Ankush Agarwal's Blog: Always ख़ुश , page 3

April 4, 2020

Dreams

How do I write about the dream?

I'm sure, I had many.

'coz that's the world I see,

when I close the eyes,

my unknown fantasy.

Do I see another reality,

or a realm mundane?

it's a world with anything possible,

and void of any pain.

I've been to places

with unparalleled scenery

Those glorious white peaks

dancing with greenery

I've laughed many laughs

killing time with utmost glee

so close to my loved ones

whom I don't meet in reality

I've won many a battles

and achieved the impossible

Done those things with ease

which in life are impractical

The world there, is a happy place

such dreams have been many

then why is it so, that

I don't remember any?

Then there were dreams

Too embarrassing to share

these are the ones recurring

but I'd keep them a private affair

All the nightmares since childhood

I somehow distinctly remember

and they still manage to scare me

and I can't help, but surrender

The happy ones make my body glow

even the weird ones are fair

I just wish the nightmares

never do re-occur.

© Ankush Agarwal

05 Apr 2020

I'm sure, I had many.

'coz that's the world I see,

when I close the eyes,

my unknown fantasy.

Do I see another reality,

or a realm mundane?

it's a world with anything possible,

and void of any pain.

I've been to places

with unparalleled scenery

Those glorious white peaks

dancing with greenery

I've laughed many laughs

killing time with utmost glee

so close to my loved ones

whom I don't meet in reality

I've won many a battles

and achieved the impossible

Done those things with ease

which in life are impractical

The world there, is a happy place

such dreams have been many

then why is it so, that

I don't remember any?

Then there were dreams

Too embarrassing to share

these are the ones recurring

but I'd keep them a private affair

All the nightmares since childhood

I somehow distinctly remember

and they still manage to scare me

and I can't help, but surrender

The happy ones make my body glow

even the weird ones are fair

I just wish the nightmares

never do re-occur.

© Ankush Agarwal

05 Apr 2020

Published on April 04, 2020 21:15

•

Tags:

dreams, napowrimo, poem-challenge

Random Rhymes

For Jim always is

a happy brown clown,

Living in a tilting building

in downtown

He loves to put, bright

makeup on his face

always dresses in polka dots

and an orange colored lace

He goes by the name

of A Delirious Idiot,

The crowd finds it funny

and his acts are hilarious

Tales of his deeds, are

always sought after

My friends always tell me,

with roaring laughter

My kids also love him

more than fairies

As he carries not books,

but berries in libraries

One day, when I met him

I asked him a question,

"Can I please give you

a genuine suggestion?"

He told me, "I'm willing to,

give you my attention

As long as you promise to

not give me any tension."

I told Jim, that, I'm not so sure

With so many problems around, with no known cure

a silly laugh, in these times, is not an allure

and that he needs to act, like a man matured.

He told me:

"Watson, this is elementary,

So, don't be pedantic.

Treat life as a poetry

and die a romantic"

"Look at me dear,

I've got a hole in my heart

and before my breaths are over

I want to play my part."

"I am left with, only a year or two

To solve world's problems, I got no clue."

I noticed, he wanted to do something,

before his chances blew

So, that's why he's in a rush,

he knew time flew.

He couldn't laugh himself,

so he made the country smile,

Hiding his sorrows behind the mask

The eye-shadow was his guile.

The bright makeup on his face

hid his pain very well

The lace covered his sufferings,

so no one could tell.

The polka dots he used to

camouflage something more

He wanted his audience to laugh

and not cringe on sight so gore.

His makeup wasn't funny, but hideous

He really was a delirious idiot.

But I made him a secret promise

and I will never let him down...

for Jim always was

a happy brown clown.

© Ankush Agarwal

04 Apr 2020

a happy brown clown,

Living in a tilting building

in downtown

He loves to put, bright

makeup on his face

always dresses in polka dots

and an orange colored lace

He goes by the name

of A Delirious Idiot,

The crowd finds it funny

and his acts are hilarious

Tales of his deeds, are

always sought after

My friends always tell me,

with roaring laughter

My kids also love him

more than fairies

As he carries not books,

but berries in libraries

One day, when I met him

I asked him a question,

"Can I please give you

a genuine suggestion?"

He told me, "I'm willing to,

give you my attention

As long as you promise to

not give me any tension."

I told Jim, that, I'm not so sure

With so many problems around, with no known cure

a silly laugh, in these times, is not an allure

and that he needs to act, like a man matured.

He told me:

"Watson, this is elementary,

So, don't be pedantic.

Treat life as a poetry

and die a romantic"

"Look at me dear,

I've got a hole in my heart

and before my breaths are over

I want to play my part."

"I am left with, only a year or two

To solve world's problems, I got no clue."

I noticed, he wanted to do something,

before his chances blew

So, that's why he's in a rush,

he knew time flew.

He couldn't laugh himself,

so he made the country smile,

Hiding his sorrows behind the mask

The eye-shadow was his guile.

The bright makeup on his face

hid his pain very well

The lace covered his sufferings,

so no one could tell.

The polka dots he used to

camouflage something more

He wanted his audience to laugh

and not cringe on sight so gore.

His makeup wasn't funny, but hideous

He really was a delirious idiot.

But I made him a secret promise

and I will never let him down...

for Jim always was

a happy brown clown.

© Ankush Agarwal

04 Apr 2020

Published on April 04, 2020 19:34

•

Tags:

napowrimo, poem-challenge, random

That Place

That terrace,

from my house, was visible.

