rental application.- Letter from employer stating position, length of employment as well as salary.

– Tax returns from the last two years.

– Last two pay stubs.

– Guarantor (If salary does not qualify for 40x monthly rent).

– Verification of assets such as equities, real estate, etc.

– Bank statements form the last two months.

– Name, address and phone number of the previous landlord.

– Two business reference letters.

– Two personal reference letters.

– Photo identification ( passport or driver’s license).

Camera – Bringing a camera along is a good idea, especially when you are seeing some apartments in rapid succession and could use shots of the interiors and exteriors to jog your memory.

Tape Measure – It’s a good idea to tote a tape measure along to make sure that your furniture will fit into an apartment. Be sure to come prepared with the measurements of this furniture.

9. Choose the apartment that suits you best.

After you’ve seen the property available, you can decide on an apartment. Many people only have to look at an apartment once to conclude it’s the perfect place for them, but others will have to weigh the advantages and disadvantages of multiple rentals carefully. If you are doing this, you have to consider which property is at the best location regarding such things as commuting, weekend entertainment, and traveling outside of the area. Further, you should think whether any repairs are necessary, whether the apartment unit itself is laid out functionally and has space for all your belongings and whether it has ample natural light. Above all else, you must ascertain whether you can comfortably afford the rent and the cost of utilities.

10. Prepare and submit an apartment rental application.

Renting an apartment in Manhattan requires more than just giving basic information and writing a check. Future renters should understand the qualifications necessary to rent in the city. These include:

Income Requirements — Most landlords require tenants to earn 40 to 50 times the monthly rent of the apartment as their annual salary. This refers to guaranteed income and does not include bonuses. (i.e., If the property is $3000.00 a month, you must earn $120,000.00 to $150,000.00 a year to qualify to rent the apartment.)

Lease Guarantor – If an applicant does not meet the financial requirements, the landlord may require a Lease Guarantor. This is the person who pays the rent if the tenant fails to do so. They are required to navigate the same application process as the tenant and earn 80 to 100 times the monthly rent. Also, most landlords favor tri-state guarantors (people who reside in New Jersey, New York or Connecticut).

Application / Credit Check – This is a single document that will provide a landlord with all of an applicant’s required financial, professional and personal background information. (Credit checks are only applicable to US residents).

Application Fees – Application fees are typically required when you submit your application and range in price from $50–$100 (per application) for a rental building and anywhere from $250–$1,000 for a co-op or condo building.

Certified Funds – One month’s rent and one month’s security is due when you sign your lease. Landlords require this payment in the form of two separate certified checks or money orders. These checks can be obtained at a Manhattan bank for $10–$15. Landlords do not accept personal checks or cash, but some will allow the tenant to pay with a credit card (often with surcharges of 2-3% added to the rent and security payments). If you lack a US credit history or have bad credit, landlords will many times ask for additional security.

Employer Verification Letter – This letter must be written on company letterhead and be signed by your supervisor. It should state your position, starting date, salary and, if applicable, guaranteed bonus. It should also detail whether or not you are entitled to a housing allowance and if so, how much.

Landlord Reference – When trying to rent an apartment, a glowing reference from your current landlord is a great asset. Indeed, this information is often requested during the process. If you were unable to get a letter, be certain you can pass on your landlord’s name, address, and telephone number. Without a reference, a landlord might want to do his check into your history as a tenant.

References – Every landlord doesn’t require references, but it is better to be prepared for that request. In addition to a landlord’s letter, a reference from an accountant or attorney reflects favorably on you. Decide on your references and have up-to-date contact information for them.

Bank Statements – You should come prepared for at least the last two months worth of statements.

Tax Returns – In some cases, you may be asked to provide tax returns, so it is essential to bring the last two years of returns with you.

Photo Identification – It will be necessary to show a driver’s license, passport, or some other form of government-issued photo ID.

Pet Deposit – Many buildings and landlords are pet-friendly but can require an additional month of deposit for pets – in case of any damage or other problems.

Brokerage Agreements – Since tenants pay the brokerage fees in Manhattan, it is customary to be asked to sign a fee agreement when enlisting the help of a broker. This agreement only states that you agree to pay a fee to the broker if they help you to obtain a lease on a particular apartment. You do not have to pay a brokerage fee if you are unable to secure a lease through a broker.

Brokerage Fees – The brokerage fee in Manhattan can be up to 15 percent of the annual rent. This is usually required when you sign your lease. You are only responsible for this fee if you secure an apartment through that broker. Fees should always be made payable to the brokerage firm and not a specific agent. If an apartment listing says NO FEE, there will be no broker fees charged at any stage.

