Mark Jewell's Blog: Selling Energy, page 226

November 17, 2017

Cap-Ex Cost Recovery

On Tuesday, we discussed the landlord/tenant dynamic and the metric to focus on when presenting an expense-reducing capital project to a landlord. Today, I’d like to delve into a bit of bonus landlord/tenant content that I cover in the weeklong Efficiency Sales Professional™ Certificate Boot Camp.

Here’s the question: Could the landlord use a “capital expense cost recovery” clause and have the tenants repurpose wasted utility dollars to help improve the building? The short answer is “in many cases, yes,” and in the next several paragraphs I’ll review this often-overlooked lease provision and how you might leverage it in your future efficiency projects.

The cap-ex cost recovery clause is something that most experienced real estate operators will know about. Many of them, however, are really financial engineers who authorize the capital to buy buildings. They may not have really read many of their leases cover to cover. They may not know that the ability to claw back savings that you generate for your tenant by investing in expense-reducing capital projects is usually hidden in a definition of operating expenses. It’s a provision that’s not often called out in a separate section of the lease.

The lease will describe various categories of operating expenses that are customarily passed through: roads and grounds, housekeeping, security, repairs and maintenance, administration, utilities, etc. The description of operating expenses will typically prohibit the landlord from passing through capital expenses.

However, you may very well see that certain capital expenses CAN be passed through as long as they meet one of the following criteria:

The capital improvement is mandated by government regulation

The capital improvement is motivated by life safety concerns

There is a reasonable expectation that a capital improvement will generate operating expense savings for all tenants, in which case the landlord could pass the capital costs through to the tenants using a reasonable amortization schedule.

The lease usually has some language as to whether or not they can charge carrying cost while the debt is being amortized. In some cases, the lease may also mention that the pace and magnitude of the savings that the capital expenditure(s) produce will determine the pace and magnitude of the tenant assessments.

If you don’t already sell to non-owner-occupied properties, I recommend you consider adding them to your list of potential targets. The last time I looked, the Department of Energy’s Commercial Buildings Energy Consumption Survey (CBECS) estimated that 38 to 40 percent of the built environment in the office and retail sectors is non-owner-occupied real estate. That’s a big slice of the market pie that certainly merits getting smart on how to best position your efficiency solutions in landlord/tenant settings.

The post Cap-Ex Cost Recovery appeared first on Selling Energy.

November 16, 2017

Use the Power of 12

How do you gain access to the influencers and decision-makers when approaching a new organization with an efficiency project? I like to say, “Use the power of 12.” Why 12? Because 12 is the biggest number I can think of that’s a single syllable. It could be the power of 37 for all I know, but bottom line is, it’s not power of one.

When someone invites you into the organization or you encounter someone in the organization and you ask that person what he or she needs in terms of energy efficiency, that individual’s response is not necessarily the best barometer of what the entire organization needs.

When you’re doing a project with a large organization, you’re going to be working with many different people. They’ll have different personalities, different organizational imperatives, and different challenges they need to face every day. How your project impacts those goals, wishes, dreams, and desires may be totally different depending on who in the organization is making the decisions and who will be giving you direction to provide a solution that will alleviate their pain.

In the context of large organizations, forget the “Power of One” and think bigger. Zoom out and look at the organization as a whole. Determine who the different players might be, how they fit into the decision-making chain, and then map their relationships to determine the path to project approval.

The post Use the Power of 12 appeared first on Selling Energy.

November 15, 2017

How to Win Over Your Audience

How do you prepare a presentation that will win over your audience? The first step is to carefully contemplate the ways in which your audience might resist. I believe that repetition is the mother of learning, so if you anticipate the objections and you inoculate your presentation with the answers to those objections, you’ll have a much more seamless approach to persuading somebody to do what you want them to do. Addressing these objections also shows them that you’ve carefully thought through everything, which will reduce their anxiety.

Ultimately, you need to determine the reward that would most resonate with each specific player in the decision-making process of an efficiency deal. If it’s a sustainability director, it’s likely the pride of removing untold thousands of tons of CO2 emissions from the environment. If it’s the chief financial officer, it might be giving him/her greater certainty about budgeting and insulation against utility price spikes. If it’s the engineering department, it might be finally giving them the reward of a phone that doesn’t ring as frequently with hot/cold complaints.

