Mohit Tater's Blog, page 513

March 14, 2020

7 Benefits of Selling on Amazon

Many sellers from different corners of the world consider Amazon to be one of the top places for selling products. As a marketplace, it justly deserves to be one of the most comfortable platforms for buyers. Nonetheless, Amazon can also be a top pick for sellers who aim at making the transaction happen and develop their business. Below are some of the ultimate facts that will probably make you eager to begin your selling activity on Amazon.

You can secure your profits with an FBA program

Fulfillment by Amazon is a program that allows you to delegate many product-related functions to Amazon. For instance, Amazon takes full responsibility for keeping your merchandise in warehouses and handling returns if such happen. Therefore, you can be confident that all the issues will be processed appropriately. Moreover, you do not need to continually think about where to store your goods and how to ensure timely delivery. Nevertheless, you are expected to pay a specific fee for Amazon services, but this fee is nothing compared to potential profits from selling.

You can conduct Amazon product analysis

Using Amazon as a platform to sell products allows oneself to exploit a multitude of Amazon research software. For example, an ama top product analyzer can help you maintain excellent market positions and ensure product visibility. Such tools are designed to make it easier for sellers to discover which products are worth selling. Moreover, one can utilize a product tracker Amazon tool not only for identifying profitable profits but also for setting relevant prices. In essence, Amazon software serves as a helper when it comes to setting prices for its own merchandise. Market prices change every day, and Amazon has made it possible to detect the smallest price fluctuations. Overall, the tracking of regular product research for Amazon makes it possible to improve market positions and stay ahead of the competition.

Great customer value

The point that makes many customers in many countries love shopping on Amazon implies the ease of doing so. Just because shopping on Amazon is exceptionally convenient, customers put great value into this platform. This fact is ultimately beneficial for all the sellers since customers can readily buy their products. Moreover, buyers trust Amazon and therefore, the chances of a transaction taking place are relatively high. If you boost the number of positive reviews and encourage more customers to place detailed product feedback, you will attract even more loyal customers.

Support cannot be underestimated

You already know that Amazon can perform shipping and storing operations instead of the actual seller. On top of that, Amazon guarantees 24-hour support to ensure fast issue resolution. Plus, the platform strives to provide you with all the essentials you will need while growing your business, from supporting you with tax collection to helping you with inventory tracking.

Your website is ready in a matter of minutes

Usually, you will need to create a personal website and modify it until it gets polished and user-friendly. Needless to say, you will often need to increase your spendings and pay quite a lot for your own website. If you set up a selling activity on Amazon, you can free yourself from such costs. To become a seller, you only need to create an account, and you are almost there. Another excellent benefit in terms of this point is the way your webpage looks. You can free yourself from continuously thinking about how to improve your page to make it look better. And, of course, there are no risks associated with launching a personal website.

Affiliate program

Affiliate programs on Amazon make it possible to make your products visible to many customers. The way the program works is plain: someone places a link to your Amazon products on their webpage or a personal blog, and readers click the link. As a result, they realize they want to buy your products.

In other words, Amazon puts a great deal of effort to make more and more people benefit from Amazon, even non-sellers. As long as many people are genuinely interested in passive profits, many individuals opt for this referral program. And since many people are interested in advertising your goods in their blogs, you can exploit such an opportunity and engage even more new customers.

Big customer base

With Amazon, you do not need to pay a fortune to make more people familiar with your merchandise. In fact, Amazon is one of the biggest online retailers and, respectively, it has a great customer base. Such a base allows e-store sellers to save up a great deal of money on marketing. Active users are shopping on a daily basis, so Amazon is a place where demand exists by default.

Drawing a bottom line, Amazon can be assumed as one of the top online retailers. Becoming a seller might be beneficial both in terms of saving money and attracting a large number of customers with a minimum effort. No matter what you sell and how many units you have, you can always end up with success on Amazon.

The post 7 Benefits of Selling on Amazon appeared first on Entrepreneurship Life.

5 Ways to Fund Your Dream Retirement

What’s your dream

retirement? Lounging on the beach? Travelling around the world? Owning a nice

home for your grandchildren to visit? No matter what you plan on doing in

retirement, you can put yourself in a good financial position by following any

of these five tips.

1.

Start Saving

The best way to

finance your retirement is to put money away in savings. Saving money is one of

the most difficult aspects of managing your personal finances, but it’s

important if you want to have enough money to enjoy life while you’re not

receiving a paycheck. You don’t want to be house poor because your retirement

funds only cover your basic living expenses.

The key to saving

money for retirement is that you’ve got to put money away consistently.