Owner Paid Fees – In certain instances, a landlord may pay a portion of a fee to a broker. Under New York State law, the broker must notify the person responsible for paying the fee, whether that is a tenant or sponsoring corporation. Elika’s Renters Representation will help you prepare your application, double checking all requirements and following up with the leasing organization quickly to ensure that nothing slips through the cracks, particularly in extraordinary circumstances. (See Appendix C for more details.)

Negotiating and Signing the Lease – In times when the market is soft, there is an opportunity in the Manhattan rental market to negotiate more favorable lease terms. Elika’s Renters Representation can offer you expert advice and guidance as to whether negotiation is possible and how to go about it. Bear in mind, however, that even in a soft market, a landlord will walk away from a deal if it does not make financial sense. Once you have agreed on the terms, the lease will need to be signed by all parties, including the landlord, renter, and if applicable, guarantors. All of the necessary documents need to be signed before you can move ahead, so if you are enlisting a guarantor from outside the area, you need to be prepared to ship documents quickly. Once the lease is signed, it’s time to make a toast—the apartment has become yours officially.

More to Consider Before Renting

Special Rental Situations

When going to rent an apartment in Manhattan, there are some special situations that you may need to be prepared to address. These include the following:

Roommates – Usually landlords will not accept more than two names on a lease. Roommates are held jointly responsible for rent and broker fees. Also, roommates are held responsible for any other roommate’s unpaid rent. Elika’s Renters Representation therefore strongly suggests that roommates sign is written agreements which bind each of them to the rental fee and terms of the lease. Regarding the financial requirements for renting, landlords will often consider the combined income of the roommates.However, this can vary from landlord to landlord, and you should tell your broker ahead of time if this is how you plan to qualify for an apartment. Also be aware that landlords may require a guarantor even if your combined income meets the financial requirements, so that is why you also need to notify your broker of this circumstance.

International Tenant — If you pay taxes outside of the United States, or if you have a housing allowance from your job, your qualifications are assessed differently. If this is the case, you can consult with Elika’s Renters Representation about the financial resources you will need to become eligible to rent. Without a U.S. rental history, many of those relocating from abroad are required to pay additional security. Some landlords may even require as much as six months to one year of rent to be paid in advance depending on your particular circumstances.

Pets — Your four-legged canine friend can sometimes prove to be your worst enemy when it comes to obtaining an apartment in Manhattan. Most landlords in New York City do not accept dogs over twenty pounds, and in many cases even frown upon smaller dogs, cats, and other small domestic animals. If you have a pet or plan on getting one, your choice of apartments may be limited, so you should alert your broker to this situation.

Walls — Since it’s often difficult to find affordable two-bedroom apartments, many prospective tenants look for one-bedrooms that can be converted into two by the installation of a temporary wall. Elika knows of several reputable businesses in Manhattan that will deliver and erect a wall for a fee. However, many landlords do not allow these shares, so you should advise your broker if you plan on going this route. Be aware that you are often responsible for removing the wall at the end of your lease.

Manhattan Apartment Sizes

The city boasts many standard-sized apartments, but several types have their special kind of layouts. Here are descriptions of a few:

Studio — This is a one-room dwelling in which the living room and the bedroom are in a single space. In larger studios, the kitchen is in a separate room, while in others the eating area can be found along one wall in the main space. Studios are also referred to as efficiencies.

Alcove Studio – This is a one-room apartment that also offers an open area adjacent to the main space which is used for sleeping. This type of dwelling is also referred to as an L-shaped studio because of its configuration or a junior—one bedroom.

Flex (convertible) Two – This is a one-bedroom apartment that features large space, typically the living room, transformed into another bedroom and a smaller living room by the installation of a temporary, also known as pressurized, wall dividing the space.

Junior 4 – This is a one bedroom apartment that features an alcove area in the living room, which is typically used as a dining room, or converted into a second bedroom.

Flex 3 – A two-bedroom apartment with an alcove in the living room that is convertible to a room.

Classic 6 – This type of apartment exists exclusively in prewar buildings, and describes a dwelling with six rooms: a living room, a formal dining room, a kitchen, plus two full sized bedrooms, and a small third bedroom, generally referred to as the maid’s room. (Classic 7s and 8s also exist, and offer one or two additional full-sized bedrooms).

Furnished Apartment – These apartments are leased for short periods of time—anywhere from one week to one year—and contain all the furniture, kitchenware and bath ware you would need to live comfortably.

Manhattan Building Types

There are three basic kinds of buildings in Manhattan: Doorman, Elevator (attended and unattended) and Walk–Up (unattended):

Doorman Building – The types of buildings that offer doormen tend to be on the larger side and offer the most significant amount of safety and security. They also afford the highest level of comfort and convenience because your doorman can do a lot for you while you’re not home, including such things as taking drop-offs of packages and dry cleaning. If you are new to the city, you will quickly learn that Manhattan revolves around deliveries, and having someone who can sign for your packages can feel like the ultimate luxury. Within buildings that have doormen, there are kinds of formats: luxury high–rise, standard, and part-time doorman.