It was only a stone's throw away;

witnesses are those miserable pebbles,

whom I had launched with full strength and vigor

those were not stones, but jewels

vaguely remembered, like first crush in schools

Some of those gems are still in flight,

above that terrace, where we played day and night.

That terrace which has a rusty door

is now a portal to times before

Will there be Holi colors still on that wood?

Or that chalk dust from childhood?

Our Antakshari songs still echoing

in those walls, now decaying

Is someone still waiting

in that narrow staircase?

with ink scribbled on paper,

but message written on her face

That discarded ring, would yet be hidden

in that out-of-bound corner, still forbidden

I can't reach that terrace now,

some strangers now go and lock it.

But it doesn't appear far to me, when

I find some pebbles in my pocket.

© Ankush Agarwal

02-Apr-2020

from my house, was visible.

It was only a stone's throw away;

witnesses are those miserable pebbles,

whom I had launched with full strength and vigor

those were not stones, but jewels

vaguely remembered, like first crush in schools

Some of those gems are still in flight,

above that terrace, where we played day and night.

That terrace which has a rusty door

is now a portal to times before

Will there be Holi colors still on that wood?

Or that chalk dust from childhood?

Our Antakshari songs still echoing

in those walls, now decaying

Is someone still waiting

in that narrow staircase?

with ink scribbled on paper,

but message written on her face

That discarded ring, would yet be hidden

in that out-of-bound corner, still forbidden

I can't reach that terrace now,

some strangers now go and lock it.

But it doesn't appear far to me, when

I find some pebbles in my pocket.

© Ankush Agarwal

02-Apr-2020

Published on April 04, 2020 19:30

•

Tags:

napowrimo, place, poem-challenge

April 1, 2020

I am...

...A wandering thought !

Visiting places unseen

or relived in a forgotten dream.

I disappear; ere I exhaust.

...A tender embrace !

Friendly, reassuring touch

not too fast, not too much.

I'm a memory, time can't erase.

...A wish unfulfilled !

Desires, hopes, ambitions scattered

flawless mirror with reflections shattered

I'm confined in walls, yet to be built.

...A simple smile !

Choked heart with unfettered laugh

happy face in a decaying photograph

I'm Always Khush - not once in a while.

Visiting places unseen

or relived in a forgotten dream.

I disappear; ere I exhaust.

...A tender embrace !

Friendly, reassuring touch

not too fast, not too much.

I'm a memory, time can't erase.

...A wish unfulfilled !

Desires, hopes, ambitions scattered

flawless mirror with reflections shattered

I'm confined in walls, yet to be built.

...A simple smile !

Choked heart with unfettered laugh

happy face in a decaying photograph

I'm Always Khush - not once in a while.

Published on April 01, 2020 09:05

•

Tags:

introduction, napowrimo, poem-challenge

February 2, 2020

10 years with Udaan

26th Jan, 2010: Thinking that I should celebrate the republic day in its true spirit, I had volunteered for a CSR initiative with Udaan. This republic day, the association became 10 years strong and some of the episodes are still fresh in my otherwise frail memory.

We started with reading stories in English for the young minds in a small room designated as the Udaan Library. Within a few days, we graduated to playing board games as an additional activity to help build their confidence and make the students think strategically. I remember teaching chess to a few students and a game with Bharat is still very close to my heart. Bharat was a bright student and had taken a liking to chess from the very first game. It took only a few games before I ended up on the losing side. Admittedly, I am not a very good chess player, but I prefer to remember that game as an example of being a good coach. J

In Udaan, we are called Bhaiya/Didi and not Sir/Madam and that’s just one of the reason behind the bonding we share with the students. We are not just mentors and coaches but also their friends and in many cases feel as responsible as their elder brother/sister. That small room did not stand the test of time and Mumbai’s fast changing landscape, but the relationship I had developed with my first batch of students is still strong and resilient.

Teaching and Computers have been my passion and hobby; and hence when came the opportunity to Teach-Computers to Udaan students, I quickly grabbed it. That’s where I had first met Vinay, one of my favourite students and Nancy, who had infinite love and good wishes for her students in her heart.

The lab used to be in a dark basement of the erstwhile Transocean building, but was very well maintained from inside. Looking back, it sorts of had a poetic symbolism as most of the underprivileged students were being brought up in a tough dark environment but by providing good education to them, Udaan had lit up a spark inside.

The Saturday Club was another memorable association, which also was great fun for ourselves. Making fun presentations for “Around the world” with Ginny and launching an imaginary aeroplane at the start of each class are now stuff of the legend. I also taught Science weekday classes for a little while, which were hugely popular amongst the students. Many students asked me to take all their science and maths classes and it was heart-breaking not to accept it, owing to my work commitments. However, I can only aspire to be as good as Rajeev, my friend and fellow volunteer. Rajeev used to take Science-experiments class in the Saturday club and had such an enthralling style that even teachers used to line up outside his class to witness his magic.

During the culmination of the club each year, we used to make final presentations in the form of exhibitions and models, songs, dance and often we did go whole nine-yards. Both figuratively and literally.

Tulsi’s performance as the little brown mouse in the Gruffalo story still makes me smile.

During Udaan’s annual sports day event, I used to hone my photography skills and it made me proud whenever my click found its way to Udaan’s newsletter, boards, etc. However, the real pride was seen in the shining eyes of the winners of the race and the winners of the annual trophy. The entire day is an amazing experience which could not, and should not, be put to inert words for the sake of doing justice to the real experience.