Ideally, you’d make a small retirement contribution every paycheck. In order to

do that, you should abide by a monthly budget. Keep track of your monthly

expenses and use a portion of what you have left over for savings

contributions.

You should make sure that you’re using the right kind of savings account to hold your retirement funds. A regular savings account doesn’t yield very much interest. Furthermore, it’s easy to take money out of a regular savings account. Consider opening an IRA account, instead, which yields a higher amount of interest and prevents you from transferring your funds.

2.

Get Investing

One of the best

ways to fund your retirement is to develop a passive income. A passive income

is any kind of income that you don’t have to actively work for. It’s a great

way to supplement your retirement funds.

Stocks and bonds

provide some of the best investing

opportunities. When you buy a stock, you’re essentially buying a piece of

company, and you’ll be rewarded with a small share of the company’s profits. The

more stocks you own in a company, the higher your dividends will be—so long as

the company is doing well. Bonds are similar, but they’re issued by the

government to fund federal programs, and you’ll be paid back the full you paid,

plus interest.

Success in the

stock market requires patience. Don’t panic when the stock price falls for a

company you have ownership in—hold onto your shares for as long as possible and

trust that the price will rebound. That being said, do research on a company

before you buy shares so you’ll have an idea of whether or not they’re going to

truly grow and become more profitable in the future. Also, use your initial

dividends to buy even more stock in the company so that your dividends will

grow over time.

3.

Invest in Property

Real

estate is a great asset to invest in because most properties grow in value

over time. If you hold onto a property for a long time, there’s a high

likelihood you’ll be able to sell it for more than you bought it for.

Whether or not

you’re already a homeowner, consider purchasing an “investment property.” You could

rent out the property to tenants and make extra money for retirement

contributions. When you’re ready to retire, you could sell the home and use the

cash for your retirement funds, which should be a pretty substantial amount of

money. Consider getting government-secured loans so you can try and get lower

mortgage costs.

4.

Sell A Company

You’re an

entrepreneur, so there’s a good chance that you plan on starting up one or more

businesses throughout your career, if you’re not a business owner already. Question:

if you plan on retiring, then who’s going to run your business while you’re off

golfing at the country club? Answer: whoever’s willing to pay you for your

company. Selling one or all of your companies is a terrific way to earn your

retirement funds.

You can also sell

parts of your business, like a brand or department that’s doing very well.

Sometimes, there are buyers who are just looking for a good website. If your

company has a website with a strong design and lots of high-quality content, you

might be able to dispose of it for cash.

5.

Get a Reverse Mortgage

Last, but not lease, there’s the reverse mortgage. A reverse mortgage is a good way to gain extra income during your retirement. How does a reverse mortgage work? Basically, you give up some equity in your home in exchange for a monthly paycheck (so instead of paying a mortgage payment, you’re receiving a mortgage payment).

A reverse

mortgage may be a great option for you so long as you don’t intend on passing

on your home to any family members—your family members may have to pay back the

equity that’s been removed from the home, or sell the home to recoup the funds.

If you plan on leaving the property to family members, just be sure that you

speak with them about it beforehand and make sure they’ll be financially

prepared.

Your dream

retirement doesn’t have to be a dream at all! Just follow these five tips to

help you save.

The post 5 Ways to Fund Your Dream Retirement appeared first on Entrepreneurship Life.

March 12, 2020

How to Start a Hemp Farm

If you’re agriculturally minded and interested in starting your own business – why not consider a hemp farm? With cannabis being legalized in several states in recent years, and CBD products being used more widely for healthcare purposes, it’s a great time to get into the market.

Furthermore, hemp has been used throughout the centuries for several different things, such as making clothing, fuel and insulation – opening up more selling opportunities for you.

If this sounds like something you might be interested in, here’s a few things you need to know before you get started.

Get a License

Before you begin farming, by law you will be required to get a license in order to grow industrial hemp. However, the state you are based in will have an effect on that, too. You will need to be farming in a state that has legalized marijuana use – make sure you do your research into this before you proceed with anything else.

Land

Once you have determined whether or not you can legally grow hemp in your state, you’re going to need to acquire a good plot of land. You might already have this in place, which is why you’re looking into farming in the first place. If so, then great, but if not then start searching for farming properties that can accommodate the size of your cultivation project – however big or small you intend it to be. Make sure you get the soil tested before you buy, too.

What Hemp are You Growing?

As mentioned briefly before, hemp can be harvested for various purposes. You might want to grow hemp to extract the CBD oil that is used for healthcare remedies, such as pain relief, anxiety, and to ease the symptoms of diseases like MS. On the other hand, you might want to grow hemp for textiles, nutrition (hemp seeds are good as part of a balanced diet) or one of it’s other many uses. Decide what you want to grow the hemp for, as farming techniques and needs will differ depending on this.