Luxury High–Rise – These kinds of buildings have a full around-the-clock staff consisting of multiple doormen and attendants. They often offer such amenities as hotel-type concierge service, on-site health clubs, pools, laundry service and children’s playrooms. The specific luxury amenities will vary from building to building but will leave you feeling thoroughly pampered.

Standard Doorman – These buildings have someone on duty 24 hours a day and offer the safety and convenience of having a doorman without the extra luxury amenities.

Part–Time Doorman – These buildings usually have doormen for day shifts, but rely on security cameras or some other type of technology to protect residents at night.

Elevator Building – These buildings do not have doormen on duty, though some may employ elevator attendants. Regarding security, convenience, and price, these kinds of buildings are considered somewhere between doorman buildings and walk-ups. They often have laundry rooms in the buildings, as well as intercom systems, but the amenities stop there. Still, if these buildings are adequately maintained, they can be comfortable places in which to live.

Walk–Up Building – These buildings do not have doormen or elevators. They can be townhouses or brownstones (4–5 stories), above storefronts (usually 1-2 stories), or low–rise buildings (free standing 4–5 stories). They are the most reasonably priced kinds of apartments in the city, yet they have very few amenities. Most walk–up buildings do, however, have double door security and a few have more sophisticated features, such as intercoms and security cameras. As with elevator buildings, the quality of life in walk-ups can vary greatly depending on the degree to which they are maintained.

Manhattan Building Ownership Types

In Manhattan, there are three different ways buildings are owned, and they each vary about the approval process you need to go through to live in them, as well as other related requirements. The easiest building to move into is a rental, followed by a condominium, which has greater restrictions, and then a co-operative building, where the requirements for moving into the property can be stringent.

Rental Buildings – A single landlord owns the whole property, which can be rent stabilized or non-rent stabilized depending on the real estate laws. Landlords typically require the standard paperwork (discussed above) and a credit check, as well as one month’s rent and one month’s security deposit, for you to be approved to move in. The approval process can take anywhere from one day to one week, but usually no longer.

Condominiums (Condos) – Each unit is individually owned and can be used either as a personal residence or rented out to somebody else as an investment property. Regulations for moving into a condo are set by the board– a governing body for the building made up of individual owners. As long as owners follow the board’s regulations, they can set their rental price and lease length. Owners will typically require you to furnish the standard paperwork, plus whatever additional information they feel necessary for approval. Also, applicants may be asked to supply extra paperwork that is deemed necessary by the board, but generally, the board does not have the right to turn down an applicant that an owner is willing to rent to. Tenants are required to pay application and board and move–in fees, as well as additional security if needed. With a condo, the approval process can take anywhere from one week to one month.

Cooperatives (Co-ops) – These buildings are similar to condos being privately owned, but in this arrangement, individuals own shares in the building based on their apartment’s size and value, and not the deed to the unit itself. Co-ops tend to have the most precise rules and regulations about rentals. In addition to the standard paperwork, the co-op board almost always requires far-reaching financial and personal information. Prospective renters must attend an extensive interview with the building’s co-op board, and once approved are usually required to pay large application, board, and move–in fees, as well as extra security. If you are from abroad or do not have an extensive credit history, it can be challenging to get the co-op board’s approval. The approval process can take a month or more.

The post How to Rent an Apartment in NYC appeared first on ELIKA Real Estate.

July 30, 2018

Negotiating Real Estate: Becoming a Smart Negotiator

Certainly, your exclusive buyer’s agent is there to advise you during negotiations. However, it is easy for buyers to get lost in the moment. Emotions frequently push out rationale thoughts, and you can stop listening to the advice your agent is providing you.

It is essential to have a negotiating strategy early in the home buying process and stick to it. We provide tips to help you get a fair deal.

Know the value

You need to know the property’s value before making an offer. Your agent should present you with relevant comparable sales, or comps. This helps you formulate a fair value, and this figure assists you in staying financially disciplined. Writing it down is also a helpful reminder.

Real-Time Market Indicators

Seasoned property buyers know that it is nearly impossible to time the market in its peaks and troughs. However, market corrections bring opportunity to your negotiations in real-time. Monitor your marketplace to base your negotiations not just on lagging indicators such as comps but also on today’s valuation. Having an expert buyer’s agent in your corner can help you dig deeper into the numbers to make the right calculations.