Now at the same time, you might have some purpose-driven CEOs, like the guy who founded Whole Foods, willing to entertain a conversation about how putting refrigerator door seals and LED lights in and doing all sorts of other wonderful things for his supermarkets will have an excellent impact on the environment. Somebody like the guy who runs REI… similar conversation.

Just realize that there are some people who do things just for themselves, some who do things for their organization selflessly, and then others who ultimately do selfless things for mankind. It’s your job to figure out what you’re up against and to prepare a presentation that will address your audience’s objections and cater to their desires.

The post How to Win Over Your Audience appeared first on Selling Energy.

November 14, 2017

NOI Drivers

Today, we’re going to discuss the metric that you should focus on when presenting an expense-reducing capital project to a landlord.

For most landlords, one of largest controllable operating expenses is the utility bill. Payroll for the chief engineer, porter, doorman, and so forth may make up a portion of the landlord’s controllable operating expenses; however, these costs generally pale in comparison to the utility costs.

Your task is to convince the landlord that a reduction in operating expenses for his or her building through energy savings will result in an overall increase in his or her Net Operating Income (NOI). NOI is the mother’s milk of real estate investors. It’s why they get up and put their pants and dresses on in the morning.

In a case like this, there are three drivers of higher Net Operating Income:

Higher rent

Lower vacancy/less tenant churn/better tenant retention or attraction

Lower landlord share of operating expenses

If you want to sell energy efficiency effectively in the commercial real estate environment, you have to explore these drivers, determine which ones might have the greatest positive effect on your prospect’s NOI, and then make a credible connection between your offering and the driver you’re aiming to improve.

The post NOI Drivers appeared first on Selling Energy.

November 13, 2017

Dealstorming Your Way to The Sale

As any of my trainings will attest, making a sale in today’s environment is incredibly complex. It’s more important than ever to be aware of who the players are, what is most important to them, and how to speak their language, often while juggling several other tasks at once.

Of course, these are responsibilities we often shoulder on our own, pouring over research and building relationships with prospects. But how would the process benefit if others were bought into it?

The answers may lie in Dealstorming, the latest book by Tim Sanders. His main concept utilizes teamwork as a way to bolster business-to-business interactions, in many cases the more challenging the better. In the vein of our own offerings Sanders believes it’s important to deputize people outside of sales, only this time it’s to provide creative problem solving or a fresh point of view within your own team.

If everyone has a stake in the process (as well as their own take on it), a stalled project or a difficult sale can resolve in ways you never imagined. With a quick read and some planning, Dealstorming will help you take that chance.

Here is the summary from Amazon:

“As a B2B sales leader, you know that by Murphy’s Law, despite your team’s best efforts, some deals will inevitably get stuck or key relationships will go sour. And too often, it’s the most important ones – the last thing you need when millions of dollars are on the line.

“Dealstorming is Tim Sanders’s term for a structured, scalable, repeatable process that can break through any sales deadlock. He calls it ‘a Swiss Army knife for today’s toughest sales challenges.’ It fixes the broken parts of the brainstorming process and reinvigorates account management for today’s increasingly complicated sales environment.

“Dealstorming drives sales innovation by combining the wisdom and creativity of everyone who has a stake in the sale. You may think you are applying teamwork to your challenges, but don’t be so sure. There’s a good chance you’re operating inside a sales silo, not building a truly collaborative team across your whole company. The more disciplines you bring into the process, the more unlikely (but effective!) solutions the team can come up with.

“Sanders explains his seven-step Dealstorming process and shows how it has helped drive results for companies as diverse as Yahoo!, CareerBuilder, Regus, and Condé Nast. You’ll learn how to get the right team on board for a new dealstorm, relative to the size of the sales opportunity and its degree of difficulty. The key is adding people from non-sales areas of your company, making them collaborators early in the process. That will help them own the execution and delivery after the deal is done.

“The book includes real world examples from major companies like Oracle and Skillsoft, along with problem finding exercises, innovation templates, and implementation strategies you can apply to your unique situation. It’s based on Sanders’ many years as a sales executive and consultant, personally leading dozens of sales collaboration projects. It also features the results of interviews with nearly two hundred B2B sales leaders at companies such as LinkedIn, Altera and Novell.

“The strategies laid out in Dealstorming have led to a stunning 70% average closing ratio for teams across all major industries, leading to game-changing deals and long-term B2B relationships. Now you can learn how to make dealstorming work for you.”

The post Dealstorming Your Way to The Sale appeared first on Selling Energy.

November 12, 2017

Weekly Recap, November 12, 2017

Tuesday: Check out how to turn a “No” into a “Yes.”