Equipment

Any farm needs quality equipment to make your life easier. Some of the items that you will need as a hemp farmer include a seed drill, a combine (used in other mainstream farming) and if you are growing hemp for CBD oil, you will need a specific CBD hemp harvester for that. You will need to purchase hemp processing equipment, too.

Seeds

Of course, no farm is complete without its crop. CBD seeds bulk buying options are available and best for industrial farmers. Find the best quality seeds you can to achieve a rich, fruitful crop.

Sales

Like all businesses, you will have to make sales to survive. Do your research into potential buyers for your product, whatever you’re using the hemp to make. Hire a good marketing team to help guide you in how to best advertise your product to buyers.

With the use of hemp for both medicinal and several other purposes becoming more popular, it truly is a good time to get into hemp farming.

The post How to Start a Hemp Farm appeared first on Entrepreneurship Life.

How Spreads Matters in Forex Trading

In the Forex market, the spread is the difference in pips between the bid price (purchase price) and the ask price (sale price) for a given currency pair such as EUR/USD. Spread is the way that many Forex brokers use to obtain benefits for each transaction that their clients (traders) make through their trading network in the market. For example, at any given time, a broker may be paying a price of 1.3500 to buy or sell EUR/USD; however, this same broker will allow its clients to buy the currency pair at 1.3501 or sell it for 1.3499.

As we know, the quoted price for any currency pair is expressed by means of the combination of the symbols of the two currencies that make up the pair and the bid and ask price as shown below:

-Base Currency/Quote Currency | Bid Price/Ask Price

Thus, if at a given moment, the price for the euro against the US dollar is equal to 1.3500-1.3502, this price is expressed as follows:

-EUR/USD = 1.3500/1.3502

Bid is defined as the maximum price at which the market is willing to buy, which is why it is also recognized as the purchase or demand price. Therefore, it is the price at which the trader will enter the market if he is selling the currency pair.

Ask is defined as the minimum price at which the market is willing to sell, which is why it is also identified as the sale or offer price. Therefore, it is the price at which the trader will enter the market if he is buying the currency pair.

The difference between the Bid price and the Ask price is what is known as the spread. The spread is expressed in points, and in the case of the Forex market in pips. In the case of the previous example, the spread for the EUR/USD is 2 points or pips.

How do spreads work?

To better illustrate what spreads consist of in the Forex currency market, we will use the following example:

Suppose an investor wants to open a buy position on the EUR/USD pair at a price of 1.3401. Immediately the broker with which this trader operates will satisfy the request of his client and carry out the purchase operation on his behalf, with the difference that the broker will probably buy the EUR/USD at 1.3400 (or even 1.3399 for this operation, depending on the market conditions and its liquidity providers), obtaining as profit for the transaction 1 pip. Now suppose that the trader wants to close the position and sell immediately (assuming that the price of the currency pair has not changed) for one reason or another; In this situation, it will only be able to sell at 1.3999, since we must remember that now the broker is selling at 1.3400, but it charges a 1 pip in the spread as profit from the operation.

For this reason, to obtain profits when trading in the Forex, it is necessary to surpass the spread over the price with an advantage. Otherwise, the balance of the operations will remain at zero or even be negative in the event that the trader closes the position at entry price. This is of utmost importance in currency pairs that generally have a high spread, as in the case of AUD/JPY, whose spread can reach 8 pips depending on the broker.

Why is it important to understand the topic of spreads?

One of the biggest difficulties regarding the issue of spreads in the Forex market is to really know how much the broker we have hired for the service is charging per operation and if this charge is really fair.

Something that many beginning traders and investors do not know is that it is possible to manipulate spreads on the trading platform without the clients realizing it, and there are brokers led by unscrupulous people who use this practice to increase the advantage over their clients and obtain greater Profits. Because the Forex market is not fully centralized or regulated, this practice is observed more frequently than it should be.

For this reason, it is necessary that the trader selects brokers who have a good reputation and who have never been accused of price manipulation. Although it is not an absolute guarantee, it is also recommended to operate with a broker regulated by a major financial regulatory body such as the Financial Conduct Authority or CySEC, as these entities require companies to meet strict requirements regarding the financial services they offer, especially in terms of equity and quality.

Even in the case of brokers that do not perform any undue price manipulation, the issue of spread is important since it represents the highest cost for the trader. A trader that operates with a broker that charges low spreads will have less costs in their transactions, and in the long term, this will mean a very important saving. On the contrary, if a trader uses the services of a broker with high spreads, he will have to generate higher profits in his operations just to offset the effect of the spread.