Back it up

Your offer price is stronger when it is based on the unit’s fair value. However, merely stating this your view is not enough. You need to back it up with the facts. Remember, no two properties or units are exactly alike. If you think the unit you are bidding on is worth less, state why you think that is the case. Perhaps the comparable sales are a bit stale, or this unit needs more work.

Understand the seller’s motivation

Your buyer’s agent can help you determine why they are selling. For instance, if the sellers are going through a divorce, they may take your lowball bid more seriously. Alternatively, the sellers may be in no rush to sell and are waiting for the right offer.

Supply and Demand

The ability to negotiate greatly depends on the supply and demand of a particular property type. A desirable property in a desirable location at a broadly affordable price point will bring more competition that may dictate the ability or lack of in negotiating.

Being Liked

There is a saying in business that if you want to be liked, get a dog. However, in real estate, the sellers’ warm feeling towards you are positive and can work in your favor. There is an emotional connection to the property, particularly if they have raised kids there, and it is not simply an investment. If you pass along a letter to the seller and explain how much you love the place, that will help boost your chances.

On the flip side, being brusque and rude undoubtedly hurt your negotiating position. If a competing offer is similar, you will likely lose out.

Reach common ground

Try to build some positive momentum by agreeing to the simple stuff. These are items you are willing to concede. Perhaps you are flexible regarding the closing date. Let the seller know, and you come across as reasonable, and you are in a position to ask the seller for concessions.

Understand the seller’s point of view

Try to put yourself in the seller’s position. When you do so, objectively decide if you are being unreasonable. If so, this could indicate it is time to revisit your offer.

When doing so, let the seller know that you have heard his/her position, and understand it. You may not completely agree, but at least the seller does not feel ignored.

Get it in writing

Once you reach mutually acceptable terms, it is important that both parties sign the contract as soon as the attorney has completed his/her due diligence. In New York State, oral contracts are theoretically as binding as a written one. However, it is much more difficult to prove. You will sleep better at night once the seller signs on the dotted line.

The breaking point

At some point, you need to know when to walk away. You do not want to waste your time if you have given your best and final offer and gone as far as you can reasonably go on other items.

The post Negotiating Real Estate: Becoming a Smart Negotiator appeared first on | ELIKA Real Estate.

July 29, 2018

5 Simple Ways to Help You Save for Your Down Payment

So you’ve finally settled on it. You want your dream home in NYC. Or maybe you’re just looking for something a little larger than your current apartment or closer to work. Whatever your reason for wanting to buy an apartment in NYC, like every buyer, you’ll need enough saved for a down payment. Maybe you’ve already found the right apartment but are just a bit short on the minimum needed for the down payment. Read on to learn how you can help save towards homeownership.

Why down payments matter

Your down payment is the money you bring to seal a purchase contract and show that you’re serious about buying. If you’re applying for a mortgage it shows lenders that you’re financially capable of coming up with money. Plus, the more you can put on your down payment the lower your monthly payments will be. In NYC, the minimum down payment is 10% of the purchase price. But not a lot of buyers will be thrilled by this and are unlikely to take it seriously unless there is very little demand for the property.

20% is far more common and is the standard threshold for co-ops. Any down payment below 20% will require the buyer to pay something extra Private Mortgage insurance (PMI). This is an insurance policy which ensures that in the event of a default the insurance bails you out and pays the lender. Should that happen your credit will still be ruined, and you’ll face the consequences of default.

So it makes sense to try everything to save that 20%. Sometimes buyers turn to family for gift funds to help then reach that magic number. Whether you choose to do that or not, you’ll still want to work to save as much as you can. Saving money for a down payment is just like saving for anything else. Have a plan and stick to it.

1. Create a monthly budget

Better to get the boring part out of the way first. You can’t save without a budget. Figure out how much you need to save and what expenses you can cut to help you reach that goal. No one likes having to make sacrifices but that’s what it takes. Sites like Mint and You Need a Budget can help you stay on track. To make things easier, set up a savings account and put part of your salary in there every month.

2. Cut one bill, then another

While working on your budget look for bills that you can cut. Start with one bill for the first month and next month find another that you can do without. Then put the money you save into your savings account. Trim is a great app to help you monitor your spending and find subscriptions you can cancel.

3. Start a side hustle

You don’t necessarily need to get a second job to save more money. It is possible to earn something on the side, usually by monetizing a skill you already have. For instance, if you do photography you could start doing photos for weddings, parties or family portraits. Other side hustles that can be a good source of income include freelance writing, dog walking and selling handmade crafts online through sites like Etsy. Instead of spending your money from the side hustle put it all in your savings account.

4. Tap into your 401K

This can be risky but it’s one of the fastest ways of obtaining cash for your down payment. However, it’s not to be done without a clear understanding of the tax repercussions from taking a loan out on or withdrawing money from your 401K. if you’re still a long way off from retirement age and can replace the withdrawn funds before then, tapping into your 401K can be a great option.

