Jonathan Clements's Blog, page 27

August 16, 2025

I never expected this…..

Fortunately, that distance I experienced is not being repeated with my grandchildren. But I’m getting ahead of myself.

When we married, I explained to everyone that the word “step” did not exist in our blended family. However, I soon learned there was no such thing as the Brady bunch.

Getting married when both our daughters were 15 was a natural disaster, one could expect. While we had enough bedrooms for each, sharing a bathroom was unacceptable. Every other weekend was tense. The boys were fine; however, my little one was left to bond with the dog. Five kids, five different personalities, all wanting the same thing — their birth parents.

We got through those years and many more. Flash forward 40 years for the real story. Those five kids gave us nine grandchildren; the word step almost disappeared. Our nine are not only close to one another but also very close to us.

Firstly, they all adore their Bubba. I am, surely, a beneficiary of that bond as well. As a blended family, I was careful not to encroach on my wife’s ex-husband's territory and invited him and my ex-wife, along with her spouse, to every family get-together at our weekend house. Thanksgivings, too, were very well attended.

Sadly, our exes both died after being ill. While the kids and grandkids were sad and missed them, they now seemed free to engage with us on a deeper level. We became mom, dad, grandmother, and grandfather to all. The concept of a real family finally took hold.

While it varies somewhat depending on what’s happening in their lives, we spend significant time with each grandchild. We have a lot of one-on-one time to discuss their hopes and dreams. They seek advice and listen as we give it.

My bonds are strongest with those who finished college or are now in their last two years and want life and career advice. Weekly lunches/breakfasts in a restaurant for those living and working nearby are highlights of our week.

I wanted to make sure they got what I never got. The secret is that I enjoy being with them more.

I made the guest list for my surprise (not) 80th birthday party. I cut it down from 120 to 89, with 65+ attending. Lots of people were away in the middle of the summer. Several grandchildren put much effort into what they wanted to say. Their speeches were profoundly touching and very much appreciated. I also enjoyed spending time with family, old friends, and new ones.

Here’s the jackpot. Five years ago, my wife’s daughter gave me the best present anyone could ever receive. She expressed regret for taking 35 years to accept me. It took a traumatic event for her to realize how much I loved her mother. It was a silver lining in a very dark cloud.

This was not a story about money or retirement. Instead, it is about the importance of relationships and making them better. So many families grow apart. Our focus is keeping everyone close for as long as we can.

The post I never expected this….. appeared first on HumbleDollar.

Trump Accounts

Do you remember ERTA, 1981 legislation which liberalized the Individual Retirement Account statute so everyone with wages could contribute up to $2,000 a year and take a tax deduction? Contributions increased from 4.8 Billion (1981) to 28.3 Billion (1982) or 490%!

And, do you remember the Tax Reform Act of 1986, which did not change eligibility to contribute to an IRA, every American wage earner and their spouse remain eligible to contribute, but by mucking up the tax deduction, IRA contributions declined by 63% from 1986 to 1987 - 37.8 Billion (1986) to 14.1 Billion (1987)?

Today, there are the new "Trump Accounts", as described in detail by Bogdan Sheremeta, One Big Beautiful Act: Tax Breakdown and Planning Strategies, 8/15/25.

There are still a number of questions about these accounts, which are scheduled to be available July 1, 2026:

Must the account be established by the federal government? Probably not, since the government contribution of $1,000 only applies to children at birth. The majority of children eligible for a Trump Account are lives in being.

Who makes the election to accept the $1,000, and how? Probably the parents, and perhaps on their federal income tax return.

Will Roth conversions be allowed and if so, are they available before age 18?

Will RMD rules apply if these are maintained as Traditional IRAs?

There is a $2,500 limit on employer contributions, is it annual or lifetime, is it per child or per employee?

Do employer contributions count towards the $5,000 annual limit?

I have many other questions, such as after reaching age 18, do the regular IRA rules, contribution limits, investment options, etc. apply?

Anyways, the reason for my post is to encourage you to invest in Trump accounts for your child, grandchild, neice, nephew, ... to create a legacy, to help children develop a savings habit (a savings account to be maintained for their entire life).

In 1984 and 1987, when each of my two children were born, I opened up Uniform Gifts to Minors Act tax deferred annuities with $1,000 gifts and invested those monies in equity index funds. The goal was to achieve a 12% tax deferred rate of return (the average annual rate of return for the S&P 500 from 1946 to 1984 was estimated at 11.6%) for 60 years - which, if you remember your powers of 2, takes $1,000 at birth and changes it into $1MM at age 60 (ignoring sequence of returns risks).

Along the way, I moved those monies to Roth IRAs. As of today, both are on track to be IRA Tax-Free Middle Class Millionaires, in 2044 and 2047.

I call them Ben Franklin Child Roth IRAs. Why Ben Franklin and long term investing? I encourage you to read: Ben Franklin's Last Bet, The Favorite Founder's Divisive Death, Enduring Afterlife, and Blueprint for American Prosperity by Michael Meyer.

For Ben, long term was 200 years!

23.7

0.626984127

?

The post Trump Accounts appeared first on HumbleDollar.

August 15, 2025

Harder Than It Looks

This highlights a key challenge for investors: On the one hand, picking stocks can sometimes be as easy as it looks. That was the case initially with Novo Nordisk. When Ozempic hit the market, it was clear the company had a winning formula. Patients were routinely losing as much as 20% of their body weight. Sure enough, positive financial results followed. An investor who chose to bet on this trend would have been right.

But if stock-picking can be this straightforward, then why does it often turn out to be so hard? Decades of data tell us that it’s enormously difficult, even for professional fund managers, to beat the market. Why is that?

Recent research sheds light on this question. In a study of more than 20,000 mutual funds over a 35-year period, researchers found that fund managers actually do a reasonably good job at picking stocks. But that turns out to be only half the battle. When it comes to timing decisions, fund managers struggle. In nearly every geography and every time period, timing decisions subtracted value. Stock-pickers, in other words, are good at picking stocks but not very good at deciding when to buy and sell them. A closer look at Novo’s recent history can help us understand why this is often so challenging.

For Novo Nordisk—despite its early success with Wegovy—everything seemed to go wrong at the same time.