I remember the decade gone by with joy and humbleness at the same time. It has been a highly enriching and educating experience for myself. I have learned various key skills in undertaking these projects, made great friends and lifelong associations, collected beautiful memories and continue to strive to spread happiness.

Published on February 02, 2020 07:23

August 3, 2014

Challenges and opportunities

It is said that speaking in public is the numero uno fear in people; but kids at Udaan have always been special and different from the rest.

I am volunteering for the Saturday Club again in this term, but chose a different club just to break the monotony. This Saturday was my first time with "The Book Club". I was there early to soak in the atmosphere and to comfort the butterflies in my own stomach. 25-30 young kids entered the room and were neatly divided into 6 groups with one volunteer in each group. I had 5 curious minds joining me in my group. After a quick round of introductions, we faced the mighty challenge to pick only one of the multiple stories packaged in attractive colors and characters. To solve the great mystery, we applied the time trusted technique of - "Akkad Bakkad Bambe Bo". This broke the ice. We then dived right into the colorful world of 'Bubbles' - the naughty chimp and talked about his extravaganza of drawing on the walls of his home and then helping his Mom clean it up. My 5 friends then all drew a bouquet and added a thank you note for their own Moms. Then came the interesting part of one kid in each group going to the center of the classroom and sharing the story with all. I was preparing myself for having to convince one of the kids to take this up, but it was the other way round. All the 5 were keen to take this up and I, instead had to convince them that only 1 of them will get to be the narrator that day.

This Saturday, I learnt the true meaning of the old adage of "Converting challenges into opportunities". Adulthood brings a lot of fear and scepticism with it, but sky is the limit for these kids. They are ready to take the flight, to take that 'Udaan'.

Published on August 03, 2014 04:05

October 4, 2013

My first published book - inviting reviewers

My first book is now published and I am inviting honest reviews for the same. The promoters are offering specimen copies to interested people/group in exchange for their opinion/review/feedback. Such reviews could be published on consumer websites, and the reviewer's blog or website, if any. Please let me know, if you would be interested for the same. The book is available on below sites (The hyperlinks take you to the book):

Packt Pub

Amazon UK

Amazon.com

Barnes and Noble

Safari Books

Oreilly

The book is available both in paperback and ebook format. You could also download sample chapters in PDF format.

Book DetailsLanguage : English

Paperback : 114 pages [ 235mm x 191mm ]

Release Date : September 2013

ISBN : 1849696640

ISBN 13 : 9781849696647

Overview:

Learn to quickly set up and effectively use day-to-day IT servicesUnderstand the vital terminologies in a simplified mannerLearn to swiftly deal with issues and resolve recurring problemsKeep track of your assets and plan for safer changesUse the tool with easy-to-follow, step-by-step instructions to achieve your milestones

What you will learn from this bookGet to grips with the prerequisites and process flows for managing helpdesk activitiesSet up ITIL processes easily and quickly in your team/organizationUnderstand the purpose, objective, and scope of the core processesDiscover and manage IT assets, purchase orders, and contractsControl changes and deploy successful releasesManage the Knowledge base, create reports, and schedule backupsResolve incidents quickly and minimize adverse impact, while avoiding the recurrence of issuesMeet the challenges and minimize risks in maintaining a successful service desk

In DetailIT service management (ITSM) refers to the implementation and management of quality IT services that meet the needs of your business. ServiceDesk Plus is an integrated web-based helpdesk tool that assists you in planning, setting up, and achieving the timely execution of IT services efficiently.ServiceDesk Plus 8.x Essentials is a practical, hands-on guide that walks you through the features of ServiceDesk Plus 8.x to help you set up and manage day-to-day IT services. The book also helps you to understand and practice the ITIL methodologies while using the tool for daily operations.ServiceDesk Plus 8.x Essentials conceptualizes the ITIL framework and takes you through the core processes and their implementation in ServiceDesk Plus 8.x in an easy and practical manner.The book will also help you to learn the process flows and manage incidents, problems, assets, and configurations while understanding the scope and responsibilities of the helpdesk. It also takes you through controlling changes and releases and highlights the features of the tools. If you need a concise handbook for a complete understanding of the metrics, challenges and risks of ITSM, then you have found the right book.With ServiceDesk Plus 8.x Essentials, you will learn everything you need to know to administer and manage IT services using ServiceDesk Plus, while making ITIL concepts practical and fun.ApproachThis is a practical, hands-on guide that assists you in setting up and efficiently managing ITSM.Who this book is forServiceDesk Plus 8.x Essentials is for IT helpdesk managers, administrators, and staff, serving as a compendium for service management concepts useful for them.

Table of ContentsPreface

Chapter 1: Conceptualizing IT Service Management

Chapter 2: Managing Incidents and Problems

Chapter 3: Managing Assets and Configuration

Chapter 4: Controlling Changes and Releases

Chapter 5: Service Desk – Where the Value Is Realized

Chapter 6: Making Life Easier – Handy Features

Index

Packt Pub

Amazon UK

Amazon.com

Barnes and Noble

Safari Books

Oreilly

The book is available both in paperback and ebook format. You could also download sample chapters in PDF format.