5. Sell things you don’t need

Make use of sites like eBay, Craigslist, and OfferUp. Almost every household has clutter lying around that hasn’t been used in months or years. Go through your entire home and find anything that you can sell. Doing this also means you’ll have fewer things to move when it comes time for moving day.

The post 5 Simple Ways to Help You Save for Your Down Payment appeared first on | ELIKA Real Estate.

July 28, 2018

What Are Riders to Purchase and Sale Contracts

Surely, you have heard the expression that the devil is in the details. This applies to real estate transactions as well. Many people assume the contract is boilerplate, but that is indeed not the case. This is where riders come into play.

What are contract riders?

When you make an offer, a standard contract with the basic terms, including your offer price, is sent back and forth between the buyer’s agent and the seller’s agent. Once both parties agree to the terms, it goes to the attorneys for due diligence.

The basic contract usually includes a paragraph that mentions provisions will be added, deleted, or altered. Lawyers accomplish this with separate documents, called riders, which address the unique circumstances. While these should not change the basic terms that the two parties have agreed on, lawyers typically include language that the riders supersede anything agreed to in the basic purchase and sale agreement.

Why do I need a rider?

The purpose of a rider is to protect your interests. While contract riders involve a lot of nitty-gritty details that may seem trivial, your lawyer is putting in language that protects you.

Riders typically expand on the terms included in the purchase and sale contract. Generally, it is not the time to renegotiate certain items, such as the purchase price. Typically, your lawyer will include items such as sellers paying for the necessary repairs needed after an inspection. Your lawyer might also state the timeline for a final walk through, what is included in the final sale, and the closing date. The seller should also state the apartment’s general condition, including that is leak free and the appliances are in good working order.

The rider will also state what happens if the seller is unable to close on time. Typically, he/she must pay you to lease back, and your lawyer will state the amount. If there are unique circumstances, your lawyer will address these in the rider.

The riders are negotiable and typically go back and forth between the attorneys.

Co-ops

As you might expect, when you are purchasing a co-op, this requires special consideration. Given the necessary board approval, your lawyer may want to put in language regarding the timing and what happens to your deposit if you are denied. The board likely wants to interview you, and the rider should mention timing.

Your lawyer may ask the seller to acknowledge that any significant changes done to the unit were approved by the co-op board. Otherwise, the board may delay your closing while the seller gains their compliance.

A rider’s limits

Mostly, there are no limits to what a seller or buyer can put into a rider. A buyer or seller can make unreasonable demands, and it is generally legal. Illegal provisions typically relate to discrimination based on race, religion, gender, sexual orientation, or anything else forbidden by federal, New York State, or New York City housing laws.

Renters

Landlords can also have riders on the standard leasing contract. These might relate to him/her requiring rental insurance and the landlord’s requirement to put in window guards. But, you should read it carefully. Generally, as the form gets longer, the likelihood the landlord’s demands are unreasonable increases.

The post What Are Riders to Purchase and Sale Contracts appeared first on | ELIKA Real Estate.

The Importance of Contract Riders

Surely, you have heard the expression that the devil is in the details. This applies to real estate transactions as well. Many people assume the contract is boilerplate, but that is indeed not the case. This is where riders come into play.

What are contract riders?

When you make an offer, a standard contract with the basic terms, including your offer price, is sent back and forth between the buyer’s agent and the seller’s agent. Once both parties agree to the terms, it goes to the attorneys for due diligence.

The basic contract usually includes a paragraph that mentions provisions will be added, deleted, or altered. Lawyers accomplish this with separate documents, called riders, which address the unique circumstances. While these should not change the basic terms that the two parties have agreed on, lawyers typically include language that the riders supersede anything agreed to in the basic purchase and sale agreement.

Why do I need a rider?

The purpose of a rider is to protect your interests. While contract riders involve a lot of nitty-gritty details that may seem trivial, your lawyer is putting in language that protects you.

Riders typically expand on the terms included in the purchase and sale contract. Generally, it is not the time to renegotiate certain items, such as the purchase price. Typically, your lawyer will include items such as sellers paying for the necessary repairs needed after an inspection. Your lawyer might also state the timeline for a final walk through, what is included in the final sale, and the closing date. The seller should also state the apartment’s general condition, including that is leak free and the appliances are in good working order.

The rider will also state what happens if the seller is unable to close on time. Typically, he/she must pay you to lease back, and your lawyer will state the amount. If there are unique circumstances, your lawyer will address these in the rider.

The riders are negotiable and typically go back and forth between the attorneys.

