Mohit Tater's Blog, page 673

August 4, 2016

How Pokémon Go Could Have Been an Even Bigger Success

Everybody is talking about Pokémon Go, and whether you are an avid player looking to catch those elusive rare Pokémon, or are a bit bewildered by the trend, you can’t fail to appreciate its impact. When we come to review 2016 at the end of the year, amid all of the sad celebrity deaths, crazy politics and general tragedy, the Pokémon Go phenomenon is sure to provide some much needed levity to how we remember this year.

While Pokémon Go is currently being downloaded and accessed at a faster and higher rate than any other game or app and is making a great deal of revenue, there are a few things we can see with hindsight that, if the developers Niantic had handled them better, could have made this game an even bigger success. Here, we look at how Pokémon Go could have done better:

Server Issues

If you run a website, you’ll probably know how important it is for your users to actually be able to access it whenever they want. For ordinary bloggers and business site owners, this comes down to web hosting. When you choose a package from a provider like bestwebhosting.co.uk you opt for one that offers enough bandwidth to support all of your potential visitors. Of course, when you are running something as big and bandwidth intensive as an augmented reality game, it becomes more complicated, but the principle is still the same – you need enough server power to keep all of your visitors supported. Niantic were not expecting Pokémon Go to be as big a hit as it was and their servers have been a real bugbear for players of the game. Things are improving, but these problems early in the game’s life may have frustrated people and lost them players.

Badly Handled International Rollout

As a result of the server issues, Niantic were not able to release Pokémon Go throughout the world according to their original schedule. However, they could have handled this better. They gave no real updates on when the game would become available in places like Europe and Canada, where, with all the hype about the game, people were desperate to play it and found workarounds that allowed them to do so – therefore meaning the servers were getting pressure from these countries’ users anyway.

Lack of In Game Information

Many players complained that the game itself didn’t include enough information on how to play. This may have been intentional, driving users to the internet and generating more hype, however it made it a less user friendly experience than most game developers aim for and may well have driven off some confused players.

Who knows whether Pokémon Go would actually have been even bigger if they had handled these things better – all we can really say for sure is that it will go down on record as one of the most interesting game launches of all time, and one of the big trends of 2016.

The post How Pokémon Go Could Have Been an Even Bigger Success appeared first on Entrepreneurship Life.

July 29, 2016

Why Small Business Owners Say All Their Hard Work is Worth It

By Michelle Di Gangi, executive vice president of small and medium size enterprise banking at Bank of the West

Small businesses are the backbone of the American economy. Always on the job, small business owners throw themselves into their work in order to build financial stability and ultimately create a lasting legacy for their families. The road is not always easy for America’s entrepreneurs.But new research affirms that despite the challenges,small business owners say the juice is worth the squeeze.

The 2016 Bank of the West Small Business Growth Survey and Index sheds light on this. More than eight in ten small business owners say that they put everything they have into running their business—and yet an overwhelming 86 percent say all they’ve sacrificed for their business has been worth it.

So what’s driving today’s entrepreneurs to take the plunge?

Free to Chart Your Own Path

Owning your own business comes with a level of freedom and flexibility simply not afforded by a traditional 9-to-5. Ninety-four percent of small business owners say that owning their own business puts them in charge of their own destiny, 91 percent love the freedom that comes with owning a small business and 83 percent say running their company makes them feel empowered.

Small business owners also feel they are making a difference by running companies integral to their local communities by contributing to the local economy (84%) and making a positive impact on the community (80%). Running a business brings small business owners closer to home, as well: 70 percent say their small business provides them with opportunities to connect with their families and 67 percent feel they’re providing a legacy for their families through their small businesses.

For America’s small business owners, these perks far outweigh the challenges that go along with the job, from living with the uncertainty that comes with owning a business (52%) and always being on the job (43%), to financial worries keeping them up at night such as socking away enough to retire (41%), ensuring their families are financially comfortable (35%) and managing cash flow (31%).