For many traders, the spread can be the difference between making a profit or a loss. For example, if a trader performs many short-term trades (of a few minutes) daily, the spread may end up absorbing his profits, especially if he trades with a broker characterized by high spreads, and his trading profits are low. In the case of traders who carry out long-term operations that generate many profit pips, the spread is of little relevance since it has little impact on the results of their transactions.

How to select the most convenient broker based on spreads?

When selecting a broker to operate in the Forex market, several criteria must be taken into account, including the spread. As indicated above, the impact of the spread on the costs of the trader depends on the frequency of operations, the duration, and the average profit that the trader obtains in his transactions. In this way, a trader who trades very frequently and gets few pips in each trade should look for a broker that charges the lowest spreads in the FX market so that their profits are not precisely diluted by the effect of the spread. In this case, it is best to open an account with an ECN broker, since these are characterized precisely by their extremely low spreads, although it must be taken into account that in many cases these companies obtain their benefits by charging commissions for each transaction.

The STP brokers also offer good trading conditions regarding spreads, thanks to its liquidity providers and operating systems. With respect to Market Maker brokers, spreads are generally higher, and since these companies act as the trader’s counterparty, there may be conflicts of interest and, in some cases, even price manipulation. However, Market Makers offer fixed spreads for most of the time, which may be advantageous for some traders.

Likewise, as mentioned in the previous section, another recommendation is to select a broker that has a good reputation, and above all, that does not have accusations or complaints about fraudulent price management. If the selected broker is regulated, even better for the trader as this provides a higher level of security.

The post How Spreads Matters in Forex Trading appeared first on Entrepreneurship Life.

10 Retail Marketing Tips That Will Keep Your Business Running Year Round

All people have to buy things, you can

love it or hate, but you still have to do it. That is good news for business

owners, but the struggle is, how to beat the competition and attract more

customers? Retailers have to be at the top of their game constantly. Otherwise,

someone else might “steal” their customers. We assume your business

is present online since that is one of the most powerful tools for gaining more

new customers. Hence, a lot of our tips will be dedicated to the things you can

do in the online world, but we also did not forget about those tricks that

provenly work in the real world of brick-and-mortar shops.

1. Google Shopping Campaign is a Must

As a retailer, you need to take

advantage of all possibilities out there, including Google shopping campaigns.

Whether you run an online business or a brick and mortar shop, selling directly

through SERPs is a great way to increase sales. Make sure all product pictures

are of high quality and include promo deals and discounts.

2. Target Your Group

of Shoppers

If your business is still not on social

media, do not wait anymore. Make an account and invest in social media

advertisements. What is so great about them is that you can custom target your

group of shoppers. If you sell fishing equipment, for example, most likely, 90%

of your target audience are males. You can also select the preferred age and

city area, etc. There are so many options for choosing your target group, which

allows you to play a bit until you find that ideal target group.

3. How Can More

People Visit Your Store

Although a lot of shopping happens online, if you have a brick-and-mortar store, it is still important to have buyers who come to visit it. You can create special offers that are valid only in-store, it will increase your storefront traffic. Invest in outdoor business signage that will promote special deals and also promote it online. Offer a free gift; it always works. Or visit https://www.shieldcoart.com for more custom signage ideas.

4. Approach to Locals

Are you a newbie in town, and have no

clue about locals and their customs? It is time to change that. Your store

needs to become a part of the community, relevant for the locals, so they can

get emotionally attached to it. Perhaps prepare small gifts and vouchers for

people from your neighborhood, we are sure you will win them over with these

small gestures.

5. Are You Keeping Up

With Podcasts?

Podcasts are the latest hit in the US,

and they are slowly becoming globally popular since they are so easy to listen

to while driving or commuting. Based on what you are selling, and your target

audience, you can find a niche that is suitable for you.

6. Improve Your

Videography Skills

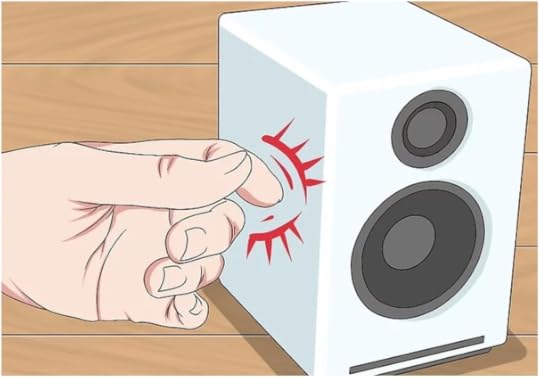

Are you aware of how many people watch YouTube videos? And not just YT, but videos on social media in general? Facebook and Instagram have both welcomed short videos that could be an excellent way to promote your products and allow potential customers to see them. You can get creative and make funny videos that can go viral in no time, so think about it.

