Jonathan Clements's Blog, page 144

June 1, 2023

The Journey Continues

I WROTE MY ESSAY for My Money Journey 14 months ago. Since then, our family’s journey has continued apace—including rethinking where we live.

The highlight of the past 14 months was the addition of another grandchild. We now have four grandsons, ranging in age from five months to 10 years old. Last summer, our younger son and his wife purchased a home in Monmouth County, New Jersey, roughly an 80-minute drive north of us. Our oldest son and his family live in New York City. After some pandemic-related dislocations, our two children and their families seem solidly located in the greater New York City area.

Lots have also happened on the financial planning front. Last year was the first full year of retirement for my wife and me. I had minimal consulting income—about $850. Without significant earned income, 2022 was the year we kicked off our retirement-income plan.

I officially joined the ranks of America’s seniors and enrolled in Medicare last September. My wife followed in March. After some careful analysis and a lot of discussion, we opted to start my wife’s Social Security at the beginning of 2023, while delaying mine. Many of the articles and comments posted on HumbleDollar were helpful in making that decision.

I officially joined the ranks of America’s seniors and enrolled in Medicare last September. My wife followed in March. After some careful analysis and a lot of discussion, we opted to start my wife’s Social Security at the beginning of 2023, while delaying mine. Many of the articles and comments posted on HumbleDollar were helpful in making that decision.

We also completed most of the large home improvement projects we had planned, so we should have a better grasp on our budget going forward. As part of our tax return preparation, I reviewed our 2022 spending. The impact of inflation on food, gas and dining out was noticeable. I used the spending data to update our projected budget for 2023 and beyond.

We now have two fixed income sources: my pension and my wife’s Social Security. These cover our needs, but not all our wants. We’d like to pick up our travel game. We have an Alaska trip booked at the end of the summer, and we’re discussing where else we want to visit. In addition to some big trips, we’d like to take more smaller trips to see new places and to visit family and friends.

To make sure we have sufficient income for all this, I simplified our retirement portfolio and put about five years of “discretionary” expenses in a couple of Vanguard Group short-term bond funds. I was able to set up a recurring withdrawal that’ll be deposited in our money market fund on the 15th of each month.

Part of my retirement-income planning includes projecting our future tax bills, including Medicare’s Part B IRMAA costs. New Jersey has a retirement-income exclusion provision, but that benefit disappears if your income is too high. I try to keep track of our income and tax burden as the year progresses. There are two “levers” I can use to reduce our taxable income if we get close to a scary tax cliff.

First, we saved in health savings accounts for a number of years, which give us a bucket of tax-free income we can use for medical expenses, including Medicare premiums and dental or vision expenses. Second, we started Roth IRAs a number of years ago, and have done several Roth conversions, and these accounts give us another pot of potential tax-free income. On top of that, my wife’s Social Security retirement benefit is somewhat tax-preferred. At most, 85% of her benefit will be subject to federal income taxes, and New Jersey doesn’t tax Social Security benefits.

It’s now been two years since we moved permanently to our New Jersey beach home. When we made the decision to move, we acknowledged that the timing was a bit premature, and we weren’t sure if living fulltime in a resort community was right for us. We left behind family and friends in Pennsylvania, and we knew we wanted to be more involved in our grandchildren’s lives and activities.

The upshot: We’ve spent the past year seriously discussing how and where we want to spend our retirement years. Many of these discussions occurred in the car while traversing the Garden State Parkway to visit the kids and grandkids. We decided to explore either moving closer to them or purchasing a second home near them.

We connected with an excellent realtor in Monmouth County, New Jersey. She was knowledgeable, professional and patient. She showed us dozens of homes, from $300,000 condos to $1.5 million single-family homes. I ran a variety of analyses looking at our monthly cash flow and the impact on our retirement savings. We considered converting our beach home to a rental property that we might occupy part of the year.

In addition to financial considerations, my wife and I spent a fair amount of time discussing how we wanted to spend our days in the near and long term. We thought about what our days and weeks would look like. While we wanted to spend more time with our children and grandchildren, we also acknowledged that they had their own busy lives that are taken up with work, school and friends.

Meanwhile, we have friends and activities in our town. Since this is a resort town, many of our friends are “weekend” friends who we see several weekends a month. We decided we weren’t ready to give that up. Our children also enjoy visiting our beach town when they have time. This is getting more difficult for the older grandkids, who are now more involved in sports and other activities.

The more we thought about all the considerations, the more we realized we weren’t ready to make a move. I had an “aha” moment late last year as I was reviewing our budget, and estimating what the purchase of a second home would mean. I realized that the line item I assumed for travel was similar to what a second home would cost us. That begged the question: If we plan to travel pretty extensively over the next five years, why do we want a second home?

We realized what we needed was a bedroom near the kids. We can accomplish that with hotels, Vrbos and, on occasion, staying with the kids. It probably means driving more miles than we would if we bought a second home, but that’s a tradeoff we’re willing to make at this point. In five years, our thinking may change.

Richard Connor is a semi-retired aerospace engineer with a keen interest in finance. He enjoys a wide variety of other interests, including chasing grandkids, space, sports, travel, winemaking and reading. Follow Rick on Twitter @RConnor609 and check out his earlier articles.

Richard Connor is a semi-retired aerospace engineer with a keen interest in finance. He enjoys a wide variety of other interests, including chasing grandkids, space, sports, travel, winemaking and reading. Follow Rick on Twitter @RConnor609 and check out his earlier articles.The post The Journey Continues appeared first on HumbleDollar.

May 31, 2023

May’s Hits

Did you end up with a surprisingly large tax bill? Next year, advises Rick Connor, see if you can trim that bill by making a belated contribution to an IRA or solo 401(k)—and perhaps even claim the saver's tax credit.

U.S. stocks have outperformed foreign shares in 12 of the past 15 years—and yet there remains a strong case for diversifying internationally, argues Adam Grossman.

"Once retired, beware of being lulled into the couch potato syndrome," says Marjorie Kondrack. "The less we do, the less we feel like doing. Lassitude becomes a lifestyle."

If you manage the household finances, how can you make it easy for your spouse or children to take over? Howard Rohleder adopted his father-in-law's approach—and created his own "Mary Jean list."