Book DetailsLanguage : English

Paperback : 114 pages [ 235mm x 191mm ]

Release Date : September 2013

ISBN : 1849696640

ISBN 13 : 9781849696647

Overview:

Learn to quickly set up and effectively use day-to-day IT servicesUnderstand the vital terminologies in a simplified mannerLearn to swiftly deal with issues and resolve recurring problemsKeep track of your assets and plan for safer changesUse the tool with easy-to-follow, step-by-step instructions to achieve your milestones

What you will learn from this bookGet to grips with the prerequisites and process flows for managing helpdesk activitiesSet up ITIL processes easily and quickly in your team/organizationUnderstand the purpose, objective, and scope of the core processesDiscover and manage IT assets, purchase orders, and contractsControl changes and deploy successful releasesManage the Knowledge base, create reports, and schedule backupsResolve incidents quickly and minimize adverse impact, while avoiding the recurrence of issuesMeet the challenges and minimize risks in maintaining a successful service desk

In DetailIT service management (ITSM) refers to the implementation and management of quality IT services that meet the needs of your business. ServiceDesk Plus is an integrated web-based helpdesk tool that assists you in planning, setting up, and achieving the timely execution of IT services efficiently.ServiceDesk Plus 8.x Essentials is a practical, hands-on guide that walks you through the features of ServiceDesk Plus 8.x to help you set up and manage day-to-day IT services. The book also helps you to understand and practice the ITIL methodologies while using the tool for daily operations.ServiceDesk Plus 8.x Essentials conceptualizes the ITIL framework and takes you through the core processes and their implementation in ServiceDesk Plus 8.x in an easy and practical manner.The book will also help you to learn the process flows and manage incidents, problems, assets, and configurations while understanding the scope and responsibilities of the helpdesk. It also takes you through controlling changes and releases and highlights the features of the tools. If you need a concise handbook for a complete understanding of the metrics, challenges and risks of ITSM, then you have found the right book.With ServiceDesk Plus 8.x Essentials, you will learn everything you need to know to administer and manage IT services using ServiceDesk Plus, while making ITIL concepts practical and fun.ApproachThis is a practical, hands-on guide that assists you in setting up and efficiently managing ITSM.Who this book is forServiceDesk Plus 8.x Essentials is for IT helpdesk managers, administrators, and staff, serving as a compendium for service management concepts useful for them.

Table of ContentsPreface

Chapter 1: Conceptualizing IT Service Management

Chapter 2: Managing Incidents and Problems

Chapter 3: Managing Assets and Configuration

Chapter 4: Controlling Changes and Releases

Chapter 5: Service Desk – Where the Value Is Realized

Chapter 6: Making Life Easier – Handy Features

Index

Published on October 04, 2013 02:47

November 16, 2012

Owning the Distribution of Release Notes

I had written this blog for manageengine.com and won a $100 award for the same. Sharing it here now:

http://blogs.manageengine.com/servicedesk/2012/10/04/owning-distribution-release-notes/

http://blogs.manageengine.com/servicedesk/2012/10/04/owning-distribution-release-notes/

Published on November 16, 2012 20:14

November 29, 2011

The stoy of Financial Crisis 2008 and Lehman's bankruptcy

It was a little difficult for me to understand the causes of 2008's financial crisis and especially Lehman's Bankruptcy. I have read a few books on the same ("Too big to fail" being the favorite) and lots of reports, blogs and discussions on the same. Here I am trying to put a summary of how the crisis unfolded (mostly for my own understanding). A lot of the below is taken from FCIC's inquiry report. For any questions/comments, plz feel free to add in your comments:

------------------

Introduction of Commercial papers and Repo: Rise of Shadow Banking and focus on money market, instead of capital.

Due to rise of shadow banking, traditional banks faced stiff competition due to Regulatory restrictions (Capital Base, Cap in interest rates, etc.)

This led to relaxed regulations and removal of interest cap.

Since interest cap was removed, traditional banks needed more security. Fed became the lender of the last resort. Concept of Too Big to fail was born.

Due to stiff competition and risky bets in Repo and papers market, a few banks went bust which in turn effected mortgages.

To support mortgages, FNMA/GNMA/FHLMC (Fannie Mae,Ginnie Mae,Freddie Mac) were constructed to guarantee loans.

Ginnie was first to securitize in 1970.

Being GSEs, they were highly profitable (low cost of borrowing).

In 1980s, IBs began to securitize different types of Loans. (ARMs, non-mortgages auto loans etc.)

They started to mimic banking activities outside the regulatory framework. And to fund, they used capital/money market instead of deposit base in traditional banks.

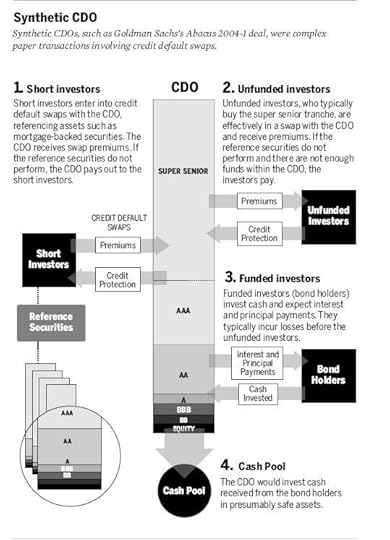

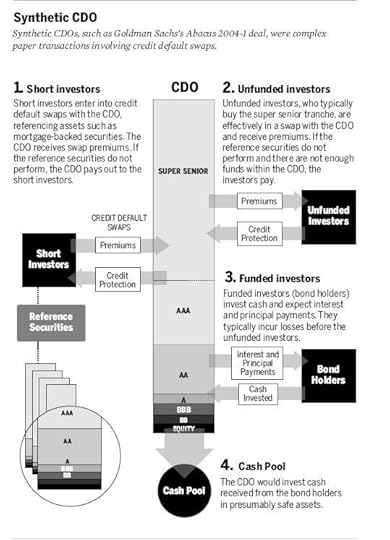

Introduction of Pooling & Tranching for diversification of products and risk.