7. Celebrate All

Holidays

Valentines, Easter, Christmas, New

Year, 4th July, Thanksgiving, and even St.Patrick’s day, you have to keep up

with all holidays and if possible, offer different packaging and limited

editions for those occasions. Shoppers love things that have a theme, and any

of these holidays are a great opportunity to boost sales.

8. Impulsive Shopping

Have you ever made an impulse purchase?

Of course, you did, but why? What forces us to spend our money without previous

planning? The sense of urgency. When we have a feeling that something is

quickly selling out, we are more determined to get it. Hence, short-term offers

and specials deals that last only 24 hours or expire soon are a great way to

inspire people to spend more.

9. Plan and Prepare

for Seasonal Peak

What is the busiest time of the year

for your business? Is it Black Friday, summer, winter, or Christmas holidays?

We are sure you know the answer, that is why you need to prepare for that

period on time. Special offers, design, limited products, it all has to be

prepared on time. Because if you are not ready, your competitors will certainly

be.

10. How to Have

Returning Buyers

You need to keep your customers coming

back for more, and remarketing campaigns are exactly what you need to do. If

your product has a lifespan, it means that after a certain time, you need to

remind your customers to repurchase it. Also, if you have other products that

go well with one another, it is always good to recommend them.

The Bottom Line

The goal of every business is to grow,

and you cannot do that if you first do not invest in your marketing. Whether

you opt for just one of these strategies or several of them, you have to keep

in mind that they all need some time to show results. Also, do not forget to

track all the numbers to see how much you have benefited from different

marketing tricks.

Author’s

Bio:

Karen is a BS graduate in Architecture.

Her love in home design brought her to write some blogs that help to give ideas

in their dream house design. She also helps businessmen and entrepreneurs

through writing on how business signs help in building their brand and company

name.

The post 10 Retail Marketing Tips That Will Keep Your Business Running Year Round appeared first on Entrepreneurship Life.

Pros and Cons of Debt Management Programs

There are individual financial institutions that offer debt management programs to help debtors pay their debts faster and easier. Companies that run these programs work hand in hand with the creditors to make sure you repay your debts like medical fees, credit card debts, unsecured loans, and collecting debts.

How do they work? It’s simple. A debtor will have to pay a certain amount monthly to an account run by the debt management platform or company. The company will then use the money to pay all of the debt from creditors under the plan.

Debt management programs typically run for about three to five years by regularly making monthly payments to all your creditors. Also, companies that run DMPs profit from this by adding interest to your monthly payments that will serve as a fee to their services.

Pros of Debt Management Programs

Here are the advantages of enrolling in a debt management program:

Lesser Debt

One of the selling points of debt management plans is their ability to negotiate the lowest interest and easiest repayment terms for you. An explanation will be made on your behalf, which will be given to the creditors, prompting them to lower your interest rate and others. However, this is not all assured since the creditor will have the last say. This means that if they opt not to cooperate with them, things will stay as they are.

But, if the program manages to convince your creditors, especially to lower your interest rate, your debt will be less. Also, the plan will be able to pay off the principal amount with your monthly payment, instead of it going to the interest. A debt management program’s goal is to lessen your debt and to pay it as soon as possible for three to five years.

One Monthly Payment

If you are struggling to make ends meet by paying off multiple accounts every single month, then subscribing to a debt management program will be beneficial for you. Instead of paying in multiple accounts monthly, you will only make one single payment every month if you enroll in a DMP.

The DMP will make an account where you can pay monthly. DMP will then use that money to pay the creditors themselves. This will be less of a hassle for you since you will only have to worry about a single monthly payment instead of keeping track of the calendar to remind yourself to pay a lot of accounts in their due dates.

No Phone Calls

A lot of people agree to the fact that most creditors are annoying since they regularly call you and harass you to stick to the monthly payment now and then. You can’t blame them, though, as calling the debtors to remind them of their schedule is the best way to get a hold of them.

With DMPs, an advisor will be taking charge of these transactions for you. This means that you will not be getting phone calls always since they are in charge of paying the creditors, not you. Also, if you think the creditors are taking things too far, a specialist in your DMP will settle the transaction directly.