Co-ops

As you might expect, when you are purchasing a co-op, this requires special consideration. Given the necessary board approval, your lawyer may want to put in language regarding the timing and what happens to your deposit if you are denied. The board likely wants to interview you, and the rider should mention timing.

Your lawyer may ask the seller to acknowledge that any significant changes done to the unit were approved by the co-op board. Otherwise, the board may delay your closing while the seller gains their compliance.

A rider’s limits

Mostly, there are no limits to what a seller or buyer can put into a rider. A buyer or seller can make unreasonable demands, and it is generally legal. Illegal provisions typically relate to discrimination based on race, religion, gender, sexual orientation, or anything else forbidden by federal, New York State, or New York City housing laws.

Renters

Landlords can also have riders on the standard leasing contract. These might relate to him/her requiring rental insurance and the landlord’s requirement to put in window guards. But, you should read it carefully. Generally, as the form gets longer, the likelihood the landlord’s demands are unreasonable increases.

The post The Importance of Contract Riders appeared first on | ELIKA Real Estate.

July 27, 2018

Home Insurance versus Home Warranty

We have previously discussed the importance of home insurance. In fact, lenders require it, although we recommend having insurance even if you do not have a mortgage.

However, this is different than a home warranty. While you can consider both a type of insurance, each covers different circumstances.

Home insurance

A home insurance policy covers expenses for your repairs when there is an event, such as a natural disaster, fire, and theft. When you are shopping for an insurance policy, you need to understand what is covered and the deductible. You can choose a higher deductible in order to lower your premium, but this provides less protection since you have to pay more out of your pocket in the event you need the insurance.

For a condo, you own the unit, so you need to insure it and all of your contents. In a co-op, you are a shareholder, owning a percentage of the entire building. In this case, you should have insurance for your personal property, and the co-op board will purchase a policy that covers the building. Your monthly maintenance fee contributes to funding the policy.

Home warranty

You are not required to have a home warranty. Unlike a home insurance policy, which would cover the items when there is a specific event, a home warranty covers the item for normal wear and tear. Home warranties cover specific appliances when these breakdown, either paying for the repair or give you money towards a replacement, depending on the policy’s details.

Typically, the items include the furnace, air conditioning, washers/dryer, and dishwasher. Again, it behooves you to examine the specific policy to see your coverage and deductibles. It is not unusual for the policy to have a modest deductible. The basic warranty may not cover the most expensive items, although you can purchase additional coverage to include items not covered in your policy, if you wish.

A negotiable item

When you are purchasing your home, you can ask the seller to pay for a home warranty for a period of time, typically a year. This can help ease your concern, particularly if the appliances are older. Sellers might go along to alleviate the buyer’s anxiety and help close the deal. A survey taken several years ago showed homes with a home warranty sold faster and for more money, although this was conducted by American Shield, a large provider of home warranties.

Cost-benefit analysis

If you are getting a home warranty on your own, weigh the premium cost against the potential repair expense. You might find it more economical to place the money in a fund that you can use for repairs or replacement. This takes discipline to create a special savings account and regularly contribute money, however. Of course, if you are handy, you might not need a home warranty policy at all.

You do not get to choose your own person to conduct the repair. When something breaks down, you call the warranty company, which sends someone from one of its contracted repair companies. You should keep this in mind if you already have someone in mind that you like very much.

The post Home Insurance versus Home Warranty appeared first on | ELIKA Real Estate.

July 26, 2018

Protecting Your Smart Home from Hackers

The Internet of Things (IoT) is about connecting devices to the net. It involves many ordinary devices that are found around the home, such as coffee makers, washing machines, dryers, dishwashers, locks, and security cameras. Imagine your clock connected to the Internet, as well as your windows, blinds, water heaters, lighting, air conditioning and heating. In fact, it extends to virtually any device, and it is part of automating your home, which is also called a smart home.

[image error]

Many people of a certain generation recall the television show The Jetsons. But, this fictional show, with things running with the push of a button, is quickly becoming a reality. However, while a smart home is designed to make your life easier, you need to prepare for the security pitfalls.

Hack Attack

The new technology leaves people exposed to hacking, unfortunately. Even worse, you may not know a perpetrator has committed a crime against you until much later.

Your first line of defense is to protect your e-mail accounts. Beware of phishing, a scam where the sender sends a request for you to share personal information from a seemingly legitimate organization’s e-mail address.

Line of defenses

There are several things you can do to protect yourself and your home from a hacker. First, make sure the device’s security is up to date. This is typically not as simple as doing so on your PC, which seeks updates and does so automatically. When there is an update notification, you should download it and complete the process as soon as you can.

Next, there are malware programs you can purchase. Certain basic ones are free, but you should consider buying an upgrade for extra protection. Many new routers are built considering smart home protection. If yours is a few years old, you may wish to consider upgrading it.