This raised complexity giving hard times to rating agencies. Since, participants needed good ratings, they chose and paid high fees to rating agencies.

With favourable ratings and transfer of risk, subprime market started to boom.

Then boom in Derivatives and birth of CDS which increased complexity even further. CDS were not regularised like insurance and Naked CDSes placed risky bets.

90s saw huge mergers of banks. 10 largest banks owned 55% of industries assets. Late 90s, Banks started to work closely with Insurance agencies. In 1998, Citicorp merged with Travelers (Insurance) to form Citigroup. However, as per the Glass-Steagal act, Citigroup had to breakup and divest many Travelers Assets. Instead of breaking the largest bank, govt repealed the act.

Pooling and tranching got more and more complicated.

90s subprime lending became abusive.

Entire 90s upto end of 2000 economy grew in every quarter; but also the national debt.

2001, economy showed signs of slowing down was construction was still booming peaking in 2004.

Oct 2001, introduced the “Recourse Rule”. it would have to keep a dollar in capital for every dollar of residual interest. it increased banks’ incentive to sell the residual interests in securitizations. After securitization: Holding securities rated AAA or AA required far less capital than holding lower-rated investments.And a final comparison: under bank regulatory capital standards, a $100 triple-Acorporate bond required $8 in capital—five times as much as the triple-A mortgage backed security. Unlike the corporate bond, it was ultimately backed by real estate.

2005-2007 – Some members in Fed, wanted to put stricter norms for predatory lending, but Alan greenspan was not in favour. During this time, funds rate (short term) were gradually increased from 1% to 5.25%. However, mortgage rates (long term) continued to fall as Foreign Investment into US was providing the long term liquidity.

Meanwhile, Option ARMs, esp with negative amortization (Paying less than the interest thereby increasing the Principal) were growing exponentially. If the house prices fall, the borrower is better off walking away from the house and the loan as the house will be of less worth than the loan itself.

Piggyback Mortgage: The lender offered a first mortgage for perhaps 80% of the home’s value and a second mortgage for another 10-20%. Borrowers likedthese because their monthly payments were often cheaper than a traditional mortgage plus the required mortgage insurance, and the interest payments were tax deductible. Lenders liked them because the smaller first mortgage—even without mortgage insurance—could potentially be sold to the GSEs.

asset-backed commercial paper (ABCP) : short term borrowing with MBSes as collateral. It not only was riskier for the lender, it also indirectly took them off the balance sheets and hence required less capital to back it up. Also, to keep the ABCPs running, banks provide liquidity support to these against a small fee. This liquidity support meant that the bank would purchase, at a previously set price, any commercial paper that investors were unwilling to buy when it came up forrenewal.

they built new securities that would buy the tranches that had become harder to sell. Bankers would take those low investment-grade tranches, largelyrated BBB or A, from many mortgage-backed securities and repackage them into the new securities—CDOs. Most of these CDO tranches would be rated triple-A despite the fact that they generally comprised the lower-rated tranches of mortgage-backed securities. CDO securities would be sold with their own waterfalls, with the risk-averse investors, again, paid first and the risk-seeking investors paid last. As they did in the case of mortgage-backed securities, the rating agencies gave their highest, triple-A ratings to the securities at the top

In 1998, Multisector CDOs (Pooling in mortgages, aircraft leases, Mutual Funds, etc.) were introduced. However, in 2002 they performed poorly and the wisdom gained was that the wide range of assets had actually contributed to the problem; according to this view, the asset managers who selected the portfolios could not be experts in sectors as diverse as aircraft leases and mutual funds.So CDOs came back to subprime mortgages.

It was common for CDOs to be structured with 5-15% of their cash invested in other CDOs; CDOs with more than 80% of their cash invested in other CDOs were typically known as “CDOs squared.”

Finally, the issuers of over-the-counter derivatives called credit default swaps, most notably AIG, played a central role by issuing swaps to investors in CDOtranches, promising to reimburse them for any losses on the tranches in exchange for a stream of premium-like payments.

July 2007 – A pilot prog was launched to examine subprime under Ben Bernanke. The rules would not take effect until October 1, 2009, which was too little, too late.

Repo 105: an accounting manoeuvre to temporarily remove assets from the balance sheet before each reporting period.

Early 2008: decision by the federal government and the GSEs to increase the GSEs’ mortgage activities and risk to support the collapsing mortgage market was made despite the unsound financial condition of the institutions. While these actions provided support to the mortgage market, they led to increased losses at the GSEs, which were ultimately borne by taxpayers, and reflected the conflicted nature of the GSEs’ dual mandate.

Mar 2008: Bear Stearns’s demise. JP Morgan announced its acquisition of Bear Stearns on Mar 18.

Now the focus was on Lehman. The chief concerns were Lehman’s real estate–related investments and its reliance on short-term funding sources, including $7.8 billion of commercial paper and $197 billion of repos at the end of the first quarter of 2008. There were also concerns about the firm’s more than 900,000 derivative contracts with a myriad of counterparties.

On March 18, Lehman reported better-than-expected earnings of $489 million for the first quarter of 2008. Its stock jumped nearly 50%, to $46.49. But investors and analysts quickly raised questions, especially concerning the reported value of Lehman’s real estate assets.