Cons of Debt Management Programs

Debt management programs also have their fair share of drawbacks such as the following:

Closing of Accounts

Probably one of the most significant drawbacks of a debt management program is the need for you to close all your accounts except for one. This single remaining account will be left open but will only be used in cases of emergency. This is their way of ensuring you do not take any more debt, which will make your subscription longer than expected.

Negative Impact on Your Credit

DMPs default on your debts on your behalf and then renegotiate them for easier repayment terms. Creditors will not be happy about this since they will be losing a significant amount of money in return. This might prompt them to blacklist you in their financial institution.

Also, these defaults will be seen by other companies, which will be a disadvantage if you are looking to apply for a new credit line or loan in the future. Once this happens, you will have no choice but to apply for loans through bad credit loan lenders only.

No Legal Protection

The absence of legality of DMPs has its benefits, especially the lack of evidence of being insolvent in your accounts. However, this lack of legitimacy also has its own downsides. DMPs are not legally binding, meaning you can exit the program quickly. This also means that your creditor may also choose to leave.

This can prompt them to make an investigation of their own, finding proof of your insolvency in your debt. The lack of signs of you being insolvent is one of the most common reasons creditors leave the program.

Everything that you have agreed on the terms and conditions in the program will be revisited, so making sure you keep your creditors satisfied by sticking to your monthly payments is the best move to avoid them leaving the program.

Takeaway

Before subscribing to a debt management program, make sure to secure your assets, establish an emergency fund, and look through all the pros and cons. There might be a lot of selling points in subscribing to a DMP, but the lack of legality in DMPs is one of the most common reasons people opt not to.

The post Pros and Cons of Debt Management Programs appeared first on Entrepreneurship Life.

Fahad Al Rajaan: A Brief Biography

Fahad Al Rajaan is an accomplished Kuwaiti businessman with extensive experience of the finance and investment sectors.

Born in Kuwait on 23rd December 1948, Fahad Al Rajaan received the appointment of PIFSS (Public Institution for Social Security) Director General from the Kuwaiti Government in 1984. He also oversaw operations for Wafra Investment Advisory Group, serving as Chairman from 1985, as well as serving as Ahli United Bank’s Chairman from 2000 until 2015.

Mr Al Rajaan commenced his highly successful career working for the Kuwait Investment Company as a Manager after graduating university. The Kuwait Investment Company helped develop the Kuwaiti economy, setting industry standards for responsible and profitable investment in the nation since 1961.

In 1981, Mr Al Rajaan went to work for the Kuwait Real Estate Investment Consortium, serving as the organisation’s Managing Director and Chairman. The Consortium manages a comprehensive investment portfolio, overseeing ventures for corporate and private companies, as well as funding new business start-ups.

Mr Al Rajaan was selected by the Kuwaiti Government to serve as PIFSS Director General in 1984. In this role, he was responsible for overseeing the Kuwaiti social security system.

The PIFSS was established in 1977 by the Kuwaiti Government. Its ultimate mission is to ensure that profits derived from Kuwaiti natural resources enhance the lives of all Kuwaiti citizens.

The PIFSS iFahad Al Rajaan: A Brief Biography

s responsible for managing and implementing Kuwait’s state pension scheme. Because of its unique structure, the PIFSS is able to provide improved investment liquidity and more security to policy holders, thereby providing all of Kuwait’s citizens with enhanced pension provisions.

In 1992, Mr Al Rajaan received the appointment of Company Director of Ahli United Bank. It was in this role that he oversaw operations of Bahrain’s biggest lender by market, which became a 100% state-owned organisation in 1971. Ahli United Bank specialises in commercial banking and investment advisory services for corporate clients, offering specialist wealth management, offshore, private banking, and treasury services to select clientele.

Mr Al Rajaan attended Washington D.C.’s American University, graduating with a Business Administration degree in 1974.

Fahad Al Rajaan is an accomplished golfer. In 2013, he became the Dubai Duty Free Cup champion, beating four previous winners to the number one spot.

Mr Al Rajaan is married, with two sons and two daughters. He ranks amongst the world’s top 500 most influential Arabs worldwide.

The post Fahad Al Rajaan: A Brief Biography appeared first on Entrepreneurship Life.

How Perfectionism Hurts Businesses

Perfectionism is a behavior in which a person cannot detach from trying to strive to be without flaws. They put high standards on themselves so that when people are examining their work, they want to be sure that there’s nothing that could be picked apart. Some want to be validated in that they’re good enough and show that they’re doing work that measures up. It’s a compulsive pattern that has neurotic components to it. People who are perfectionists have unrealistic standards for themselves, and it can be detrimental to a person’s mental health.

What are the ways that perfectionism can impact a business owner?