"Keep in mind that financial emergencies have no respect," writes Dick Quinn. "A water heater doesn’t care how much income you have or how old you happen to be."

Series I savings bonds aren't as simple as they seem. Rick Connor digs into the details.

"He charged my credit card $360 while I silently fumed," recounts Jim Kerr. "Nothing gets under the skin of a penny-pinching frugalist like being pickpocketed by someone who’s not even wearing a mask."

We're used to recessions and recoveries. But what about economic trends that last for far longer? Adam Grossman says they're trickier to handle—but he offers three suggestions.

"We discovered after the fact that the guy we’d hired in 2016 wasn’t actually an expert in estate planning," writes Dana Ferris. "He was a divorce attorney who did a little estate work on the side."

Should you move in and out of stocks depending on whether the market is cheap or expensive? That strategy might have worked at one point—but it doesn't seem to work anymore, says Adam Grossman.

What about our twice weekly newsletters? The best-read Wednesday newsletters were Kathy Wilhelm's The Medicare Maze and Kristine Hayes's My Retirement Home, while the most popular Saturday newsletters were Free to Be and Eyeing the Future, both written by me.

The post May’s Hits appeared first on HumbleDollar.

May 30, 2023

Time to Decide

I'LL BE TURNING 65 this year, so I’ve been researching my Medicare options. Even though I work in health care—and many of my patients are on Medicare—the task of choosing a plan is no less onerous for me.

I’ve read the information provided on Medicare.gov and watched numerous YouTube videos from insurance brokers. These brokers tend to support two types of Medicare coverage. Retirees might opt for a bundle that includes Medicare Part A, B and D, plus a supplemental private insurance plan commonly known as Medigap. Alternatively, seniors could choose Medicare Advantage, which effectively combines Medicare Part A and B, along with additional coverage for things like prescription drugs and eyeglasses, into one comprehensive policy.

For those who aren’t fluent in Medicare jargon, Medicare Part A covers inpatient hospital care and Part B outpatient care. Part D covers the cost of prescriptions not administered in a hospital. You can look up the finer points here.

Over the past three years, I’ve had some experience handling option No. 1—traditional Medicare plus supplemental insurance—for my elderly parents. During this stretch, both were in the hospital for different health issues that resulted in charges ranging from $10,000 to more than $60,000. Their traditional Medicare coverage bundle has always paid all their bills.

My stepfather passed away in 2021, but I continue to manage these bills for my 89-year-old mother. I’ve been impressed that all of the bills have been paid and there have been no additional out-of-pocket costs.

Meanwhile, many of my patients have Medicare Advantage plans. Most seem happy with the coverage. Their monthly cost is minimal and, with some policies, there are extra benefits, such as gym membership reimbursement, plus vision, hearing and dental coverage. These extras aren’t covered by traditional Medicare and can represent important savings for people on fixed incomes.

Those patients who aren’t happy with their Medicare Advantage plan generally complain about the high cost of medications or having to use in-network health care providers. These plans also require a referral from our office if the patient needs to see a specialist, and they may also need preauthorization from the insurer before getting imaging or certain branded medications.

The staff in our billing office have told me that Medicare Advantage plans tend to be more difficult to work with than traditional Medicare. For example, our office employs a medical assistant who is dedicated solely to dealing with insurance-mandated preauthorizations.

I’ve experienced the administrative burden myself. Several of the Medicare Advantage plans require me to fill out a lengthy seven-to-10-page patient history form once a year for each patient, which tends to simply repeat the extensive documentation already in our electronic medical records system. At the end of a long day, the last thing I want to do is fill out another long document that duplicates what’s already in the patient record. Traditional Medicare usually doesn’t have these requirements.

I don’t recall any patients complaining to me regarding traditional Medicare coverage, the kind my mother has. These patients can use any health care provider or hospital that accepts Medicare. They usually don’t need a referral or preauthorization from their primary care provider, either. They may have issues with medication prices at times. Drug costs and coverage seem to be a moving target for both Medicare Advantage and Medicare Part D drug insurance plans.

Recently, I had an elderly woman in our office late one afternoon with COVID symptoms that had lasted more than four weeks. She had chest pain and severe shortness of breath. She couldn’t walk across a room without having to stop due to difficulty breathing.

Based on her symptoms, and knowing that patients with COVID are at risk for blood clots, I urged her to go to one of our city’s emergency departments that day to make sure that she didn’t have a pulmonary embolism. She was hesitant to go. When I asked why, she told me that she owed money from a previous hospital visit and lives on a fixed income. She has a Medicare Advantage plan that didn’t cover all of the costs from her prior emergency department visit.

I finally convinced her to go to the hospital. Fortunately, she didn’t have any blood clots. She ended up being diagnosed with long COVID. Even though I was looking out for her best interest, I feel guilty that my recommendation added to her medical debt.

The lesson I take from this: Even though Medicare Advantage plans offer lower premiums than traditional Medicare, they often come with additional costs that can quickly add up if you’re sick. Some of these include higher deductibles, copayments and coinsurance costs than those incurred by seniors with traditional Medicare.

While not having a monthly premium for a Medicare Advantage policy might sound appealing at age 65, we might need to see a specialist in another state as we age. This can get complicated with a Medicare Advantage plan.

In fact, last fall, the Mayo Clinic—well-known for its coordinated care approach with difficult cases—warned its Medicare-eligible patients in Arizona and Florida that most Medicare Advantage plans consider the Mayo Clinic to be out-of-network. It recommended its patients instead enroll in traditional Medicare plus a Medigap policy.

All this helped guide my own decision. After weighing all the options, I’m going with traditional Medicare plus supplemental insurance, like my mother. I recently received my Medicare card in the mail. I plan to enroll in Medicare supplement Plan N, which typically covers 100% of the cost of Part B outpatient services. I also plan to buy Part D prescription drug coverage.

Which is better, traditional Medicare or Medicare Advantage? Offer your thoughts in HumbleDollar's Voices section.

Scott Martin is a semi-retired family medicine physician associate (previously known as a physician assistant) and has been practicing medicine for the past 18 years. His previous career was in academia doing research and teaching at the University of Georgia. He and his wife enjoy traveling and spending time with family. Check out Scott's earlier articles.