Small Business Owners Are Confident, Despite Economic and Political Question Marks

This year’s survey shows that the sacrifices and hard work that small business owners put into their businesses are paying off. Despite a growing lack of confidence in the general economy and uncertain political climate, small business owners remain resilient. While 40 percent have a negative outlook for the economy in the year ahead (up from 35% in 2015), an overwhelming eight in ten have maintained a positive outlook on their own businesses over that same timeframe. In the near term, 91 percent expect their business’s profitability to either increase or stay the same,with more than half of small business owners saying their business is poised for significant expansion in the next year (52% vs. 47% in 2015).

Business financials over the past year show stability tilted towards growth across the small business sector, as seen in the 2016 Bank of the West Small Business Growth Index score of 55. In fact, seven out of 10 small businesses in this year’s survey fall into the Index’s growth category – reflecting a combination ofincreases in profitability or revenue, as well as investments back into their companies.

How to Succeed in Business

What does it take to run a successful venture?

Small business owners surveyed rated personal leadership qualities as more critical keys to success than business acumen. Passion for work (70%) and self-confidence (64%) top the list, above business skills such as a clear vision for the business’s future (49%) or tangible assets such as offering an innovative product or service (38%).

Perseverance and strong leadership can be the secret to pushing ahead of the pack. It’s not enough to just lean in—if you want to succeed, you’ve got to go all in.

About Michelle Di Gangi

Michelle Di Gangi is Executive Vice President of Small- and Mid-size Enterprise Banking at Bank of the West, where she oversees a team of professionals who provide expertise and guidance to small business owners across the country.Michelle has been with Bank of the West since 2008, and holds a BS in Psychology and MBA, both from UCLA. She also has a MsEd in special education from USC

The post Why Small Business Owners Say All Their Hard Work is Worth It appeared first on Entrepreneurship Life.

July 26, 2016

Avoid Online Fraud with These XTrade Europe Tips

Scammers are everywhere. Wherever you go or whatever you do, you must keep your eyes open these days. This is especially true in the world of online trading. If you are starting a career in this business, you must be aware that millions of people are being fooled every single year. Cheaters have improved their schemes and they use high-end technology in order to get our money or our personal information. They combine these improved methods with traditional tricks, making them a serious threat for online investing community.

Here are few tricks you should use to avoid these online scammers and protect your capital once for good.

XTrade Europe Tips For Sage Online Trading

Don’t trust anyone

Probably the most usual strategy that online scammers use when they want to fool us is using identity of reputable companies or individuals. It is like some kind of evergreen strategy. For example, you can be contacted by someone, claiming he works at Xtrade Europe or other reputable brokerage company. In reality, these people work for themselves and their main goal is not to give you a free bonus or something like that. No, their main goal is to take your money and give you nothing in return. So, before you deposit any money, you must check whether the platform you are planning to use is legit or not. If you, for example, want to start investing career with Xtrade Europe, the only place you should leave your credit card number is their official trading platform.

Do a research

In the old days, checking information on certain companies was a time-consuming job. Today, you can do it with a couple of clicks. Use the power of Internet to check everything you want to know about companies from your list. You should also check what other people say about brokers you are planning to trade with.

Beware of fake ID number

People usually think a caller ID cannot be hacked. This kind of opinion will definitely lead you to disaster. As we said in the beginning, scammers use a hing end technology for cheating people, and making a fake caller ID is just one of the secret weapons from their arsenal. This is why you should be extremely careful when talking with someone on the phone. Instead to talk with this person, you should call him back instead.

Do not pay in advance

Reputable companies like Xtrade Europe would never ask you to pay in advance. Scammers do the opposite. They try to convince people to pay them in advance because they do not have nothing to give them in return. They use different strategies like promising a prize or a secret investing strategy that will make us rich.

Safe payment

Always pay through proven and reputable online paying services and try not to charge your credit card every time you see a payment form on your screen. In addition, it is known that paying services like Western Union are extremely unsafe, because refunding is almost impossible. If a company you want to trade with ask you to use only these suspicious paying services, without giving you any other options, you can be sure that you are marked as a pray by online scammers.