First came competition from entities known as compounding pharmacies, which were able to capitalize on a quirk in the law. Under FDA rules, if an important medication is determined to be in short supply, these independent pharmacies are permitted to manufacture knockoffs to help ease the shortage. These custom-made versions are based on the same active ingredients as the branded drug but are usually sold at much lower prices. This was the situation Novo Nordisk faced—and is still facing. Because of Ozempic’s quick success, Novo Nordisk had a hard time keeping up with demand. As a result, in 2022, the FDA allowed compounding pharmacies to begin producing knockoffs.

In the years since, Novo worked to expand its manufacturing capacity and, earlier this year, the government declared that the shortage was over. That meant that compounding pharmacies should have stopped producing their lookalike weight-loss drugs. They haven’t followed the rules, though, and Novo has had a hard time shutting them down. According to a recent press release, Novo Nordisk has filed more than 130 lawsuits, but it continues to be an uphill battle. In one recent case, a judge dismissed Novo’s claim against a compounder, arguing that no patients had been harmed by the knockoff it produced.

Compounders were just the first of Novo Nordisk’s problems. Then came competition from a brand-name drug company, Eli Lilly. It released its own, very similar, weight-loss drug in late 2023, putting additional pressure on Ozempic’s market share. Worse yet, Lilly has been working on a pill version of its drug. This would be a significant advancement over existing treatments, all of which require injections, something that’s off-putting to many people.

The combined effect: Since hitting a peak last summer, Novo shares have lost substantial value, and the stock’s outlook is far from clear. If you’d been an investor in Novo Nordisk over the past five years, you might have made a terrific profit. Or, depending on the timing, you might instead have realized a significant loss.

Stories like this are hardly unique. Consider Microsoft. In the roughly 40 years since it went public, its stock has dramatically outperformed. In round numbers, it’s gained about one million percent. But it hasn’t been profitable every year. In fact, if you’d held the stock over the 14-year period when Bill Gates’s successor, Steve Ballmer, ran the company, you would have realized an 8% loss, even including dividends.

Meta, the company formerly known as Facebook, went through something similar not long ago. When CEO Mark Zuckerberg announced that the company was shifting its focus to the “metaverse,” its stock took a dive, losing more than 60% of its value in 2022. When the company later backed away from the metaverse and instead started focusing on AI, its stock turned around and is up nearly eight-fold over the past three years. Just as with Microsoft, you might have done very well or very poorly with this stock depending on the timing.

The most recent example: Tesla. For a variety of reasons—possibly including Elon Musk’s personal unpopularity—car sales have been sliding. The result: Earlier this year, the stock was down nearly 50%. It’s still down, though less so. What’s next for Tesla shares? It’s an open question.

That brings us back to Novo Nordisk. No doubt, it’s a great company. All of the stock-pickers who recognized the potential of its weight-loss products could see that. But the outlook is entirely unclear. On the one hand, it is working on its own pill-based version of Ozempic, to better compete with Lilly and leave the copycats behind. But at the same time, science advances every day. One recent headline read: “Scientists May Have Identified a Natural Alternative to Ozempic.” Is there validity to that claim? It’s too early to tell.

The bottom line: Stock-picking is tricky because it can sometimes look easy, and that obscures the hard part, which turns out to be the timing. That’s why Warren Buffett has often joked that his favorite holding period for a stock is “forever.” But that’s easier said than done.

The alternative? As you might guess, I see this as another reason investors are generally well served by index funds, which hold stocks through thick and thin, unaffected by the headlines of the day.

Adam M. Grossman is the founder of Mayport, a fixed-fee wealth management firm. Sign up for Adam's Daily Ideas email, follow him on X @AdamMGrossman and check out his earlier articles.

Adam M. Grossman is the founder of Mayport, a fixed-fee wealth management firm. Sign up for Adam's Daily Ideas email, follow him on X @AdamMGrossman and check out his earlier articles.The post Harder Than It Looks appeared first on HumbleDollar.

What has been my relationship with money? That story starts around age 8. Every kid needed caps and beans.

That question just popped into my head. The answer is part of a long journey that always included some form of saving albeit quite modest for many years.

When I was a kid, raising money for important stuff like miniature plastic soldiers, caps for my six guns, beans for the pea shooter and ice cream cones was a necessity. No allowance in my home.

We acquired our wealth by selling Kool-Aid, collected empty soda bottles for the two cent deposit, shoveling snow, shining shoes, selling greeting cards door to door, collecting garbage and shoveling coal in our apartment building and assorted other entrepreneurial ventures. As a teenager I worked in a pet shop and for the city library. My pet shop pay was $5.00 a week - working two hours each day after school and all day Saturday. The library paid $0.75 an hour, but I worked my way up to $1.10.

What did I do with the money I saved? Of course there was the traditional piggy bank as a child. Later there was a passbook savings account - you actually got to see a teller enter your updated wealth in a book and then you brought the book back to the bank to have interest credited. Some money went into a Christmas Club account. Even back then I liked the idea of isolating money for a designated purpose.

When I began working full-time after graduating high school, I signed up to save via direct deposit to our local credit union. They had good interest rates and the best rates on auto loans. My first monthly payment was $49 for a new 1963 VW Beatle that cost $1,895.

Later I enrolled in payroll deduction Savings Bonds and then a 5% discount employee stock purchase plan. I still have some of the bonds now reaching their 30 year limit and all of the company stock, except some shares I gifted our children years ago.

In my early 20s I began dabbling in stocks - totally ignorant about what I was doing and urged into penny stocks by a cigar, cigarette, pipe smoking broker. Good old Leo. It was fun and a way to spend lunch hours watching the ticker, but not profitable. On the other hand, a learned some valuable lessons before they were devastating.

My stock holdings were enhanced in the 1970s when the company used a TRASOP and PAYSOP. They were types of tax-credit Employee Stock Ownership Plans that were available for a limited time. Both allowed companies to receive a tax credit for contributing their own stock to a retirement plan for employees. I have those shares of stock too.

Between 1965 and 1982 I began investing in mutual funds. The money involved was the minimum required by the fund. I was just fulfilling my need to save despite my lack of skill. That money later disappeared into college tuition.

Investing only became a real thing with me when we added a 401k to our company benefits program in 1982. It was my job to manage the plan and communicate it to employees. I learned a lot working on the implementation and designing the employee communications with experts on retirement planning and investing.

I enrolled in the 401k to receive the maximum employer match. I don’t recall the total percentage I saved back then, but I do remember increasing the percentage with raises when possible. In 1982 we were just six years away from starting ten years of college expenses with 1,2 or 3 in school at once.

In 1992 I was made department manager when it was decided the incumbent should retire. From then until 2006 I had various titles including general manager and director but doing essentially the same job - for higher salary. The titles made it easier to work with unions, on acquisitions and with senior management. The games we must play.