Lehman built up its liquidity to $45 billion at the end of May, but it and Merrill performed the worst among the four investment banks in the regulators’ liquidity stress tests in the spring and summer of 2008.The company was also working to improve its capital position. First, it reduced real estate exposures (again, excluding real estate held for sale) from $90 billion to $71 billion at the end of May and to $54 billion at the end of the summer. Second, it raised new capital and longer-term debt—a total of $15.5 billion of preferred stock and senior and subordinated debt from April through June 2008.

On June 9, Lehman announced a preliminary $2.8 billion loss for its second quarter—the first loss since it became a public company in 1994. The share price fell to $30. Three days laterLehman announced it was replacing Chief Operating Officer Joseph Gregory and Chief Financial Officer Erin Callan. The stock slumped again, to $22.70.

On June 25, results from the regulators’ most recent stress test showed that Lehman would need $15billion more than the $54 billion in its liquidity pool to survive a loss of all unsecured borrowings and varying amounts of secured borrowings.

By July 10, Lehman’s major tri-party repo lenders pulled back. (Also because JPMorgan, Lehman’s clearing bank, had refused to negotiate for Lehman.)

Sep 04: LB told JPMorgan about the upcoming 3rd quarter result and the plans to bolster capital by: Investment from Korea development bank, sale of IB division, sale of real estate assets, division of company, etc.

September 9: news that there would be no investment from Korea Development Bank shook the market. Lehman’s stock plunged 55% from the day before, closing at $7.79.That same day, Fuld agreed to post an additional $3.6 billion of collateral to JPMorgan. Lehman’s bankruptcy estate would later claim that Lehman did so because of JP Morgan’s improper threat to withhold repo funding. Zubrow said JP Morgan requested the collateral because of its growing exposure as a derivatives trading counterparty to Lehman. Steven Black, JP Morgan’s president, said he requested $5billion from Lehman, which agreed to post $3.6 billion.

10-Sep 2008: Lehman reports $28billion of shareholder equity (more reported equity than it had 1 year earlier). Shareholder equity is a measure of solvency. (=total assets minus its total liabilities.). Shareholders' equity represents the amount by which a company is financed through common and preferred shares.However, it was believed that its real estate and other assets have been overvalued by 60-70billion dollars.

10-Sep night: a New York Fed official circulated a “Liquidation Consortium” game plan to colleagues.The plan was to convene in one room senior-level representatives of Lehman’s counterparties in the tri-party repo, credit default swap, and over-the-counter derivatives markets—everyone who would suffer most if Lehman failed—and have them explore joint funding mechanisms to avert a failure.According to the proposed game plan, Secretary Paulson would tell the participants they had until the opening of business in Asia the following Monday morning (Sunday night, New York time) to devise a credible plan.

11-Sep: JP demanded another $5billion from Lehman in cash.

Friday, September 12, Lewis (BofA CEO) called Paulson to repeat his assessment—no government support, no deal. (Next day he finalized buying Merrill Lynch).

Sat Sep 13 night: Deal with Barclays looked probable, if the private consortium assist by taking care of $40-50billion toxic assets.Sun Morning: 14-Sep: Barclays informed that FSA has declined to approve the deal. (The issue boiled down to a guarantee—the New York Fed required Barclays to guarantee Lehman’s obligationsfrom the sale until the transaction closed, much as JP Morgan had done for Bear Stearns in March.Under U.K. law, the guarantee required a Barclays shareholder vote, which could take 30 to 60 days. Though it could waive that requirement, the FSA asserted that such a waiver would be unprecedented, that it had not heard about this guarantee until Saturday night, and that Barclays did not really want to take on that obligation anyway.)

Monday 15-Sep: 1:45AM Lehman filed for bankruptcy.

------------------

Introduction of Commercial papers and Repo: Rise of Shadow Banking and focus on money market, instead of capital.

Due to rise of shadow banking, traditional banks faced stiff competition due to Regulatory restrictions (Capital Base, Cap in interest rates, etc.)

This led to relaxed regulations and removal of interest cap.

Since interest cap was removed, traditional banks needed more security. Fed became the lender of the last resort. Concept of Too Big to fail was born.

Due to stiff competition and risky bets in Repo and papers market, a few banks went bust which in turn effected mortgages.

To support mortgages, FNMA/GNMA/FHLMC (Fannie Mae,Ginnie Mae,Freddie Mac) were constructed to guarantee loans.

Ginnie was first to securitize in 1970.

Being GSEs, they were highly profitable (low cost of borrowing).

In 1980s, IBs began to securitize different types of Loans. (ARMs, non-mortgages auto loans etc.)

They started to mimic banking activities outside the regulatory framework. And to fund, they used capital/money market instead of deposit base in traditional banks.

Introduction of Pooling & Tranching for diversification of products and risk.

This raised complexity giving hard times to rating agencies. Since, participants needed good ratings, they chose and paid high fees to rating agencies.

With favourable ratings and transfer of risk, subprime market started to boom.

Then boom in Derivatives and birth of CDS which increased complexity even further. CDS were not regularised like insurance and Naked CDSes placed risky bets.

90s saw huge mergers of banks. 10 largest banks owned 55% of industries assets. Late 90s, Banks started to work closely with Insurance agencies. In 1998, Citicorp merged with Travelers (Insurance) to form Citigroup. However, as per the Glass-Steagal act, Citigroup had to breakup and divest many Travelers Assets. Instead of breaking the largest bank, govt repealed the act.

Pooling and tranching got more and more complicated.

90s subprime lending became abusive.