Wednesday: Learn why you should figure out what yardsticks your prospect is using to measure his or her own success and then connect the dots for your prospect.

Thursday: Replace myth with math and motivation so that there is a compelling reason to move a project forward immediately.

Friday: Learn how to dispel the old building myth.

Saturday: Check out “4 things you can learn from stand up comedians about public speaking” for great insights into engaging an audience with emotions, body language and speech structure.

The post Weekly Recap, November 12, 2017 appeared first on Selling Energy.

November 11, 2017

4 Skills Comedians Can Teach You About Public Speaking

As efficiency sales professionals, we are frequently required to give presentations and master the art of public speaking. I’ve written blogs about how to prepare for a winning presentation because it’s both challenging and vital to our success as successful sales professionals. Public speaking takes practice and finesse.

If you are at all uncomfortable speaking in public or giving presentations (or if you just want to improve your abilities), I highly recommend reading an article in Lifehack on how stand-up comedians captivate an audience, enough to make an entire audience laugh for hours. This article offers some great insights into engaging an audience with emotions, body language and speech structure. Give it a read and apply a few in your next presentation!

The post 4 Skills Comedians Can Teach You About Public Speaking appeared first on Selling Energy.

November 10, 2017

How to Dispel the Old Building Myth

Have you ever tried selling an efficiency product or service to a prospect with an older building, only to hear your prospect say something like, “Our building is older, so you’d expect it to be less energy-efficient.”? This is a very common myth and you should be prepared ahead of time to overcome your prospect’s objection. Today, we’ll discuss a couple of responses that you might use to dispel this myth and move the discussion forward.

Response #1: “John, it’s funny you should say that because a lot of people are under that misconception (with all due respect). Did you know that the oldest building to get an ENERGY STAR® label in this country was built in 1820? How old is your building?”

Chances are, John’s building was built well after 1820, and you can then continue the discussion with the response below.

Response #2: “In our research, we found that older buildings actually score better than newer ones as long as they have been retrofitted with more contemporary building systems and are being operated properly. Older buildings are often made with better quality materials, thicker walls, and smaller windows, all of which is great for thermal insulation. Additionally, older buildings are more likely to have had retrofits done than newer buildings, since the chillers, boilers, motors and drives on newer buildings are less likely to have totally worn out and needed replacement.”

The post How to Dispel the Old Building Myth appeared first on Selling Energy.

November 9, 2017

Replace Myth with Math and Motivation

“Value is created by the compression of time.”

The quote above comes from Peter Drucker, an acclaimed management consultant who wrote nearly 40 books during his career and who is widely recognized as a sort of “Einstein” of American management theory. In the context of energy efficiency, this quote means that if you know that there is something valuable that you should be doing to enhance energy efficiency, the faster you do it, the more value you will create for your shareholders or other stakeholders.

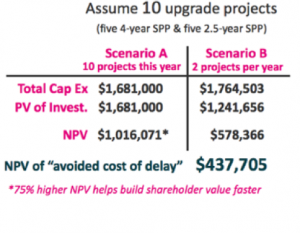

Conveying the cost of delay with calculations using hypothetical scenarios can be very effective in motivating your prospect to take action immediately. Below, you’ll find a pair of scenarios that uses five four-year simple payback period projects and five two-and-a-half-year simple payback period projects (not that I embrace simple payback period as a metric… this just gives you some layman’s terms that allow you to get your arms around how quickly these projects provide financial returns).

In Scenario A, you do all ten projects this year. In Scenario B, you do two projects per year over the course of five consecutive years.

If you do Scenario A, you will invest approximately $1.7 million, and over a five-year investment horizon, you’ll wind up with a net present value of $1,016,071.

If you do Scenario B, it will cost you slightly more to fund the projects (because inflation raises the price of labor and materials over the course of five years), and when you add up the savings that you are getting from all of these projects, your decision to phase in the projects costs you over $400,000 in net present value.

So why is there such a big difference in net present value? If you only do two projects in Year 1, you have eight other projects that have not yet begun producing savings. In the second year, you have two more projects feathered in; however, you still have six projects that have not yet started their savings streams. Ultimately, you have this delta of missing savings, and that is what constitutes the $437,000 in lower net present value.

Keep in mind what this means. You can get a 75% higher net present value if you did all 10 projects this year as opposed to phasing them in over a five-year period.