Scott Martin is a semi-retired family medicine physician associate (previously known as a physician assistant) and has been practicing medicine for the past 18 years. His previous career was in academia doing research and teaching at the University of Georgia. He and his wife enjoy traveling and spending time with family. Check out Scott's earlier articles.The post Time to Decide appeared first on HumbleDollar.

Other People’s Money

ACCORDING TO OXFORD Languages, the word invest means to “expend money with the expectation of achieving a profit.”

I like this definition better than some others because it includes the word “expectation,” which therefore should exclude casino gambling and sports betting. But what if you have an expectation of winning? Couldn’t casino gambling and sports betting both be considered investments? As Zach Galifianakis’s character said in The Hangover, “It's not gambling when you know you're going to win.”

How can one create this expectation? Much like eating steak at The Capital Grille, it’s best done using other people’s money.

I first put this axiom to the test during my Grand Tour of Europe, when I visited the Danubiana Art Museum outside Bratislava, the capital of Slovakia. After inspecting some ridiculously expensive but rather pedestrian pieces of modern art, I came across one of those racks that contain brochures of local must-see tourist attractions: balloon rides, ghost tours, ancient caverns and such. One of them offered €10 in chips for visiting the nearby Olympic Casino. Well, I picked up two, one for me and one for the missus.

The casino gave us €20 in special chips—the catch being they needed to be wagered. My inner arbitrageur kicked in and I started to figure out how I could most efficiently turn these funny euros into real ones.

I knew the house edge for blackjack and craps could be as low as zero for a skilled player, the only problem being I was not a skilled player. That left roulette and, as European roulette does not have a double zero, the house edge was only 2.7%.

I think the house was on to me. The croupier would not let me play roulette with my special chips. Instead, I made my way over to the blackjack table and tried to remember my basic strategy: always split aces and eights, double down on 11 and stand on a 17. Tyche, the Greek goddess of chance, was on my side. As soon as I lost my last pretend chip, I converted the real ones I’d won into 40 real euros.

Those were promptly taken across the street to the Sky Bar for delightful views of Bratislava and, if I remember correctly, four equally delightful cocktails—one of which had dry ice vapors shooting out of a monkey’s head.

The next time I entered a casino was four years later. My wife and I had a house guest who may have had a gambling problem. Before she’d even arrived, she inquired about local options and was quite adamant that gambling was on the itinerary.

There used to be a time when there were only three gambling options in this country: Vegas, Atlantic City and the local bookie. Now, you can’t throw a Pai gow poker table without hitting a casino.

Back then, a casino was filled with romance and style, a place where James Bond in a tux and Plenty O’Toole in a low-cut evening gown played baccarat and sipped Dom Perignon. I caught the tail end of this glory in the 1980s when I was in the Navy and visited the Monte Carlo Casino. A jacket and a modicum of manners were required for entry. I felt like James Bond— without Ms. O’Toole’s company, unfortunately.

My wife and I reluctantly joined our house guest’s gambling adventure. Once in the casino, she made a beeline for the slots, squeezing between a woman in a wheelchair breathing from a portable oxygen tank and an old man using a walker. This definitely wasn’t the set of Diamonds Are Forever.

Meanwhile, we made a beeline for the cashier and signed up for first-timer’s free play: $10 in slot play or $20 in food. We chose the sure thing and treated our now-poorer guest to a free lunch. The chicken wings tasted fine, but it wasn’t steak.

In an effort to secure a free steak, I subsequently contacted FanDuel, which offers online sportsbook gambling. It offered me $150 for placing one $5 bet. The catch was that the $150 was in non-withdrawable free bets. My plan was to turn this $150 in funny money into something more than $5 in real money.

To get that $150, I placed a $5 bet on the Chiefs to cover the 3.5-point spread against the Chargers on Sept. 15, 2022. While it didn’t matter whether I won or lost, a win to kick off my venture would have been nice. Unfortunately, with just two minutes remaining in the game, Chargers’ quarterback Justin Herbert dashed my hopes by throwing a fourth down 35-yard pass—a pass that set up a touchdown that resulted in the Chiefs winning by just three points.

I knew a calmly calculated scientific plan was now required. Three days later, after I settled down, I initiated one. I figured a series of $5 bets would best ensure investment success. With the house’s 9% take, I estimated this investment should yield about $61.

I’m from New York. Besides standing on line, walking fast and talking faster, there’s one thing that makes a New Yorker stand out—their utter indifference to college sports. This left the NFL, Major League Baseball and… tennis? I decided that a little internet research might be useful and found a large number of sites that offered expert betting analysis, almost as many as those offering expert stock analysis.

I perused a few, but much like expert stock analysis, the advice offered seemed quite cursory. In the end, I decided to bet based on a sophisticated internal analysis—my gut. This had the added benefit of making watching these games all the more exciting. Before this “investment” scheme, I’d never bet on sports. I can subsequently understand why this excitement can cause problems for some people.

After wagering my last non-withdrawable dollar, I cashed out and determined that my profit was $110, almost twice my expected gain. Much like my stock market profits, I’m going to chalk this up to superior analysis—though I have no plan to wager any of my own money.

To keep with the theme of this article, I used my FanDuel investment profit to buy me and the missus the best steak in town. It tasted pretty damn good.

Michael Flack blogs at AfterActionReport.info. He’s a former naval officer and 20-year veteran of the oil and gas industry. Now retired, Mike enjoys traveling, blogging and spreadsheets. Check out his earlier articles.

Michael Flack blogs at AfterActionReport.info. He’s a former naval officer and 20-year veteran of the oil and gas industry. Now retired, Mike enjoys traveling, blogging and spreadsheets. Check out his earlier articles.The post Other People’s Money appeared first on HumbleDollar.

May 29, 2023

Not Quite Magic

My aspirations were based on a movie I saw starring Doris Day, Romance on the High Seas. It’s about a glamorous, adventurous and romantic cruise with beautifully dressed people, exotic locales, lively music and the beguiling sea. Doris Day sang, “It’s Magic.” All in glorious Technicolor.