If you’re putting unrealistic expectations on yourself or your team to perform as a small business owner or entrepreneur, you’ll create pressure and make it difficult for yourself or your team to meet these goals because you or they can’t live up to these expectations. It’s important to remember that everything can’t be flawless; there are mistakes made in this context, and anyone who gives off the air that they haven’t made mistakes is not showing the whole picture. Not making mistakes is unrealistic, and as your business grows, there will be a learning curve. Expecting yourself to go the right way could create anxiety for you or foster depression or anxiety in your business partners or teammates when they’re trying to please you. A perfectionistic environment doesn’t have a healthy dynamic to it, so it is something to be seriously wary of as a business owner or entrepreneur.

How does perfectionism hurt people?

Perfectionism can hurt individuals because it makes them feel extreme pressure; you might spend hours or days beating yourself up over not doing well enough or over wondering if you did the right thing. Perfectionists feel like no matter what they do, they haven’t achieved sufficient and worry that about being an imposter. The person stresses themselves out, trying to achieve goals or perfection. If you have people working for or with you, it can hurt you by straining the dynamic of the team, but it can also hurt you if you work independently. Perfectionism often puts people in a state of panic or anxiety that isn’t useful for you and can make you stagnant as a business owner.

How do perfectionism and anxiety work together?

If you struggle with anxiety, you may feel like you want to alleviate that anxiety by doing a “good job.” It’s different from striving to meet regulations in the workplace or to do your best with your business, but anxiety or perfectionism can both attach to the idea that you didn’t do a “good enough” job. That can be a problematic issue for a small business owner. It can make you stagnant, and for some people, perfectionism even leads to an individual giving up on their dreams or getting ill because the anxiety and tendency to overdo it hurts them so severely. It’s important to discuss issues related to anxiety and perfectionism in therapy.

How can a business owner learn to manage perfectionism?

One way to deal with this issue is to talk about these concerns in counseling. A clinical therapist, whether it’s someone you’re seeing via online therapy or in a private practice setting, can help you manage perfectionism so that it doesn’t take over your life. People must learn to deal with perfectionism; you don’t want it to overtake you to the point where you’re not able to function because that is dangerous, and it could be closer than you think if you struggle with perfectionism or putting too much pressure on yourself. Make sure to seek out a mental health provider to talk to, whether that’s someone in your local area or remotely.

The post How Perfectionism Hurts Businesses appeared first on Entrepreneurship Life.

How to Organise a Conference – Business Conference 101

Conferences bring together the growing community of people and relationships build by your product or brand. By holding a conference for your business, you get to create a community, build your brand, share your expertise, learn from others and Network/make new connections among other things. Organising the conference from scratch is one of the most important aspect of the event.

These quick steps should help you organise

a flawless business conference.

Decide on the best theme

This is one of the first things you have to

do because all conferences need a theme.

You need something that will unify the entire event altogether without

taking away from the subject matter.

Your theme should be relatable, catchy, and

trigger an emotional response from the audience. When setting up the theme,

consider what your message is, who your target audience is and what you want

them to get out of the conference. The theme should guide you in branding and

advertisement.

Assemble

a team

There is a vas amount of work that come with organising the conference; you simply won’t do it on your own. Organising it will depend on the type of people you bring onto the team

You need to get a dedicated team of

individuals who will be ready to assume the responsibilities fully. The team should be split into planning,

administration, sponsorship ad marketing to help make the conference organisation

easy. Having a large team will help you make all the arrangements and plan the

conference successfully and on time.

Check for well organised, well driven and enthusiastic team players.

Budget and business plan strategies

Being clear from the jump about what you

hope to achieve from the conference will help in its success. Whether you are funded by sponsors or not,

you need to put together a budget.

If this is not a corporate event, the end

goal is to turn in a profit at the end of it all. This is why you need to

create a clear picture of the expenditure you are willing to use for the

conference and the income you expect to earn in the long run.

Keep in mind that you are going to go overboard or under the budget more or less due to some estimations on your budget. Also, the registration fee should not be the only source of income on the event. You can look for other areas to save and make more money.

Talk to sponsors if you need to

When selecting the sponsors, you want at the

event, keep the theme and attendees in mind. Try as much as possible to find a

good match for the conference.

Start by looking for sponsors that are

known to find similar events in your area. Make sure you communicate with them

and let them know how much say they have in the entire event. Decide if you

want their branding and equipment in your conference.

Don’t do too much otherwise you might

overstep the boundaries between funding and integrity of the entire event. If

you can afford to cater for the event financially on your own, there you are in

no need for sponsors

Find

a venue and set the date

This probably sounds like one of the

easiest tasks when it comes to organising your conference but its not. Before

you start searching for a venue, it’s probably better to set the date first.