Now, your prospect may see this information and express concern about having the manpower to do all 10 projects in one year. When this kind of objection comes up, I would say something like, “Well, $437,000 of additional net present value buys a heck of a lot of performance bonuses, not to mention Chinese food and pizza in late night conference settings to make sure these projects are done.”

Then they may say, “Well, I don’t have the money.” How do you respond to this? Ask them a question like, “If I offered to give you a 25% discount on any of the projects that you do manage to get done this year, how many of these 10 projects would you get done?” Most people say, “Wow, 25% off?! For a discount like that, I would probably do all of them.” Then you respond, “Okay, well let’s take a closer look at the numbers. The $437,000 of net present value is very close to 25% of the $1.681 million of first cost. So, if you’re telling me that you would jump through hoops to find the money, find the staff, and find the resources, even if you had to outsource and borrow some money to get these projects done at a 25% discount, essentially that is what you would be getting without an additional discount – assuming you do all ten projects this year.”

Finally, they may express concerns about the debt service, assuming they need to borrow money to do all the projects in one year. You can simply emphasize the fact that $437,000 pays for a lot of debt service, especially at the low interest rates that are now available for energy efficiency projects.

So what’s the moral of the story? Replace myth with math and motivation. Reframe the situation so that there is a compelling reason to move forward immediately.

If you were confused by any of the calculations used in this example, check out my three-part Financial Analysis of Efficiency Projects online training series. If you really understand how the math works, you’ll be better positioned to use it as a motivator in your next meeting.

The post Replace Myth with Math and Motivation appeared first on Selling Energy.

November 8, 2017

Use the Right Yardsticks and Connect the Dots

To be a truly successful sales professional, you must reframe the benefits of your product or service so they can be measured with yardsticks your customer is already using to measure their success. I’m sure most of you have heard me say this before, and I repeat it often because I believe that this concept is absolutely vital to efficiency sales success.

Today, I’d like to share a story that comes from one of our Efficiency Sales Professional™ Certificate Boot Camp graduates. This ninja (who we’ll call Nancy) started out her sales career selling anti-violence training programs to schools.

Nancy would go into each school to meet with the principal, and she would typically say, “I’m here because my mentor and I are advancing this anti-violence program that I think would greatly benefit your school.” Before too long, the conversation would advance to, “How much does it cost?” She would tell the principal the price (I believe it was somewhere around $9,000), at which point the principal would recoil and say, “Did you take a look around? I mean, we don’t have enough books, we don’t have enough computers… we hardly have enough money to put the chains on the doors to keep the drug dealers out during the school day. Where do you think I’m going to get $9,000 to buy your training system?”

Nancy was a sales professional, and was unfazed by this concern. She would say, “Let me ask you a question: How many fistfights did you have last month?” At which point the principal would say something like, “Oh, don’t even get me started.” Nancy would continue, “Well, what happens when you do have a fistfight?” The principal would respond, “We suspend the kids.” Nancy would then ask, “One kid or both kids?” The principal would say, “Both kids, since we can’t usually determine who threw the first punch.” She would then ask, “How many days do you suspend them for?” At which point the principal would respond, “A minimum of three days.” Nancy would respond, “So, if I’m doing the math right, is it true that this district gets paid $40 per day for every student who shows up to school?” The principal would respond, “Yes.”

Now comes the fun part. She knows that every fistfight costs this principal 3 days x 2 kids x $40, or $240 of potential funding from the district. So, she would respond, “You know, with all due respect Mr. Principal, you’ll probably break even on this $9,000 investment in the first month of the fall semester, and after that you can use all of your outsized savings to pay for more books and computers, which you and I both know you need.”

Nancy told me that when using this rationale, her success rate was better than 95% (as well it should have been, because she was connecting dots and using the right yardsticks). I’m sure when she walked into the room, before she started speaking, there was no way that the principal was thinking about average school attendance subsidies or how much revenue he loses from the district every time he suspends two kids for three days each. He probably hadn’t even thought about quantifying and monetizing the number of fights he’d had in the school. Once all those dots were connected, it was easy for him to agree with her that the best thing he could possibly do is buy her training system and start using some of the savings of avoided lost subsidies to improve the learning outcomes in his school.

So what’s the moral of the story? Figure out what yardsticks your prospect is using to measure his or her own success, connect the dots for your prospect, and make your product or service a “no-brainer” investment decision.

The post Use the Right Yardsticks and Connect the Dots appeared first on Selling Energy.

Selling Energy

- Mark Jewell's profile

- 7 followers