In our younger years, my husband and I had a lot of caregiving responsibilities, so I put my dreams of vacations aside. But with those years behind us, I began to dream again of going on a cruise. My husband wouldn’t budge. Did I forget to mention he’s an inveterate homebody?

One day, I decided it was now or never. I marched over to our local AAA store and gathered information. I chose a cruise to the New England states and Nova Scotia during the fall, when I could also enjoy the scenic foliage during my favorite time of year.

Having never ventured too far from home on my own, I was somewhat apprehensive about traveling alone. But as luck would have it, a friend agreed to go with me. As she’s a veteran cruiser, it seemed an ideal situation. I bought some spiffy new outfits and I was off.

My enthusiasm was quickly derailed. Not long into the cruise, I got seasick, despite taking precautions and proper medication. Not long after that, I caught a nasty cold. I also hadn’t taken into account that the quiet life at home was at odds with my new schedule. In my desire to get the most out of my vacation, I wanted to fully embrace everything. I just didn’t pace myself. I was up and at ‘em early every day, never a moment’s rest.

By the time we got to Nova Scotia, I was sick and exhausted but fiercely determined to enjoy the tour—even if it killed me. All I remember is a lot of pine trees viewed from a bus. I then dozed off from lack of sleep, helped by the drone of the guide’s voice and the motion of the bus.

To top it off, the bus stopped at a flea market, where we had to stay until it was time to get back on the bus. What? How mundane and humdrum—I could visit flea markets at home. I wanted to see more of Nova Scotia.

I was disappointed with most of the tours, especially the one in Bar Harbor, Maine. I had always wanted to see Acadia National Park and learn more about it. I love nature and being outside. But the guide was obsessed with birds. Every 10 minutes, he would stop the tour, pull out poster photos of various birds, and begin a stifling lecture on the habits and distinctions of each. To say he was “for the birds” is putting it mildly—and the pun is intended.

Finally, a spunky little woman in the tour group—who shall remain nameless—let him know, in a nice way, that she had paid for a guided tour, not a course in ornithology. He then sullenly relented and the other tour members thanked her for speaking up.

The Boston tour was a little more enjoyable. It’s a clean city, not too much walking, and historically interesting. The guide was a good speaker and knowledgeable, except he just had to get into politics. He started inoffensively by talking about the Kennedys and their close ties to Boston. But he segued from there into his own political beliefs. Shades of Doonesbury—but he wasn’t a humorist or even a satirist. Heaven help us, he was an extremist.

When we got to Newport, Rhode Island, it was raining. I decided to forgo a tour, as I’d previously seen the sumptuous mansions of the ultrarich. I just idly passed the time visiting a few shops, not wanting to stray too far from the ship. By this time, I’d had it with the guided tours. I think the savvier cruisers booked early and chose the better tours.

I will say the food on board was good and plentiful. But because of my cold, I lost my sense of taste for a few days, much to my disappointment. The evening entertainment was pleasant, but nothing unforgettable. One night there was a singing group who sang a medley of songs from Jersey Boys , the Broadway show that’s a musical biography of The Four Seasons, the rock-and-roll doo-wop band.

To my surprise, one of the singers in the group—a handsome young man—came into the audience and invited me to dance with him to Frankie Valli’s hit, “My Eyes Adored You,” a poignant song about unrequited love. We danced the whole number with the spotlights on us. Did I just have my 15 minutes of fame?

Despite the dance, my overall experience didn’t meet my expectations, which were probably too fanciful. There’s a wide gulf between aspirations and reality, but I was glad I had my vacation. I would have always wondered what I’d missed if I hadn’t gone.

Besides, I did have a few magic moments and the satisfaction of realizing my dream of a “Doris Day cruise”—even if it wasn’t quite as dreamy as I imagined.

Marjorie Kondrack loves music, dancing and the arts, and is a former amateur ice dancer accredited by the United States Figure Skating Association. In retirement, she worked for eight years as a tax preparer for the IRS’s

VITA

and TCE programs. Check out Marjorie's earlier articles.

Marjorie Kondrack loves music, dancing and the arts, and is a former amateur ice dancer accredited by the United States Figure Skating Association. In retirement, she worked for eight years as a tax preparer for the IRS’s

VITA

and TCE programs. Check out Marjorie's earlier articles.The post Not Quite Magic appeared first on HumbleDollar.

How I Got This Way

THIS IS MY FIRST article for HumbleDollar. I’m new to the site, but not new to writing for the public and, indeed, I’ve contributed regular columns to some small newspapers.

My life has had more twists and turns than going down a Kentucky country back road filled with hillbillies, of which I am one. Kentucky is either the poorest state in the country or next to it by any measure you want to look at. Still, at age 65, I feel like I’ve had a rich life and done it all.

I’m a husband and father of five. I’ve also had chronic health issues for 30 years. We’ve had family members struggle with depression. We suffered through relatively low-paying jobs with multiple employers that either had massive cutbacks, spinoffs or straight up went bankrupt.

Yet our family has survived and at times thrived. I was never unemployed and sometimes held up to three jobs at once. But I sure had a lot of jobs I didn’t like. Still, it all paid off.

In fact, I retired at 59, and my wife and I are financially secure. Three of our children became civil engineers, one a mechanical engineer and another an elementary school teacher. All graduated college with no student loans and some with substantial bank accounts. The youngest graduated this May. They still have their problems, but at least money hasn’t been one of them.

How did this happen? It’s not hard for me to pinpoint the biggest reason.

The life experiences of my parents resulted in who we became. My mother was raised by a farmer and grain mill worker during the Great Depression. She was one of 11 kids. My maternal grandfather was in the army in World War I and served in France. He lost a hand in a mill accident and later his wife when she was age 47. They had four sons in World War II at the same time. My grandfather did more with one hand than most people do with two.

My father was one of six children. Dad served in World War II and had a brother-in-law who was captured at the Battle of Kasserine Pass in North Africa. That uncle became a prisoner of war for about 24 months. My dad’s brother was the mortar platoon leader at Pork Chop Hill, which was overrun during the Korean War.