For most conferences, 6 months to a year and more is probably a nice timeline

for a conference.

You will also need to calculate the average

number of attendees at the conference. Once you have these two figured out, you

can pick out the venue. Make sure you

schedule it for the weekdays, don’t pick a conflicting date and try to avoid

winter conferences.

Decide

on the speakers

Recruiting guest speakers is an important

role in conference organisation. You end goal is to get a solid line-up of

speakers so you can guarantee a professional experience for your attendees as

well as attract more.

One way to capture the attention of potential attendees is by inviting big league/celebrity speakers to the event. People will probably respond to popular and well-respected speakers. This will also boost your credibility levels in the other potential speakers making it likely for them to attend as well.

Create a list of speakers you would want

attending the event and contact them about the event. Make sure you address the

requirements, compensation and supporting equipment to the attending speakers.

Put

together the agenda

When you finally have all your key elements

in place you can start planning the agenda. You want to get into this part of

planning at least 4 months before the set conference date.

Create an agenda based in the expectations of

the attendees, their knowledge on the subject matter, the expected presentation

by guest speakers and anything else important to the event. Make sure to

include interactive sessions, Q&A and workshops when setting up the Agenda.

Register

the attendees

This is where you get people to sign up for the conference. The first thing you should do is create a website for your conference. It should include the conference programme, registration, and all the details about the conference.

If you opt out of the website creation, you

can hire a third party for ticketing. Ticketing is Very stressful and hiring a

third party makes it easier. All you have to do is decide the price based on

the budget and the payment methods for money transfer.

Promote/advertise

the conference

There are plenty of ways you can promote your conference on a budget. Social media platforms, Niche-related forums and your Blog is a good way to start in promoting the conference. Encourage your speakers, workmates, team members and attendees to help you advertise the conference online.

Final

word

All that is left now is hosting your

conference. On the set date, you will be hands on in the event with other

organisers and the guest speakers. Make sure you have backup speakers on speed dial

before the event in case of any cancellations. After the event, follow up with

all your attendees to appreciate participation as well as collect feedback.

The post How to Organise a Conference – Business Conference 101 appeared first on Entrepreneurship Life.

How Can an Employer Thank Their Staff

A happy workforce is a motivated and productive workforce. It can be easy for management and owners to forget to show their employees their appreciation for all their hard work. When saying thank you to members of staff, it is essential to do it in a way that is meaningful to them. Management does not want to seem just to be handing out empty platitudes and coming across as insincere.

Employers may want to thank staff but don’t know how to go about it. A working relationship is sometimes built on everyone doing their jobs effectively, and the human touch can get lost in a busy workplace. There are some great ways to thank and motivate staff, so both employees and management enjoy a good relationship. Sometimes it is the more unusual methods that can get great results.

Hand Out Gym Passes

Keeping fit is a big part of many people’s lives. Working for most of the week and then having to pay for gym fees can be a barrier for employees. Giving out gym memberships may be too costly, but how about giving out complimentary gym passes every so often to say thanks?

A local gym may even be happy to give them to you for free as they’ll have the chance to sign up for the employees who go for a workout. Staff with good physical and mental health will be happier and more productive.

Give (Some) Extra Holidays

Staff may love their jobs, enjoying coming in every morning to chat with their colleagues and get stuck into their work. However, they also have lives outside of the office. Hobbies, family, friends, pets, and other aspects of their lives are also important.

A business owner allowing some unexpected time off in addition to their regular holidays may see their grateful employee become even more productive than they already were.

Make Them Part of the Company

Even the most devoted employee still knows the company ultimately belongs to someone else. By utilizing an employee share plan, an owner gives their staff business shares in their company.

An owner giving away part of their business to their employees can show they want their staff to be part of the company journey. Employees will know that they will directly benefit from the success of the company, giving them extra motivation to make the business more successful.

Praise Them in Public

It doesn’t always have to cost money when making staff feel appreciated. If someone has done particularly good work, then send an email around the team about the project and mention that person as having gone over and above. If they are sitting among their peers in the office or canteen, then thank them in front of colleagues. Everyone likes to feel appreciated and know they’ve done an excellent job.

Final Thoughts

Every business wants to have motivated staff who are happy in their work. Reduced staff turnover, higher profits, and a positive working atmosphere are just some of the benefits. Whether you choose to make staff feel valued by giving them shares to include them in the company’s future growth, or if you only plan to say thanks more, it’s a good idea to let staff see your appreciation.

The post How Can an Employer Thank Their Staff appeared first on Entrepreneurship Life.