In 2006 I was made Vice President- a 45 year quest for me. That made me eligible for stock options, enhanced bonuses and other incentive stock compensation. I kept all those shares of stock too and invested the bonus money.

Today (yesterday anyway) my employer’s stock equals about 20% of our total investments and generate good dividend income - currently reinvested. That percentage of investments in one company is not recommended, however. It’s a misplaced loyalty with me. Every material thing we own is the result of one career with one company and a few very helpful people in that company.

The fruits of our labor are a pension, social security, a rollover IRA (my old 401k) and a brokerage account where the company stock resides along with the first few years of combined Social Security benefits in several muni bond funds.

That’s my relationship with money - always saving and the benefit of lots of time, but likely never optimizing the potential. I followed and still do a rather simplistic, seat-of-the pants approach to everything money. Nothing sophisticated or well planned, never focused on minimizing taxes, but clearly benefiting from the absence of misfortune and the great benefit of an amazing partner through it all - for our 50th anniversary we renewed our vows in Cana, Israel. No wine though.

Big trip travel is probably over for us, but we still have a bank account designated “travel” and as long as I can drive, we will be going somewhere. I wonder if they will welcome us in Canada?🥵

The post What has been my relationship with money? That story starts around age 8. Every kid needed caps and beans. appeared first on HumbleDollar.

One Big Beautiful Act: Tax Breakdown and Planning Strategies

My goal is to focus on reviewing the Title VII - Finance, specifically focusing on Subtitle A - Tax.

There are many changes and my goal is to focus on the most important provisions impacting individuals and small business owners.

Let’s get into it:

Section 70101. Extension of the tax rates.

The OBBBA makes the tax rates enacted in the TCJA 2017 permanent.

As a reminder, if this bill didn’t pass, the tax rates would’ve reverted back to the pre-TCJA tax rates (15%, 25%, 28%, 33%, 39.6%).

In addition, starting in 2026, there will be an extra year of inflation adjustment for the 10% and 12% brackets. This roughly equates to ~$100 of tax savings as long as you are over the 12% bracket due to more of your income being taxed in lower brackets due to inflation adjustments.

Section 70102. Extension and enhancement of increased standard deduction

The bill makes the TCJA standard deduction permanent. This also means that the personal exemption will not be coming back.

It also increases the base standard deduction from:

$15,000 → $15,750 (single)

$22,500 → $23,625 (head of household)

$30,000 → $31,500 (married jointly) for 2025

The standard deduction will continue to get inflation adjusted after 2025.

Section 70103. Senior deduction

Before Jan 1, 2029, a deduction of $6,000 will be allowed for each taxpayer who is age 65 before the close of the taxable year, effective 2025.

This means that if you are married filing jointly, and both are 65 or older, you may qualify for a $12,000 deduction.

However, the $6,000 amount will be reduced by 6% of the amount by which your modified adjusted gross income exceeds $75,000 ($150,000 if you are filing jointly).

For example, say you are single and have $85,000 MAGI ($10,000 over the threshold). $10,000 * 6% = $600.

The maximum senior deduction is $5,400. Also, the deduction applies regardless of whether you take the standard or itemized deduction.

Tax planning opportunity: consider the additional impact of the $6,000/$12,000 deduction on Roth conversions. Effectively, older taxpayers could harvest more conversions at a lower tax rate. However, an analysis is needed on the impact on IRMAA and/or the taxability of their Social Security benefits.

Section 70104. Child tax credit

The child tax credit amount is increasing from $2,000 to $2,200, effective 2025.

In addition, the child tax credit amount will be permanent (as a reminder, it was going to sunset to $1,000, the pre-TCJA amount, if it wasn’t enacted).

Starting in 2026, the $2,200 amount will also be increased by a cost-of-living adjustment. The Social Security number of a child is required to claim this credit on the parent's tax return.

In addition, starting in 2025, the $1,400 refundable credit (the maximum amount you can get refunded if you have no tax liability) will also be adjusted based on the cost of living.

Section 70105. Deduction for qualified business income

The bill makes the 199A (QBI) deduction permanent. As a reminder, it was supposed to sunset after 2025 (starting with 2026). This is great news for self-employed business owners and owners of pass-through businesses (like partnerships and S corporations) who receive a 20% qualified business income tax deduction.

The tax bill also increases the income phase-out range for SSTBs (businesses providing services in healthcare, law, accounting, consulting, etc.) from $50,000 to $75,000 (single) and from $100,000 to $150,000 (married jointly) starting in 2026.

It also creates a minimum $400 deduction as long as you have at least $1,000 of qualified business income, starting in 2026.

For example, say you have a small business where you materially participate and earned $1,000 net income. Your QBI deduction will be calculated as:

20% * $1,000 = $200, but the minimum is $400, so your deduction will be $400.

Both the $400 amount and the $1,000 income threshold are increasing for inflation starting in 2027.

Section 70106. Increased Estate and Gift Tax Exemption

The estate and gift exemption ($13.99M per individual, or $27.98M for married couples) was going to be significantly lowered to ~$7M per individual as part of the TCJA expiration.

But with the bill, the estate and gift tax exemption is increasing from $13.99M to $15M, effective in 2026.

It will also increase with inflation, as has been the case, after 2026.

Section 70108. Extension and modification of qualified residence interest

You can claim an itemized deduction for “qualified residence interest,” which includes interest paid on a mortgage secured by a primary or secondary home.

For mortgages incurred after December 15, 2017, the maximum limit of debt that you can receive a mortgage interest deduction for is $750,000.

The bill extends the $750,000 amount and makes it permanent.

There is also a section that allows mortgage insurance premiums (related to FHA loans) to be treated as interest, so this amount will be treated like interest for the purpose of the mortgage interest deduction, effective 2026.

Section 70111. Limitation on tax benefit of itemized deductions

You may remember that pre-TCJA there was a “Pease limitation” that put a limit on the maximum amount of itemized deductions that you can take.

This new bill brings back a much more modified version of the “Pease Limitation,” effective in 2026 for high earners.

The total itemized deduction will be reduced by 2/37 (~5.4%) times the lesser of:

Itemized deductions

Taxable income that exceeds the amount of the 37% bracket

Effectively, if your taxable income is less than ~$626,350 (for single) or $751,600 (for married jointly), you wouldn’t be impacted by the limitation.