While a lot of people use free public Wi-Fi, but these are vulnerable to attack. Once a hacker accesses your phone or laptop, your other devices are now open to attack.

Try to frequently change your password. It is inconvenient, but it helps to defend your home devices. This is challenging, but avoid obvious passwords (e.g., password or some derivation such as password123). Capital letters and special symbols are a good idea to include. Of course, if you are not prompted, change the device’s default username and password immediately after you purchase the item.

Experts recommend buying large, well-known brands, such as Samsung and LG. This gives you more resources defending against a hack and likely a better response in case it happens. You should also check the devices’ settings. Some may not need to access the Internet.

Moving on to more complicated steps, you can use separate Internet connections for your devices. You can set up a different connection or split up your existing one using a virtual local area network. You can hire companies to take care of the latter for you.

An extra layer

There are devices you can purchase that only look for suspicious activity on your home gadgets. These range from around $130 to $250. However, we recommend using care when deciding whether or not to purchase such items since these are relatively new and have not gone through extensive testing.

The post Protecting Your Smart Home from Hackers appeared first on | ELIKA Real Estate.

July 25, 2018

The Biggest Pros and Cons of Living in New York City

It’s something of a cliché that there’s nowhere else in the world like New York. And it’s true. It’s one of the most iconic cities in the world and many people dream of moving there. Thing is though you can’t have the good without the bad. New York can be a tough place to live. Not everyone can hack it. But for those who can, it can be a heck of a place to live. If you dream of one day making a life in NYC, it’s important that you keep your expectations in proportion. There are pros and cons to living here so weight them carefully before you start looking for an apartment.

Pros

The Food is amazing – Hands down. The food is one of the best things about living in NYC. The diversity of it means there’s always something there for someone. Whether it’s the Neapolitan pizza at Motorino Pizza in East Village, the Black Label Burger in Minetta Tavern, the ramen noodles in Ivan Ramen or just one of those monster cookies at LeVain Bakery you’re sure to find many things to love.

There’s always something to do – People move to New York to find something new. There’s always something to do, even just walking through Lower Manhattan which always has surprises in store. There are museums to almost everything, most of which offer student discounts. And let’s not forget shows on Broadway, the bustling nightlife in East village or the numerous annual events held every year.

You don’t have to drive anywhere – You sure can if you want to but why go through the stress. The subway can take you all over the city and a taxi or Uber is never far away. It’s also easy to walk everywhere and it’s when walking that you learn what the city is all about.

There are plenty of career opportunities – Whatever your career path, you’ll find endless opportunities in NYC. This is the place to come if you’re looking to make a career in finance, fashion, modeling, advertising, PR, and marketing.

Cons

It’s an expensive place to live – renting and buying an apartment is pricy and that goes for a lot of things in NYC. Whether it’s the morning coffee, taxi ride or evening meal, the cost of living in NYC can eat up your funds fast. it’s always money, money, money.

There’s a serious lack of quiet and personal space – NYC can be very noisy with aggressive traffic and personal space is something of a premium. For new arrivals, it can take a while to get used to so be ready for the subways during rush hour, the crowded streets and be sharing living space with people.

It can be draining – You’ll need a thick skin to live in New York. New Yorker’s have a reputation for being rude and aggressive. The sheer act of living there absorbs your energy as you’re always walking somewhere, being aware of your surroundings and working most of the day. If you don’t learn how to deal with the stress or develop a thick skin, you won’t make it.

The winters are cold – While the summers can be hot and humid, the winters are bitterly cold. Also, rain and the city don’t go well together so if you see dark clouds on the horizon make sure to bring that umbrella.

The post The Biggest Pros and Cons of Living in New York City appeared first on | ELIKA Real Estate.

July 24, 2018

You Likely Need More than the Minimum Credit Score

The government-sponsored enterprises, The Federal National Mortgage Association (Fannie Mae) and The Federal Home Loan Mortgage Corporation (Freddie Mac) require a certain minimum FICO Score. However, your lender ultimately decides on whether to extend you a mortgage. Generally, lenders and co-op boards look for higher scores.

Unless you are a cash buyer, obtaining a mortgage is a key part of the home buying process. Therefore, we think it behooves the majority of buyers to understand this arcane topic.

The minimum

Fannie Mae and Freddie Mac both require a minimum 620 FICO Score. You can have as low as a 580 FICO Score for an FHA Loan, which is insured by the Federal Housing Administration, providing you have a minimum 3.5% down payment, or a 500 FICO score if you can put down 10% of the purchase price.

If you are eligible for a VA loan, there is no minimum required score.