The post Avoid Online Fraud with These XTrade Europe Tips appeared first on Entrepreneurship Life.

July 24, 2016

How Fintech Supports Small Business Funding

Financial technology, or fintech, has revolutionized the lending industry. Fintech startupsmade a splash in the business world in 2015 by disrupting the traditional financial services sector. Fintech companies, including alternative online lenders, are transforming the industry and making it easier for small businesses to obtain adequate funding and operate efficiently. There are many ways that fintech supports and benefits small business owners, especially when it comes to funding growth.

What is Fintech?

After the 2008 financial crisis, entrepreneurs saw an opportunity to overturn traditional banking and lending services. Fintech companies started to emerge, including payment processing firms, alternative lenders, wealth management services and cryptocurrency. These fintech organizations use an online and digital-based approachthat makes it easier for small businesses to send and receive funds and help entrepreneurs access the capital they need to grow their businesses.

Fintech has transformed the way that small businesses get funds. The financial crisis made it especially difficult for small businesses to secure adequate financing from mainstream banking institutions. This meantthat a number of entrepreneurs were not able to fund their startups. Similarly, many small business owners could not get the financing they needed to grow their businesses. When mainstream lenders were unable or unwilling to meet the needs of small businesses, alternative lenders stepped in to create new opportunities for the small businesses in need of funding.

How Fintech Benefits Small Businesses

Fintech firms can offer many benefits for small businesses that are in need of capital. One major benefit is that these lenders can more easily determine a small company’s ability to repay the loan. Many traditional lenders have a hard time accessing credit risk for new and small businesses. Each small business is distinct, even those that are in the same industry. This makes it challenging and expensive to consistently monitor small businesses with variable cash flows and unique needs. However, fintech firms access and use a variety of real-time data online, making it easy for them to make a loan decision in a matter of moments.

Another major benefit of fintech companies is their flexibility. Based on information from a Harvard Business School report on small business lending, banks are more likely to deny small business owners a traditional loan if it is less than $250,000, if the individual has been in business for less than 2 years or if their credit score is less than 640. On the other hand, alternative lenders are a bit more flexible in their credit decisions because they are using actual business data and can offer different amounts and terms that fit each small business’ individual needs.

How Technology Supports the Lending Process

With payment processes like Square making it easier for small businesses to receive money, it should come as no surprise that fintech firms have also found ways to use technology to create a more efficient and effective lending process. Here are just a few ways that technology supports small business lending:

• Quick credit decisions. As previously stated, alternative lenders use real-time data to more accurately determine a business owner’s ability to repay loans. By connecting the business owner’s financial accounts like online banking or PayPal, alternative lenders are able to effectively make a decision in a matter of moments.

• Convenient access to funds. Whereas traditional banks may have a lengthy decision process and take even longer to deliver the funds, alternative lenders allow small business owners to access the funds quickly and conveniently through their online platform. This means that users can get the funds they need, when they need it, no matter where they are.

• More options for lending. No two small businesses are exactly alike and neither are their funding needs. Alternative lenders offer more options for small businesses who have particular needs. For instance, some lenders offer loans as small as $1,000 while others provide a revolving line of credit for businesses that have ongoing capital needs.

• Easily compare lenders. Now, entrepreneurs can easily compare options for alternative lenders online. This allows small business owners to conveniently get competitive rates and it empowers business owners to make the best decision for their business.

Fintech organizations have already created so many opportunities for entrepreneurs who need to fund their startup and for small business owners who want to grow their business. As these firms continue to find new ways to improve small business processes through the use of technology, it will be exciting to see what is on the horizon for fintech.

The post How Fintech Supports Small Business Funding appeared first on Entrepreneurship Life.

July 20, 2016

Meeting Confidence – Making Your First Impression Count

As a freelancer you have no brand or corporate reputation to fall back on, it’s all down to you. Making a good first impression is even more important. As ever, a little thought and preparation can make a huge impact on the impression you make.