For example, say you make $700,000 as a single individual ($73,650 over the 37% bracket) and have $50,000 of itemized deductions. The lesser of the two is $50,000 * 5.4% = ~$2,700. The final itemized deduction is $47,300.

Note that this section shall be applied after the application of any other limitations for itemized deductions (i.e. SALT cap of $40,000).

Tax planning opportunity: if you are a high earner and considering making a large donation (e.g. using a DAF), it makes more sense to do so in 2025 rather than 2026 due to the limitation.

Section 70114. Extension and modification of wagering losses

The bill limits how much you can deduct for gambling losses to 90%, effective in 2026.

In addition, the “up to the extent of winnings” limitation still stands.

For example, say an individual has $50,000 of gambling losses and $50,000 of gambling winnings.

The new law only allows taking 90% * $50,000, or $45,000, as an itemized deduction (since we have sufficient winnings of $50,000).

If the winnings were $30,000, we would only be allowed to take the $30,000 as a loss deduction.

There is talk to change the 90% limit back to 100% after certain members of Congress learned about this change. They are calling it the “FULL HOUSE Act,” so it’s unclear whether this will still be implemented.

Note: in order to claim gambling losses, you have to itemize the deductions. Considering that most people take the standard deduction, you would effectively sacrifice a tax-free portion of income just to claim the loss, which may or may not even be worth it depending on the losses.

Section 70120. Limitation of state and local taxes

The state and local tax deduction cap is increasing to $40,000 in 2025 for itemized deductions. The $40,000 limit applies to both single individuals and married filing jointly (the “marriage penalty” still applies).

The $40,000 amount will increase to $40,400 in 2026 and continue to increase by 1% annually until 2030. In 2030, the state and local tax deduction cap will revert to $10,000.

Importantly, there is a $500,000 modified adjusted gross income (MAGI) threshold (for both single and married filers), and the deduction will be reduced by 30% of the amount by which it exceeds that threshold, but not below $10,000. This means that after $600,000 of MAGI, the SALT limit is $10,000.

Interestingly, the MAGI is defined as “adjusted gross income increased by any amount excluded from gross income under section 911 (foreign earned income), 931 (income from Guam, American Samoa, or the Northern Mariana Islands), or 933 (income from Puerto Rico).”

This means that tax-exempt interest is not included in the definition of MAGI, as it normally is.

In addition, if you are in the $500,000-$600,000 MAGI range, you will lose 30 cents of SALT deduction for every $1 you earn in this income. Taxpayers could experience the “SALT torpedo” due to the high marginal tax rate (~40%) in this range.

Tax planning opportunity: If you are in this income range, consider calculating the impact of shifting taxable savings interest products (like HYSA) toward tax-exempt interest (Muni bonds) due to the MAGI definition.

Tax planning opportunity: If you are in this income range, consider doing tax loss harvesting, maximizing your pre-tax contributions, HSAs, and accelerating deductions or postponing income (for business owners) to reduce your MAGI.

Section 70201. “No tax on tips”

A new $25,000 deduction is created for “qualified” tips, effective from 2025 through 2028.

The qualified tips are defined as “tips that are paid voluntarily without any consequence in the event of nonpayment, are not subject to negotiation, and are determined by the payor,” and conform with the Treasury list.

The Treasury will publish a list of qualifying occupations and provide guidance to clarify any additional information to prevent abuse.

Sorry lawyers and accountants… You can’t change your billing structure to be tips only.

The $25,000 deduction is reduced by $100 for each $1,000 by which your modified adjusted gross income exceeds $150,000 (single) or $300,000 (married).

The deduction is allowed even if you take the standard deduction. In other words, you don’t have to itemize to claim this deduction.

Example:

You make $50,000, of which $30,000 is from tips, and are single. You will receive a $25,000 deduction for the tip income, saving ~$3,000 on your federal taxes.

The IRS also announced that for 2025 there will be no changes to any W-2 forms, potentially including the tip amount on them. However, more information is coming on how this deduction can be taken for 2025 (perhaps the taxpayer will just need to keep good records for 2025).

Section 70202. “No tax on overtime”

A new $12,500 deduction (single) or $25,000 (married jointly) is created for “qualified overtime compensation,” effective from 2025 through 2028.

Qualified overtime is defined as overtime pay required under Section 7 of the Fair Labor Standards Act of 1938.

The deduction is reduced by $100 for each $1,000 by which your modified adjusted gross income exceeds $150,000 (single) or $300,000 (married).

Also, this deduction is on a per-return basis, so if you file jointly and only one spouse works overtime, you can take a $25,000 deduction assuming you meet other qualifications.

Overtime will be included on the W-2 in 2026, and will be “reasonably estimated” for 2025, similarly to the tips deduction. More clarification is coming on this. As with the “no tax on tips” provision, the deduction is allowed even if you take the standard deduction.

Example:

Your MAGI is $100,000, of which $10,000 is from overtime, and you are single. You will receive a $10,000 deduction for this overtime, saving ~22%, or about $2,200 on your federal taxes.

Importantly, the overtime deduction is calculated as the overtime rate minus the regular rate, not the full overtime rate. In other words, if you make $45/hr as overtime and your regular wage is $30/hr, only $15/hr of overtime will count toward the deduction.

Section 70203. No tax on car loan interest.

There will be a $10,000 deduction on car loan interest, effective from 2025 through 2028.

The deduction will be reduced by $200 for each $1,000 by which your modified adjusted gross income exceeds $100,000 (or $200,000 if married).

The interest must:

Have originated after December 31, 2024,

Be used to buy a car the original use of which starts with you (this means that used vehicles do not qualify)

Be for a personal use vehicle (not for business or commercial use)

Be secured by a lien

In terms of a vehicle, it must be a car, minivan, van, SUV, pick-up truck, motorcycle with gross weight of less than 14,000 points AND final assembly must be in the United States to qualify.

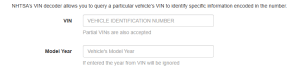

The IRS recently clarified how the final assembly would work: “the location of final assembly will be listed on the vehicle information label attached to each vehicle on a dealer's premises" or “taxpayers may rely on the vehicle's plant of manufacture as reported in the VIN number to determine if a car has undergone final assembly in the United States" using the National Highway Traffic Safety Administration (NHTSA) Vin Decoder.

Refinancing qualifies as long as the initial loan qualifies (after Dec 31, 2024, new car, etc.) and only up to the amount of the original loan you refinance. Any extra amount borrowed beyond the original balance doesn’t qualify for the interest deduction.