Dad opened his own business after the war selling radios, televisions and furniture. He was a heck of a salesman. My mom raised us kids and ran a small business out of the house as a seamstress making clothes and doing alterations. They were both workaholics because they had to be for their growing family.

As a child, I learned pretty quickly that, if you thought life was unfair or you were overworked, you better not complain to our parents. They were too busy to listen and, in any case, they weren’t having any of it.

One thing they did for us: get us jobs at an early age. I’m proud to say that I was the youngest one put out on his own. This is what defined me and set me up for the rest of my life. I had a paper route at age 10.

Those newspapers were delivered seven days a week, 365 days a year through rain, sleet and snow. I had to collect the bill from the customers and then make my way to the post office to get a postal money order, so I could pay the newspaper each Saturday.

I had a flat tire and learned my first lesson shortly after I began my “employment” as a paperboy. The inner tube was shot. I went down to the local hardware store and bought a replacement. Afterwards, I went to my father’s store and stuck out my hand, telling him the situation and expecting reimbursement. My dad hemmed and hawed, mumbling something about how I had a job now, but eventually he gave me the money.

I was clueless as to what had just happened until my older brother filled me in. He said, “Kenny, you work now, so you can’t ask Daddy for anything anymore. You have to pay for it yourself.” I had committed a breach of etiquette, but accepted this news because my older brother was my idol. He was just looking out for me by telling me my mistake. My second lesson: Don’t be offended when good people tell you what you’re doing wrong.

I never asked Daddy or Momma for anything again, and I learned that I needed to be independent. Yes, I was on my own.

Those papers were delivered to the poorest section of town and to the housing projects. The third lesson from the paper route: While money won’t buy you happiness, the lack of money certainly buys you misery. You don’t want to end up like some of my then customers. They call it work because it can be unpleasant, but I learned from my customers that there were other things there were even more unpleasant than work.

There are lots of stories from that paper route to the present day, with lots of success and maybe even more failures. I hope to relate them all on this website. I sure would like to help somebody the way my brother helped me so many years ago.

Ken Begley has worked for the IRS and as an accountant, a college director of student financial aid and a newspaper columnist, and he also spent 42 years on active and reserve service with the U.S. Navy and Army. Now retired, Ken likes to spend his time with his family, especially his grandchildren, and as a volunteer with Kentucky's Marion County Veterans Honor Guard performing last rites at military funerals, including more than 350 during the past three years.

Ken Begley has worked for the IRS and as an accountant, a college director of student financial aid and a newspaper columnist, and he also spent 42 years on active and reserve service with the U.S. Navy and Army. Now retired, Ken likes to spend his time with his family, especially his grandchildren, and as a volunteer with Kentucky's Marion County Veterans Honor Guard performing last rites at military funerals, including more than 350 during the past three years.

The post How I Got This Way appeared first on HumbleDollar.

May 28, 2023

Losing Value

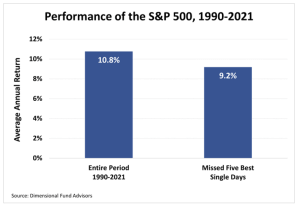

PERHAPS YOU’VE SEEN charts like the one below, which comes from Dimensional Fund Advisors. The message: Investors who try to time the market in search of better returns often end up damaging their results. To many investors, this seems intuitive, because trading isn’t easy.

But to others, market timing appears to make a lot of sense. For instance, for years, Yale University professor Robert Shiller has been maintaining a measure of market valuation known as the cyclically adjusted price-earnings (CAPE) ratio. It’s a way of measuring how expensive the market is, and it has an intuitive appeal of its own.

But to others, market timing appears to make a lot of sense. For instance, for years, Yale University professor Robert Shiller has been maintaining a measure of market valuation known as the cyclically adjusted price-earnings (CAPE) ratio. It’s a way of measuring how expensive the market is, and it has an intuitive appeal of its own.

In 2000, for example, the dot-com bubble was clearly visible on a chart of the CAPE ratio. Sure enough, the market experienced a steep decline from that peak, falling nearly 60%. Similar patterns are visible around the market tops in 1929 and in the late 1960s.

It’s data like this that makes many folks believe in market timing. For them, it’s just plain common sense to sell stocks when they’re overpriced and to buy them when they’re underpriced. For those who believe in market timing, it would appear borderline reckless to take a buy-and-hold approach, given how clear a guide the CAPE ratio appears to be.

Who’s right in this debate? In a recent study, Derek Horstmeyer, a professor at George Mason University, looked at this question. Together with colleagues, he used 100 years of market data to compare the returns of two hypothetical portfolios: a static 50% stock-50% bond portfolio and an actively traded portfolio that adjusted its holdings in response to market valuation.

The actively traded portfolio used what Horstmeyer called a “20-12” trading rule. During periods when the CAPE ratio was between 12 and 20—meaning the market was neither particularly expensive nor particularly cheap—the active portfolio held the same 50% stock-50% bond allocation as the buy-and-hold portfolio. But when the market got expensive, with the CAPE over 20, the active portfolio shifted to a more defensive stance, with just 30% in stocks and 70% in bonds. Meanwhile, when the market fell into bargain territory, with the CAPE under 12, the active portfolio became more aggressive, shifting to a 70% stock-30% bond allocation.

What did Horstmeyer’s team find? Historically, the 20-12 trading strategy would have worked well, delivering outperformance of about 0.4 percentage point a year. That’s not enormous. But compounded over many years, it would have been meaningful. There’s one problem, though: Horstmeyer found that this outperformance was short-lived. Initially, the outperformance was there. But in 1950, the results reversed. Between 1950 and 2000, the buy-and-hold approach outperformed the active strategy by about 0.8 percentage point a year. And since 2000, the buy-and-hold strategy’s advantage widened further, to 1.9 percentage points a year.

These results make sense. Over time, and especially since the advent of the internet, it’s become much easier for everyday investors to access market information. This has made it much harder for professional investors to beat the market by having access to more information. There’s a famous story, for example, about Benjamin Graham. He’s regarded as the father of modern investment analysis and was an early hedge fund manager.