Confidence is key

If you don’t have confidence in yourself why would anyone else. You need to be confident and relaxed when you meet a client. This isn’t something that you can change overnight but a few things can make a bit difference to the impression that you make.

Confident people move and speak at a measured pace. You need to learn to slow down. If you’re nervous this will feel unnatural as you’ll want to rush so if it’s feeling unnatural you’re probably getting it right!

Your posture can also make a huge difference. Sit up straight and don’t hunch, and remember to smile. Smiling makes a huge difference, far more than most people believe.

If you’re looking for more tips on this, this article on assertiveness will help.

Dress to impress

How you dress may vary depending on your line of work, who the client is, and where you are meeting. As a rule of thumb, what you wear to a meeting when you are a freelancer should be smart, but in most circumstances, not business formal. If you are unsure, err on the side of overdressed / formal.

Don’t overthink this. Yes dressing appropriately will help, no it probably won’t make a huge difference. The client will be looking to find out more about you, your skills and your behaviour during the meeting. If you impress them with what you say and what you’ve done, your wardrobe probably won’t be an issue whatever you’re wearing (within reason!).

Be on time

Make sure you arrive on time. You should aim to be no more than 10 minutes early, and certainly not late. If you are travelling a distance to attend the meeting, you should aim to be in the area before this, in case of delays to your journey. Just be mindful about what you do with any spare time you may have, as you won’t make a great first impression if you arrive looking hot and sweaty having been for a long walk, or smelling of the nearest fast food restaurant.

Be prepared for small talk, and make the most of it

Once you arrive, you will probably find yourself involved in a bit of small talk, perhaps while you wait for others to arrive, or while refreshments are being made. This is your opportunity to start building a relationship so don’t waste it. This is an opportunity to show that you are a confident, positive person and will be fun to work with. If the weather is bad don’t dwell on it or moan about it, chat about something else instead. If the client brings up the bad weather make light of it and move on, don’t dwell on it. Being positive makes a good first impression, and shows the client that you have a confident ‘can do’ attitude.

Listen to the client

Once you get down to business, the client is likely to do some talking about both their company and requirements. Listen to what they have to say and take plenty of notes, as there will be a time for questions later. If you keep asking questions throughout, it will not only interrupt their train of thought, it may lead to the conclusion that you have not done any research before the meeting.

Organise your portfolio

The client may be meeting with several freelancers, so it is important to demonstrate why they should pick you. Just as those going for job interviews are told to tailor their CV, as a freelancer, it is important to tailor your examples. This will show the client that you have done the research beforehand, and have the necessary skillset to do the task required. If you have prepared and rehearsed some relevant examples, it is much easier to come across as confident and knowledgeable than it is if you are trying to recall past projects as you go along. If you are showing your portfolio, make sure that everything you need is in a logical order so that you can quickly access any examples you want to show. You can quickly become flustered if you can’t find what you are looking for, which can throw you off for the rest of the meeting.

Rehearse answers to obvious questions

Once you have finished pitching to the client, it will be their turn to ask you questions. You should respond to these in a concise way, without looking as if you need to think too much about your answer. If you ramble on, or are hesitant to answer straight forward questions, the client is likely to question how well you know your stuff. Questions about experience and previous projects are almost certainly going to be asked, so make sure you have some well-rehearsed answers ready for them.

The post Meeting Confidence – Making Your First Impression Count appeared first on Entrepreneurship Life.

July 19, 2016

Startup Culture – 5 Tips On Handling Investments For Startups

Startup culture is booming. Everyone wants to be an entrepreneur.Getting a investor to invest in your idea is a first step. But how to manage the investment? How one should make the most out of it? Here are a few tips which are helpful to new entrepreneurs in handling their investment:

1. DO NOT PUT EVERYTHING AT ONCE:

Young entrepreneur tend to be focused on growth with a long range mindset. After all, everyone wants to think ‘Big’. Thinking big means to think on a larger note, this kind of thinking in finances can be your worst enemy. For example, a tech startup engaged a firm for business planning services. The startup had a great product with lots of potential, and one it launched- the business was immediately making money. On paper the owners were millionaires. But why the startup did visited the firm. Because the reality was they were rich on paper but broke in the bank. They had no cash!