Lenders will be required to report the interest paid to the taxpayers.

Section 70204. Trump accounts and contribution pilot program

A Trump account, defined as an individual retirement account (IRA) which is not a Roth, could be established for the exclusive benefit of an individual under 18 years old.

The maximum contribution amount per year is $5,000. No contribution will be allowed for 12 months after the enactment of the law (July 4, 2025), so no immediate action is needed at the moment. No tax deduction is allowed for contributions to the Trump account. No withdrawals are allowed before age 18.

The account also must be invested in an “eligible investment,” which is defined as a mutual fund or ETF that:

Tracks a qualified index (like the S&P 500 or another broad U.S. equity index with regulated futures trading)

Does not use leverage

Has an expense ratio of 0.10% or less

Meets any additional criteria set by the Secretary

A qualified index must be broad-based, primarily U.S. company equities, and not industry/sector-specific.

Once the beneficiary turns 18, the account is treated similarly to a traditional IRA, but further clarification is needed on the details from the IRS.

Employers can also contribute to a Trump account on behalf of an employee (or dependents), subject to a $2,500 limit.

A new pilot program is also created that provides a $1,000 tax credit for a child who is a U.S. citizen, born between January 1, 2025, and before January 1, 2029.

Section 70301. Full expensing for certain business property

Bonus depreciation is made permanent and is now 100% as long as the property is placed in service and acquired after January 19, 2025. This is great news for all of you who invest in rental properties and perform cost segregation studies.

The bill also increases the maximum amount a taxpayer may expense under Sec. 179 to $2.5 million, reduced by the amount by which the cost of qualifying property exceeds $4 million.

Section 70404. Dependent care assistance program

A Dependent Care Flexible Savings Account is a tax-advantaged benefit offered by some employers, which allows employees to use pre-tax dollars to pay for eligible dependent care expenses.

As part of the bill, the dependent care FSA limit is increasing from $5,000 to $7,500, effective in 2026.

Section 70405. Enhancement of Child and Dependent care tax credit

The bill raises the maximum percentage of qualified expenses you can claim for child and dependent care from 35% to 50%, effective in the 2026 tax year.

The 50% will be reduced by 1% for each $2,000 by which your adjusted gross income exceeds $15,000 (but not below 35%) and further reduced by 1% for each $2,000 ($4,000 if married jointly) by which your adjusted gross income exceeds $75,000 (single) or $150,000 (married jointly).

Section 70413. Additional expenses treated as qualified higher education expenses for 529 accounts

One of the limitations of 529 plans was that you weren’t able to use them for certain costs outside of tuition.

So, parents of a high school child who attends a public school weren’t able to use their 529 plans to offset some costs, but that changes with the following expenses qualifying for students attending a public, private, or religious K–12 school:

→ Tuition

→ Curriculum and curricular materials (i.e., any specialized courses needed as part of the enrollment in class)

→ Books or other instructional materials

→ Online educational materials

→ Tuition for tutoring or educational classes outside of home (tutor must not be a family member and must be licensed) as part of the enrollment or attendance of K–12 school (so doesn’t apply for homeschooled children).

For example, say your child is struggling with math in high school or even middle school. Tutoring could be classified as an eligible distribution for purposes of the 529 plan.

→ Fees for a nationally standardized achievement test, an advanced placement examination, or any examinations related to college or university admission (think ACT/SAT tests, AP exams)

→ Fees for dual enrollment in an institution of higher education (for example, say your high school child takes college credits)

→ Educational therapies for students with disabilities provided by a licensed provider (huge!)

The effective date for these changes applies to distributions made after “the date of the enactment of this Act,” which is July 4, 2025.

So, for any distributions after such a date, these expenses will be qualified on the federal level.

Quick note - different states do it differently, and this will apply to all the 529 changes discussed in this email.

Some states say, “we will follow whatever the IRC Section 529 says,” also called conforming 529 states (about 20 states). Some states say, “we create our own rules,” also called non-conforming states.

So, it’s important to check what your state will end up doing. Additionally, OBBBA increases the annual limit for these types of expenses from $10,000 to $20,000 per year beginning in 2026.

This probably doesn’t really matter unless your child is attending a private school.

Section 70414. Certain postsecondary credentialing expenses treated as qualified higher education expenses for 529 accounts

Many people didn’t want to contribute to 529 plans because of “what if my child doesn’t go to college!”

This section helps ease that concern a bit.

This new section covers tuition, fees, books, supplies, and equipment required for enrollment or attendance in a recognized postsecondary credential program. It also covers fees for testing and fees for continuing education required to maintain a credential.

So, what is a “recognized postsecondary credential”?

It means:

> Any postsecondary credential that is industry-recognized and is issued by a program that is accredited by the Institute for Credentialing Excellence (for example, Certified Information Systems Security Professional (CISSP))

> Any certificate of completion of an apprenticeship that is registered with the Secretary of Labor (for example, finishing an electrician apprenticeship program that earns a certificate)

> Any occupational or professional license issued or recognized by a state or federal government (CPA license, yay!)

> Any recognized postsecondary credential as defined in Section 3(52) of the Workforce Innovation and Opportunity Act

Note that it’s not just enough to earn a certificate.

The program itself must qualify and be a legitimate pathway to earn that credential. The bill defines programs that are on official state lists under WIOA, listed in the Veterans Benefits directory, or identified by the Secretary as reputable programs.

Section 70421. Opportunity zones enhancement

The tax bill makes opportunity zone investments (economically distressed areas) permanent, effective 2027 with certain changes.

As a reminder, opportunity zones allow you to:

Defer capital gains tax

Receive a step-up in basis for a set percentage

Or even fully eliminate capital gains

Section 70424. Permanent and expanded deduction for charitable contributions

Cash charitable contributions of $1,000 (or $2,000 if married) will now be deductible even if you don’t itemize your deductions. In other words, if you take the standard deduction, you can still deduct your charitable contributions starting in 2026. This is a great change because ~90% of people were taking the standard deduction.

Cash donations include those made by check or credit/debit cards. They don’t include securities, household items, or donor-advised funds.

Tax planning move: You want to donate $1,000 to charity in 2025. You have a 22% marginal tax rate and take the standard deduction in 2025.

You would be better off waiting until 1/1/2026 to make this donation, which will save you ~$220 on taxes that year vs. $0 saved in 2025. This is because the new tax change is enacted as of 2026.