In 1926, he was studying the railroad industry, when he got an idea. The next day, he traveled to Washington, D.C., to get a look at industry data that was available only on paper, in the office of the Interstate Commerce Commission. Sure enough, Graham found what he was looking for, and that led to a 50% gain on the stock he identified. This opportunity, though, was one that was only obvious to someone willing and able to sift through files in a government office. Today, anyone with an internet connection could do the same thing—and that, I think, helps explain Horstmeyer’s findings.

Things began to change even before the internet. In 1976, near the end of his life, Graham made these comments in an interview: “I am no longer an advocate of elaborate techniques of security analysis in order to find superior value opportunities. This was a rewarding activity, say, 40 years ago…. I doubt whether such extensive efforts will generate sufficiently superior selections to justify their costs.”

The lesson for investors: There’s no question that market timing seems intuitive. It feels like the right thing to do. So, why does the data so clearly point in the other direction? In addition to greater data availability, I see two other factors.

First, the market isn’t always rational. Often, when valuations are high, they end up going higher still. Look at the CAPE ratio during the 1990s to see a clear example. A rational investor might have concluded that the market was overpriced as early as 1993, when the CAPE crossed 20. But then it kept going. By 1995, it had topped 25 and, in the end, it went as high as 44. To be sure, an investor who had sold back in 1993 would have avoided the meltdown that occurred in 2000, but he also would have missed out on seven years of gains, which would have far outweighed those later losses.

The second reason a valuation-based approach to trading doesn’t work in practice is that the market is unpredictable, making it impossible to know when it might move higher. We saw this as recently as 2020. In the spring, the economy had largely come to a stop, the market had dropped more than 30% and most people had no idea how long the crisis would last. But on March 23, the Federal Reserve stepped in to contain the damage, and the market immediately turned higher. The market gained 9% the next day and 14% by the end of that week. A month later, the S&P 500 had gained 28%. By year-end, it was up 68% from its low point.

What Horstmeyer’s study makes clear, in other words, is that valuation ratios are just one factor in determining the direction of the market. World events are at least as important, and there’s no chart that can tell us what might be around the corner. A ceasefire in Ukraine, for example, would likely spark a market rally, but no one knows when or if something like that might happen. The bottom line: Difficult as it might be sometimes, investors’ best bet is to choose an asset allocation—and then to stick with it.

Adam M. Grossman is the founder of Mayport, a fixed-fee wealth management firm. Sign up for Adam's Daily Ideas email, follow him on Twitter @AdamMGrossman and check out his earlier articles.

Adam M. Grossman is the founder of Mayport, a fixed-fee wealth management firm. Sign up for Adam's Daily Ideas email, follow him on Twitter @AdamMGrossman and check out his earlier articles.The post Losing Value appeared first on HumbleDollar.

May 26, 2023

Eyeing the Future

I DON’T TRACK MY finances that closely and I don’t make big financial moves very often. Partly, it’s because I’m so busy with other things. But partly, it’s because I’ve come to see the virtue in benign neglect.

Still, this is shaping up to be a surprisingly busy year. I’ve taken a handful of financial steps—with three key goals in mind:

No. 1: Prepaying retirement. Like many others as they approach retirement, I have the urge to get key expenses out of the way before my earned income disappears. I’m not sure this impulse is entirely rational. Even once we retire, big expenses will keep cropping up, so there’s a limit to how much we can prepay the future.

Yet prepaying costs is undoubtedly part of my motivation in remodeling my house now rather than later. That said, there’s another, more rational reason to get the project done soon: Elaine and I will have more years to enjoy the renovation before we’re potentially forced out of our home by old age, and any cost overruns will be easier to handle while I still have some earned income.

Similarly, in an effort to get costs out of the way, I’ve been writing some big checks to my grandson’s 529 college savings plan. I promised to build the account up to $50,000, and I got there last month. I’ve also said I’ll do the same for any other grandchildren who happen to turn up.

A digression: Based on his parents’ income, my grandson almost certainly won’t qualify for needs-based aid under the current financial-aid system, so funding the 529 seems like a sensible move. On the other hand, when I ponder the student loan mess and the outcry over rising college costs, I sense we could see wholesale changes in the way colleges are priced and financial aid is disbursed. What will that mean for money stashed in 529s? I wish I knew.

No. 2: Prepaying taxes. While I continue to save a modest amount each year, these days I’m mostly moving around the money I’ve already accumulated. What’s behind these moves? A key goal: Reduce my future tax bills, especially once I’m in my 70s and required minimum distributions (RMDs) will force me to pull significant sums each year from my traditional IRA. Those RMDs, coupled with Social Security benefits, are likely to put me in a lofty tax bracket.

To trim future tax bills, I’ve been stashing money this year in three accounts that offer tax-free growth. First, I’m hoping to fully fund my solo Roth 401(k) in 2023, which would mean moving $30,000 into the account as my “employee contribution.”

Second, I’ve been converting a portion of my traditional IRA to a Roth. I converted $80,000 last year and another $50,000 on 2023’s first trading day. I’ll likely convert another chunk later this year, when I have a better handle on my 2023 taxable income. There’s a good chance that chunk will be a large one—because my income this year looks like it’ll be modest, thanks in part to the collapse in digital advertising. HumbleDollar has never made a lot of money, but lately it’s been barely breaking even, with this year’s revenue from advertising running 25% below 2022’s level.

With my Roth conversions, my goal is to get my income close to the top of the 24% tax bracket. That seems like an especially smart strategy for the next three years—for two reasons. First, without Congressional action, today’s tax law will sunset at year-end 2025 and we’ll revert to 2017’s more punishing tax brackets. Second, in 2026, I’ll turn age 63—which means thereafter high taxable income, including income resulting from Roth conversions, could trigger premium surcharges once I turn age 65 and become eligible for Medicare.

What’s the third tax-free account I’m targeting? That would be my health savings account (HSA), which I’m eligible to fund this year because I have a high-deductible health insurance policy. Even though I’ll likely incur some medical expenses later in 2023, my plan is to pay those costs out of pocket while leaving my HSA to grow, so it’ll be available to help with my retirement’s medical expenses.

No. 3: Paying it forward. In stashing money in my solo Roth 401(k) and undertaking Roth conversions, I’m not just trying to limit my future tax bills. I’m also aiming to build up these accounts with an eye to bequeathing them to my two kids.