This situation arose due to their mismanagement of profits. They invested ‘everything͛’ back into a new venture.

2. FINANCIAL MENTOR:

Don’t do it alone. There are many people out there who think that they need to have to ‘have money’ to work with an advisor. There are financial firms which work with clients at each stage of the game. With a startup; you embark on something that impacts not only you but futures of many. Every business starts with an idea and requires some money. Money is not everything but it means a lot! If used properly, it can be a critical tool to turn your vision into reality.Financial mentors will give you an idea of areas in which you can earn most profit. Save some money and make sure you got someone great to help on financial matters.

3. MAINTAIN AN EMERGENCY CASH FUND:

As per the standard rule of thumb, one must possess three to six months of emergency cash in hand. Well in actual you need a bigger cushion of cash than this. Especially, if you have no other income source. Instead of three four months, save enough for a year at least. You don’t want yourself to financially crunch, when you want to dedicate yourself for the startup. Having a strong financial foundation in place is the key for both a successful entrepreneur and a startup. The biggest startup a company has is the entrepreneur. Cut your personal expenses and save for yourself. If you can, better hold on your day job.

4. DON’T MERGE YOUR ASSETS:

Keep business and personal expenses separate. Any money you spend on business related expenses; it should be deductible from the business income. Everything should remain separated whether you are selling out small sums of money or making a significant financial investment.

5. DIVERSIFY THE INVESTMENTS:

If you are taking on the high risk of starting a business, keep your investments conservative. Diversifying between a range of asset class including stocks, real estate, commodities, bonds and cash reduces overall risk. Entrepreneurs need to be mindful about loading up on investments in their area of expertise.

CONCLUSION:

The above given methods will surely reduce the risk and will help you gain the most out of your investment. Doing a startup is a full time job. You need to dedicate yourself fully to it to make it successful. Along with your determination these methods will prove fruitful to you in handling your cash and investment.

The post Startup Culture – 5 Tips On Handling Investments For Startups appeared first on Entrepreneurship Life.

20 Business Books for Entrepreneurs in 2016

Regardless of whether you do it by means of an eReader, or prefer a hard copy, reading is one of the best ways to obtain knowledge. Although we are aware that, as an entrepreneur, you do not have too much time on your hands, you should know that finding some time to read is crucial for your success. If you are hell-bent on making progress in your line of work, as you definitely should be, think about spending your spare time by reading some of these business books for entrepreneurs:

As a Man Thinketh – Written by James Allen, a philosophical writer from Great Britain, this book was published way back in 1902. Although more than a century old, many businessmen still abide by this book, so you should definitely give it a go.

Meditations – Diving even deeper into the waters of time, this book is a collection of inspirational quotes, written by Marcus Aurelius, a well-known Stoic philosopher. Keep in mind that there is a reason why people still find this book more than useful.

The Obstacle Is the Way – Yet another example of the principles of ancient Greek Stoicism, this book, published in 2014 and written by Ryan Holiday, offers examinations of leaders throughout the history, from Marcus Aurelius to Steve Jobs.

Business Adventures – This book is a collection of New Yorker stories, collected by John Brooks. This one is Bill Gate’s number one favorite, what more is there to say?

Zen and the Art of Motorcycle Maintenance – Maybe you’ll find it strange to see this book by Robert M. Pirsig in a list like this one, but there is a reason why Brad Feld recommended it as an entrepreneur reading material – but we’ll let you interpret it on your own.

Reality Check – With chapters that emanate the feeling of blog posts, you, as an entrepreneur, have much to learn from each one. Written by Guy Kawasaki, this book has been recommended by successful entrepreneurs.

Surely You’re Joking, Mr. Feynman! – This autobiography, written by the man mentioned in its title, Richard P. Feynman, is a useful tool for any entrepreneur. If you don’t believe it, we’ll let the fact that Feynman won the 1965 Nobel Prize in Physics convince you to give it a read.