Section 70425. 0.5% floor on charitable deductions

OBBBA created a floor on the deductions for charitable contributions equal to 0.5% of Adjusted Gross Income (AGI, Line 11 of your 1040), starting in 2026, if you itemize.

This means that your charitable deduction is only allowed if it exceeds 0.5% of your AGI.

Tax planning move: You make $1,000,000 of AGI per year. You are itemizing the deductions in 2025. You also donate $10,000 per year to charity and are in the 37% marginal tax rate.

If you donate $10,000 in 2025, you can take the entire $10,000 deduction (since you are itemizing).

If you donate $10,000 in 2026, you can only take $10,000 - ($1,000,000 * 0.5%) = $5,000 deduction due to the new 0.5% AGI floor. The $5,000 deduction is “wasted” and doesn’t save ~$1,850 on taxes.

You would be better off donating $20,000 in 2025 and skipping the $10,000 deduction in 2026 to save ~$1,850 on taxes. A Donor Advised Fund (DAF) can be a great choice in this situation, as it would allow you to donate $20,000 and split $10,000 in Y1 and $10,000 in Y2, but get the full $20,000 deduction in Y1.

Section 70431 Qualified Small Business Stock (QSBS)

Under Section 1202 of the IRC, this provision allows investors and founders to exclude capital gains from your federal income taxes from the sale of qualified small business stock.

Currently, you must hold QSBS for 5 years to exclude up to 100% of capital gains, subject to certain limitations.

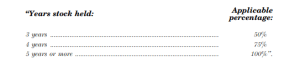

The new bill establishes a minimum 3-year holding period with a phased schedule, along with an increase in the asset qualification threshold:

Section 70432. Repeal of revision to de minimis rules for third-party network transactions (1099-K)

1099-K is a form that tracks payments you received from third-party payment networks (like payment apps or marketplaces), including Venmo, PayPal, CashApp, Etsy, eBay, and others.

You may remember that under the American Rescue Plan, the 1099-K thresholds started changing. The IRS implemented a phased-in approach (i.e., $2,500 in 2025, $600 in 2026) to ease into the reporting requirements.

Well, OBBBA repealed the $600 threshold goal and rolled back to a $20,000 total limit AND 200 transactions, effective 2025.

Say you’re selling something on eBay and your total gross sales are $10,000 in 2025. You will generally not receive a 1099-K for the 2025 tax year.

BUT your state may have a lower reporting threshold; even if your gross payments don’t exceed the federal limit, you could still get the 1099-K form.

Also, there is an exception - even if you don’t meet the $20,000 / 200 threshold this year, the platform may still treat your payments as reportable IF you exceeded the threshold in the previous year.

Importantly, just because you have not received the form doesn’t mean that all of the transaction activity shouldn’t be reported. The Form 1099-K reporting threshold does not determine whether payments are taxable or whether a tax return must be filed. It’s simply an administrative change.

All income is taxable unless the tax law specifically excludes it, even if you don’t receive a Form 1099-K.

Section 70433. Increase in threshold for requiring information reporting with respect to certain payees

Businesses must issue a 1099-NEC or 1099-MISC if they pay a non-employee and contractors $600 or more in a calendar year.

The OBBBA changed the $600 threshold to $2,000 starting in 2026. In addition, starting in 2027, the $2,000 will be adjusted annually for inflation. Adjustments will be rounded to the nearest $100.

Section 70501. Termination of previously owned clean vehicle credit (§30D)

If you buy a qualified used electric vehicle (EV) or fuel cell vehicle (FCV) from a dealer for $25,000 or less, you could qualify for the used clean vehicle tax credit (worth 30% of the sale price, up to a maximum of $4,000). This credit is non-refundable (direct reduction of your tax liability for the year).

The new law removes this credit as of October 1, 2025. This means that you have to take delivery of this car (or “place in service”) on or before September 30, 2025. If you were already planning to do so, it might make sense to do it before the deadline.

However, you still need to meet the qualification rules for the used EV credit:

Must buy from a dealer

Sale price of less than $25,000 (doesn’t include taxes or title/registration fees)

Model must be 2 years earlier than the calendar year (a car bought in 2025 needs a model year of 2023 or older)

In addition, your adjusted gross income (AGI) may not exceed $150,000 for married filing jointly or $75,000 for single filer.

Section 70502. Termination of clean vehicle credit

If you take delivery of a new plug-in electric vehicle (EV) or fuel cell vehicle (FCV), you may qualify for a $7,500 clean vehicle tax credit.

The bill changes the deadline to September 30, 2025, as with the previously discussed used vehicle EV credit.

Some details regarding the credit:

→ Per 2024 regulations, this Clean Vehicle Tax Credit must be initiated and approved at the time of sale, but some rules apply:

→ The MSRP of a pickup truck, van, or SUV must be $80,000 or less; for all other passenger vehicles, $55,000 or less.

→ Final assembly must be in North America.

Your adjusted gross income for either the current or prior year must be $300,000 or less for joint filers and $150,000 or less for single filers.

This credit could actually be combined with the new legislation on the auto loan interest deduction that I've previously discussed.

Section 70505. Termination of energy efficient home improvement credit (§25C)

If you make qualified energy-efficient improvements to your home, you may qualify for a tax credit of up to $3,200.

The maximum credit you can claim is:

→ Exterior doors ($250 per door and $500 total)

→ Exterior windows and skylights ($600)

→ $2,000 for qualified heat pumps, water heaters, biomass stoves, or biomass boilers

The new tax bill changed the deadline to December 31, 2025 (instead of December 31, 2032). The improvements must be “placed in service” before the deadline, meaning these items must actually be installed before January 1, 2026.

Section 70506. Termination of residential clean energy credit (§25D)

The Residential Clean Energy Credit is 30% of the costs of new, qualified clean energy property for your home installed.

Some expenses include:

Solar electric panels

Solar water heaters

Geothermal heat pumps

Fuel cells

This credit will expire with respect to expenses made after Dec. 31, 2025.

Overall, there are a lot of tax changes. If you have any questions or comments, feel free to comment below.

Bogdan Sheremeta is a licensed CPA based in Illinois with experience at Deloitte and a Fortune 200 multinational. He shares insights on taxes and personal finance through his newsletter, helping thousands of readers to make smarter financial decisions. He has over 140,000 followers on X and 110,000 on Instagram.

The post One Big Beautiful Act: Tax Breakdown and Planning Strategies appeared first on HumbleDollar.