While a Roth isn’t the great inheritance it once was—thanks to the death of the stretch IRA—it’ll provide my children with a pool of income-tax-free money and potentially 10 years of tax-free growth after my death. Because I have no plans to spend the money during my lifetime, it’s 100% invested in stocks, in the guise of Vanguard Total World Stock Index Fund.

Recently, within my Roth IRA, I swapped from the mutual fund version (symbol: VTWAX) to the exchange-traded version (VT), thus lowering my annual expenses by 0.03 percentage point. While exchange-traded index funds typically have lower ongoing expenses than their mutual fund counterparts, I’ve resisted owning ETFs to date because you lose a little to trading costs every time you buy and sell. But I’m pretty certain I won’t be doing any selling in my Roth, so trading costs aren’t a concern.

By contrast, in my traditional IRA, which I plan to draw down during retirement—and, indeed, will be required to do so—I’ve avoided ETFs and instead stuck with regular index mutual funds. Could I save a few dollars by converting my traditional IRA to ETFs, even after factoring in some occasional buying and selling? Perhaps. But it doesn’t seem worth fussing with. No doubt true penny-pinchers would disagree.

In bequeathing my Roth accounts to my children, I’m hoping to set an example for them—that we, as a family, should strive to pay it forward to the next generation. I’m unlikely to bequeath so much that my kids never need to work again and, in any case, I don’t think that’s desirable. On the other hand, I do think it’s desirable to bequeath a sense of financial security—the knowledge that, if my children have a rougher financial journey than me, they’ll still be okay come retirement. That sense of financial security, I believe, is worth far more than the raw dollars involved—and I hope my kids will pay it forward to their kids.

Jonathan Clements is the founder and editor of HumbleDollar. Follow him on Twitter @ClementsMoney and on Facebook, and check out his earlier articles.

Jonathan Clements is the founder and editor of HumbleDollar. Follow him on Twitter @ClementsMoney and on Facebook, and check out his earlier articles.The post Eyeing the Future appeared first on HumbleDollar.

Skill or Luck?

NASSIM NICHOLAS TALEB has written a trilogy on the topic of chance: Fooled by Randomness, The Black Swan and Antifragile. I didn’t find these three books to be easy reading, plus Taleb has strong opinions, which may turn off some readers. Still, there’s a host of investment lessons to be culled from his works.

Taleb argues that randomness plays a powerful role in financial markets and, indeed, it influences market outcomes far more than most of us realize. One result: We’re often “fooled by randomness.”

According to Taleb, most active managers who beat the market over a few years are simply lucky—which may explain why persistent outperformance is so rare. He labels those who ascribe their market-beating results to skill as “lucky fools” since, more often than not, randomness—better known as luck—is the probable reason for their success.

Consider this thought experiment: You ask 10 people to flip a coin 10 times. It’s unlikely any one of them will flip, say, eight heads in a row. But if you ask 10,000 people, it’s highly likely that several will achieve this feat. With a large sample size, you should expect there to be several “successful” coin flippers. Such is the nature of randomness. Long streaks of positive and negative events do occur, even though they seem improbable to us.

Globally, there are many thousands of individuals, money managers and institutions investing in stocks. Based on randomness alone, there’ll be some managers with market-beating results in any given period. But you can’t conclude that skill explains this short-term outperformance. Instead, most managers likely beat the market because they were lucky—and luck isn’t a “strategy” we should expect to persist.

It’s common for investors to favor an actively managed fund if it boasts market-beating three-, five- or 10-year performance. Such results seem to demonstrate that the manager is skilled at picking investments and investors assume this outperformance will continue. But rather than skill, we could be looking at the record of a manager who’s simply been lucky.

Bill Miller of Legg Mason Capital Management’s Value Trust beat the S&P 500 for 15 consecutive years and then flamed out. Was he skilled or lucky? It’s worth remembering that with enough investors picking U.S. stocks, even a 15-year market-beating record may be explained by randomness.

Does this mean there’s no one skilled at stock investing? No. Successful investors like Warren Buffett come to mind. But it takes many years to conclude that an investor is truly skilled. Buffett’s investment record spans decades, so we can be confident that his long-term performance isn’t solely due to luck. Still, he didn’t consistently pick winning stocks throughout his career. No one bats a thousand.

You might opt to buy an actively managed fund to get exposure to a specific asset class if its fees are reasonable and there’s no index-fund alternative available. In doing so, it’s understandable if you take into account the fund’s track record. Just be sure you aren’t considering the fund solely because it performed well recently.

While it’s easy to be a buy-and-hold investor with index funds, you have to keep tabs on actively managed funds to make sure you don’t get stuck with sub-par performance. And if you decide to jettison a poor-performing active fund, what then? Do you go back to square one and pick another actively managed fund with a good record?

The lesson: We can’t be sure that a three-, five- or 10-year record of beating the market means we’ve found a manager who’ll continue to produce superior returns. A manager specializing in, say, small-cap stocks may generate market-beating returns when small-cap stocks are in vogue. But should market sentiment shift to another class of stocks, those market-beating returns will likely evaporate. Such shifts in sentiment seemingly occur at random and are hard to predict.

Occasionally, due to social, cultural or demographic trends, one sector of the economy will outperform the broad market for an extended period. One example is the aging of the U.S. population and the outperformance of health care stocks. Does investing in a growing sector of the economy represent skill? Perhaps—if, say, you invested when those stocks were underperforming and later recognized that those same stocks had become overvalued, prompting you to sell the shares near their peak.

I’d be less inclined to consider it skill if you jumped on the bandwagon after the trend had become apparent. The problem: You may not know when the party is over—and your gains could quickly slip away.

“But wait,” some say. “I’ve picked individual stocks most of my life and I’ve beaten the market. Doesn’t that mean I have stock-picking skills?” Perhaps. But often, people who claim outperformance are focusing exclusively on their winning investments. They may conveniently forget about their stock picks that underperformed and were sold at a loss. Without knowing the degree to which your successful picks outnumbered your unsuccessful ones, and over what time frame, it would be hard to conclude that you have investment skill.