Things Hidden Since the Foundation of the World – The French philosopher René Girard certainly knew his way around business. Containing his thoughts about the world and business, the author cleverly points out what we may have missed.

Think and Grow Rich – Don’t let the cheesy title fool you – this book is amazing when it comes to the way one sets their goals. This one is Napoleon Hill’s classic business book.

Benjamin Franklin – Every entrepreneur that has been in the game for a while knows that Ben Franklin was an entrepreneur, and a good one at that. Having started from nothing, he worked his way up, so you’ll definitely want to read about this in words of Walter Isaacson.

The Innovator’s Dilemma – There is a reason why Jeff Bezos, the founder of Amazon made all his executives read this book by Clayton Christensen. There is no book that explains how to beat large companies in their own respective fields better than this one.

The Fountainhead – This interestingly-named book, written by Ayn Rand has a lot of useful advice for any entrepreneur. Nothing captures the entrepreneurial passion and spirit better than this book.

The 7-Day Startup: You Don’t Learn Until You Launch – This is one of the top books for entrepreneurship first-timers. Dan Norris, the writer of the book, has experienced years-long failures, until he reached success, so you can definitely learn a thing or two from him.

The Ultimate Real Estate Investing Blueprint – As reported by Huffington post, the real estate industry is looking to pick up pace in 2016, so educating yourself about this line of work is advisable. The mentioned reading resource, written by Sean Terry from Flip2Freedom, is an excellent guide to learning how to flip houses.

Blink – In this book, Malcolm Gladwell throws a look at the science behind decision-making and general intuition. These are great subjects for any aspiring entrepreneur.

How to Get Filthy Rich in Rising Asia – Bearing a heavy title, this book by Mohsin Hamid is about growing up in a Southeast Asian slum and rising above this to become a successful entrepreneur. There is a lot to be learned in this interesting book.

Zero to One – Published in 2014 and written by the PayPal cofounder Peter Thiel, this book’s focus is on making use of technology to build a successful business. It also preaches research as an essential part of diving into a startup.

Elon Musk: Tesla, SpaceX and the Quest for a Fantastic Future – Behind this hefty title is a cleverly-written biography of Elon Musk, written by Ashlee Vance. This book explores Musk’s journey from South Africa to involvement with many successful businesses, such as Tesla and PayPal.

Unbroken: A World War II Story of Survival, Resilience and Redemption – Yet another book that isn’t strictly business-related, it is an inspiring true story, featuring Louie Zamperini, who faced huge challenges in the world’s largest war. It is, above all, a story of personal sacrifice and perseverance – traits hugely linked to the world of business.

Creativity, Inc.: Overcoming the Unseen Forces that Stand in the Way of True Inspiration – If there’s someone who can tell you stories about creativity and innovation, that is Ed Catmull, the co-founder and CEO of Pixar. We warmly recommend this book.

This reading material will help you dive into the world of entrepreneurship. While it may be difficult to read each and every one of the mentioned books, start with those that inspire you the most – you won’t regret it!

The post 20 Business Books for Entrepreneurs in 2016 appeared first on Entrepreneurship Life.

July 18, 2016

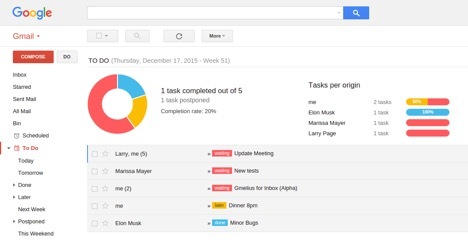

Gmelius: A Must-Have Extension for the World’s Most Popular Webmail Client

Gmail is the greatest emailing service currently available on earth. However, even the greatest can be improved. Who hasn’t wished that Gmail was a bit more convenient to use? Gmelius is a web extension that lets a user truly take control of his or her inbox.