Keeping Calm

A personal financial plan, on the other hand, can be costly–whether it’s implemented or not. For instance, if we don’t do what we know we ought, actions like making a Roth conversion or moving money out of a high-fee mutual fund, we could find our finances treading water. Or, if we follow a poorly-conceived plan, we might even go under.

My wife and I hope to sidestep both pitfalls as we put the money plan for our senior years into motion. But I’m finding I can’t avoid facing the emotional cost of changing the habits and thinking I’ve developed over years of nurturing our retirement savings.

Dripping in. I recently cut back on my work hours as I phase into retirement. Along with my work schedule, however, my paycheck also got pruned. That means less salary for all purchases, including new shares of stock.

Even so, my wife and I have no logical reason to feel pinched for money. Currently, my part-time pay covers the usual expenses for my family’s frugal lifestyle. There’s even enough left over for low-key leisure pursuits, like the limited travel that keeps us close to our elderly mothers. My employer also pays the bulk of my health insurance premium. And I have an array of other benefits, including a generous allowance for paid time off.

Meanwhile, our finances are underpinned by investment accounts at all-time highs. We can’t take credit for their growth. Our heaviest lift was plunking part of each paycheck into index funds during decades of a mostly soaring stock market. Those steady deposits have swelled into the money pool from which we’ll pull our future living expenses. For now, those funds are untapped, but could be used for any purpose.

Yet, despite my lengthy list of financial blessings, since shifting to part-time I occasionally feel less wealthy. I know my sense of lack stems from a slimmer paycheck. No, I don’t hunger for more spending money. I just wasn’t prepared for my reaction to the skinnier contributions now dripping into my stock-index funds.

Before moving to part-time, a chunk of my paycheck was diverted to buy stocks in my Roth 403b. By comparison, it now seems like just a bit, even though it's still big enough to get the company match. In addition, I expect my employer will continue to add an annual bonus into my tax-deferred 403b. I also invest the money I deposit into my Health Savings Account (HSA).

But I miss the thrill of saving back a wad of cash to purchase the promise held in a new batch of stocks. Shaving a few cents off a cup of coffee with the senior discount just doesn’t give me the same kick. I know, I know. Some folks are never content.

Flowing out. I suppose my emotions will adapt to my new reality, just in time to take another hit as I move into the next phase. I aim to hold my work hours in the physical therapy clinic steady for at least two years. Then, at age 65, I’ll either stay the course or drop off the regular schedule to PRN status, working only when called upon. Or, I may heed my wife’s wishes and promote myself to full-time retiree.

For me, full retirement means no payday, aside from a paltry pension I’m eligible to collect at age 65 ½. Therefore, my wife and I will look to our savings for most of the money to pay bills, until I begin drawing Social Security at age 70. We’ll also get a smaller, but helpful amount from my wife’s Social Security check, which she expects to start in two years when she hits age 62. Her instinct is to wait, but Mike Piper’s Open Social Security calculator advises claiming it early.

Assuming I do retire in two years, we’ll rely chiefly on our investment portfolio to cover 4 ½ years of expenses, until my Social Security begins. That means selling stocks to generate spending money for the first time. Or, we might pull from the “bond” side, instead. The source could range from the simple freedom of a stash of short-term bonds or bond funds and cash to the commitment of an annuity. Either way, we’ll be dipping deep into savings that have yet to be disturbed. And even after my Social Security adds a nice addition to the pot, my wife and I are counting on those savings to pay for the retirement we anticipate enjoying.

My rational self is nodding his logical head at our spending strategy. Makes sense–it’s the reason we socked the money away, after all. But his emotional sidekick feels rising anxiety thinking of rafts of money flowing out of our portfolio, rather than in. The question is: Am I confident our income plan can take the hits that are sure to come our way?

Staying Afloat. True, I can’t predict the future, but I’m reasonably certain that over the next three decades a slew of companies will fail, inflation will rise and I may still be alive. How will my wife and I cover these challenges?

For starters, we invest in thousands of companies across the globe through low-cost index funds. So when some businesses go belly-up, we’ll still own stock in those that are thriving. Stocks also offer the best chance of beating inflation, so that our portfolio holds its value decades from now, even if our dollars don’t.

Still, much of my optimism for our future results lies in our past behavior. My wife and I have never taken risks with our spending by treading too close to the limit of our paycheck. Or plunged into debt to satisfy this week’s burning desire to buy. We can’t take full credit for that, since we’ve avoided the troubles that befall many families. Even so, I suspect we’ll continue to make choices that give us a margin of financial safety.

In similar fashion, we’re not calculating the highest withdrawal rate we think our portfolio will bear as a starting point for selling stocks. Instead, we plan to leave a comfortable cushion untouched by ordinary spending, ready to absorb the financial shocks that may come our way. We’re thankful to have that choice, and know many families don’t.

Assuming we do avoid financial calamity, will I one day lament following a money plan that’s leaner than it might have been? Maybe, but I doubt it. Instead, I hope I’m content knowing we kept a measure of worry at bay by keeping close to the money habits that landed us where we now stand.

The post Keeping Calm appeared first on HumbleDollar.

The Day I Cashed In My Forgotten Treasure

I have a few hundred pounds of out-of-circulation notes. The Bank of England moved from paper to polymer notes a few years ago, and I had forgotten about some paper notes at the bottom of our safe. By the time I rediscovered them, they were no longer legal tender, and the period to exchange them at normal banks had ended.

Knowing I was flying to London, I decided to bring them with me and present myself at the Bank of England headquarters to exchange them for crisp, shiny new £20 notes. I conducted myself in an exemplary manner, figuring I really didn't want to be on the radar of the custodians of the nation's money supply. Better safe than sorry is my motto!

After exiting the building slightly richer, I reflected on the history and physical manifestation of this institution and other central banks around the world, and how their existence and combined decisions directly impact my retirement finances. I felt a tiny sense of connection, however small, to a system that I usually only read about in the news. My own financial stability is not solely determined by my investment choices. It's also shaped by the actions of these powerful bodies.

They are tasked with the balancing act of keeping the economy stable, and every adjustment they make to the money supply or interest rates has consequences that echo through every sector—from the housing market to the stock market. These echoes are what will eventually directly impact the quality of life I can afford in my retirement. My small errand yesterday was a reminder of a much larger and more complex financial world that we all live within. Hopefully they conduct their business wisely. And on a more personal note, that my name hasn't been flagged as a person of questionable character!

The post The Day I Cashed In My Forgotten Treasure appeared first on HumbleDollar.