Entire 90s upto end of 2000 economy grew in every quarter; but also the national debt.

2001, economy showed signs of slowing down was construction was still booming peaking in 2004.

Oct 2001, introduced the “Recourse Rule”. it would have to keep a dollar in capital for every dollar of residual interest. it increased banks’ incentive to sell the residual interests in securitizations. After securitization: Holding securities rated AAA or AA required far less capital than holding lower-rated investments.And a final comparison: under bank regulatory capital standards, a $100 triple-Acorporate bond required $8 in capital—five times as much as the triple-A mortgage backed security. Unlike the corporate bond, it was ultimately backed by real estate.

2005-2007 – Some members in Fed, wanted to put stricter norms for predatory lending, but Alan greenspan was not in favour. During this time, funds rate (short term) were gradually increased from 1% to 5.25%. However, mortgage rates (long term) continued to fall as Foreign Investment into US was providing the long term liquidity.

Meanwhile, Option ARMs, esp with negative amortization (Paying less than the interest thereby increasing the Principal) were growing exponentially. If the house prices fall, the borrower is better off walking away from the house and the loan as the house will be of less worth than the loan itself.

Piggyback Mortgage: The lender offered a first mortgage for perhaps 80% of the home’s value and a second mortgage for another 10-20%. Borrowers likedthese because their monthly payments were often cheaper than a traditional mortgage plus the required mortgage insurance, and the interest payments were tax deductible. Lenders liked them because the smaller first mortgage—even without mortgage insurance—could potentially be sold to the GSEs.

asset-backed commercial paper (ABCP) : short term borrowing with MBSes as collateral. It not only was riskier for the lender, it also indirectly took them off the balance sheets and hence required less capital to back it up. Also, to keep the ABCPs running, banks provide liquidity support to these against a small fee. This liquidity support meant that the bank would purchase, at a previously set price, any commercial paper that investors were unwilling to buy when it came up forrenewal.

they built new securities that would buy the tranches that had become harder to sell. Bankers would take those low investment-grade tranches, largelyrated BBB or A, from many mortgage-backed securities and repackage them into the new securities—CDOs. Most of these CDO tranches would be rated triple-A despite the fact that they generally comprised the lower-rated tranches of mortgage-backed securities. CDO securities would be sold with their own waterfalls, with the risk-averse investors, again, paid first and the risk-seeking investors paid last. As they did in the case of mortgage-backed securities, the rating agencies gave their highest, triple-A ratings to the securities at the top

In 1998, Multisector CDOs (Pooling in mortgages, aircraft leases, Mutual Funds, etc.) were introduced. However, in 2002 they performed poorly and the wisdom gained was that the wide range of assets had actually contributed to the problem; according to this view, the asset managers who selected the portfolios could not be experts in sectors as diverse as aircraft leases and mutual funds.So CDOs came back to subprime mortgages.

It was common for CDOs to be structured with 5-15% of their cash invested in other CDOs; CDOs with more than 80% of their cash invested in other CDOs were typically known as “CDOs squared.”

Finally, the issuers of over-the-counter derivatives called credit default swaps, most notably AIG, played a central role by issuing swaps to investors in CDOtranches, promising to reimburse them for any losses on the tranches in exchange for a stream of premium-like payments.

July 2007 – A pilot prog was launched to examine subprime under Ben Bernanke. The rules would not take effect until October 1, 2009, which was too little, too late.

Repo 105: an accounting manoeuvre to temporarily remove assets from the balance sheet before each reporting period.

Early 2008: decision by the federal government and the GSEs to increase the GSEs’ mortgage activities and risk to support the collapsing mortgage market was made despite the unsound financial condition of the institutions. While these actions provided support to the mortgage market, they led to increased losses at the GSEs, which were ultimately borne by taxpayers, and reflected the conflicted nature of the GSEs’ dual mandate.

Mar 2008: Bear Stearns’s demise. JP Morgan announced its acquisition of Bear Stearns on Mar 18.

Now the focus was on Lehman. The chief concerns were Lehman’s real estate–related investments and its reliance on short-term funding sources, including $7.8 billion of commercial paper and $197 billion of repos at the end of the first quarter of 2008. There were also concerns about the firm’s more than 900,000 derivative contracts with a myriad of counterparties.

On March 18, Lehman reported better-than-expected earnings of $489 million for the first quarter of 2008. Its stock jumped nearly 50%, to $46.49. But investors and analysts quickly raised questions, especially concerning the reported value of Lehman’s real estate assets.

Lehman built up its liquidity to $45 billion at the end of May, but it and Merrill performed the worst among the four investment banks in the regulators’ liquidity stress tests in the spring and summer of 2008.The company was also working to improve its capital position. First, it reduced real estate exposures (again, excluding real estate held for sale) from $90 billion to $71 billion at the end of May and to $54 billion at the end of the summer. Second, it raised new capital and longer-term debt—a total of $15.5 billion of preferred stock and senior and subordinated debt from April through June 2008.

On June 9, Lehman announced a preliminary $2.8 billion loss for its second quarter—the first loss since it became a public company in 1994. The share price fell to $30. Three days laterLehman announced it was replacing Chief Operating Officer Joseph Gregory and Chief Financial Officer Erin Callan. The stock slumped again, to $22.70.

On June 25, results from the regulators’ most recent stress test showed that Lehman would need $15billion more than the $54 billion in its liquidity pool to survive a loss of all unsecured borrowings and varying amounts of secured borrowings.