Improve Gmail Productivity

At work, I’m constantly using Gmail to chat, schedule, keep track of tasks, and of course, send dozens of emails a day. When I’m juggling multiple tasks in this manner, some default features of the Gmail interface can be infuriating. For frustrated Gmail users like me, Gmelius promises to improve Gmail productivity and make the inbox easy to use.

Gmelius (pronounced “Gmail-ius”) is a free web extension for Chrome, Safari 9+ and Opera. There are paid premier and business versions as well. This is the review of the Gmelius Premier version.

After testing Gmelius Premier for a month, I have to say I’m impressed by all the wonderful perks the service offers. Here is what I found most useful and awesome about Gmelius Premier:

Schedule Emails to be Sent at a Later Time

I’ve always wanted this feature and didn’t know where to get it until I started using Gmelius Premier. With Gmelius Premier, I could automatically schedule emails to be sent on a certain date and during a certain time in the future. I sometimes work late on weekdays, and I have emails to be sent early the following morning. I’m never up early after a late night at work, so I sometimes had to disrupt sleep to send emails. But with Gmelius Premier I could just schedule an email to be sent early the following day. If you want to send an email during a later time when you would be busy, or want to send it on a later day without forgetting about it, Gmelius Premier’s Send Later feature will be highly useful to you.

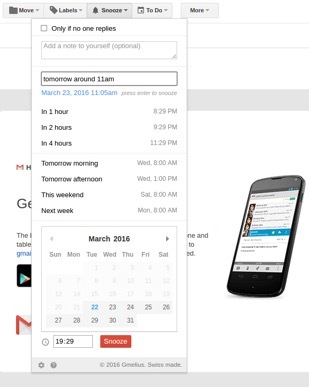

“Snooze” Emails

Avid Gmail users will know the impossibility of keeping track of emails to respond to later. I used the star feature to mark emails that I can’t respond to right away, but need to later. I would then sort the whole inbox for the yellow or green stars, which, needless to say, is an incredible hassle. Not to mention the times I have forgotten to do so. Gmelius Premier lets users “snooze” emails. Basically, a “snooze” button appears on top of the inbox so I could reserve emails to be read later. Also, I could turn on email reminders so that I don’t forget to respond to snoozed emails. This feature is a lifesaver for me.

Hashtag Templates

Gmelius Premier has this amazing feature where I can create an email template and a hashtag for it. So, if I need to send a hundred similar emails at the same time, I could just type in the hashtag to the subject line and simply send. When creating the template, I can adjust settings to choose the Gmail address I wanted to send from, choose CC and BCC recipients, and add labels and subject lines. Markdown syntax is supported for smart tagging. This is the feature about Gmelius Premier that I liked the most.

In addition, I could personalize the Gmail inbox and customize the to-do lists and task manager. The only con that I found is that it’s difficult to format the toolbar in Gmail after installing the extension. But the developer has said that this problem will be fixed soon. I highly recommend Gmelius Premier to anyone who wants to improve their current Gmail experience.

The post Gmelius: A Must-Have Extension for the World’s Most Popular Webmail Client appeared first on Entrepreneurship Life.

July 14, 2016

Three Ways Small Businesses Can Get The Most Out Of New Technologies

The era in which we live in is the most technologically advanced and diverse eras the world has seen – and this characteristic is expanding at an exponential rate. This upward trend in technology’s advancement has granted many vendors to create unbelievably progressive pieces of technology that are made available at our fingertips. We use these components to gather information, complete tasks, and carry out our day-to-day lives – in fact, I’d bet that most of you are reading this article on a smartphone.

With these trends in mind, the small business world should be divulging into the world of these new technologies, as they garner the possibility of major successes in the business world. However, we sadly see many businesses failing to do so, which is resulting in enormous losses across the board. I wanted to share three opportunities your business has to get the most out of today’s rising technologies.

Mobile and Wearable Technologies

The world has become increasingly dependent on mobile and wearable technologies. In fact, studies have shown that 91% of the US adult population owns a cell phone, and of that 91%, 61% of these are smartphones. Furthermore, the IDC predicts that 112 million wearable devices will surface throughout the next three years, and with these numbers, it is vital for a small business to immerse themselves within this digital trend. Smartphones and wearables are rapidly overtaking any other consumer shopping options, which are making the world of eCommerce an increasingly viable option in the small business world.