August 14, 2025

Selling our business – a done deal

So, Friday August 8th, the sale of our business settled. We had struck a 2 week delay, which was quite an annoyance, but ultimately didn't prevent the sale and handover from going remarkably well. It's wonderful to feel that we have given the new owners the very best chance of success. In the last few weeks customers and staff were spending more time talking with the new owners and less with us, exactly as we hoped!

We had said for several months that we wanted the new owners to succeed and to grow the business beyond what we had achieved. It feels like we have given them every opportunity to do so. The benefits of being younger and coming into the business with enthusiasm and a fresh perspective all bode well for prosperous times ahead.

HD has talked a lot about luck lately. At this moment I feel like we have been very lucky. We stumbled upon a run down business in a small country town with a very robust, stable economy. It wasn't purchased after lots of thorough analysis and consideration. More accurately, it was purchased on gut feel and a healthy dose of hope.

The town came to embrace the business and our particular approach. Our staff came from a broad and varied background. Our turnover was low, so typically we saw people stay with us, learn, develop and grow. I don't think we were experts in recruiting, but we stumbled upon some very good people.

When it came time to sell, a buyer came along that was well suited and could secure the funds for the sale. The handover was excellent and I look forward returning as a customer.

We could take undue credit for this, but it feels like good fortune also played a very large part.

So now we both have a new and very different world ahead of us. By we, I mean my Dad, now retired at 77, any myself, 51 and in search of "what's next?".

Dad tried to retire at 68 but was stunningly unsuccessful. He lasted 3 months before launching himself back into small business. Now at 77 he seems to have a much stronger sense that retirement is really here this time. But a characteristic of small business is that it can become all consuming. It can feel like all your thought and energy get channelled into how to make the best of the business. So other interests suffer. Now he faces the challenge of rekindling old interests and strengthening old relationships. I really think he will go OK, but it will certainly take some effort. I just hope that both he and my Mum can make it through with their sanity intact.

For me, I'm now sitting at a table in warm sunshine, on an idyllic island off the coast of Queensland. A holiday to clear my mind after the intense activity of the business sale has been great.

I'm certain that I want to keep working, but I also know that I would like to have less strain on my body and mind. We're not under pressure to return to work quickly, so I'm looking forward to thinking through where I might be of some value, without working myself into an early grave.

The whole process from purchase, via growth, to eventual sale has been a fantastic ride. Not easy, not for the faint hearted but a wonderful experience.

Looking forward to whatever is next!

The post Selling our business – a done deal appeared first on HumbleDollar.

Stablecoins: Not My Kind of “Stable”

If you own Treasuries, TIPS, or a well-diversified bond portfolio, you already know what safety looks like: steady income, predictable maturity dates, and the full faith and credit of the U.S. government.

Stablecoins? They’re a different animal.

A stablecoin is a digital token pegged to the U.S. dollar and usually backed by assets like Treasury bills. It can be transferred instantly worldwide, which sounds great — until you remember there’s no FDIC insurance, no government guarantee, and no regulator standing behind it in a crisis. If the issuer gets into trouble, you’re just another unsecured creditor waiting in line.

Here’s the real kicker for investors:

Those Treasury bills or other safe assets backing the stablecoin generate interest — but the yield goes to the issuer, not to the holder.

In exchange, the holder gets a dollar-pegged token that depends entirely on the issuer’s operational competence and integrity.

Yes, stablecoins can make sense for crypto traders or businesses that need instant settlement. But for us individual investors — especially those already holding Treasuries or TIPS — the benefit is thin. We already have:

Direct ownership of the safest assets. No middleman, no counterparty risk.

Guaranteed payment at maturity. Whether we buy a 3-month bill or a 30-year TIPS, we know exactly what we’ll get back.

Yield in our own pocket. The interest belongs to us, not a coin issuer.

So if someone is tempted to move part of their bond portfolio into stablecoins because they sound “modern” or “efficient,” remember: they’d be giving up a government guarantee and a real yield for a digital promise and no interest.

When it comes to safety, I’ll take my boring ladder of Treasuries and TIPS over a shiny token any day.

The post Stablecoins: Not My Kind of “Stable” appeared first on HumbleDollar.

Free Social Security Taxability Calculator

While researching an article on the impact of the recent One Big Beautiful Bill Act (OBBBA) I stumbled upon a very useful, free Social Security Taxability calculator. The calculator is a downloadable Excel spreadsheet. I found it while viewing a YouTube video presented by The Retirement Nerds. The video did a nice job of explaining some of the provisions of the tax bill, especially the new $6,000 bonus senior deduction. The presenter used the calculator to demonstrate the interaction between income, SS taxability, and how the new deduction comes into play.

I wasn’t familiar with this site or the presenter so I did a bit of research and it seemed legitimate so I downloaded it from this site. I’ve played around with it a number of times and I’m pretty impressed. It is not a complete tax return calculator, but it does a few things well, and provides some useful information for what-if studies. It has been updated for to include the 2025 tax law changes, including the new senior deduction.

In general, you input your “base case” which is your AGI, tax-exempt income, the amount of your SS benefits, and any applicable Schedule 1 adjustments (there is a tab that describes them). The tool calculates the percent, and amount, of your SS benefit that is taxable. It shows the details of that calculation – one of the more complex calculations in the tax code. It also determines your standard deduction, your new senior deduction (if any), taxable income, estimated tax, effective tax rate, and marginal tax bracket. It includes a nice table, and graphic, that shows how much income “headroom” you have until you reach the next tax bracket.

One of the more interesting features is a large table entitled “Incremental scenarios adding more non-Social Security Income”. This table provides 25 rows to investigate the impact of additional income on your tax calculation. You input a dollar amount in the first row, and it increments each row by that amount. For example, if you input $1,000 in the first row, the succeeding rows will be $2,000, $3,000 and so on up to $25,000. The columns in the table update some of the previous tax calculations for the new income amount, with the end result being the revised taxable income. It has a column that clearly shows how, in certain situations, an additional $1 of income can pull additional SS benefits into the taxable category, and how the effective marginal tax rate can be greater than the marginal tax bracket.

There is also nice graphic to the far right that shows a summary of the base case, including how the calculated tax falls into the marginal tax brackets. Someone looking to understand how the taxable portion of your SS benefit is determined, and how additional amounts of income impact your overall tax situation, may find this useful. Roth Conversion studies would be another good use of the tool.

The post Free Social Security Taxability Calculator appeared first on HumbleDollar.