The notion that luck plays a greater role than skill in stock investing bolsters the argument for index-fund investing and broad diversification. The global economy is so dynamic, so subject to geopolitical, cultural, social and natural forces, that prudence dictates we spread our investment bets widely—and not depend too heavily on the stock-picking skills of others.

Be passive, stay diversified, keep costs down, rebalance periodically and stay the course over the long term. That’s how small investors can earn returns that beat many professionals.

Philip Stein, currently retired, was a public health microbiologist and later a computer programmer in the aerospace industry. He maintains that he’s worked with bugs, in one form or another, his entire career. Phil and his wife Jeanne live in Las Vegas. His previous article was Saved by Compounding.

Philip Stein, currently retired, was a public health microbiologist and later a computer programmer in the aerospace industry. He maintains that he’s worked with bugs, in one form or another, his entire career. Phil and his wife Jeanne live in Las Vegas. His previous article was Saved by Compounding.The post Skill or Luck? appeared first on HumbleDollar.

May 25, 2023

A Late Save

MANY RETIREMENT savers fund tax-deferred accounts—with good reason: The money we contribute pre-tax to an IRA or 401(k) reduces our taxable income, plus that money grows tax-deferred until withdrawn.

But there are two lesser-known benefits that are worth keeping in mind. First, with IRAs and solo 401(k)s, you can contribute for last year right up until the tax-filing deadline in April of the following year. That means you can calculate your tax bill, make an IRA contribution that’s credited to last year—and voila—cut the tab you owe Uncle Sam. It’s like time travel for tax breaks.

I’ve used this strategy several times, including for 2022’s tax year. I’m self-employed and have a solo 401(k). My consulting income has fluctuated over the past five years. Often, the bulk of it arrives in the last quarter of the year. That makes a belated solo 401(k) contribution a good lever to pull to avoid unexpectedly high tax bills.

There’s an added benefit if you’re over age 59½. Any contributions made for a prior year can be immediately withdrawn penalty-free if you need the cash. To be sure, the withdrawal would be considered taxable income, but that may make sense if you expect to be in a lower tax bracket in the current year.

Unfortunately, after Dec. 31, you can’t make a contribution to a regular employer-sponsored 401(k) plan for the previous tax year. What to do? Up until the tax-filing deadline in April, you could instead contribute to a traditional IRA for the previous year, though your contribution won’t necessarily be tax-deductible.

That brings me to a second tax break—one for low- and middle-income savers that I wish more people knew about. The retirement savings contribution credit, or saver’s tax credit, rewards workers for funding retirement accounts by giving them money back for their contributions. The credit depends on income. If you qualify, it can be 50%, 20% or 10% of the sum saved up to $2,000.

That means the maximum credit an individual might earn is $1,000, or 50% of his or her $2,000 contribution. You can save more, of course, and probably should. You just won’t get extra tax credit for the dollars over the $2,000 threshold.

To qualify for the saver’s tax credit in 2023, a single filer can have an adjusted gross income of up to $36,500 and a married couple up to $73,000. What if you’re just above the qualifying line? Tax-deductible retirement savings might drop your income enough to make you eligible. That’s because retirement contributions are subtracted from gross income when calculating adjusted gross income.

I’ve put this credit into play several times while volunteering with a local VITA tax preparation site. In one case, the client was a 60-year-old widow with a modest income from a part-time job. In 2022, she worked more than she expected but didn’t have any taxes withheld. She owed approximately $2,500 when we filed her return.

Later, she asked why she owed such a relatively large amount, and how to prevent it from happening again. I reviewed her return and found one solution was to have her employer withhold taxes at the rate of about 7% of her income. There was a second way to go, however.

She hadn’t made any IRA contributions in 2022. I asked if she had an IRA and money to contribute to it. I explained that she was eligible for a tax deduction on the amount contributed, and likely a saver’s credit on top of that. This was the week before this year’s April 18th tax filing deadline, so time was of the essence.

She thought she had an IRA and was confident she had money to contribute. Since she was over age 50, her maximum allowable IRA contribution for 2022 would be $7,000. That limit climbs to $7,500 for 2023. I suggested she contact the IRA administrator and confirm it would accept a contribution for 2022 before the deadline. If so, I could submit an amended 2022 tax return for her.

She left somewhat confused about the credit and concerned that the tax-filing deadline was looming. Unfortunately, she didn’t come back. I’m not sure she completely understood the strategy. I also recommended that she have her return completed earlier next year, so there’d be more time to make adjustments. I hope she follows through.

Had she been able to make a timely contribution for 2022, the revision to her tax forms would have been simple. Her total taxes owed would have been reduced by the amount of the contribution multiplied by her marginal tax rate. Her revised adjusted gross income would also be used to determine her eligibility for the saver’s credit. The credit, if she had qualified, would have further reduced the amount of taxes she owed.

This strategy has the potential to work well for many low-wage earners, either early in their careers or possibly in retirement. You don’t have to go whole hog to get the benefit, as the table below shows.

Single workers earning $35,500 in 2022 could have reduced their taxes from $2,501 to $2,061—a savings of $440—by contributing $2,000 to an IRA. Under the same scenario, if they could have afforded to contribute $7,000, their tax bill would have dropped to $1,461, for a total savings of $1,040.

Do you have a grandchild just graduating from high school and not going straight to college? I previously wrote an article explaining how a parent or grandparent could contribute to a child’s Roth IRA. As long as the grandchild meets the eligibility criteria for the saver’s credit—age 18 or older, not a fulltime student and not anyone’s dependent—he or she should qualify for the credit. A grandchild who enlists in the military after high school would be a great candidate for this strategy—and for some family financial support.

Richard Connor is a semi-retired aerospace engineer with a keen interest in finance. He enjoys a wide variety of other interests, including chasing grandkids, space, sports, travel, winemaking and reading. Follow Rick on Twitter @RConnor609 and check out his earlier articles.

Richard Connor is a semi-retired aerospace engineer with a keen interest in finance. He enjoys a wide variety of other interests, including chasing grandkids, space, sports, travel, winemaking and reading. Follow Rick on Twitter @RConnor609 and check out his earlier articles.The post A Late Save appeared first on HumbleDollar.