Additionally, as many of us know, ensuring a website is fully optimized for mobile devices is a new ranking factor in the eyes of Google, and this is yet another reason behind the push for mobile technology. Simply keeping mobile users in mind can significantly bolster the potential of a small business.

Search Engine Optimization

While we are on the topic of ranking factors, implementing proper search engine optimization within your website can serve as a “make or break” factor in today’s online-focused consumer world. As the digital world is incredibly competitive, a well-optimized website can show customers and search engines that it is the best possible option for their needs.

Of course, there is a lot that goes into the world of search engine optimization, and it is important to stay up-to-date with new industry trends, because tactics that may have worked two or three years ago can ultimately be the worst tactics to employ today. Be sure to keep this in mind, and if you are completely unsure where to begin, Moz’s Beginners Guide to SEO may be a great place to start.

Social Media

Social media is arguably one of the most prolific features of today’s younger generation. Within the business world, it allows us to maximize our marketing endeavors with the ability to push our message to an extremely targeted audience. Plus, consumers and businesses exist among each other on these platforms. This allows for open communication between one-another.

This means it is important for a small business to uncover what social media platforms their customer base exists on, and use this to their advantage. Analyze this group of people, and find what types of content they are engaging with on social media. Replicating this can be a fantastic starting point in the world of social media.

Remember, social media is called “social” media for a reason. It should be used for brand building, rather than a direct sales line. No one wants a direct sales pitch. It is important to engage in conversations and build trust among your brand’s identity.

The post Three Ways Small Businesses Can Get The Most Out Of New Technologies appeared first on Entrepreneurship Life.

What You Should Know When Getting Internet Services for Your Company

If you ever had to live through the years when dial-up internet connections reigned supreme, then you would know the feeling of gritting your teeth while waiting for a tiny file to load. Despite the fact that wireless broadband solutions are now much more widely available, you could still end up investing in a plan that is too slow to carry out all of the tasks that your business needs to get done at lightning speed. To save yourself the headache of calling for technical help over and over, here are some things for you to look into before sealing the deal with any corporate internet provider.

Built-In Security Measures

Some companies offer security measures in bundles, sometimes at an added cost. These include anti-virus and anti-spyware software that could help protect your computers from suspicious activity. Ask about these features and any limitations they might have, such as the number of terminals that they can protect.

Bundles or Promos

Ask nicely enough, and you may be able to get certain services for a steal. Try asking about discounts for long-term contracts, as companies are much more likely to give you leeway if you plan to stay with them for a long time.

Free Trials

If you can, try to take advantage of any free trials that your company may be eligible for. It will give you a good idea of how stable the connection is in your area. If, during the trial period, you already begin to experience a slew of problems, then that’s a sign that they may not be the right service provider for you.

Advertised and Actual Speeds

Though some companies advertise super fast speeds, often, the actual performance may only be a certain percentage of that. Ask your provider upfront about what the average speed usually is. If they try to insist they are always at top speeds, then odds are, they are just trying too hard to impress you. Look for a different provider instead.

Installation Requirements

Nothing can be more frustrating than to have the installation technicians arrive, only to find out that you’re lacking the necessary hardware to get the connection going. To confirm whether your cables and wires are compatible with current internet services, try asking the office building administration for more information.

In Short: Know Everything That You Can

When you are investing in any type of service in order to make your business run more smoothly, you have every right to know as much information as possible about what you will be trading your hard earned money for. It is always better to be safe than sorry, so make sure that you forward any concerns that you have to the person in charge of the internet service provider. If you are able to gain only the best connection for your company, then the quality of the service that you will provide your clients will also certainly improve, which means better business and better profits for you and your employees.

The post What You Should Know When Getting Internet Services for Your Company appeared first on Entrepreneurship Life.