By July 10, Lehman’s major tri-party repo lenders pulled back. (Also because JPMorgan, Lehman’s clearing bank, had refused to negotiate for Lehman.)

Sep 04: LB told JPMorgan about the upcoming 3rd quarter result and the plans to bolster capital by: Investment from Korea development bank, sale of IB division, sale of real estate assets, division of company, etc.

September 9: news that there would be no investment from Korea Development Bank shook the market. Lehman’s stock plunged 55% from the day before, closing at $7.79.That same day, Fuld agreed to post an additional $3.6 billion of collateral to JPMorgan. Lehman’s bankruptcy estate would later claim that Lehman did so because of JP Morgan’s improper threat to withhold repo funding. Zubrow said JP Morgan requested the collateral because of its growing exposure as a derivatives trading counterparty to Lehman. Steven Black, JP Morgan’s president, said he requested $5billion from Lehman, which agreed to post $3.6 billion.

10-Sep 2008: Lehman reports $28billion of shareholder equity (more reported equity than it had 1 year earlier). Shareholder equity is a measure of solvency. (=total assets minus its total liabilities.). Shareholders' equity represents the amount by which a company is financed through common and preferred shares.However, it was believed that its real estate and other assets have been overvalued by 60-70billion dollars.

10-Sep night: a New York Fed official circulated a “Liquidation Consortium” game plan to colleagues.The plan was to convene in one room senior-level representatives of Lehman’s counterparties in the tri-party repo, credit default swap, and over-the-counter derivatives markets—everyone who would suffer most if Lehman failed—and have them explore joint funding mechanisms to avert a failure.According to the proposed game plan, Secretary Paulson would tell the participants they had until the opening of business in Asia the following Monday morning (Sunday night, New York time) to devise a credible plan.

11-Sep: JP demanded another $5billion from Lehman in cash.

Friday, September 12, Lewis (BofA CEO) called Paulson to repeat his assessment—no government support, no deal. (Next day he finalized buying Merrill Lynch).

Sat Sep 13 night: Deal with Barclays looked probable, if the private consortium assist by taking care of $40-50billion toxic assets.Sun Morning: 14-Sep: Barclays informed that FSA has declined to approve the deal. (The issue boiled down to a guarantee—the New York Fed required Barclays to guarantee Lehman’s obligationsfrom the sale until the transaction closed, much as JP Morgan had done for Bear Stearns in March.Under U.K. law, the guarantee required a Barclays shareholder vote, which could take 30 to 60 days. Though it could waive that requirement, the FSA asserted that such a waiver would be unprecedented, that it had not heard about this guarantee until Saturday night, and that Barclays did not really want to take on that obligation anyway.)

Monday 15-Sep: 1:45AM Lehman filed for bankruptcy.

Published on November 29, 2011 01:13

July 26, 2011

A heartfelt message

The following is a translated version of a message we received from the father of a kid, suffering from cancer. Some of us had joined hands to contribute money to enable the father to have his son operated. Such messages, show us how even our little deeds could make such a huge impact on someone's life:

“My dear sisters and brothers, I am an uneducated and underprivileged person who lost my parents at an early age and could not get enough education. Yet, struggling with daily bread and butter, I have never committed a crime or deceived anybody knowingly or unknowingly. I surrendered myself to religion and my venerable Guruji who taught me to ever remain honest and humble, even in the face greatest of provocations. I always got opportunities to earn money using devious means but have eschewed that path even in the face of greatest of provocations. Guruji used to tell me that one day misfortune will befall you yet you will meet the most beautiful people one can ever meet and they will show you the path of enlightenment. Today is the day. God has sent you to me to emancipate me. Your love and dedication to my dying child have brought back my lost faith on humanity. Irrespective of whatever happens, I have decided to dedicate my life for the service of humanity. You all have taught me that that I have to love the world, make a supreme sacrifice. You have taken me to the path of enlightenment in this most difficult interregnum. May God bless you all, may you live ever happily, and may no disruption ever touch your mind.

I want to say more but I am not endowed with eloquence, even in my mother tongue. Hence I pray silently for you. For me, silence is the greatest beatitude which forms a swirling pearl of prayer in this complex and inexplicable cauldron called life.

As sun sets in the ocean, I commend all of you to the holy feet of the Lord."

“My dear sisters and brothers, I am an uneducated and underprivileged person who lost my parents at an early age and could not get enough education. Yet, struggling with daily bread and butter, I have never committed a crime or deceived anybody knowingly or unknowingly. I surrendered myself to religion and my venerable Guruji who taught me to ever remain honest and humble, even in the face greatest of provocations. I always got opportunities to earn money using devious means but have eschewed that path even in the face of greatest of provocations. Guruji used to tell me that one day misfortune will befall you yet you will meet the most beautiful people one can ever meet and they will show you the path of enlightenment. Today is the day. God has sent you to me to emancipate me. Your love and dedication to my dying child have brought back my lost faith on humanity. Irrespective of whatever happens, I have decided to dedicate my life for the service of humanity. You all have taught me that that I have to love the world, make a supreme sacrifice. You have taken me to the path of enlightenment in this most difficult interregnum. May God bless you all, may you live ever happily, and may no disruption ever touch your mind.

I want to say more but I am not endowed with eloquence, even in my mother tongue. Hence I pray silently for you. For me, silence is the greatest beatitude which forms a swirling pearl of prayer in this complex and inexplicable cauldron called life.

As sun sets in the ocean, I commend all of you to the holy feet of the Lord."

Published on July 26, 2011 21:07