What the score means

There are three national credit bureaus, Equifax, Experian, and TransUnion. Each could very well have a different FICO score for you, however. The Fair Isaac Corporation had provided several explanations for the variation, including different time periods when the score request was made, varying information reported to the bureaus, and lenders reporting information to the bureaus at various times.

The scores range from 300 to 850. A bad credit score is 300 to 629 while fair or average credit is indicated by a score of 630 to 689. Lenders consider your credit good range if the score is in the 690 to 719 range. If your score is at least 720, you have excellent credit.

Since there are three scores, lenders typically use the middle score. Hopefully, there is not too much variation, though.

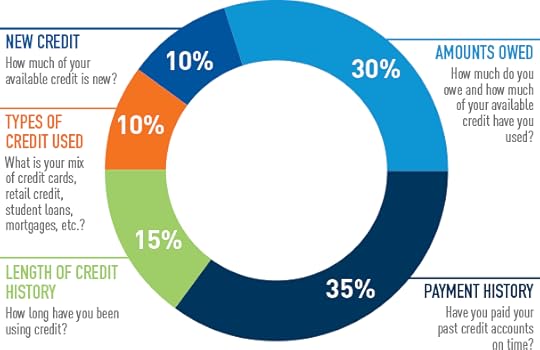

The components

Five categories comprise your FICO score. These are weighted differently, however. Your payment history is the most heavily weighted, at 35%. Next, the amount you owe accounts represents 30%, with a particular emphasis on the availability under your revolving credit (e.g., credit cards). Lenders want to see how much debt you are carrying versus the amount that you can borrow, with the lower, the better. Your length of credit history counts for 15%. Rounding it out, the type of credit and new credit (e.g., new credit inquiries and recently opened accounts), each represents 10% of our score.

One person has bad credit

If you are buying a house with someone that has poor credit, and this is indicated by his/her credit score, there are other options you can pursue. You can apply for a mortgage by yourself, providing you can get approved. Remember, there are other items that lenders look at, such as income, notably your debt to income ratio, and employment history.

There are legal ramifications that you should also consider. You are the one financially responsible for the mortgage. However, this does not affect the property’s ownership, and you can still hold the title in two names, regardless. If you go down this route, this means he/she has a financial interest but does not have a corresponding financial obligation.

The post You Likely Need More than the Minimum Credit Score appeared first on | ELIKA Real Estate.

July 23, 2018

This STAR Tax Relief Shines Brightly

The New York State School Tax Relief Exemption, or STAR, is a property tax break. The program, which was initiated in 1997, provides real estate property tax relief to the state’s residents. The program reduces local property taxes for eligible residents, with the school district reimbursed by New York. Thus, the district’s school funding is unaffected.

It is not a well-understood program. In fact, there are two types of STAR: Basic Star and Enhanced STAR. Providing you meet the qualifications, you can receive significant tax savings.

The idea

It is a simple concept. The overarching goal is to provide New York State’s residents with a break on property tax. However, there are income thresholds to exclude the wealthy under the assumption that they do not need the break,

Basic STAR

You are eligible for the Basic STAR program on your primary, owner-occupied residence, providing your income when combined with your spouse, is less than $500,000. If this is the case, the first $30,000 of your home’s value, which includes co-ops and condos, is exempt from tax.

Enhanced STAR

This is the more generous program, which is designed to provide senior citizens with a tax break. For those residents that are at least 65 years old and incomes that are $86,000 or less this year ($86,300 for 2019), the first $66,800 of your home’s value is exempt from tax.

In New York City unlike many of the state’s other cities, the benefit applies partially to New York City and school taxes. New York City’s Department of Finance assesses your property annually. There are two residential classes. Class 1 applies to one-to-three family homes, while Class 2 is for co-ops, condos, and rentals with more than four units. For Class 2 properties, the property tax rate is 12.719%, with a school tax rate of 11.869%. It is 20.385% for Class 1 properties (7.426% school tax rate).

Remember to register

Generally, you do not receive the credit automatically. When you are applying for the STAR benefit, you need to register with New York State. The good news is that you only have to do this one time. After that, even if you become a senior citizen and qualify for the Enhanced STAR program, you do not need a new registration.

In order to register, you need to have the property owners’ names and social security numbers, address, approximate date the property was purchased, and a current school tax bill. You will also need the address of any other residential property that you own in the state.

Additionally, the state asks for your federal or state income tax returns. Otherwise, if you did not file a tax return, you need your income information, including wages, interest and dividend income, unemployment compensation, pension income, social security, and other income.

In practice

A lump sum amount is paid to the building, and the management company is responsible for making sure you receive the payment. However, it can do this in a variety of ways, including a cash payment, a credit (e.g. to your monthly maintenance), or adding it to the reserve fund.

The post This STAR Tax Relief Shines Brightly appeared first on | ELIKA Real Estate.